ETH vs SOL: Deep dive into the biggest L1 war (Part 2)

In Part 1, we broke down Ethereum and Solana as two distinct ecosystems with specific technological frameworks, user demographics, and philosophies. Now, we’ll take these insights further to look at actionable strategies for navigating these assets in the current cycle and beyond.

Ethereum and Solana have established themselves at similar ends of the crypto investment risk curve, but also they are very different offerings when you do the due diligence. Solana appeals to the short-term, high-risk generation looking for fast results and immediate returns, while Ethereum is built for those with a long-term vision, institutions, and serious investors valuing security, scalability, and resilience.

In Part 2, we’ll break down why Solana is best suited for high-reward swing trades and why Ethereum holds its ground as a solid, long-term asset.

Let’s go!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Solana: Instant Gratification Meets High Returns

Solana embodies the high-octane, quick-return approach that resonates with a generation driven by instant results. Recent studies show that 63% of crypto investors fall within the 18-34 age range, and they’re looking for assets that align with their short-term goals. Solana’s monolithic structure enables fast, inexpensive transactions, making it perfect for high-frequency trading, meme coins, and high-turnover DeFi applications.With everything on a single layer, Solana offers a fast, straightforward experience—no extra steps, no high fees. It’s built for on-the-go trading, perfect for those who want speed and simplicity. No need to mess with multiple layers or wait around for transactions to clear. Solana’s streamlined setup follows the same addictive formula that made apps like TikTok and Netflix popular.

This structure is ideal for meme trading, which is set to pick up as we move deeper into the cycle. With capital flow showing demand for SOL as a way to access meme coins, Solana’s positioned as the go-to chain for this crowd, and sentiment this cycle confirms it.

On top of that, Solana’s inflationary token model, at roughly 5% annually, keeps tokens accessible at the expense of scarcity and fits the high-speed trading narrative of SOL. In a high-growth market, this setup gives investors multiple scaling opportunities and plenty of swings without needing leverage to capture solid returns which have seen already which we will touch on later.

Social Media Influence and Retail Psychology

Social media platforms like TikTok and Instagram amplify the appeal of Solana by fueling FOMO (Fear of Missing Out), driving retail investors toward impulsive, dopamine-driven trades. With influencers flashing wealth and success stories across social media, Solana is primed to capture these users. The same devices used to watch influencers are used to trade Solana on apps like Phantom and swap meme coins on Jupiter. It’s an ideal setup for impulsive, high-energy trading that fits right into a retail investor’s mindset.Ethereum: A Foundation for the Long Game

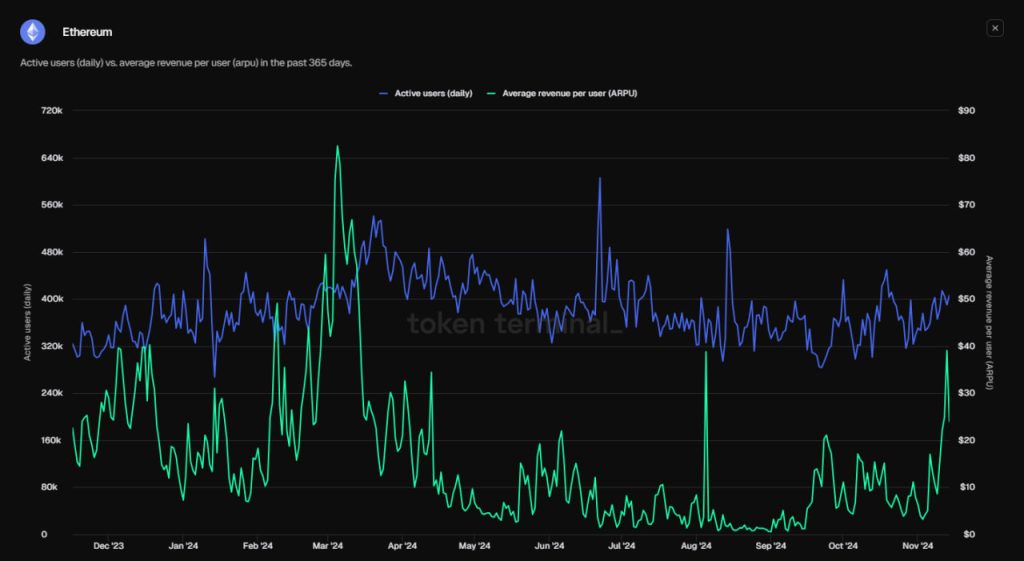

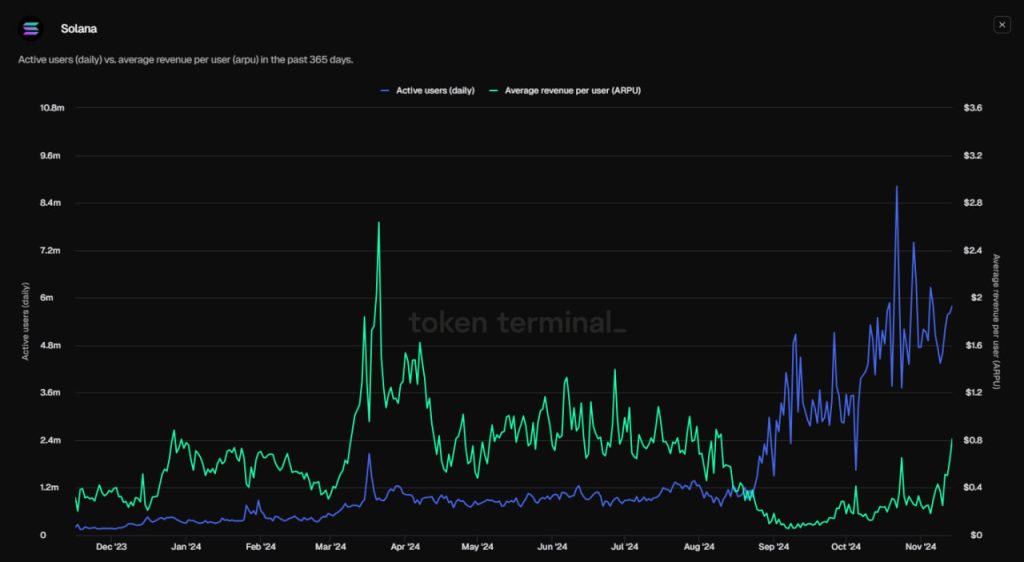

Ethereum, by contrast, has positioned itself as the serious investor’s blockchain, a platform for those who prioritise security, institutional backing, and long-term growth over fast returns. The layered (modular) structure of Ethereum, which separates transaction processing on Layer 2 from security and decentralisation on Layer 1, is built for resilience and scalability—features that large institutions and serious investors look for.Thus, Ethereum is seen as a “global settlement layer” and has attracted backing from major players like BlackRock, UBS, and CoinBase, who see it as an ideal platform for tokenizing real-world assets. This modular setup, while slightly more complex, offers scalability without sacrificing security. It’s what institutions trust for high-value projects, ensuring Ethereum’s role as the backbone for decentralised finance. We can see it by looking at average revenue per user chart: an average Ethereum users generates roughly $40 in revenue

In contrast, Solana generates roughly $1.2 per user. Thus, this solidifies further our take that there are significant difference in audiences these two ecosystems attract. Ethereum is for big players and institutions, while Solana is perfect for retail participants.

Further, Ethereum’s deflationary tokenomics, established with EIP-1559, burn a portion of transaction fees, creating a long-term store of value. Since the upgrade, Ethereum’s revenue increased significantly, reinforcing its role as a trusted, long-term asset. This deflationary model appeals to the sophisticated, long-term investor looking for stability, not high-frequency trading.

Further, Ethereum’s deflationary tokenomics, established with EIP-1559, burn a portion of transaction fees, creating a long-term store of value. Since the upgrade, Ethereum’s revenue increased significantly, reinforcing its role as a trusted, long-term asset. This deflationary model appeals to the sophisticated, long-term investor looking for stability, not high-frequency trading.

Economics: ETH vs SOL

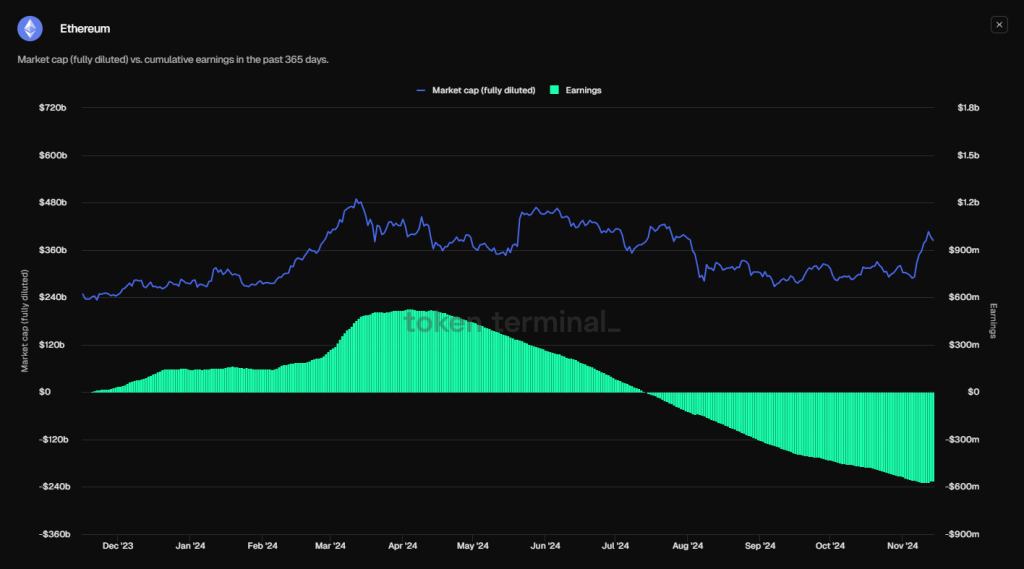

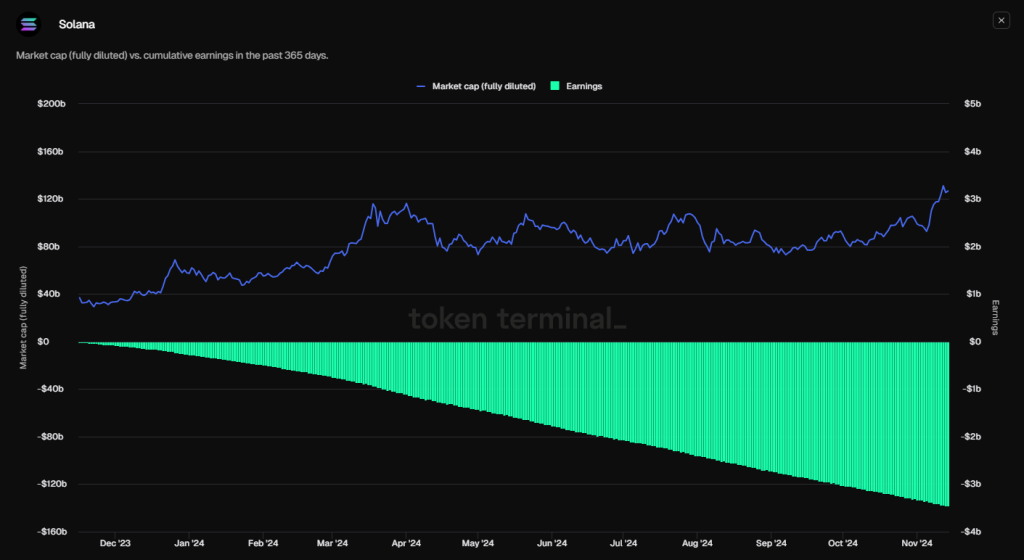

To further understand distinctions between Ethereum versus Solana, let’s look at their economics for a bit.The best metric to quantify the profitability or “value-accrual” for tokenholders that we found is the earnings. Earnings is how much tokens were burnt (accrued to tokenholders) versus how much tokens were inflated (dilution for tokenholders). When earnings are positive more tokens were burnt than added to supply. When they are negative, more tokens were added to the supply than burnt.

Let’s start with Ethereum. In the last 365 days the earnings have been net negative, diluting shareholders by roughly $600m. That represents roughly 0.16% inflation, which is very insignificant.

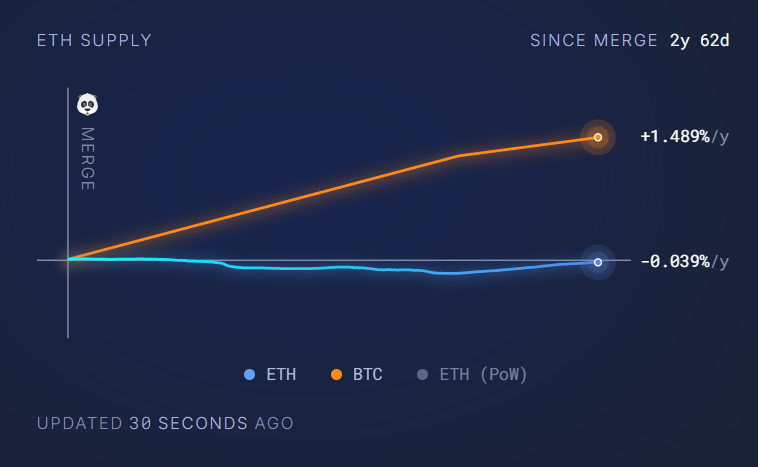

However, Ethereum is still profitable if we measure it since the “Merge”, an upgrade that made Ethereum deflationary. While Bitcoin, an asset that is widely recognised as store of value, inflated by 1.5%, Ethereum deflated by 0.04%.

This highlights the attraction of Ethereum for long-term investors. If you’re coming in with a long-term horizon and significant capital, Ethereum is naturally going to stand out more. Sure, we’ve seen a dip in earnings since August, but Ethereum has had stretches this year where earnings were positive. This shows it can generate real returns depending on blockchain activity, and it’s likely to swing back to positive territory when demand spikes again.

On the other hand, Solana’s earnings tell a different story. The chart shows a consistent trend of dilution, with no signs of slowing down. Solana’s earnings steadily move downward, almost forming a pattern that doesn’t offer much reassurance for long-term value. For big-money, long-term investors, this consistent dilution would be a red flag, making Solana less attractive as a stable investment compared to Ethereum.

With Ethereum, we’re looking at a different mentality altogether—a shift toward a store-of-value asset similar to Bitcoin. Ethereum’s robustness, security, and reputation have established it as a multi-cycle hold, an asset with the resilience to withstand market shifts. Its consistent adoption by institutions reinforces this, aligning Ethereum with the values of “smart money” investors who prioritise security, sustainability, and long-term growth.

Year-to-Date Performance:

Despite ETH being superior store of value than SOL, when we compare the year-to-date performance of Solana and Ethereum, the contrast is clear. Solana’s 300% growth reflects its role as a higher-reward, higher-risk play that appeals to those looking to trade actively within cycles.

Ethereum, on the other hand, has achieved a 65% move, which might seem underwhelming to those seeking aggressive returns, but it aligns with its role as a stable, long-term hold.

In a bull market, you wouldn’t be constantly re-entering Ethereum; the returns don’t justify it for short-term gains. Instead, Ethereum suits an accumulation strategy with strategic entries, such as our $2,200 low-leverage trade recommendation we put out to our members a few months ago. This approach fits Ethereum’s profile as an asset that benefits from being held through cycles potentially depending on your time horizon. Meanwhile, Solana’s volatility provides multiple points for scaling in, leveraging its high upside in a market cycle.

Strategy Playbook

Trading Solana: Leveraging Volatility for Short-Term Swings

With Solana, the strategy is simple—capitalise on its explosive moves and high volatility. Solana’s setup allows for multiple scaling opportunities without needing high leverage, given its potential for substantial percentage gains. This makes Solana ideal for spot positions, with leverage only necessary in rare cases. In a fast-moving market, proper risk management on key levels can allow traders to take advantage of these swings effectively.Solana’s year-to-date performance highlights its role as a swing trade asset, allowing you to scale in on pullbacks and capture multiple moves to the upside. With high volatility, leverage becomes an option, but often just holding through its swings can deliver solid returns.

Given its potential for substantial gains relative to its risk, Solana is an asset you’d likely rotate out of as the cycle ends—shifting into BTC or ETH as long-term holds when things top out again. Trade the trade, accumulate the investment, and leverage their qualities against each other—that’s the mark of a true market player.

Investing in Ethereum: The Long-Term, Multi-Cycle Hold

Ethereum’s setup requires a different approach altogether. Its proven resilience, institutional adoption, and modular design make it more than a trade—it’s an asset to hold over the long haul. Public support from influential figures like Trump and strong institutional interest have solidified Ethereum as a serious, long-term play.Adopting Michael Saylor’s mindset of “buy the top forever” applies here—Ethereum is a multi-cycle hold, where the focus is on consistent accumulation rather than chasing short-term moves. As Ethereum continues to cement its place as the foundation for decentralised finance, this is the asset to park capital in for those looking to build wealth over time.

Cryptonary’s Take

In this two-part deep dive, we’ve broken down Ethereum and Solana from the ground up—two contrasting assets built for entirely different kinds of investors. Solana’s appeal lies in its fast-paced trading and high returns, making it the asset of choice for those after immediate gains. Its simplicity and speed capture the attention of retail investors looking to capitalise on hype and quick swings.On the other hand, Ethereum offers stability and a secure foundation for those thinking in cycles, not days. Its robust structure, growing institutional adoption, and deflationary setup make it the asset to hold for the long game. It is a native home for decentralised finance and is consider to be the “global settlement layer”

The takeaway? Solana is a winner and trade for this cycle, but accumulate Ethereum for the future as it has the best economic model in the entire market. Use Solana’s volatility and short-term gains to your advantage, while letting Ethereum serve as the bedrock of your portfolio for years to come. To many of you view them the same. We hope this shows you they are not.

Peace! Cryptonary, OUT