ETH vs SOL in 2025-26: Rotation Ahead?

The rivalry between Ethereum and Solana has shaped crypto for years. Two networks built on divergent philosophies, each proving its own version of success. The question now is simple: which one will outperform into 2026? The data gives us a clear story. Let’s dive in…

As 2025 draws to a close, Ethereum (ETH) and Solana (SOL) remain two of the most influential ecosystems in crypto. Ethereum, the established leader, anchors decentralised finance and tokenised real-world assets with proven reliability and institutional trust. Solana, the high-speed challenger, continues to grow its retail base through low fees, instant finality, and an expanding on-chain economy.

This report compares the two networks across fundamentals, upgrades, and capital flows, while analysing how Digital Asset Treasuries (DATs) and ETF inflows are influencing market positioning into 2026.

In this report:

- Side-by-side comparison of ETH and SOL fundamentals

- Ethereum’s upcoming Fusaka upgrade 👀

- ETF flows and Digital Asset Treasuries (DATs)

- Stablecoin and liquidity trends

- Cryptonary’s midterm outlook into 2026

Two Networks, Two Philosophies

Ethereum and Solana represent two distinct approaches to the same question: how to scale blockchains for global adoption. Ethereum’s modular design distributes demand across layer-2 networks that settle to its mainnet. Solana’s monolithic architecture keeps everything on one layer, optimised for speed and simplicity.

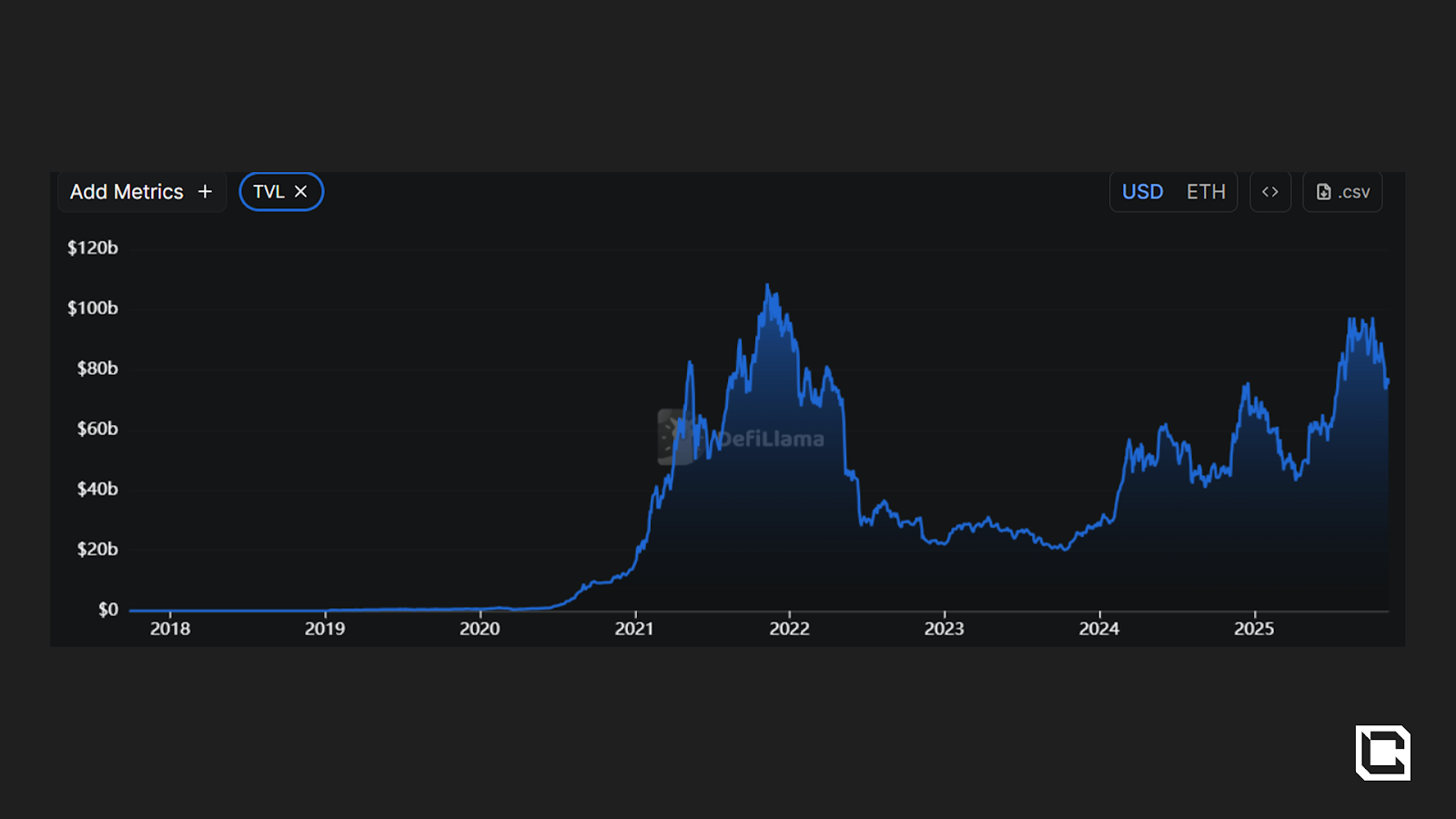

TVL of Ethereum

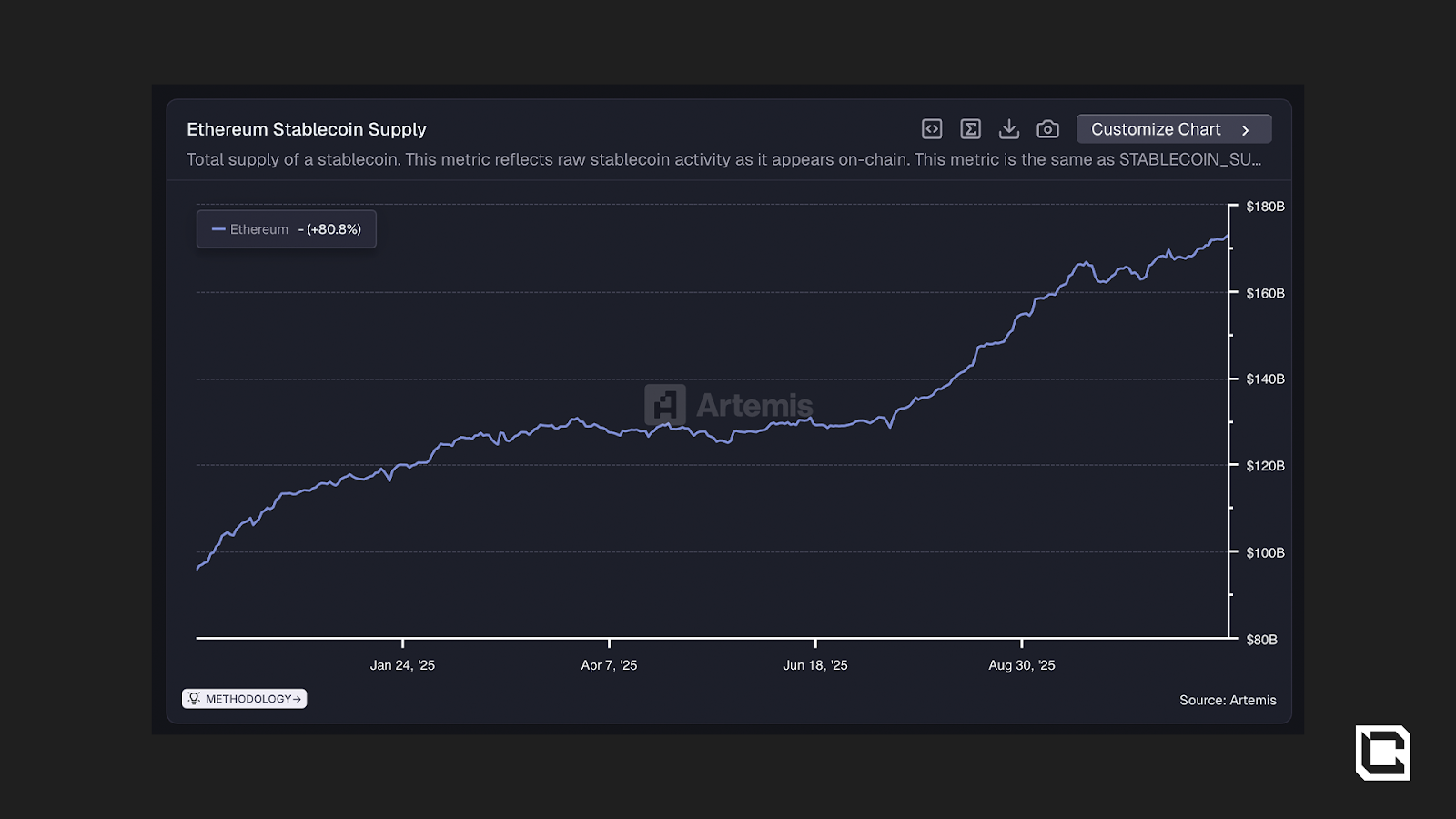

Ethereum continues to dominate in liquidity, total value locked, and real-world asset adoption, reflecting its deep institutional foundation. Its TVL, now around $75 billion, has stayed resilient despite recent volatility, and its stablecoin supply of roughly $180 billion anchors most of tokenised finance across USDT and USDC. Together, these reinforce Ethereum’s position as the primary settlement layer for institutional capital.

Stablecoin supply on Ethereum

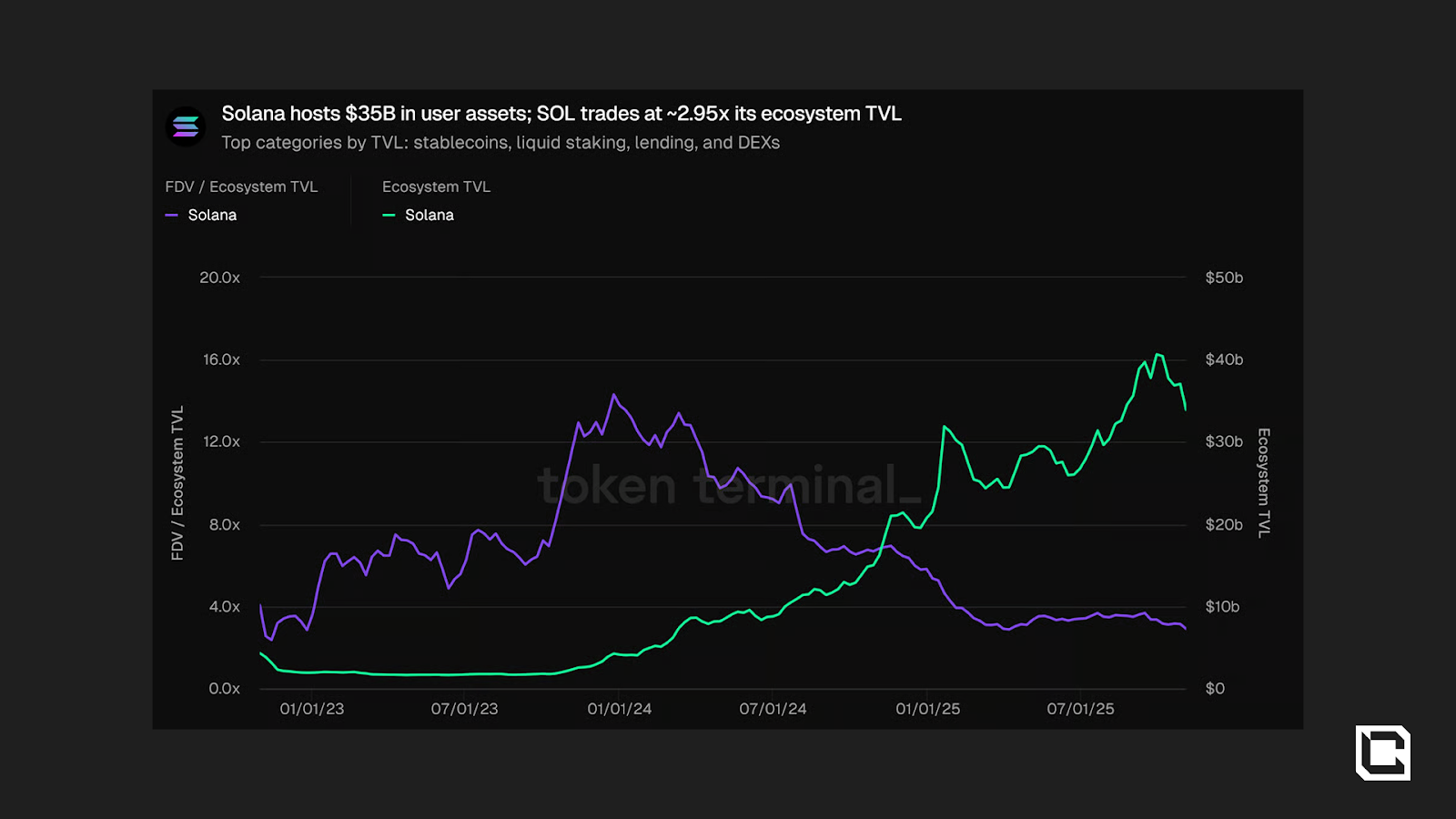

Solana, by contrast, leads in activity and efficiency. Its fees are effectively zero, its throughput unmatched, and its retail energy keeps daily active users around 3 million, roughly eight times Ethereum’s mainnet.

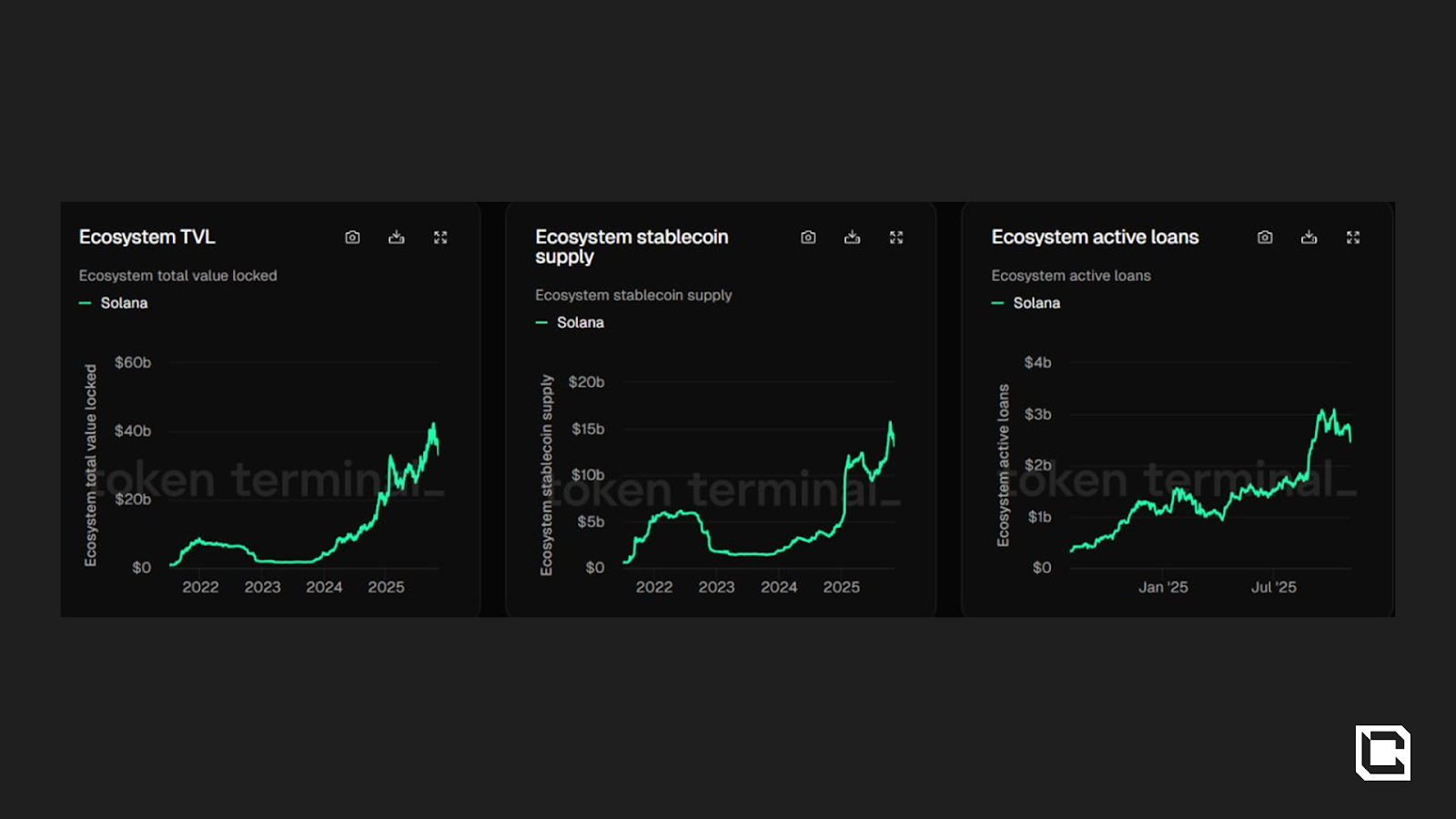

TVL of Solana

TVL, Active Loans and Stablecoin Supply on Solana

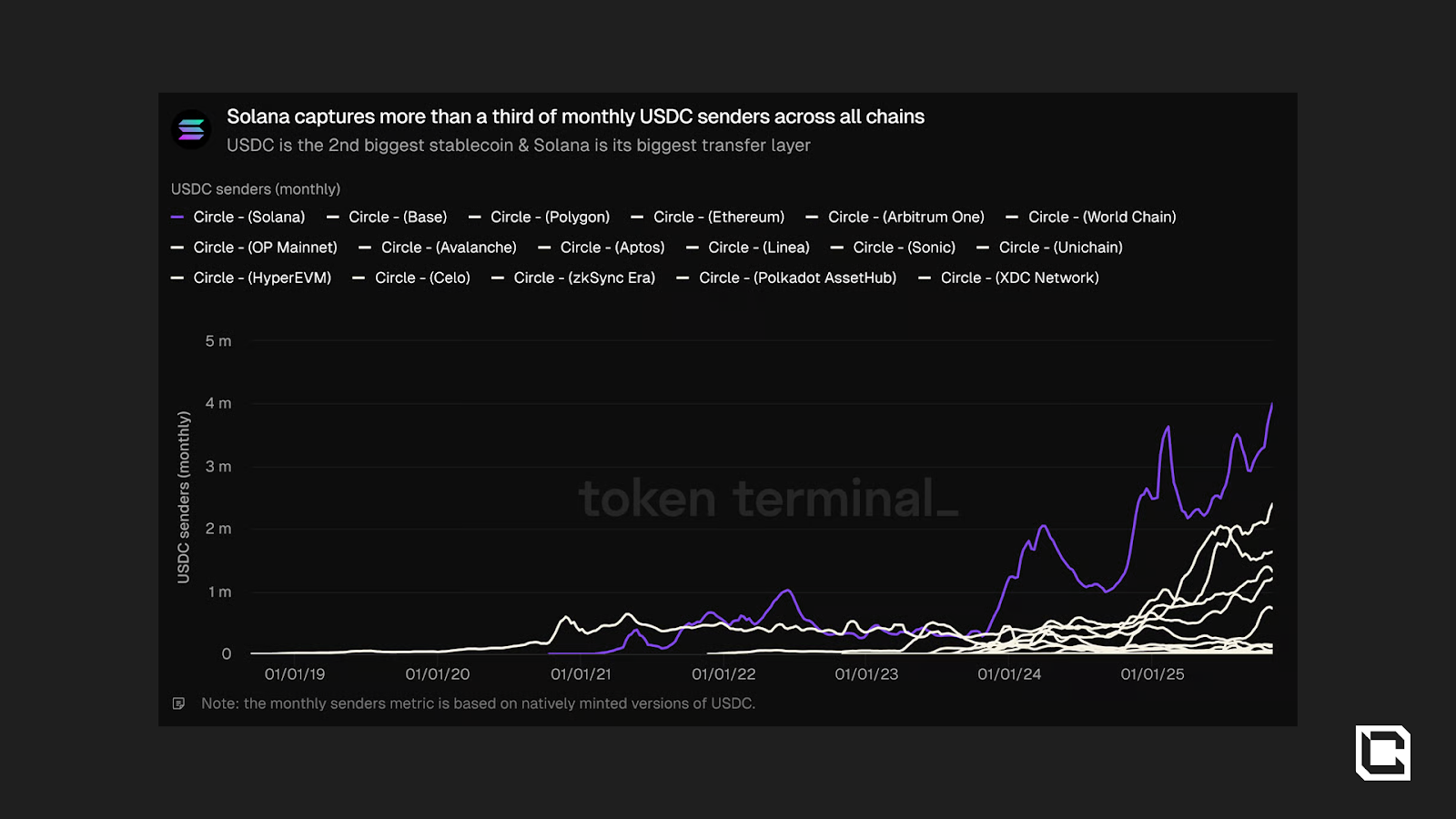

Stablecoin supply has grown 248 per cent this year to $14 billion, driven by USDC adoption and fast-moving DeFi activity. Solana captures a third of all monthly USDC transfers and remains the biggest transfer layer for USDC.

USDC transfer market share by chain

However, not only are stablecoins gaining traction on both chains, but tokenised stocks and synthetic assets are beginning to appear across both spot and perpetual markets. Platforms like Hyperliquid and Ostium now list equities such as Apple, Tesla, and Nvidia as on-chain perpetuals, while spot xStock markets backed by real assets were introduced on Solana.Adoption of tokenised assets remains early and slower than many anticipated, but the groundwork for a unified financial system is forming, one where traditional and crypto-native assets trade seamlessly side by side. The value of tokekised assets on both chains is slowly grinding higher, and we expect more assets coming on-chain in the coming years. This, in turn, will likely translate into higher valuations for both ETH and SOL, as many asset issuers will need to buy the underlying asset for staking to secure their issued assets.

Revenue and Developers

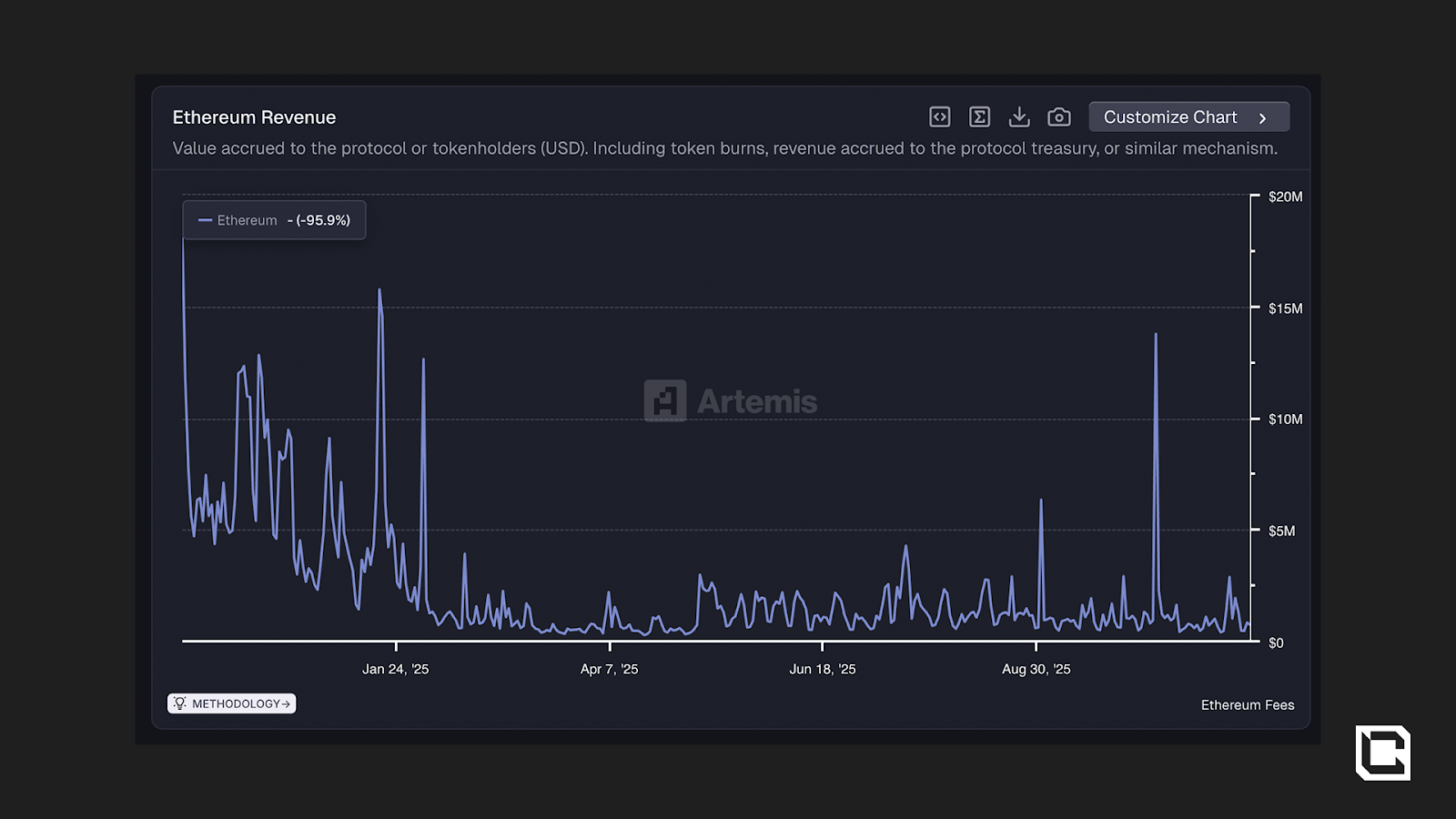

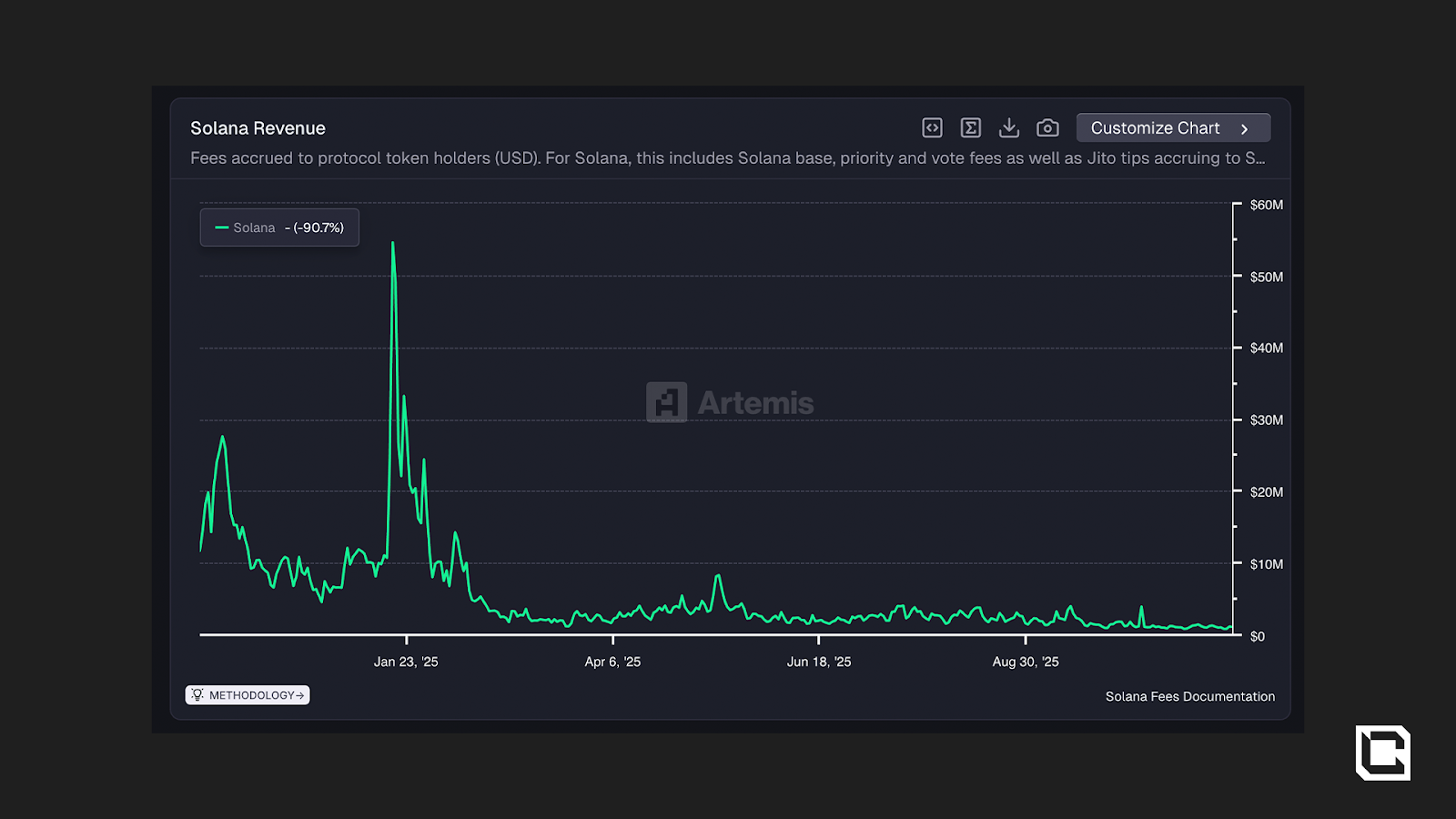

Both ecosystems face revenue compression as network fees normalise, yet their dynamics differ. Ethereum captures more value per transaction, signalling institutional activity, while Solana’s higher efficiency-to-fee ratio, averaging $20–25 million in monthly protocol revenue compared with Ethereum’s $10–20 million, shows it is monetising scale more effectively.

Ethereum Revenue chart

Solana Revenue Chart

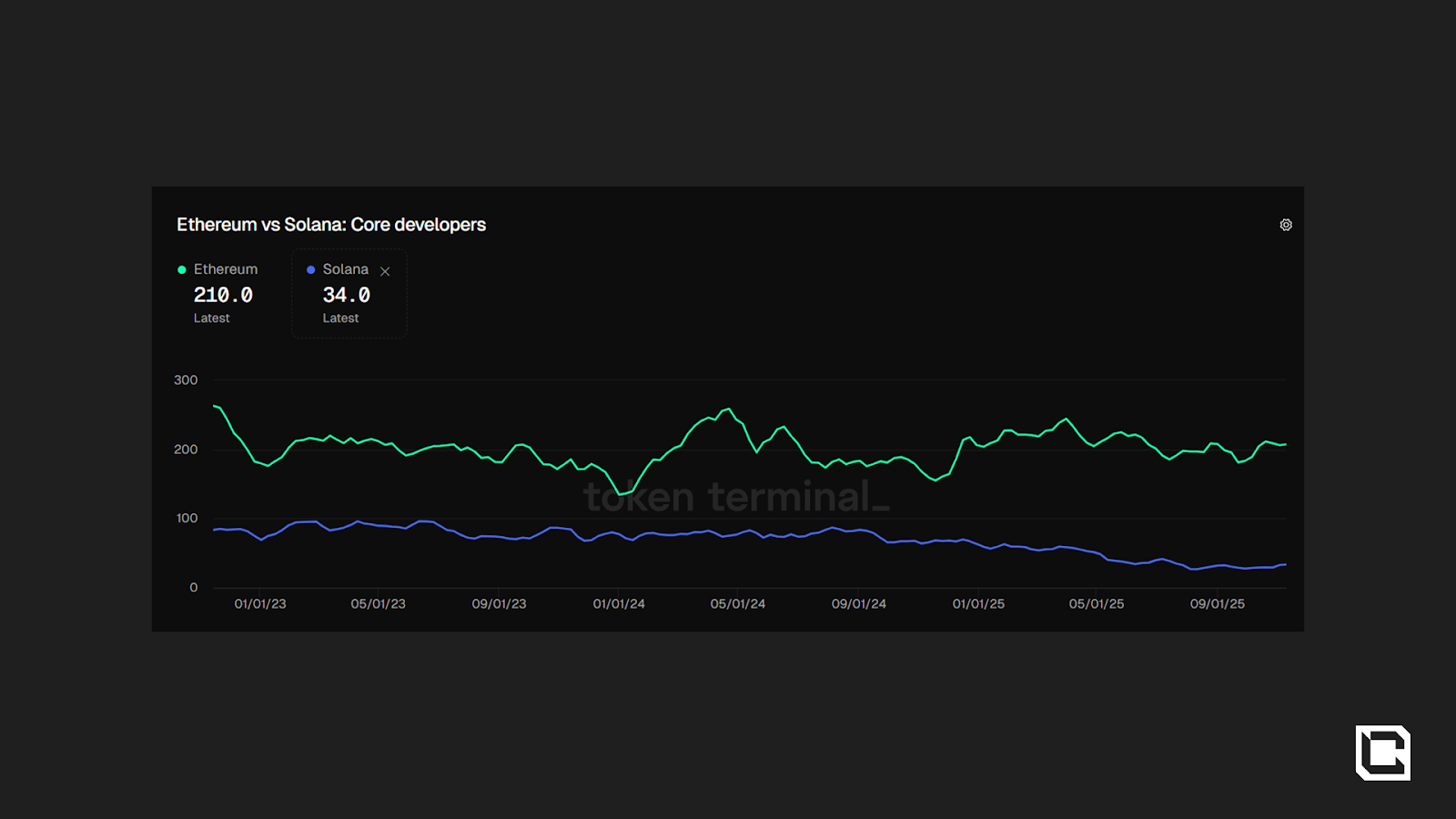

On the developer side, Ethereum still leads with about 5,700 active monthly contributors, but Solana’s 83% yearly growth in new developers highlights accelerating innovation at the application layer, particularly in real-time DeFi and memecoin ecosystems. When it comes to unique developers, again, Ethereum leads across all chains, commanding 10% of the developer market.

In summary, Ethereum remains the institutional backbone of decentralised finance and a settlement layer for institutions, while Solana has become the retail engine of on-chain activity, while also used for stablecoin transfers.

New Ethereum Upgrade is Coming

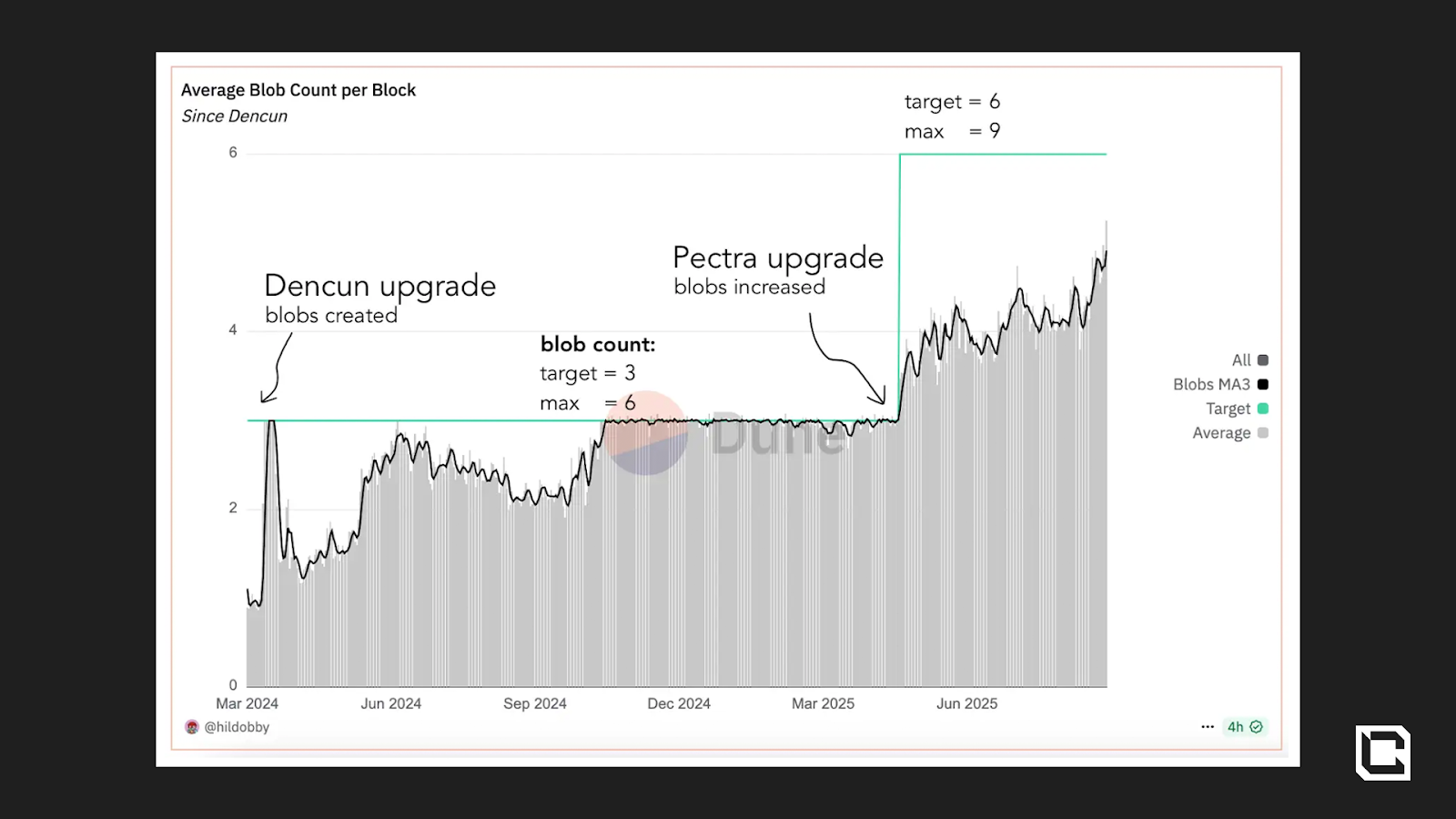

Talking about new upgrades, the Fusaka upgrade, scheduled for December 3, 2025, marks Ethereum’s next leap in scalability and efficiency. It follows Pectra and introduces PeerDAS (Peer Data Availability Sampling), allowing Ethereum to scale data capacity up to eight times without increasing hardware strain on nodes. Instead of storing every piece of rollup data, nodes store only a small fraction, cutting costs and improving performance.

L2 usage of blobs over time

These changes expand the network’s blob capacity, improve validator efficiency, and lower rollup costs, directly enhancing the user experience. As a result, Ethereum becomes more capable of supporting the growing Layer-2 ecosystem that powers the majority of its activity today.Key improvements:

- Increased blob capacity and data throughput across Layer-2 networks.

- Lower transaction and posting costs for rollups like Arbitrum, Base, and Optimism.

- Streamlined validator operations and reduced congestion across the base layer.

Ethereum’s Gas Evolution and Market Response

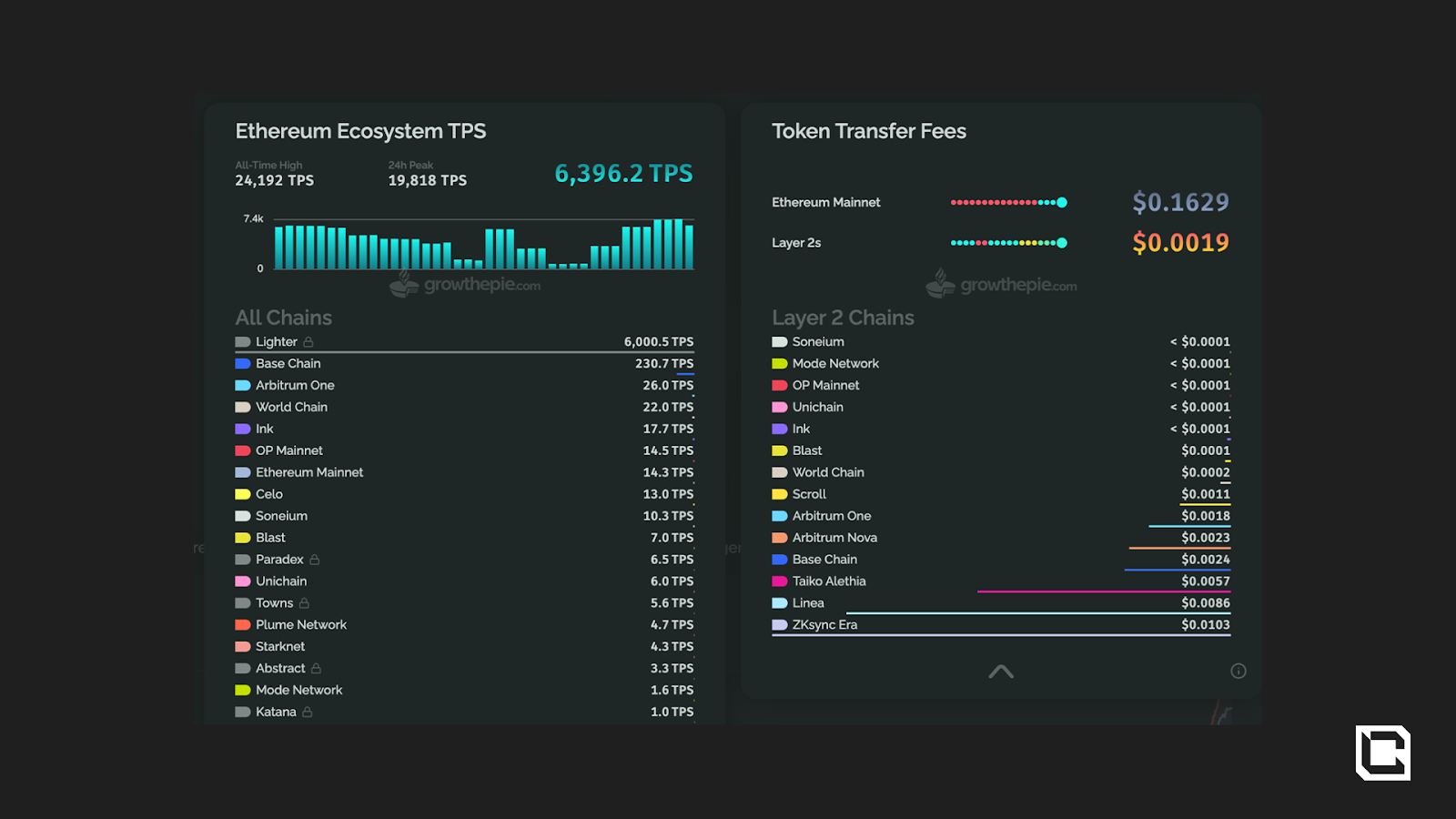

Ethereum’s high gas fees once made retail participation nearly impossible. In prior cycles, users routinely paid $30–$50 per transaction, limiting DeFi to high-value participants. The Dencun and Pectra upgrades changed that dynamic. Average layer-2 transaction costs have fallen by more than 95%, now averaging only a few cents, allowing retail users to re-enter the ecosystem without prohibitive costs.

Ethereum Ecosystem TPS and Fees

When the Pectra upgrade went live in May 2025, Ethereum’s price surged over 50% within a week as confidence in the network’s scalability returned, and over 150% over the months post-upgrade. While short-term market reactions are unpredictable, major infrastructure upgrades often coincide with higher on-chain activity, deeper developer engagement, and renewed institutional inflows.

ETH/USD Chart Post Pectra Upgrade

Fusaka continues this momentum by aligning cost efficiency with throughput, narrowing the gap between Ethereum and faster monolithic chains while preserving security and decentralisation. For retail users, it unlocks affordable access to DeFi, gaming, and NFT markets. For institutions, it strengthens Ethereum’s position as the trusted settlement layer for global tokenised assets.The Rise of ETF Flows and Digital Asset Treasuries (DATs)

Co-founder and Head of Research at Fundstrat Global Advisors

Digital Asset Treasuries (DATs) and ETF flows have become the dominant forces behind institutional accumulation in 2025. Together, they form the structural base of long-term capital entering the market, defining how liquidity now concentrates across ecosystems.

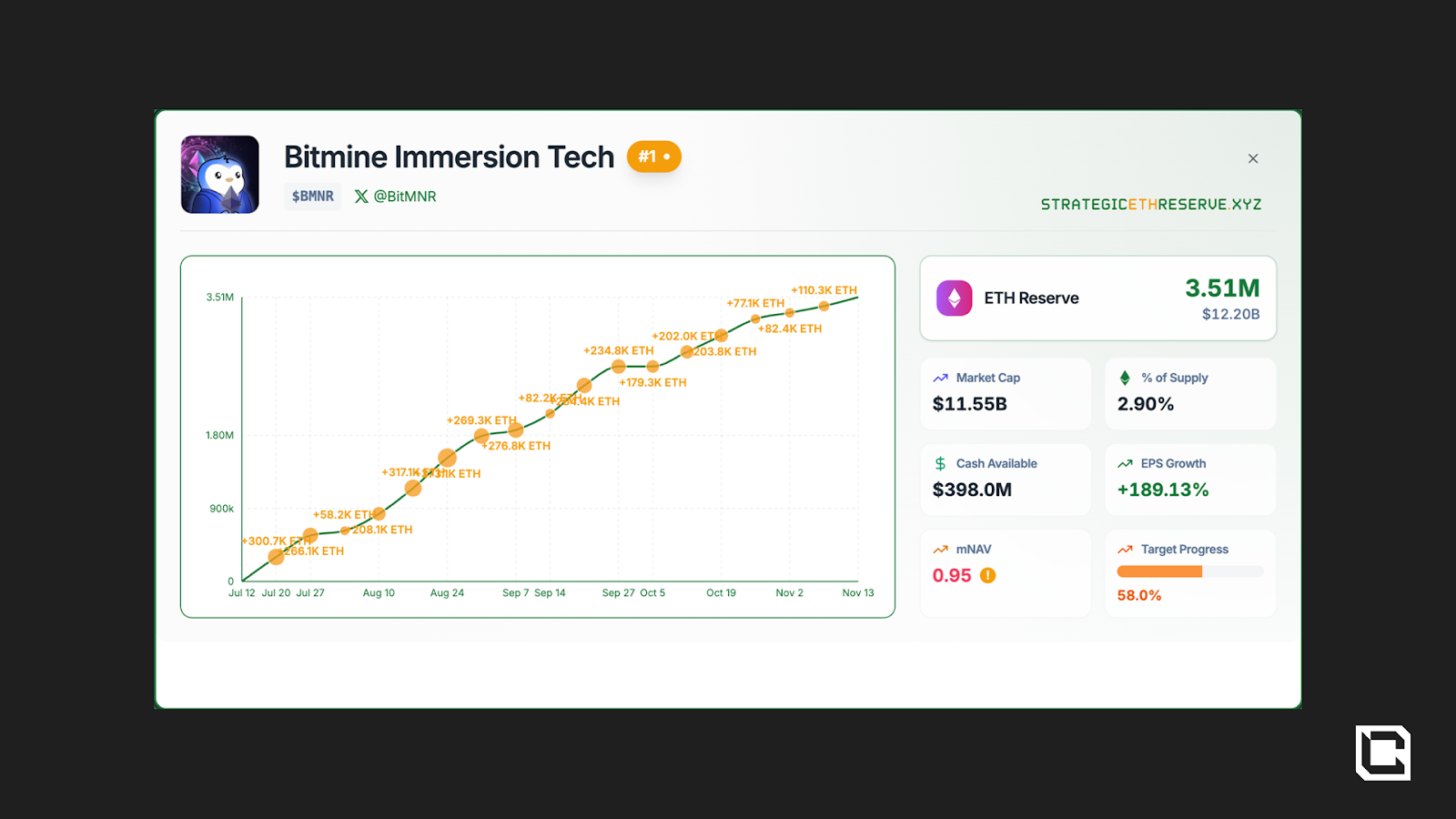

Ethereum has taken centre stage again because of private treasuries like Tom Lee’s Bitmine Immersion Technologies. In recent months, Bitmine has accumulated 3.5 million ETH, equivalent to 2.9% of the total supply, with a stated goal of reaching 5%. Lee’s approach mirrors Michael Saylor’s Bitcoin strategy, positioning Bitmine as Ethereum’s corporate accumulator of last resort. His purchases during market dips have earned him a growing reputation as the “Ethereum Saylor.”

Bitmine Immersion Tech ETH buys

Bitmine Immersion Tech ETH buys

On the Solana side, institutional adoption continues through the success of Bitwise’s BSOL ETF, launched in late October. The fund became the top-performing crypto ETF in the U.S. within a week, surpassing BlackRock’s Bitcoin ETF with $417 million in weekly inflows. BSOL provides both spot exposure and staking rewards, marking the first fully regulated yield-bearing ETF for a non-Bitcoin asset.

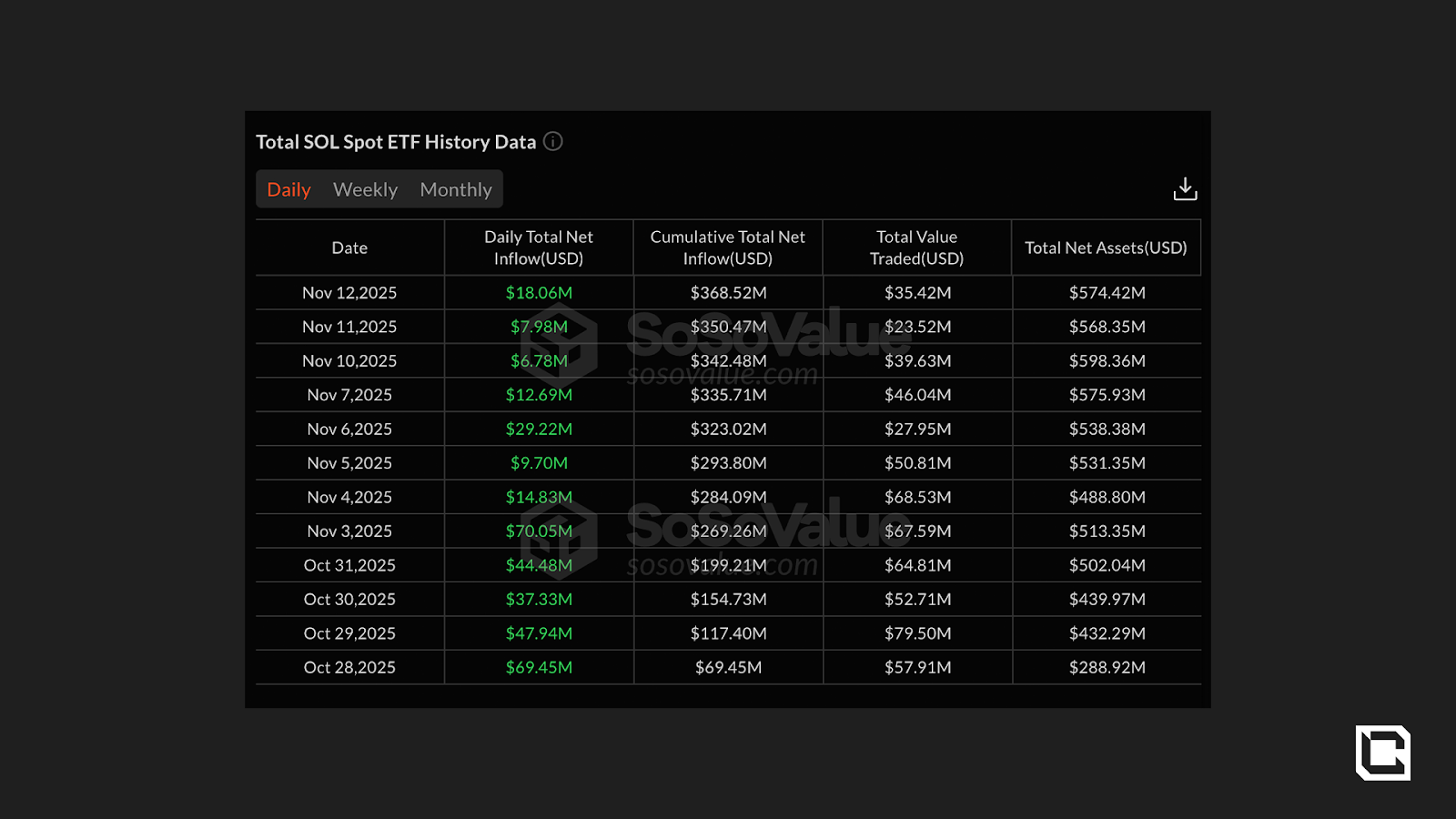

SOL Spot ETF Flows

This cements Solana’s position as the high-growth counterpart to both Ethereum and even Bitcoin. Institutional portfolios are beginning to treat these assets as complementary.

SOL Spot ETF Flows Data

Together, DAT accumulation and ETF adoption are institutionalising both networks. Bitmine’s multi-billion-dollar Ethereum reserve and the rise of BSOL signal a structural shift in market composition. Long-term liquidity is now being driven by corporate treasuries and regulated funds rather than short-term traders, marking a new phase of institutional integration for both Ethereum and Solana. Our take is that, if we zoom out, the institutionalisation of these assets will compress the volatility and will likely depict a slow-grind higher pattern over the coming years.Network Economics

As investors and traders, this is probably one of the most important things to watch. The economic structure of each network defines how value circulates and compounds over time. Ethereum emphasises monetary discipline and burn-based scarcity, while Solana prioritises accessibility, scale, and participation.Staking and Issuance:

Ethereum’s transition to proof of stake reduced annual issuance by more than 90%. The EIP-1559 mechanism permanently removes a portion of every transaction fee, creating periods of net deflation when on-chain activity rises. Current data shows annual supply growth near 0.77%, with more than 37,000 ETH burned each year.

ETH Inflation and Burn Data

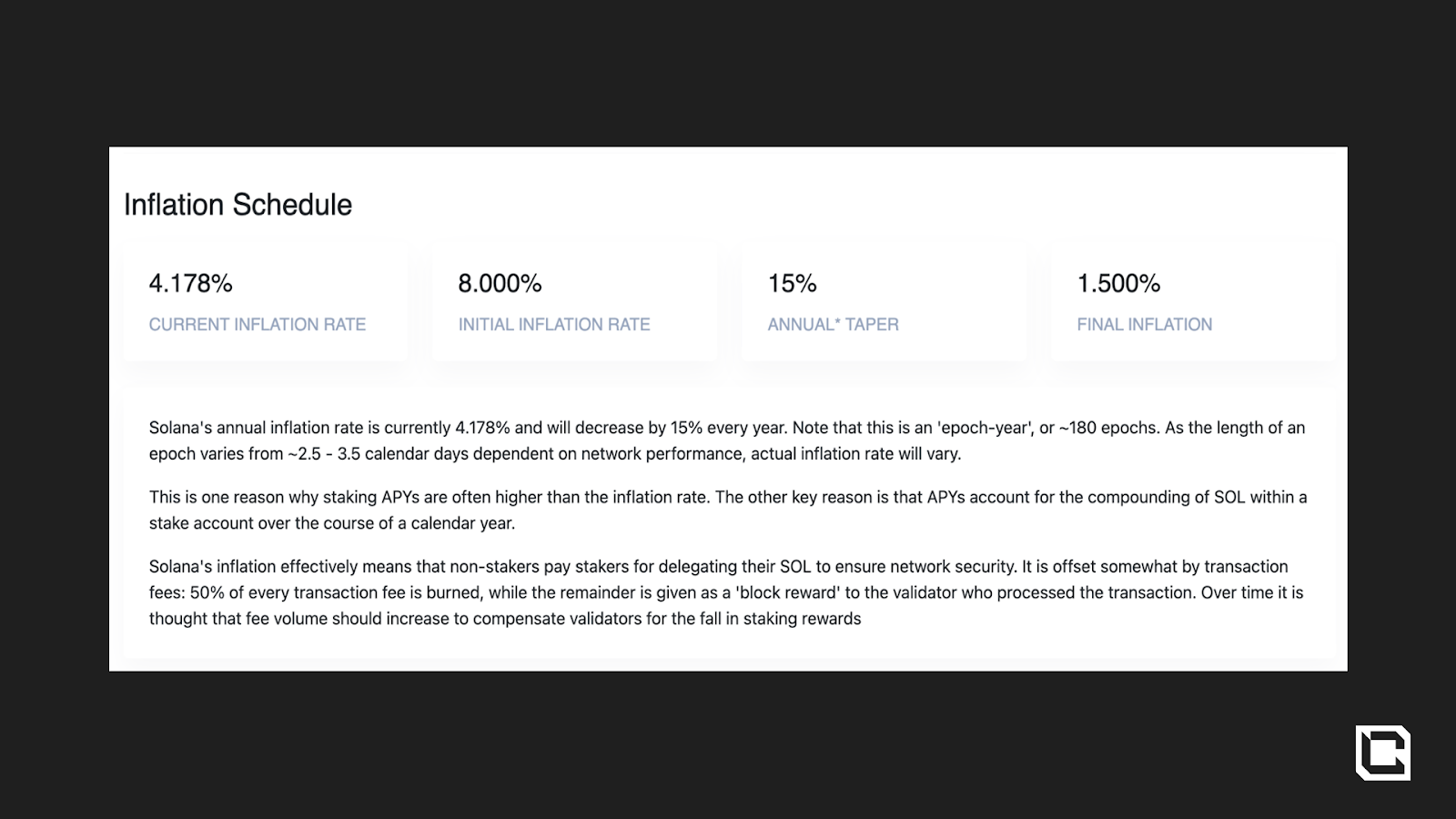

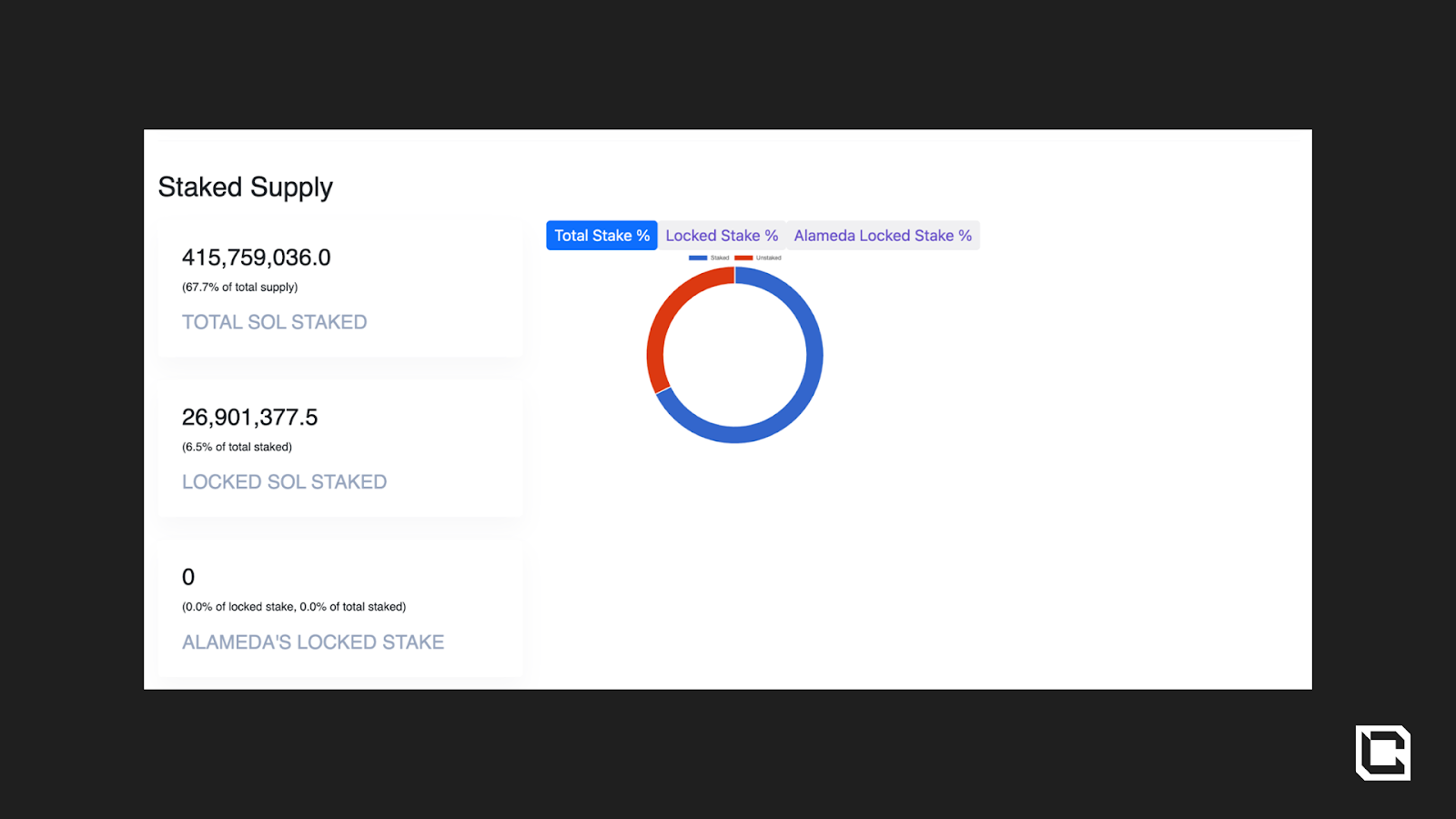

Solana launched with an 8% inflation rate, which automatically decays by roughly 15% per year until it reaches a long-term floor of 1.5%. The current rate is around 4.2%. About 68% of SOL is staked, primarily to offset inflation rather than generate excess yield. Validator and liquid staking returns average 6–7%, effectively preserving purchasing power for participants. As transaction volume and fee burns rise, Solana’s inflation pressure continues to ease over time.

SOL Inflation Data

Staked SOL data

Unlike Ethereum, Solana’s burn mechanism does not guarantee deflation but moderates inflation through activity. Half of all transaction fees are burned permanently, while the other half is paid to validators. In the near term, Solana remains mildly inflationary but stable. Over the longer term, as network usage scales and inflation declines, net issuance could move toward equilibrium. If that balance is achieved, Solana’s monetary structure would evolve into a high-throughput system where user demand naturally regulates token supply.Fee Structure and Value Capture:

Ethereum dominates in total fee revenue due to its position as the primary settlement layer for high-value DeFi and institutional activity. Its burn mechanism links network usage directly to token scarcity, giving ETH deflationary leverage during periods of high demand. Solana, by contrast, focuses on scale. Its near-zero transaction costs encourage mass participation and continuous activity across applications. Despite lower per-transaction fees, Solana’s overall fee revenue has remained strong, averaging $20–25 million per month in 2025, showing that scale is offsetting thinner margins.Supply and Circulation:

Ethereum and Solana both rely on their native tokens (ETH and SOL) to pay network fees, secure validators, and serve as core collateral within their ecosystems. The difference lies in how supply interacts with usage.Ethereum’s design ties demand directly to scarcity. When activity increases, more ETH is permanently burned, reinforcing its role as a store-of-value asset and the settlement layer for tokenised capital.

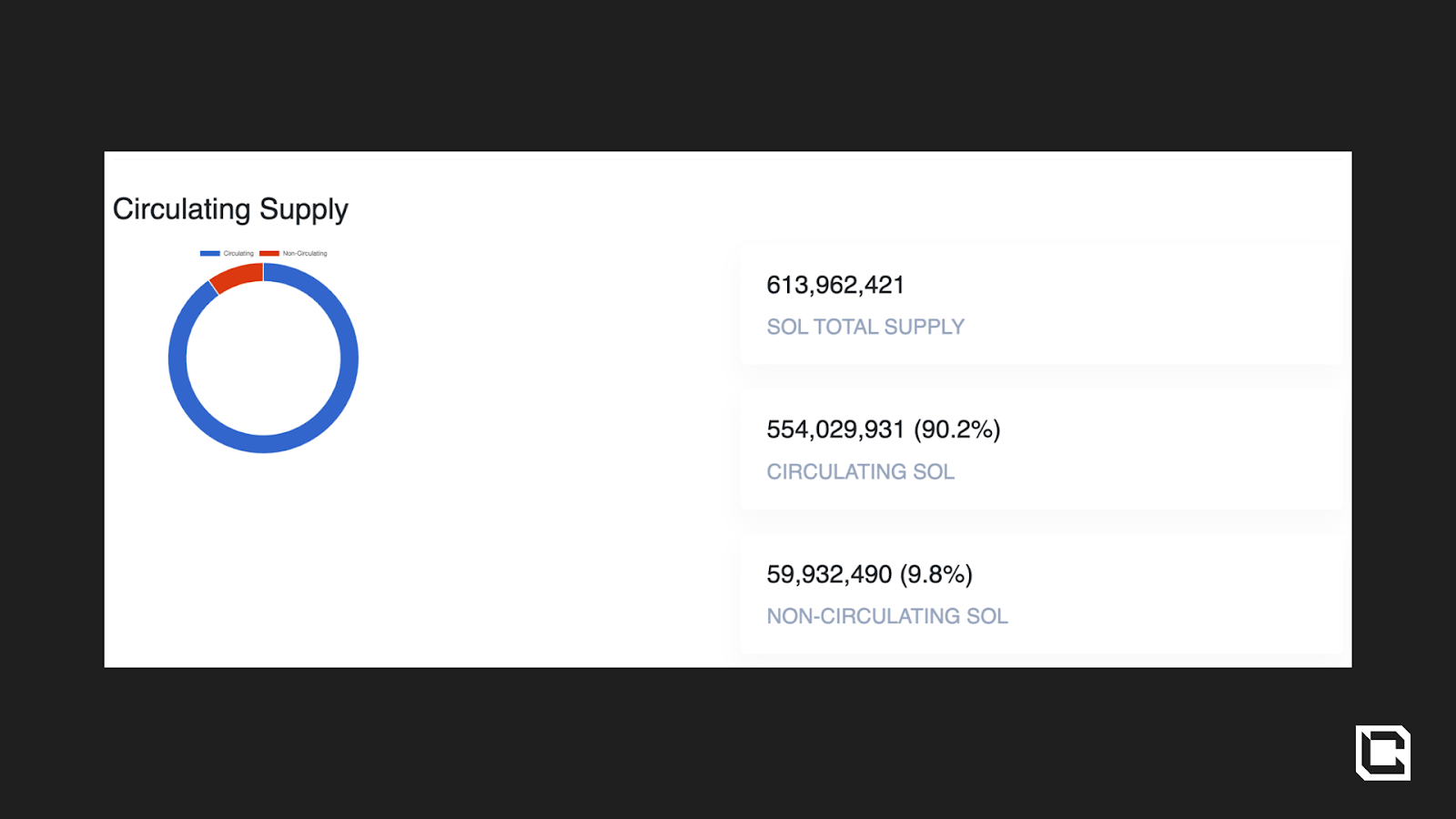

Solana, on the other hand, maintains a highly liquid and widely distributed supply. Around 90% of SOL’s total tokens are already in circulation, with much of it actively staked, traded, or used across DeFi and application activity.

SOL circulating supply data

Technical Analysis

SOL/ETH has retraced since the January peak at 0.093 and is attempting to form a base around 0.040. Immediate support sits at 0.040, with the weekly 200 EMA sitting around 0.038 as secondary support. Below that, the next demand lies at 0.032-0.033. On the upside, 0.055 is the range top, first resistance, followed by 0.064 and 0.077, before the prior ATH at 0.093.Momentum is soft, weekly RSI is around 0.037, and its average is at 0.039, and price has been compressing in a downtrend since late June. A weekly close back above the downtrend line and 0.055 would unlock 0.064 and 0.077. Failure to hold 0.040/0.038 increases the probability of a drift into 0.032-0.033 before any constructive rebuild.

Cryptonary’s Take

In our opinion, both Ethereum and Solana have already entered a new phase defined by institutional validation and real utility. Each network has proven its model works, but they now compete across very different strengths. Ethereum is deep, reliable, and institutionally aligned. Solana is fast, retail-driven, and increasingly liquid. The amount of stablecoins and tokenised assets is increasing on both chains consistently.Ethereum’s Fusaka upgrade reinforces its position as the financial foundation of crypto, improving scalability for rollups and supporting the next generation of on-chain capital markets. Its economic structure remains the most disciplined in the industry, and its integration with Digital Asset Treasuries positions ETH as the conservative core of institutional portfolios.

Solana, on the other hand, has evolved from a speculative playground for memes to a high-velocity payment layer. The BSOL ETF and growing DAT inclusion confirm rising institutional confidence. Its retail user base and transaction throughput continue to expand faster than any other chain, reflecting a network that thrives on activity and innovation.

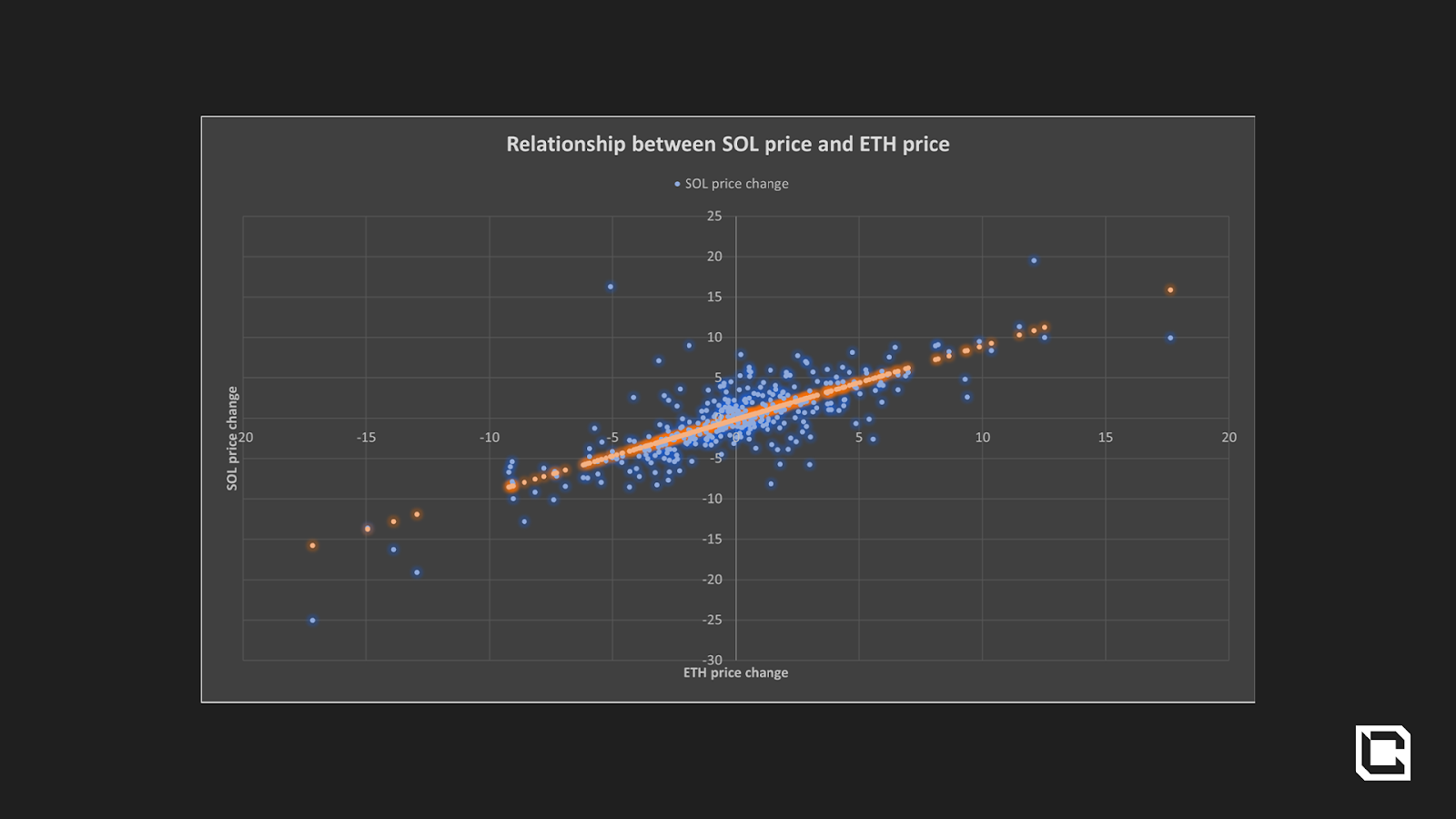

There is a strong relationship between the price of SOL and ETH. In a risk-on environment, SOL outpaces ETH by two to three times. In a neutral or defensive market, ETH delivers steadier one-and-a-half to two times returns with lower volatility.

Relationship between SOL and ETH price changes

For 2026, we think Solana will outperform ETH because of a lower market cap, increasing institutional flows into staked ETFs and growth in tokenised assets. We are accumulating SOL using liquidity pools while also earning passive income, check out our full guide here.Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms