Ethereum vs Solana: A deep dive into the biggest L1 war (Part 1)

Most of you aren’t viewing the market the right way—and, to be honest, most participants don’t. In this report, we’re diving deep into Ethereum vs. Solana—not just to compare numbers but to explore what truly makes each of these blockchains unique.

Most of you aren’t viewing the market the right way—and, to be honest, most participants don’t. People look at investment and trading like they’re dealing with lifeless objects, analysing assets as if they exist in isolation, detached from emotion. But that’s the wrong way to see things. It’s not just about the numbers or price charts; it’s about understanding how people engage with technology.

In this report, we’re diving deep into Ethereum vs. Solana—not just to compare numbers but to explore what truly makes each of these blockchains unique. We’re breaking down the psychology behind these assets, looking at how different demographic sectors, grouped by knowledge and network, perceive and value each chain. You’ll see how Ethereum and Solana’s specific setups give each of them an edge, whether for long-term security or for capturing quick gains this cycle.

If you’re ready to see beyond the surface and gain a full-spectrum understanding, keep reading. This isn’t just another analysis; it’s the roadmap to viewing the market in a way most people overlook.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The tech behind Solana vs. Ethereum

Before we dive into the tech side of Ethereum and Solana, let’s lay out why this really matters. In our view, the technical design of each blockchain isn’t just a set of specs on a whitepaper—it’s the foundation that shapes how people interact with these networks. The structure, ease, speed, and fees all affect how users perceive these assets and ultimately drive their investment decisions. It’s not just about which blockchain is “better” but which one resonates with the needs, habits, and impulses of different types of investors. This is at the core of our hypothesis: tech influences human behaviour, and in turn, human behaviour impacts the asset’s growth and market positioning.Ethereum (Modular scaling)

Ethereum has a modular structure. The core layer (L1) focuses on security and decentralisation, while Layer 2 (L2) solutions handle transaction processing and scalability. This setup keeps Ethereum’s base stable but introduces an extra step for users. Think of it like having separate streaming subscriptions—Netflix for shows, Disney+ for movies, ESPN for sports. It’s not as streamlined, but each part is optimised for quality and resilience.Pros:

- Security & decentralisation: Ethereum’s core layer is highly decentralised, making it robust and secure, which is ideal for long-term stability.

- Scalability with flexibility: Offloading transactions to L2s means Ethereum can scale without compromising security.

- User complexity: Moving between layers can be clunky for users, especially those who aren’t tech-savvy. It requires more effort and feels more “technical” than Solana’s straightforward approach.

- Liquidity fragmentation: The layered structure splits liquidity across L1 and multiple L2 solutions, creating fragmented capital and a less seamless user experience.

Solana (Monolithic scaling)

Solana, on the other hand, runs on a monolithic structure, meaning everything—from transactions and data storage to security—is handled on a single layer. Users don’t have to worry about switching between different layers, which makes it fast and easy to use. It’s like a one-stop app, similar to Netflix or TikTok, where you open it, everything’s there, and you can interact quickly without any extra steps. This structure caters perfectly to a generation seeking speed and simplicity.Pros:

- Speed & efficiency: Everything being on one layer means Solana is fast and responsive.

- Low fees: With no extra layering, transaction fees stay low, which is ideal for frequent, small-scale trades.

- Lower decentralisation: Solana sacrifices decentralisation to achieve this speed. With fewer validators, it’s not as resilient or secure as Ethereum.

- Scalability challenges: Solana’s single-layer approach works well now, but it may face bottlenecks as more users pile in. We’ve already seen some congestion, raising questions about its ability to scale in the long run.

Tokenomics

Inflation is a fundamental split between Ethereum and Solana, and it shapes how investors see each asset and what kind of experience each network delivers. The way each chain handles inflation directly impacts user behaviour and ultimately defines who each chain is built for. An inflationary model vs. a deflationary one means we’re looking at two very different plays, each attracting investors with their own goals, timelines, and priorities. These aren’t just technical differences—they’re choices that pull in different kinds of users and shape the entire vibe of each network.Ethereum: Deflationary asset with long-term appeal

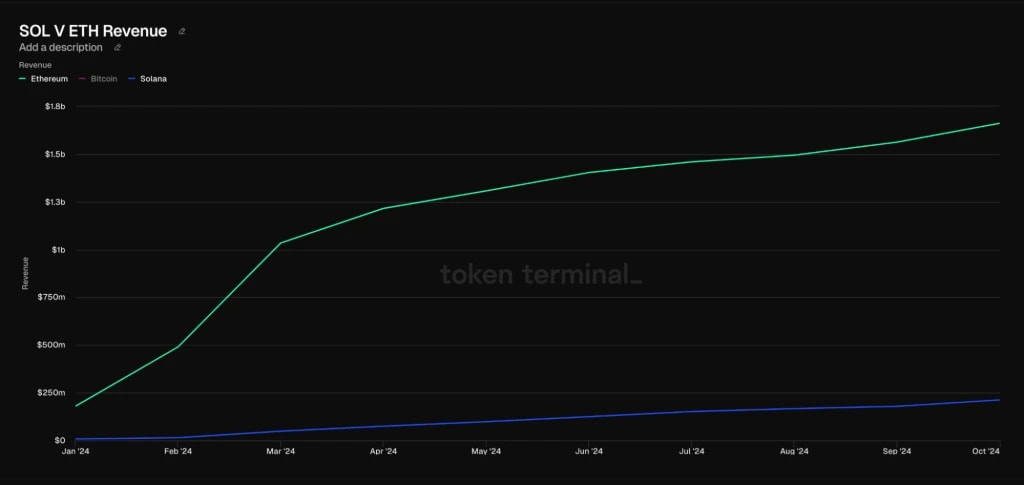

Ethereum’s setup is all about scarcity. EIP-1559 introduced a burn mechanism that removes a chunk of ETH from circulation with each transaction. With an issuance rate hovering between 0.5%-1% per year, Ethereum has the potential to go fully deflationary when network usage spikes. This isn’t just a technical detail; it makes ETH an asset that holds and grows in value over time, a digital store of value that serious investors and institutions can trust to hold their ground. They’re thinking in decades, not just the next cycle, and Ethereum’s deflationary mechanics align with that mindset.The numbers tell the story. Since EIP-1559, Ethereum’s revenue jumped from $46.433 million to a whopping $12.461 billion—a serious 26,736.52% increase. That’s not just hype; it’s solid demand, and it makes Ethereum a foundation for those who value predictability and security. Every transaction adds to that scarcity, cementing Ethereum as a go-to for anyone playing the long game.

Solana: high inflation for high throughput

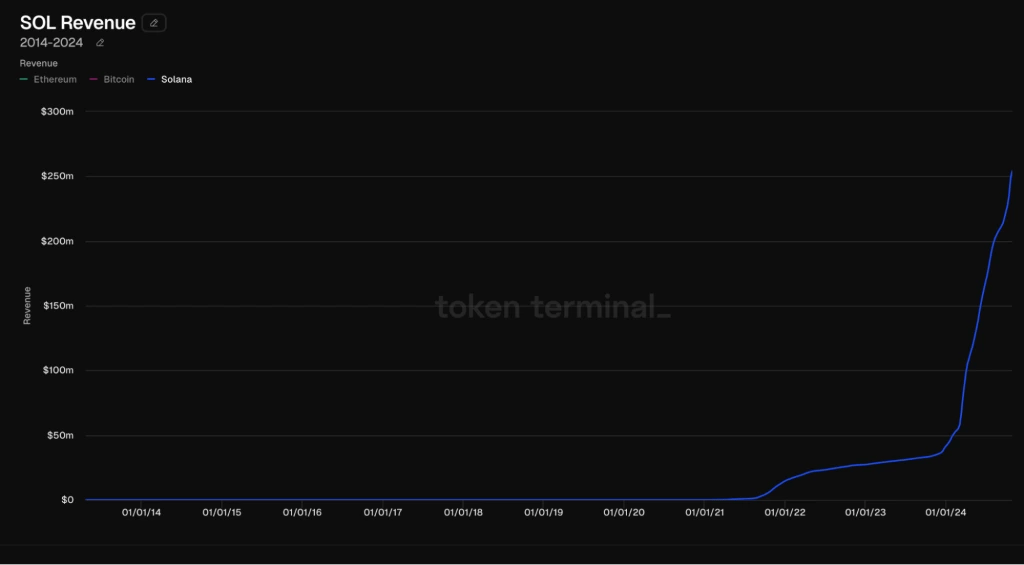

Solana plays an entirely different game. With a high inflation rate of around 6-8% per year, Solana isn’t focused on scarcity—it’s built for growth and scale. This inflation fuels the network’s high-speed, low-cost model, ensuring fees stay affordable and the network remains accessible. It’s like the blockchain version of a social media app, built to keep users engaged and constantly moving. The inflation rate is set to taper off to a long-term target of 1.5%, but that’s way down the road. Right now, Solana’s all about high throughput and accessibility.Revenue growth reflects this retail-first approach. Solana’s revenue surged from $1.168 million to $252.537 million—a 21,521.32% increase. It’s nowhere near Ethereum’s numbers, but it’s enough to keep Solana’s high-speed machine running. For retail traders dabbling in memes, gaming, and fast DeFi trades, this setup is perfect. They’re not looking to pay $20 for a transaction or wait around; they want in and out, fast and cheap, without sacrificing usability.

You can see Solana’s revenue acceleration compared to Ethereum’s, which has been steadily growing since the EIP-1559 upgrade. This alone speaks to the psychology at play. Think about it: the cycle begins, memes start to kick off, and it’s an opportunity to fulfil that instant gratification desire, so revenue explodes for SOL. Keep this in mind as we go deeper.

Adoption breakdown

Adoption is often the clearest signal of a network’s success and potential longevity. Both Ethereum and Solana have built distinctive ecosystems tailored to different audiences, driving adoption through unique Dapp offerings, developer communities, transaction volumes, and user experiences. Here’s how each network stacks up and why their differing approaches appeal to different types of investors.Dapps and developers

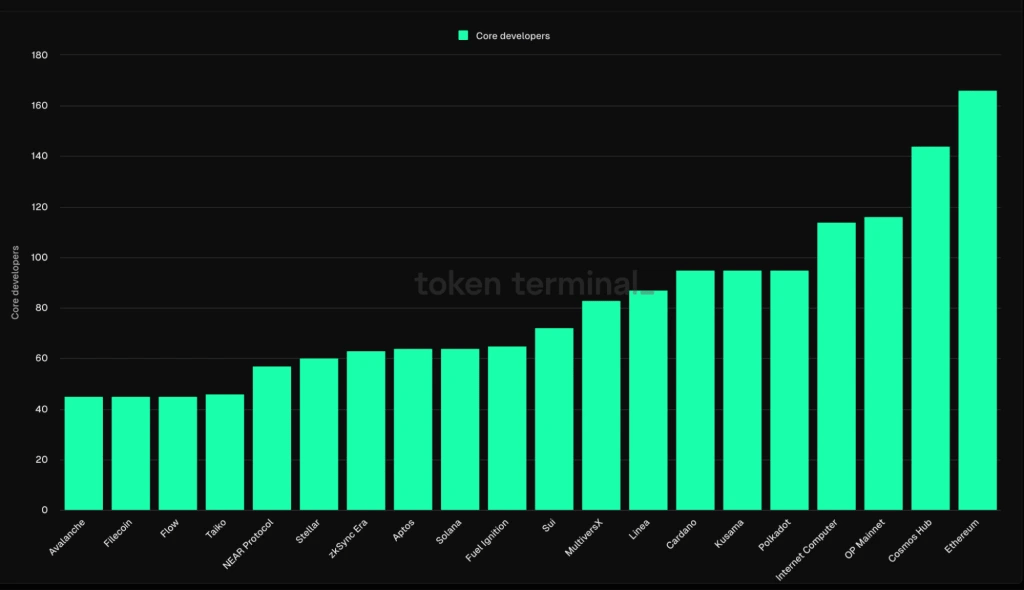

Ethereum’s status is backed by real institutional interests such as BlackRock, UBS, Sony, Samsung, CoinBase, and Stripe. Take BlackRock, for example. The world’s largest asset manager is looking at Ethereum as the place to tokenize real-world assets—think about stocks, real estate, and bonds on the blockchain; this is becoming a very real conversation. This move speaks volumes. Ethereum’s mature ecosystem, deep developer community, and serious decentralisation make it an ideal candidate for these large-scale, institutional-grade projects. The modular, secure architecture that Ethereum offers is exactly what asset managers need—a stable, long-term platform that can handle high-value assets with full transparency and security.

Then there’s the sheer volume of Dapps on Ethereum, which reflects its dominance. Ethereum has the biggest, most active developer community in the game, with thousands of Dapps spanning DeFi, asset management, and complex financial services. This isn’t just a retail playground—Ethereum has established itself as the backbone of DeFi, where projects needing real security and decentralisation can operate without compromise. For institutions, the size and credibility of Ethereum’s Dapp ecosystem cement its place as the network for serious, high-value projects to thrive.

On the other hand, Solana’s Dapp ecosystem is a different beast altogether. While it’s growing fast, it’s nowhere near Ethereum in terms of scale, diversity, or complexity. Solana’s Dapps are built with a retail-first mindset, focusing on speed, low fees, and user-friendly experiences. This is where you’ll find gaming apps, meme-driven projects, and social tools that are designed for high engagement, not heavy-duty finance. Solana’s setup is all about accessibility and cheap transactions, leaning into its fast, single-layer architecture. It’s perfect for high-volume retail activities but doesn’t bring the institutional-level security that Ethereum is built on.

This contrast in dapp volume and focus makes it clear: Ethereum and Solana are each carving out their own lane. Ethereum’s finance-heavy ecosystem is the go-to for long-term, sophisticated players who need security, stability, and a solid foundation for high-stakes projects. Financial heavyweights like BlackRock backing Ethereum for tokenizing real-world assets only strengthen its role as the backbone for serious financial applications. Solana, on the other hand, is making its mark with the retail crowd, appealing to users who want quick, easy access to high-energy, interactive apps without worrying about complex layers or security models. Each network is built for a different crowd and a different purpose.

Total Value Locked (TVL)

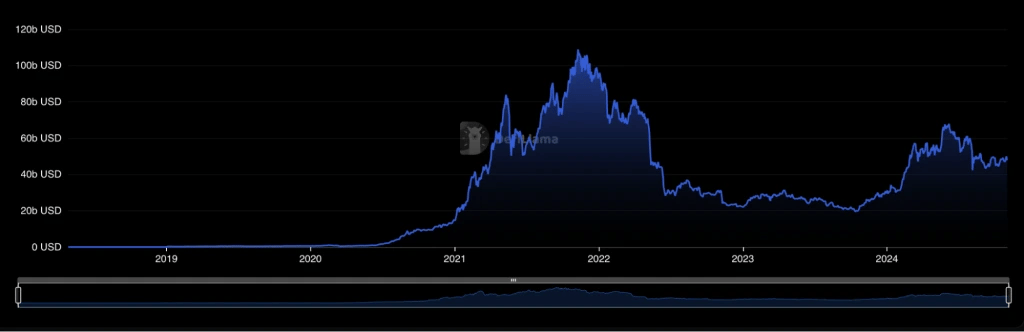

TVL, or Total Value Locked, is a measure of the capital within a network’s DeFi ecosystem, reflecting the trust and commitment of users. Ethereum leads TVL by a significant margin, which signals a strong, stable ecosystem that has earned the confidence of serious investors. A high TVL indicates that large amounts of money are being securely managed within Ethereum’s network, reinforcing its position as a reliable platform for financial applications. High TVL also signifies that users, institutions, and big investors see Ethereum as a place to park their capital long-term, reflecting its value as a stable and trusted environment. ETH TVL(main net alone) sits at around $47.96b

Solana’s TVL is lower but growing steadily. This reflects its retail-focused user base, who may not be committing large amounts of capital but are more active in using the network for smaller, frequent transactions. The steady growth in TVL indicates that Solana’s approach is working for the audience it’s attracting, even if it’s not competing directly with Ethereum in the high-value DeFi space. SOL TVL sits around $6.22b

![]()

The big picture: Who each network attracts

As a result of their tech, tokenomics, and culture, these two blockchains pull in completely different types of people, and that’s what shapes their whole story. Each chain speaks to a unique crowd with its own values, goals, and mindset.The sophisticated long-term investor – “Smart Money”

This crowd is made up of long-term, strategic investors—what people often call “smart money.” They’re not interested in quick wins or daily price swings; they’re all about assets that have real value and stability. For them, investing is about security, scarcity, and a sustainable future. They’re looking for networks with long-term growth potential, revenue-generating setups, and models that protect value over time. This group wants assets they can stack and hold, knowing they’re building toward something solid that’ll grow and appreciate in the years ahead.Ethereum’s built for the “smart money”—institutions, serious investors, and long-term thinkers. They’re not put off by the L1 and L2 complexity; they see it as a feature that ensures security and scalability. They’re looking at Ethereum as a foundation for high-stakes, large-scale finance. For the ones who value resilience and sustainability, Ethereum’s layered structure is a match with their long-term perspective.

The retail trader – “Dumb Money”

Then there’s the retail crowd—the so-called “dumb money.” This group isn’t just driven by the idea of making money fast; it’s fueled by a need to keep up, to prove something, to win in a game where they feel constantly outpaced. It’s emotional, raw, and often rooted in envy and social comparison. Every time they open their phones, they’re hit with reminders of people who seem to be winning at life—flashy lifestyles, success stories, luxury splashed across Instagram and TikTok. It creates this relentless itch to catch up, to close the gap, and to do it fast.So they dive in headfirst, hunting for quick profits without a plan. Strategy? Patience? Forget it. They’re chasing trends, jumping into whatever’s hot that day—meme coins, hype plays, you name it. For them, investing isn’t about building long-term; it’s about trying to flip a quick win, feeling that rush. With trading apps and social media sitting side-by-side on the same phone, they’re in a constant loop of emotional influence and impulsive action, letting hype and FOMO guide their every move.

Solana is the perfect setup for retail. It’s the TikTok or Netflix of blockchain—fast, simple, and accessible. For the retail crowd, it’s all about getting quick access to Dapps, meme coins, and trading without any friction. They’re not interested in dealing with layers or technical steps. For them, Solana’s simplicity and speed make it the ideal fit for quick wins and fast trades.

Cryptonary’s take

In this first part, we've dissected the unique architectures, user bases, and core philosophies driving Ethereum and Solana. As we've seen, Ethereum aligns with those who seek long-term stability and value preservation, while Solana’s high-speed, accessible model appeals to retail investors looking for quick trades and lower fees.In Part 2, we'll go beyond the surface and dive into actionable strategies tailored to each blockchain. Whether you're leaning toward Ethereum's steady growth or Solana’s fast-paced dynamics, we’ll provide insights on how to position yourself to capitalise on these assets' distinct advantages. Stay tuned—there’s much more to explore as we outline how to play each of these assets from an investor's perspective.