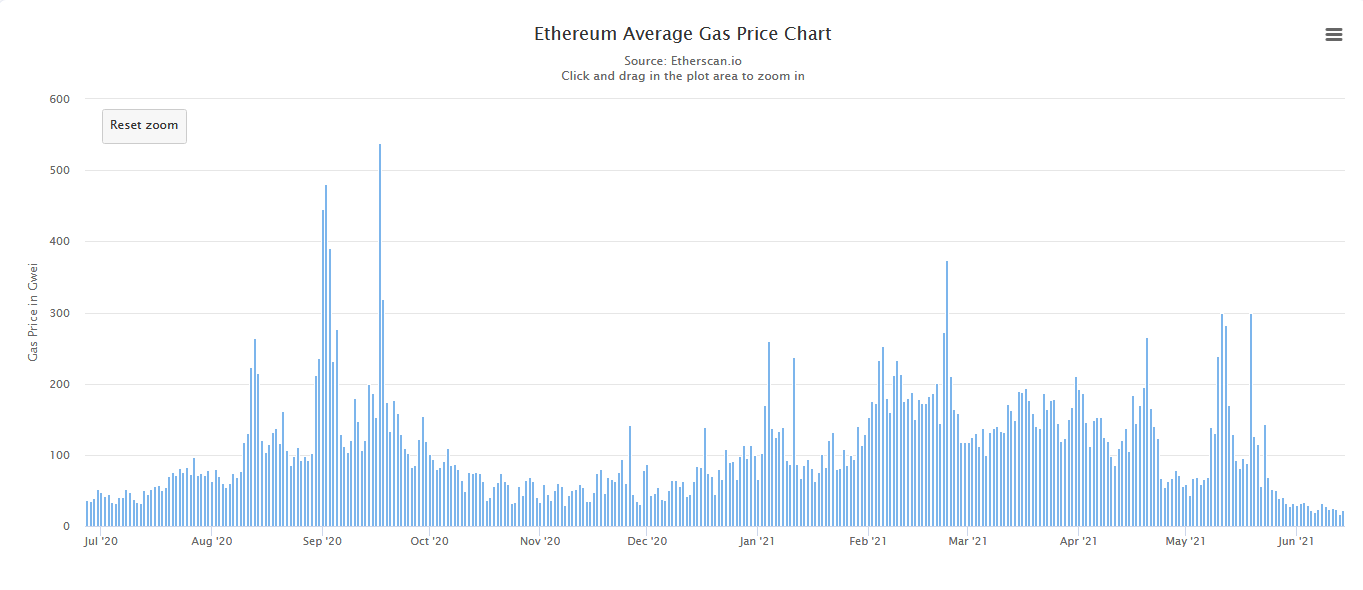

The Ethereum blockchain is suffering from the shortcomings of PoW, caused in part by the explosion of DeFi over the last year. Congestion reached a climax in May with some smart contract transactions costing hundreds of dollars and smaller investors being completely priced out as a result.

Although ETH2.0 is on the horizon, there are several solutions available now that drastically improve Ethereum’s scalability. Layer 2 solutions have been a hot topic recently with many protocols attracted by the huge improvements in transaction speeds and costs. In this report we’ll have a look at some of the statistics, and discuss what L2 means for Ethereum and DeFi.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Introduction

Layer 2 solutions are gradually lifting the load on the Ethereum network. Gas prices are currently at the lowest levels in months, with an additional USD cost reduction caused by the price drop of ETH. This is mainly caused by reduced activity on Ethereum; however, a fair portion of the reduced gas price has to do with Ethereum L2 solutions.

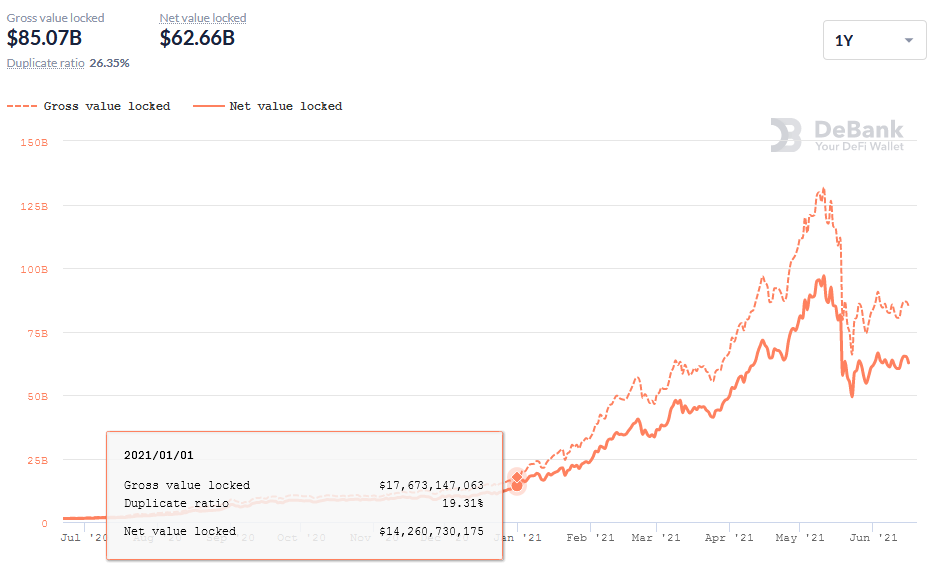

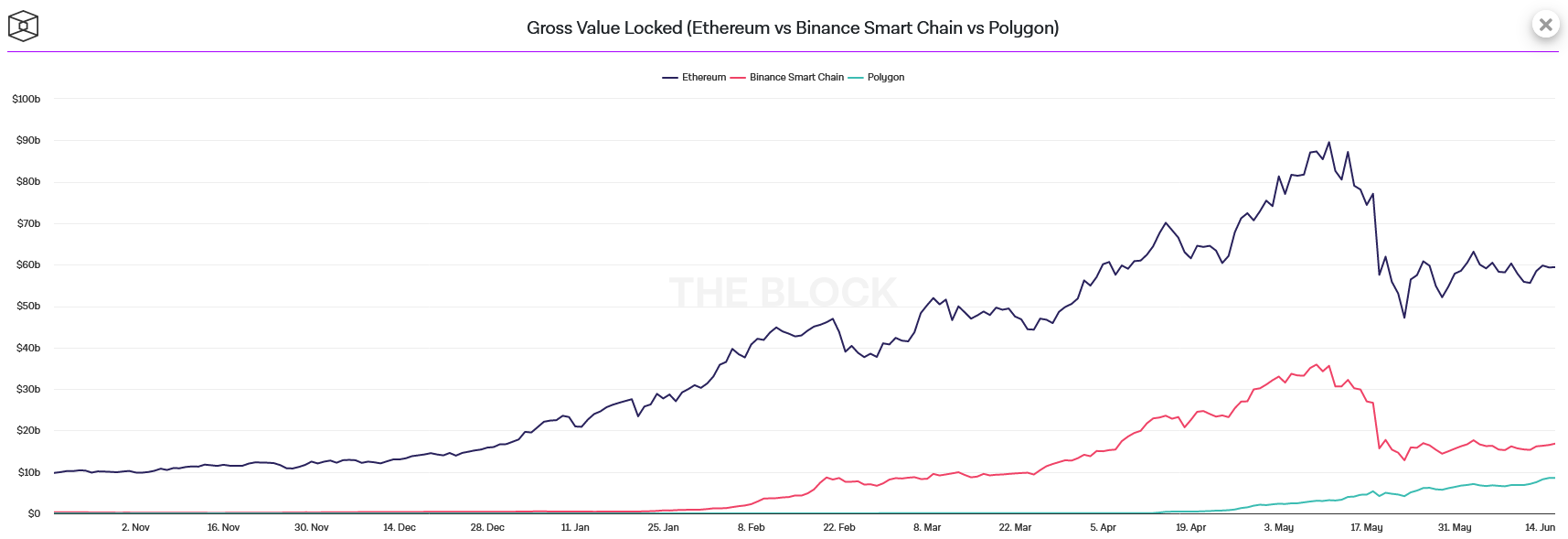

The correction in May caused a 30-40% run on the DeFi Total Value Locked (TVL), mirroring losses in the wider crypto market. However, TVL is still up over 430% since the start of the year and we would expect this number to recover and surpass the previous all-time high quite quickly once a market-wide recovery is takes place.

Despite the recent lower gas prices protocols are still moving over to Layer 2 solutions in their droves. L2 solutions such as Polygon are rapidly becoming more mainstream, facilitating further growth of the DeFi sector through faster and cheaper transactions and smart contract executions.

We have already covered how the various L2 solutions function in this report, so let’s look at some of the statistics for Layer 2 solutions (using Polygon as an example) and how they are affecting the DeFi economy.

Polygon

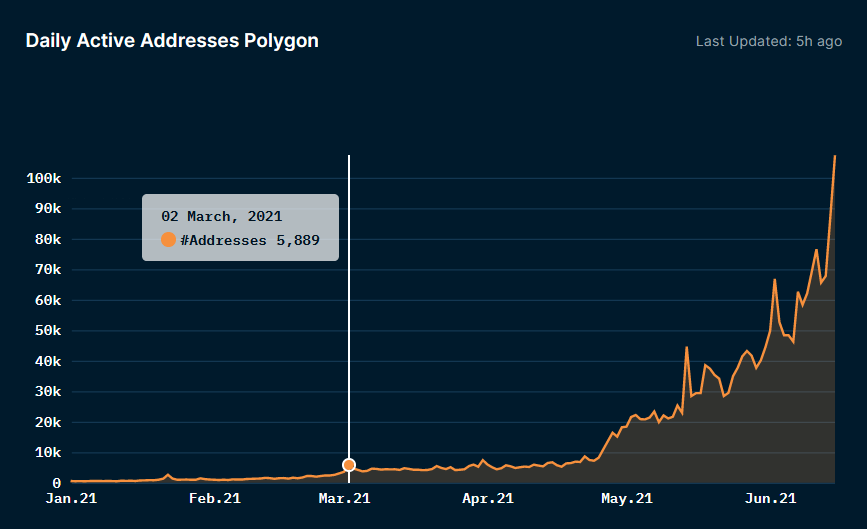

Polygon is becoming one of the most popular L2 solutions for Ethereum. It is hard to ignore the hype surrounding MATIC, and in this case the hype is backed up with tangible evidence. The number of active Polygon addresses has increased exponentially in the last couple of months with no sign of slowing down.

Polygon is becoming one of the most popular L2 solutions for Ethereum. It is hard to ignore the hype surrounding MATIC, and in this case the hype is backed up with tangible evidence. The number of active Polygon addresses has increased exponentially in the last couple of months with no sign of slowing down.

Users

Polygon, like other L2 solutions, has contributed to opening up DeFi to those with smaller accounts. Before the recent reduction in gas prices a standard smart contract execution on an Ethereum DApp cost upwards of $100. This priced out most investors as the only way to justify this cost was if the fee was negligible compared to the value of funds being moved (thousands of dollars’ worth).

It is important to note that Polygon is not replacing Ethereum; it is merely handling traffic that would otherwise be on the Ethereum base layer. Thus, Polygon reduces congestion on the Ethereum network, whilst simultaneously lowering the entry requirements for smaller investors to use DeFi.

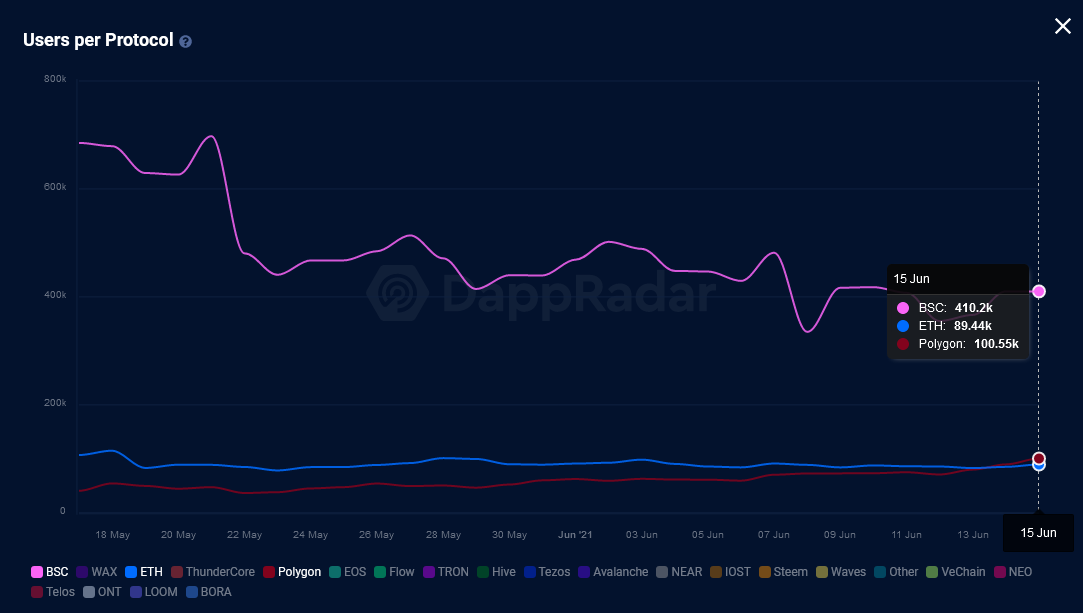

Active wallets using DApps in the last 30 days has surpassed the number for Ethereum, showing that there is high demand for this cost effective solution to congestion on the Ethereum blockchain.

Transactions & Fees

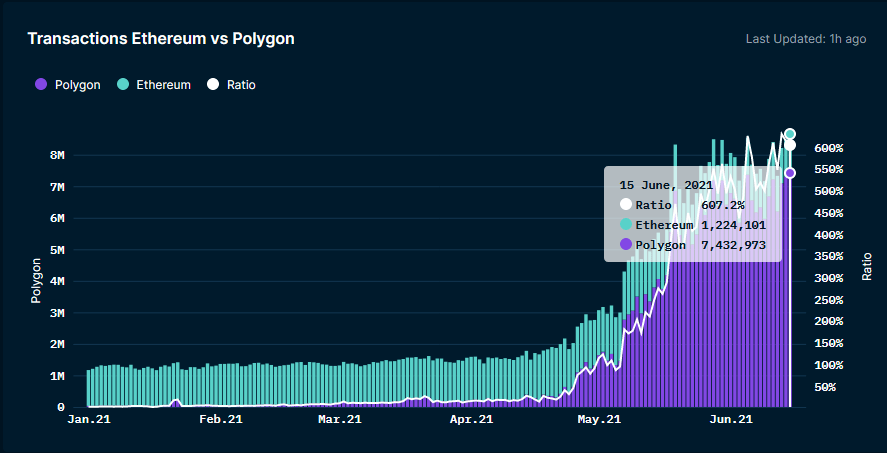

Transactions handled through Polygon have surpassed those on Ethereum by a staggering amount. Granted, a lot of these are micro-transactions; however, these figures cannot be ignored - it shouldn’t cost $6-7 to claim $1 worth of staking rewards if that is what the user wants to do.

These figures show that retail traders and investors are taking full advantage the cheap costs of using Polygon.

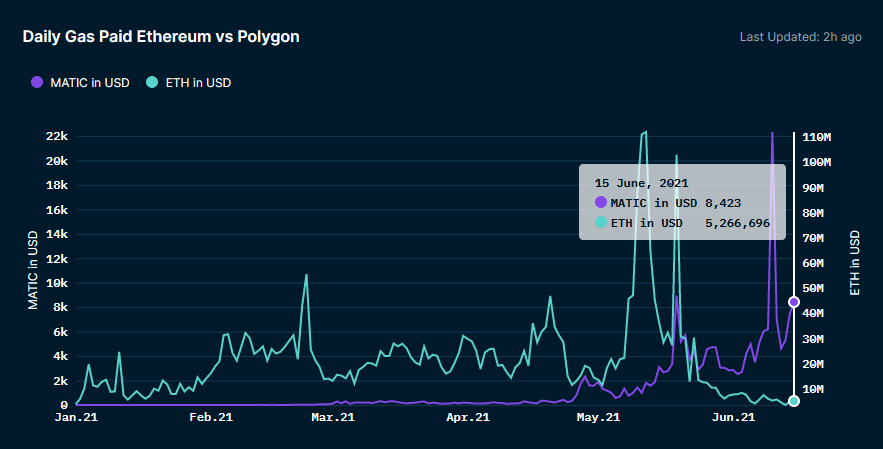

Observing the total gas fees paid on Ethereum compared to the fees paid on Polygon it is easy to see why the solution is so attractive for users. Simply put, Polygon is handling 7 times the transactions of Ethereum for less than 0.2% the cost. This efficiency really adds up for high-frequency traders and smaller investors.

Value Locked

Looking at Gross Value Locked (GVL) statistics we can see that Polygon has seen steady growth that was almost unphased by the mid-May correction. This trend will likely continue going forward into the second half of 2021, right up until ETH2.0 is launched.

The recent price action of the MATIC token has also benefitted from the exponential increase of users and transactions. Polygon never set out to replace or compete with Ethereum. Instead, it has succeeded in scaling it, and has taken advantage of the dominating effect that Ethereum has over other projects that have set out to replace it.

Aave & SushiSwap Migrations

There is an ever-growing list of DeFi protocols migrating to Polygon take advantage of its extremely cheap fees and high speed. Aave and SushiSwap are two prime examples of this migration.

For some context, Aave is a decentralised lending protocol built on Ethereum that allows users to borrow (or lend) a large range of crypto assets and stablecoins. With a TVL of over $12 billion it is one of the largest DeFi protocols. SushiSwap is a decentralised exchange, also built on Ethereum, with an average trading volume of over $200m per day.

Both of these protocols benefit greatly from reduced transaction costs and higher speeds. For example, since SushiSwap is an exchange it becomes far more attractive to potential users if the fees are as low as possible and orders are executed quickly.

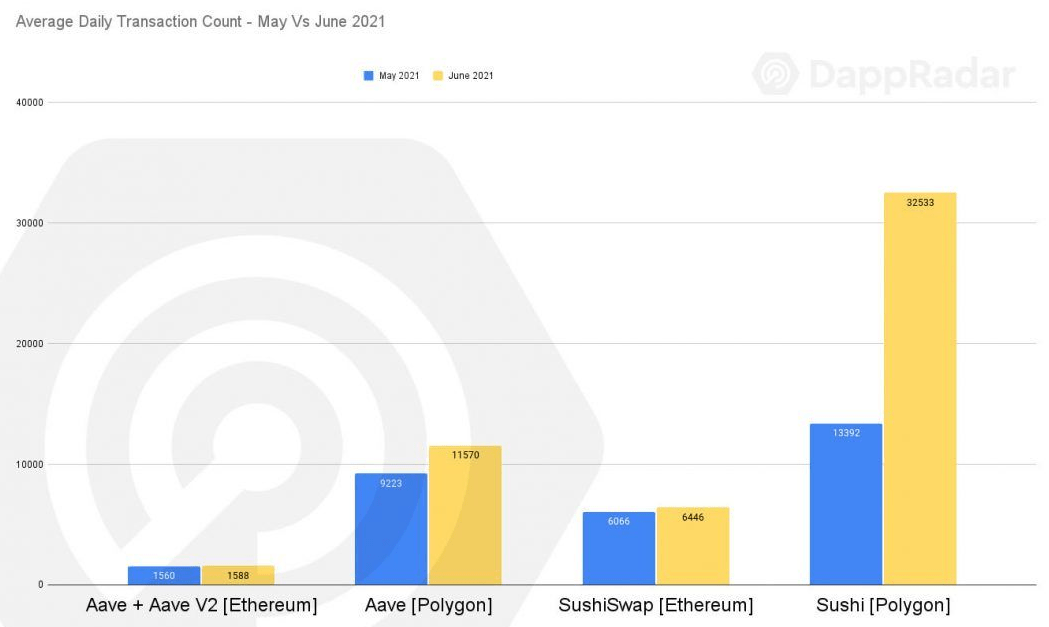

Aave and SushiSwap have both registered more transactions on the Polygon sidechain than their Ethereum base layer counterparts. It should also be noted that in the transaction count above that the numbers for June are only for the first half of the month.

Statistics show that SushiSwap on Ethereum Layer 1 still handles more transactional volume, when measured in USD value, than its Polygon counterpart. This indicates that whales still prefer to use the Ethereum base layer, which makes sense as Ethereum is more secure and trusted, and gas fees are negligible for those with tens of thousands of dollars in capital.

Discussion

The current state of DeFi on Ethereum L1 is not sustainable for all but the wealthiest users. The introduction of ETH2.0 will scale Ethereum for the future; however ETH2.0 is not likely to be rolled out until some point in 2022.The key takeaway is that unlike projects labelled as “Ethereum Killers”, L2 solutions actually complement the Ethereum network rather than compete with it. Currently these solutions have a kind of placeholder role relieving the pressure on the Ethereum network. Another benefit of L2 is that they will be completely interoperable with ETH2.0, scaling the already impressive improvements that the Ethereum upgrade will bring.

An interesting theory is that Layer 2 solutions could well be a catalyst for another DeFi Summer in 2021 due to the massive improvements they bring in terms of transactions speed, cost, and user experience in general. The exponential increase of active wallets using Polygon could be an early indicator of this being the case.

Layer 2 undoubtedly makes Ethereum more accessible to retail investors. We believe that the crypto market is in a super-cycle, and this would pave the way for massive amounts of capital to flow in to DeFi. Additionally, it is obvious to us that DeFi is extremely undervalued and essentially still in its infancy. Just as in traditional finance, productive assets are the key to growing sustainable wealth as they lead to passive income – the earlier these assets are accumulated, the greater the future returns.