Ethereum update: Is the Pectra upgrade going to be a game-changer?

Ethereum has faced doubt at every stage of its evolution, yet it continues to drive the industry forward. As the market questions its future, ongoing upgrades and on-chain metrics signal a blockchain that's far from slowing down. Is Ethereum being underestimated once again? Let's dive in…

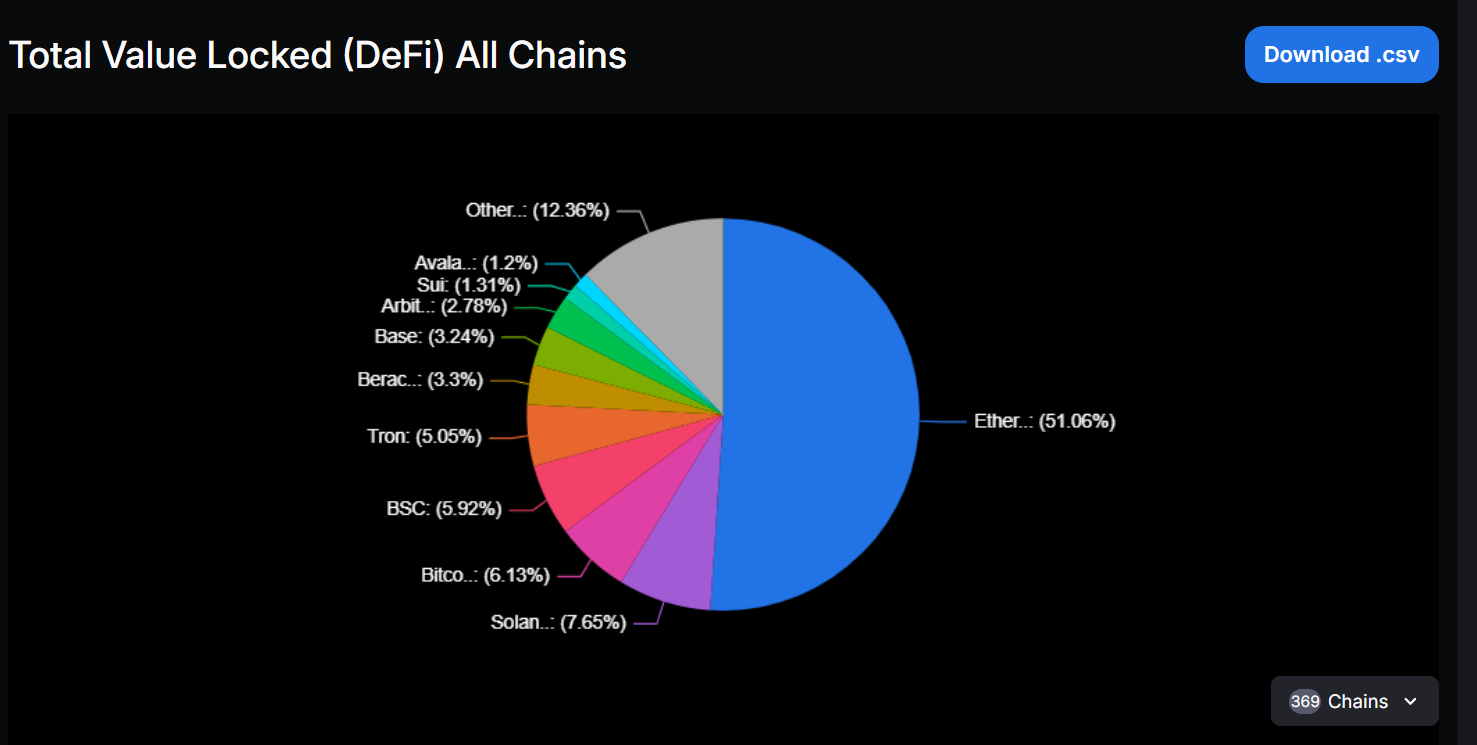

Despite the prevailing bearish sentiment, Ethereum remains the backbone of the blockchain industry, driving DeFi, decentralised exchanges, and the stablecoin economy. While short-term market narratives cast doubt, a closer look at the numbers and ongoing developments tells a different story. With over 50% of DeFi's total value locked (TVL), leading DEX volumes, and unmatched tokenised asset activity, Ethereum's role is as dominant as ever.

This report will break down Ethereum's position across key sectors, its growing market influence, and the impact of the upcoming Pectra upgrade. More than just a routine update, Pectra introduces critical improvements to staking, transaction efficiency, and user experience - strengthening Ethereum's long-term appeal for both developers and investors.

As the market questions Ethereum's trajectory, we examine whether this scepticism is warranted or if Ethereum is once again being underestimated.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Ethereum's market position

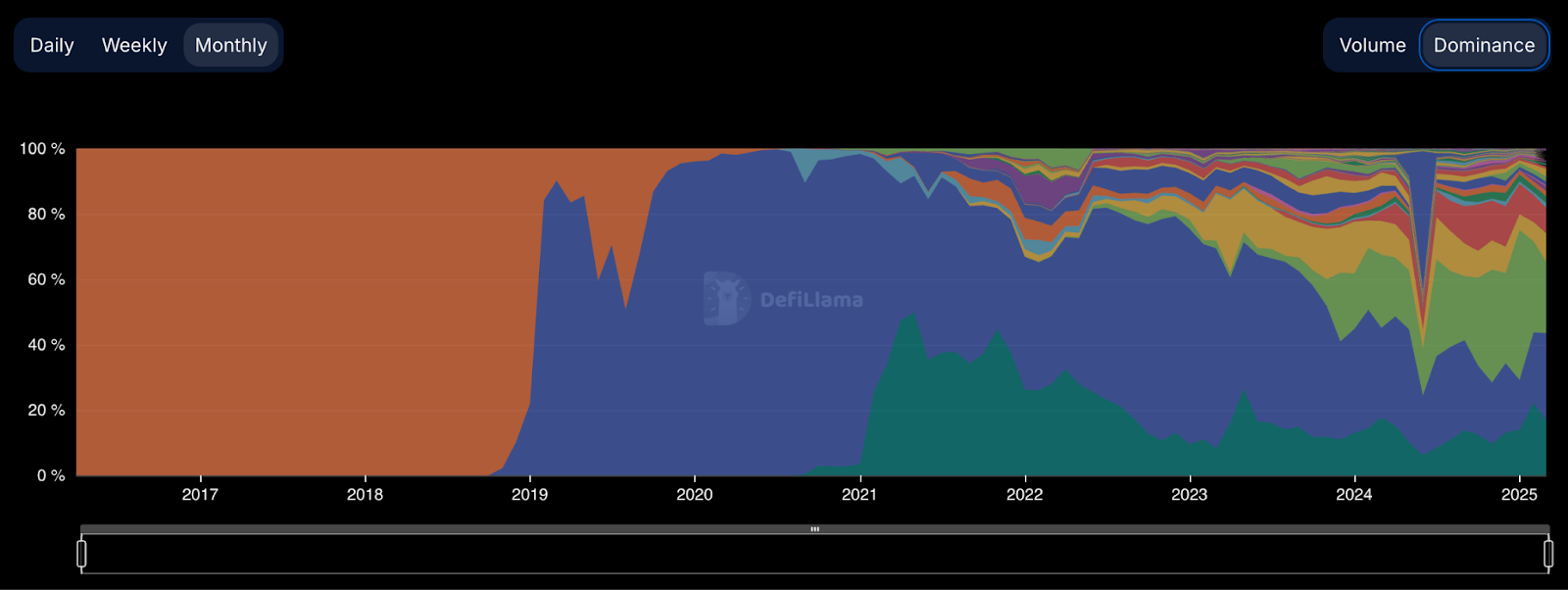

Let's start from the top. Ethereum continues to be the centrepiece of DeFi's infrastructure, commanding 51.06% of the total value locked on-chain. There is no second best. This dominance underscores the continued trust of developers, liquidity providers, and institutional players who rely on Ethereum's security and infrastructure to power decentralised finance.Even though, in the last few years, it lost some market share, its influence extends deeply into decentralised exchanges (DEXs), where it accounts for 26.77% of total trading volume as of March 2025.

As the go-to chain for secure, on-chain trading, Ethereum remains a critical hub for liquidity and financial applications, reinforcing its role as the primary settlement layer for crypto markets.

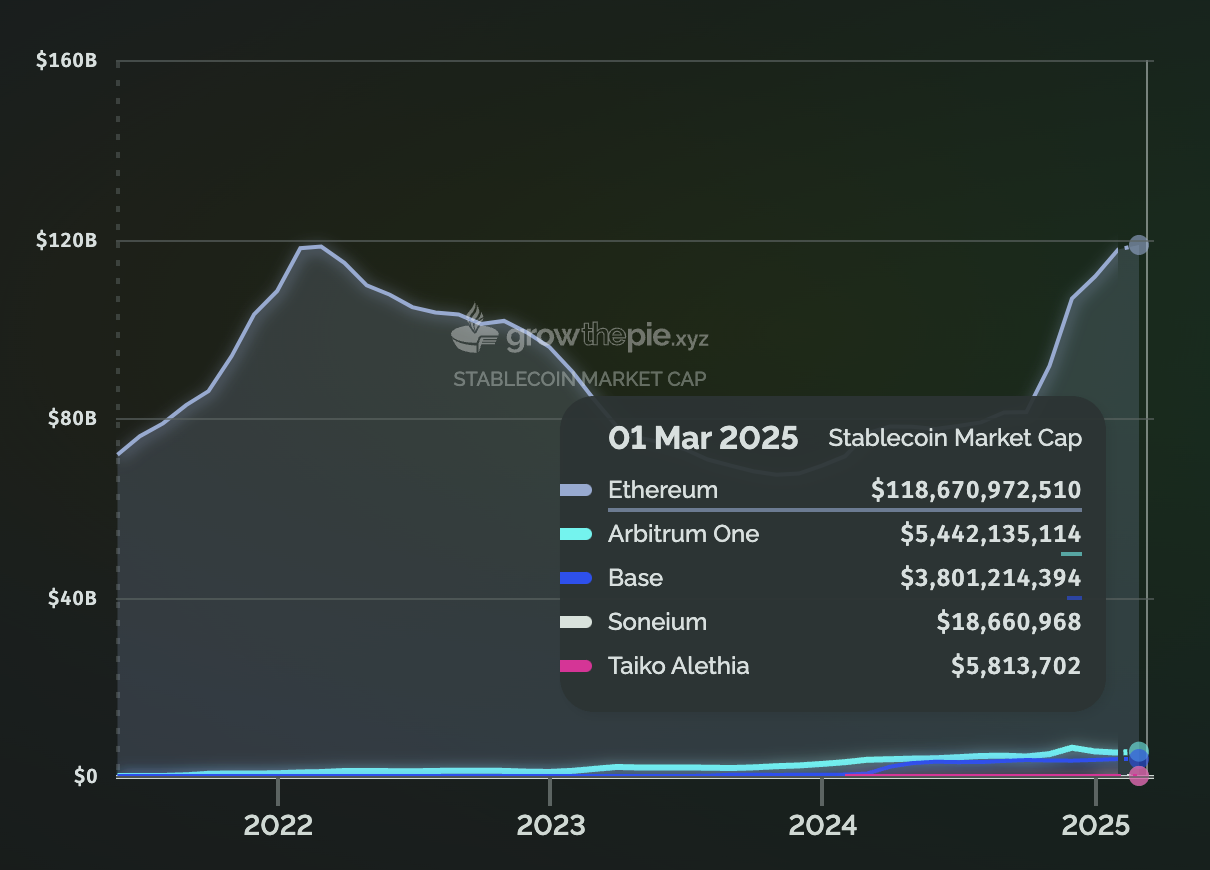

Ethereum's architecture is also the foundation of the stablecoin market, securing $132 billion of the total $224 billion market cap - far surpassing any other chain.

Whether facilitating USDC transactions or supporting niche algorithmic stablecoins, Ethereum remains the preferred network for issuing and transacting stable-value assets, making it indispensable to global crypto liquidity.

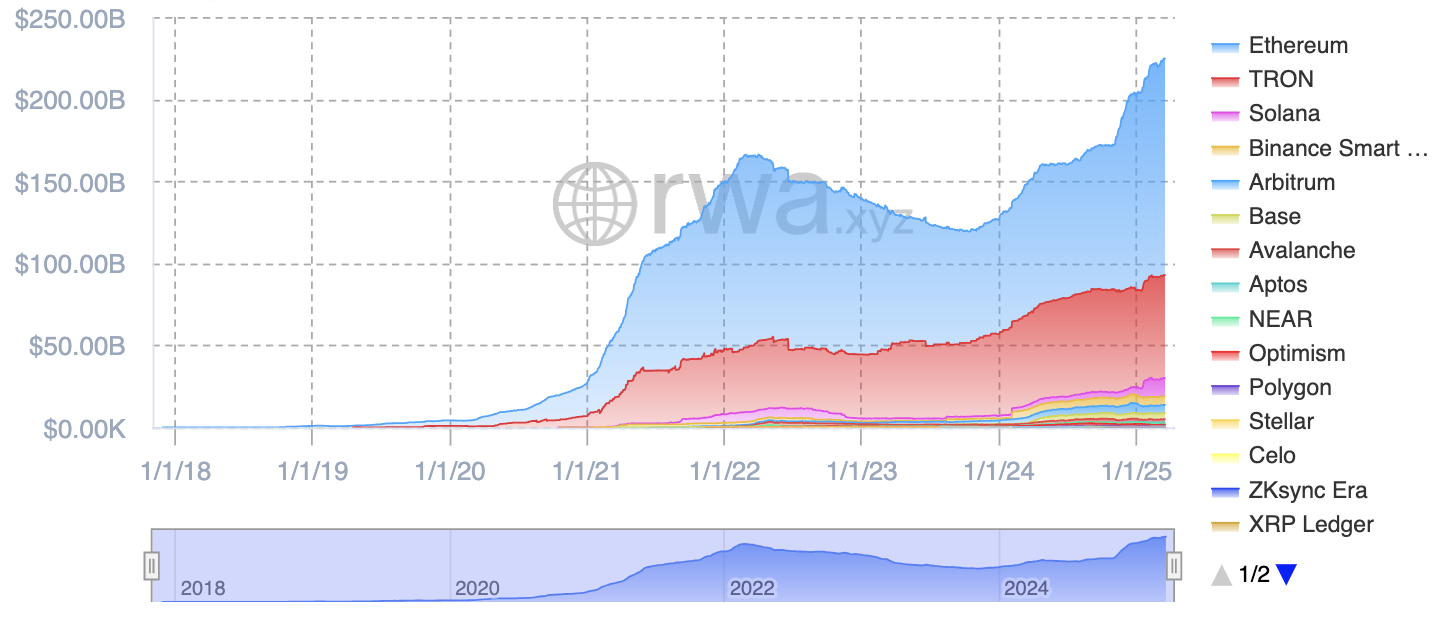

Beyond DeFi and stablecoins, Ethereum's infrastructure leads in tokenised real-world assets (RWAs). The network hosts $3.1 billion of the total $4.55 billion in tokenised treasuries and almost the entire tokenized commodities market, securing $1.23 billion of the $1.24 billion market cap.

These numbers highlight Ethereum's role as the preferred blockchain for institutional-grade assets, proving its ability to support high-value, regulated financial instruments.

Layer 2s

Layer-2 scaling solutions (L2s) have been a cornerstone of Ethereum's vision of modular scaling in the last few years. Let's have a look on how are they performing as it can present a more accurate picture of what is going on the Ethereum-land.Surge in L2 engagement

Data highlights an impressive growth in the Layer 2 sector over the last years, with active addresses reaching upwards of 8.18 million, showcasing expansion as these solutions provide efficient transaction solutions and reduced gas fees. Particularly, platforms like Base and Arbitrum have seen substantial user activity and are leaders in the L2 race.

Most L2s are now cheaper and faster than alternative solutions like Avalanche or Solana. However, despite massive growth, L2s still remain a very fragile solution in terms of security. Most of the L2s are akin to centralised custodies due to weak security designs and centralisation.

However, we need to admit, the Ethereum ecosystem has scaled, L2 vision is playing out exactly as it was outlined in their roadmap, and users are enjoying cheap and fast transactions on L2s. But does that mean it's all smooth sailing? Not quite…

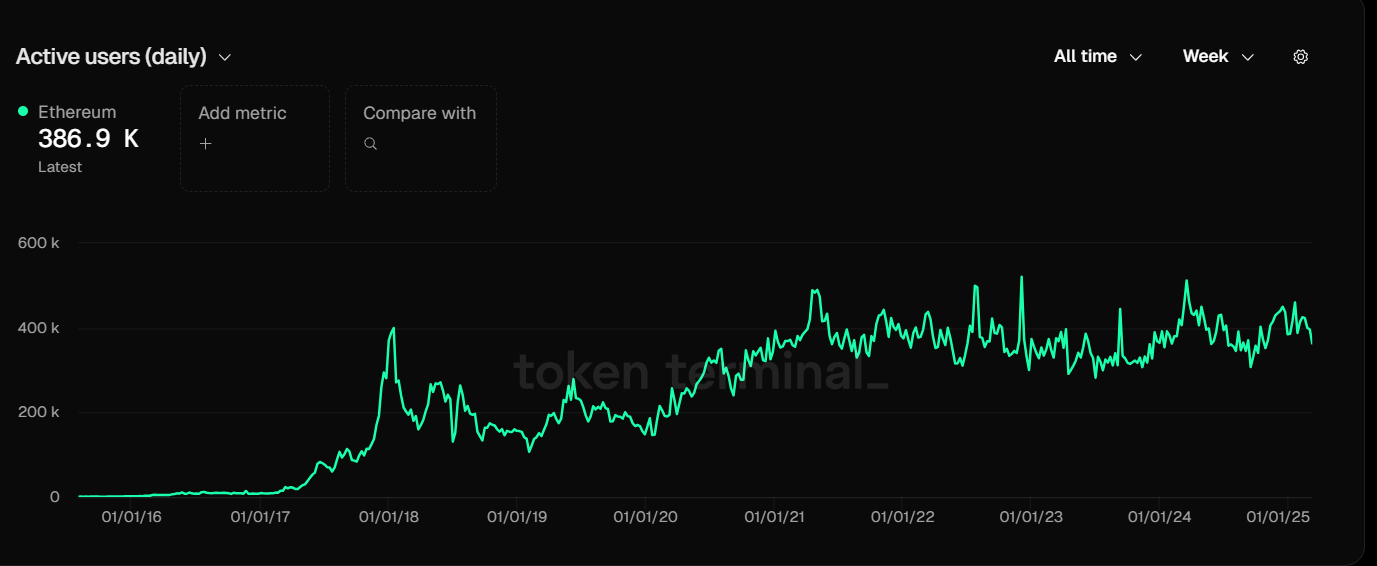

Ethereum's L1 stagnation

In contrast, Ethereum's main layer has not mirrored this expansive trend. With approximately 1.87 million active addresses, averaging around 400k users daily. It shows that while the main layer retains a substantial user base, it is not experiencing the growth seen in Layer 2 environments and is stagnating.This indicates that existing users are staying within the ecosystem, but it's unable to attract new users due to limited scalability, poor UX and high gas fees.

RWA and stablecoin dynamics

Interestingly, despite the stagnation in user growth on L1, it remains a predominant platform for Real World Assets (RWA) and stablecoins. The stablecoin market cap on Ethereum's L1 is significantly higher, sitting at around $120 million, compared to just $10 million on L2 platforms.This discrepancy points to a continued trust and preference for Ethereum's main layer when it comes to more substantial financial operations and RWA engagements, likely due to its established security and decentralized nature.

This contrast between user activity on L2s and real capital concentration on L1 highlights a key trend - while day-to-day transactions are moving to L2s, serious capital still trusts Ethereum's base layer.

The fact that RWAs, stablecoins, and institutional-grade assets remain heavily anchored on L1 underscores its role as the settlement layer for high-value operations. However, Ethereum Mainnet still faces a lot of challenges, and many users simply don't like using the Mainnet when there are better alternatives like Solana or L2s

The Pectra upgrade could be pivotal to solving this, making Ethereum's L1 more efficient without compromising the security that keeps major financial activity rooted there.

With the Pectra upgrade set to improve scalability, efficiency, and staking mechanics, Ethereum is positioned to solidify its lead and redefine how users interact with blockchain. Let's now dive into what the upgrade is all about!

The Pectra Upgrade

The Pectra upgrade is one of Ethereum's most significant developments to date, introducing key improvements in network efficiency, scalability, and user experience. A new testnet, Hooli, went live on March 17, 2025, with Pectra testing scheduled for March 26, 2025, to finalise preparations.If the Hooli test succeeds, the Mainnet upgrade is expected in late April or early May 2025, with developers finalising the exact date after assessing test results.

Rollout will be phased, and Pectra aims to streamline staking, enhance transaction flexibility and user experience, and lay the foundation for long-term scalability. Here is what is planned:

Phase 1: Immediate Enhancements

EIP-7251 - Increased Max Staking BalanceEIP-7251 increases Ethereum's maximum effective staking balance from 32 ETH to 2,048 ETH per validator, significantly altering how staking is structured. Previously, staking more than 32 ETH required running multiple validator instances, leading to higher network overhead, increased signature processing, and operational inefficiencies.

By allowing larger stakes per validator, this upgrade reduces computational load, simplifies management, and enhances consensus efficiency.

For institutional validators and liquid staking providers, this change is good. Large-scale stakers can now consolidate thousands of validators into fewer instances, lowering gas fees, infrastructure costs, and signature processing demands per epoch.

Liquid staking protocols like Lido and Rocket Pool benefit from easier validator scaling, making reward distribution and staking operations more efficient. Along with this, the recent filings for Staked Ethereum ETFs and its potential approval in 2025 are bullish for ETH, and the upgrade is timely for institutional players.

However, this shift also introduces centralisation risks. Fewer validators controlling larger stakes could increase the influence of institutional entities, potentially reducing network decentralisation. While solo stakers remain unaffected, EIP-7251 optimises staking efficiency but comes with trade-offs, requiring ongoing monitoring to prevent excessive control by large entities.

EIP-7702 - Account Abstraction

This is one of our favourite changes about this upgrade as it aims to reduce user friction when interacting with Ethereum and drastically improve the UX. Here is how:

- Paying Gas with any ERC-20 Tokens: Allows users to pay gas fees with tokens like USDC instead of ETH. Users don't need to hold ETH specifically for gas, making Ethereum more accessible, especially for newcomers who might only hold stablecoins or other tokens when first making their transactions.

- Third-Party Fee Sponsorship: This mimics a subsidised experience, as users can interact with Ethereum without paying gas directly. For example, a gaming dApp might cover gas to onboard new players, enhancing user adoption. Remember people complaining about high gas fees? Now, it can be outsourced, keeping the UX frictionless.

- Bundled Transactions: Account abstraction allows multiple actions (e.g., approving a token and executing a swap) to be batched into a single transaction. It reduces the number of times a user pays gas, lowering the perceived cost of interacting with Ethereum. Solana and other non-EVM chains enjoy fewer clicks per user, which was the main argument for the bad experience on EVM land. Now, this will be changed.

EIP-6110 - On-chain validator deposit processing

EIP-6110 streamlines validator deposits by shifting their processing from the beacon chain to the execution layer, significantly reducing activation delays. Currently, validator deposits undergo a multi-step process where execution layer transactions must be manually included by beacon chain proposers, causing wait times of several hours before activation.

By integrating deposits directly into execution blocks, EIP-6110 eliminates dependency on consensus-layer polling, reducing activation time significantly. This upgrade not only enhances Ethereum's staking infrastructure but also makes the validator onboarding process more predictable and efficient.

Faster activation ensures better network responsiveness, benefiting solo stakers, institutional validators, and liquid staking providers alike. While EIP-7702 was about improving the UX of users, EIP-6110 improves the UX of validators.

Phase 2: Long-term scalability & efficiency

In the second phase of the Pectra upgrade, Ethereum introduces critical enhancements that focus on long-term scalability and network efficiency, which are essential for maintaining Ethereum's competitiveness in the blockchain space. Warning, very technical…PeerDAS (Peer Data Availability Sampling):

- PeerDAS is designed to enhance data availability and reliability, a fundamental aspect for the successful operation of Layer-2 rollups. This upgrade is a preparatory step towards more comprehensive sharding solutions expected in future Ethereum updates.

- By improving data handling capabilities, PeerDAS ensures that information is more accessible and verifiable across the network, which is crucial for maintaining high security and functionality as the network scales.

- Replacing the older Merkle Patricia Trees (primarily used to store the blockchain's state, transaction data, and receipts) with Verkle Trees, this update significantly reduces the state size on the Ethereum blockchain.

- The reduction in state size facilitates faster transaction verification and also aids in the transition towards stateless clients. This shift is expected to lower the hardware requirements for validators, potentially increasing network decentralisation by allowing more participants to run nodes.

Why the Pectra upgrade matters

The Pectra upgrade is a major step forward for Ethereum, bringing improvements in scalability, security, and user experience. It's designed to enhance Ethereum's core infrastructure for the long-term evolution of the network. From validator upgrades to better transaction handling, these changes make Ethereum more efficient, accessible, and future-ready.Scalability & security: Strengthening Ethereum's foundation

By increasing validator flexibility and introducing account abstraction, Ethereum is streamlining its operations to make staking easier and transactions more flexible. These improvements make Ethereum more attractive to institutional players and enterprise adoption. As demand for blockchain infrastructure grows, Ethereum's ability to scale efficiently will be key to maintaining its dominance.A More Developer-Friendly Ecosystem

Ethereum is making it easier than ever to build on the network. With programmable externally owned accounts, improved cryptographic efficiency, and higher data throughput, developers can create more complex and efficient applications without friction. Whether it's DeFi, gaming, or tokenised assets, Ethereum's more versatile development environment is set to attract a broader range of builders.A thriving developer ecosystem leads to new applications, more innovation, and increased adoption-all of which add to Ethereum's long-term value.

Better UX = Higher adoption

For everyday users, Pectra makes interacting with Ethereum simpler and more flexible. Features like paying gas fees in tokens other than ETH or automating transactions improve accessibility, removing one of the biggest pain points for newcomers.A smoother, more user-friendly experience encourages more people to engage with Ethereum, boosting network activity and security.

The UX has been the pain point of the Ethereum mainnet and the broader EVM ecosystem for years. This upgrade can be a game changer in terms of bringing more user friendly blockchain experience and increasing adoption.

Future-Proofing Ethereum: Preparing for What's Next

Blockchain adoption is growing, countries and institutions have never been more bullish on blockchain technology, and Ethereum needs to stay ahead of rising demand. Pectra's focus on scalability, transaction efficiency, and validator optimisation ensures that the network can handle more users, more applications, and larger-scale operations without performance trade-offs.With technical advancements aligning with potential regulatory tailwinds, Ethereum is setting itself up for sustained growth and broader adoption. However, price hasn't been catching up with the latest developments, let's examine the price action more closely.

Technical analysis

On the weekly timeframe, Ethereum broke below long-term trendline support in the first week of March, alongside a key breakdown below the $2,132 level, a major historical support. This move also led to a loss of the 200 EMA on the weekly chart, a critical level that previously acted as a strong support zone.Looking ahead, downside support sits around the $1,550 region, a level where buyers have historically stepped in. On the upside, Ethereum faces multiple resistance levels, starting with $2,132, followed by the weekly 200 EMA around $2,300, which also aligns with the broken trendline.

For Ethereum to turn structurally bullish again, it needs to reclaim $2,132, regain strength inside the broken trendline, and establish a base above the 200 EMA on the weekly. Until that happens, $1,600 remains an open downside target.

ETH/BTC pair analysis

Ethereum's performance against Bitcoin has been deteriorating since 2022 when ETH/BTC made a local top around the 0.085 level. Since then, the pair has remained in a clear downtrend, consistently breaking key structures to the downside.

Currently, it is hovering around a crucial 2021 point of interest (POI)-a zone between 0.022 and 0.027, which previously acted as the launchpad for Ethereum's 2021 rally. This region is now acting as major support, and a breakdown below it could accelerate further downside towards the 0.017 - 0.02 range, marking the next significant demand zone.

On the upside, ETH/BTC has multiple levels that need to be reclaimed before any signs of strength emerge. The first major resistance is at 0.03 - 0.031, a demand zone that was recently lost and flipped into resistance.

Beyond this, a more critical level sits at 0.04, which has historically played a pivotal role in ETH/BTC trends. A reclaim of 0.04 would indicate a shift in market dynamics, signalling Ethereum's potential to regain strength against Bitcoin.

At present, ETH/BTC remains weak, with bearish momentum dominating the structure. Whether the current support holds or breaks will determine Ethereum's trajectory relative to Bitcoin in the coming months.

Cryptonarys Take

Ethereum is struggling to attract new users at the L1 level but dominates in capital inflow. Over $120 billion of the $130 billion stablecoin market cap is parked in L1, and it leads in tokenised treasuries and commodities. Institutional money continues to trust its security and liquidity, reinforcing L1 as the go to for DeFi. Yet, despite this strength, L1 user growth has remained stagnant, with transactions failing to surpass previous highs.Meanwhile, L2s have exploded in adoption, effectively scaling Ethereum while diverting direct activity from L1. Arbitrum, Optimism, and Base now collectively host over 8 million active addresses, compared to Ethereum's 1.87 million. This shift shows Ethereum's success in scaling but also highlights that its core layer is losing traction in direct user engagement. Ethereum's main chain still remains primarily a settlement layer rather than an active user hub.

Pectra aims to change this by enhancing L1 usability. Account abstraction (EIP-7702) will allow gas payments in stablecoins as well as gasless transactions, lowering friction for users. Validator improvements will streamline staking, making Ethereum more accessible. If implemented well, these changes could reignite L1 adoption, positioning Ethereum as both a liquidity hub and an active ecosystem for users.

For Ethereum to lead in both capital attraction and user growth, Pectra must be executed flawlessly. If it successfully makes L1 more accessible while maintaining Ethereum's security and liquidity advantages, it could trigger a new era of engagement on the main chain and reignite the Ethereum narrative.

Peace!

Cryptonary's OUT!