Evaluating Thorchain's position and prospects in DeFi

One of our core DeFi bets, THORChain, continues to attract new integrations—and each integration brings new users, whether directly or through a third-party protocol. The key issues facing THORChain boil down to the lack of interest in DeFi generally and the encroachment of other cross-chain comms protocols.

In a multi-chain market, swapping native assets is only part of the story. The cross-comms sector has seen huge developments over the last couple of years, mainly in the "communications" side of things.

That said, there is demand for a battle-tested protocol that can move wealth between chains; that protocol is still THORChain.

Key questions

- What's behind THORChain's (RUNE) underperformance, and how is it adapting to the evolving cross-chain landscape?

- Could a proposed RUNE burn mechanism be the game-changer THORChain needs?

- Is RUNE poised for a significant price movement? Our technical analysis reveals key levels to watch.

- How is Chainflip disrupting the THORChain ecosystem, and what does this mean for THORSwap (THOR)?

- What's our take on FLIP's future, and how does its emissions schedule affect our decision?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

State of THORChain - why the underperformance?

One of the key selling points for THORChain is the liquidity black hole that locks up assets and demands RUNE to back those assets in liquidity pools - which gives RUNE an intrinsic value.

Unfortunately, that liquidity just hasn't flown into THORChain as we anticipated. Why? The critical issue is the increasing popularity of cross-chain messaging infrastructure, like LayerZero and Chainlink's CCIP.

Rather than becoming the top dog in the cross-chain world, THORChain has been relegated to niche swaps between integrated chains; the impact of protocols like LayerZero cannot be ignored.

Relegation to a niche has undoubtedly limited THORChain's potential, but it still has a place. It is still up there with the most trusted and used method of moving wealth between chains, using native assets. Bridging remains the most popular method.

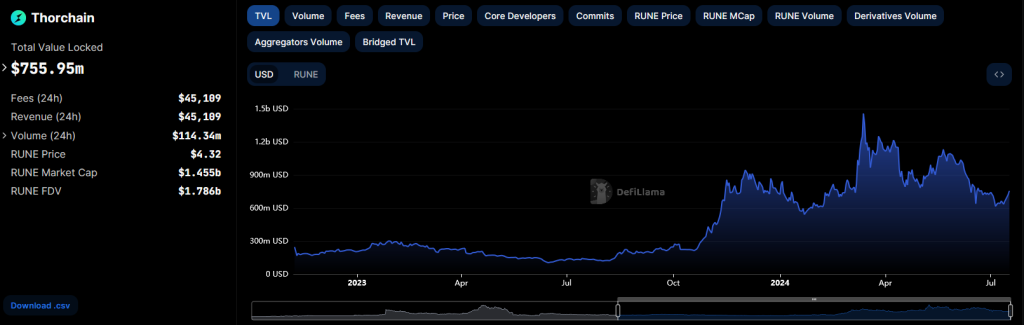

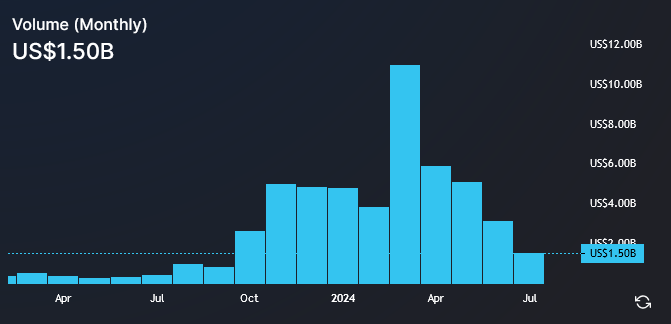

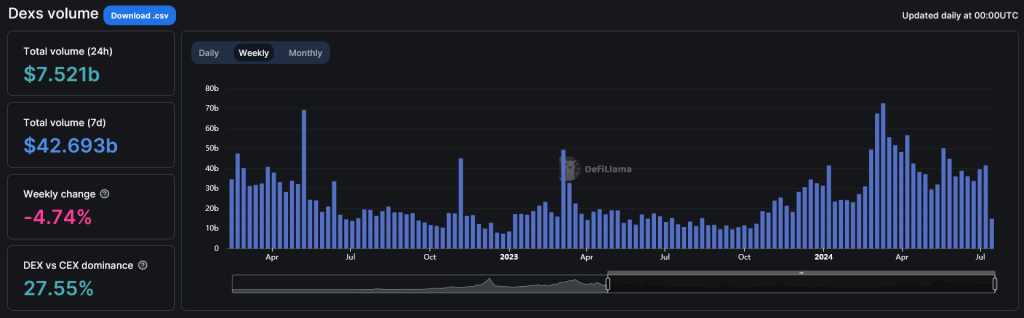

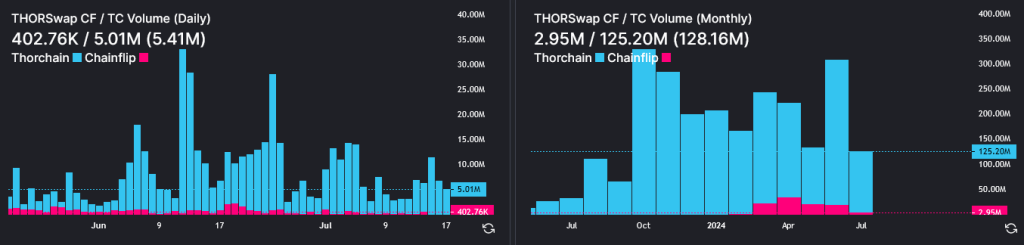

As a DEX, volume is still up compared to last year. However, the decline in the charts is largely in line with the overall decrease in total DEX volumes marketwide.

If we're being honest, the market for DeFi is lagging. Bitcoin has been teetering around previous all-time highs, and DeFi reflects this. The key issue is that many protocols are launching, but fresh capital is not flowing into the market yet.

In essence, the existing capital in the market is only being passed around among the projects; there are many hands in the pie, but the pie is not getting bigger.

But could THORChain find a way to get a bigger slice of the pie?

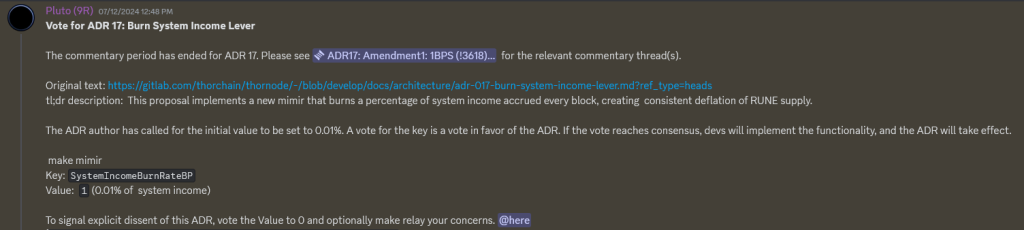

One of the key developments in the pipeworks for THORChain is the proposal to implement a RUNE burn per swap.

Although not yet confirmed, the update will add to RUNE's already deflationary characteristics. Key concerns revolve around the fact that the burn will take away revenue from LPs. Still, the counter-argument is that by burning RUNE, wealth will be more evenly distributed to other stakeholders in the network.

The main beneficiaries will be validators, but it also fixes the ongoing narrative that THORChain lending is overleveraged with insufficient failsafe:

Currently, the lending circuit breaker allows the minting of RUNE if drastic market volatility causes the RUNE price to drop significantly quickly. By giving nodes the option to mint and burn RUNE depending on requirements, the hope is that confidence in the lending system is improved.

It's about providing more options in case of system instability—however unlikely. The proposal is more about boosting confidence in THORFi and giving THORChain another tool under its belt in the event of a black swan event that rocks the market.

Technical analysis (RUNE)

RUNE is holding strong at key levelsRUNE is retesting crucial levels on the larger weekly timeframe, finding significant support at the 200EMA. This indicator is a bullish signal, showing that $RUNE has strong underlying support.

With the broader markets heating up, RUNE looks poised for potential gains, possibly aiming for a run to $11 and beyond. The alignment of these technical factors suggests that RUNE is ready for a bullish move.

Chainflip is rocking the boat

When we first backed THORSwap, the THORChain ecosystem was small. Since then, there have been many additions—new front-ends, wallets, and direct connections to the THORChain infrastructure.One of the most successful additions has been Chainflip, a cross-chain messaging/wallet protocol that uses THORChain to facilitate swapping, amongst other things:

- Chainswap utilises a "JIT" process for swapping to combat MEV.

- Swap requests are subject to bidding rather than just being executed. This means that multiple "executors" see the swap request and submit the best price they can for the swap.

- This removes the opportunity for the front-running bots to extract value, as the bots cannot confirm which pool will be used to fulfil the transaction.

- For larger swaps that would cause significant slippage, market makers can collude to fill the pool as required to reduce potential slippage whilst still profiting from the swap.

The fact that THORYield, the key data aggregator for the THORChain ecosystem, is now tracking THORSwap (TS)/Chainflip (CF) volume is telling. Although the ratio is small, the fact that there is now a direct competitor to THORSwap handling swaps more efficiently is cause for a revision of the THOR thesis.

Although not enough to warrant a complete exit, we'll reduce our exposure to THOR and focus mainly on RUNE as our bet on the THORChain ecosystem.

Are we investing in FLIP?

Short answer - no.FLIP is essentially an incentive token used to fuel the Chainflip infrastructure. As such, its primary function is to be sold by validators.

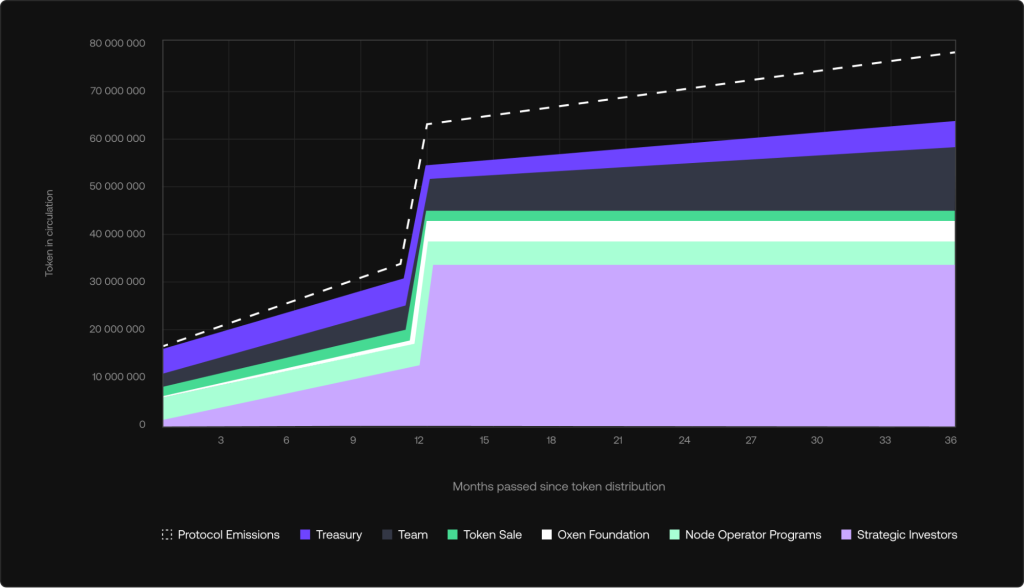

FLIP launched in November, and the emissions schedule is pretty aggressive:

We're approaching a considerable cliff unlock in November, and even with regular emissions between now and November, supply will increase ~100%.

Although not a replacement for THORSwap, Chainflip has come onto the scene and has already taken significant market share within the THORChain ecosystem after just a few months. Generally, we do not have the same conviction in THOR as we once did.

Ultimately, the base protocol handles volume across all THORChain front-ends—for this market segment, we'd instead focus capital on RUNE itself.

Technical analysis (FLIP vs THOR)

THOR is rebounding with renewed strengthTHOR has shown significant strength by bouncing off from a key support area of $0.16, surging more than 35% from this level. THOR is finally gaining momentum after breaking down from its uptrend in April 2024.

It now appears to be heading towards the $0.367 area in the medium term. This rebound suggests a potential recovery phase, making THOR a coin to watch for further bullish developments.

FLIP is breaking out and surging ahead

FLIP seems to be finally breaking out of the downtrend which began in March 2023. In July 2024, FLIP has surged about 50%, rising from $1.20 to $1.80. It is now on its way to test the critical resistance level at $2.26.

If this zone is absorbed, FLIP could make a strong run towards $4.27 in the coming months. The recent bullish momentum is a promising sign for investors, indicating potential for substantial gains ahead.

Cryptonary's take

The original thesis for THORChain was that of an OG cross-chain protocol. As with all new sectors, the tides constantly shift, and innovation happens. LayerZero has specifically changed the game regarding cross-chain comms and continues to do so.Although THORChain is tied to the Cosmos IBC, comparable to LayerZero as a cross-chain messaging service, it is largely limited to Cosmos-based protocols. The intermediary function of the RUNE token and its economic value remains strong, but THORChain simply hasn't captured the expected value.

This is partly a function of DeFi protocols, which are generally underperforming as the attention isn't there. However, the development of competition with more flexible functionality is also a massive factor in the underperformance.

Regarding the THORChain ecosystem and the many tokens launched over the last few years, shifting the focus to RUNE is the key takeaway. We keep using the term "niche" to describe THORChain within the cross-comms sector. But first and foremost, THORChain fulfils the role of a DEX.

The key issues are not so much a lack of innovation as new protocols expand the cross-comms sector's scope.

Three years ago, we would never have imagined the functionality that the cross-chain sector now provides. THORChain is becoming the UNISwap of the industry—but you wouldn't compare UNISwap to Lido; it's an utterly different ballgame.

We've always divided the cross-comms sector into three categories: DEXs, communications (e.g. Polkadot, Cosmos IBC, LayerZero, etc.), and bridges.THORChain remains the leader in cross-chain DEXs, but not everything can be achieved with a simple swap.