Let’s face it, the best time to buy BTC was pre-2017.

It’s still a great asset in your portfolio, but it’s probably never gonna do another 100X.

Yet, each day presents us with the opportunity to get in on ground zero of assets with the potential for exponential multiples.

Now, there is an art and science to picking the winners – and that’s where we shine.

The assets in this report are NOT random!

This is the cheat code for how investors think the market will move in August.

And the best part, we added an extra something in the report to help you spot the outperformers.

Let’s dive in.

TLDR 📃

- Get insights into where investors think the market is headed next month.

- Discover how to spot potential winners.

- Navigate the high-performing sectors, moderate opportunities, and low-potential sectors.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

OK, Cryptonary, what tokens should I buy? 🛒

Like TradFi has different industries and sectors, the crypto market also operates in sectors.

These sectors all perform at different times as the narratives within the market shift and change.

So, to make things easier, we’ve split the assets into three categories

- The performant sectors: you SHOULD expect a significant uptrend in these tokens.

- The meh sectors: you MAY see some uptrend in these tokens.

- The duh sectors: you probably WON’T see an uptrend in these tokens.

Performant sectors 🚀

Investors expect to see the most significant moves in the performant base layers and infrastructure sectors.

Base Layers

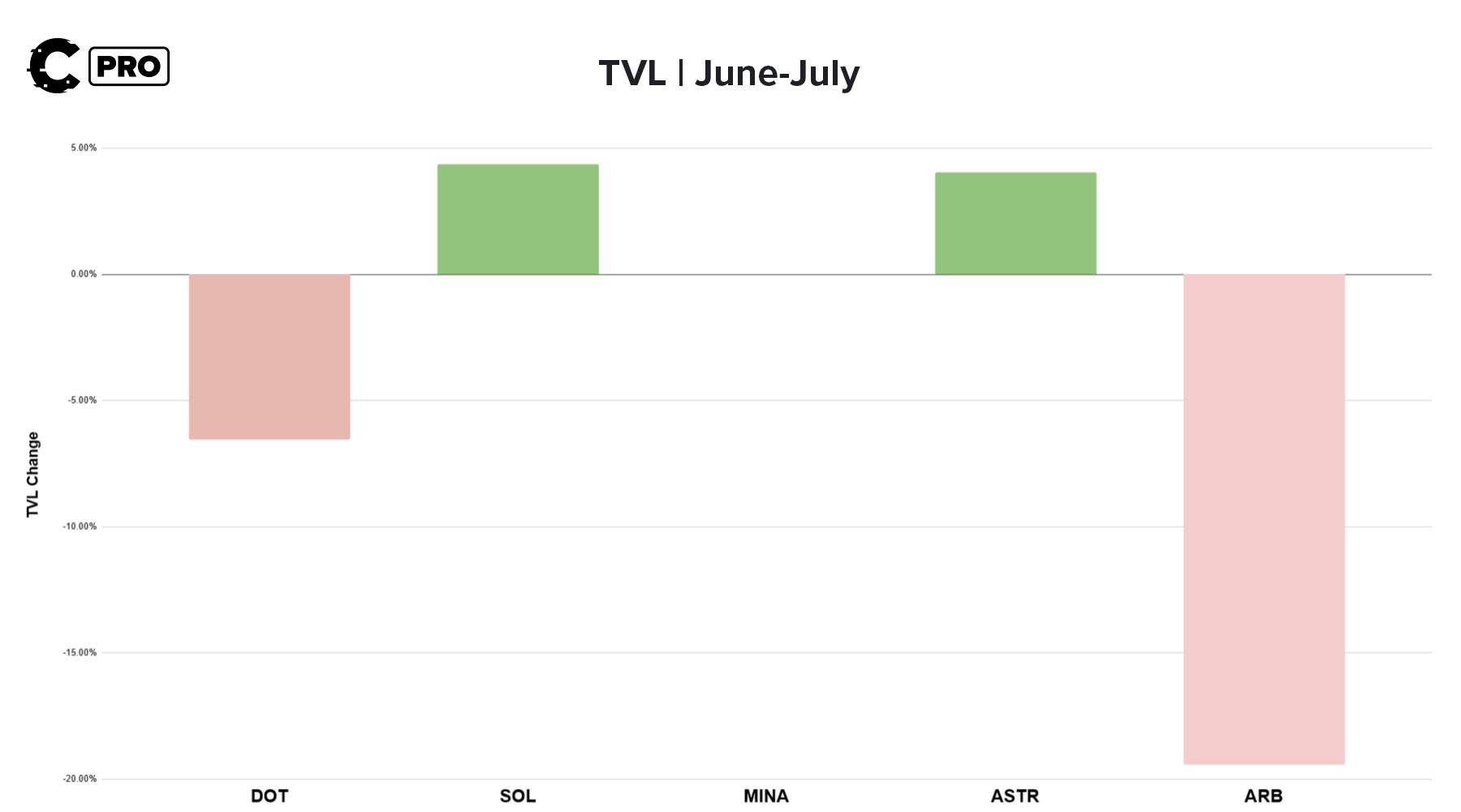

Base Layers provide the bedrock on which everything else in Web3 is built. Our current priority assets in the sector are ARB and SOL.

Arbitrum actually lost $550 million in TVL throughout July. However, considering Arbitrum’s TVL was overcooked, a one-month decline is not a big deal.

Here are the most important updates for the sector:

- Polkadot: Polkadot 1.0 is complete - they have fully realised the roadmap in the whitepaper. However, the protocol is now looking towards Polkadot 2.0.

- Solana: DeFi continues to recover on Solana, with notable TVL growth throughout July. But it’s not out of the woods yet - Solana needs a downpour for a full recovery. For our latest take, click here.

- Mina: The seed has been planted, but the product is taking longer than expected to shoot. However, Zeko, a zk-powered L2 launched on Mina, signals great things ahead.

- Astar: Astar has been working with governments in Asia, that much we know. However, it has also been grinding out partnerships with crypto projects too.

- Arbitrum: The Arbitrum DAO grants program is taking shape - DAO participants have been voting on a milestone to fund the grants program with 3.360 million ARB.

Infrastructure

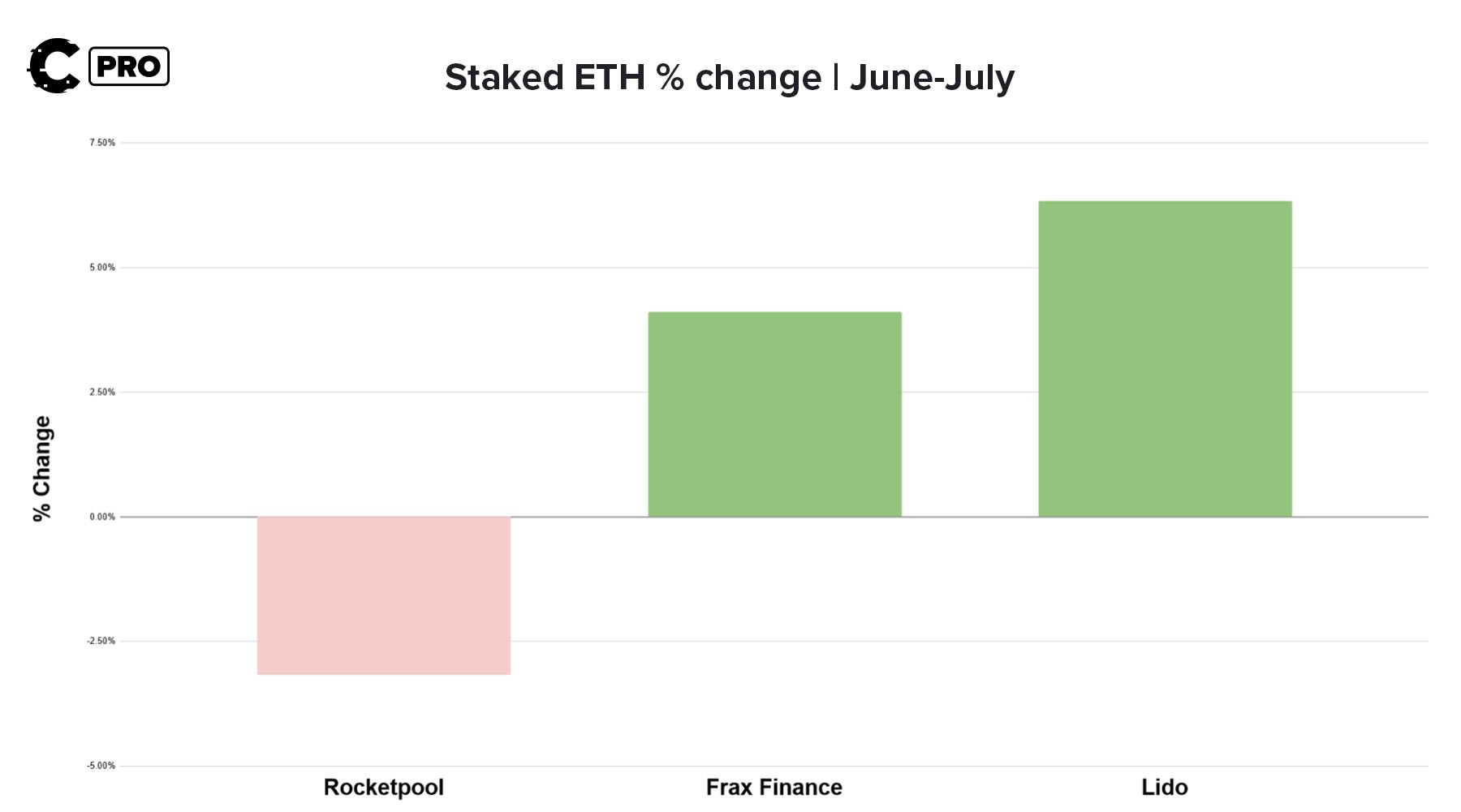

Infrastructure, specifically liquid staking protocols, continues to be the bedrock of DeFi expansion.

The outlier here is RocketPool, which lost 14,750 ETH or 3.17% of the total staked throughout July.

Here’s what’s been happening in the world of crypto infrastructure:

- Lido: Lido DAO recently voted on a snapshot to redefine Lido’s core principles and keep Ethereum as a decentralised, censorship-resistant, and the “value layer” of the internet.

- Frax: The Curve exploit from a couple of weeks ago brought a negative narrative to Frax Finance. The frxETH/ETH was at the risk of being depegged for a while, but the latest analysis shows that Frax had zero exposure or losses.

- RocketPool: Nexus Mutual, a DeFi insurance protocol, has invested $27.3 million (14,000 ETH) into RocketPool’s rETH liquid staking token to diversify Nexus’ capital pools.

Meh sectors 😑

Now, let’s move on to the “Meh” lower-priority sectors.

The cross-chain communication and decentralised exchange sectors are performing well, but the market sentiment isn’t strong enough to trigger explosive moves.

Cross-chain communications

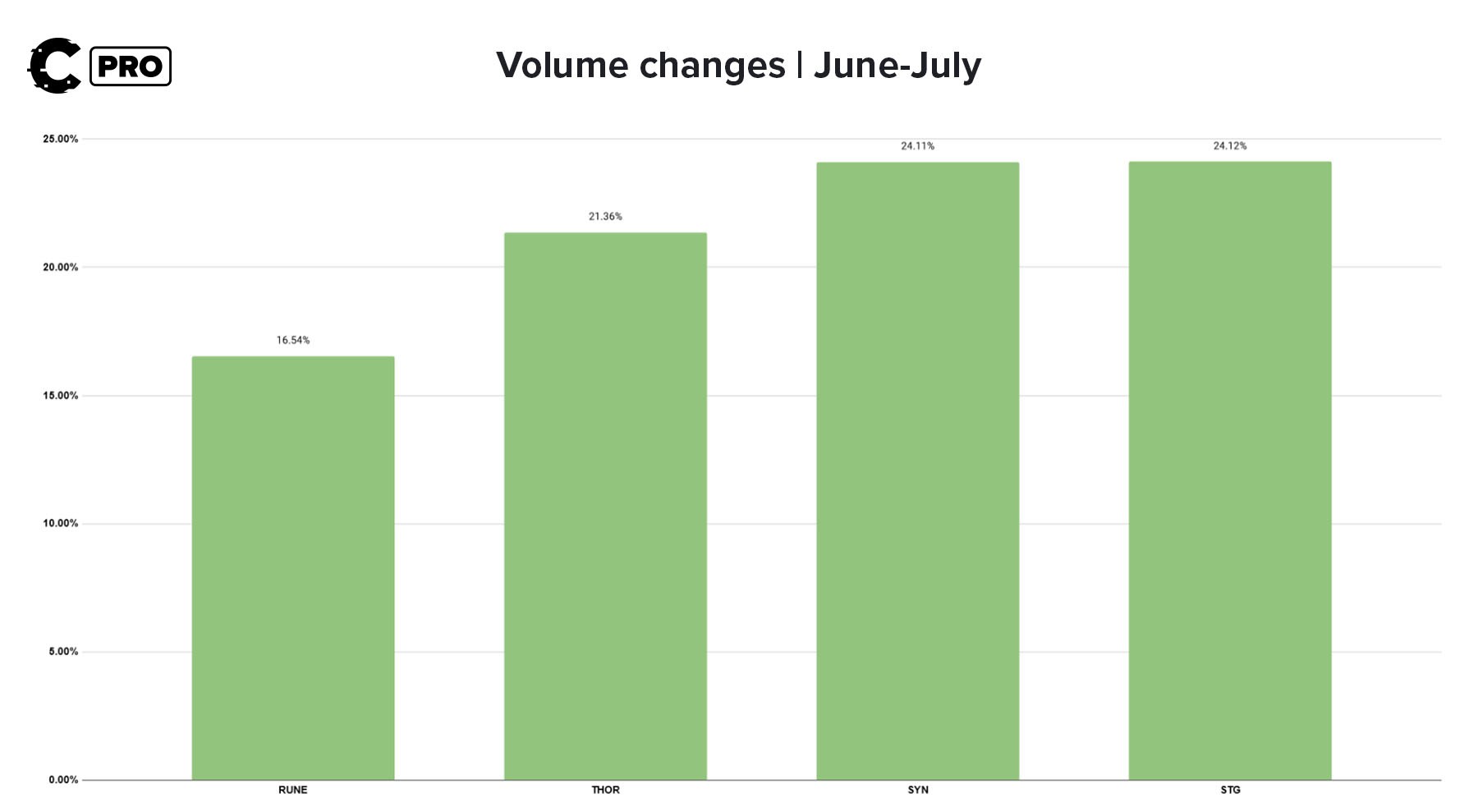

The cross-chain comms sector produced favourable volumes throughout July.

SYN and STG were top performers, and Stargate remains the top dog within the sector.

Although volumes were up in July, this does not mean the cross-chain comms sector is on the road to full recovery. For instance, THORChain and THORSwap volumes are still down over 85% from all-time highs.

Here are the major highlights in cross-chain communications:

- THORChain/THORSwap: The THORChain ecosystem has been working tirelessly to bring additional utility through products like lending and streaming swaps.

- Synapse: is close to the realisation of SynterChain to revolutionise the value accrual model for the SYN token while birthing a whole new Synapse-based cross-chain ecosystem.

- Stargate: is on an ongoing quest to connect all chains with the latest round of asset support aimed at the Fantom ecosystem.

Decentralised exchanges

The beating heart of crypto, decentralised exchanges witnessed an uptick in activity in July as volatility returned with a vengeance after XRP’s glorious win against the SEC.

DEXs are a crucial aspect of DeFi, and they keep getting better:

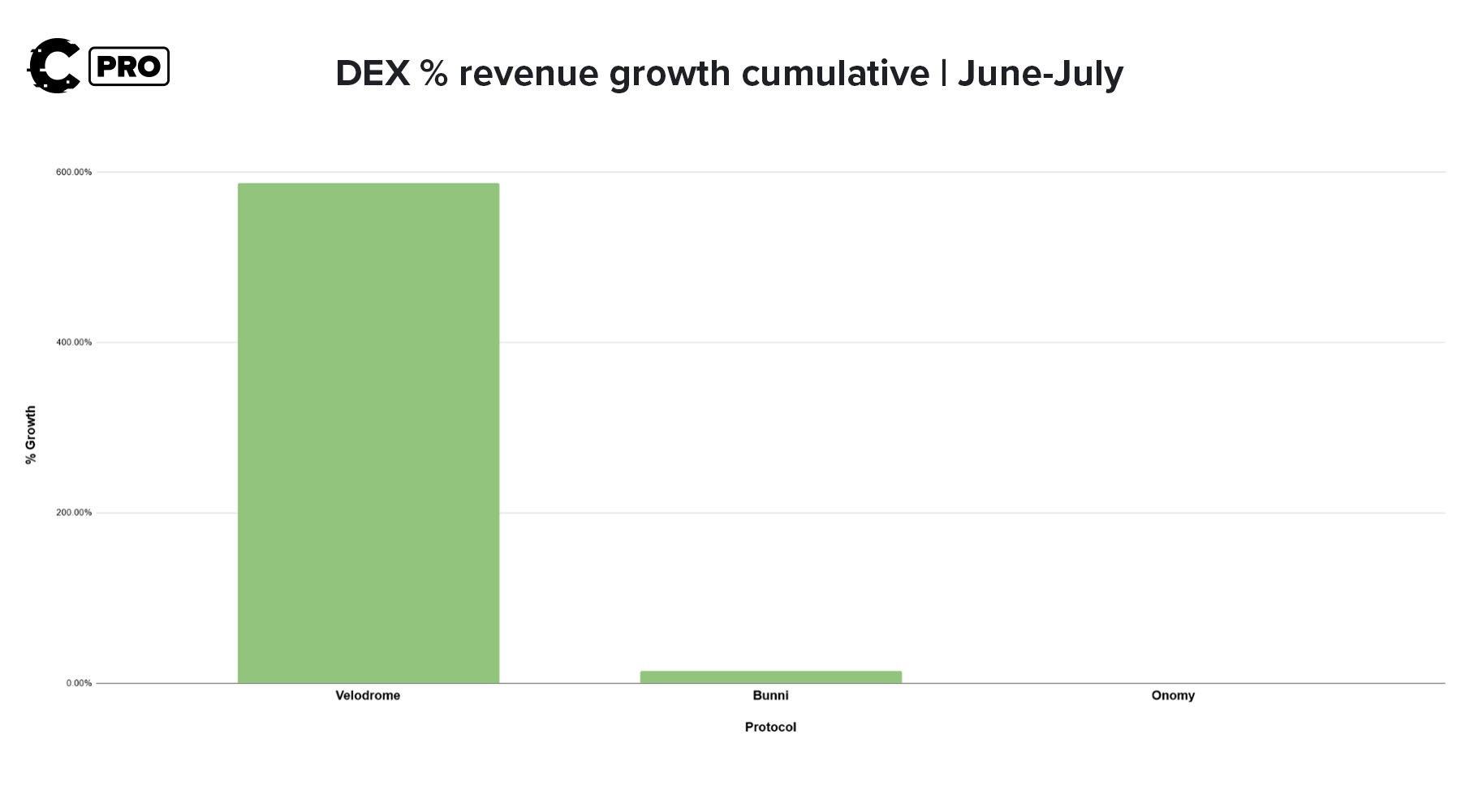

- Velodrome: is on a roll. Its protocol revenue increased massively to new all-time highs in swap fees in July. Aerodrome, a Velodrome project, has also launched on Coinbase’s Base.

- Bunni: veLIT holders recorded $156k in revenue in July, and there’s now additional lockup and buy pressure for veLIT now that Liquis has launched.

- Onomy: We are still waiting for an Onomy product, but NOM is set for a new listing on the Cosmos-based DEX, Osmosis.

Duh sectors 🙄

These sectors are flat overall; the narrative in these sectors is largely indifferent, and they are unlikely to be the focus in the next few months.

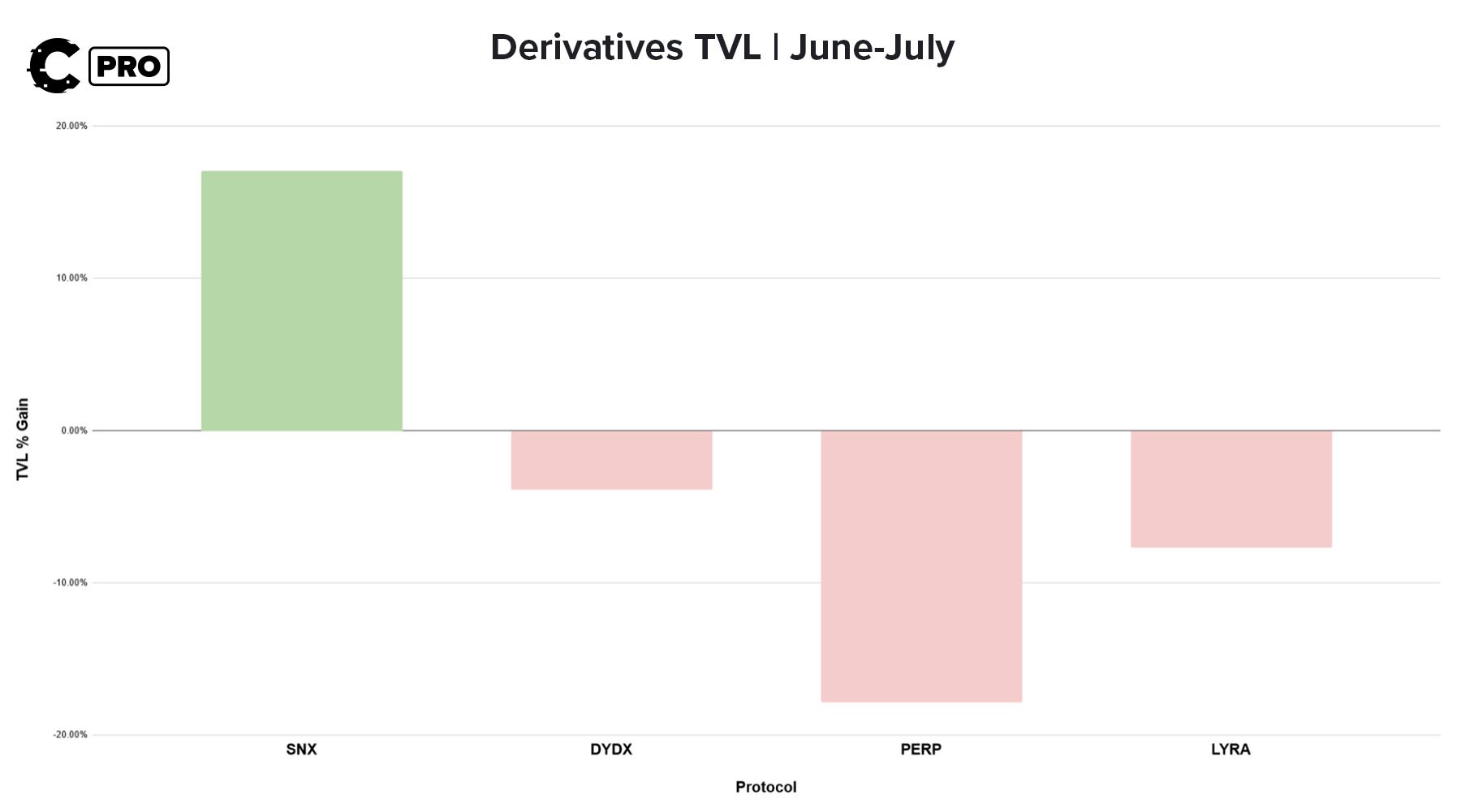

Derivatives

While derivatives might not have any momentum, the protocols in this sector haven’t stopped building.

- Synthetix: released a “what’s next” post on the protocol’s future. Infinex, the new front end, is one of the expected upgrades.

- dYdX: released a new post outlining the rewards and incentives model for the upcoming v4 upgrades, such as a new fee structure and a scoring system to calculate rewards.

- Perpetual: launched a supplementary vault called “Shower Room” to complement its new Hot Tub product.

Web3 VCs

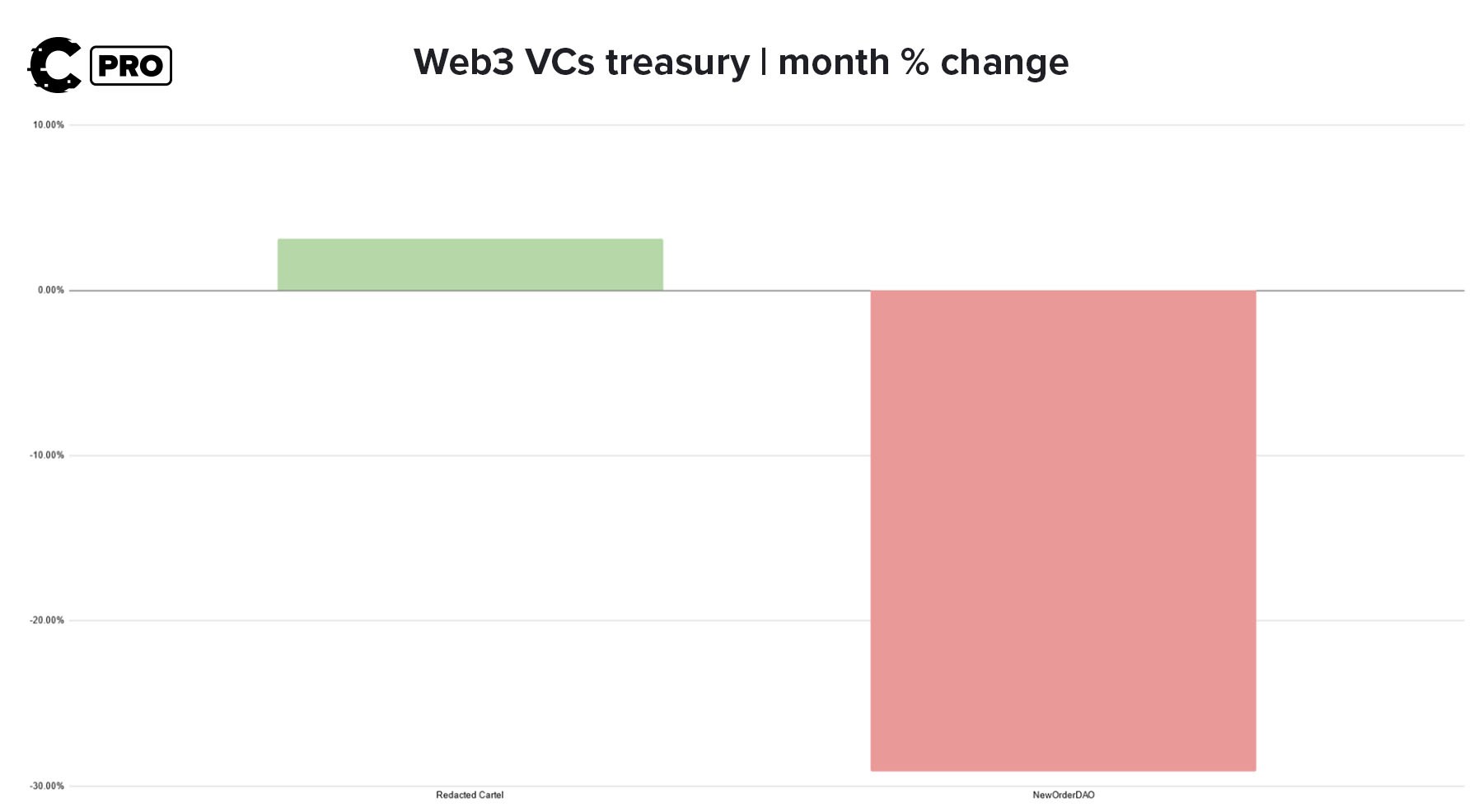

We are still in a bear market, and Web3 VCs are still stuck in that undefined spot between optimism and pessimism.

While we await confirmation that the bull is back, here’s what Web3 VCs are doing:

- New Order: Grass by Wynd Network, one of the protocols funded by New Order, has launched a campaign to attract node operators.

- Redacted Cartel: working hard to launch DINERO and pxETH. The Hidden Hand governance incentives marketplace has also seen positive feedback from the protocols involved.

Cryptonary’s take 🧠

So again, Cryptonary, where should I put my money?

It all starts with the asset’s health.

We created a simple-to-read asset health table with a colour code system to aggregate the information on all the assets in this report.

The code is as follows, but we may change the composition in future reports.

- Green sector/assets: investors are paying attention to these assets in the next month, and we SHOULD see a significant uptrend.

- Yellow sector/assets: investors are somewhat indifferent about these assets, but we COULD see some performance.

- Red sector/assets: investors aren’t paying attention to these assets, and we probably WON’T see any positive movement over the next month.

PLEASE NOTE:

- There are no bad assets or sectors in this report

- Just because an asset or sector is in red does not mean it’s a poor investment.

- Each asset is ranked relative to the other assets on the list, not the entire market.

- These are high-conviction long-term plays; they won’t hit their price targets within days like meme coins.

As always, thanks for reading! 🙏

Cryptonary, out!