Disclaimer: This is not financial or investment advice. You are responsible for your own capital decisions.

What happened?

A significant liquidation event occurred on Hyperliquid's perpetual futures DEX, impacting the HLP (HyperLiquidity Provider) vault. A large leveraged ETH position was liquidated, resulting in around a $4 million loss to the HLP vault, which serves as the community-owned liquidity pool, taking the other side trades on the platform.An "attacker", potentially being hedged on CEXes, went on a massive long run on ETH. Many thought it was another insider front-running announcement similar to Strategic Crypto Reserve that happened just before the crypto summit at the White House.

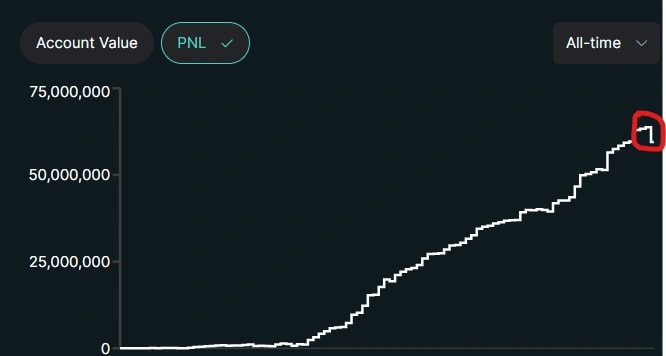

However, the attacker was exploiting the liquidation logic on Hyperliquid. He removed his margins, and HLP had to take on bad debt and incur slippage because of how liquidation works on Hyperliquid. The Hyperliquid team has stated this was not an exploit, and the system managed the event pretty well without collapsing. The $4 million loss equates to approximately one month of HLP profits, and the vault remains net positive overall.

In fact, if you are a user who deposited 2-4 weeks, you might have a 1%-1.5% haircut. But overall, if zoomed in, the HLP vault is still very profitable.

Market reaction?

The market responded swiftly, with HYPE dropping 8.5% in the immediate aftermath. The sentiment is a bit mixed, with some traders viewing the event as a stress test the platform passed (similar to Solana outages), while others remain sceptical as it is similar to what happened to GMX a few years ago (no one knows what is going on with GMX now)

However, what we need to think about is whether this kind of extraction can happen further. Thus, we were waiting to see how the team behind Hyperliquid responded.

They were clear that this wasn't an exploit but just a market force, which we agree with, as HLP isn't a risk-free strategy. To prevent potential incidents in the future, the team decided to lower max possible leverage on BTC and ETH.

What is next?

- HLP depositors: If you deposited to HLP vault relatively recently, then it is possible that you are taking around 1% haircut on your USDC at the moment. But zoomed, the strategy is very likely to be profitable over time again.

- HYPE trader/investor: It is not the time to buy the dip yet. HYPE keeps bleeding off the back of this incident. Furthermore, we still think macro isn't optimal just yet. Likely, we might even see a single-digit HYPE in the coming months. So, hold your fire.

- General Strategy: Maintain a balanced strategy. This is a reminder to diversify and not put all your eggs into 1 basket. This time, nothing to worry about in the mid-to-long term. However, bear markets are the times when protocols get stress tested, and black-swan events tend to happen. Capital preservation is here.

Cryptonary's take

The HyperLiquid incident is a very short-term pain for HLP depositors in our opinion. There were no hacks, and the loss is just a result of market forces and risks. The loss is small, and when zoomed, the HLP is still one of the most profitable yield strategies on USDC.The team responded well. Also, they have decreased the maximum leverage possible to prevent further incidents like this. Overall, it is a good stress test, and Hyperliquid is the solvent. We know some of you might be farming USDC on the HLP vault, and we decided to update our community and share our thoughts on how we are reading the recent liquidation event on Hyperliquid.

Soon, we will publish a more comprehensive update on Hyperliquid, discussing the latest developments, fundamentals and security. Stay tuned!

Peace!