Granted, crypto and AI are different technologies on different growth paths. Yet, the few protocols that have found a way to combine both ideas have become favorites with investors.

The thing is Crypto x AI needs sound Web3 infrastructure and that’s where Flux comes in as a serious contender offering DePIN (decentralized physical infrastructure).

While the DePIN sector is becoming extremely competitive, the Flux ecosystem might have one of the best value propositions and network effects in the sector right now.

In this report, we examine how Flux has evolved to become a formidable Web3 infrastructure solution.

But, is FLUX a promising investment opportunity?

Let’s find out.

TDLR

- Flux is a decentralized web3 infrastructure network offering computing power, data storage, and blockchain services.

- Flux has strong network effects with over 12,000 nodes, 100,000 cores, 268TB RAM, and 6.8PB SSD storage - much higher than competitors.

- Revenue and adoption metrics are growing rapidly, with 1,363 paying apps now on Flux.

- Flux is benefiting from the AI and decentralized physical infrastructure (DePIN) wave. It has partnerships with Nvidia, Kadena, Polkadot, etc.

- The base case target is $3.45 (previous ATH), 3.2x from the current price. The bull case target is $10.35, a 10x current price.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

A quick introduction to Flux

The Flux network is a layer 1 blockchain building a Web3 infrastructure for dApps to operate on its ecosystem. The network offers a combination of cloud computing, data storage, and blockchain-as-a-service solutions. Developers can design, create, and deploy scalable and interoperable blockchain applications.Flux’s consensus algorithm is Proof-of-Useful-Work or PoUW, which incentivizes meaningful computational work rather than mindless mining. This allows less wastage of energy resources, and the network is more efficient, sustainable, and environmentally friendly.

Flux uses a GPU-mineable version of the ZelHash algorithm (Equihash 125,4) for mining with ASIC/FPGA resistance. Blocks are added every 2 minutes, and the block reward is 75 FLUX. Miners receive 50% of the block rewards, i.e. 37.5 FLUX and 11.25 parallel assets.

Unlike some Web3 solutions, Flux is completely decentralised.

At the heart of the technology, the network is operated on top of a Linux system called FluxOS, which provides a high-availability of computational power. The decentralised approach to cloud computing is driven through its Flux nodes, operated by community Flux holders.

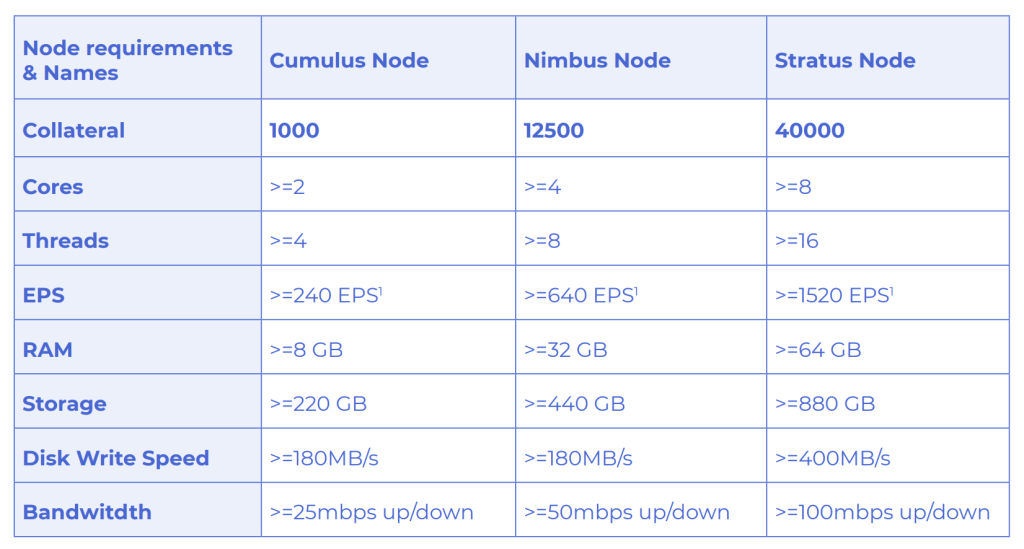

As illustrated above, the nodes come in 3 options, which provide varying computational power for developers to launch their websites, blockchains, dApps, etc. It includes:

- Cumulus

- Nimbus

- Stratus

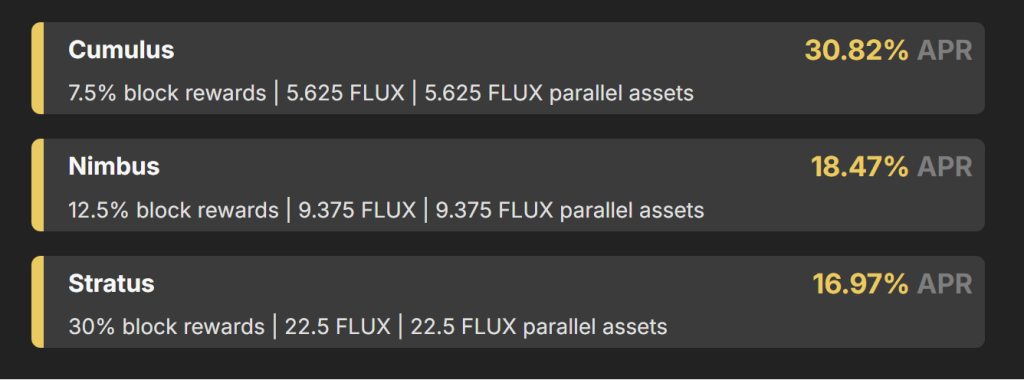

The Flux ecosystem has also made Flux assets accessible on multiple chains with parallel assets through their ‘Fusion App” within the Zelcore wallet. Currently, parallel assets have been released on Ethereum, Tron, BSC, Solana, Kadena Avalanche, Ergo, and Algorand. Furthermore, GPU miners and Flux node operators earn parallel assets on top of their regular block rewards through parallel mining, as observed in the above chart.

Lastly, minor Flux holders can stake their holding by either using the on-chain Titan staking chain or Coinmetros’ shared Fluxnide Staking services. There are rewards from both operations, which are distributed to the stakers. Both staking paths require a minimum of 50 FLUX staked, with the APR varying according to the terms.

Tokenomics

From an investor perspective, FLUX offers a terrific tokenomics and distribution outlook.

The protocol has a maximum supply of 440 million. At the moment, 342,846,213 tokens are in circulation. Out of the total supply in circulation, around 114,268,000 FLUX is locked for node operators and keeping strong liquidity.

The Flux Foundation has a miniscule 2.9% allocation, with the Flux team keeping 0.7%. Exchange listing/liquidity is allocated another 1.7% of the total supply.

Overall, the tokenomics indicates that intrinsically, there is minimal selling pressure, as the protocol incentivises to lock up Flux as collateral, further reducing the supply. With 1/3rd of the circulating supply locked, prices are expected to drive higher as more people may set up nodes, which locks more supply.

What is the value proposition in Flux?

Now, as highlighted in the introduction, Flux is one of those projects that has been in the industry for over two years. Yet, its value proposition has significantly improved in 2024 due to the growing interest in artificial intelligence (AI) and related crypto protocols. One key example is Render, which has benefited from the positive wave of sentiment.Now, Flux could be aligning itself with this wave since, from a technology perspective, it can form the foundation for multiple AI-crypto projects. AI protocols require an exhaustive amount of computational resources, which can get very expensive on centralised networks. The booming AI economy has increased the demand for GPU chips, making them extremely expensive. Here, Flux presents a cheaper alternative to its competitors.

At the moment, there are 5269 GPUs connected to the Flux Core, which can be accessed.

When it comes to data storage and cloud computing, Flux offers its services at a fraction of the cost of major centralised networks. Using the cost calculator, it can be identified how cost-effective Flux’s services are relative to Azure, Google Cloud, and AWS.

Strong network effects

One of the most impressive features of the Flux ecosystem is its network resources. The exchange has 12,919 total active nodes. For a market comparison, Internet Computer or ICP, which has a market cap of $6 billion, has 124 nodes.

Alongside, the total cores operated by the nodes are 102,989 with data storage of 268.25 TB in total RAM and a Total SSD of a whopping 6.81 PB, which is around 6810 TB. This is a clear advantage for the protocol, which is undervalued in the market compared to other DePIN protocols.

Important partnerships

Nvidia has been a force to reckon with in the mainstream AI sector. In its recent earnings report, the company's quarterly revenue soared to $22.1 billion, a 22% increase from the previous quarter and an astonishing 265% rise year-over-year.Hence, it doesn’t hurt that Flux has a collaboration with NVIDIA through its inception program. Such a partnership can significantly improve Flux’s capability as a Web3 infrastructure.

The network has also established integrations with other blockchain projects, demonstrating its adaptability in the industry. These collaborations include Kadena, Coinbase’s Rosetta, and added nodes for both Polkadot and Kusama networks.

Valuation exercise

Valuing a Web3 infrastructure service provider like Flux comes down to multiple aspects. We have highlighted the network effect and partnership aspect in the earlier sections. These form an important part from a point of adoption and expansion, where Flux is formidably doing well.Now, setting a target for the FLUX token in this current market comes down to a few other things.

Let us evaluate Flux’s recent demand and revenue statistics for an outlook.

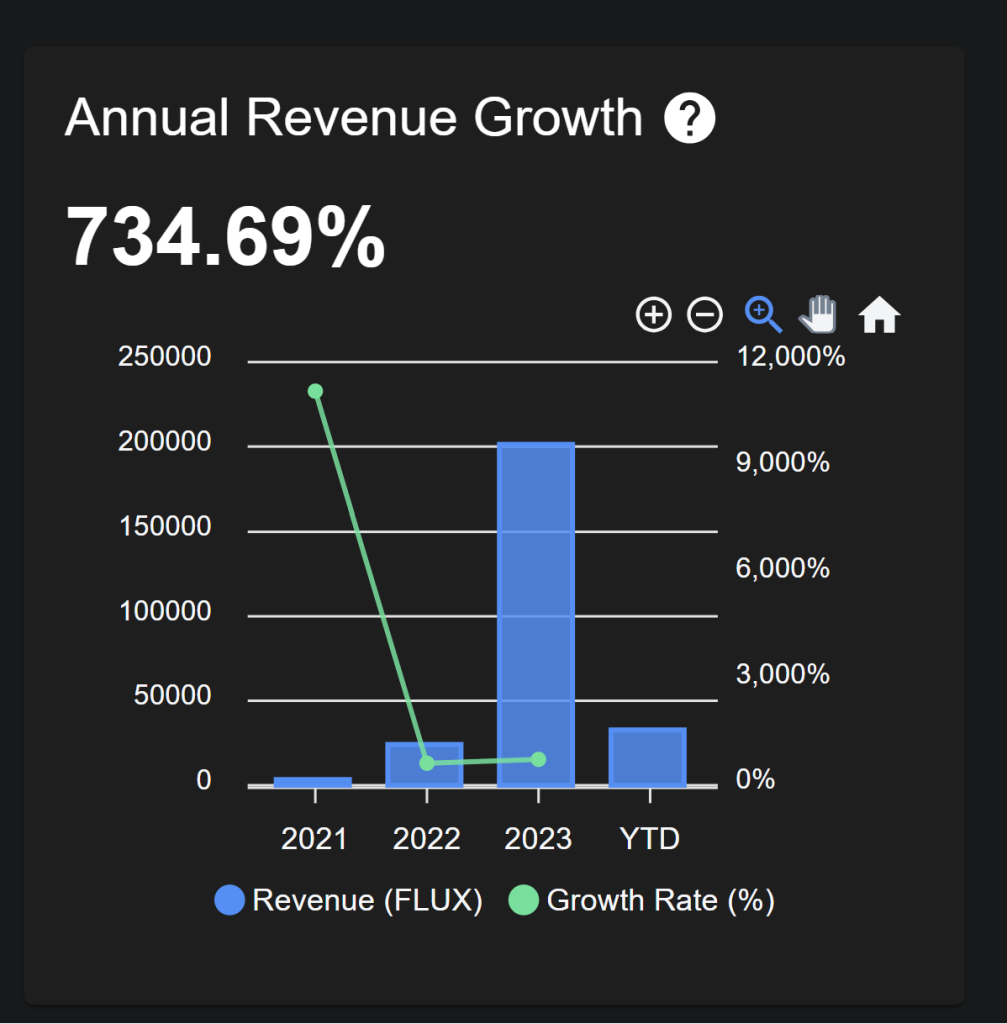

Flux registered a significant increase in year-on-year annual revenue growth in 2023, with a 734% increase.

Its 30-day annualised revenue came to around 15,274 FLUX. We will consider it as 15,300 tokens. Calculating an average of $0.80 for February, the fees come around $12,240.

Hence, annual revenue based on current market activity is around $1.46 million.

This is a decent collection, and with a market cap of $365 million, its Price-to-Sales ratio comes around 250x, which is pretty high.

However, when compared with ICP and or Filecoin, their P/S ratio comes up to 24,874x and 533x.

Now, ICP’s whopping P/S ratio is not an anomaly. They do not generate a lot of revenue, which is acceptable considering they have only 124 nodes. ICP’s strength remains in its long list of partnerships and name value, but the project has stagnated from a growth outlook.

For Flux, however, it currently has 1363 paying apps on its network. The average order value, which indicates how much Flux each app spends, has also reached an all-time high valuation.

So all these points together indicate that Flux can only appreciate over the next bull run. Considering the asset is also becoming relevant because of the AI narrative, as a base case scenario, it should reach its previous all-time high.

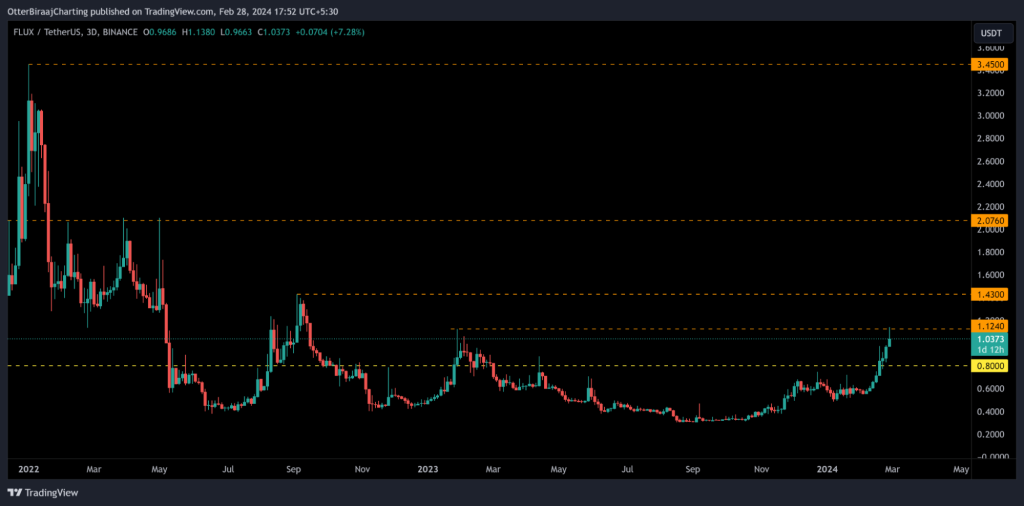

Hence, a base case for FLUX is $3.45. i.e. 3.2x, with a market cap of $1.2 billion.

Now, based on the fact that Flux provides a better network effect and P/S ratio than larger competitors, the protocol should be able to claim more market share.

Keeping that in mind, a 3x multiple from its previous ATH will be $10.35.

Therefore, a bull case for FLUX is $10.35, i.e. 10x, with a market cap of $3.6 billion.

It is important to note that we have taken a 3x rise from its previous ATH because of the discrepancy between price and market cap. We haven’t seen enough from Flux to overtake the major competitors yet, so it will still lag behind Filecoin and ICP in the market going forward.

Technical analysis

Flux’s price is up 90% in 2024. It is currently close to breaking above its 2023 high of $1.12. With positive momentum on its side, the token can swiftly break across the resistance lines at $1.12 to test $1.43.

An ideal buy-in position would be somewhere around the support range of $0.80. However, the market is currently displaying up-only volatility, so investors should keep that in mind. Building a long-term position at $1 is also a feasible option for the long run.

Cryptonary’s take

There is a burgeoning market interest in AI and DePIN networks right now. Flux is right at the middle of it as a potential leader in the Web3 infrastructure ecosystem. Its decentralised, community-driven setup increases its affinity to be an option.The market value highlights its potential as an undervalued protocol. While adoption and expansion are on the rise, more customers, such as software developers and businesses, need to run their ecosystems on Flux. Only an increase in adoption can positively impact Flux’s price, and the bullish target largely depends on this factor.

Until then, Cryptonary Out!