Flywheels of 2025: Deep Dive Into Crypto Treasury Companies

In 2025 institutions are waking up for crypto and a new level of financial engineering is happening to the market. Should we worry or should we capitalize on this upcoming wave? Let’s dive in…

Bitcoin's role in corporate treasuries is now well-established. Strategy (formerly MicroStrategy) set the tone back in 2020, and since then, the number of public companies holding BTC has continued to grow. In June 2025 alone, 26 new companies added Bitcoin to their balance sheets. For most, it is a mix of inflation hedge, asset diversification, and capital positioning.

But there is a second movement starting to form.

Ethereum and other crypto assets are being added to corporate treasuries too, though not with the same playbook. Some companies are holding ETH as a reserve asset, but others are staking it, using it in validators, or preparing for infrastructure use cases tied to stablecoins and DeFi activity. In short, ETH is being used in ways that are more operational than symbolic.

This shift is happening alongside policy changes. The GENIUS Act, passed just recently, gives banks the ability to issue stablecoins under a formal regulatory framework. Most of these stablecoins are expected to be built on Ethereum, which means banks may eventually need to hold ETH to secure their stablecoins. A few companies are already moving in that direction.

This report looks at how Bitcoin and Ethereum are now being used by treasury teams, what kinds of strategies are being deployed, and why the Ethereum side of the story may be just beginning.

Call it the Ethereum flywheel. And the game just started.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The Bitcoin Treasury Playbook

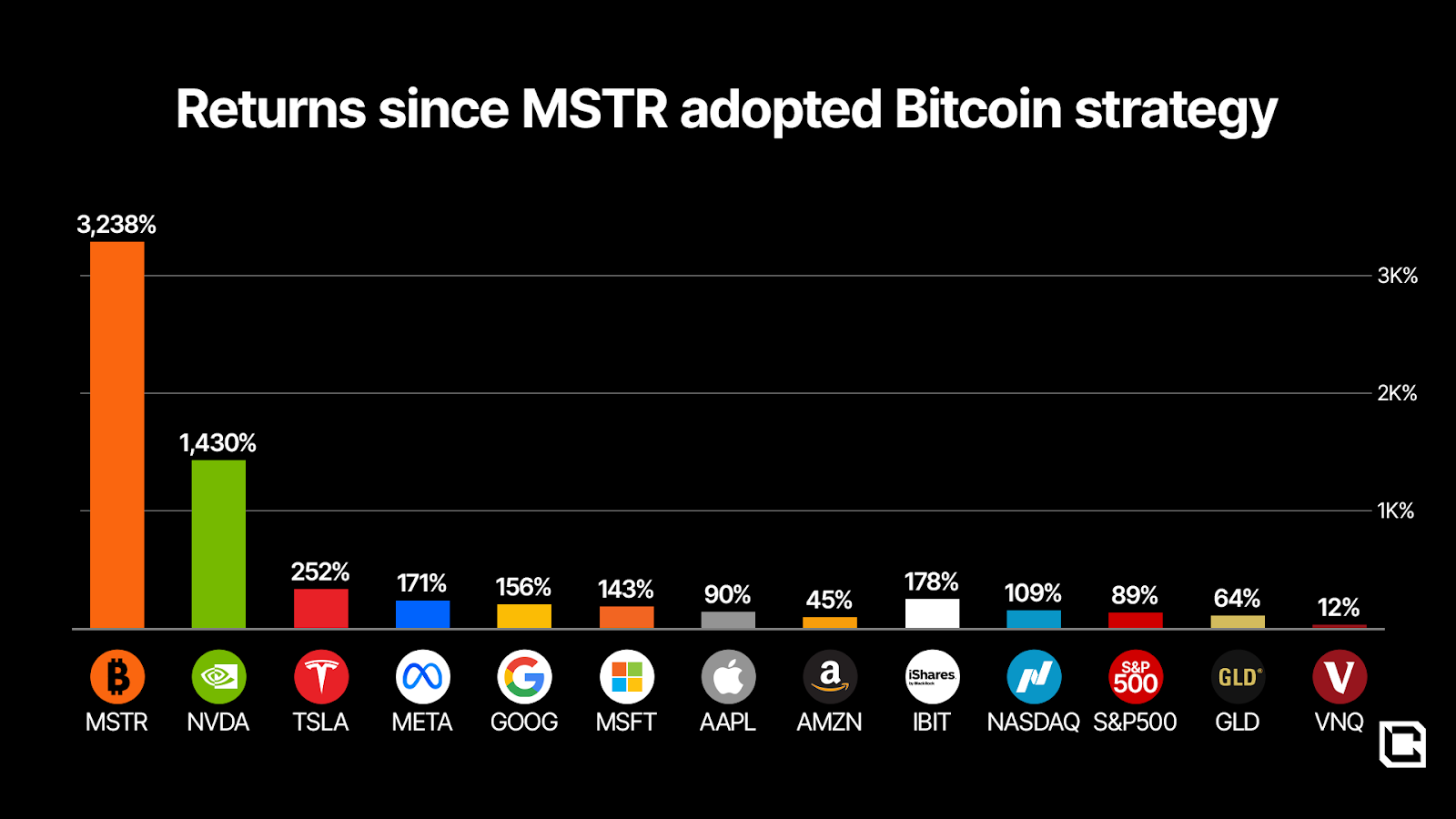

Bitcoin's path into corporate finance began with a single company taking a very public risk. In 2020, MicroStrategy, now known as just Strategy, allocated $500 million from its balance sheet into BTC. At the time, it was treated as an experiment. But the move paid off: Strategy has unrealised profits of over $40b, and the MSTR stock has outperformed the S&P500, Gold, Tesla, Nvidia and many other big names. Strategy's success set a precedent that others began to follow.

By mid-2025, that trend had matured. More than 250 public companies now hold Bitcoin on their balance sheets, and 26 new firms joined in June alone. The range is wide, mining companies, software firms, holding companies, and even retailers. The common thread is that each is using Bitcoin as part of a broader treasury strategy. However, for some it is the core of their existence. The whole mission of such companies is to accumulate as much BTC as possible.

A Look at Recent Additions

- BitFuFu: 1,792 BTC

- Cipher Mining: 1,063 BTC

- KULR Technology: 920 BTC

- Aker ASA: 754 BTC

- GameStop: Added BTC after raising $1.5B in March 2025

- Méliuz & MercadoLibre: Latin American firms using BTC as reserve capital

- Critical Metals Corp: Raised $500M in convertible debt to acquire BTC

- Amazing AI PLC (UK): Announced its Bitcoin Treasury Policy in June 2025

Why Companies Are Doing This

There are a few common reasons behind BTC treasury decisions:- Hedging macro risk: With rising concerns over inflation and monetary policy shifts, Bitcoin is viewed as a hedge against fiat exposure.

- Improving shareholder value: In some cases, companies have seen stock performance respond positively after adding BTC. Looking at MSTR's performance, it is hard not to adopt a BTC strategy.

- Financing efficiency: Some firms are using low-cost debt to acquire Bitcoin, betting that it will outperform their cost of capital over time. (Again copying the playbook of MSTR)

The high-level trend is clear, but the details matter. To understand what's actually happening behind the scenes, we need to look at how these treasuries are being structured.

How BTC Treasury Companies Operate

There is no single model for how companies build and manage a Bitcoin treasury. Some treat it as a simple allocation from excess cash. Others structure it more deliberately, using financial tools or operations to build long-term exposure. The approach depends on a company's risk appetite, available capital, and broader business strategy.

Common Methods Used

1. Direct Cash Allocation The simplest approach is to use part of the company's cash reserves to buy Bitcoin. Firms like Méliuz have allocated a fixed percentage of their cash, often between 5% to 15%, into BTC. This is often framed internally as a strategic reserve.2. Capital Raising Some companies, pioneered by Strategy, raise capital specifically to buy Bitcoin, often through debt. For example, Critical Metals Corp raised up to $500 million via convertible debt in January 2025 to acquire BTC. This approach is based on the view that Bitcoin will outperform the company's cost of capital over time.

3. Stock Sales and Corporate Issuance A few companies have issued equity or used corporate actions to fund BTC purchases. GameStop, for instance, raised $1.5 billion through a stock sale in March 2025, then announced a BTC allocation a few weeks later.

4. Corporate bonds and other instruments.

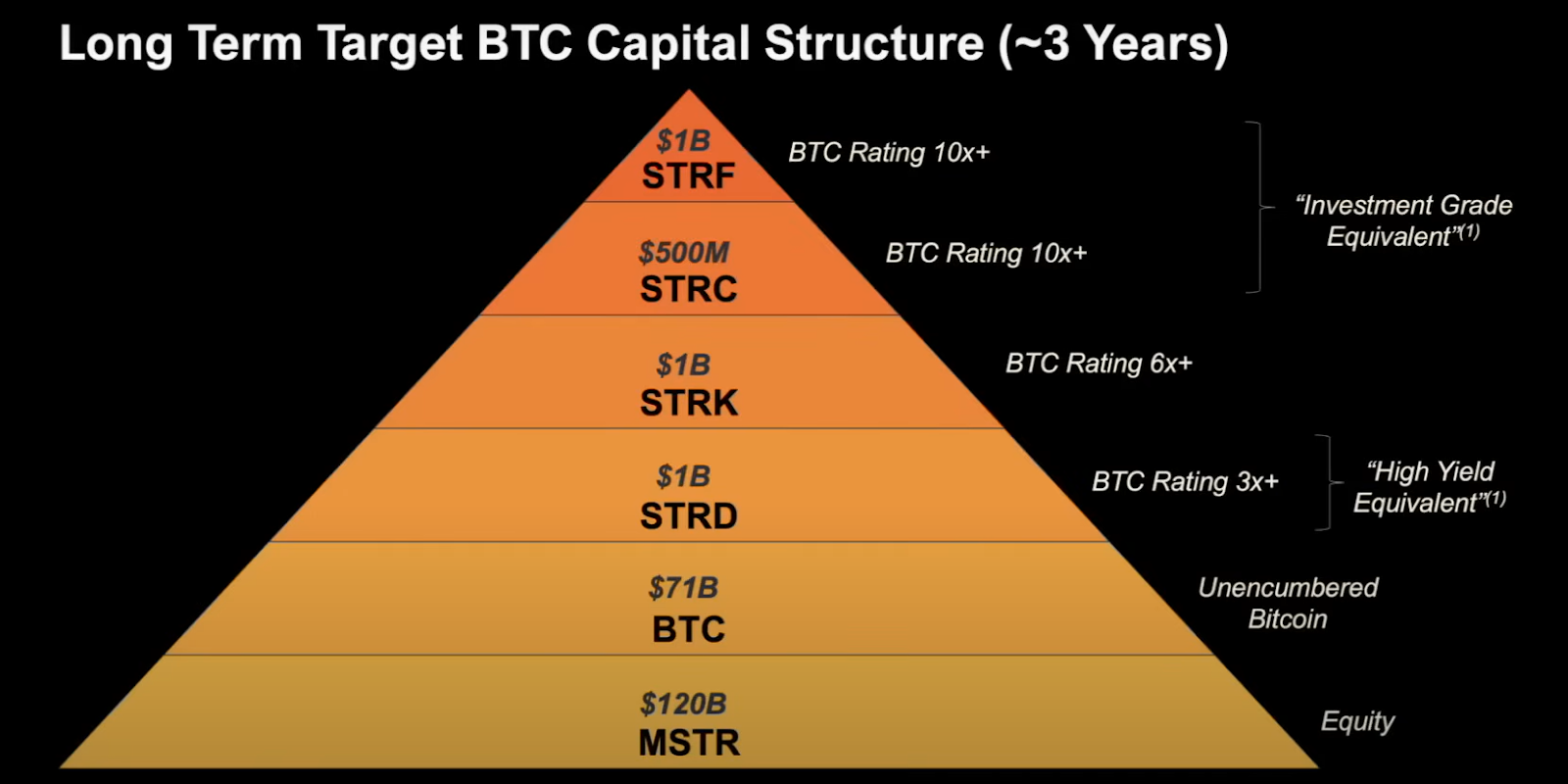

Strategy is doing an insane job with raising as much capital as possible through various instruments. On top of their stocks, they are using USD-denominated yield products to raise even more cash to buy more BTC. So it has been very positive for the balance sheet and the stock's performance.

Strategic Thinking Behind It

Each method reflects a slightly different motivation. For cash-rich companies, BTC serves as a long-duration hedge. For capital-raising firms, the move is a growth bet. For some, it is the core of their existence. But all of them share a core belief: Bitcoin may outperform traditional assets over time, and they want exposure on their terms.Some firms also use these moves as part of a broader investor narrative. Adding BTC can help attract a different base of shareholders, including those who see crypto exposure as part of a high-conviction portfolio.

The crypto community, seeing the massive success from these strategies, started to follow the same strategies for different assets. Ethereum treasury strategies, for example, are going heavy into replicating the success of BTC-focused treasuries but with slightly different tweaks.

Ethereum Treasury Companies Begin to Form

As Bitcoin treasury strategies became more common, a few companies began exploring whether Ethereum could serve a similar purpose. But Ethereum's structure changes the way it fits on a balance sheet. It is definitely not just an asset that sits idle (unlike BTC), it is rather the part of an active network. This opens the door to different strategies.In 2025, several companies publicly shifted into ETH-focused treasury models. This has resulted in a massive influx of capital to ETH. Some started by converting existing BTC holdings into ETH. Others raised new capital to build out dedicated ETH positions. What makes this group different is that ETH is a yield-bearing asset and, therefore, most companies are staking their ETH, not just holding it.

Key Examples

- SharpLink Gaming In 2025, SharpLink shifted its business model to hold and stake over 280,000 ETH. This represented a major pivot from its original focus on gaming and betting infrastructure.

- Bit Digital After raising $173 million, Bit Digital moved its entire treasury from BTC into over 100,000 ETH, aiming to become one of the largest public ETH holders.

- BitMine Immersion Technologies With Tom Lee as chairman and support from investors like Peter Thiel, BitMine raised $250 million to build an ETH-focused treasury strategy. But later doubled down on their thesis, and have accumulated around $2b in ETH.

- GameSquare Approved a $100 million allocation into ETH in July 2025, citing alignment with future stablecoin and network infrastructure needs.

- BTCS Increased its ETH position to over 29,000 coins after raising $62.4 million earlier in the year.

Why Ethereum?

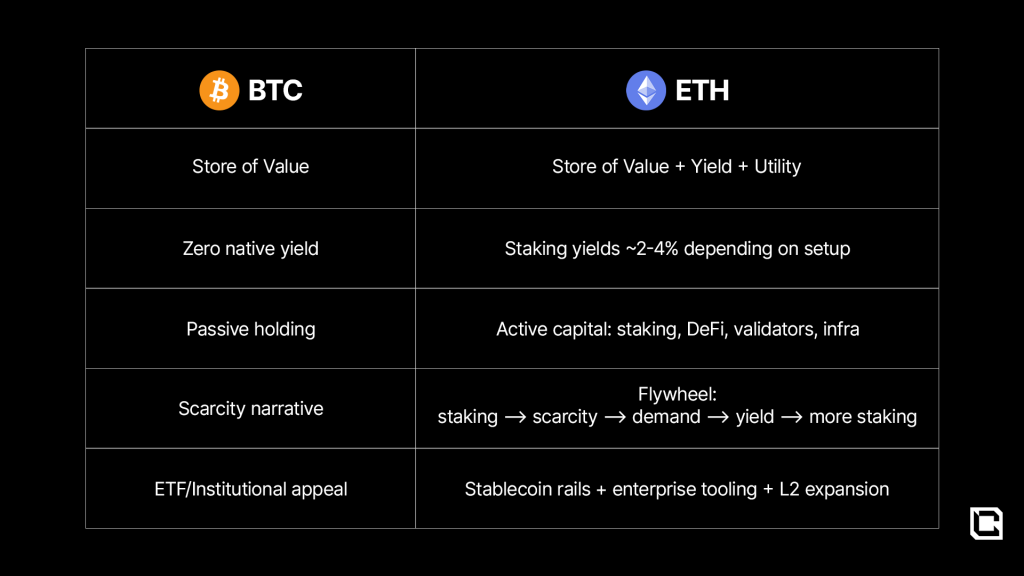

Ethereum allows companies to go a step further than Bitcoin. With staking, ETH becomes a productive asset that can generate yield. Some companies use this to enhance capital efficiency, while others see it as a way to align more closely with the network itself. One of the main objectives of the treasury companies (either Bitcoin or Ethereum) is to increase BTC/ETH per share. That would imply that buying these treasury shares is better than simply buying BTC or ETH in spot markets. However, there is an interesting difference between how Bitcoin treasury companies increase BTC per share versus ETH treasury companies increasing ETH per share.- BTC treasuries use various financial tools like corporate debt and equities to raise capital to purchase BTC. If done properly (E.g. raise more cash when stock trades at premium relative to BTC), this increases Bitcoin per share through arbitraging volatility of the stock.

- ETH treasury companies can use the same strategies of issuing stock and debt to acquire more ETH, but since ETH is a productive asset, they can also stake ETH and over time ETH per share ratio will naturally grow. This is more sustainable and requires less leverage, less reliance on price increase compared to BTC treasuries, which makes ETH a more attractive asset to accumulate per share relative to BTC.

The regulatory picture is part of what's pushing this forward. With the GENIUS Act now in effect, the role of Ethereum in corporate finance could expand much faster than before.

Policy Changes and the GENIUS Act

In July 2025, the GENIUS Act was signed into law, creating a formal framework for the issuance and custody of payment stablecoins in the United States. For the first time, banks and approved entities received legal clarity on how they could participate in the stablecoin market.This regulatory shift is expected to reshape how financial institutions engage with blockchain infrastructure, and Ethereum is central to that conversation.

Key Provisions of the Law

- Who can issue: The law restricts stablecoin issuance to federally qualified institutions, including national banks, certain nonbanks, and foreign bank branches operating in the U.S.

- Custody and reserves: Issuers are required to maintain 1:1 reserves in approved forms and meet strict transparency and auditing standards.

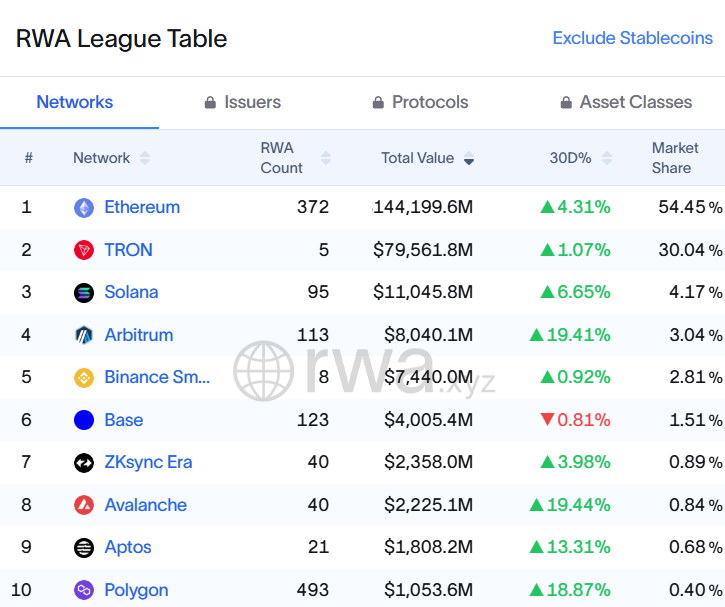

- Blockchain usage: While the law does not mandate which network to use, over half of all stablecoins today operate on Ethereum, making it the most likely base layer for adoption.

Bank Activity Underway

Since the law passed, several major banks have started preparing to issue stablecoins or support them through custody and backend operations.- Bank of America: Reportedly planning its own stablecoin product, with details expected later this year.

- Citibank & Morgan Stanley: Exploring pilot programs to connect existing payment infrastructure to tokenized settlement layers.

- Custodia Bank & Vantage Bank: Already launched a jointly issued stablecoin on a public blockchain in March 2025.

Currently Ethereum is home for more than 50% of Real-World Asset are on Ethereum. With a more friendly regulatory environment, there will likely be more assets tokenised on Ethereum. That will require more security in terms of staking. If the bank and institutions want to issue their assets on-chain, they will need to buy and stake ETH to secure their assets.

The ETH Flywheel: Front-Running the Banks

As banks/institutions work through the regulatory and operational hurdles of stablecoin issuance, a group of Ethereum-native treasury companies is already moving ahead. These firms are buying ETH in size, staking it, and positioning themselves to benefit from any future demand created by institutional activity.

Their early moves are creating a reinforcing cycle, higher demand increases ETH price, spilling over to more activity on the Ethereum chain, staking yields generate more ETH and more ETH is burnt, the price goes up and network security improves, attracting more capacity for further tokenisation of assets.

Early Movers and Their Strategy

- SharpLink is staking its full ETH treasury, generating consistent rewards while aligning its business model with Ethereum's infrastructure layer.

- Bit Digital completed its transition from Bitcoin to Ethereum, and now operates as one of the largest public ETH holders.

- BitMine raised $250 million to build its ETH treasury, and has already seen its stock rise over 1,100% in 2025. Investors include high-profile names like Peter Thiel.

- BTCS and GameSquare have also allocated tens of millions into ETH, with public filings outlining their staking and validator plans.

Positioning Before the Shift

The assumption behind many of these moves is straightforward. If banks are going to launch Ethereum-based stablecoins and other RWAs, they may eventually need to hold and stake ETH as part of the process. Companies that are already doing this are effectively positioning themselves ahead of that shift, potentially gaining exposure before institutional demand drives further price and yield compression.This early positioning could also have broader implications. If ETH becomes harder to acquire and more of it is locked in staking, the long-term supply picture, and the role of corporate holders starts to look very different.

Broader Market Implications

The rise of ETH treasury companies is already changing the structure of Ethereum's supply. As more ETH gets moved into long-term corporate holdings and staked for yield, the amount of liquid ETH available in the open market continues to shrink. This has implications for pricing, volatility, and how Ethereum is treated in broader financial models.

Shrinking Circulating Supply

The more ETH is locked in staking contracts, the tighter the available supply becomes. As of July 2025, over 28 million ETH are staked, and a growing portion of that is held by treasury-focused entities. These coins are often not available for short-term liquidity and are tied to long-term strategic holdings. If institutional staking increases further, this effect could compound.ETH as Productive Capital

Bitcoin is often treated as a static asset, something to hold and preserve. Ethereum behaves differently. Once staked, ETH becomes productive capital, generating yield through validator rewards. This adds a second layer to its value proposition, especially for companies looking to optimise capital returns.It also creates a feedback loop. As more ETH is staked, yields adjust, security improves, and the network becomes more attractive to both developers and institutions. This dynamic could shape how Ethereum is priced in future cycles, especially if banks join the system and start competing for the same base asset.

A Shift in Market Structure

If current trends hold, ETH is likely to start outperforming BTC on a sustained basis. Its weekly structure switched from bearish to bullish by making higher lows and higher highs. The last time it happened was in 2019 and after ETH rallied over 300% against BTC.A new wave of treasury companies that are entering ETH, stablecoins and tokenised assets can finally bring fresh narrative, energy and performance to the Ethereum ecosystem.

Cryptonarys Take

Bitcoin has already found its place in corporate finance. The process took time, but it's now a well-understood strategy for companies looking to hedge risk, diversify reserves, or signal conviction and outperform the market by leverage-longing BTC via different financial instruments.Ethereum is earlier in the cycle, but the mechanics are slightly different. Instead of just holding ETH, companies are staking it, generating returns, and integrating more directly with the infrastructure layer of the network.

This is an operational shift. What we're seeing with ETH treasury firms is not a mirror of the Bitcoin model. To increase ETH per share, Ethereum treasury companies don't have to always raise more money to buy more ETH. It can generate yield on its own due to its role as a staking asset.

It's a new approach, tied to Ethereum's role in powering stablecoins, DeFi rails, and validator networks. And with policy opening the door for banks and institutions to enter, timing becomes a critical factor. We think the trend of treasury companies is just getting started and will get wilder.

We are already seeing more applications of Michael Saylor's playbook on many different crypto assets. For example, aside from BTC and ETH, we now have:

- Solana treasury companies: DeFi Development Corporation, SOL Strategies

- Hyperliquid treasury companies: Hyperliquid Strategies, Hyperion DeFi

- Ethena treasury company: StablecoinX by Ethena Labs

Cryptonary, OUT.