Follow the dollars: Inside the $35 trillion stablecoin boom

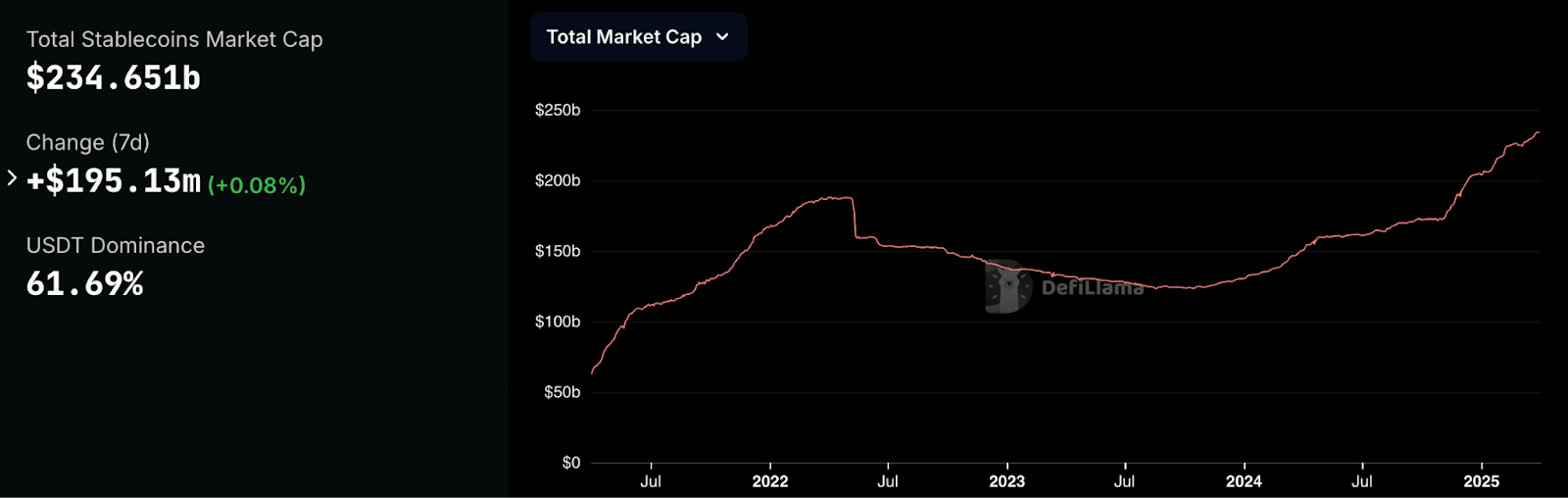

$230+ billion in supply. $35 trillion in annual volume. And that's just the beginning. While markets go sideways, with uncertain environments across the board, this one sector keeps climbing. Stablecoins are quietly doing something rare in this industry: delivering real-world product-market fit.

Stablecoins have become crypto's most adopted product. In the past 12 months alone, they've processed over $35 trillion in transfer volume, eclipsing every other crypto use case by orders of magnitude. Whether it's trading on decentralized exchanges, cross-border payments, remittances, or even on-chain payroll, stablecoins are now core financial infrastructure.

This has drawn the attention of both institutions and governments. Major players like Visa and PayPal are integrating stablecoins into their operations. Meanwhile, the Trump administration has taken clear steps to establish a regulatory framework, with the GENIUS Act and STABLE Act advancing through Congress. These moves signal growing U.S. alignment toward legalizing and scaling stablecoin usage, especially as geopolitical competition for digital currency leadership heats up.

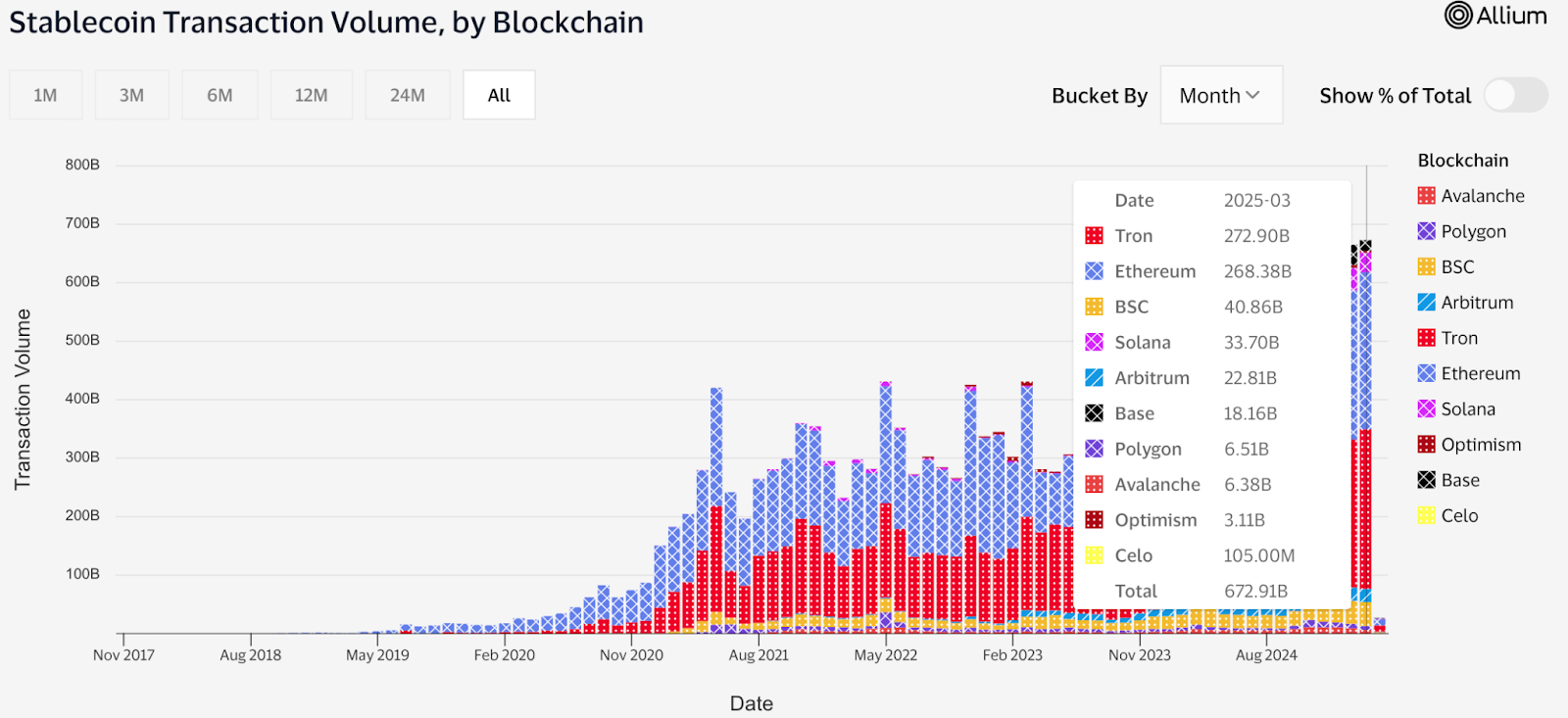

On the protocol side, there's no one winner, but multiple strong contenders. Ethereum remains the dominant chain by trust and security, Solana is gaining enterprise momentum for its speed and cost efficiency, and Tron, while often under-discussed, quietly leads in emerging markets and dominates in raw volume. This multi-chain evolution, paired with new primitives like yield-bearing stablecoins, makes the next phase of stablecoin innovation even more compelling.

In this report, we break down where the stablecoin market stands, who's leading the charge, where the risks are, and what's next as the world builds on-chain dollars at scale.

The state of stablecoins: A market snapshot

As of Q1 2025, the stablecoin sector stands at a total market capitalisation of approximately $234 billion, underscoring its status as one of the most resilient and steadily growing verticals in the digital asset ecosystem. Despite broader market volatility, stablecoin TVLs have maintained upward momentum, solidifying their role as core infrastructure in crypto.USDT and USDC continue to dominate, together making up the vast majority of circulating supply across all major chains. USDT leads in terms of total supply and reach, especially on networks like Tron and Ethereum. Meanwhile, USDC, with its U.S. regulatory alignment and institutional integrations, remains the preferred stablecoin in DeFi and enterprise-facing applications.

Together, they power over 90% of all stablecoin volume, though newer entrants like FDUSD and PYUSD are beginning to carve out niche utility in specific ecosystems.

Transaction activity paints an even more bullish picture. According to data, monthly stablecoin transfer volume grew 115% year-over-year, reaching over $35 trillion in the last 12 months. This growth has come not just from crypto-native use cases, but also from the rise in real-world payment adoption and remittance flows, especially in regions with unstable fiat currencies or banking limitations.

When we break down stablecoin usage, four primary verticals emerge:

- Trading: The most immediate and visible use case, where stablecoins serve as dollar-denominated liquidity across both centralized and decentralized exchanges.

- Payments: Payments are increasingly used for cross-border transactions and B2B settlements, particularly in emerging markets.

- DeFi: Powering everything from lending markets to perpetuals and yield farming strategies.

- On/Off Ramps: Acting as the bridge between fiat and crypto, especially in countries where crypto-fiat exchange infrastructure is lacking or inefficient.

Chain wars: Where stablecoins live

Stablecoins aren't just multiplying but also choosing where to live. And the three ecosystems currently leading the charge are Ethereum, Solana, and Tron, each dominating a different aspect of the stablecoin economy.Ethereum is still the trust and settlement layer of the stablecoin world. With over $124 billion in stablecoin TVL, it commands 53.46% of the total market, cementing its lead as the most trusted network for institutional-grade money. It's where the largest issuers like USDC and USDT hold their deepest liquidity, and where permissioned DeFi and enterprise use cases naturally prefer to operate.

Solana, meanwhile, has carved out a very different lane as the high-speed, low-cost execution layer. With one of the lowest transaction fees across any major chain, Solana has become the go-to chain for payment companies, commerce apps, and emerging consumer fintech tools. Whether it's streaming salaries in USDC, tipping creators, or running microtransactions across games and DePIN apps, Solana's performance edge is winning over builders.

Tron, often overlooked in Western narratives, is dominating across Asia and Latin America. Its grip on the remittance market is no longer anecdotal- Visa's official stablecoin dashboard shows Tron consistently leading in active addresses and daily transaction counts. Its partnership ecosystem, particularly around USDT usage, has made it the stablecoin backbone in regions with high demand for fast, cheap cross-border transfers.

Real-world adoption is here

The list of traditional fintechs embracing stablecoins reads like a who's who of the internet economy: Stripe, Robinhood, PayPal, and Revolut have all integrated stablecoins into their offerings, from enabling crypto payouts to facilitating international transfers.The biggest signal, however, comes from Visa, which has directly integrated USDC into its backend infrastructure on both Ethereum and Solana. This isn't a marketing partnership but a full-blown operational bridge that allows Visa to settle payments in USDC instead of waiting days for traditional banking rails. Visa's public dashboard shows active deployment, with USDC being used for actual commercial flows, not just pilot tests.

Adding to the momentum, Circle filed for its IPO in April 2025, signaling not only confidence in its own business model but also growing public market appetite for stablecoin issuers. It marks a transition from crypto-native startups to publicly accountable financial infrastructure players, an evolution that could open the door for ETFs, regulated lending, and broader institutional entry.

Stablecoins are also embedding themselves in new verticals. They're showing up in cross-border settlements, used by freelancers, small exporters, and migrant workers bypassing clunky banking systems. In the creator economy, USDC and other stablecoins are now default rails for fan donations, creator tips, and royalty payouts. Even gaming integrations, particularly in web3-native environments, are leaning on stablecoins as neutral, low-volatility in-game currencies.

Yield-bearing stablecoins

As stablecoins go mainstream, the next frontier is clear: turning them into yield-generating instruments. Welcome to the rise of yield-bearing stablecoins, where users don't just park their money; they earn on it.What are yield-bearing stablecoins?

Traditional stablecoins like USDT and USDC aim to hold a fixed $1 peg and offer no built-in yield. Yield-bearing stablecoins, on the other hand, are designed to accrue interest or staking rewards while maintaining relative price stability. They may not always stick to an exact $1 peg, but their promise lies in creating capital-efficient stable assets that work harder for holders.Some maintain soft pegs that float slightly (e.g., sUSDe), while others use wrapped architectures that blend the benefits of DeFi yield with price stability. This category blurs the line between money market funds and crypto-native innovation, making it one of the most promising and debated trends in the space.

Leading players

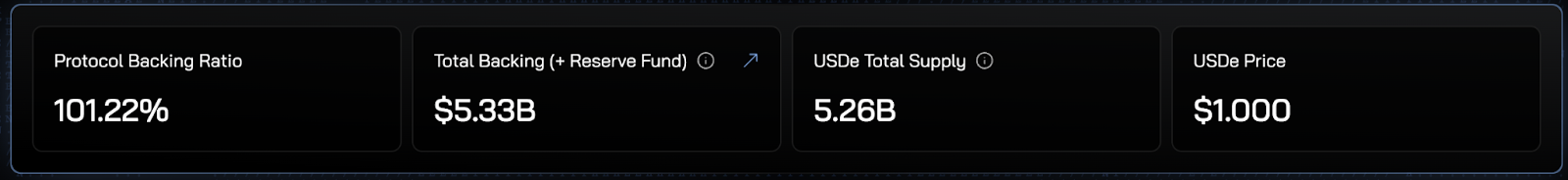

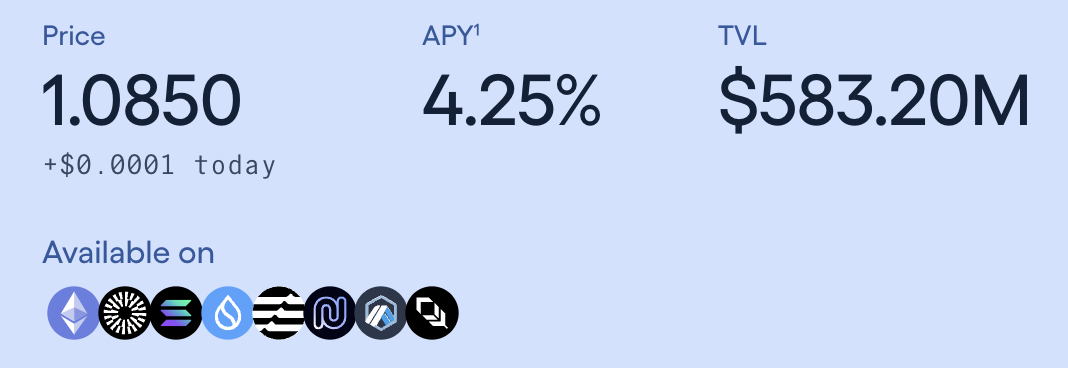

Several protocols are already pioneering the yield-bearing stablecoin model:- Ethena (sUSDe)

However, its stability is dependent on the effectiveness of its hedging engine and derivatives markets, which introduces risk during volatile market conditions. With integrations across DeFi and nearly $2B in TVL, Ethena is setting the benchmark for this new class of "synthetic dollars."

- Usual ($USD0 & $USD0++)

While yields peaked at 95.7% in December 2024, the current APY is around 11.14%. However, recent changes like altering the redemption rate from 1:1 to 0.87:1 have triggered concerns around liquidity, redemption mechanics, and user trust. The 4-year lock-up adds another layer of illiquidity, and although the protocol guarantees a risk-free rate baseline, the dual exit mechanism complicates usability.

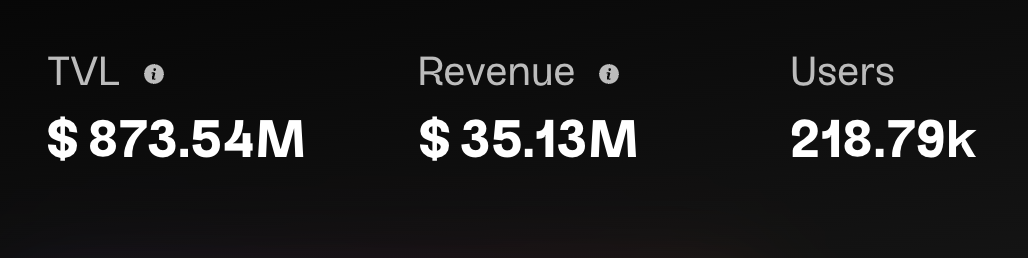

- Ondo - ($USDY)

This positions Ondo as a bridge for conservative capital to enter the stablecoin space. Its growing integration footprint is a sign of increasing demand for tokenized, real-yield products that meet U.S. regulatory standards.

Yield sources

Yield-bearing stablecoins tap into two core streams of yield:- On-chain yield: Staking rewards (e.g., from ETH or SOL validators), lending protocols like Aave or Compound, and liquidity provision in AMMs. These sources are native to crypto and accessible via smart contracts.

- Off-chain yield: Backing assets like U.S. Treasuries, repo markets, and money market funds (MMFs) generate yield in TradFi and are increasingly tokenized or represented on-chain. Circle, for example, parks a significant portion of USDC reserves in BlackRock's government MMF, although those yields don't flow directly to holders yet.

Risks and sustainability

Yield doesn't come free, and neither does stability.- Peg instability: Some of these stablecoins may drift from their peg due to market volatility or protocol mechanics, especially if underlying hedges break down or liquidations occur.

- Unsustainable APYs: Early-stage protocols often offer eye-popping yields to attract liquidity, but these are rarely sustainable. Market dilution, emissions-driven returns, and reliance on volatile DeFi yield sources can create long-term risk for holders.

Regulation: The game has changed

The regulatory tide in the U.S. is turning, and stablecoins are front and center in that shift. Under the Biden administration, the digital asset industry faced ambiguity and cautious rhetoric. But the 2025 return of President Trump has sparked a very different tone in Washington: one of open support and legislative urgency for stablecoins.A pro-digital asset push from the top

On January 23, 2025, the Trump administration issued an executive order titled "Strengthening American Leadership in Digital Financial Technology." This marked a clear pivot in federal policy - one that prioritises innovation and competitiveness in digital assets. The order laid the foundation for encouraging regulatory clarity, fintech integration, and a legal framework to govern payment-focused stablecoins.This top-down backing is already transforming how lawmakers approach stablecoin legislation.

The GENIUS & STABLE Acts

Two major bills are currently working their way through Congress:- GENIUS Act (S.919): Introduced by Senators Hagerty, Scott, Lummis, and Gillibrand, this bill outlines a federal licensing framework for payment stablecoins. It mandates 1:1 reserve backing, transparency, redemption guarantees, and strict AML/KYC compliance. It passed the Senate Banking Committee on March 13, 2025, with a bipartisan 18-6 vote major signal of political alignment.

- STABLE Act (House draft): Championed by Representatives French Hill and Bryan Steil, this version focuses on state-level issuer flexibility while mirroring many of the GENIUS Act's consumer protections. It has passed preliminary committee stages and is expected to move toward a House floor vote this quarter.

Both bills aim to codify stablecoins as legitimate payment infrastructure, not as securities, while giving issuers a clear path forward.

The political timeline

At the White House crypto summit on March 7, 2025, Trump explicitly called on Congress to pass stablecoin legislation by August 2025. That public pressure has accelerated momentum, even as some debates remain unresolved, like whether all issuers must be federally regulated or whether state oversight is enough.If passed, these bills would represent the first comprehensive federal laws for stablecoins in the U.S., and would trigger a cascade of regulatory action from agencies like the Treasury, SEC, and OCC. Importantly, implementation deadlines are built into the current Senate bill, requiring final rules within one year of enactment.

A New chapter for stablecoins

This regulatory clarity, combined with bipartisan support, is exactly what the stablecoin sector has been waiting for. It not only legitimizes the asset class for institutional players but also opens the door for banks, fintechs, and corporates to enter the space with confidence.While regulation still faces roadblocks and political compromises, the direction is clear: Stablecoins are no longer a gray area. They're on the fast track to becoming an official pillar of the U.S. financial system.

Global regulatory moves

Stablecoin regulation is evolving rapidly across the globe as well. While the U.S. pushes ahead with bipartisan momentum, Europe and Asia are setting their own pace, with many moving faster and more decisively.In the EU, the MiCA framework came into effect in mid-2024, introducing strict reserve, licensing, and transparency rules. It has already attracted major players like Circle, which launched MiCA-compliant USDC. MiCA is now seen as the global benchmark for stablecoin regulation.

Asia is fostering innovation with regulatory clarity. Singapore continues to issue licenses under its Payment Services Act, while Japan has legalized fiat-backed stablecoins under its updated Fund Settlement Act. These moves are helping build a stablecoin-powered fintech stack across the region.

Meanwhile, central banks worldwide are trialing CBDCs, but in most regions, stablecoins remain ahead in adoption and utility.

Risks, challenges & the road ahead

Depegging risk is risk, particularly for algorithmic or yield-bearing stablecoins. We've seen examples like UST in the past. Even asset-backed stables like USDC briefly lost their peg during high-stress events. Confidence is everything and it's fragile.Another growing concern is concentration risk. Tether ($USDT) still holds over 60% of the total stablecoin market cap, and while it's widely used, questions about its reserve disclosures linger. Meanwhile, emerging stablecoins offering high yields could dilute market trust if they fail to maintain peg integrity or liquidity.

Going forward, this space needs to balance innovation with safety. Clearer regulation, transparent audits, and a diversity of models across chains and use cases will be essential to support stablecoins as critical infrastructure for global finance.

Cryptonary's take

Stablecoins are quietly doing what most crypto products only promise: real adoption. While macro remains shaky and crypto debates regulation vs. innovation, stablecoins are quietly pulling ahead. And now, the U.S. is finally stepping in with clarity, not a crackdown. With the GENIUS and STABLE Acts gaining traction, Circle pushing for a public listing, and fintechs like Stripe and PayPal integrating stables at the rails level, this sector isn't waiting for the bull to come back but is building through it.And for those looking to ride this momentum, here's how we'd get positioned (assuming broader market is risk-on. P.S. now it is not):

- Bet on chains, most stablecoins are - Follow the flows. Ethereum has liquidity and trust. Solana brings speed and scale. Tron dominates global usage. Choose the ecosystem where real stablecoin volume is building.

- Stablecoin issuers - Circle is going public. Others will follow. If you want to ride the upside of stablecoin infrastructure, track the players building regulated, scalable issuance.

- DApp protocols - DeFi protocols, stablecoins are used the most (Aave, Curve, Ethena, Ondo, you name it)

Cryptonary, OUT!