FOREX On-Chain

The time has come! We’re finally at the end of the cross-chain communications series. We’ve covered the most feasible methods of closing the gaps that exist between chains – but how can one gain exposure to this upside? We got you covered!

In this journal, we will go through the protocols that we believe have a good chance of capturing substantial growth and the most market share within the sector. We often compare the cross-chain sector as comparable to FOREX - instead of fiat being exchanged, it’s crypto. Although the FOREX market trades on average $6 trillion in volume per day, it would be unrealistic for us to target that kind of volume.

However, the premise is the same, and we believe the market will value this sector highly in the coming years.

We’ll cover the “who’s”, the “why’s”, and the “wen’s”, as well as provide a brief update on the projects we have already covered previously! It doesn’t matter what the market looks like; these teams are always BUILDING.

As the saying goes:

“Build and ye shall receive”

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The Winning Solution?

We have covered the methods that protocols are using to connect the liquidity and information that would otherwise be segregated on each chain. To recap, the solutions are as follows:- Liquidity Pools – using an Automated Market Maker infrastructure with an intermediate chain that registers any transactions on both the sending and receiving chains.

- Synthetic Assets – using synths and a database protocol to allow the minting on synths on one chain, and the burning on another, to move wealth between chains.

- Bridges – using a combination of wrapped assets and liquidity pools to allow users to move assets from chain to chain.

- Layer 0 Protocols – uses a communication infrastructure to validate information or assets sent from one chain to another.

Honest answer? None of them.

The real answer depends on what is trying to be achieved. The best solution is the one that allows users to seamlessly move wealth and information between chains without a second thought. Unfortunately, the hard reality is that there is no solution that is that good – when we find one, CPro will be the first to hear about it!

The solutions we have mentioned are widely used and are often interoperable with each other. When two or more of these solutions are used by a protocol in tandem, we end up with a versatile and highly reliable product, and so we value this over choosing one “winning” solution.

Stating the Obvious

We have scoured many projects that utilise cross-chain liquidity pools as the method of moving wealth chain-to-chain. However, we would still put our money on the THORChain/THORSwap ecosystem being the best in this category.THORChain Ecosystem (RUNE & THOR)

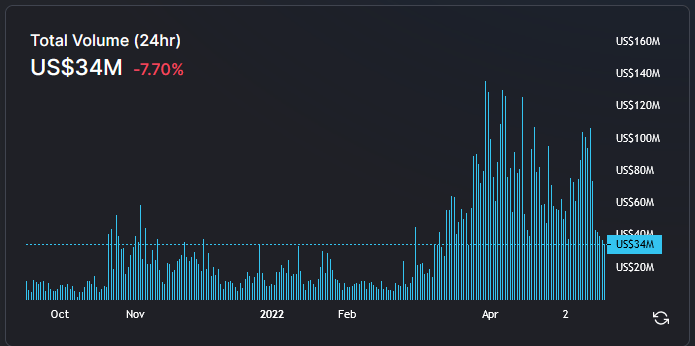

Throughout 2022 we have seen an explosion in volume on the THORChain network. This has largely been driven by the launch of synths, which have made using THORSwap cheaper and more user friendly.

We have covered this ecosystem pretty extensively already, so we won’t go into too much detail. For more information, check out the THORChain and THORSwap journals.

The targets still stand:

$90 for RUNE

$1 Billion Market Cap for THOR

Up next….

Unexpected X-Chain Participant (SNX)

Other than THORChain, we believe that another one of our projects has the best chance of success within the synthetic asset sector, none other than: Synthetix. When we first started looking into Synthetix the protocol was purely for minting synthetic assets and facilitating the trade of these derivatives. With the implementation of cross-chain synths, in our opinion the value of Synthetix as a platform will increase significantly due to increased volume. This in turn should lead to more revenue generation, and subsequently a positive reaction by the token price.Target for SNX: $60

Again, we have covered Synthetix extensively here so we will save some valuable word count for some new protocols.

The market recently has provided another opportunity to deploy capital – but where?

Synapse Protocol (SYN)

Labelling itself as a “Universal Cross-Chain Liquidity Protocol”, Synapse utilises a combination of liquidity pools, communications infrastructure, and bridges to create a comprehensive cross-chain solution for EVM compatible chains. Synapse’s user experience is great, and there is ample liquidity available so slippage when swapping/bridging is minimal for the average DeFi user. Where it falls short is that it only supports EVM compatible chains and L2s.

SYN is a multi-chain token that exists on a few chains and is the utility and governance token for Synapse Protocol, distributed as follows:

The max supply is 250 million tokens, with emissions of around 260,000 tokens per week (between 5-9% inflation per year). The token does not have any direct value capture in the same way that RUNE or SNX has; however, the demand for the token comes from its use in validation, providing liquidity and, of course, there is a large speculative element.

Despite the general state of the crypto market since the protocol launched in September 2021, Synapse has seen a relatively steady increase in transactions. We believe that despite the lack of direct value capture, the gradual reduction in emissions since launch coupled with increasing usage and past performance during market rallies, it is reasonable to assume that Synapse will perform well in the future.

We would compare Synapse to THORChain if we were to compare it to anything, just with limited scope and less value accrual. As such, we believe it is reasonable that Synapse would be able to reach the THORChain market cap during the most recent rally (RUNE at $13, which puts the market cap at $3.9 billion).

With a circulating supply of 184.38 million and a target market cap of $3.9 billion, this would put SYN at a token price of around $21.

Stargate Finance (STG)

Built as a proof-of-concept for the LayerZero protocol (mentioned here), and built by the LayerZero team, Stargate Finance is a cross-chain “unified liquidity” bridge that will facilitate the transfer of assets between any chains that have LayerZero endpoints. LayerZero carries the messages; Stargate carries the assets.

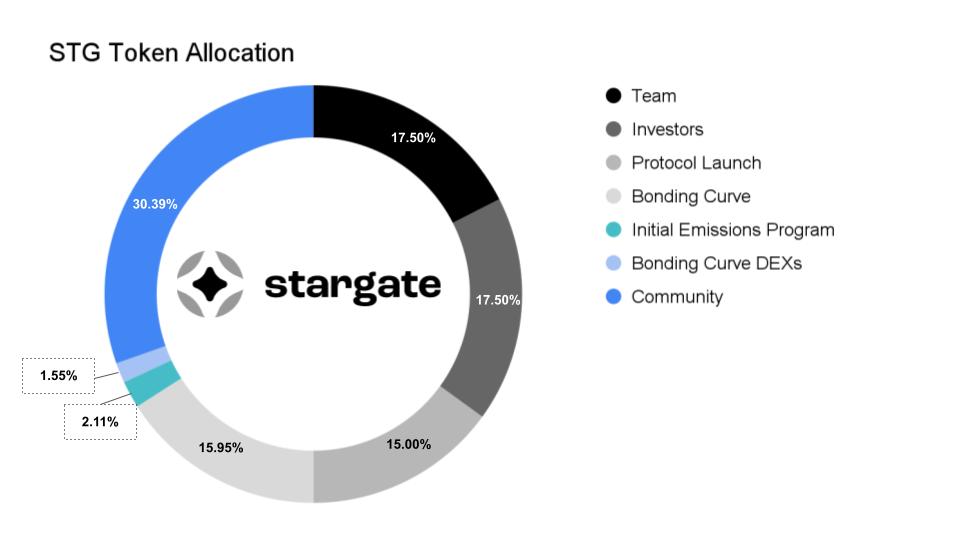

STG is the utility and governance token of Stargate Finance, and is distributed as follows:

STG launched in March 2022 with several large backers, represented in the investor allocation above - 35% of the tokens are allocated between early investors and the team. This is quite high; however, the rest of the tokens are largely distributed to the public through various incentive programs.

We could not find a circulating supply for the token, so it is difficult to provide a target. Considering the launch in March 2022, and the tokens sold at the IDO, we believe there are around 150-170million STG currently circulating. With a TVL of around $780 million at the time of writing and a not-yet functioning product, we believe the token is vastly underpriced ($0.61 at present).

Due to the LayerZero protocol's potential reach and cooperation with many more chains than Synapse, and the addition of revenue through staking, we believe that Stargate Finance can achieve a valuation at least 1.5x higher than the target for Synapse.

Assuming a circulating supply of 170 million STG and a target market cap of ~$6 billion, that puts the target for STG at around $35.30.

Synapse and Stargate both use a combination of 3 out of the 4 solutions we have highlighted - bridging, elements of Layer 0 communications, and liquidity pools. Thus, we believe they are worthy additions to our “assets of interest”.