This under-the-radar protocol could bring FOREX's $7.5 trillion trading volume on-chain

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

In January 2021, crypto hit an all-time high: $68 billion of coins and tokens changed hands on a single day.

That’s a lot.

But crypto is dwarfed by FOREX, the worldwide market for fiat currency trading. Banks, governments, and individuals conduct more than $7.5 trillion in FOREX trades on a typical day. It’s the world’s largest market.

Could a crypto protocol bring FOREX on-chain?

We didn’t think so. And then we encountered a groundbreaking protocol that's ready to rock the boat in cross-border trading, challenging the reign of USD-pegged stablecoins and connecting the dots in the fragmented DeFi landscape.

Onomy Protocol could bridge the gap between FOREX and crypto.

TLDR

- Onomy Protocol aims to bring FOREX to DeFi by issuing stablecoins of all major fiat currencies and facilitating cross-chain transactions.

- Built on Cosmos for cross-chain support, Onomy has three major components: Onomy Reserve (ONES), Onomy Exchange (ONEX), and Arc Bridge.

- NOM is the ecosystem’s utility, governance, and staking token, with hyperinflation until the supply reaches 250 million.

- Fair valuation for NOM is $2.50-$3.75, it all depends on development and adoption rates for elements of the ecosystem.

- Invalidation milestones are based on development progress at 6 and 12 months.

- Action points include accumulating NOM at $0.40-$0.60, staking, and exiting at specific price points.

- Conviction level: 25%.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Bringing FOREX on-chain

DeFi is missing out on one of the world’s largest markets. FOREX handles more than $7.5 trillion in trades — per day.This vast market could be represented on-chain by a sufficiently ambitious project.

Decentralised FOREX trading is a huge opportunity, but any protocol attempting it would have to clear two significant hurdles.

First, it would have to support stablecoins pegged to a wide variety of international fiat currencies: EUR, GBP, and YEN are just the beginning. Current stablecoins are almost all pegged to the US dollar, which is the global settlement currency.

Second, the protocol would have to solve the problem of DeFi fragmentation. There are many ecosystems — Ethereum, Solana, Avalanche, Polkadot, and so on — each with strengths and weaknesses. Communication between these chains is difficult. For a decentralised FOREX to work properly, stablecoins would have to be freely transferable between chains. The protocol would essentially have to issue its own cross-chain stablecoins.

These problems have seemed intractable. But that was before we learned about Onomy Protocol.

Audacious intentions

The Onomy ecosystem has multiple parts. Together, they could support seamless trades of stablecoins pegged to all the world’s fiat currencies. In essence, Onomy could be its own FOREX — and claim a significant share of that $7.5 trillion daily pie.

The ecosystem is based on Onomy Protocol, a proof-of-stake layer-1 blockchain built using the Cosmos architecture and secured by the NOM token.

Because it’s based on Cosmos, it is capable of multi-chain transactions through the Cosmos network. Onomy can communicate with other chains, transferring tokens and data efficiently.

Onomy’s goal is to link TradFi and DeFi, bringing FOREX to everyday users and institutions.

That goal requires three major components:

1. Onomy Reserve

Onomy Reserve (ONES) is the protocol’s core product. ONES acts like a central bank, facilitating the issue and redemption of stablecoins and the deposits used to create them. ONES is like the Federal Reserve of the Onomy ecosystem. In addition to issuing its own USD-based stablecoin, ONES will issue stablecoins pegged to all major fiat currencies.Onomy calls these stablecoins Denominations, or Denoms for short. Denoms will be backed by various assets and over-collateralised to account for volatility. The mechanism for backing stablecoins is similar to the one used by MakerDAO’s DAI.

2. Onomy Exchange

The Onomy Exchange, ONEX, is a multi-chain/cross-chain decentralised exchange. ONEX uses an order book to let users place orders for their swaps. ONEX is designed to operate exactly like a CEX.ONEX will host a platform for trading a variety of crypto assets as well as Denoms issued by ONES. Liquidity providers can earn yields by depositing assets in ONEX liquidity pools.

3. Arc Bridge

The third key component, Arc Bridge, facilitates the transfer of tokens and Denoms between chains. Unfortunately, the current version of Arc Bridge seems to have the same vulnerabilities as other bridges.NOM tokenomics

NOM is the utility and governance token for Onomy Protocol. It has three main use cases:- Staking: Securing the network through PoS.

- Governance: The Onomy DAO manages Onomy Protocol with NOM used in the voting mechanism.

- Buy and burn: Onomy will operate a buy and burn program based on protocol revenue earned through swap fees.

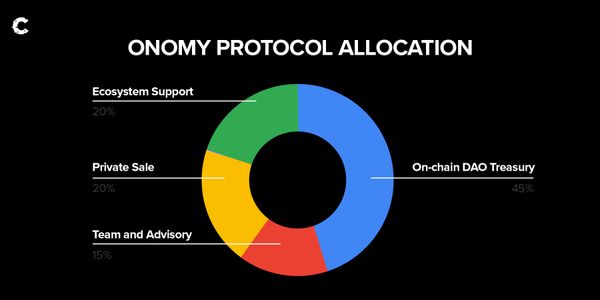

Initial distribution:

- Community allocation: 45% to the Onomy DAO treasury for use in liquidity mining and incentive programs.

- Ecosystem development: 20% to support ecosystem decentralisation efforts.

- Early investors: 20% earmarked for sale to early backers and partners.

- Team and advisors: 15% to the development team and advisory partners.

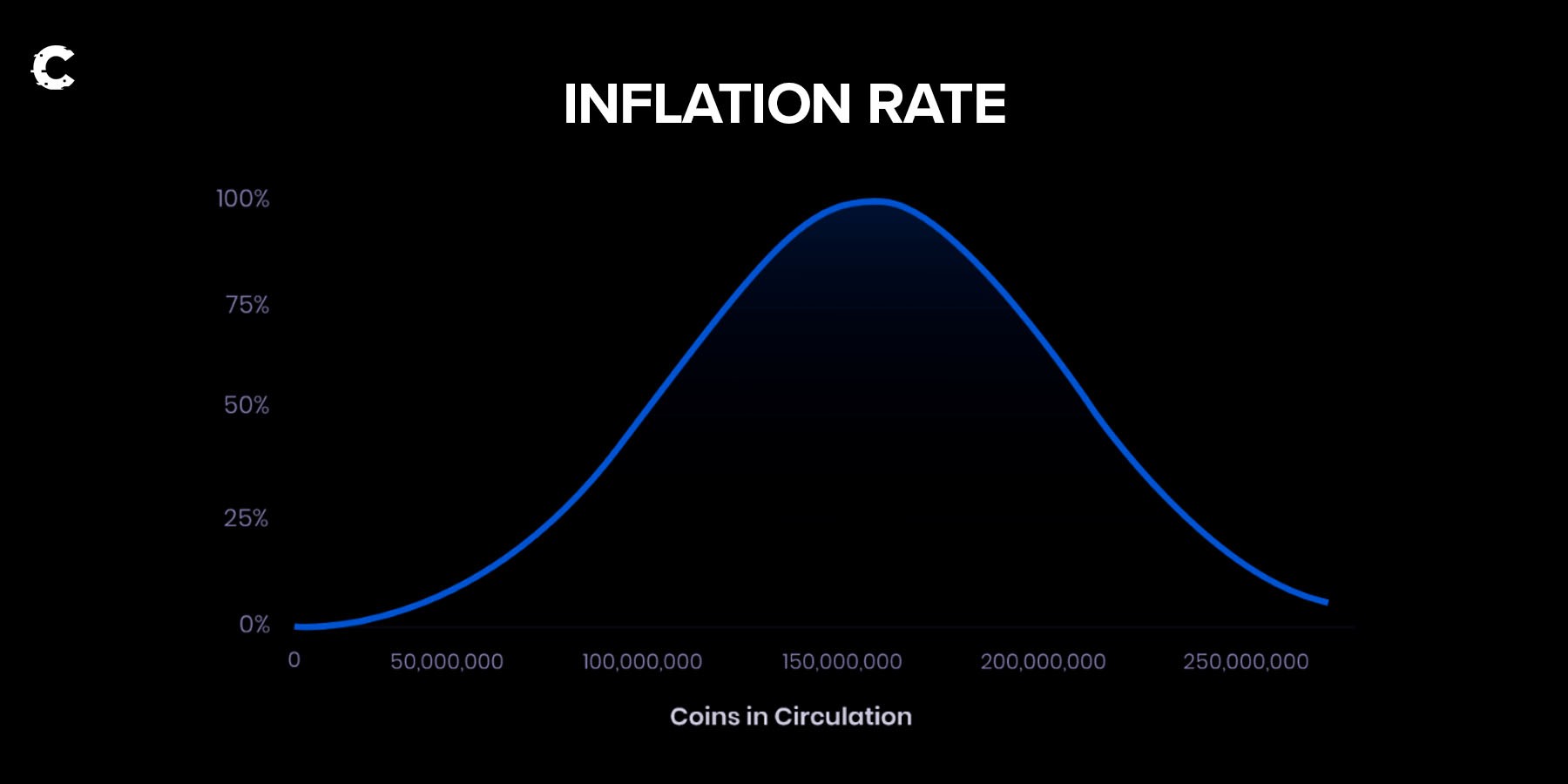

A hyperinflation rate will be in effect until the existing NOM supply reaches 250 million. After this period of high inflation, staking rewards will stabilise and selling pressure will be reduced significantly as time goes on. Due to the NOM hyperinflation period, staking is crucial. Holding without staking through a 100% inflation rate is illogical, as it dilutes any holdings.

Current statistics for NOM tokens:

- Circulating supply: 32.6M

- Total supply: 127.9M

- Market capitalisation: $27.4M

- Current price: $0.84

Target

With a market cap of $27.4M, we believe that NOM is undervalued. Given the development stage and potential target market (remember, FOREX enjoys a trading volume of $7.5 trillion per day), a fair valuation is $500 to 750 million.This valuation comes from a comparison of other DEXs. Ultimately, Onomy is a DEX — a “front” for ORES. And, it’ll be the first part built. There’s a multiplier here, though, that considers the whole ecosystem's potential upon completion.

Considering inflation, that would put NOM at a price of $2.50-3.75.

Longer term, a market cap in the billions is achievable. This depends on the adoption of Denoms stablecoins, ORES deposits, usage of ONEX, and the execution of the development roadmap.

Invalidation

Our invalidation for the thesis is based on development progress. We’ve set out a few milestones where we’ll be reevaluating our position:- By November 2023: Onomy DEX should be live. We would expect transactional volumes of at least $800k daily. If not, we’ll sell 50% of our allocation.

- By May 2024: ORES should at least be in testnet. If not, we’ll sell 100% of our allocation.

Cryptonary’s take: Conviction level 25%

Conviction level is based on our experts' confidence in an investment's probability of success based on past performance and the challenges the investment may face in the future.Onomy Protocol aims to tap into the massive potential of decentralised FX trading by introducing stablecoins for major fiat currencies and facilitating cross-chain transactions.

The NOM token serves multiple purposes within the ecosystem. While the protocol faces some challenges, it presents a significant opportunity for investors who are willing to stake their tokens. We believe the token is undervalued and holds a fair valuation at $2.50-$3.75.

Long-term success depends on the adoption of Denoms stablecoins, ORES deposits, ONEX usage, and development progress. We have set robust invalidation milestones at 6 and 12 months to reevaluate the project's standing.

Action points

Here’s what we plan to do:- Accumulate NOM at $0.40-$0.60 from Gate.io, KuCoin or Bitfinex.

- Store and stake NOM with Keplr wallet through the Onomy App. Pendulum and Cosmostation are the best validators. We will stake with one of them.

- Sell 50% at $1.13.

- Sell 20% at $2.00.

- Sell 10% at $3.75.

- Hold the remaining 20% for multiple years while monitoring progress.

Of course, we would close our position in full should one of our invalidation criteria be met.