But what if there was a way to cut through the chaos and unlock the secrets to supercharging your crypto portfolio? This would be a data-driven approach to lead you on a precise path to profits.

We love alpha and are always searching for it.

But let's face it: alpha is elusive, not usually replicable, and sometimes, it is a random stroke of luck that launches a coin to the moon.

In the crypto market, it is the "beta" plays that deliver the "guaranteed" profits. Beta assets move in lockstep with the major coins but with amplified volatility and the potential for outsized gains.

Through rigorous quantitative analysis, we've uncovered the best "beta" assets for major coins like Bitcoin, Ethereum, and Solana. These beta coins are the high-octane plays that have the potential to outperform the market leaders when the bulls start charging again.

Inasmuch as the bull is alive, this battle-tested playbook will make you money.

Sounds exciting?

Let's dive in…

TLDR

- There's so much hype and noise in crypto; we cut through it all with cold, hard data analysis.

- Today, we laser-focused on identifying the highest-potential "beta" assets to lead the charge when Bitcoin, Ethereum, and Solana go on their next bull runs.

- Using quantitative metrics, we separated the wheat from the chaff to find assets with statistically significant correlations.

- This isn't advice; it's a battle-tested data playbook to supercharge your portfolio when the bulls start stampeding again.

- For the DeFi degen, we uncovered the top beta token to amplify Solana's gains. For the meme lords, we pinpointed the beta coins painted all shades of WAGMI.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What are beta assets?

Generally speaking, a return on an asset can be expressed using the following formula:Asset return = alpha + beta x independent asset

Alpha is the portion of an asset's return uncorrelated to the general market or a main asset. It is the critical success factor that makes an asset detach from the market or main asset and make completely independent moves.

For example, let's say ETH and SNX are the main and beta assets, respectively. SNX moves in the same direction as ETH, but one day, while ETH was down 5%, SNX rose 87%—completely independent moves.

You start digging deeper and discover that SNX made a groundbreaking announcement with the US Federal Reserve to print millions of dollars and buy back SNX…

If you somehow managed to front-run that information, congrats, you had an alpha, and you'll win BIG.

Beta is a portion of an asset's return that is directly related to or caused by the moves of another asset. For example, in our quantitative analysis of the relationship between WIF and SOLs, we concluded that WIF and SOL have a strong and significant relationship with each other. Generally, when SOL moves in any direction, WIF follows in the same direction but with a bigger magnitude.

The crypto market is mostly dominated by the beta coefficient rather than the alpha coefficient.

Why?

Numerous studies show that the crypto market is inefficient and dominated by irrational behaviour. Market participants also exhibit an extreme level of herding behaviour.

All participants are here for the singular objective of watching numbers go up.

Additionally, the crypto economy is built so that liquidity is almost always paired with the gas asset (E.g. SOL-WIF, ETH-SNX liquidity pools). Therefore, all other things being equal, any moves in the main assets automatically cause the same directional move in the second asset.

As a result, you can get an extreme consensus price behaviour where everything goes up and down together.

In other words, the beta coefficient is a dominant factor here, and the alpha coefficient is almost negligible. You don't usually see an asset mooning if the BTC tanks. Everything moves in tandem.

What does it mean for you?

You can supercharge your investment returns if you can accurately identify positively related betas greater than 1. For example, let's say you are bullish on SOL and expect it to deliver a 3x upside. The SOL betas will follow SOL but will likely provide much higher returns than SOL's 3x. Important note: The reverse is also valid—if SOL drops 30%, the betas will go in the same direction and lose more than 30%.So, how do you use betas to your advantage?

Very simple. In an ideal world, you should hold betas with bigger coefficients on the way up and avoid them at all costs on the way down. The higher the coefficient, the bigger the moves both up and down.

So, how do you find betas with the highest coefficients?

Through quantitative analysis.

Some might argue that you don't need to go deep into data, as beta assets are just common sense. The argument goes something like, "LINK is a beta for ETH, KWENTA is a beta for SNX, trust me, I know, or I trust my gut."

But no…

Sometimes, what might seem common sense isn't backed by actual data.

For example, we initially thought that KWENTA was a beta play for SNX because it is a front-end for Synthetix. But if you look deep into the price actions of both KWENTA and SNX, based on historical data, Kwenta actually doesn't behave as a beta for SNX.

Moreover, even if your gut feeling is right, it won't help to pinpoint and identify the beta with the highest coefficients for the highest potential return.

Therefore, quantitative analysis is the way.

Data is an objective way to see things as they are. At Cryptonary, we love data, so we did the quantitative analysis for you and analysed beta assets for BTC, ETH, and SOL.

But before we list out the betas, here's a quick introduction to terminology

Quick terminology

Beta coefficient: Think of it as a multiplier, and consider the return you can potentially get for investing in beta versus the main asset. For example, If the beta coefficient is 2 when the main asset moves 10%, the beta asset can move 20%P-value: Simply speaking, it is the probability that the relationship between the two assets is solely due to randomness/chance. Therefore, ideally, when testing a hypothesis, you want this value to be as low as possible.

Generally, it is agreed that a p-value of 0.05 is "sufficient" evidence that the relationship is not due to chance, but the lower the value, the bigger the evidence.

R-squared (R² or the coefficient of determination): This is a metric to indicate how much of the variance of the dependent variable is "explained" by the independent variable. In our case, how much of a beta asset's price is caused by the main asset's price?

A value between 0.2 and 0.3 is considered good in social sciences because most researchers try to find directional relationships (E.g., education influences income, gender influences risk-taking, etc.). In exact sciences, R-squared is very close to 1 because rockets won't fly unless you are precise to the last digit.

Even though you want this number to be as high as possible, we are interested in a directional move. Therefore, we will stick to social science standards where 0.2 and 0.3 are common. Anything above this range should be considered above average.

We don't need to be precise about whether WIF will hit $9.99 or $10.1 when SOL hits $500 as long as the WIF's price moves in the same direction as SOL but with a bigger magnitude; that's sufficient for us.

We hope the above information didn't tire you as we approach the most interesting part.

The results…

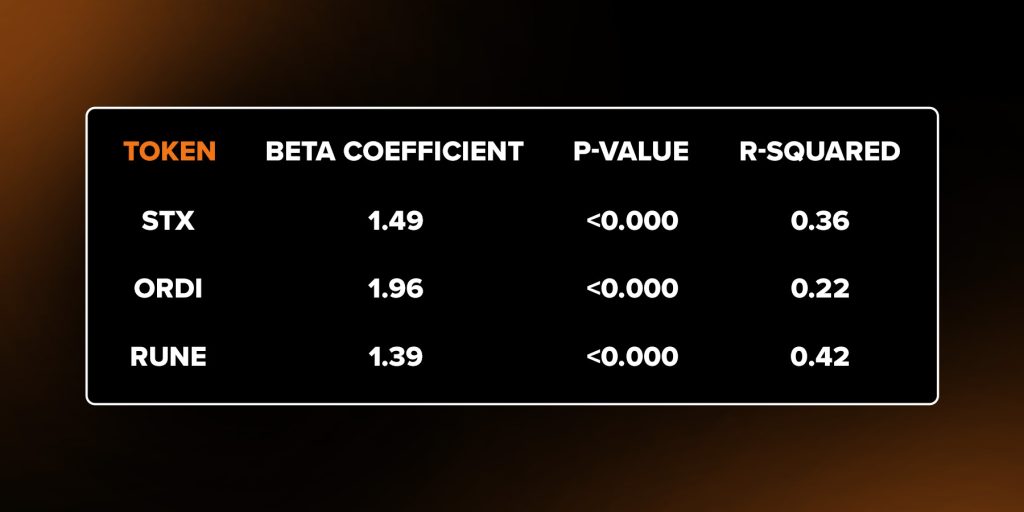

BTC's beta assets

- STX

- ORDI

- RUNE

Key takeaways

BTC beta for maximum return: ORDIIf you want maximum return and, by extension, higher volatility, ORDI has the highest coefficient.

Safest BTC beta: RUNE

Rune has the lowest coefficient but the highest R-squared. It means that BTC's impact on RUNE is more predictable and consistent.

All in all, if you want the highest beta on BTC, ORDI should be your choice, but if you want the safest beta, then it is RUNE.

ETH's beta assets

Interestingly, all the coins listed here are in Cpro's picks as assets we are backing to win. More interesting is that you would have made almost a 4,000% gain on PENDLE if you got in after our initial coverage. Check out the full "Crypronary's Picks" here.- PENDLE

- LINK

- OP

- ARB

- SNX

- LDO

Key takeaways

All models show significant evidence for the relationship with ETH.Moreover, most of them have an R-square greater than 0.4, which indicates the models have an above-average accuracy. Generally speaking, except for LINK, you will probably outperform ETH in this bull run by holding any of the above assets.

Least attractive ETH beta: LINK

SNX and LINK are the least attractive betas, especially LINK.

Most attractive ETH beta: OP

OP is potentially the best beta for ETH.

Of course, if you time your entries perfectly, you can outperform ETH with any of these assets. But if you are the type of investor who tends to Dollar-Cost-Average in ETH, you might as well consider DCAing into OP instead to squeeze out the most from the bull run.

SOL's beta assets

We broke down SOL's beta assets into two categories: small-cap coins and memecoins.Small cap altcoins

- JUP

- JTO

- NOS

- DITH

Key takeaways

Looking at the numbers, we can see that JUP is a strong beta for SOL. Its R-squared is exceptionally high, which implies the high accuracy of the influence of SOL on JUP.Even though p-values are low for almost all assets, NOS and DITH seem to be a not very good bet as SOL beta due to low R-squared and beta coefficients.

Best small cap beta for SOL: JUP

Considering all factors, if you prefer avoiding meme coins, focusing on legitimate projects, and having a bullish outlook on SOL, JUP is the strongest beta asset to SOL. You can expect JUP to outperform SOL in the remainder of this bull market.

Note. Not being a good beta asset to SOL doesn't mean the asset is bad per se. It just means that the price doesn't follow SOL and moves independently. This can be both good and bad.

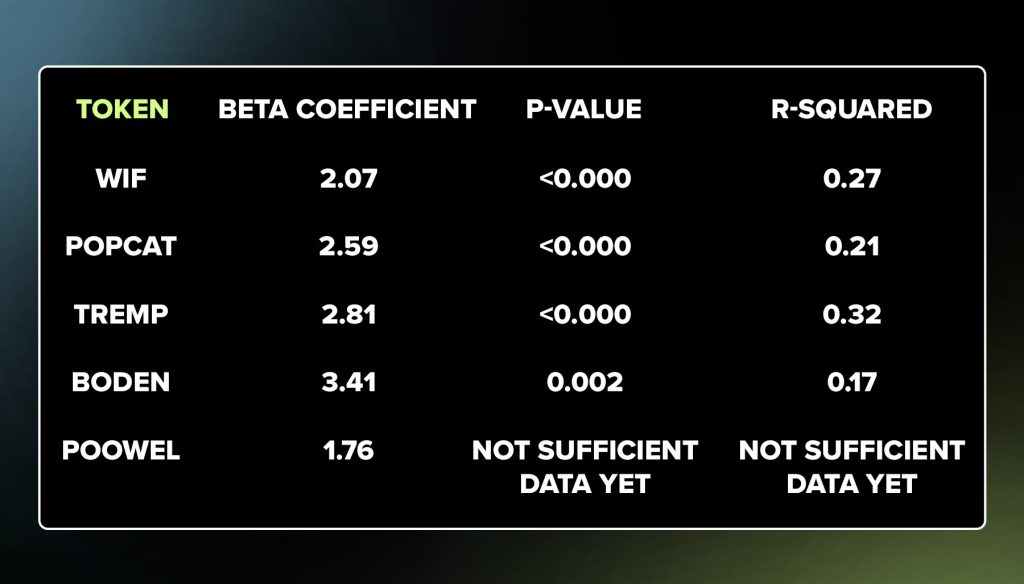

Memecoins

Looking at the meme category, we can see that it is indeed more volatile than Solana's small-cap altcoins (Higher beta coefficients and lower R-squared). The data shows that memes can provide better returns than small-cap altcoins if you can withstand pullbacks and temporary volatility.- WIF

- POPCAT

- TREMP

- BODEN

- POOWEL

Key takeaways

Best memecoin beta to SOL: POPCAT and TREMPAll of the above memes have a significant relationship with SOL. It is interesting to see that POPCAT can potentially provide better returns than WIF if the bull market is set to continue.

This isn't surprising. WIF has established itself as a bluechip memecoin, and we've previously moved it from the 'high risk' category to the 'mid risk' category in Cryptonary's picks.

Between PolitiFi memes, even though Boden has a bigger coefficient, higher p-value and lower R-square make us think that TREMP is potentially a better beta asset for SOL.

POOWEL is a newer PolitiFi meme in which some of our community members are already invested. There is insufficient data to draw conclusions yet, but it is also starting to behave like an SOL beta.

Cryptonary's take

Investing in beta assets is a smart, data-driven approach to supercharging your investments. No more guesswork, no more chasing random pumps.Through the quantitative analysis in this report, you now wield a powerful data-driven edge. You understand that in crypto, the "beta" assets—those highly correlated to the major players yet imbued with explosive multiplier effects—offer the surest path to maximising gains.

Whether you're a Bitcoin maximalist, an Ethereum maxi, or a Solana degen, the insights here equip you with a precise, battle-tested playbook. Just cold, hard data revealing the optimal beta tokens to amplify your profits as the bulls charge through the next 12 - 15 months.

The data don't lie. All that's left is to make your move, executing with strategic precision and unshakeable conviction.

And this time, you'll be primed to win.

Cryptonary, Out!

Take Your Crypto Strategy to the Next Level

Beta assets can supercharge your portfolio—but knowing which ones to pick is the key to success. At Cryptonary, we do the heavy lifting with data-driven research, expert insights, and real-time market updates to help you make smarter moves.🚀 Join 230,000+ investors using our proven strategies. Try Cryptonary risk-free for 7 days and gain the edge you need in this bull market.