Note, on 27th January 2023, Friktion announced that they are sunsetting the platform. This is likely due to negative impacts of the FTX implosion and dwindling Solana DeFi use. We expect a part 2 article which will explain what happened, and any next steps.

This time we’re looking at Friktion, a protocol that started with DeFi Option Vaults (DOVs), but is fast becoming much more.

With the long-term goal of being a one-stop shop for retail, DAO and institutional portfolio management, there is certainly a lot of room for growth.

Today, we give an overview of what Friktion are, how it works, and what the future holds for the platform (pssst, we also discuss how to qualify for a potential token airdrop!)

Before reading on, make sure you check out our report on DOVs. It contains vital information needed to understand this report.

Without further ado, let’s get down and dirty with Friktion.

Note, we have a podcast with Friktion founder Uddhav coming out soon!

TL:DR

- Friktion aims to be the first of its kind, a DeFi hedge fund used by retail and institutions alike.

- Massive focus on education and transparency, with some outstanding resources for users to learn from.

- AIRDROP COMING! How to qualify at the end of this article!

What is Friktion

Built on Solana, Friktion’s aim is to become the first true DeFi full-stack portfolio management service. In other words, they want to be the first DeFi hedge fund, open for anyone and everyone to use. This isn’t just aiming for retail either, they have their eyes set on everyone, from institutions and DAOs to you and me.

Offering permissionless access to institutional-grade structured products and risk management, they aspire to be the one-stop for portfolio management for all, offering a range of sustainable yield and risk-managed products, with the end goal of catering to every level or risk appetite in customisable ratios.

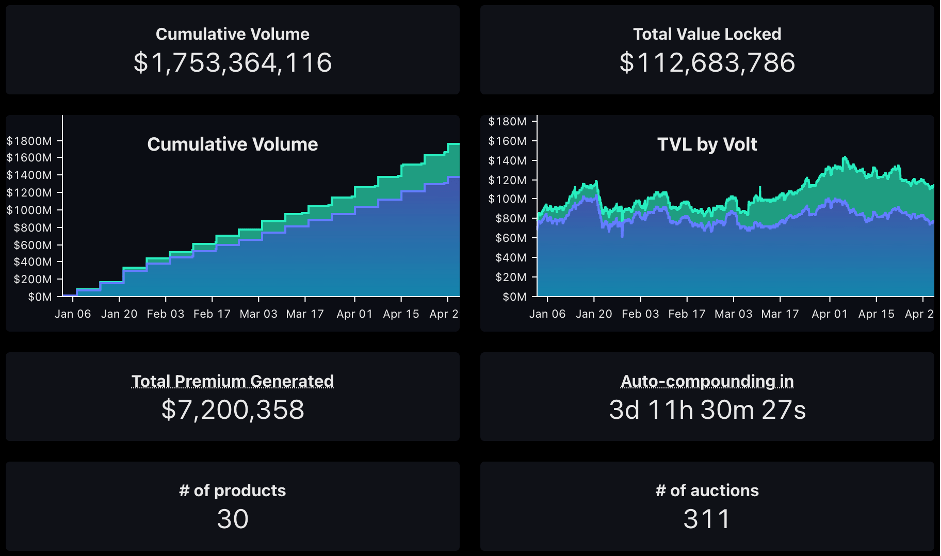

They opened their doors in October 2021, and launched on mainnet in December that year. With almost $2bn in cumulative volume, they are certainly a quick starter, and currently hold the title of the largest seller of options on Solana across CeFi and DeFi.

Note, Deribit has just launched Solana options, so we need to keep an eye on how this affects Friktion.

The protocol has 2 major aspects to it, the retail side, where users can connect to the dApp and invest in Volts, and the DAO / institutional side, where they create custom strategies to manage treasury funds.

Friktion are working with Investin to allow anyone to create a fund using the Volts available on Friktion. Investin works in a similar way to eToro copy trading, where users can deposit funds and copy trades of a specific manager. This has huge potential, and we can’t wait to see the details once they are released.

Team

Founders are Alex Wlezien and Uddhav Marwaha.The team comes from proprietary trading and quantitative research firms (commodities, treasuries, volatility products, crypto assets), full-stack blockchain engineering, monetary policy and UI/UX design.

I’ve been in extensive talks with Uddhav, one of the founders, and found him extremely helpful and happy to talk. I’m impressed by the team and their mission. Let me tell you why…

Investors

Recently raised $5.5m from an list of impressive VC’s. These were Jump Crypto, DeFiance Capital, Delphi Ventures, Sino Global Capital, Tribe Capital, Castel Island Ventures, Dialectic, Petrock Capital and Solana Capital! This funding is being deployed into building circuits and Friktion as a whole.Target Market

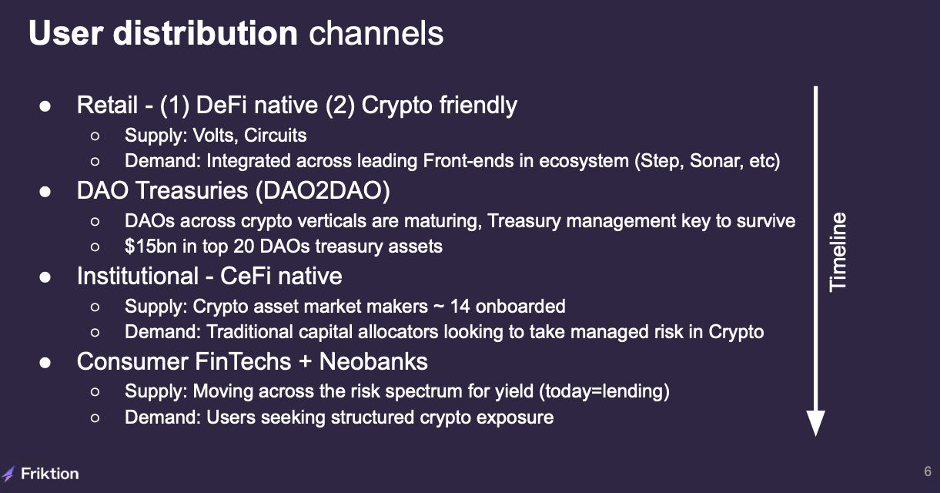

See below, it shows the target market and sequence of growth.

Blockchain Ambitions

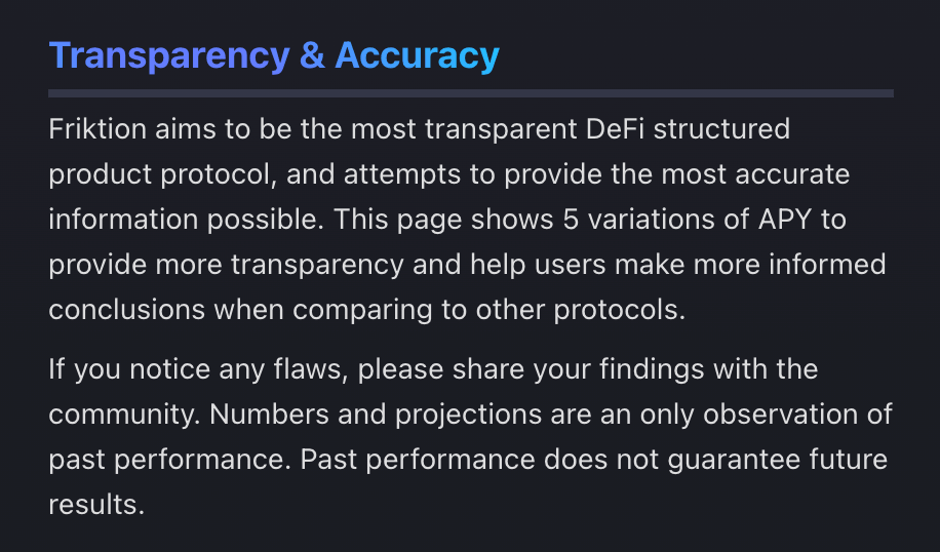

Currently only on Solana, however, there are plans to go cross-chain, allowing DAOs and users on any chain to use Friktion. I believe we will see an announcement about this soon.Focus on Education and Transparency

Friktion has an education and information first approach. They are incredibly open and detailed on all aspects of what they do. This is something that’s hard to find in crypto. Not necessarily due to bad intentions, but largely also the effort and understanding that is required to teach everyone the complexities of derivative strategies. Make sure to check out their Twitter, as scrolling through here you will see exactly what I mean.I highly recommend going over their Medium articles as well. If you're interested, here’s a great one to start with. It covers implied volatility and the volatility surface, plus pricing and trading volatility.

The Retail Side – Friktion Volts

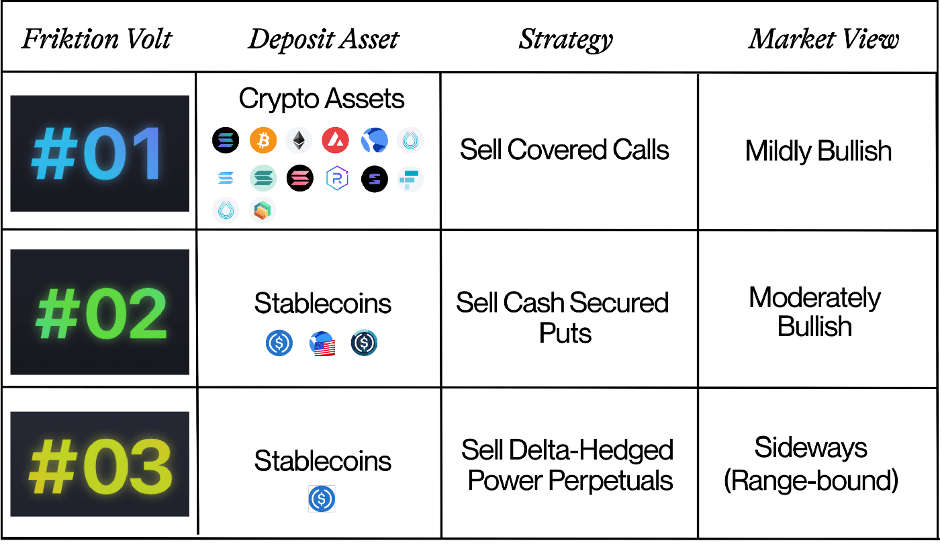

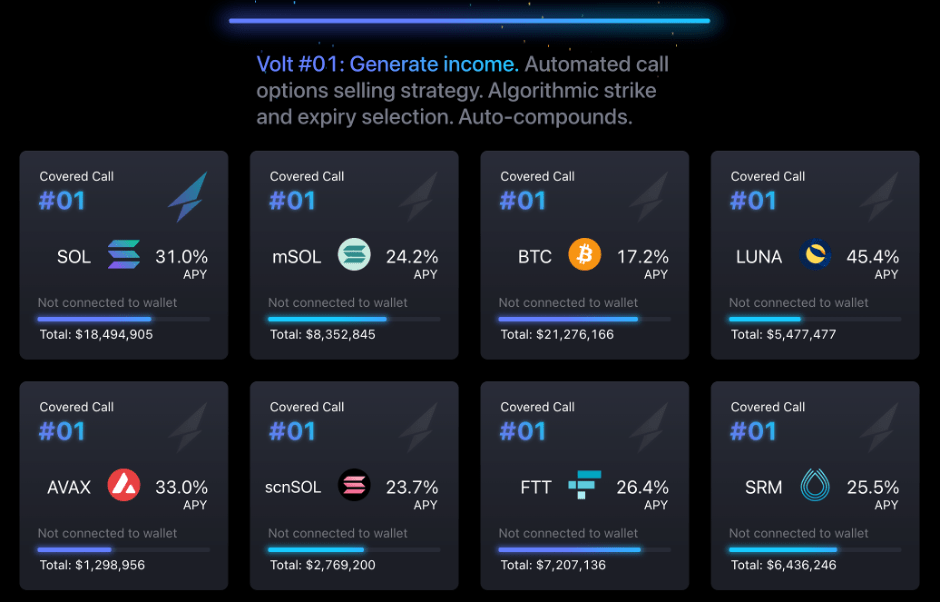

Volts is the term Friktion gives to its structured product vaults. A play on the electrical theme of the protocol (like their NFT collection, Lightning OGs, more on this later 👀).

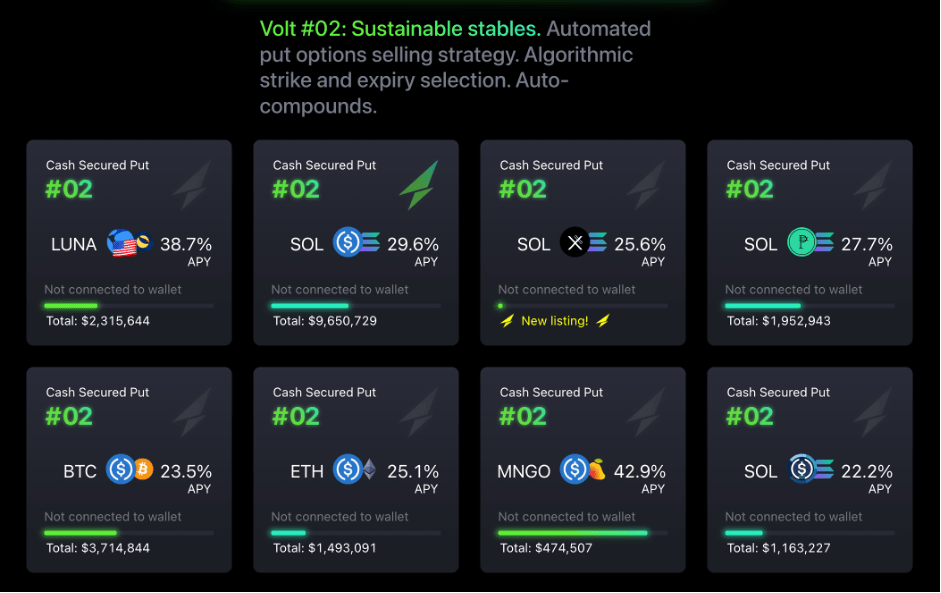

Volts 1 and 2 are the covered calls and cash-secured puts option vaults we see across DeFi Option Vault (DOV) protocols.

Friktion does these a little differently, which we will look at shortly. Volts 3 and 4 are more complex, and can’t be classified as DeFi Options Vaults, instead, they’re structured products. This is a step towards their end goal of complete portfolio management.

Friktion supports a wide and ever-growing range of assets (currently 31). Check out their analytics page to see the full list.

How Does it Work?

The Volts run in epochs (cycles), which last 1 or 2 weeks depending on the strategy. Users deposit into the Volts at any time. The deposit is put in a queue and deployed in the next epoch (Friday mornings at 2am UTC). When the epoch ends, users can claim returns, or auto-compound (funds will be auto-compounded unless a withdrawal is requested prior to the next epoch).Liquid Tokens

Once deposited and the epoch begins, users can mint fTokens, which represents your share of ownership in the Volt. This can be compared to mSOL or stETH (liquid staking SOL through Marinade or ETH through Lido). There are plans to give the fToken a range of use cases, with the first being collateral for borrowing.Fees

There is a 0.1% standard withdrawal fee, and a 10% performance fee. The small withdrawal fee is great to see when compared to some other protocols, as it means Friktion only really earns when you earn. Also, as it’s a withdrawal fee, if you roll over your positions without withdrawal (you can do this indefinitely) you aren’t charged (until you remove the money from the platform).UI/UX (User Interface / User Experience)

The Friktion platform is very intuitive, easy to use, and packed full of all the information you could possibly want. Rather than run through the platform, I encourage you to have a look yourselves. It is honestly a joy to use, and their recently added explore page makes it even more retail friendly.Notifications

Another new feature is the notification system, powered by Dialect. It notifies you when your Volts are complete, and lets you know how much you earned in each Volt. Next steps include guiding users through the deposit, withdrawal and claim process, and delivering notifications through other channels, such as Discord or Telegram.Portfolio Tracking System – Coming Soon

This is something that really stands out, showing even further their focus on transparency, education and openness. Friktion are integrating a portfolio tracking system that will allow users to see their historic and real-time profit and loss, among other things. This will be powered by ZettaBlock, who won Friktion’s Solana Riptide Hackathon ($30,000 prize).Friktion claim to be building a portfolio management experience unrivalled across CeFi and DeFi – after seeing their analytics page, and knowing what they are building out, I’m excited to see how they develop.

Analytics Page

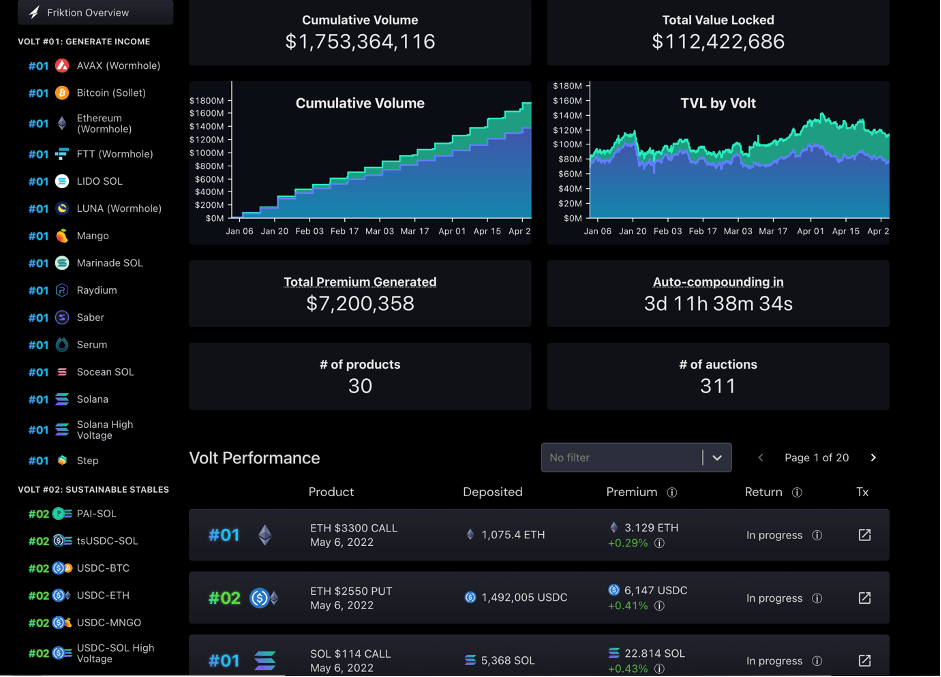

The analytics page is incredibly comprehensive. There are some aspects missing, such as a view of personal transactions and a personal profit and loss page (both of which are coming soon). Even still, the amount of detail is far more than any competitor that I’ve seen. They include details of all historical profit and loss (very specific details, including strike prices and historical charts) and much, much more. Be sure to click the link and see the page for yourselves.

Why So Detailed?

There is a reason for Friktion’s incredibly comprehensive analytics page, and it ties into their notification system, portfolio tracker including full profit and loss (coming soon), educational material and docs (including a Friktion Learn platform that is coming soon), and fully doxxed team. We mentioned it above, but see the below screenshot from the analytics page.

Current and Historic TVL

Friktion has a very stable track record when it comes to TVL, never falling below $80m as you can see on the chart below (from 2/5/22). This only includes Volts 1 and 2, as the 3rd and 4th Volts are new.

Some historic data for you:

16/02/22 - $604m traded volume, $97m TVL, 17 products, $2.8m premium generated.

As you can see, they are growing rapidly, with double the Volts, almost double the products, and around 3x the premiums and cumulative volume in under 3 months.

What’s Next?

Those who believe we are in a crab market may have avoided Volts 1 and 2 as they would have had to create their own strategy, with Volt 3, this is done for you. The same goes for Volt 4, which aims to be delta neutral, meaning the returns aren’t affected by price movements.Clearly, users have not been scared off, as TVL has remained so consistent. As Friktion iterates and ships new products, which serve entirely new market participants (so they are tapping previously untapped customer bases), and improves the education, user experience, and products they currently offer, I believe we will see solid and consistent growth in the TVL, and all other statistics. This gives me a very positive outlook on the future of Friktion.

Returns

I’m not going to go into too much detail here, as you can see the weekly returns of every Volt since creation on the Analytics page, as well as the cumulative returns (what you would have if you had put your money in at the start, and left it there).However, as a quick overview, since inception the ETH call pool has achieved 16.13% APY, SOL call achieved 27.31% APY. BTC put achieved 20.83% and ETH put achieved 22.31%.

The only Volt that has achieved meaningfully negative returns is the Serum call Volt, which due to one massive price spike in late March, which saw it go from around $2 to around $2.50, has achieved -54.48% APY. It’s important to note that Friktion, as a relatively new protocol, continuous iterates on how it chooses its strikes. Also, as it’s a call option pool, depositors make a negative return compared to buying and holding spot, they don’t lose any USD value.

Friktion is also the only protocol that sells SOL call options that have never been exercised and has much better risk management than most competitors.

Volts 1 and 2

Check out this great video on how Volt 1 works.

The epochs begin on Fridays at 2am UTC, which is when the strategy is deployed (through blind Dutch auctions designed by Channel RFQ, market makers bid on-chain for options being sold by the Volt).

Volt 1 offers high and low voltage Volts. High voltage selects strike prices that are closer to the current price, meaning they are more likely to be hit. These are higher risk and higher reward (as they generate higher premiums). In the future, there is potential to explore more options in terms of risk/reward.

DeFi Options Vault’s Failure

In their basic form, DOVs are not useful long term investment tools. They do not perform well against buy and hold strategies over the long term, as you can see in this report.This is something that all DOV providers are trying to combat, but Friktion is leading the pack, creating and publishing its strategies, so others can benefit from what they learn.

How Friktion is Trying to Fix This

Unlike many other protocols, they try to keep their displayed returns realistic and decide strikes so the options are unlikely to be exercised. They put considerable thought into this, and so far it has proved successful in difficult market conditions, when other vaults have suffered. To prove this, Friktion shows all returns for every Volt since inception, including returns for each epoch (cycle) and cumulative returns since inception, plus much more, on their analytics page. I hope this will become industry standard, as it is essential for furthering the sector and building trust, especially with non-crypto native users.Option Auctions

Note, Friktion has just announced a new partnership with Paradigm, which will bring a new and diverse range of liquidity into the auctions. See the details in the thread below:

The options sold using the funds deposited into Volts 1 and 2 are auctioned off to a variety of market makers through Channel RFQ. This is done via blind Dutch auctions, meaning the bidders don’t see what others bid, and when the auction is complete, the options are sold to the highest bidders, working down until all sold.

Let’s run through an example, selling 500 SOL options:

MM #1 bids $11 per SOL option, for 350 options

MM #2 bids $10.50, for 100 options

MM #3 bids $10 for 250 options

MM #4 bids $9.5 for 100 options.

In the above example, MM #1 and MM #2 would get the full allocation, and MM #3 would be sold the remaining 50 SOL options at $10 each. MM #4 would get none.

Combatting Market Maker Front-Running

Troubles have arisen due to the predictable nature of DOV auctions (they have previously always run the auctions at 8am on Friday mornings). Market makers have front-run the auctions, suppressing the prices, resulting in cheaper options and lower returns for DOV depositors.This has been described as one of the biggest issues facing DOVs, and is something Friktion has taken a keen interest in. They have tested and iterated repeatedly, and continue to do so, to optimise the process.

If you’re interested, these articles by Friktion do an incredible job of explaining the issue, and what they are doing to fix it. The second one is an analysis of how their strategy worked, and what is best to do going forward.

We’ll get to Volt’s 3 and 4 shortly, but 1st, there’s something we need to cover…

Entropy

If Entropy succeeds, we will write a stand-alone report on it. For the time being, it’s a very new product without any track record, so I’m going to stick to the basics.Entropy is Friktion’s in house perpetual futures exchange (read this for info on futures). It’s on Solana, powered by Mango Markets, and has 3 products, perps, volatility perps and power perps.

Note, Entropy will have its own token, so whilst it will indirectly benefit Friktion token-holders, it’s unlikely they will get any sizeable revenue share from the exchange.

It uses margins and liquidations (for more information on this, check out this report, similar to other perp exchanges such as dYdX, Binance and FTX.

Power perps exist on Ethereum through Squeeth, although the AMM model used means funding rates are excessively high. Entropy attempts to fix this by using an order-book style.

Power Perpetuals Power perps are a form of perpetual who track the price of an asset raised to a power (for example, normal perps are BTC1, while power perps (on Entropy) are BTC2. You can get power perps to the power of 3 and more, but Entropy only allows to the power of 2.

If you’d like more information on power perpetuals, make sure to check out our guide, the Friktion power perp explainer, and, for even more depth, read the Paradigm paper that brought the instruments into existence.

Volatility Perpetuals

Volatility perps on Entropy track the implied volatility from centralised exchanges (Deribit, Bit.com and Okex) using an Oracle provided by Genesis Volatility.Fees

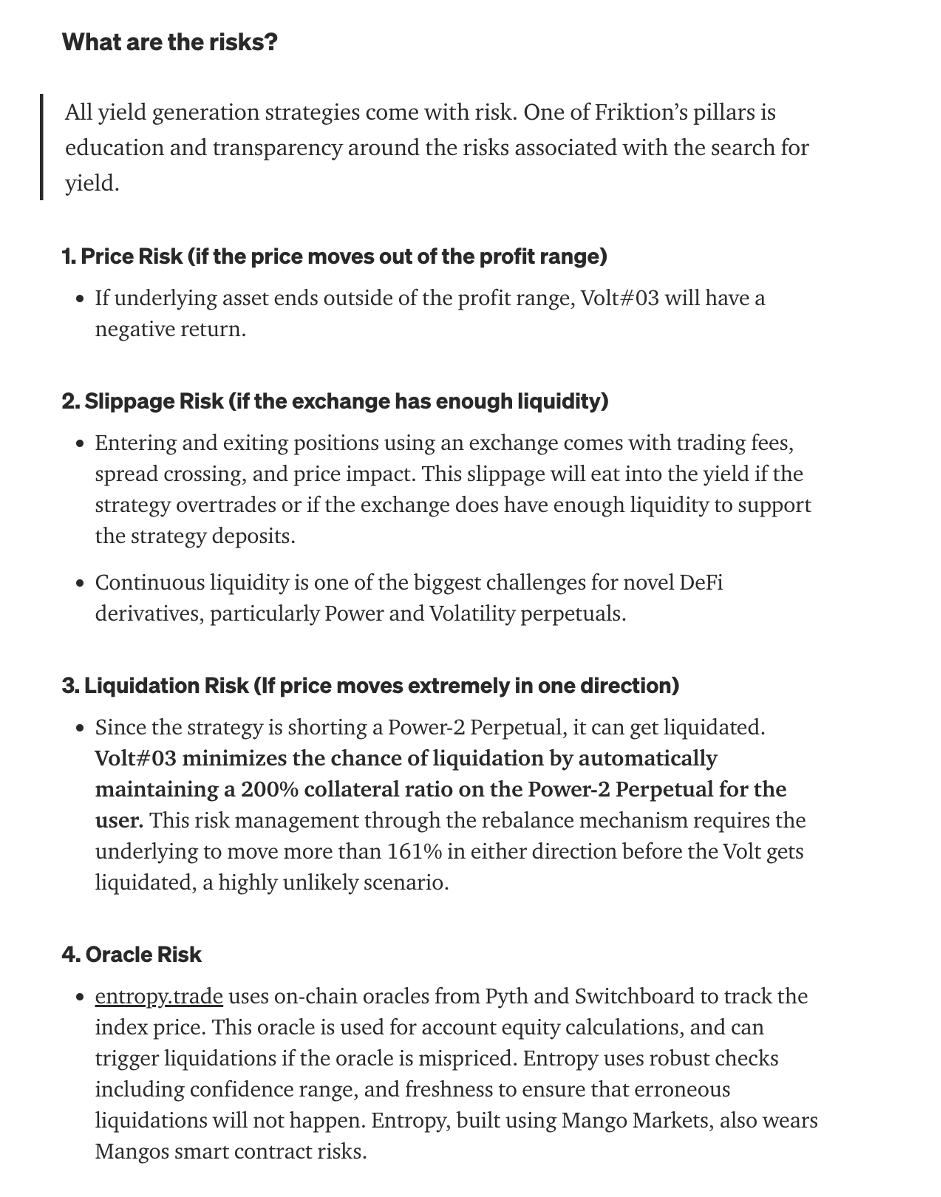

0.05% for takers (purchasers of perps), 0% for makers (sellers).Risks

Entropy’s liquidity is absolutely vital for Friktion. Volts 3 and 4 use the liquidity available on Entropy, so if there’s low liquidity, or it’s overpriced, affects how much capital the Volts can handle, and what returns they receive.There are plans to get market makers onboard to ensure liquidity on Entropy, the team is currently trying to figure out how to do this without over incentivising and eating into returns of customers (or running out of Entropy tokens too quickly).

Anyone can market make using their open-sourced bot, and those that do will be eligible for an airdrop of Entropy tokens when launched. Find the Github here if you’d like to run one.

If Entropy is unable to attract market makers for a reasonable price, and users who set up a bots don’t provide sufficient liquidity for the demand, Volts 3 and 4 will fail (or at least be capped below their potential).

The success of Friktion’s delta-hedged strategies (Volts 3 and 4), and any additional strategies that involve perps (likely most of them) currently rely entirely on Entropy. This is a potential failure point, especially as attracting liquidity to niche and potentially illiquid markets such as power perps and volatility perps could be a massive challenge (without paying a premium and eating into returns).

However, other exchanges offer perps, new ones are popping up that offer power perps, and I’m sure we will see others with volatility perps in the future. With some tweaks in the offering, and some adjustments in structure, I see no reason Friktion couldn’t partner and integrate with these other platforms, should Entropy run into troubles.

Also, Entropy will be launching its own token, so this will allow them to seed liquidity to a certain extent, although it’s supply likely won’t be limitless (if it is, that causes it’s own troubles).

Certainly something to keep an eye on going forwards. We will keep up with developments and update you where necessary.

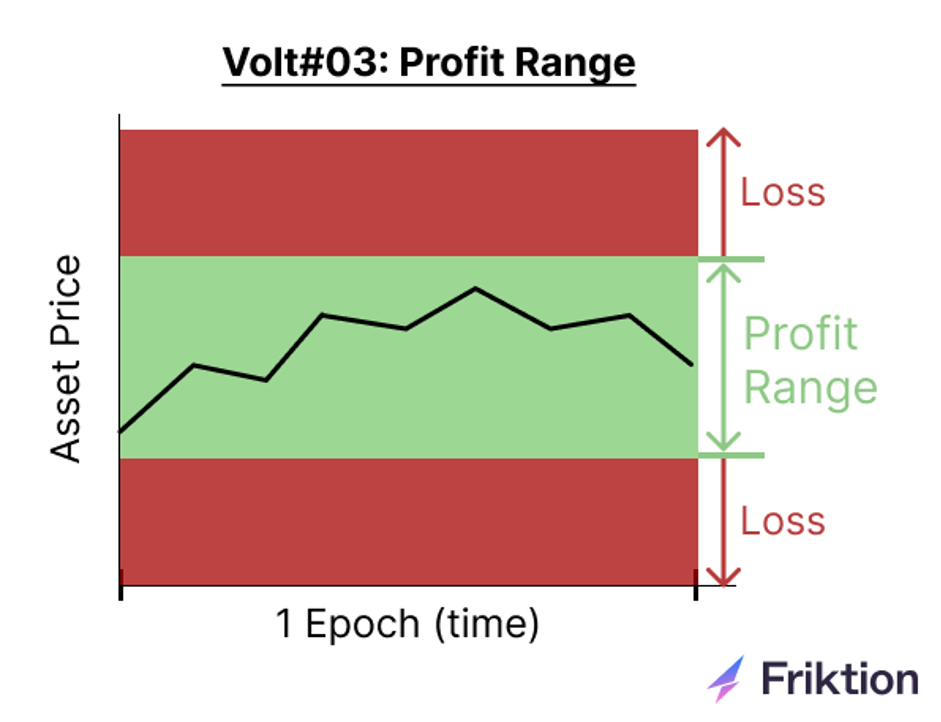

Volt 3

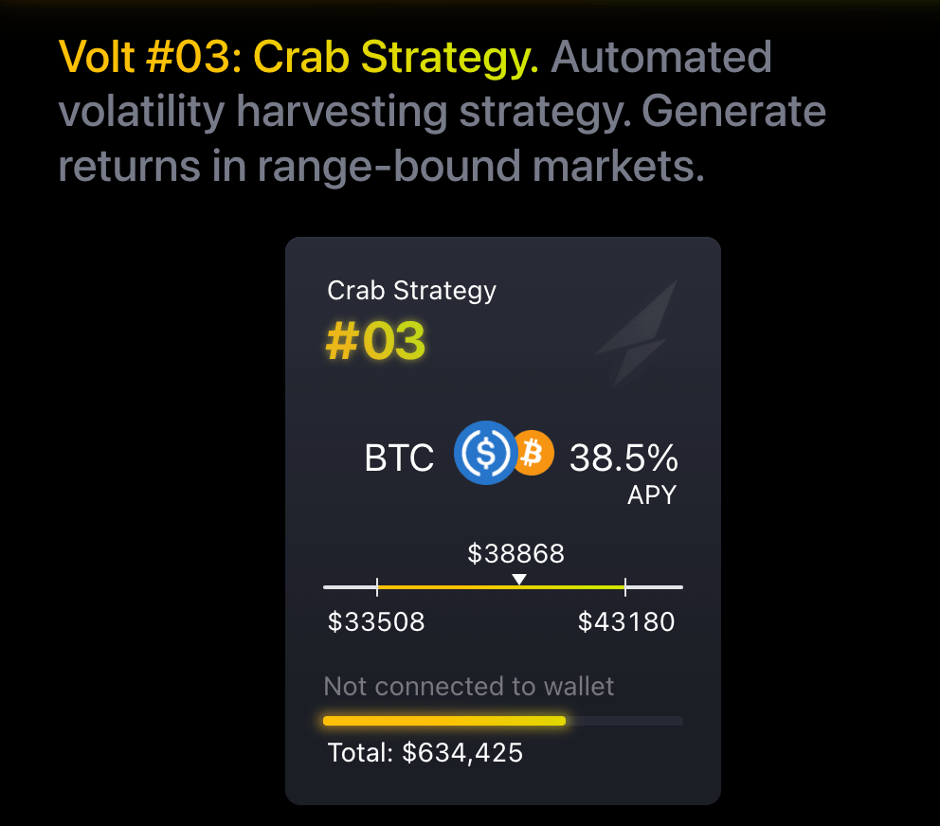

Volt 3 is a crab strategy, making returns in sideways markets using power perps. It monetises market turbulence, making it negatively correlated to the market.

I’ll put a more detailed breakdown at the end of this article, and the full mechanics are available here:

But essentially:

The Volt takes out a short power perpetual position, which collects funding rates, whilst delta hedging with a normal perpetual position twice the size of the short (to protect against directional risk).

This means that the strategy profits if the underlying asset (such as BTC) stays within the range (currently around $35,000 and $44,500).

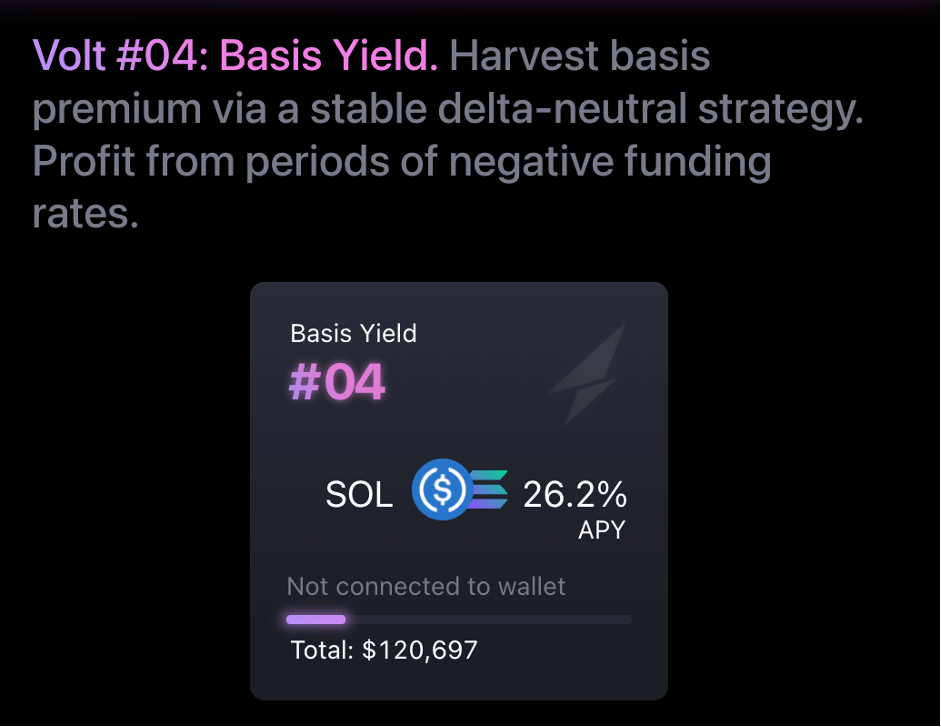

Volt 4

Volt 4 works by taking a long SOL-PERP position, whilst simultaneously taking a short spot position on SOL of the same size. This protects against price movements, making the strategy delta-neutral.

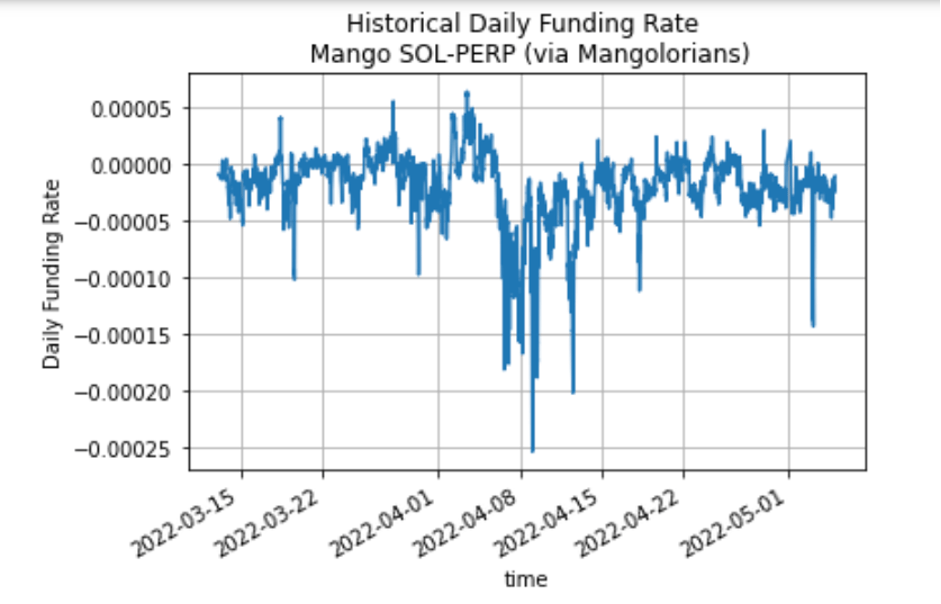

The strategy earns yields when the SOL-PERP funding rate is negative, as the long position then harvests the funding payments. If funding is positive, the position would achieve negative returns, as it would have to pay funding to short positions. As you can see from the image below, this hasn’t happened vary often over the last few months. Also, if the Volt observes consistently positive funding rates, it will exit the long position, and wait for them to turn negative again before re-entering.

Volt 5 – Alpha Leak from our Podcast!

Who doesn’t love an alpha leak? In conversations with Uddhav, he gave us some information on how Volt 5 will work.It will be impermanent loss (IL) protection that could be integrated with DEXs, allowing them to offer IL protection to their liquidity providers. It will use a power-0.5 perp to achieve this.

The logistics and costs of this are unknown, so we can’t consider the risk/return or likely success of the Volt.

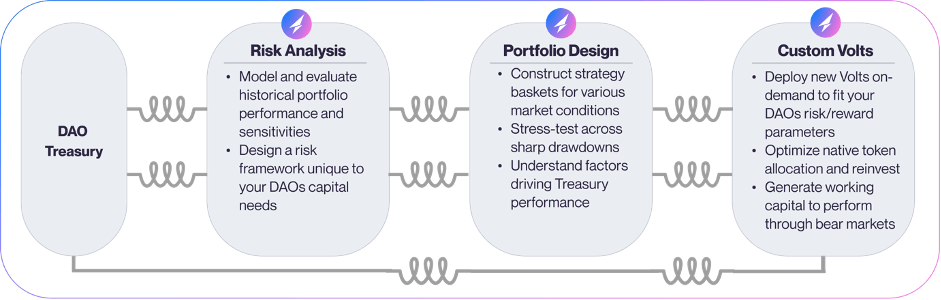

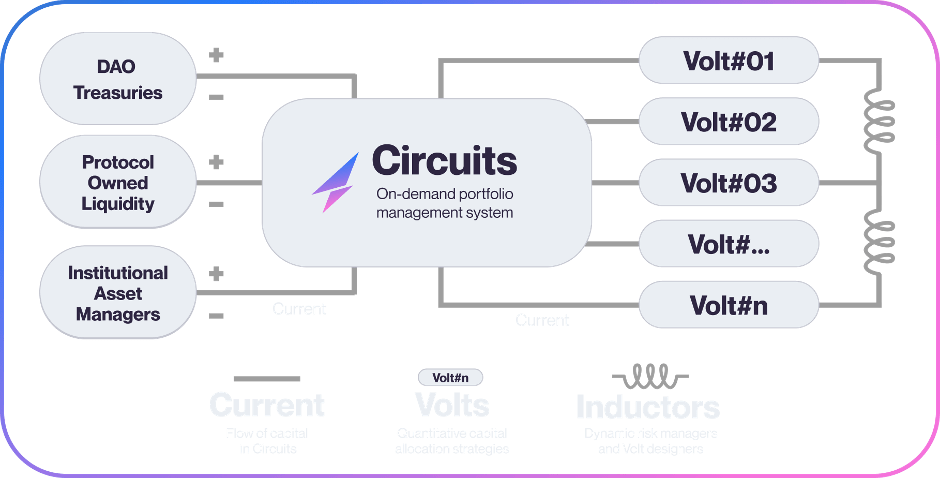

Circuits (DAO Treasury Management)

Simply put, Circuits is a DAO treasury management platform, custom made for desired return and risk tolerance. Created to address the lack of quality customised portfolio management for DAOs. Circuits aims to be to DAOs what J.P.Morgan is to institutions, creating carefully considered and intelligent investment strategies for the organisations to ensure they can survive and thrive in any market conditions.It starts off with a risk analysis of the DAOs current holdings, their risk appetite, return targets, maximum drawdown and volatility. Then they design potential portfolios, stress-test them, and create custom Volts. The circuits can utilise the Volts using Friktion’s back-end (but not the front-end that retail sees) in specially created ratios.

Once they decide on a strategy, back-testing is performed to ensure it has the desired results.

They are currently managing around 5-10 DAOs on Solana, and are in talks with more. We are still in the very early stages, so it will be interesting to check back on this in a couple of months, and potentially write a stand-alone report on Circuits (as there is a lot more to cover and consider!).

At the moment it is not clear how the relationship between Circuits and the Friktion token will play out, as the token design and workings, as well as the structure and growth of Circuits, are still in development. However, there are clear synergies, such as the ability for new custom Volts to be created in Circuits, then deployed on Friktion. Direct revenue share from Circuits to token holders is not likely, at least in any large amount, as this money is much better used enhancing Circuits.

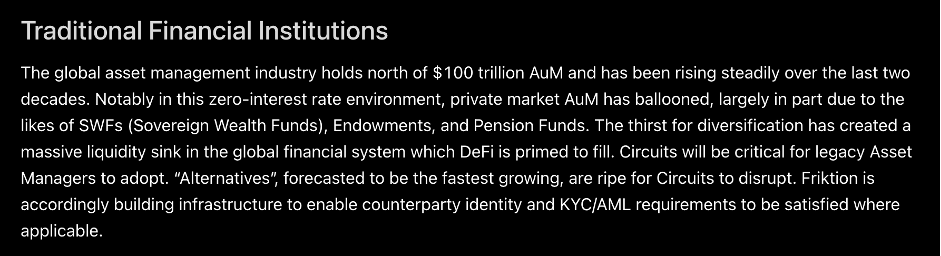

Did Somebody Say Institutions?

One exciting thought is what this could be in the future. Massive traditional institutions are looking for ways to benefit from crypto, and if Friktion can offer a relatively risk-free (or at least a carefully tailored amount of risk) way of doing that, it could be huge.The efficiencies that can be gained through the money-legos (protocols building on top of, and integrating with, one another) and innovation that can only happen in DeFi are massive. The returns that could be achieved will be greater than traditional CeFi hedge funds could possibly achieve. If done right, and safely, in a controlled DeFi environment, that leads us into the future of finance.

Friktion already beginning work on a permissioned Circuit interface, similar to what Aave did, to allow institutions and TradFi as a whole to get involved.

This helps onboard large players into crypto from the traditional world into crypto, and whilst regulatory uncertainty makes it a difficult undertaking, I personally would love to see it.

Wen Friktion Token

Now, what you’ve all been waiting for. Token news.Friktion has confirmed there is a token coming. They have also as good as confirmed that there will be an airdrop of this token to existing Friktion users.

So, how can we get this airdrop? And when can we expect it?

Well, I found some alpha when researching Friktion…

Whilst the team has not confirmed the above, there have been hints and clues dropped that back up the statement.

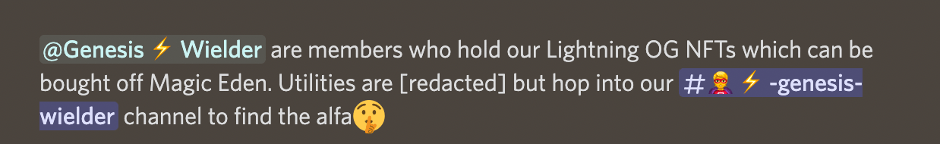

I recommend getting involved with the platform, using their Volts, testing out the Entropy platform, and if you have the funds, buying a Lightning OG NFT (although this won’t be necessary for the airdrop, and nothing has been confirmed, there are clues that it has hidden value and utility yet to be released).

Note, Entropy is very early on and can be buggy, only use a small amount that you are happy to lose. It's likely that the process of setting up the account and making a transaction will be the most important part.

For a guide on how to use Friktion, and potentially get the airdrop, check out the video we recorded for The $1 Quadrillion Bet (we posted this on March 23rd and mentioned the airdrop then 👀). Video below:

[embed]https://youtu.be/2QF5M058nSo[/embed]

Lightning OGs – Friktion NFTs

A member of the community has created this awesome dashboard for the NFTs.

There is a lot of discussion about the Friktion NFTs, and it seems virtually confirmed that they will at least have utility on the Friktion platform. It would be unproductive for us to speculative if there will be some sort of an airdrop for holders, however, this is certainly a possibility, and has been rumoured amongst the community.

See more details, and discussions about utility on the Friktion official forum.

Discussion around yield for NFT holders.

Lightning OGs can be purchased here.

Note, for the Alpha DAO proposal, we are I'm recommending a limit on the purchase price of the NFTs at 7 SOL. This has yet to be accepted.

Considerations

All in all, very bullish on Friktion. The airdrop gives us a great opportunity, and I’m excited to see what this protocol can do. I would be doing a disservice to you, our readers, if I didn’t mention some considerations I’ve had.- Solana’s issues and potential.

- Neon – Solana EVM

Conclusion

It is clear that Friktion intends to become the one-stop-shop for crypto portfolio management, with a service that achieves things that would be impossible in CeFi.

Circuits gives incentives to create innovative strategies, which can then be translated onto the Friktion platform for everyone’s benefit. Friktion stated that once they hit 10 established Volts, they will be looking to suggest a personalised portfolio, where they quantitively calculated allocations to each in Volts, guided by a series of questions the user answers on desired returns and risk appetite.

The focus on innovating and improving how they choose strikes, how they run their auctions, and how they generate the best returns possible for their depositors is something I’ve not come across anywhere else in my research. This, combined with the transparency and education focus, gives me great hope and vision for the future of Friktion, and I’m excited to see what they can do.

This is a protocol I’m going to be keeping a very close eye on, and expect to be writing another report on them within the next 4 months. Certainly, as soon as airdrop and token information is dropped.

All in all, they are building and shipping at incredible speeds and moving fast in the right direction.

If you want to get involved and help shape how the protocol develops, head over to the Friktion forum, post some suggestions or comment on the topics already there. The team will certainly appreciate your input.

The future is coming, DeFi hedge funds with not only democratised access, but democratised governance. The potential this concept holds is unparalleled in my opinion, and I can’t wait to see how the space develops.

Thanks for reading! Any questions, feel free to drop Max a message on Discord.

Down in the Details

Volts 3 – The Crab Strategy

The full mechanics are available here (

Let’s look at an example:

Eugene invests in Friktion Volt 3.The Volt shorts $500 (notional value) of BTC2 PERP, and longs $1,000 (notional value) of BTC-PERP. The combination means there is no directional risk, and the long being twice the size (200% collateralisation ratio) of the short drastically reduces the chance of being liquidated.

The Volt harvests the funding payments from the BTC2 PERP short. Due to the nature of the power perp, these should always be positive.

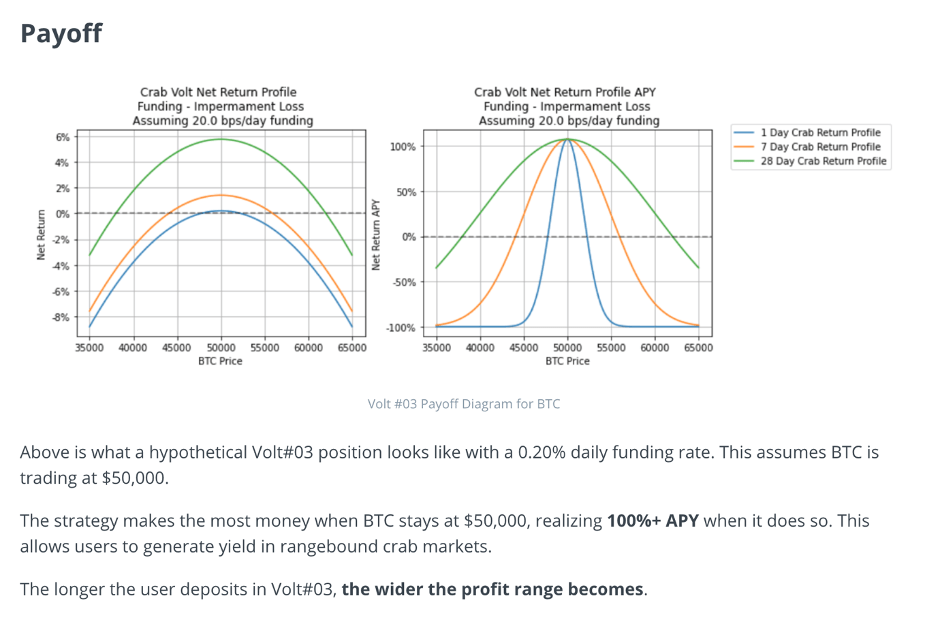

If the collateralisation ratio falls below 150%, the Volt will automatically rebalance, to prevent liquidations and reduce downside risk. See the payoff details from Volt 3 below:

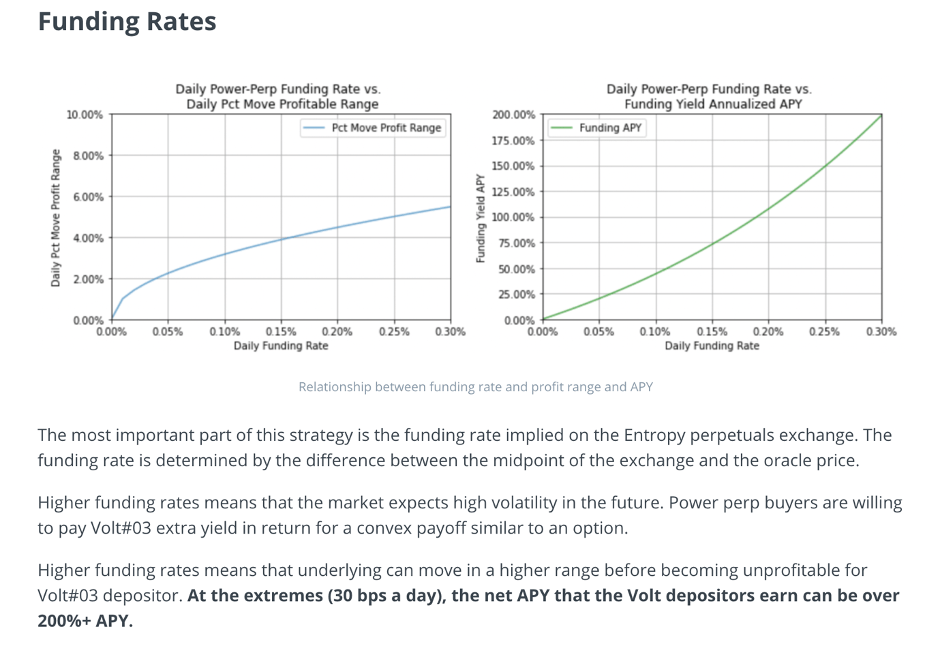

The above payoff is only true at a daily funding rate of 0.20%. The higher the funding rate, the higher the return, and vice versa. This is why I emphasised the Volt’s reliance on Entropy’s liquidity earlier on. If the market isn’t optimally liquid, the Volt’s returns are affected. If the funding rate ever goes negative, the Volt makes a loss, regardless of price action. Obviously, this is a major consideration, and one we will be keeping a close eye on as Friktion grows. See the payoff at different funding rates below (note, this does not consider negative funding).

Update Since Deep Dive Was Published (10/08/22)

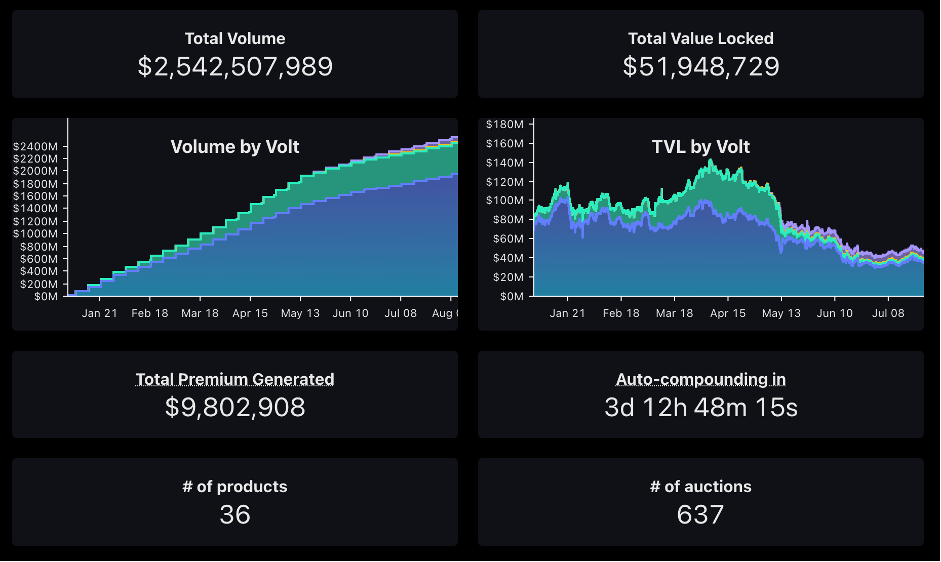

Friktion has been growing nicely, with new vaults and assets, fast shipping of products, and a great team behind it.At the time of writing our deep dive (early May 2022), there was around $1.7bn total volume, this has grown to over $2.5bn.

Total premiums were $7.2m, now $9.8m.

TVL has fallen from just over $110m to $50m, but with the current bear market and lower prices of assets deposited into Friktion, this is no cause for concern.

Volt 5

Friktion recently announced their next Volt, exclusive for Lightning OG NFT holders.For more information on the Friktion Lightning OG NFTs, read our deep dive (feel free to skip to the Lightning OG part, near the end).

The Volt is designed to keep your initial investment safe, whilst investing the interest payments into instruments such as call/put options that earn during sharp market moves.

Users can deposit SOL or USDC into the Volt, which will lend out the deposits using Tulip, then systematically allocate the interest payments into a basket of put/call options.

Portfolio Manager

We mention in the deep dive that Friktion is introducing a portfolio tracking system soon. Well, soon is now.Portfolio manager is the name, and it’s live. As you can see from the image below, it shows your portfolio value, return on investment (over its entire history), and weekly return, as well as some great visual graphs demonstrating the info. See this article for full details.

In their own words, “As DeFi ecosystems evolve across multiple Layer 1 blockchains, Friktion aims to enable users of any chain to access their risk-adjusted yield generation strategies”.

To support this mission, on 1st June, Friktion enabled cross-chain deposits from Ethereum and Avalanche, powered by Portal Bridge (by Wormhole).

This is the 1st step of many to the cross-chain future Friktion are aiming for.