But lurking beneath the surface are the unsung heroes powering the industry - oracles. These unassuming yet essential pieces of infrastructure are the linchpin connecting blockchains to the real world.

Enter Pyth Network, a cutting-edge oracle protocol supercharging the Solana ecosystem. While it may not have the glamour of blue-chip DeFi plays or the virality of trending narratives, Pyth is quietly powering the engines that drive much of the activity in the Solana ecosystem.

In this deep dive, we'll explore why Pyth's unique architecture and capabilities make it a crucial piece of the crypto puzzle. We'll unpack the factors driving the demand for its services, the potential upside for the PYTH token, and why it may be wise to have this oracle on your radar.

Oracles may not be the most exciting topic, but understanding their role is key to grasping the big picture of crypto's infrastructure.

Let's dive in!

TLDR

- Pyth is a crucial oracle protocol providing real-time price feeds to the Solana ecosystem and beyond.

- Pyth is a Solana-native oracle that allows Solana applications to access and process millions of data updates at lightning-fast speeds and with low latency.

- The PYTH token is used for governance, rewarding data publishers, and securing the Pyth Network.

- Pyth offers a relatively low-to-medium risk way for investors to gain exposure to the Solana ecosystem, making it a potential "side bet" for those bullish on Solana.

- In this report, we provide a base case price target, bull case price target, and best entry points.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What is Pyth Network?

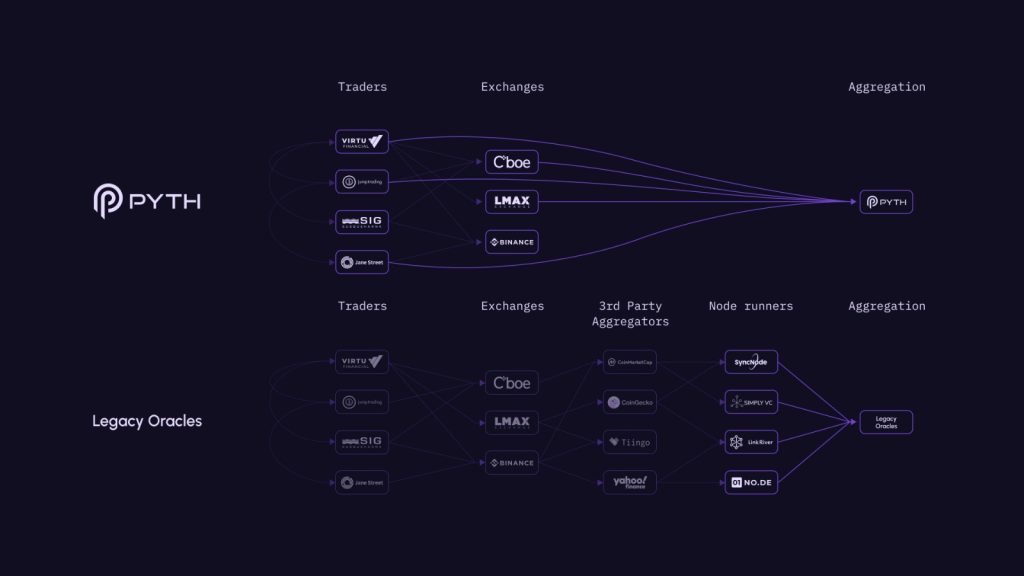

In the simplest terms, Pyth Network is a protocol that provides prices for decentralised derivatives exchanges and other prices (like gold, oil, etc) that cannot easily be represented on-chain. Think of Pyth like a Chainlink for Solana.Built using the same basic infrastructure as Solana, Pythnet is actually an independent application-specific blockchain (like a Polkadot parachain). Running similar to a Solana L2, Pyth is interoperable with Solana, but it secures its own transactions rather than relying on Solana's validators.

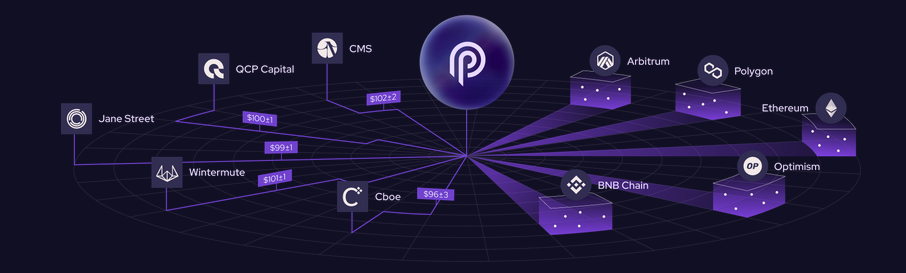

Pyth differs from most other oracles in that it utilises the Wormhole cross-comms infrastructure to provide price data to many chains but with faster processing speeds thanks to its Solana-based technology.

Pyth's price aggregation algorithms are also comprehensive in scope and precision. To recap, a price aggregator takes prices from multiple sources and produces a single number that best represents the asset's actual value based on all available details.

Through their aggregation systems, Pyth's price aggregator is often better than Chainlink when it comes to accuracy, as it can process many times more calculations—again, high throughput Solana-tech FTW.

Why is Pyth important?

Oracles (like Pyth) are essential for most on-chain trading activity that isn't handled by liquidity pools.The list of utilities is pretty much endless, but oracles are used for price aggregation—derivative DEXs need price accuracy to determine fair pricing of assets. Suppose a DEX relied on data from only one CEX to determine prices, and the price of a token on that exchange wicks to zero; then, everyone with trades on the DEX would be liquidated, which is not good. Price aggregation is important because having many sources protects people from getting rugged by error.

Specifically, Pyth is important because it does all this in the blink of an eye and at minimal cost.

The main user of Pyth is the Solana ecosystem. Solana is notorious for being difficult to get funds in and out of (to and from other chains) without using a CEX, although this has been getting better in recent months.

Additionally, many other oracles cannot keep up because Solana is so fast. A Solana-speed chain needs a Solana-speed oracle - this is Pyth.

The Solana ecosystem has been ripping, and to facilitate the degen activity (read leverage) and high-frequency trading, Pyth is working behind the scenes to maintain a useable and efficient method for DEXs to get accurate prices.

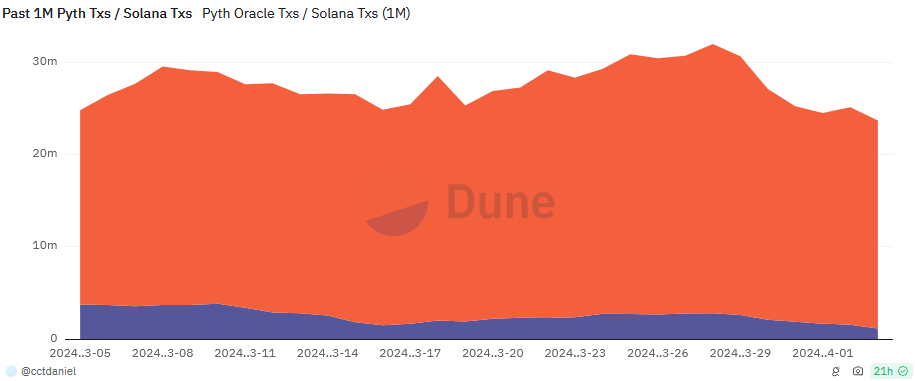

Most Pythnet transactions are Solana-related.

Around 4.22% of all Solana transactions on a given day are Pythnet transactions, a testament to Pyth's importance within that ecosystem. However, not only Solana benefits from Pyth oracles (see ecosystem above).

Pyth currently provides price data for 79 different crypto and TradFi assets.

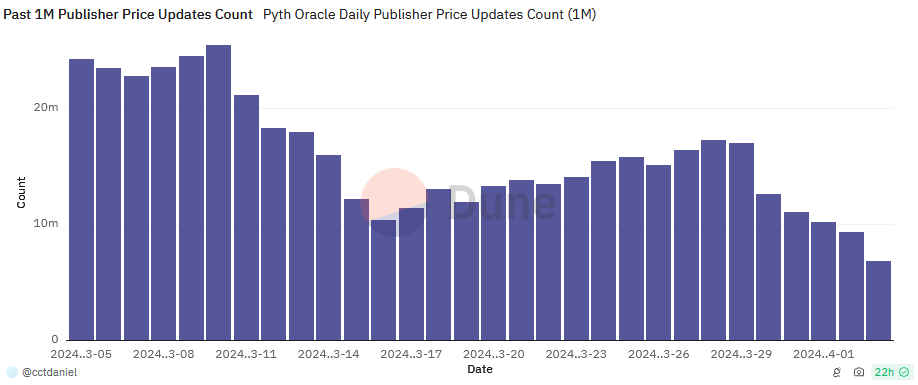

Pyth provides anywhere between 5-20 million updates per day.

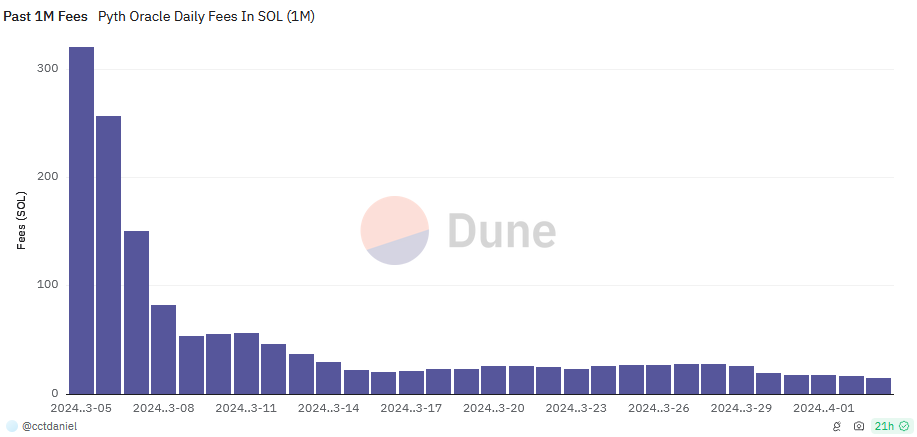

In terms of fees paid, it really depends on network demand.

For example, in the chart below, you can see that Pyth was bringing in over 250-300 SOL per day in revenue during the Solana madness last month:

So, we have clear demand and significant utility - where does the PYTH token come into this?

PYTH tokenomics

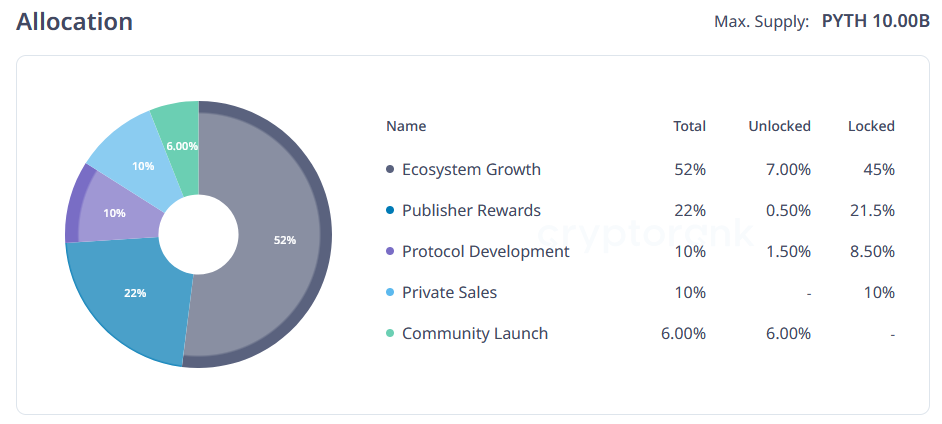

PYTH is Pythnet's governance and utility token. It is used to reward data publishers and vote on DAO proposals. Additionally, PYTH is used to secure Pythnet.The allocations are as follows.

As of 5th April 2024, 1.5 billion PYTH are circulating, with a max supply of 10 billion.

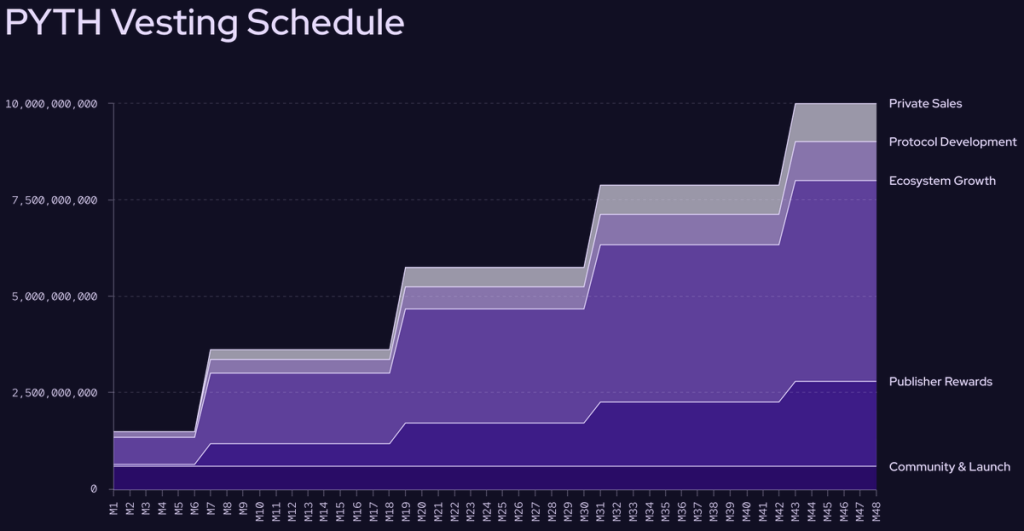

The vesting schedule is a series of cliff unlocks, with the initial launch in November 2023 (month 1, meaning we're currently in month 5.

Interestingly, a large unlock is coming up in May, which will increase the circulating supply by 140%+.

This would usually be hugely concerning, but looking into the actual allocations being released, they are treasury and rewards related and are unlikely to be dumped directly on the market immediately.

Still, it's important to keep this in mind: It will happen every six months for the next two years.

Valuation

PYTH currently has a market cap of ~$1.2 billion and an FDV of ~$8 billion.Although most unlocks are ecosystem-related, we can't ignore the significant inflation over the next two years.

In terms of valuation, our base case would be a market cap similar to Chainlink - around $10 billion.

The bull case would be Chainlink at all-time highs, around $22.5 billion.

Given the inflation situation, we'll assume a May circulating supply of 3.62 billion tokens.

This leaves us with the following targets:

- Base case: $10 billion market cap, around $2.76 per PYTH - a 4x.

- Bull case: $22.5 billion market cap, around $6.21 per PYTH - an 8x.

Still, we're confident these targets can be achieved in the short term—the token has only been around since November last year and has already reached the 1 billion dollar mark in just a few months. So, while the 8x doesn't look explosive, you can potentially record it relatively much faster than what's possible with other mid-risk plays.

Technical analysis

From a daily chart perspective, PYTH has taken a bearish structure after the asset breached under a symmetrical triangle pattern. With no support at its immediate price point, the asset will likely re-test the support range at $0.7-$0.6.

The support range coincides with the Fibonacci 0.618 level, which should be a bounce-back range for PYTH. However, it is important to note that the correction is currently aggressive. This means that the drawdown can be prolonged and deeper than market expectations.

Ideally, a break in bearish structure should be identified first before positioning for an entry.

Cryptonary's take

Given the Solana ecosystem's success, Pyth will certainly be pulled along for the ride.One additional use case that Pyth could leverage and squeeze into is the gaming sector, where in-game economies could potentially require an oracle solution, especially for cross-chain games.

The issue of the unlocks is not too concerning given that the vast majority of unlocks are for ecosystem expansion and other protocol-related finances - i.e. the Pyth treasury is unlikely to dump mass amounts of their own token unnecessarily.

Pyth is a strong low- to mid-risk asset that should perform favourably in the coming years. We consider it a side bet on the Solana ecosystem—you won't get monumental gains, but it has a place in any Solana-centric portfolio.

Whether you're looking to shore up for the long haul in Solana tokens or park some memecoin gains, consider PYTH!

Cryptonary, Out!