However, this sector has a lot of potential because it is such a low-hanging fruit in decentralising traditional networks and facilitating the mass adoption of blockchain technology.

For starters, the top-visited websites worldwide are mostly social media platforms. But they are plagued by centralised risk, restrictions on free speech, and data opacity—not to mention privacy concerns or the fact that they sell data to advertisers.

The main challenges with decentralised social media, however, are twofold: on the one hand, the need for a decentralised network that can support the social networks at scale and the chicken-and-egg problem of bootstrapping a minimum viable community.

Interestingly, a new decentralised SocialFi player seems to have cracked the code.

With a market cap under $50 million, this project is at the right place at the right time to have a clear product-market fit.

Is this SocialFi new project on track to succeed where others have failed?

Let's find out!

TLDR

- We explore SocialFi - an emerging crypto narrative with immense potential

- Our focus is on Only1, a Solana-based social media engagement platform leveraging the creator economy to incentivise user adoption

- We analyse the $LIKE, the utility token that powers the Only1 platform. What does the tokenomics look like?

- Our valuation analysis suggests Only1 could capture a significant market share of the exciting creator economy. How big could this get?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Building a minimum-viable community

People use social networks to connect with the people they care about. If the people you care about aren't on a new social network, you have little motivation to try it out. Your friends probably feel the same way, so neither you nor your friends are joining the new network.Traditional social networks like Facebook, X, and Instagram rely on their existing networks of friends, family, and acquaintances to retain their positions. And for new entrants, gaining traction will require finding a way to address the chicken-and-egg problem of bootstrapping a minimum-viable community.

This is why new entrants like Ello, Minds, and Vero, among many others, have failed – you probably never heard of them or are struggling to remember them.

But there's one hack for building a minimum viable community – the creator economy.

The creator economy is an ecosystem where independent content creators, artists, influencers, and others build and monetise direct relationships with their audiences. While most people ordinarily won't go to a new social network because their friends and family aren't there, they'll be more likely to go there if the creators or content they like are on the new network.

Despite being a relatively new entrant in the social media landscape, TikTok's meteoric success underscores the creator economy's potential to drive user adoption.

And back to our point, by tapping into the burgeoning creator economy, a decentralised social platform can incentivise users to join by providing access to compelling content creators.

Users no longer need to have existing connections on the platform. Instead, users are drawn in by the allure of unique, high-quality content from creators they admire or discover. Network effects can then take hold as the platform gains traction, facilitating the growth of decentralised social networks and communities.

Creators and their fans around the world are connecting better than ever before. The multiple mediums of interaction have birthed a modern revenue model. These are some of the facts which further solidify that statement:

- 39% of consumers watch more content now than a year before

- 44% of advertisers plan to increase spending with content creators in 2024

- Brands are expected to increase creator content budget by 25%

Introducing Only1

Only1 is a social media engagement platform built on Solana. It is a membership-based platform where creators can earn money and connect with their fans through different channels.

Only1 eliminates intermediaries or payment processors using blockchain technology, enabling direct peer-to-peer transactions. This allows creators to earn 100% of the subscription fee from their followers.

Because it is built on Solana—the people's chain—it is usable, fast, and has cheap transaction fees. While this is a subjective observation, any protocol built on Solana in 2024 is exposed to more users than any other L1 blockchain.

Only1 recently released an H1 2024 roadmap highlighting their on-ramp payment partnership with Alchemy Pay. The roadmap also mentioned development in user safety, sales optimisation, and user experience.

Only1 is not a new platform. It was launched in 2021 during the previous bull market. The product has been developed through the bear market. During the entire FTX fiasco, Only1 faced significant loss to its treasury funds.

Regardless, the team has been able to raise capital from venture capitalists like Animoca Brands and Newman Capital.

Only1's utility token, LIKE, is around 90% down from its previous all-time high, but while it might look like a lost cause, the project has reinvented and fits our criteria for finding overlooked coins with 10x to 100x potential.

LIKE's tokenomics

The Only1 platform is powered by its $LIKE utility token. The total supply is 500 million, from which 273,286,650 is currently in circulation.The tokenomics side for Only1 can be considered a 'mixed bag'.

Let us break it down.

Positives

The LIKE token carries several fundamental utilities on the platform, listed below.- Platform fee discount: When creators create a membership pass for access, fans are eligible for a 10% discount if the purchase is made via LIKE token rather than USDC. This encourages LIKE token usage, and there is also no cap limit of the 10% discount.

- Creator's Staking Pool: Creators can launch their staking pool on the platform, where fans can stake LIKE tokens. The APY on staking pools increases with respect to creator activity, with consumer demand meeting creator supply. The higher the TVL, the more LIKE paid to launch these staking pools, and better rewards for everyone involved.

- Community reward: This brings us to user rewards on the platform, which fans can earn passively through staking pools or other events to incentivise activity and LIKE adoption.

- Content moderation through LIKE token: Content moderation is an important element of any social media platform for an ideal user experience. Any form of harmful, violent, or defamatory material can affect both creators and fans.

- Buyback and Burn: This is one of the key parts of LIKE tokenomics to improve token demand progressively. Only1 will use 20% of quarterly profits to buy back $LIKE. Part of this 20% will be utilised for community rewards token emission, and the rest will be sent to a Solana burn wallet. This quarterly burn will continue until the token supply drops to 50%.

Negatives

The LIKE token distribution could have been more investor-friendly.As mentioned above, the Only1 platform was able to raise VC capital funds, which has contributed to its token allocation.

At the moment, Venture Funding and Team Advisory have 33.7% of the allocated token supply and are undergoing a 36- and 72-month vesting period, respectively. So, the immediate concerns here are an inherent inflationary characteristic.

However, there are a couple of silver linings to ease that argument. According to the vesting schedule, more than 95% of the tokens allocated to venture funds have already been released, with the remaining tokens finishing off by August 2024. That means monthly token release will slow down significantly over the coming months.

Another aspect goes back to Only1's creator staking pools. According to their site, over 55 creators have staking pools on the platform, with each pool above 100K TVL in the LIKE token. Some staking pools are as high as 1 million, and APR is attractive, reaching 43% for certain staking pools. This highlights that tokens are locked towards utility on the platform, and there isn't any immediate selling pressure from the present circulating supply.

Only1's value proposition

To understand how big Only1 can get, let's take the example of Friend.tech.Friend.tech is one of the first SocialFi networks. It has given us an insight into how valuable the narrative can be. Launched amid a bear market in 2023, the project represented a visual bridge, transitioning from traditional social media to a Web3-based/crypto incentive social platform.

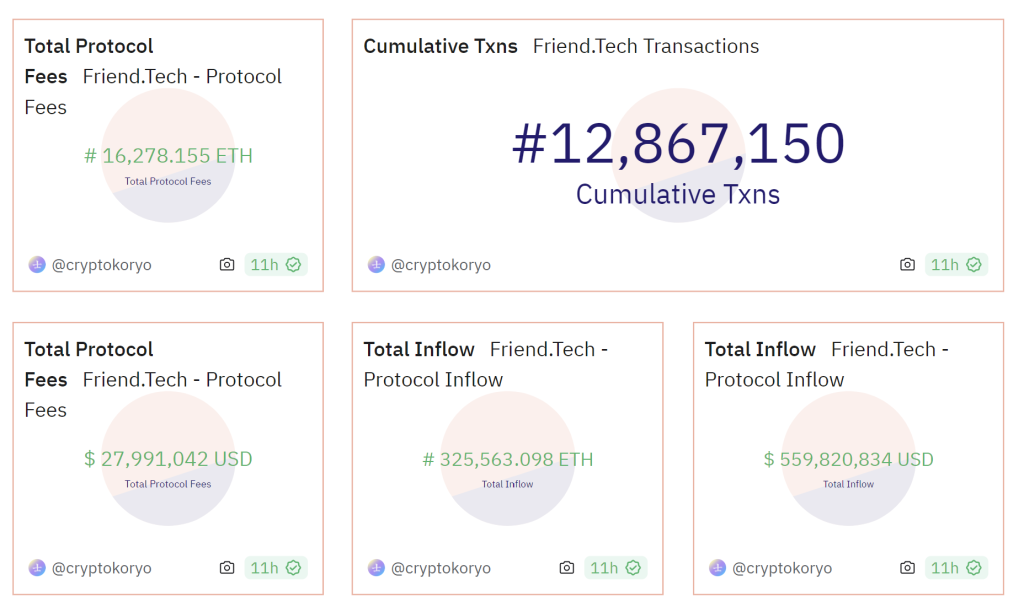

The numbers speak for themselves.

Over $52 million in TVL at its peak, around 150,000 users, the platform has generated over $27 million in revenue since August 2023.

In all essence, friend.tech proved the demand for a SocialFi narrative, but it also crashed gloriously.

The project faced scaling issues that plagued user experience, and network congestion affected user transactions. Additionally, there were issues with its incentive design, as its speculative bonding curve model depended on recruitment with any actual token utility.

Overall, the SocialFi platform was an example of both SocialFi's potential and limitations.

For Only1, this is almost like a learning curve, since their product is similar to friend.tech, but with better token utility and value accrual. More importantly, Only1 is built on Solana.

Valuation exercise

The valuation exercise for Only1 is quite straightforward, but it is based on the expectation that SocialFi will be a successful narrative in 2024's bull market.At the time of writing, Only1 has a market cap of $30 million, priced at $0.10 per token. Its all-time market cap was around $47 million in 2021, but the circulating supply has increased quite a bit over the past two years.

Earlier, we estimated the valuation of the creator economy to be around $500 billion by 2027.

Now, Only1 has been popularly touted as the Onlyfans of Solana. In 2023, Onlyfans generated revenue upwards of $6-7 billion, currently valued at $18 billion.

A bullish left-curve expectation for Only1 would see it getting about 5% of Only fans market share, which is a reasonable and conservative target.

However, in any case, Only1 could easily reach a $900 million to $1 billion market cap once the SocialFi narrative picks up.

By the end of 2025, the circulating supply will be closing on the 400 million mark.

Therefore, at a$1 billion valuation, each $LIKE token should be around $2.50. i.e. 24x.

What if things get silly, and Only1 manages to get 10% of Onlyfan's market share? You can do the math on the potential upside.

Technical analysis

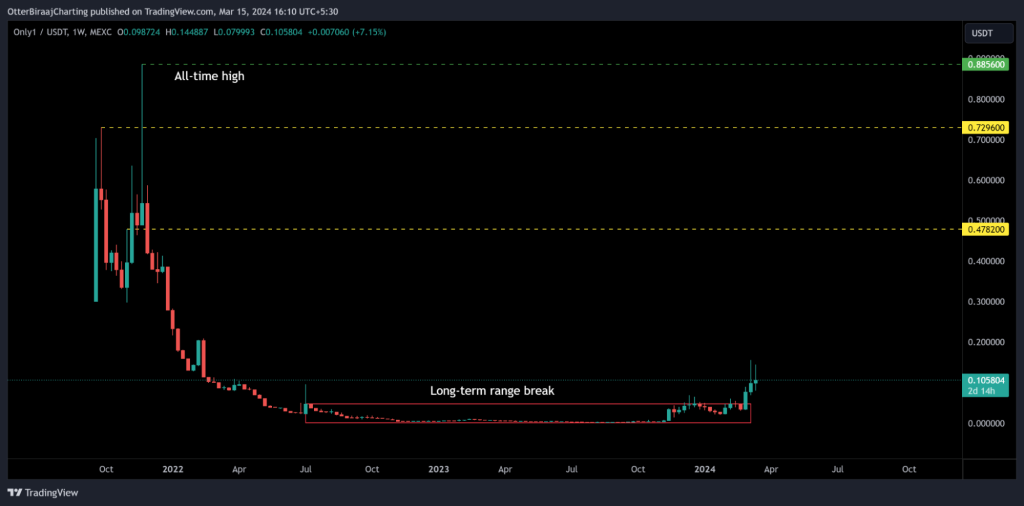

For the better part of 2022 and 2023, LIKE was almost as good as dead as the platform faced repercussions due to FTX bankruptcy. Its recent VC funds have rejuvenated its purpose, and the platform has pivoted its business model.

In 2024, LIKE breached a long-term range above $0.05, and it is currently consolidating at a multi-year high price point.

The charts do not indicate any strong resistance range; therefore, a bull-market rally would see LIKE re-test resistance at $0.478 first.

This would be a conservative target, i.e. 3.5x

The base target for $LIKE would be its previous all-time high, $0.885, i.e. 7.6x

The bullish target is $2.50, i.e. 24x, as mentioned above.

LIKE contract address: 3bRTivrVsitbmCTGtqwp7hxXPsybkjn4XLNtPsHqa3zR

Cryptonary's take

SocialFi is one narrative we are bullish on because of its worth in the Web2 economy.It is highly unlikely that SocialFi will not pick up further in the crypto landscape after friend.tech highlighted a market for it in 2023. Despite its shortcomings, there was a clear demand for a product that connected creators and fans.

Only1 is one such medium, built with a purpose where both creators and consumers can generate value. The token has a defined utility, and a profit-based burn mechanism elevates its demand.

Only1 is already beginning to onboard more creators daily, and there is an intrinsic value for this platform.

From a bull-market standpoint, Only1's LIKE is a mid-risk opportunity that can pan out and pay huge dividends over the long term.

We will monitor the project's progress over the next few months.

Until then,

Cryptonary, out!