From TradFi to DeFi: The Rise of Tokenised Stocks

For the first time ever, you can buy, sell, and hold U.S. stocks on-chain using just your crypto wallet. It’s a massive milestone for crypto adoption, and the capital rotation is just getting started… Let’s dive into what’s happening

In this report:

- Tokenised stocks are here, and why this matters

- Robinhood is expanding to Ethereum L2 – Arbitrum

- The broader market trend. Are we still early?

- Cryptonary’s take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Tokenised stocks are on Solana

Something huge has just happened in the last few days. Backed Finance, in partnership with Kraken, Bybit, and the Solana Foundation, launched xStocks, bringing over 55 tokenised U.S. stocks and ETFs (e.g., Apple, Tesla, Nvidia, SPY) to Solana. It is huge because it allows anyone to buy and sell U.S stocks like Tesla, Netflix, anytime and anywhere. This is a first of its kind, and it’s a major unlock for crypto adoption.These assets, issued as SPL tokens, are tradable on Kraken and Bybit as well on-chain. Integration with Solana DeFi protocols, such as Raydium, Kamino, and Jupiter, enables users to utilise tokenised stocks for liquidity provision, swaps, and collateral 24/7, anytime from anywhere.

Why This Matters for Crypto and TradFi

The launch of xStocks on Solana is a pivotal step toward mainstream adoption of tokenised real-world assets (RWAs). By combining the liquidity and accessibility of crypto with the stability and familiarity of U.S. equities, xStocks offers:- Democratized Access: Investors in regions with limited access to U.S. stock markets can now participate using crypto wallets and DeFi platforms.

- Enhanced Liquidity: Tokenised stocks can be traded and utilised in ways traditional equities cannot, such as in DeFi protocols, creating deeper market liquidity.

- Innovation in Portfolio Management: Investors can diversify portfolios by blending crypto and traditional assets, all directly from a crypto wallet.

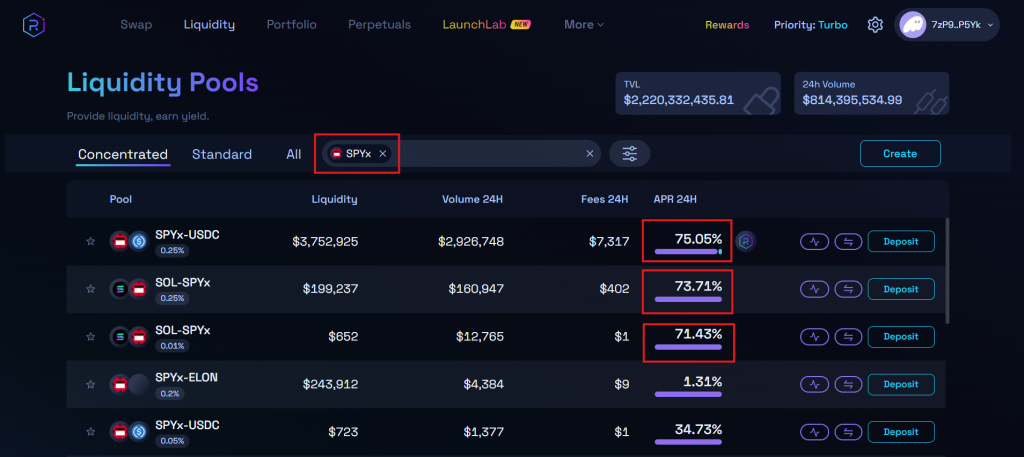

Liquidity pools with tokenised SP500 for passive income

Looking ahead, as more assets move on-chain — potentially including bonds, commodities, or real estate— flood gates are open for crypto to absorb all the capital from TradFi, which is good for L1 assets like SOL, DeFi tokens and memes due to the wealth effect it will create.We can from see the data below that the launch was successful relative to what was before, the volumes of tokenised stocks has surged massively. However, it still averages around $6m - $7m a day and almost all of that volume happens on Solana. This amount is relatively modest, however, we should remember that it is still early days for tokenised stocks.

How does xStocks work?

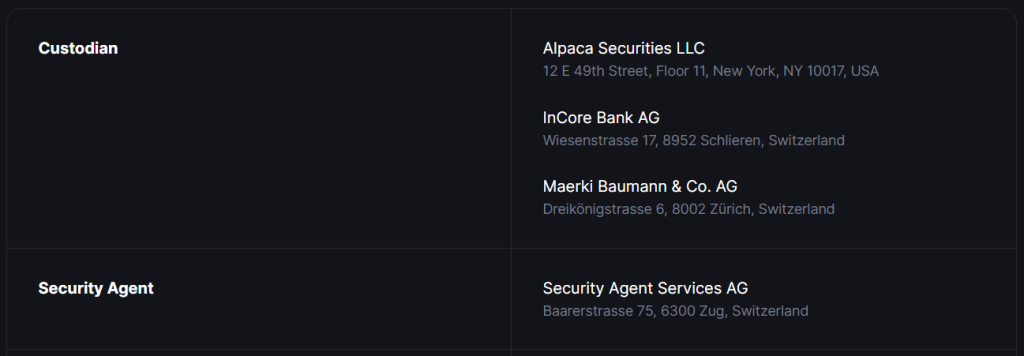

Backed Finance, founded in 2021 and headquartered in Switzerland, is a leading issuer of tokenised real-world assets (RWAs), specialising in compliant tokenised equities and ETFs.Each xStock is a token representing a U.S.-listed stock or ETFs, backed 1:1 by real shares or ETFs units custodied by a licensed 3rd party. This ensures the token’s price mirrors the underlying asset, with redemption options for cash value.

List of Custodians

Backed Finance formed the xStocks Alliance, a coalition including Kraken, Bybit, Solana, Chainlink, Kamino, Raydium, Jupiter, and AlchemyPay. The alliance aims to build an open, liquid market for tokenised RWAs, emphasising neutrality, transparency, and accessibility.Chainlink provides oracle infrastructure, including xStocks Data Streams for real-time price accuracy and the Cross-Chain Interoperability Protocol (CCIP) to support future multi-chain expansion.

This is how it works:

- Acquisition: Users can buy xStocks on Kraken, Bybit, or Solana DeFi platforms (e.g., Jupiter) simply trading them with assets like SOL or USDC.

- Trading: Tokens are traded 24/7 just like any other crypto token, with main liquidity being on standard AMM platforms like Raydium.

- Redemption: To mint or redeem, you must be KYC-verified with Kraken (and soon other exchanges). The token grants any KYC-verified holder the legal right to redeem it for the cash value of their equity token at the off-chain price (not the on-chain trading price)."

- DeFi Use Cases: xStocks can be used as collateral, lent to earn yield, or provided as liquidity in DeFi pools, which opens up a new frontier in the risk curve available for investors and traders. This is an incredible combination: the power of TradFi with the innovation of DeFi. For example, you can earn yield while holding the SP500 index or take out a loan against it to buy a house, etc.

- Self-Custody: Users control their xStocks in non-custodial wallets like Solflare or Phantom, enhancing security and privacy.

- Fractional Ownership: You can start investing in the stock market with as little as $1

Still Early, But On The Right Track

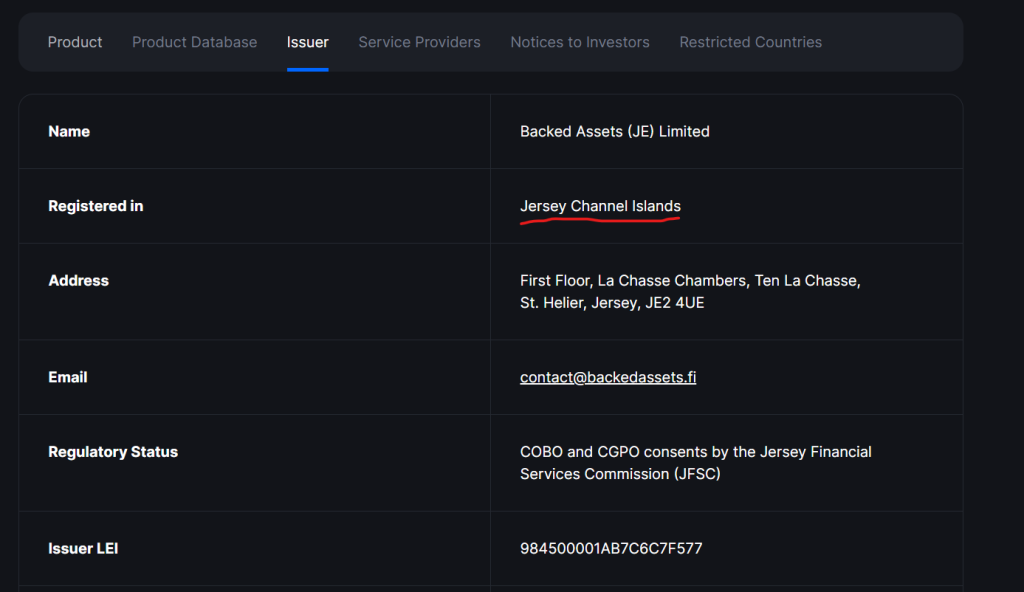

However, it is important to remember that it is still very early days, and these tokenised stocks aren’t battle-tested yet. Furthermore, we can see that the issuer is registered in the Jersey Channel Islands, which is not an ideal location to convince users about the legitimacy and soundness of what backs these stocks.

Issuers place of registry

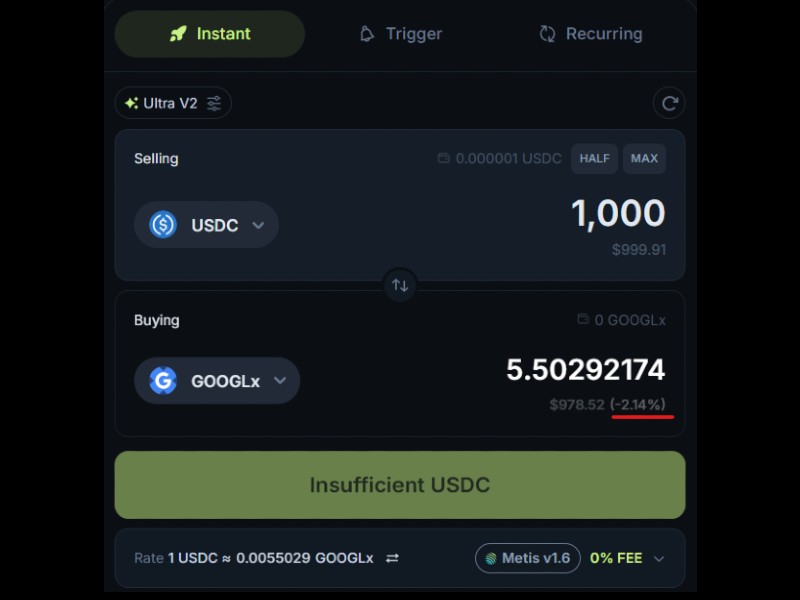

Furthermore, liquidity is another issue. Despite generating buzz on social media, the liquidity of some of these assets is currently very thin. As low as $1,000 buy on GOOGL is causing over 2% in slippage. This is unacceptable for solid trading volumes. However, it’s still early for on-chain stocks. TSLA and SPY stocks can already handle $100,000 trades with just 1% slippage — still not ideal, but promising. We believe liquidity will deepen over time especially with solid backing it has from prominent industry partners.

Slippage resulting in $1000 swap to GOOGLx

Another challenge is that, since the stocks aren’t natively issued, price discovery occurs off-chain. However, the stock market closes on weekends, while crypto markets remain active. This forces market makers to take on additional risk when holding these assets over weekends, leading them to widen spreads. As a result, trading these assets over the weekend is likely suboptimal for professional traders, and retail investors will end up paying a premium price.The Broader Trend

Despite the above challenges, the trend is clear and the floodgates are open. xStocks is just one part of a broader movement, with multiple well-known platforms recognising the potential market for on-chain stocks. For example, Robinhood, known for its superb UX, has recently announced its plans to roll out tokenised stocks on Arbitrum.30% of Robinhood’s revenue already comes crypto activities. By going after tokenised stocks it is now doubling down on crypto, starting with European investors who can trade over 200 U.S. stocks and ETFs around the clock, five days a week, with zero commissions.

What’s particularly interesting is Robinhood’s ambition to go beyond public equities. They’re rolling out tokenised shares of private giants like OpenAI and SpaceX. That is very cool in our opinion, though they have been some backlash from OpenAI itself on Robinhood’s move.

However, Robinhood doesn’t intend to stop there. Once the experiment on Arbitrum is successfully rolled out, Robinhood is planning to take things a step further by launching its own Layer 2 chain on Ethereum, designed specifically for trading and investing in tokenised stocks. Furthermore, it will host DeFi applications, Perps, Options and more.

This can potentially rival with Hyperliquid, but we believe it is too early for that as there is no product yet. Therefore, we believe the Hyperliquid trade isn’t over yet and our upside targets for $HYPE remain the same, especially with bullish macro backdrop we have right now.

Comparison between xStocks and Robinhood

Cryptonary’s Take

The pace of adoption and regulatory progress in this industry over the past 6 months has been unprecedented.Crypto-friendly administrations are popping up worldwide, with the U.S. leading the charge in embracing blockchain tech. Memecoins are now labeled as collectibles, DeFi is getting a warm hug, and TradFi companies are sprinting into crypto through stablecoins, ETFs, and now tokenised stocks. This is a 0 to 1 moment for crypto. Stocks are trading on-chain today.

Yet, the journey is far from complete. The ultimate endgame, companies natively issuing stocks on-chain, remains on the horizon. This would eliminate intermediaries, enhance transparency, and fully integrate equity markets into decentralised ecosystems. Robinhood and xStocks is just the beginning. Floodgates are open: bonds, credit, real estate, you name it, it’s all coming on-chain in due time.

Bullish on crypto. The next 2–4 quarters are gonna be a wild ride, don’t sleep on it.

Cryptonary, OUT!