Imagine a world where you can trade a fraction of a skyscraper as easily as you swap Bitcoin. A world where bonds and commodities flow through the blockchain at the speed of a tweet. This isn't science fiction - it's happening right now, and it's about to revolutionise the way we think about assets and investments.

But that's just the appetiser. The main course? An exclusive look at a groundbreaking Layer-2 chain positioning itself as the beating heart of the RWA revolution.

Built on a 4th-generation blockchain and designed specifically for real-world assets, this isn't just another project—it's a glimpse into the future of finance.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

State of RWAs

Let's start with a recap.RWAs refer to tokenised versions of traditional assets like real estate, commodities, bonds, etc., on blockchain networks. RWAs aim to bring the liquidity and accessibility of crypto to traditional assets.

They are now seen as a way to bridge traditional finance (TradFi) and decentralised finance (DeFi)

Recent developments in RWAs include growing interest from major financial institutions like BlackRock in tokenising assets. Recently, MakerDAO, a major DeFi protocol, allocated $1 billion to RWAs. Platforms like Ondo Finance and Centrifuge are launching RWA-focused products. BlackRock's BUIDL fund is tokenising US Treasury products gaining traction. Boston Consulting Group estimates that the RWA market will reach $16 trillion by 2030.

The RWA sector has been quietly growing in the background.

In recent memory - how many headlines have mentioned real-world assets within the context of crypto?

Not nearly enough.

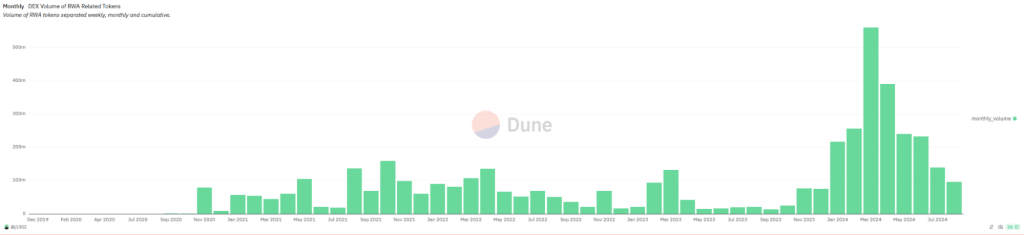

The above chart shows Ethereum volumes related to RWA tokens like CFG, MPL, and GFI—we've mentioned many RWA-related tokens in the past.

All of this is to say we are very early.

However, currently, all RWA-based protocols are built on other chains. None of these chains is optimised to facilitate cost-effective transactions and transfers of these assets. While application-specific chains are not a new concept, we've never had one that was purpose-built for RWAs—until now.

Enter, re.al.

Introducing Re.al

Re.al is a purpose-built Layer-2 chain constructed using Arbitrum as a base. Similar to purpose-built chains on Polkadot or Cosmos, the goal of re.al is to become the real-world asset hub of DeFi.Fully embracing the multi-chain future, re.al operates based on the understanding that no chain is perfect for every application. Liquidity fragmentation reduces capital efficiency; this is one of the main headwinds of RWAs and one of the main issues that re.al addresses.

Some of its key selling points include;

- Modularity: re.al is a true modular blockchain, allowing the integration of different technologies to serve RWA needs as they evolve.

- High throughput and low gas fees: L2 chains have much higher (and cheaper) throughput than Ethereum, making the re.al chain more accessible.

- Security: re.al inherits its security from Ethereum as an L2. Arbitrum is the only Optimistic Rollup with a completely fraud-proof system (especially important when dealing with RWAs).

- EVM+ compatibility: developers can build applications on re.al writing smart contracts in established languages - Solidity, C, C++, and Rust. The pool of developers using these languages is essentially all Web3 devs.

- Custom gas token (reETH): Thanks to this Arbitrum Orbit feature, re.al introduces reETH as the chain's native gas token. reETH brings native yield on re.al as it is a yield-bearing token, 100% backed by LSTs in the native bridge.

Re.al is also partnered with LayerZero, which provides cross-chain messaging services and increases the chain's utility and reach. The goal is to have the centre of RWA operations and asset verification/documentation on the re.al chain, but this is by no means limited to the Arbitrum ecosystem.

Speaking of ecosystems, re.al is in the process of laying foundation blocks for an expansive RWA-based DeFi block…

Re.al ecosystem

The chain is relatively new, and so the ecosystem has not had much time to develop. However, there are some beginnings, and TVL has grown reasonably well, considering market conditions.

TVL is up ~260% since the end of May, from $1.4 million to $3.68 million. All of this is attributed to two protocols…

Pearl v2

If you're familiar with Polygon, you'll have heard of Pearl. Originally a DEX in the UniSwap sense, Pearl has ported to the re.al chain to provide users with access to tokenised RWAs across multiple ecosystems.

Pearl is an example of the re.al chain being used as the hub for RWAs without forcing users to stick solely to the re.al ecosystem.

Pearl's logic behind this move, in their own words:

As believers in the ongoing real world asset (RWA) revolution in DeFi, we identified a strategic opportunity to embrace this shift, building a product focused on the needs of protocols and users looking to invest in tokenised real-world assets. There's a huge first-mover advantage to owning this space and deploying to re.al is our best opportunity to capitalise on the growing RWA TVL.In short, Pearl will most likely be the dominant native DEX for the re.al ecosystem.

But a DEX is useless unless there's a liquidity source, which is exactly why stacking bread is the function of this next protocol.

Stack

Ignoring the blatant McDonald's branding clone, Stack is a sort of RWA YearnFi/Aave but for RWA-based assets.

Where Pearl is the DEX, Stack is the liquidity and asset management protocol for the re.al ecosystem.

Although quite basic just now, Stack aims to be the utility arm of the new re.al ecosystem. It allows users to borrow/lend but also leverage their positions and provide access to key DeFi functionality.

MORE is the collateral-backed stablecoin built by Stack. Stack operates MORE with the exact mechanisms that the Fed uses to manage the dollar.

Interest rates are set with the same logic as the Fed—higher rates slow economic activity, and lower rates do the opposite.

Overall, the Stack protocol provides a toolbox that other Stack projects can use to provide flexibility in their offering and tap into established liquidity to "grease the wheels", so to speak.

So, we have the barebones ecosystem - what about re.al tokens?

Ecosystem tokens

There are a couple of tokens that power the re.al ecosystem:reETH

reETH is the native gas token to the chain. reETH is 100% backed by LSTs (liquid staking tokens) in the native bridge so that all ETH bridged to re.al earns yield on the chain.Like all other ETH liquid staking tokens, reETH is a derivative token backed by Lido Finance's stETH. As an LST backed by stETH, it also is yield generating (which is shared with reETH holders 1:1).

reETH It is used as the gas token for the re.al chain and is also the token used to distribute protocol revenue to RWA stakers as part of the value accrual mechanism.

There's not much else to say; it does what it says on the surface.

RWA token

The RWA token is the utility and governance token for the re.al chain. While reETH is used to pay transaction fees and perform other blockchain operations, RWA represents a "share" in the ecosystem. RWA stakers are eligible to vote in the re.al DAO to dictate the direction of the chain and its ecosystem. RWA has the following attributes as a revenue-sharing token:- 100% of transaction fees are shared with RWA stakers.

- Protocols in the re.al ecosystem are incentivised to share revenue with RWA stakers.

Tokenomics

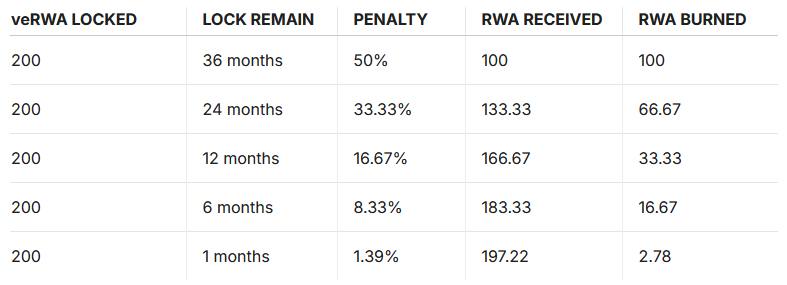

The RWA token has a deflationary model, with all tokens circulating at launch. When staked, veRWA is issued with the nuance that RWA must be locked for a set period. The penalties for unlocking early are as follows.

Any RWA forfeit by early unlocks is burned, adding to the deflationary characteristics of the token.

Locking is fairly flexible and is by no means a one-size-fits-all solution. Stakers can unlock some of their tokens, and the positions are freely transferable between wallets. If they choose, users can also extend the duration of their lock to accrue more rewards.

Where can I get RWA?

Re.al has created some comprehensive tutorials for interacting with the ecosystem, which can be found here.But long story short, you'll be bridging ETH over to re.al to get reETH. Next, you'll swap the reETH for RWA.

Cryptonary's take

Although we haven't put any price targets yet, we feel that members should be aware of re.al at this early stage. You have a first-mover advantage here that, if adequately harnessed, puts you in a prime position to capitalise on the rise of tokenised RWAs.As with all new chains, this early stage is best used to build trust and gain prestige. Although there are only a couple of protocols operating on re.al, everyone has to start somewhere.

We would compare the application-specific nature of re.al to Injective Protocol, a chain that has seen huge success in DeFi innovation. The INJ token was one of the top performers towards the end of 2023 into the start of this year.

RWA has the potential to reach our picks, but it's too early to call right now.

There is not much data to work with, as RWA has been in price discovery since launch. However, seeing as we are early and all the tokens are essentially circulating, there is a case to be made that starting DCA now with a small size is a great idea.

Generally, the more certain you are about an investment, the less reward. Why?

If there is more information to work with, it means everyone else is working with that information, too. This means they most likely have about the same—if not more—confidence in the asset and will act accordingly (buy it).

RWA is your token if you have capital to spare and are looking for an asset to dip into with a solid future narrative. We will be keeping an eye on developments in both the RWA sector and re.al as an ecosystem.

Re.al is positioning itself as a significant player in the tokenised RWA space within DeFi. With its unique approach to fee distribution, focus on community building through rewards and ambassador programs, and growing user base, re.al aims to revolutionise how people invest in and interact with real-world assets on the blockchain.