Even in the relatively static bond markets, they’ve come up with strategies and tools that allow them to make solid returns.

Back in the ‘good old days’, these were reserved exclusively for the rich and powerful; but with crypto, comes a revolution. Power to the people 🤟

Hedge funds have implemented derivative strategies for as long as they’ve existed. Earning and protecting the gains of a lucky few. Now it’s your turn…

TLDR

- Derivatives are a BIG deal (a $1 quadrillion big deal!!).

- Crypto is in its infancy, and derivatives time to shine is coming (we are early).

- Options are massively underused, with massive room for growth, and rapid innovative.

- DeFi derivatives infrastructure is exploding.

- It’s only a matter of time.

The Time is Coming

In the beginning there were stocks. Then, on the 7th day, he said, “let there be derivatives”.

This is the natural progression of any financial market. It begins with the basics. As people realise they’re here to stay, they find ways to reduce risk and increase profit. Enter, derivatives.

The Derivatives Market

Derivatives are ‘complex financial contracts based on the value of an underlying asset, group of assets, or benchmark’ – TradFi certainly knows how to make things sound boring.Simply put, they are tools used to hedge against risk or increase gains, requiring little capital input and maximum profit (if done right).

Some history for you. The stock market traces back to 1792, when the New York Stock Exchange was founded. Incredibly, derivatives weren’t popularised until the 1980s, and have blown up since then. In 2020 the global derivatives market was estimated at $1 quadrillion. For comparison, that’s over 10x the worlds gross domestic product, or 3x the estimated value of ALL GLOBAL WEALTH!!

Only a relatively small percentage of that is equity derivatives (around 2%), but you get the point – derivatives are a big deal, and they just keep growing.

Derivatives are an umbrella term, that can apply to a huge range, but there are 2 clear top dogs in the space. Futures and options. They will be our main focus.

Equities futures and options trading volume increased by 62.3% in 2019. The futures and options equity market was already very well established in 2019. If it can grow by over 60% in a year, imagine what options and futures in crypto could do!

In Crypto

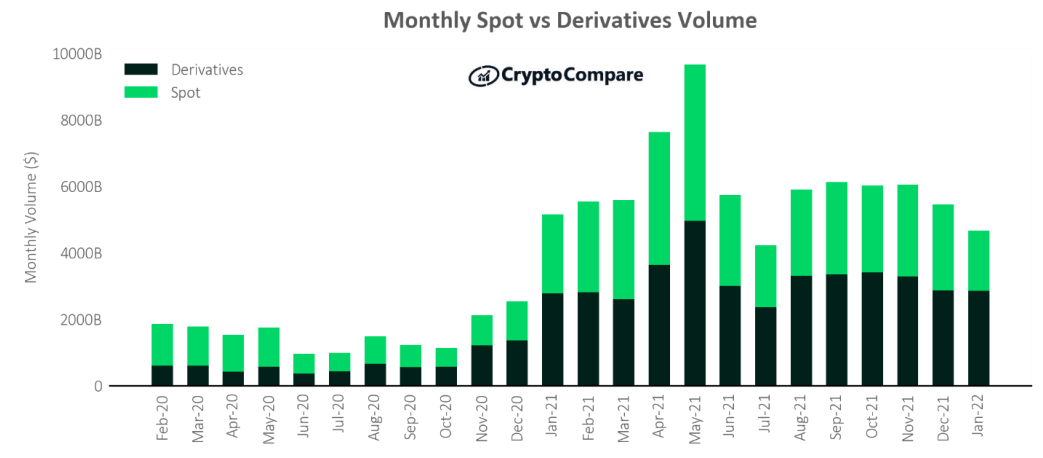

Futures and options make up around 57% of total monthly volume in crypto, a healthy number in comparison to TradFi. Data Source

Data Source

The spread is very different though, with the options volume only accounting for around 2% of spot. In US equities, its 35x that!!

So, let’s talk about futures and options…

Futures

If you’ve ever been rekt by leverage, you’ll likely have met the perpetual future, or perp for short. This bad boy gets a hard time in crypto, due to uninformed use and cascading liquidations, but when used well, it’s a great tool.

A future is an agreement to purchase an asset (such as Bitcoin) at some point in the future. The reason perps are perpetual is they don’t have a settlement date, unlike traditional futures, they roll on perpetually until you close the position.

Funding rates’ can be pretty boring, so I’ll keep it short:

The funding rate keeps the cost of futures in line with the underlying asset, by incentivising arbitrage. If the perp is trading at a premium, the funding rate will be positive, meaning traders who have long positions open will pay a fee to the traders who have short positions. If it is negative, shorts will pay longs. If the sentiment is bullish, this incentives people to close longs and take out shorts, bringing the price down, back in line with the asset.

We’ve seen mass adoption of perps over the years, first offered by Bitmex in 2016. Currently, the BTC & ETH perp monthly volume hovers around $1.5-2 trillion.

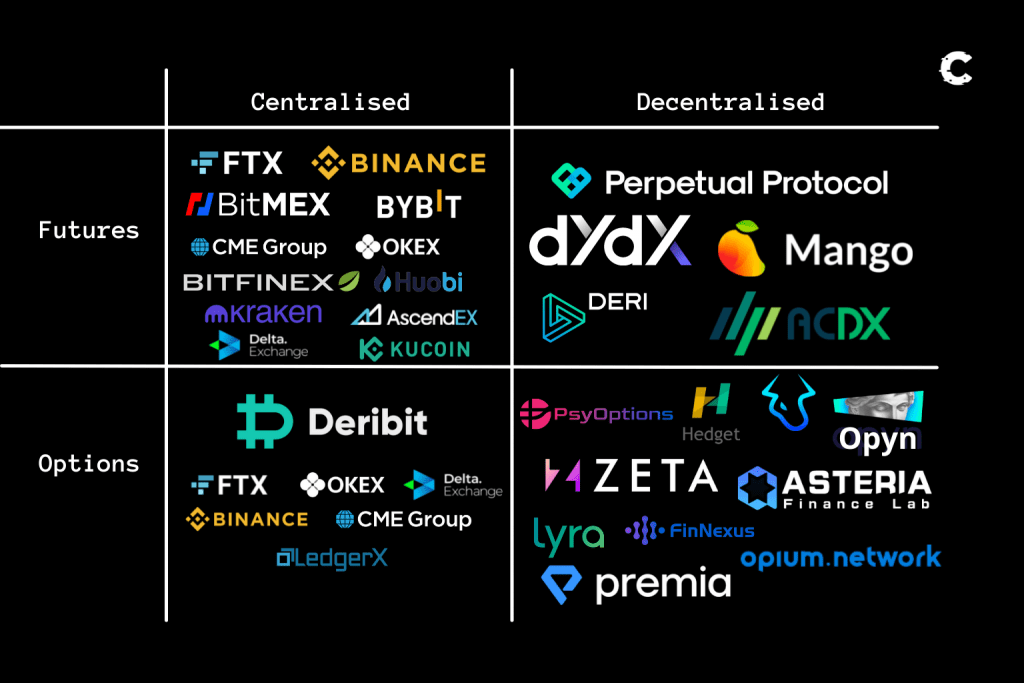

The reason this market is currently dominated by CEXs is partly down to the regulatory environment, but an influencing factor is consumer confidence. We are still in the infancy of DeFi, and trusting a new market takes time. We expect to see migration to decentralised providers over the next few years. See an overview of centralised and decentralised providers below.

Options

Options give the holder the right, but not the obligation, to buy the underlying asset at a set point in the future, for a predetermine price. This differs from futures, as there is no obligation.The options market is tiny at the moment, with a mere £35b in BTC & ETH monthly volume (I know, I know, it sounds big, but trust me, it isn’t), which is dominated by Deribit, a centralised exchange.

The reason the options market is so small is a simple one; we are early.

Institutions and the mega rich love an option, it is a great tool to hedge risk and exposure. As they continue entering the market, options use will explode.

Now, institutions will likely use liquidity aggregators such as Paradigm or CEXs, for compliance and liquidity needs, so DeFi won’t see much of that capital (worth noting that derivatives stabilise markets, so even though there isn’t an investment opportunity for us here, it will reduce volatility in the crypto markets!).

What about people like us? Traders and retail investors? Why haven’t we flocked to options – if they’re so great.

Easy. Options are relatively complex instruments, with a range of strike prices (the price you can buy the asset at) and settlement dates. Perps are much simpler and have satisfied our needs so far.

Crypto is educating people. People who would never have been traders in TradFi are now extremely skilled and knowledgeable. It’s only a matter of time until they explore the huge potential options provides.

Another point is as the market is normalised, experienced traders will see the opportunity and move into crypto. Bringing their tricks of the trade (like options) with them.

Why DeFi?

To this point, DeFi derivatives have not meaning fully taken off, due to high fees and a lack of infrastructure. This is all changing.Currently, most mature options protocols live on Ethereum, making it prohibitively expensive to use. We are seeing migration to layer 2s (L2s), and alt-L1s with lower transaction fees.

The infrastructure is EXPLODING in DeFi derivatives. I’ve been playing around with a host of platforms, and the moves they are making have the potential to be game changing!! To find out my top picks, you’ll have to read the other reports in this series!

On the L2 topic, Arbitrum is now supported by FTX and Binance, making it much cheaper and easier for retail to use the L2. There is huge growth potential for L2s this year.

Let me break down why I’m bullish on DeFi Deriv’s in some bullet points:

- Decentralised perp volume < 1% of crypto derivatives volume, options MUCH lower than that. HUGE room for growth.

- L2s and alt L1s = low gas fees.

- Composability with other DeFi applications (liquidity aggregators, credit providers and much more – this will be covered in the options article)

- More choice, new platforms popping up with wide ranges of tools, integrations, different UI/UX. For example, everlasting options and power perpetuals (these will be covered in the next article). DeFi will offer by far the most choices, tools and tricks.

Conclusion

Spot trading might be the OG in crypto, but a new era has started, marking the growing maturity of the market.Volumes have exploded over the past year, going from little use to the majority of all trading volume (up to an all-time high of 61.2% in January 2022). This is set to continue!

Almost all current volume is perpetual futures, and on centralised exchanges.

As people learn, protocols develop and innovations take place, we are seeing a migration from CeFi to DeFi. Derivatives present a massive opportunity, as we are in the very early stages of the market, with DeFi protocols just starting to get attention from the global community. The protocols in DeFi that are popping up are incredibly well built and funded, with innovative offerings and smooth user experiences. There are teething issues to be ironed out, but this is the time to get in, the time you can make serious money… if you back the winner.

Every report I’ve read whilst researching for this article has read ‘derivatives are set to explode in the next year’. Derivatives are coming, and we don’t want anyone left behind.