Hegic price prediction: Can it hit $0.50 after a wedge breakout?

Hegic is a DeFi protocol built on the Ethereum blockchain. It is designed to facilitate on-chain options trading. It was founded in January 2020 by a developer named Molly Winterminute.

Hegic

The protocol aims to simplify complex financial instruments like options, making them accessible to ordinary users for potentially high returns with lower costs. It operates on the principle of peer-to-pool trading, where users can buy and sell options directly through smart contracts without traditional intermediaries.

Its token, HEGIC, is the platform's core, which underwrites options and collects premiums, fully participating in the protocol's net P&L distribution.

Even though we are confident that Lyra will be a winner in the options sector, it currently doesn't have a token or revenue share. Hegic can be an undervalued alternative to Lyra to capitalise on in the meantime.

Now, let's talk numbers.

Investment thesis

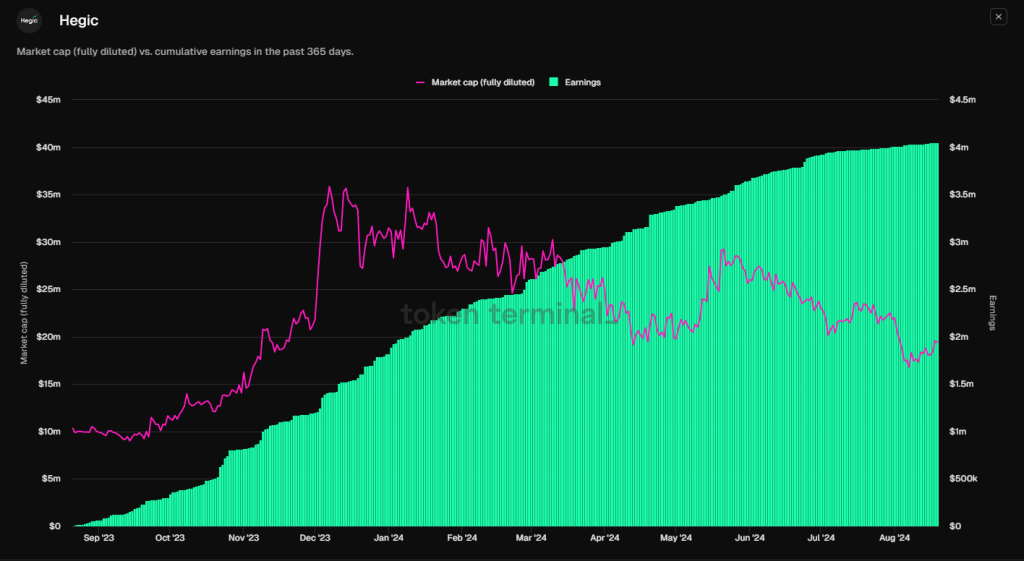

- Fully-diluted mcap: $19m

- Revenue generated in the last 12 months: $4m

- P/E ratio: ~5

In traditional markets, such low P/E ratios, especially for tech-related companies, are rare and often signal undervaluation. The current pricing suggests that the market hasn't fully recognised Hegic's potential or its consistent track record of profitability.

By investing in Hegic now, you're not just betting on potential price appreciation; you're aligning yourself with an asset that delivers solid earnings relative to its valuation. As the market catches up to Hegic's real value, there is significant upside potential, making this an opportunity to capitalise on a mispriced asset with solid fundamentals.

Further, the options sector in crypto is a relatively new primitive that hasn't yet had its time to shine. We believe the whole sector is overlooked and has yet to take off. In traditional capital markets, the volume of options traded is in the hundreds of billions. Crypto platforms have a clear market potential to eat up the market share of their centralised counterparts.

HEGIC is a revenue-generating asset that can also be used as a proxy for the whole sector. If options take off as a narrative, the market will seek ways to get exposure; since Lyra's token isn't live yet, the second obvious choice is HEGIC.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

$HEGIC technical analysis

When analysing Hegic on the weekly timeframe, we can see an interesting trend. Historically, we've seen much higher prices, with the asset reaching up to around $0.5 and even as high as $0.637 at one point. This highlights Hegic's potential in the market.However, since then, we've experienced a significant downtrend.

Price history and structure

Hegic has been around since 2021. During this cycle alone, we've had a few significant upward movements. Notably, on October 17th, we saw a 500% rally, followed by a sharp 600% wick on October 16th. These moves show the asset's capability for strong surges, but since then, the price has been settling, finding final support around the $0.01590 price point.

Wedge formation

Hegic appears to be forming a wedge pattern, which might indicate that the downside momentum is running out, especially as demand around $0.01590 is holding up. This price zone is where we'd look to accumulate and build any sort of position.Key support and uptrend

We've also observed a swing low around January 22nd, which captured a nice upward trend, forming higher lows. This has created a diagonal support line, clearly illustrated on the chart. As long as this support holds, it provides a solid reference point and accuracy for getting involved in the asset.Conclusion

Hegic is at an intriguing point on the weekly chart. This is a critical area to watch, with historical highs showing its potential and current formations suggesting a possible bottoming out. Support around $0.01590 could be key for accumulation, and if this diagonal support holds, it could signal a good opportunity to enter the market.In a cycle where the market is full of VC-backed alts, Hegic has attractive tokenomics, a fully unlocked supply, and a robust revenue share model. It is undervalued with a P/E ratio of 5 and presents a compelling investment opportunity for those looking to have revenue-generating assets in a portfolio.