We’ve made decisive changes, shedding some assets to narrow our focus on those with the most compelling potential for growth.

Ready to know how are we playing the next leg up in the bull market?

Let’s dive in…

TLDR

- We are removing the following assets from our CPro picks:

- No longer bullish: SNX, SYN, TREMP,

- Still bullish but narrowing our focus: OP, INJ, AVAX

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

No longer bullish: assets we’re dropping

Assets in this category failed to reach their potential, and our thesis has been invalidated. We are no longer bullish on them, and thus, we are cutting them from our picks.SNX

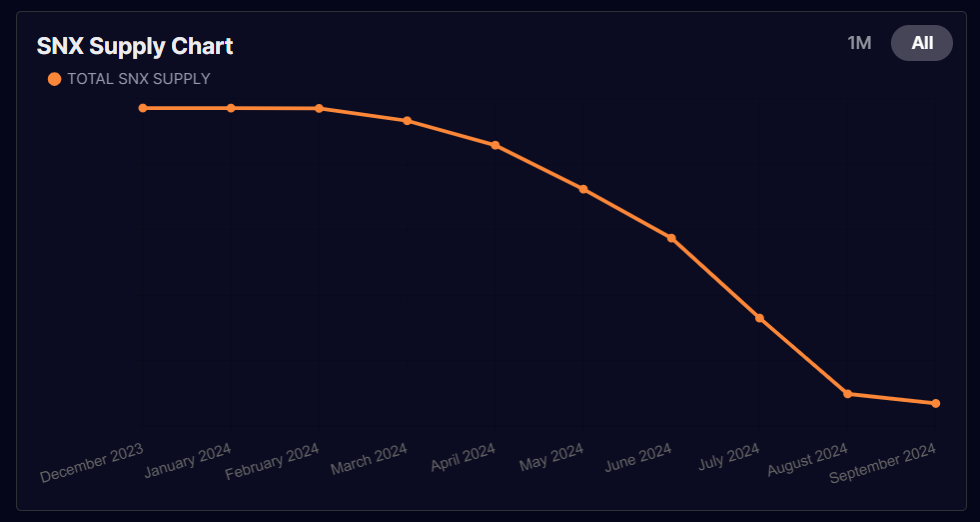

Synthetix is one of the OG DeFi platforms that has contributed a lot to the space. However, the market is moving fast, and new players are emerging. When we last provided an update on SNX, our thesis was based on its new, improved tokenomics.As we anticipated, the platform started burning SNX from its fees, creating deflationary pressure on the price. However, the momentum was short-term and faded in the last several months.

The annual burn rate is roughly 0.1% of the supply. In short, fees are not substantial enough to present a compelling investment opportunity. With key ecosystem players such as Lyra and Kwenta moving away from Synthetix’s liquidity and increased competition from HyperLiquid, we don’t see strong reasons for fees to catch up soon.

For these reasons, we are removing SNX from our CPRO picks.

SYN

Our main thesis for keeping SYN in our picks was the potential of Synapse Interchain Network, where the token SYN was supposed to be used as a gas asset. However, fast forward to today, the mainnet still hasn’t been delivered, and there is no use case for SYN except for governance.The lack of communication from the team is also concerning. On many occasions on X Spaces, the team's engagement regarding Synapse Chain developments has often lacked details, with responses tending towards broad reassurances rather than specific updates or concrete action plans.

For the reasons above, we are removing SYN from CPro picks.

Tremp

With memecoins dominating in terms of mindshare this cycle, our thesis on Tremp was closely related to the upcoming US elections. In other words, we value the attractiveness of Tremp based on whether the market is catching up with the elections narrative.However, while it has been hot for several months ago, the PolitiFi category has lost its steam. Further, Donald Trump’s winning odds aren’t as strong as they used to be.

There is still an upside for Tremp if Donald Trump manages to win the elections but the risk-reward ratio isn’t attractive anymore. For these reasons, we are removing Tremp from CPro picks.

Still bullish: narrowing our focus

This section covers assets that remain valuable and the thesis remains intact. However, they are being deprioritised as we concentrate our portfolio on the highest conviction plays.OP

Optimism (OP) has been our go-to beta play for Ethereum (ETH) for quite some time, and it has performed well in that role. However, the evolving market has introduced new beta proxies for ETH that present stronger potential and more attractive opportunities.While our initial thesis about OP remains valid—specifically, its role as a proxy for the success of Base and the broader adoption by institutional players such as BlackRock—our current assessment points to alternative assets that offer a better risk-to-reward profile.

If new developments or catalysts emerge that reaffirm or strengthen OP’s potential, particularly in connection with ETH’s performance or institutional adoption, we are prepared to quickly reassess and reintroduce it into our CPro picks.

However, OP will be removed from our list of selected assets for now.

INJ

Injective is a highly promising asset, distinguished by its innovative tokenomics and substantial market potential. The tokenomics are thoughtfully designed to foster long-term value growth, with mechanisms that promote staking, governance participation, and sustainable token supply management.As previously mentioned, our investment strategy is currently focused on a more concentrated portfolio approach. This involves prioritising assets that present the most compelling opportunities for growth and returns in the current market landscape. By narrowing our focus, we aim to allocate resources more efficiently, maximizing potential gains from top-performing assets.

This does not imply that injective is a poor investment choice. We recognise the intrinsic value that Injective brings to the table and believe it holds significant promise for continued appreciation. However, we are betting on the best candidates within the category, and for those reasons, we are removing INJ from our CPro picks for now.

AVAX

Avalanche's institutional adoption is on the rise. This growth is driven by its robust technology, scalability, and active ecosystem development, which have attracted increasing interest from institutional players seeking dependable blockchain solutions.However, despite these strengths, Avalanche is not currently leading the pack among L1s. The competition is intense, with several other L1 platforms demonstrating superior performance metrics, broader adoption rates, or a more innovative ecosystem at this moment. Thus, while AVAX is one of the reliable bets on the market among L1s, it is not the best at the moment.

We will remain dynamic and will bring it back if it proves itself to be a potential winner in the category.

Cryptonary’s take

As the market evolves, so must our strategy. Our recent adjustments reflect a disciplined approach to optimising our portfolio by shedding assets that no longer align with our highest conviction. While some picks still show promise, our thesis for these assets remains unchanged. However, our focus is on those that offer the best risk-reward potential and align most closely with our current conviction. Thus, we are focusing on those with the most compelling potential for growth and return in the current market environment.We remain committed to staying agile, ready to pivot back to these assets anytime should new catalysts emerge. Our goal is to be dynamic and continually evaluate the market, ensuring our picks are not only relevant but positioned to capture the best opportunities the market has to offer.

Peace!

Cryptonary, OUT!