Highlights From The Biggest Crypto Conference of 2025

Breakpoint is the most significant event on Solana’s calendar and is increasingly becoming one of the most consequential gatherings across the broader crypto ecosystem. It brings together the network’s founders, core developers, builders, investors, and users in one place. This year, two of our picks sat at the epicentre of that momentum. Here’s what matters, and why it’s worth paying attention…

In this report:

- Why Breakpoint 2025 mattered despite weak market sentiment

- The shift in Solana DeFi toward credit, RWAs, and real borrowing demand

- Why JP Morgan, Coinbase, and Galaxy using Solana is structurally important

- How Aura’s presence highlighted the continued role of culture in the ecosystem

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Background

Solana Breakpoint 2025, held in Abu Dhabi from December 11 to 13, unfolded during one of the more difficult sentiment environments of the current cycle. Risk appetite across crypto remains depressed, and positioning across both retail and institutional participants is defensive. Even Bitcoin trades materially below its prior highs, with Solana itself remaining well below its peak. In that environment, the decision to host a global conference with institutional participation and a forward-looking roadmap carries weight.

From its inception in 2020, Solana carried a distinct architectural identity. The network was engineered to prioritize speed and low latency at the base layer, with composability treated as a first-order design objective. Proof of History, combined with Proof of Stake, compressed time ordering and enabled throughput that traditional blockchains struggled to match. Early framing positioned Solana as the onchain analogue of Nasdaq, a venue built for real-time markets and consumer-scale execution.

This approach quickly gave Solana a reputation as an “Ethereum killer.” Instead of following Ethereum’s path, it focused on solving the issues that limited Ethereum at the time: slow speeds and high fees. By choosing performance and affordability as its core priorities, Solana became one of the first real alternatives capable of supporting large-scale, fast, and low-cost onchain activity. That framing helped drive early adoption across DeFi, NFTs, and consumer applications. We wrote a comprehensive Master Thesis on Solana here.

That design choice also exposed tradeoffs. Periods of network instability and restarts shaped Solana’s public reputation during its formative years, placing reliability at the center of how the chain was judged.

Furthermore, the collapse of FTX in late 2022 represented the most severe stress test in the network’s history. Solana’s ecosystem was closely associated with the event, and confidence deteriorated rapidly. Capital withdrew, activity slowed, and survival displaced valuation as the central concern. Developers, users, and institutions reassessed exposure at the same time.

Breakpoint 2025 illustrates how materially the ecosystem has evolved since that period. The focus has shifted toward making the network dependable and usable at scale. Infrastructure work now prioritizes reliability and the ability to operate through stress. DeFi development has moved toward stable rate products and more efficient use of capital rather than growth driven by incentives alone. At the same time, wallets and custody tools continue to improve on usability, while the broader ecosystem is increasingly designed to support regulated financial activity.

What is our takeaway from Breakpoint?

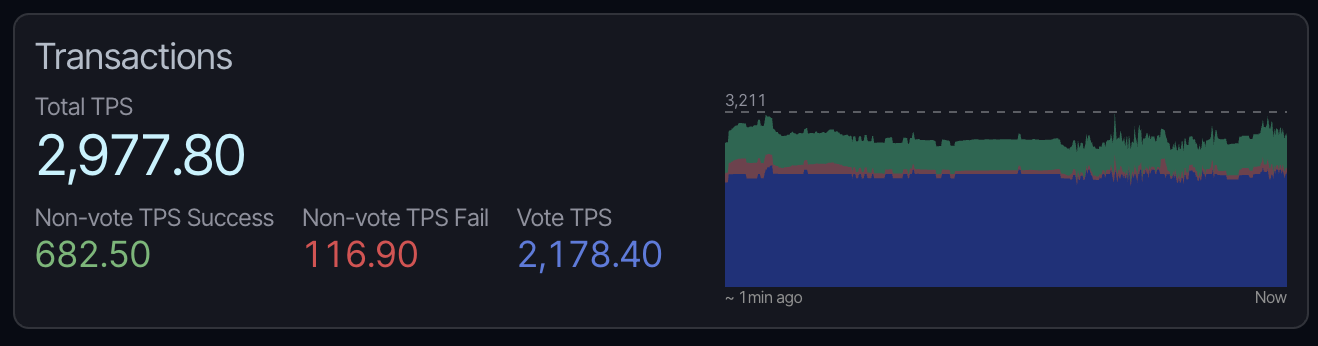

Despite muted price performance, Solana continues to attract institutional engagement through ETF-related products and is attracting a lot of developer activity. That behavior suggests parts of the market are beginning to separate short-term sentiment from long-term network trajectory. Here’re some key updates from the conference.

Firedancer: Long Awaited Upgrade Is Here

One of the key Solana upgrades that’s been confirmed during the BP2025 is Firedancer. Firedancer addresses the most persistent structural risk in Solana’s architecture: reliance on a single production validator client.Until now, Solana’s performance, usage, and ecosystem growth existed alongside a software monoculture that imposed a ceiling on institutional confidence. In distributed systems, a single client concentrates risk at the software layer, particularly during upgrades, edge cases, and periods of stress.

Developed by Jump Crypto, Firedancer introduces an independent validator client built from first principles. Client diversity reduces correlated failure risk, improves fault isolation, and allows the network to absorb bugs or partial failures without cascading disruption or outages. These properties are foundational for any system expected to support continuous market activity.

Much of the public attention around Firedancer has focused on performance, particularly throughput and latency. Those improvements matter, but they are not the core contribution. The more important change is operational resilience. A multi-client network behaves differently under pressure. It recovers more predictably and removes the need for coordinated intervention when isolated components fail. For institutions assessing Solana as a venue for trading, settlement, or tokenized assets, this materially alters the risk profile.

Firedancer also signals a shift in how Solana approaches scaling:

- Earlier phases emphasized pushing hardware limits and maximizing raw execution speed.

- The current phase emphasizes consistency under load.

From a governance standpoint, Firedancer strengthens decentralization as well. Independent client development reduces dependence on any single engineering team and distributes protocol stewardship across multiple actors. Over time, this expands Solana’s capacity to evolve without introducing new points of fragility.

Solana Ecosystem is Hot

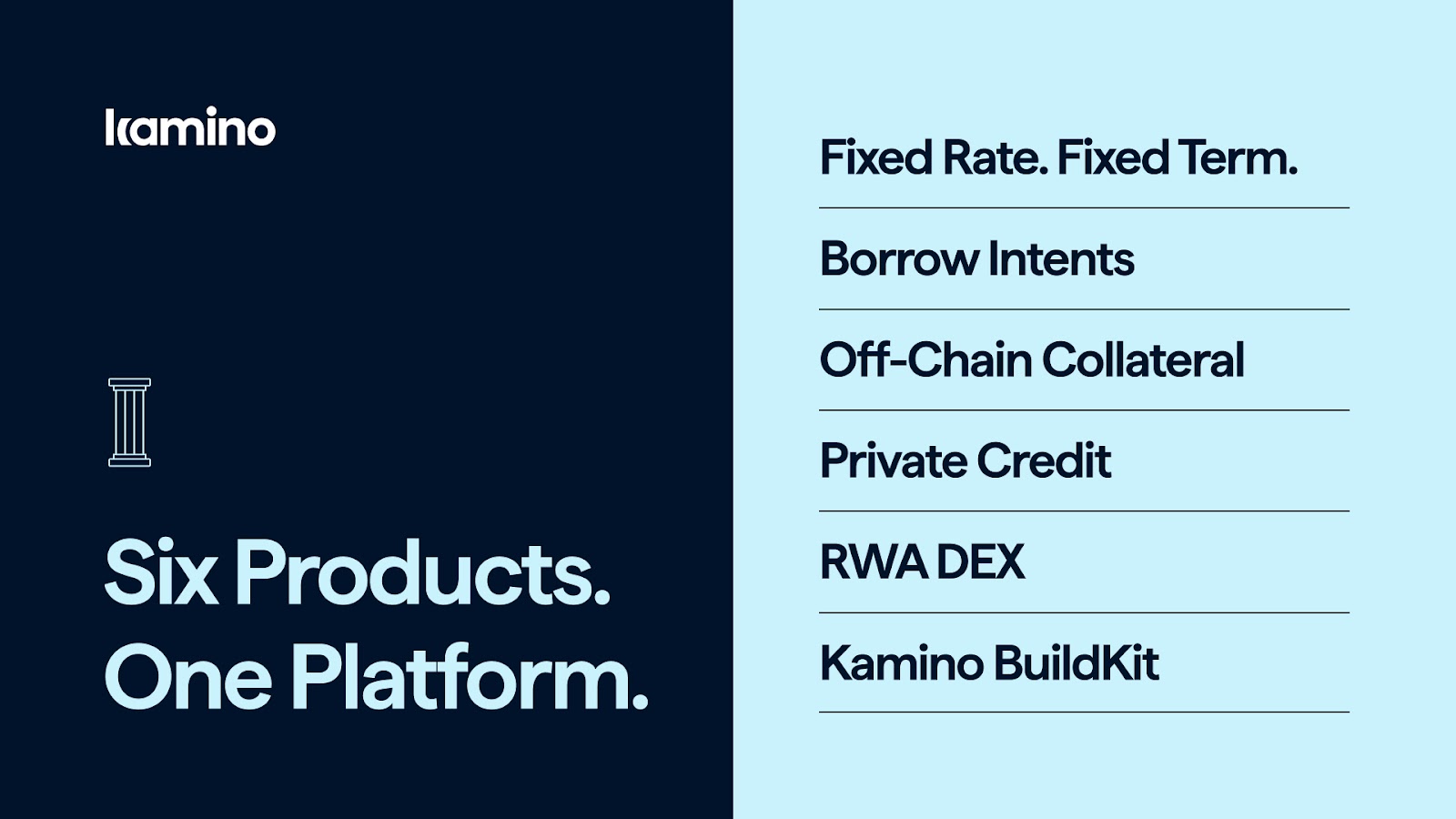

Aside from Firedancer, many Solana ecosystem projects announced new products. Kamino, one of the main liquidity hubs of Solana, arrived at Breakpoint 2025 with updated branding and 6 new products!

What began as tooling for liquidity provision and leveraged strategies is now being developed into a broader credit and capital infrastructure layer within Solana’s DeFi stack. The emphasis has moved away from short-term yield incentives and toward real borrowing demand, predictable returns, and institutional participation.

A central development is Kamino’s expansion into private credit. For the first time, onchain liquidity on Solana can access BTC-backed institutional borrow demand through Kamino’s Private Credit framework.

These are regulated, transparent credit exposures offered directly onchain, beginning with a USDC-denominated vault.

Kamino is also addressing how tokenized assets reach onchain users. Its RWA DEX is designed for issuers with liquidity structures intended to keep assets accessible at fair value across market conditions.

At the application layer, Kamino’s BuildKit reframes the protocol as infrastructure rather than a single product. Consumer-facing businesses can embed Kamino’s credit and yield functionality directly into their own products, with revenue sharing built in. This allows Kamino-powered financial products to reach users without requiring direct interaction with DeFi interfaces, expanding distribution while keeping complexity abstracted away.

Jupiter

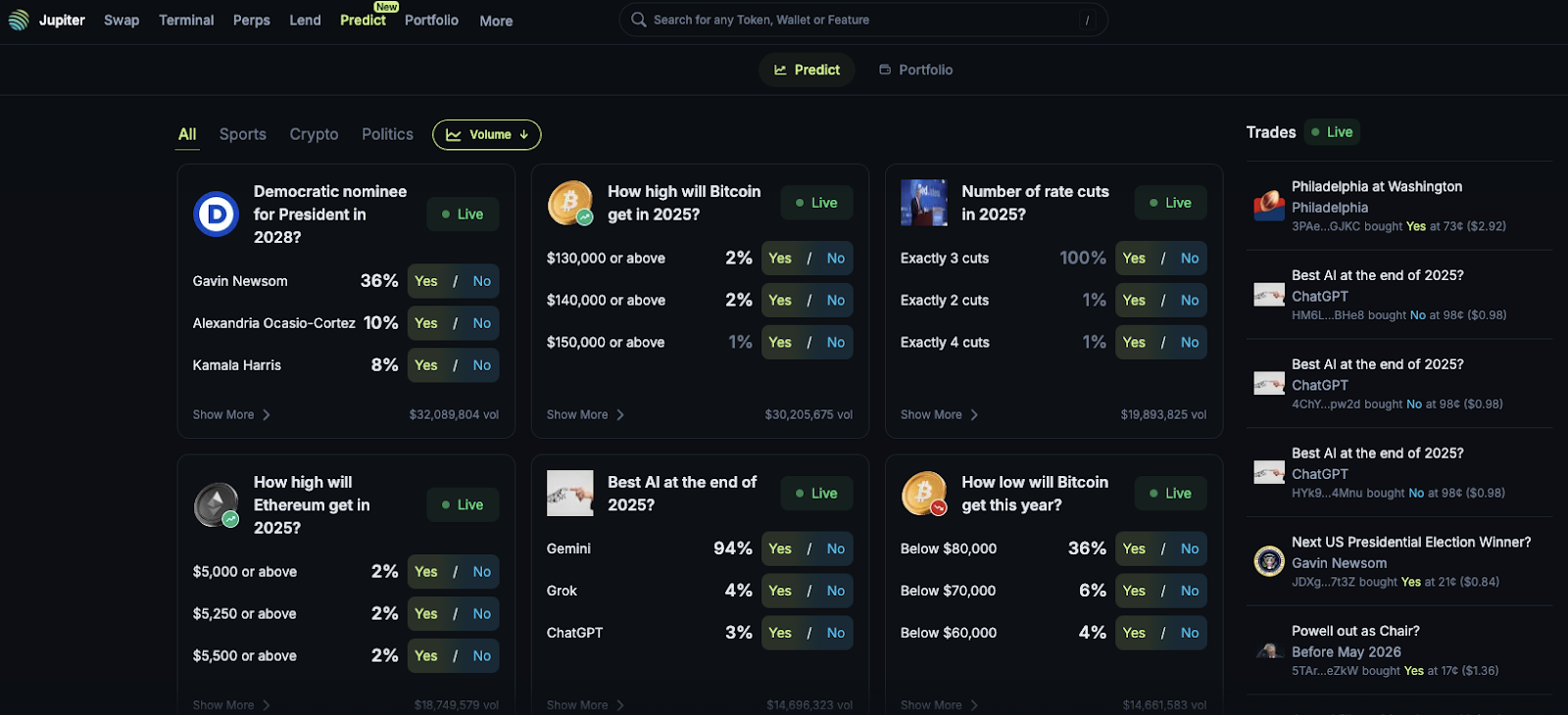

Jupiter’s presence at Breakpoint 2025 reinforced how central it has become to market activity on Solana. What began as a swap aggregator now underpins a large share of how users trade, route liquidity, and access markets across the network. For many participants, Jupiter is simply where trading happens.That prominence gives Jupiter structural weight. Liquidity and price discovery tend to gather around the venues that users trust for execution and consistency. Over time, Jupiter has absorbed that role on Solana, not through a single feature, but by becoming the default surface where activity converges.

The Kalshi integration highlighted this clearly. Kalshi operates regulated prediction markets, and its expansion onto Solana introduces a new category of compliant financial instruments. Making those markets available through Jupiter allows users to access regulated products through the same environment they already use for spot and derivatives trading. The effect is that regulated markets are introduced without forcing users into separate platforms.

Jupiter’s trajectory reflects a platform settling into its role as Solana’s primary trading venue. As the range of assets available onchain expands, Jupiter’s ability to absorb new market types without fragmenting liquidity or user behavior becomes one of the network’s more important advantages.

Phantom Cash Debit Cards

Phantom has become the primary consumer entry point on Solana. Here’re some updates from Phantom during Breakpoint:The launch of Phantom Cash and debit card functionality is very cool in our opinion. Stablecoins are handled as spendable balances that remain onchain, removing the need for manual off-ramps or intermediate steps before funds can be used. This shortens the distance between custody and consumption and makes onchain balances more practical for regular activity.

Phantom’s approach places a heavy emphasis on abstraction. Transaction fees, settlement mechanics, and routing are handled quietly in the background while users retain control of their assets. This reduces cognitive overhead without compromising self-custody, which is a necessary condition for broader adoption beyond crypto-native users.

As usage on Solana expands, wallets determine how that activity reaches end users. Phantom occupies that role by translating network capabilities into familiar financial interactions. Its evolution reflects the view that distribution and usability are as important as underlying infrastructure when building toward sustained onchain activity.

Solflare

Another wallet that presented its new product was Solflare. Solflare is focusing on strengthening self custody through hardware and intelligent tooling rather than expanding into payments. The emphasis was on helping users interact with Solana more securely and more intuitively without giving up control.

The headline release was Solflare Shield, a compact hardware signer designed to work seamlessly with the Solflare wallet. Shield uses NFC tap-to-sign to keep private keys offline while still supporting everyday actions like swapping, staking, and multisig approvals. Priced between $49 and $79, it lowers the barrier to hardware-backed security and positions cold signing as a practical default for active Solana users, not just long-term holders.

Alongside Shield, Solflare previewed Magic AI, an in-wallet assistant that translates plain-language instructions into onchain actions. The key distinction is that Magic AI does not take custody or execute autonomously. It prepares transactions and surfaces intent clearly, while final approval and signing remain with the user. The goal is to reduce complexity without obscuring control, particularly for more advanced staking and DeFi interactions.

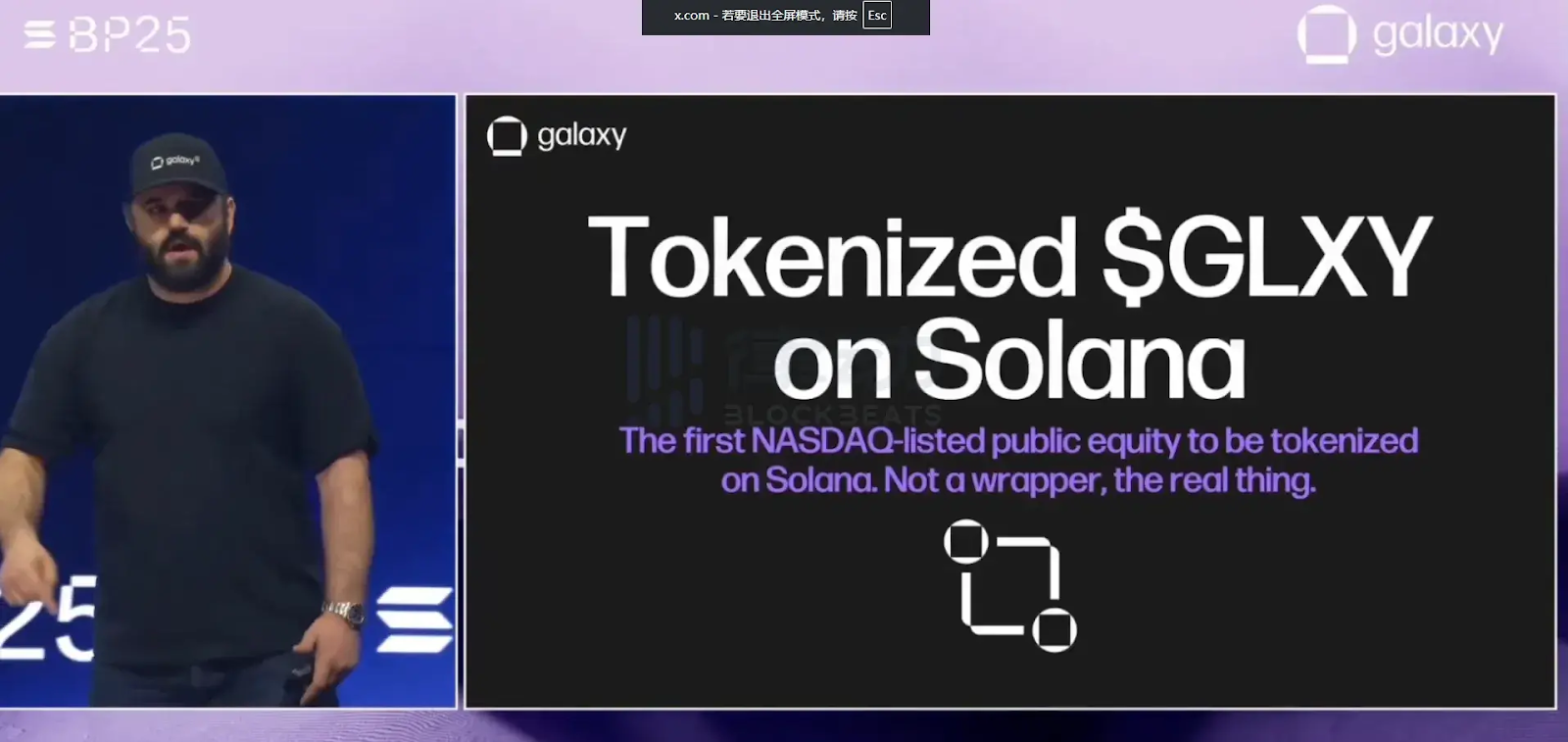

Institutions Are Here: JP Morgan, Coinbase, and Galaxy

JP Morgan’s presence at Breakpoint 2025, alongside Coinbase and Galaxy, shows how quickly the boundary between traditional finance and public blockchains is narrowing. Regulated institutions are beginning to use public networks as settlement and issuance infrastructure.The most concrete example was JP Morgan’s role in arranging a U.S. commercial paper issuance on Solana for Galaxy Digital. Commercial paper is a core short-term funding instrument in traditional capital markets, and its issuance on a public blockchain represents a meaningful step forward. The transaction positioned Solana as the settlement layer, with Galaxy acting as issuer and structurer.

Coinbase played a dual role. It participated as lead investor alongside Franklin Templeton while also providing custody and settlement infrastructure through its institutional platform. That combination signals a willingness to commit both infrastructure and capital to onchain financial activity under regulated conditions. Additionally, Coinbase announced that any onchain token on Solana will be tradeable directionally on Coinbase’s app without officially being listed. This is huge for the Solana ecosystem, as it will likely bring liquidity and volume to Solana tokens.

Galaxy’s involvement further reinforced the bridge between crypto-native markets and traditional finance. Operating across asset management, trading, and capital markets, Galaxy sits naturally between institutional capital and onchain venues. Its participation suggests growing comfort with using public blockchains for real financial instruments rather than proofs of concept.

What matters here is the structure of the issuance. A major U.S. bank arranged commercial paper on a public blockchain, with regulated institutions providing capital, custody, and settlement. That level of institutional comfort had not previously been demonstrated on open networks. The presence of JP Morgan, Coinbase, and Galaxy at Breakpoint shows growing confidence that Solana can support regulated financial activity at a meaningful scale.

Our Top Memecoin Pick: AURA

Our top meme pick was at the epicenter of this conference. AURA’s presence at Breakpoint 2025 stood out for how deliberately it leaned into the moment. With memecoin activity across Solana quieter in recent months, AURA CTO team focused on building visibility, strengthening relationships, and maintaining cultural relevance rather than stepping back.

The centerpiece of that effort was the Baldpoint Station, which quickly became one of the most recognizable booths on the conference floor. Free haircuts and branded merchandise generated steady foot traffic and organic engagement throughout the event. More importantly, the booth translated AURA’s online identity into a real-world experience, showing its culture-first positioning and the broader “aura maxxing” narrative that has resonated with its community.

That visibility extended beyond the conference hall. The Baldpoint Station was featured directly in a pinned post from Solana’s official account highlighting standout moments from Breakpoint 2025. Inclusion at that level carries weight, placing Aura among a small group of projects elevated as representative of the event itself and signaling ecosystem-level recognition beyond typical memecoin exposure.

Engagement data from the event supports that impact. LunarCrush recorded roughly 792,000 engagements and a Galaxy Score in the high 60s, with activity peaking alongside the Baldpoint Station’s visibility. The sustained attention during the conference points to growing mindshare and expanding community awareness.

Breakpoint also served as a coordination point for AURA’s team. Post-event updates referenced active discussions across the Solana ecosystem, including wallet-level conversations with teams such as Solflare, pointing toward deeper integration within the network.

It is a step forward in how our pick is positioning itself within the Solana ecosystem. Through consistent visibility and direct amplification from Solana, AURA strengthened its footing during a more selective phase of the memecoin cycle. Projects that remain culturally relevant and embedded in the ecosystem during quieter periods are often well positioned when sentiment turns, and AURA’s execution at Breakpoint places it firmly in that group.

Cryptonary’s Take

Here is our take: Breakpoint 2025 clarified something important about Solana’s position in this cycle. The ecosystem is operating from a place of maturity, with attention centered on infrastructure, execution quality, institutional involvement and long-term relevance now. A lot focus on building useful and consumer-facing products.Nearly every meaningful update pointed in the same direction. Firedancer addresses a foundational requirement for any network expected to support continuous, high-value activity. Kamino’s expansion into private credit and issuer-focused RWAs reflects a DeFi stack evolving toward real borrowing demand and capital efficiency. Wallets like Phantom and Solflare are converging on a shared outcome: making self-custody usable at scale without weakening user control.

Jupiter’s position as Solana’s primary trading surface is now embedded in user behavior, with new market types being absorbed into existing venues instead of fragmenting liquidity.

Institutional participation is reinforcing this trajectory. JP Morgan, Coinbase, and Galaxy are all doubling down on Solana. Commercial paper issued on a public blockchain marks a concrete step forward in how traditional finance is interacting with open networks, with Solana increasingly treated as production infrastructure rather than experimental rails.

Culture remains a meaningful part of the ecosystem, though attention has become more selective. Aura’s presence showed how visibility now accrues to projects that stay active and embedded during quieter periods. Direct amplification from Solana itself reflects ecosystem-level recognition that often carries forward as conditions improve.

Solana has come a long way from being defined by outages. The network now looks like one preparing for sustained use. That positioning matters in a world where traditional markets are moving toward continuous operation and tokenization. With Nasdaq now pursuing 24/7 trading, the direction is obvious: markets want to be always-on. And if that’s where TradFi is heading, what better network stands to benefit than the one long framed as the onchain analogue of Nasdaq itself.

Cryptonary, OUT!