No matter how much conviction you've built in an asset, the market owes you nothing.

As WIF and POPCAT rip through new all-time highs daily, you might sit there watching your bags become stablecoins through lack of movement.

Sound familiar?

Today, we are giving you some tough love. Hopefully, it will help you reconsider some of your underperforming assets.

Some tokens are set for the same fate as the dinosaurs… Going into extinction.

TLDR

- You should re-evaluate your portfolio periodically instead of holding onto past convictions mindlessly.

- Many former market leaders from the 2017/2021 cycles have dropped off due to a lack of innovation.

- There's a significant opportunity cost of holding underperformers.

- What coins should you consider trimming off as "dead wood"?

- What shiny new projects deserve a spot in your portfolio?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Are you bagholding?

How long have you been in crypto?You may be in your second, third, or fourth cycle.

You've been in crypto since 2017, so you must be a millionaire by now.

Do you have a yellow Lambo?

Many of us hold onto assets in which we've built conviction through previous cycles. There is nothing inherently wrong with this.

But there is one key question you must ask yourself: are the reasons I bought this asset still relevant to what's happening now?

One of the most common fallacies we hear is, "I'll hang on to x asset until it reaches all-time highs."

There is no logic to this statement without other factors being considered. At this point, you are not investing; you are hoping. And hope is not a strategy.

- How much has the token supply for that asset increased in the X years since you bought it?

- A token with a $1 all-time high in 2021 and a market cap of $1 billion might still be at a $1 billion market cap right now, but the token is only worth $0.33 due to supply inflation.

- Is the project developing at the pace you expected when it was bought?

- Crypto is full of innovation—projects that don't innovate are often left behind, and we'll discuss a couple of examples later in this report.

- Is there still an edge in holding this asset over something else?

- Opportunity cost, especially in a bull market, is a real threat and just as valid as actually losing money. While you may not necessarily lose money holding the token, you could have made more money if you invested the money in other assets.

NGMI, if you are holding these coins

We know that building conviction in assets allows you to weather the storm when things are going down. However, blind conviction in an asset that has been left behind by the market and shifting narratives is an unnecessary waste of time and resources.We don't like writing projects off, and there's a slight chance that we are wrong. But based on current information and analysis, we don't think you are gonna make it if you are holding bags of these tokens.

Dino coins from 2017

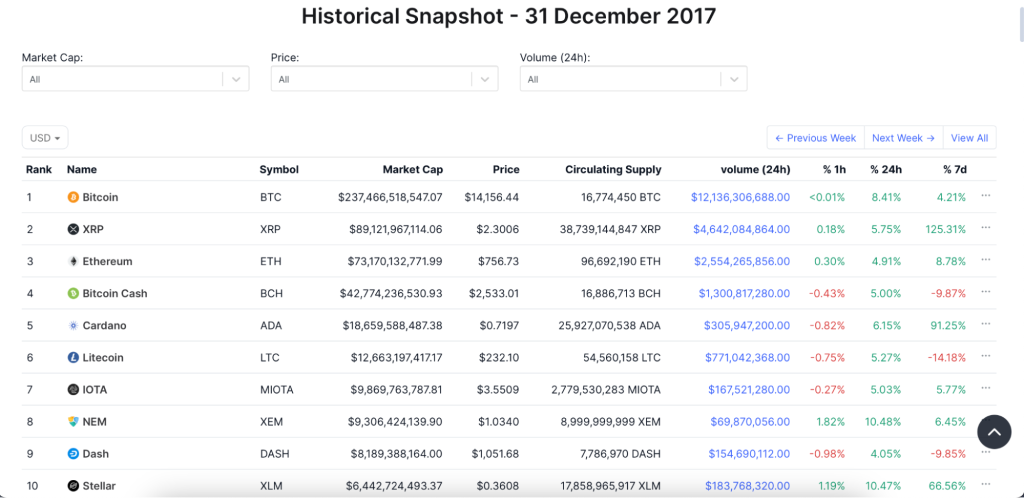

The table above shows the top 10 largest coins by market capitalisation at the peak of the 2017 bull run.

Excluding Bitcoin and ETH, the updated list includes;

- BCH

- ADA

- LTC

- MIOTA

- XEM

- DASH

- XLM

- XMR

- EOS

- NEO

Many of them have dropped off from the top 10.

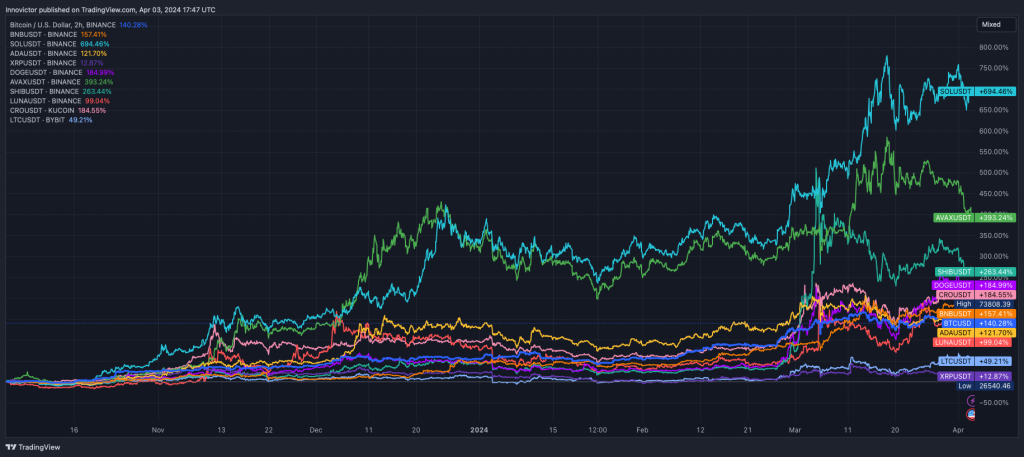

The chart below shows how they would have fared in the last six months since the current bull run started.

Except for BCH, which nearly matched Bitcoin, and that's mostly because of the Bitcoin brand, all the other assets have underperformed Bitcoin so far in this bull run.

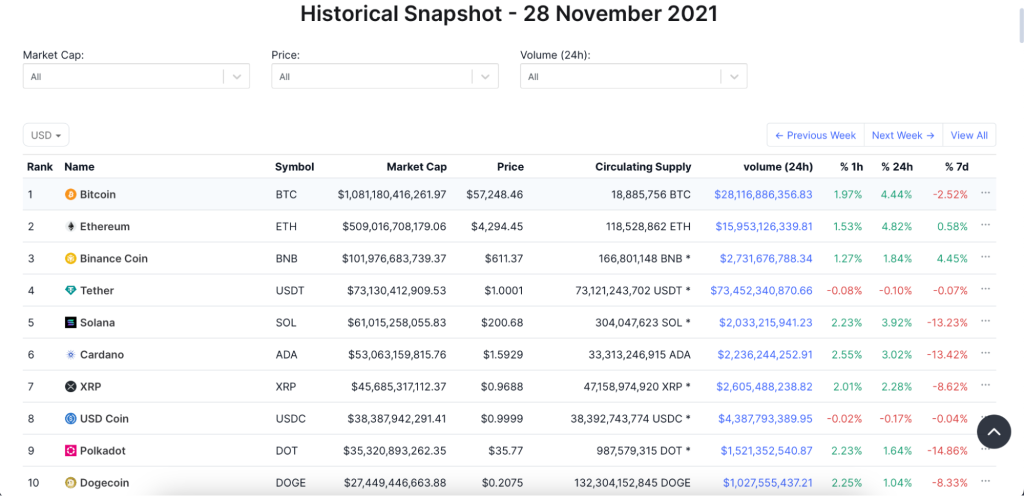

Dino coins from 2021

Let's take it one step further and examine the top 10 largest assets by market capitalisation at the peak of the 2021 bull run.

Excluding Bitcoin, ETH, USDC, and USDT, the updated list includes;

- BNB

- SOL

- ADA

- XRP

- DOGE

- AVAX

- SHIB

- LUNA

- CRO

- LTC

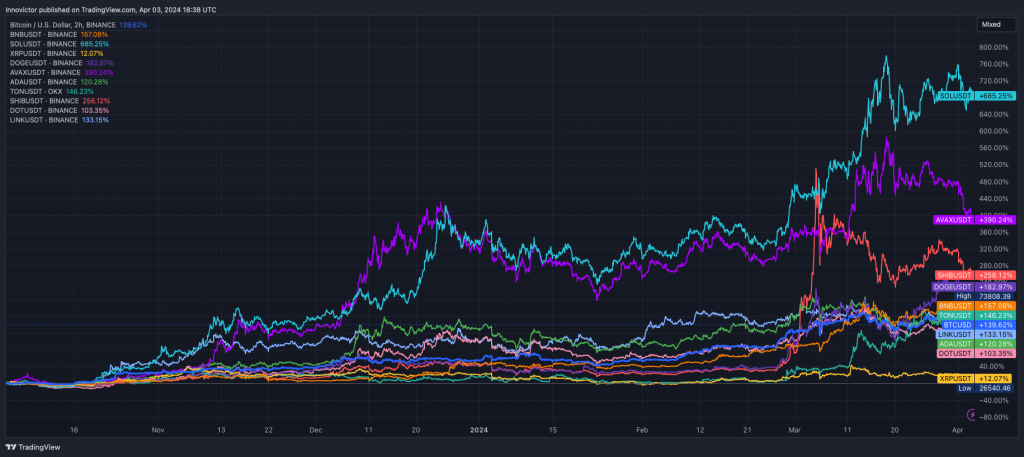

But now, let's look at how the 2021 top coins are faring so far in 2024.

There are some interesting points to note.

Starting from the bottom, the 2017 coins (LTC and ADA ) that remained in the top 10 positions in 2021 still underperforming Bitcoin in 2024. That's two bull cycles of underperformance, even though you haven't lost money because they have managed to stay in the top 10. More on underperformance and opportunity cost in a bit.

However, the coins from 2021 that are doing well in 2024 fall into two classes.

- The first class are the coins of projects that have stayed at the forefront of innovation. That's why it is unsurprising that SOL is topping the list today in terms of performance. ICYMI, check out our 2023 thesis on why SOL remains a compelling long-term bet. The second performer, AVAX, has also kept innovation with its subnets; it is taking ownership of the gaming niche. Check out our report on why AVAX is an oldie but goodie project. Like Solana, AVAX also has an emergent memecoin ecosystem, but we will talk more about memecoins in a bit.

- The second group of winners from the class of 2021 are coins that were regarded as 'shiny new coins' during that cycle.

Shiny new coins for 2024/2025

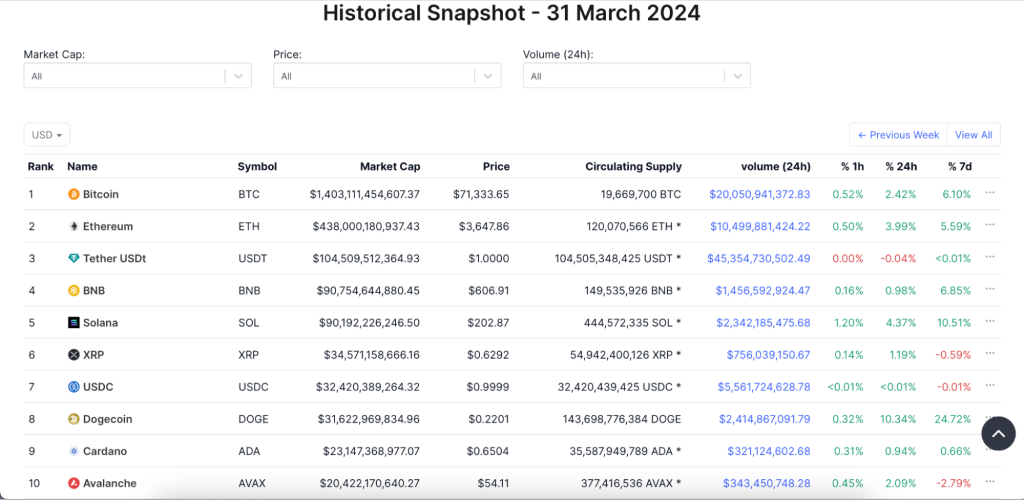

The table above shows the top 10 largest coins by market capitalisation at this point in the current bull run.

Excluding Bitcoin, ETH, and USDT, the updated list includes;

- BNB

- SOL

- XRP

- DOGE

- ADA

- AVAX

- TON

- SHIB

- DOT

- LINK

However, the list is still predominantly made up of coins that are at least three years old – but that are working hard toward innovation or embracing shiny new narratives.

- BNB is one of the battle-tested coins (at least on the regulatory front) and is still standing. Its post-CZ era would be interesting, but it still has a formidable handle on innovation.

- SOL and AVAX, we already discussed why WAGMI with these coins in the last section.

- DOGE and SHIB are memecoins; you can revisit our thesis on memecoins to understand why they are still standing strong.

- LINK is primed to unlock a $25B opportunity.

- TON is our low-risk 8x opportunity.

- We are not quite sure about DOT, and we won't be surprised if it falls off before the end of this cycle.

In the six months since the current bull run started, you'll notice that almost all the coins we have been bullish about from the last cycle have outperformed Bitcoin. Only LINK has slightly underperformed BTC. In contrast, ADA, DOT, and XRP are underperforming BTC.

Bitcoin is the base you want to be outperforming. If you are holding a token that has underperformed BTC in the last year, why are you holding it?

But now, let's switch things up and talk about the shiny new coins of the current cycle.

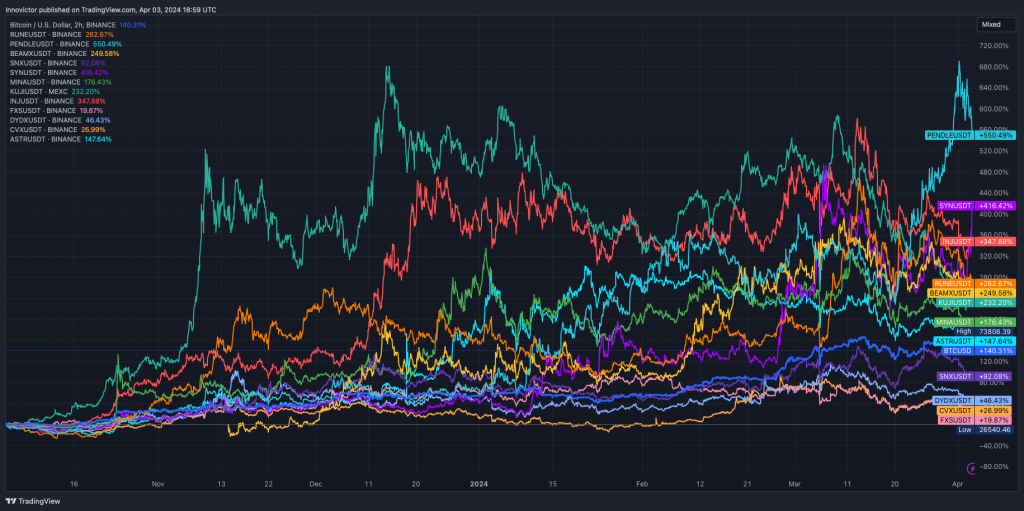

The chart above shows some of the shiny new coins in Cryptonary's Picks for this cycle. These are our mid-risk picks. You will observe that the only ones currently underperforming BTC are core DeFi plays, mostly because DeFi is not yet a trending narrative in the market.

If we switch things up much more than this to examine the performance of the high-risk coins in Cryptonary's Picks, that's where things start to get truly exciting.

Underperformance = opportunity cost

Let's take Cardano, for example…In the last five years, you would have made almost 3x more money holding BTC than ADA, and in the YTD alone, you would be down 5% on ADA compared to being 53% up on BTC.

As much as people in crypto love to spew rhetoric about the "financial revolution," most people don't have a clue how any of it works.

This means most people are only here for gains—that's the reality.

ADA, XRP, XMR - these are all "headliners" from previous bull cycles. But they've performed horribly - we can smell the seethe from XRP holders as we're typing this – but the market doesn't care about your feelings.

The crypto market has the attention span of a goldfish. Most tokens are old news, and people are interested in the newer, shiny, and lower-market-cap tokens.

Why?

They offer the most promising gains without all the baggage tokens from previous cycles tend to have.

Right now, memecoins and AI are the darlings of the market.

Take another look at the chart above!

THIS is what new participants in the crypto market are chasing.

Notice the word "chasing" in there. You cannot chase gains on an asset that will never pump (looking at you ADA, XRP, *insert other 2017 token*).

There's a reason we've been pushing memecoins so much—that's where the attention is and, therefore, the gains are.

The narrative will shift eventually, and those gains will be redistributed to other areas of the market.

Luckily, we have a roadmap outlining where we think the market goes after memecoins.

Cryptonary's take

If you take nothing else away from this report, it should be that if you take an objective look at your portfolio, there'll probably be one asset you are holding, not just because you can't bear to let it go.And maybe that's fine, but at least reassess your allocation.

60% of your portfolio in XRP? Nah g, it's not the one.

What was true a few years ago is likely no longer the case.

Even if you aren't bag-holding right now because you joined the market in the last few weeks, don't be that guy who has nothing to show for the emotional rollercoaster ride that the crypto market takes us all through without a fat bank account to show for it.

You have a chance to make life-changing money during this cycle; don't fumble the bag.

Cryptonary, Out!