How high can Hivemapper's HONEY go?

Last week we published our Hivemapper alpha report, we detailed why Hivemapper is an under-the-radar project sitting smack dab at the intersection of AI, physical infrastructure, and Web3.

We also introduced you to Hivemapper's HONEY token. Between then and now, the token is already up about 250%. If you bought then, you are already in the money!

But, if you didn't buy then, are you already too late to the party?

Today, we present our valuation exercise on what HONEY tokens.

In this report, we detail exactly how we would value HONEY, step by step so you can make informed decisions about how to play the token from here on.

Sounds interesting? Let's dive in.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

HONEY tokenomics overview

The general supply characteristics of HONEY are as follows:- Circulating supply: ~251 million.

- Total supply: ~6.171 billion.

- Max supply (fixed): 10 billion.

The initial distribution is:

- 40% to contributors for rewarding participation in Hivemapper.

- 20% to investors.

- 20% to employees.

- 15% to Hivemapper Inc. for development/operations.

- 5% to the Hivemapper Foundation; this looks mostly to be for marketing and socials.

When evaluating the economics of a token, we consider the “faucets” and “sinks” for that token.

A “sink” mechanism takes tokens out of the circulating supply. This could be through buy and burn and incentivising staking, for example.

A “faucet” is a mechanism by which tokens are added to supply - natural unlocks, staking rewards, airdrops, mining rewards for PoW chains, etc.

So, here are HONEY’s key faucet and sink mechanisms:

Faucets

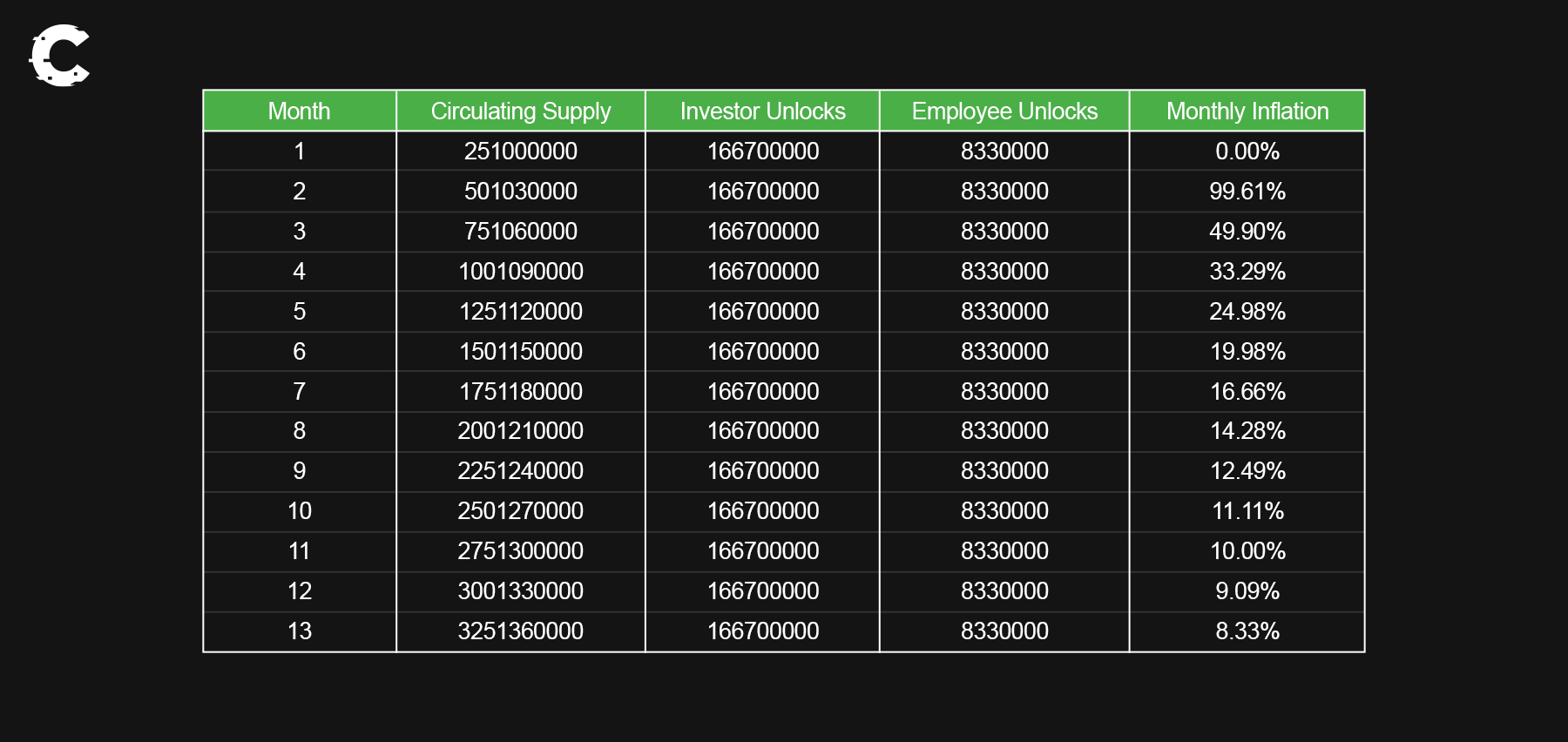

The main sources of inflation here will be the rewards system for Hivemapper contributors, the investor allocation, and the employee allocation:- The investor's allocation is subject to a 12 month lock and then 12 equal distributions per month over the next 12. This allocation is 20%. So we can assume ~166.7 million tokens will be added to the circulating supply every month over those 12 months, starting November 2023.

- Employee allocations are locked for 12 months and distributed over a period of 24 months for a total schedule of 3 years. This allocation is 20%. So we can assume ~83.33 million tokens will be added to the supply per month, starting November 2023.

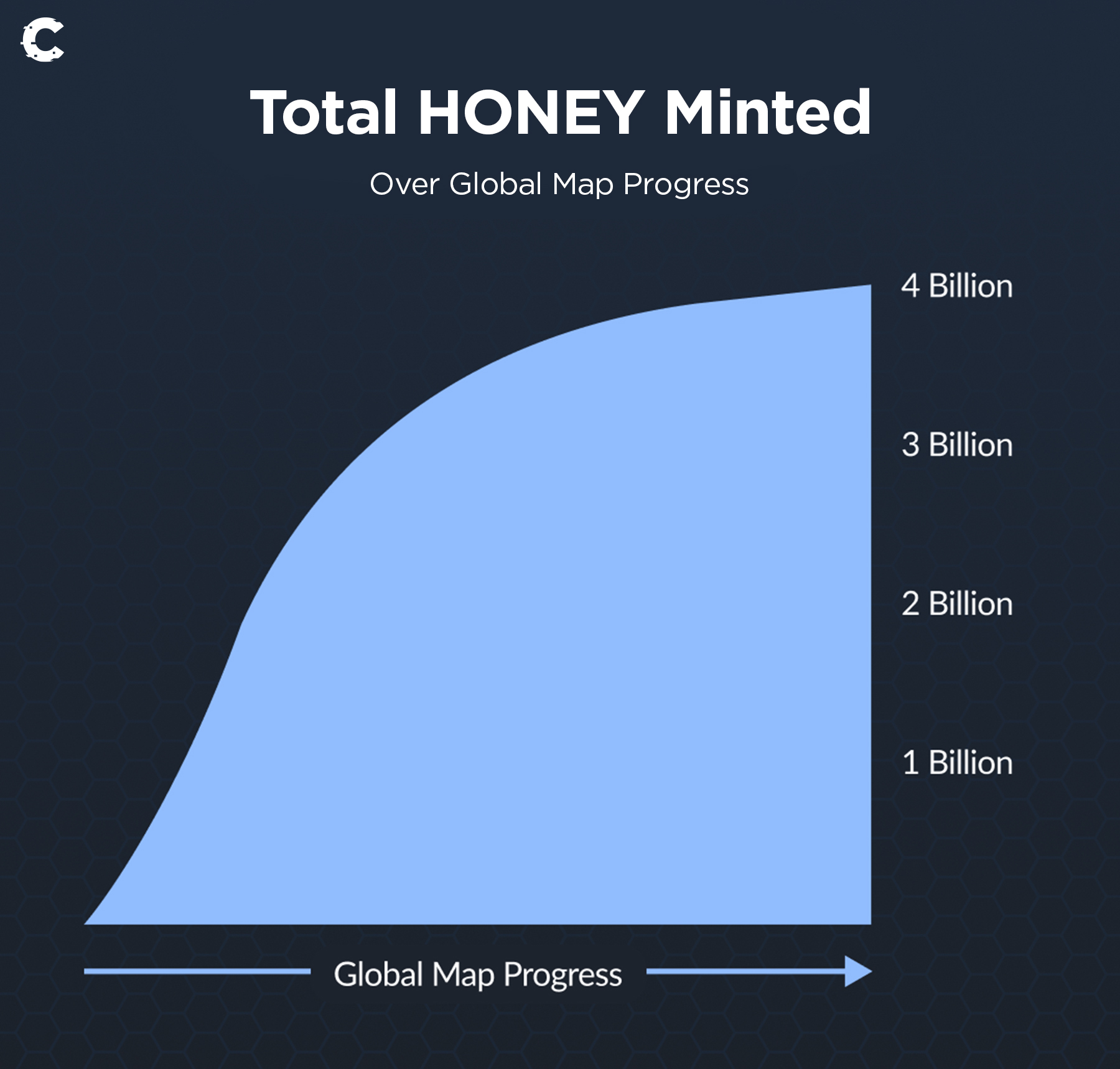

Inflation from rewards is a function of map completion:

It’s extremely difficult to estimate how many tokens will be added to supply via this route; how do we put a date on when the map will be complete?

Also, this minting is tied to Hivemapper’s sink mechanisms.

Sinks

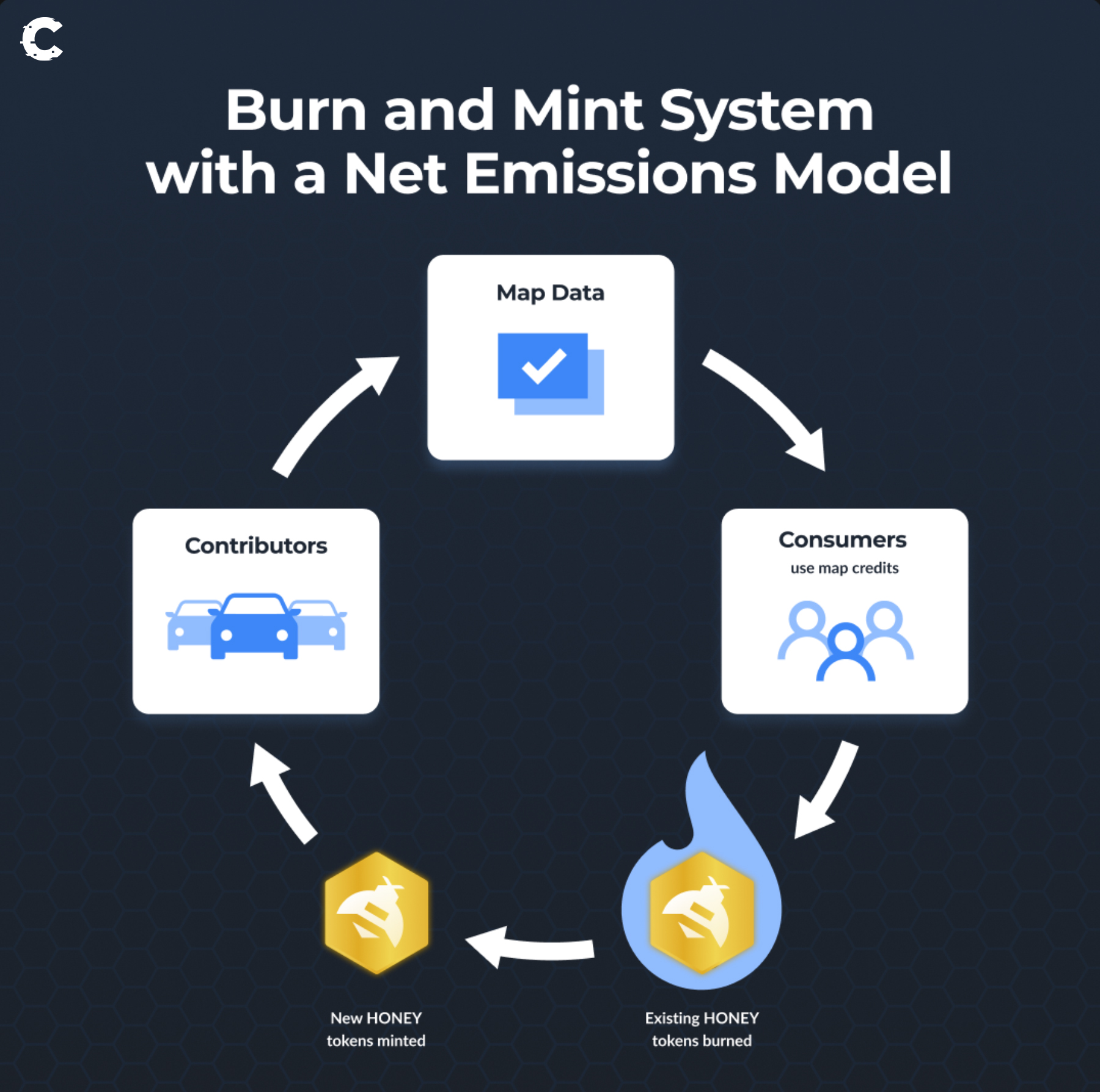

Often, you’ll find that the relationship between a faucet and a sink is not as cut and dry as categorising each. For some sources of inflation, there will be a counterbalance.

Yes, contributors are rewarded, but consumers using the service also pay for the use of the data that the contributors provide.

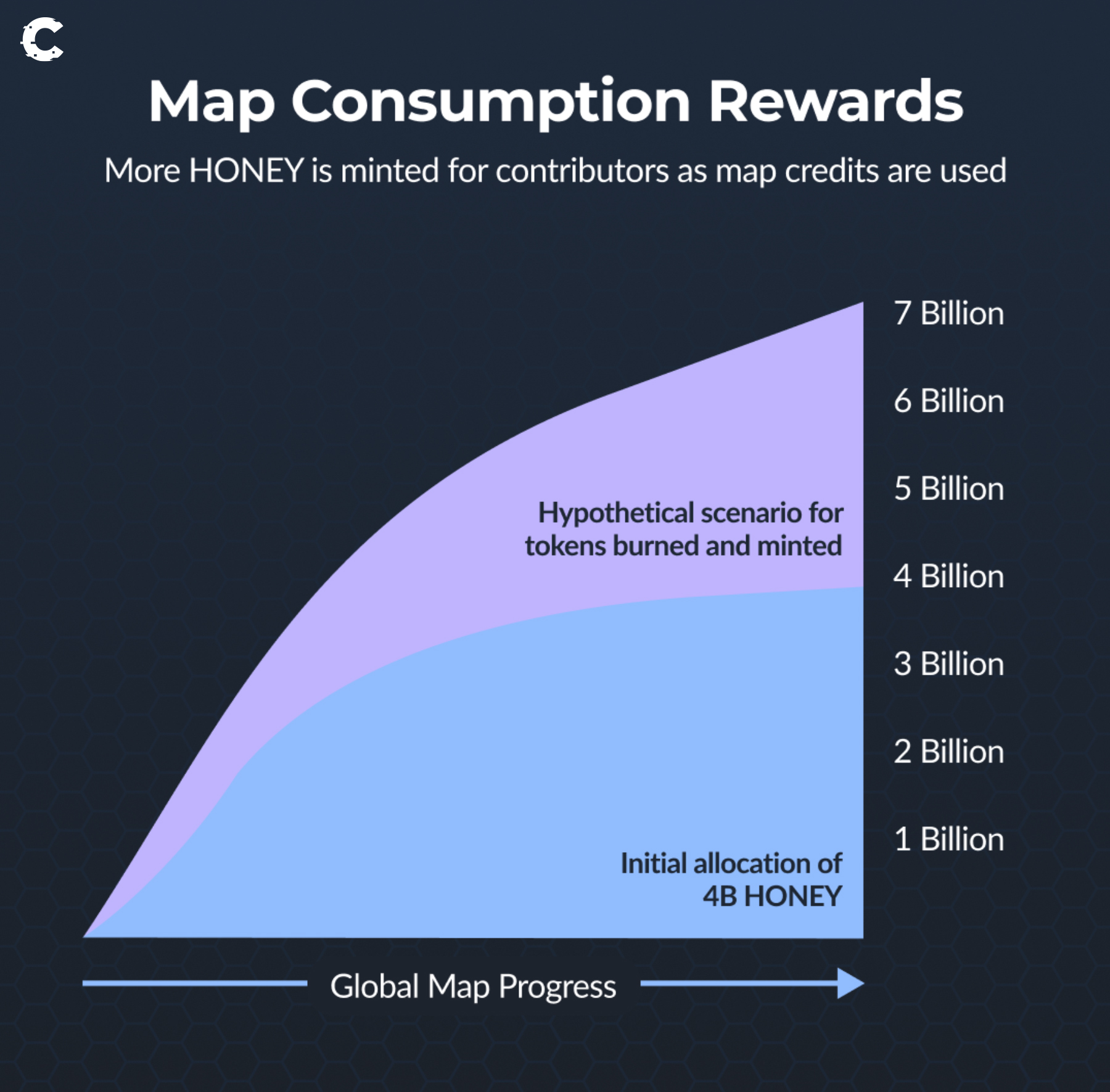

This is important because if we believe that many consumers will adopt Hivemapper, then more tokens are burned by consumers accessing the product than are minted to pay contributors.

Equally, the burning and minting of tokens as a product of usage means that the initial rewards distribution is only relevant at the moment of launch:

Basically, over time, this means that all other sources of inflation should flow into rewards as consumers purchase tokens floating on the market to pay for services.

If the majority of the world has already been mapped at some point, then it becomes a case of maintenance. The protocol should be running at net profit, with payments vastly exceeding any rewards distributed to contributors. I.e., tokens burned will stay burned.

Valuation method

We can take the current circulating supply of 251 million, coupled with the fixed inflation sources listed above (investor and employee), to figure out how much newly released tokens affect the supply.When added together, investor and employee allocations will contribute ~250 million new monthly tokens in the mid-term. That is quite heavy; check out the monthly inflation over the first 12 months starting November 2023:

However, the low market cap of HONEY gives some wiggle room as the market can absorb a lot of the supply through investor demand.

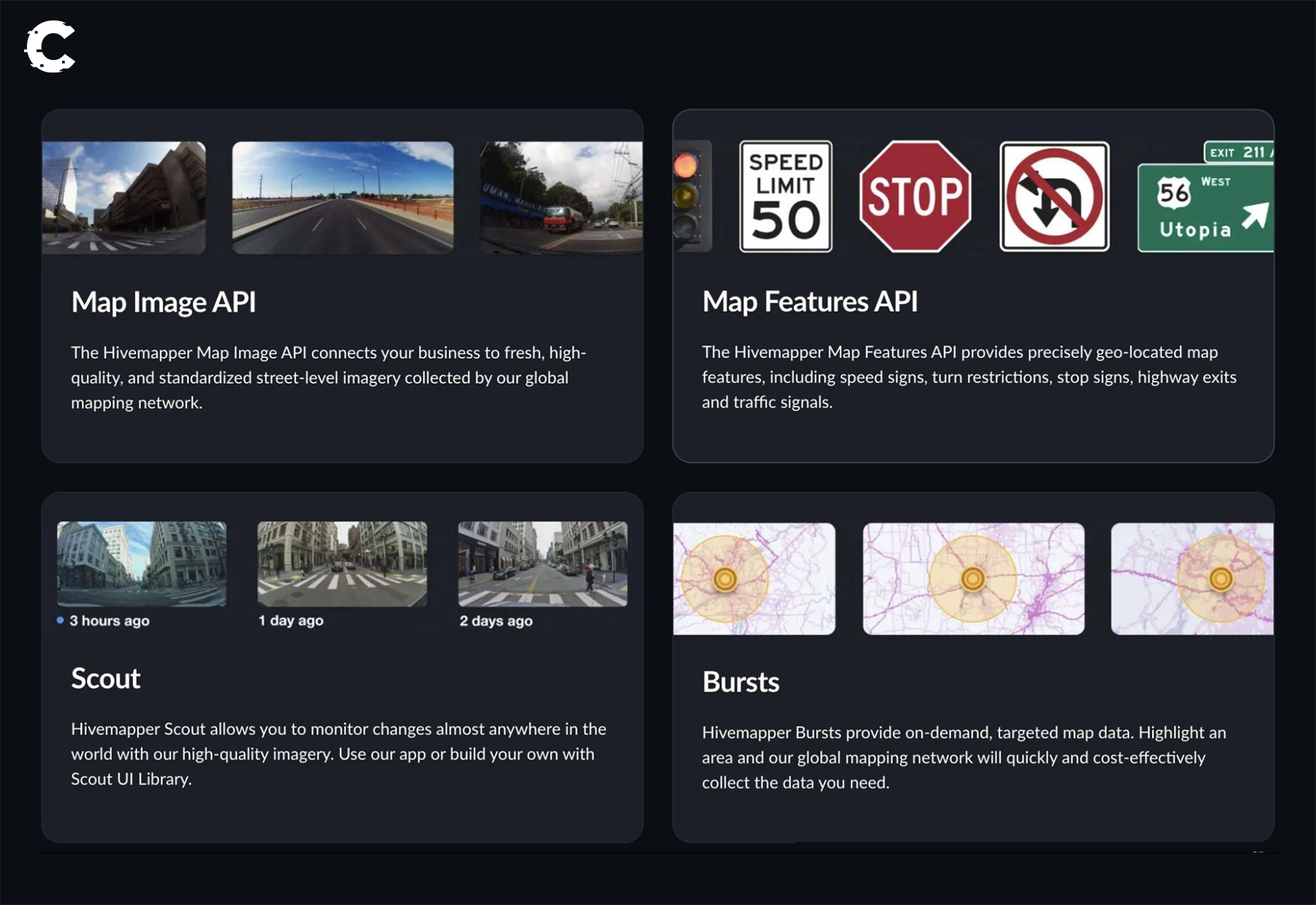

Pricing is around $1 per 1km of usage, mostly through API requests. As Hivemapper is essentially a decentralised Google Maps we will be comparing the two heavily going forward.

Generally, I like to come up with three scenarios: best case, base case, and worst case.

For a project like this, we would be looking to capitalise on the short-term, 6-12 months.

We’ll base these scenarios on a high-level view of adoption and investor speculation. We have no idea how many people will pay for the service, etc.

But the facts and hard data can only take us so far; we have to speculate at some point.

Where’s the value?

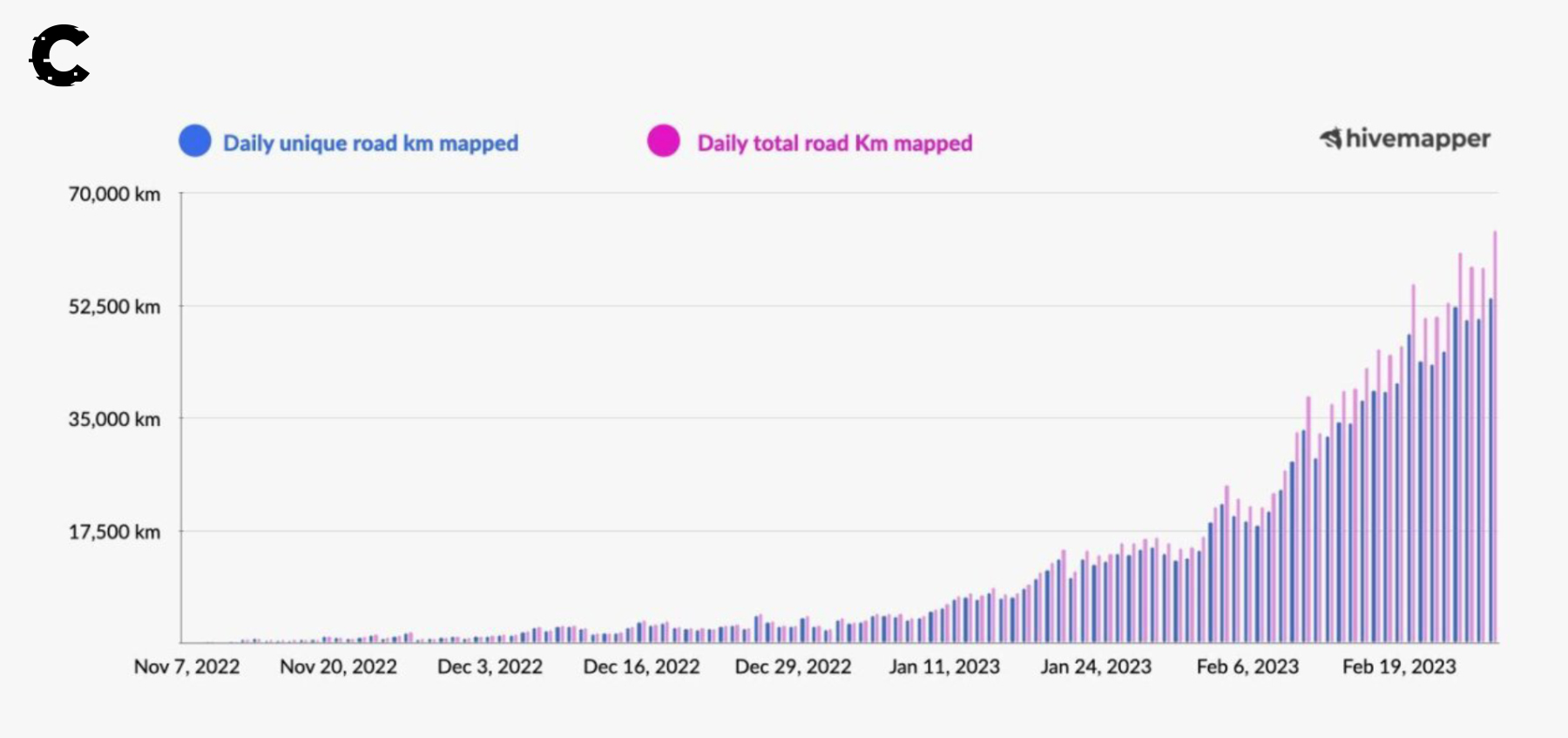

Hivemapper has already outperformed Google Maps in terms of the speed and cost at which it collects street data, plus Hivemapper’s data is more up-to-date.

Coverage is exponentially increasing and, in some areas, is rapidly becoming a viable and cheaper alternative to Google Maps, which currently has a global monopoly in the sector.

There are a few estimates of the revenue that Google Maps generates for Google, anywhere between $7-15 billion per year.

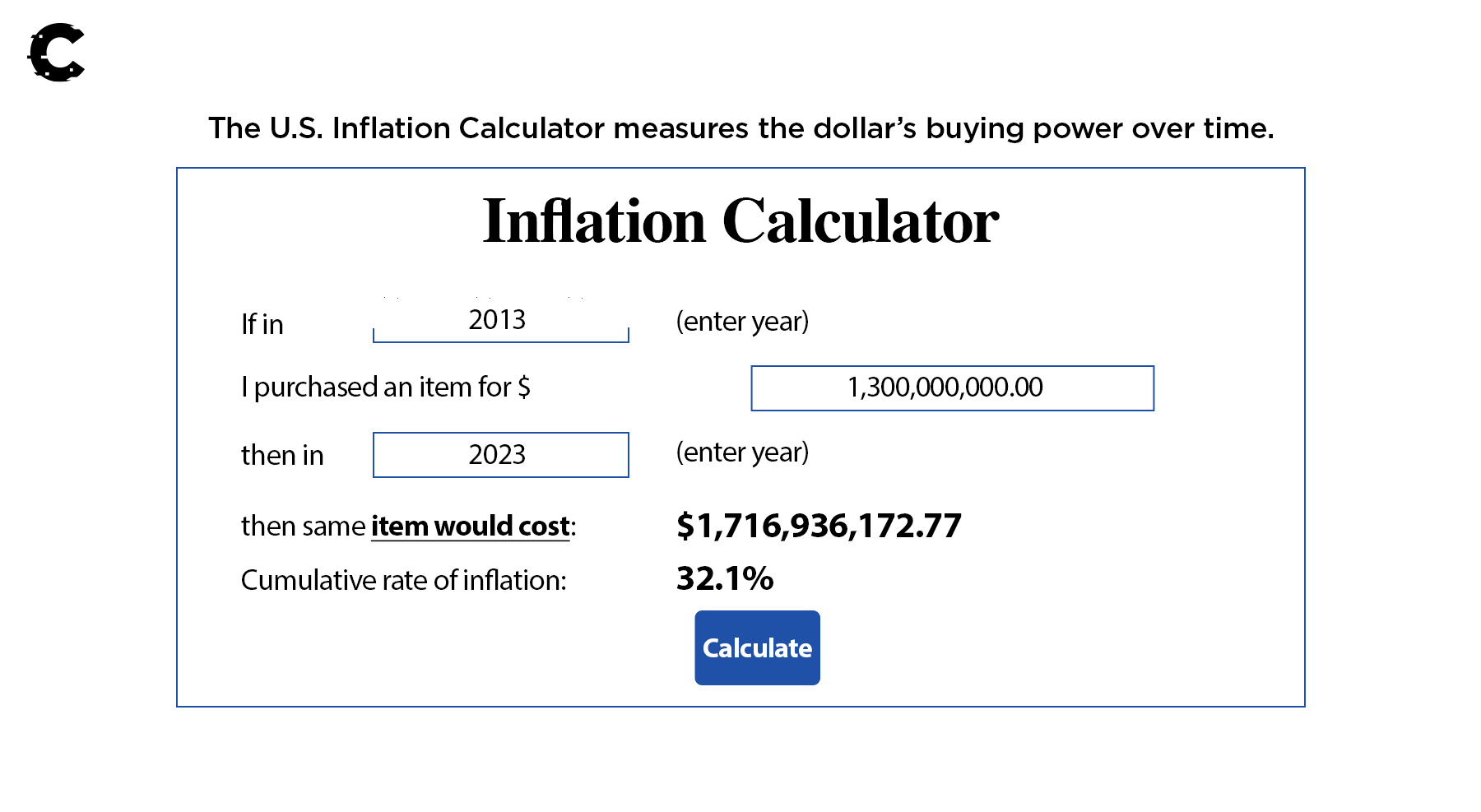

For a more direct comparison, in 2013, Google Maps acquired Waze, an app that basically did the same thing as Hivemapper but without the current tech advantage of AI to quickly identify and register things like traffic lights, road signs, etc. This acquisition was worth $1.3 billion at the time. Accounting for inflation, that would be worth around:

Since Waze’s data was far less comprehensive (as you’d expect after 10 years) than that of Hivemapper, we can guarantee that the valuation would be low if we were to apply it to Hivemapper. Additionally, given the nature of the crypto market and the tendency to massively overvalue tokens, I would say it’s fair to add a speculative 3x multiplier to that figure, giving us a target market cap of ~$5.1 billion in 12 months' time.

This gives us our base case.

Base case

Given a baseline of $5.1 billion and a circulating supply of 3.2 billion (see table above), we can come to a valuation for HONEY of $1.59 per token.Best case

The conditions for the best-case scenario would be:- Contributors are in the small minority, distributing data to a large paying consumer user base. The dynamic here would be emissions flowing to contributors over the long term.

- A healthy relationship between emissions, minting, and token burning over the long term - stable economics, contributing to investor confidence.

- Due to the above, investor sentiment remains positive throughout the high-inflation period over the first 24 months, absorbing supply through demand.

Since investor sentiment is high, we can also reduce the impact that token emissions will have, as HONEY holders would be much more likely to hang onto their tokens. Employees and investors especially would be reluctant to sell. We’ll cut the circulating supply down to 75% of 3.2 billion - 2.4 billion.

For the best case, it would be fair to add a 1.5x multiplier onto the base case market cap, given the speculated success, giving a target of $7.65 billion.

This gives us our best-case HONEY valuation - $3.19.

Worst case

The conditions for the worst-case scenario would be:- Adoption is light, and businesses/individuals are unwilling to move away from Google.

- The rate of street coverage slows down, meaning there is less data to sell.

- Investors and employees contribute significantly to selling pressure each month due to the perceived failures of the protocol.

- However, the protocol doesn’t completely flop - in which case the valuations would be irrelevant.

For the worst case, I think reducing the base case market cap to ⅙ of the base case ($850 million) is reasonable for a speculative asset with an already established business model.

With a circ supply of 3.2 billion, we can come to a worst-case valuation of $0.266.

Cryptonary's take

Our target multipliers, considering a current price of ~$0.16 are as follows:- Best case: $3.19, ~20x.

- Base case: $1.59, ~10x.

- Worst case: $0.266, ~1.7x.

Considering the run that HONEY has already had, it would be wise to take a DCA approach here. Yes, it could run higher, but in the short term, the R:R doesn’t make sense to enter with a large allocation. We will err on the side of caution when entering. However, it’s still valid to enter with small size - it’s negative EV to fade strength in bullish conditions, especially when the market cap is so low.