How the Coronavirus (COVID-19) triggered a Black Swan in 2020

The history of human coronavirus began as far back as 1965 but first really came to the world’s attention in the form of Severe Acute Respiratory Syndrome (SARS), which emerged from southern China in 2002-03 and was subsequently reported in 29 countries. In December 2019 a novel coronavirus, Covid-19, was detected in three patients in Wuhan, China and has since spread rapidly around the world, with Europe currently seen as the epicentre of its ongoing transmission.

The human consequences are far-reaching and deeply worrying of course and the severe impact on the global economy, with financial markets classing this as a black swan event.

As of Tuesday morning:

| Total cases |

Total deaths | |

| China | 80,881 | 3,226 |

| Italy | 27,980 | 2,158 |

| Iran | 14,991 | 853 |

| Spain | 9,942 | 342 |

| France | 6,643 | 148 |

| USA | 4,734 | 93 |

| UK | 1,543 | 55 |

History of ‘Black Swan’ events

Black Swan is a term used to describe an unpredictable event beyond what might be expected of any given situation and with potentially severe consequences. It was popularised by finance professor Nassim Nicholas Taleb prior to the 2008 financial crisis, when he propounded the view that black swan events are impossible to predict because of their rarity, but there should be an assumption one could happen at any time and we should therefore plan accordingly. After the 2008 crisis he used the idea to argue that if a broken system is allowed to fail it will strengthen it against such events in the future.In a broader context, the rise of the internet could be defined as a black swan event, as well as such catastrophic events as the Black Death plague, World Wars I & II and the 9/11 attacks, as well as droughts, floods, famines and epidemics.

With regard to the ramifications for investments and markets: these can of course be affected by a wide range of occurrences. Some, like Black Monday in 1987, may have been relatively predictable but others are much less so, with the rapid emergence, spread and global effects of Covid-19 being very much a case in point. Historically the Wall Street Crash of 1929 would be classified as the biggest financial black swan event until now.

Present Covid-19 situation

The consequences of Covid-19 on the global markets are being felt very keenly and the picture is worsening rapidly. On Sunday the Federal Reserve cut interest rates to almost zero and launched a $700bn stimulus package as part of a coordinated action alongside Canada, the Eurozone, Japan, Switzerland and the UK, but US markets plunged 7% upon opening on Monday, triggering an automatic suspension in trading almost immediately. The Dow Jones closed 12.93% down (in comparison, 1929 was the biggest single-day drop in US markets was on ‘Black Monday’, October 28, with a change of -12.82%). London’s FTSE 100 ended the day 4% down.Asian markets closed earlier, having fared less badly than European and US, presumedly due to positive progress on handling the pandemic better than their counterparts, who are yet to experience the peak of the breakout.

The economies of many western countries, including the USA, UK, Italy and Spain are beginning to shut down because of the outbreak. In the UK, Virgin Atlantic has cut around 80% of its flights and asked staff to take eight weeks of unpaid leave; Ryanair and EasyJet are grounding most of their aircraft and IAG, owner of British Airways, Iberia and Aer Lingus, will cut their capacity by 75%. According to the Wall Street Journal, US airlines are seeking up to £50bn in government aid. A stark warning from CAPA that most of the world’s major airlines will be bankrupt by May unless they receive financial help is chilling. Car manufacturers are also being affected, with many announcing plans to close down plants.

The global economy is reeling, and the actions of central banks so far haven’t changed the situation. Aggressive measures by the US Federal Reserve, the European Central Bank and others haven’t slowed big falls in prices or shored up confidence amongst investors. For previous black swan events such as the 2008 financial crisis, specific areas of the economy could be identified as being particularly vulnerable. This time everything and everybody are potentially affected.

In the UK, Government advice did not initially include stopping events attracting large crowds. Despite this, sports’ governing bodies such as the Premier League and English Football League (EFL) made the decision on Friday 13th to follow others in Europe in suspending their league seasons, which may have increased anxiety among the general population and accelerated issues such as panic buying. The dystopian images on television news broadcasts of empty airports, public places and social venues do nothing to ease the growing anxiety.

The currently much-used term ‘social distancing’ means that people are imposing self-isolation upon themselves, or at least limiting social engagement and activities, to contain the spread of Covid-19. In many countries this has now become non-voluntary. The consequence is a worldwide shutdown of non-essential economic activities, with resultant dire effects on both supply and demand.

In China, where it all started, the moves made to contain the spread impacted both manufacturing and services and similar effects are now seen in places like Japan, western Europe and the US. Recovery once the rate of spread begins to recede will be slow, although the fact that there are signs of improvement in China is heartening to a degree.

Intervention

The move toward drastically limited movement or self-isolation means that transport companies like airlines and train companies are already requesting bail-out from Government. Small businesses such as manufacturers, restaurants, hotels and other tourist-driven businesses, pubs and shops are also feeling the effects very quickly and resources such as healthcare and income support for many households, not just the most vulnerable, will be needed.Government can help directly with the spread of the virus itself by taking action to ‘lower the curve’ of dissemination, deferring the peak infection rate until nearer to summer, when health services will have less seasonal demand and should by then be better equipped to deal with the situation in term of available beds and increased resources such as ventilators.

Assistance to individuals with regard to mortgage payment breaks, income allowances, Universal Credit and sickness benefits, and to companies in the form of tax breaks and deferment of debt payments, will help to mitigate the effects of what is to come in the UK, which is presently a few weeks behind the situation in Italy, the worst affected European country.

Many previous major events have left the global economy and markets on the edge of a precipice, but there was always a recovery, even if it took time and followed a heavy toll in terms of lives, lifestyle and personal and corporate wealth. There is no reason to suppose that this situation will be any different, what we don’t know is how long it will take and how much damage will be inflicted before we reach the downward right-hand side of the curve.

Measures announced by the Bank of England, including lowering interest rates and taking firm steps to support business access to finance, will also help mitigate some of the impact of the Coronavirus on the UK economy.

History suggests the economic impact may be short and sharp – a temporary and transitory disruption, but as with the fact that there isn’t universal agreement among doctors and scientist as to how best to respond to the current crisis in order reduce its impact as much as possible, nor is there global consensus on the likely length and depth of the global economic downturn.

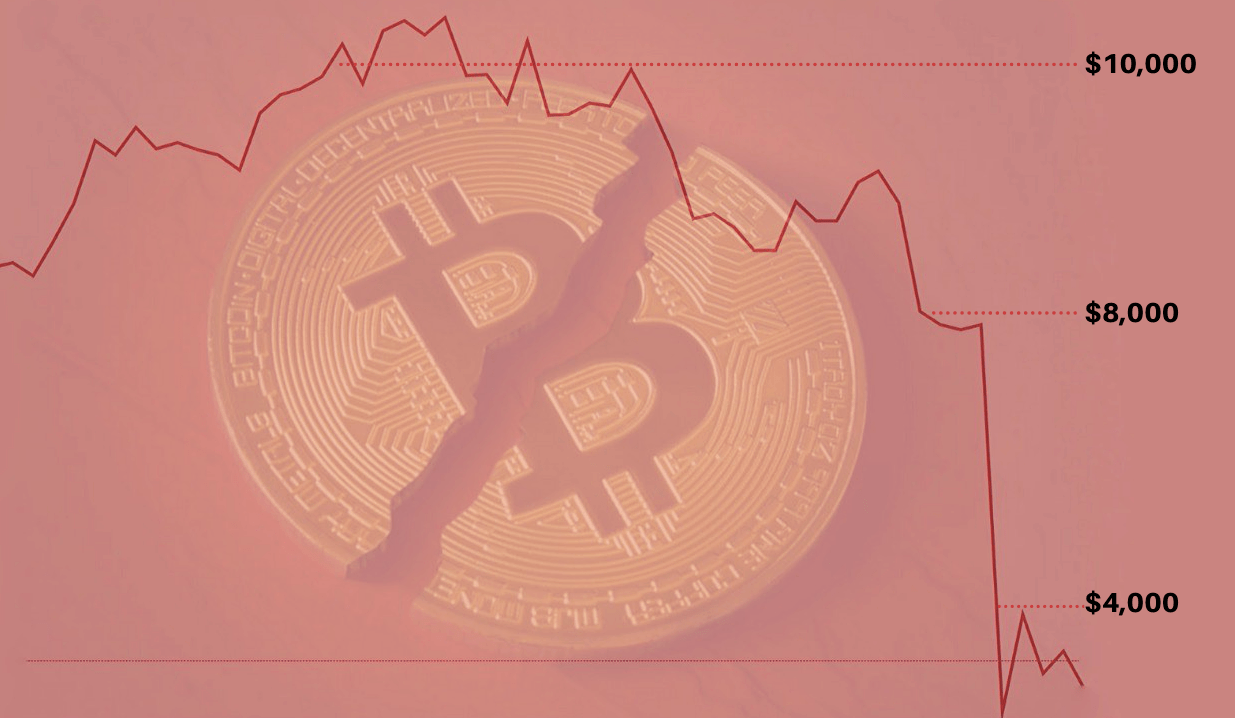

Where does Cryptocurrency fit into all of this?

Bitcoin, first released as an open source software in 2009, is widely considered to be the first decentralised cryptocurrency, but since then many variants have been created. Used primarily outside banking and government-controlled institutions and exchanged over the internet, can cryptocurrency have an effect in mitigating or even preventing the catastrophic effects of black swan events?Not being controlled by central authorities, the nature of the blockchain makes cryptocurrencies at least theoretically immune to the control and interference of governments and they can be exchanged directly.

The limited understanding of the concept has perhaps slowed its growth, development and general acceptance, but cryptocurrency has nevertheless achieved things that platforms such as PayPal aspired to and the costs for transactions are cheaper than Visa.

Major companies, investors and even countries have been looking to get in on the trade in cryptocurrencies and many experts believe that they are very much the future and will come to represent the global economy sooner rather than later.

FIAT money is controlled by central banks, in particular the US Federal Reserve, and is subject to the actions, inactions or missteps of such institutions. Bitcoin and other virtual money systems can change that, especially in countries where populations have limited access to banking facilities. It is less prone to manipulation by people or companies.

The world has a growing need to remove borders that deny true financial and social inclusion. The present worsening situation for the global economy and for global markets may prove to be a catalyst for change.

In the face of the very real possibility of such a pandemic recurring, Covid-19 - awful as it is, may prove to be a turning point for economic norms and centralised control, paving the way for cryptocurrencies to truly join the mainstream and to help serve as a buffer against future black swans by helping mitigate the consequences for companies and individuals alike.