How the media crashed the markets

The COVID-19 pandemic did not leave any stone unturned when it came to financial markets. The S&P 500 and the Dow Jones industrial average both had their worst month since 1987 (Black Monday) with an over 30% crash, oil prices took an ultra-strong hit after the increase in supply which caused its price to sharply drop by 60% and even cryptocurrencies which are uncorrelated to equities have taken a massive 50% hit.

The emotional manipulator

The media can be described as “the emotional manipulator” due to the overdramatized effects added to news stories by agencies to ensure high-level engagement. After all, media companies are businesses that need to generate revenue. Unfortunately, these added effects directly control people’s emotions and puts them in states of panic which then causes, uncalled for and unnecessary, consequences.

The most famous uncalled for consequence is the toilet paper shortage. When in panic from perceived danger, humans become irrational and selfish. This was first seen through people hoarding toilet paper and leaving some without the minimum amount required to take care of their “business”.

E. Alison Holman, associate professor at the University of California, has researched this subject in particular and came to the conclusion that the toilet paper craze was caused by the media. “A week ago, there were a handful of articles in major newspapers saying, here’s what you should do to prepare for the coronavirus. And one of the top things that was listed on at least two or three websites — major media outlets — was: Buy toilet paper”.

That begs the question: where are ethics? Especially in the current era of “political correctness” and “wokeness”.

The blessing and the curse

The internet and our ability to connect with each other regardless of our geographical location has become both a blessing and a curse.

Connecting with people in real-time and being with them at any moment in time with the click fo a button is a real blessing. However, as with everything else in life, there is another less pleasant side.

Our connectedness and now addiction to virtual social networks has made it very simple for news, regardless of its legitimacy, to spread maniacally. In fact, a team of YouTubers named “Yes Theory” were able to (experimentally) spread fake rumours about a celebrity and made it to BBC headlines very quickly.

Once the genie is out of the box, it’s almost impossible to get it back in.

COVID-19: The Infodemic

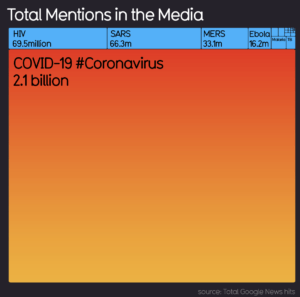

All previous epidemics and pandemics were mentioned by the media less than 70 million times, regardless of their spread and fatality rate (HIV included), but this one was special from that end. COVID-19, alone, was mentioned a staggering 2.1 BILLION times by the media since the outbreak a few months ago.

This over-coverage of the disease and the fight between media outlets to be “trending” has caused them to take some low blows. Some of which, in the UK, circulated a lockdown rumour an entire week before any official announcement or even hint by the government itself.

One of the latest ones was published by Daily Mail titled “Britons will not get back to 'normal life' for SIX MONTHS or more”. When digging into the words of the government's deputy chief medical officer, on which the article is based, we see an actually positive note being expressed and optimism in regard to the flattening of the curve, opposite to what the title entails at first sight.

Unfortunately, the media pathetically seeks refuge in fear-based strategies to generate clicks and ad revenue.

Freedom of speech

The media, being extremely under-regulated in regard to fear-spreading, uses the basic human right “freedom of speech” to suppress critics while the fact of the matter is there are limitations to freedom.

As the old adage states “my liberty ends where yours begins”. In other words, your liberty to swing your fist ends just where my nose begins.

The media has taken this basic human right for granted and not only blurred but obliterated all limits and responsibilities that come with it in exchange for clicks.

Fear vs COVID-19

Social distancing is our best bet to flatten the COVID-19 curve, which requires people to stay home as much as possible. The latter being difficult for us social creatures already takes a toll on our mental state, which makes it especially easy to generate fear-driven clicks.

Fear and panic can have very serious health implications, just like COVID-19 can. Again, how is that allowed to pass in this “woke” society we live in?

Markets crashed 3-months after coronavirus’ first appearance

In 2014, business journalist Stefan Theil, published a paper available at the Harvard Library titled “The Media and Markets: How Systematic Misreporting Inflates Bubbles, Deepens Downturns and Distorts Economic Reality”. The title alone is self-explanatory and it is a rather well-written paper that fully applies today.

A little known fact, the world’s first bubble (Tulip Mania 1637) occurred shortly after newspapers begun being printed in Germany and Holland. The 2001 dot-com bubble and the 2017 crypto bubble are both valid examples as well of irrational exuberance caused by widespread hype (through the media).

The pandemic and national emergency announcements both took a toll on the markets, COVID-19 must be contained, and these are government and WHO strategies used for that very reason. Fear, panic and market “declines” are a normal consequence.

The media, however, could have occupied a positive seat and avoided fear-based titles such as “Why Asia’s New Coronavirus Controls Should Worry the World” and actually reported the recovered cases of COVID-19.

Closing statement

The truth of the matter is, COVID-19 is a serious disease and precautions must be taken (precautions not panic-acts). The media is not the new kid on the block and their words have power, a power they’ve abused. The wording of titles can either be used to alleviate people’s pain and decrease levels of panic or induce them.

While the pandemic will certainly take a toll on the economy and previous inflationary behaviour seen by central banks has contributed to the crash, the media could have cushioned it and tried for once to be ethical.

Their selfish efforts to generate clicks has caused many to lose large chunks of their pension funds and other retirement investments that they were relying on for their survival. These people tend to be the ones the media aims to manipulate emotionally, the average person who' simply trying to peacefully live their life.

The 2008 global crisis has revealed the real face of banks, will this one expose the media’s true colours?