Today we provide you with an in-depth guide on how to build YOUR ultimate crypto portfolio.

We’ll start off with some Words of Wisdom from Karim.

TLDR

- We’ve built a tool to help you build YOUR portfolio.

- First, figure out what type of investor/trader you are, your interests and tolerance.

- Second, plan ahead and pre-set your exact actions based on any outcome.

- Third, maintain a close eye on your portfolio and evaluate it regularly.

- All of the information you need is in here.

Disclaimer: Not financial nor investment advice. This report is for entertainment purposes only. Any capital-related decisions you make are your full responsibility and yours only.

How Much to Put into Crypto?

The real answer is: depends. The good part is that we’re about to tell you what it depends on.Are you already rich? Are you very young with a steady income/salary? Are you a parent already and have responsibilities?

- Young, Steady Salary and Some Savings: You are looking to build long-term wealth. One route you could take is taking a small portion of your salary and steadily investing that into crypto. You can put a portion of your savings into crypto, how much depends on your risk tolerance and the size of those savings. The bigger the savings, the more you have to lose and hence the lower your risk tolerance. Because you’re young, you have more time and so you can take more risks than other people.

- Getting Older, Good Salary and Decent Savings: The same advice as the above applies to you, the only difference is that you can take a smaller percentage of your salary and have more returns than the lad above. Given your age, and likely responsibilities, you cannot afford to put 70-80% of your savings in crypto because if you were to lose them they would be hard to clawback - unlike the person above whose savings are easier to rebuild in a few months.

- Already Rich AF: Crypto is very volatile and you have already made it financially. Going all-in into crypto in this case would be considered degen gambling. A route we consider “wiser” is to take 5-30% of your wealth and plugging that into crypto (percentage depends on your belief in it).

- Young, No Salary, No Savings: Go get a job or build something in crypto.

Choosing your Timeframe: Investor or Trader

For most people, an investment strategy is the best way to go about portfolio management. Investing reduces the number of decisions that you must make. Inexperienced market participants are going to wreck themselves sooner rather than later trying to trade.Here’s a TLDR comparison:

- Investing: Longer timeframe (months, quarters, years, decades), less decision making, less time spent managing the portfolio, less experience necessary to succeed.

- Trading: Shorter timeframe (minutes, hours, days, months), more frequent decision making, more time spent managing the portfolio, lots of experience necessary to succeed.

The best way to figure out whether you should be trading or investing and to test your performance. Listen here.

Figuring Out the Market Trend: Up or Down?

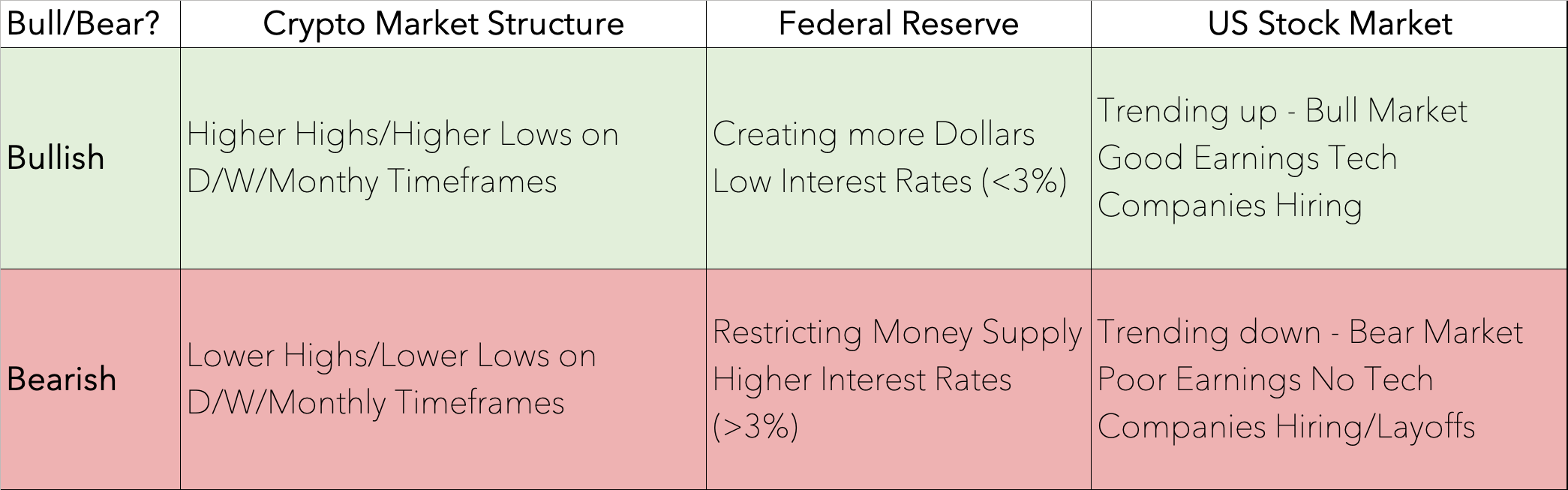

Once you’ve decided if you’re a trader or an investor, the next essential thing is evaluating market conditions. Even as an investor, there are certain times when it makes sense to reduce position size. This is a symptom of the euphoria of bull runs. Taking profit and/or reducing risk is essential. And it doesn’t have to be perfect timing – just somewhere in the middle.How do we decide if the market is in a risk-on or risk-off environment? There are a few tell-tale signs to look out for:

- Federal Reserve: USD is dominant in the world economy. What is its issuer, the Federal Reserve, doing? Is it tightening policy or loosening it? Creating more dollars (pumping prices) or limiting their supply (doing the opposite)?

- Market Structure: Has the market been setting higher highs and higher lows? Or lower highs and lower lows?

- Stock Market: What is the condition of the stock market(s)? Downtrend or uptrend?

- Sentiment: What is the overall sentiment of markets generally? Are participants euphoric? Is everyone bearish?

These questions are essential to determine whether a portfolio should mostly risk on or rotate back into cash. As much as we like to think crypto is separate from TradFi, the market has shown that crypto is still heavily correlated. As an investor, ultimately you can never be 100% sure of which direction the market will take in the short/medium/long term. So why be 100% deployed 100% of the time?

The importance of cash, or “dry powder”, as part of a crypto portfolio cannot be understated:

- Cash reduces the volatility of a portfolio.

- Cash provides more options. See an opportunity? You don’t have to decide what to sell to take advantage of it because the ammo is in reserve.

- Cash provides a cushion – think in terms of certainty. How certain are you that the market will continue in the direction you think it will?

- There’s opportunity cost in holding cash, but capital protection is key.

How Much Do You Want to Risk?

Each person has a different risk appetite based on their life conditions and responsibilities.There’s no “one size fits all” guide for risk. One way of thinking about risk appetite is to estimate how many hours you’d have to work to replace a 10/20/50% loss. Is it a significant number of hours? If yes, then it might be a good idea to lower risk.

But how to judge risk? Generally speaking:

- BTC, ETH – low risk, low chance of failure, lower reward, less volatile.

- Altcoins – higher risk, high chance of failure, higher potential reward, more volatile.

How do we balance risk?

Diversify Like a Pro

Diversification can be a great thing but unfortunately too many people over-diversify, in which case it’s called “a hedge against ignorance”.Proper diversification helps us minimize our risk of ruin. By investing in multiple assets, you reduce exposure to the downside. Diversification helps protect against unexpected events such as hacking, exploits, or other “black swan” events. If you were 100% in an asset that did utterly fail, you’d be totally wiped out. This is the risk of ruin we talk about. Your risk of ruin should be as close to zero as it possibly can be. Diversify, spread out your bets, reduce that risk.

How do we decide how much to bet?

The Poker Player Strategy

Investment bet sizing is a balancing act – too small and you may not be able to fully capitalize on opportunities; too large and you could end up going bust.The risk of failure should be avoided at all costs.

One approach is to use the Kelly Criterion (KC). The KC helps investors determine how much capital should be committed to a particular investment. It is based on the idea of maximizing the rate of return over time. This is what professional poker players use to decide bet sizing.

The equation?

Kelly % = p - (q/B)

Where:- Kelly % = % of capital to deploy in an investment.

- p = probability of success (decimal).

- q = probability of losing (decimal).

- B = Risk/Reward (decimal).

Sounds Complex AF, right?

Luckily, we’ve built a tool that does the calculation for you – and constructs a portfolio of 1-10 assets. It doesn’t work if you think whatever sh*tcoin you’ve invested in has a 99% probability of hitting your target. Limit expectations to reduce risk. The crypto market is already a relatively risky investment without pie-in-the-sky ideas of success.

Click Here to Build YOUR Ultimate Portfolio

Intuition

Experience plays a huge part in the success or failure of a portfolio. It’s all fun and games in a bull market – everyone’s making gains. However, the difference between exiting in profit/loss comes down to intuition. You’re up 10x on an investment? Take some profit. Why? Refer to the dry powder section above.The goal is to make profit. You can’t do that if you’ve run out of capital to deploy, and it’ll take 10x to break even.

Here’s a quote from one of the most successful investors of all time, Paul Tudor Jones:

You don’t have to be smart – just be sensible.

It’s likely that a few big losses will cause a new participant to leave the market. Fair enough, they were never likely to make it. Learn lessons from losses. Think about what you’re doing. Think about why you’re doing it. Keep a diary, write a journal. LEARN from your mistakes.

Time in the market is your most valuable asset. Why? Experience - it’s unteachable.

Correlation

Bitcoin has always dictated the direction of the crypto market. This is evident both in the price action of Bitcoin and the overall sentiment of the market. In the same way you shouldn’t fight the Fed – never fight Bitcoin. If Bitcoin is in a downtrend and you’re balls deep in alts – you will lose money, and fast. Conversely, if Bitcoin is in an uptrend, being balls deep in the correct alts is highly profitable.It all comes down to narratives. Generally, the market moves from sector to sector, narrative to narrative. In 2021 it was all about NFTs and Layer-1s, for example. Keeping on top of what’s popular and what’s likely to be popular in the future is key. Luckily, that’s what CPro is here for.

Invest in Things You Understand

Finally, you’re never going to be able to weather the storm if you have no clue what you’ve just bought. Learn about an asset/sector, the ins, and outs. Why is it valuable to you? Why would it be valuable to other people? Do these answers align? Building conviction can only be done with thorough research. Take an interest in your investments.Try the product and judge it from whatever perspective makes sense to you. Are you a gamer? If this project was an Xbox game, would you continue playing it? Are you a footballer? If this project was a pair of football boots, would you repurchase them when they wore out? If this project was an exchange, would you use it regularly?

You wouldn’t just blindly put $1,000 on a random number on the roulette table and expect to win. For some reason, newcomers think this is how it works when it comes to crypto. Fact - it doesn’t work like this at all. Crypto is so profitable partially because newcomers think like this.

Again, you don’t have to be smart. Just put some time and effort in, THINK, and you’ll be ahead of at least 50% of market participants.