How to manage your crypto portfolio in periods of volatility

Periods of market volatility present both challenges and opportunities. Navigating these turbulent times requires more than just intuition; it demands a strategic approach that balances foresight, discipline, and resilience.

This report is designed to equip investors and traders with the insights and tools to effectively manage their portfolios during these unpredictable periods. Whether you are a seasoned investor or new to the market, the strategies outlined herein will help you weather the storms and position yourself for the upcoming 6-18 months.

Prepare to delve into a comprehensive guide that will enhance your understanding and readiness to tackle market volatility head-on.

TLDR

- Focus on long-term gains; be prepared for short-term volatility. The future of crypto looks promising, with various positive developments.

- Maintain sufficient cash reserves to manage volatility and take advantage of investment opportunities.

- Dollar-cost averaging vs value averaging.

- Avoid these top 10 VC coins if you don't want to lose money.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Strategies for periods of volatility

Volatility refers to rapid and unpredictable price fluctuations that are common in crypto markets. During periods of volatility, having a well-thought-out strategy is crucial for investors and traders.For the majors, 5%, 10%, and 20% drops in a matter of days are normal, and for small-cap coins, these drops could happen within hours or minutes.

So, what can you do when the market is volatile?

1. Keep a long-term focus

First, if you are currently struggling with the market's behaviour, try maintaining a long-term focus. We are still up on the majority of solid plays in the year-to-date period, and we see numerous catalysts in the coming 6-18 months.As we outlined previously, this is the best time to be in crypto if you look from the macro, political, and technological perspectives: BTC and ETH ETFs have been approved; maybe the SOL ETF will come as well; potential rate cuts; pro-crypto presidential candidate; Larry Fink argues that tokenisation is the future, etc.

The future of crypto looks bright. Therefore, a long-term perspective can help investors remain disciplined and better deal with short-term market fluctuations.

2. Be strategic with managing cash

Secondly, it is important to keep some dry powder. Maintaining an appropriate level of cash in a portfolio provides a buffer against market volatility and offers flexibility to take advantage of investment opportunities.Investors should ensure that their cash holdings are sufficient to meet their short-term liquidity needs and potential investment opportunities.

In other words, always keep dry powder to capitalise on time-sensitive opportunities.

At least keep 5% of your portfolio in stables; constantly save from the paycheck to build stables stack or use defi yield opportunities/strategies to build the cash flow (more on it, potentially, in the next report)

If you feel comfortable that you have enough dry powder and a war chest to survive the volatility, you can start gradually deploying capital.

Here are some capital deployment strategies for periods of increased volatility.

3. Buy the dip with dollar-cost averaging

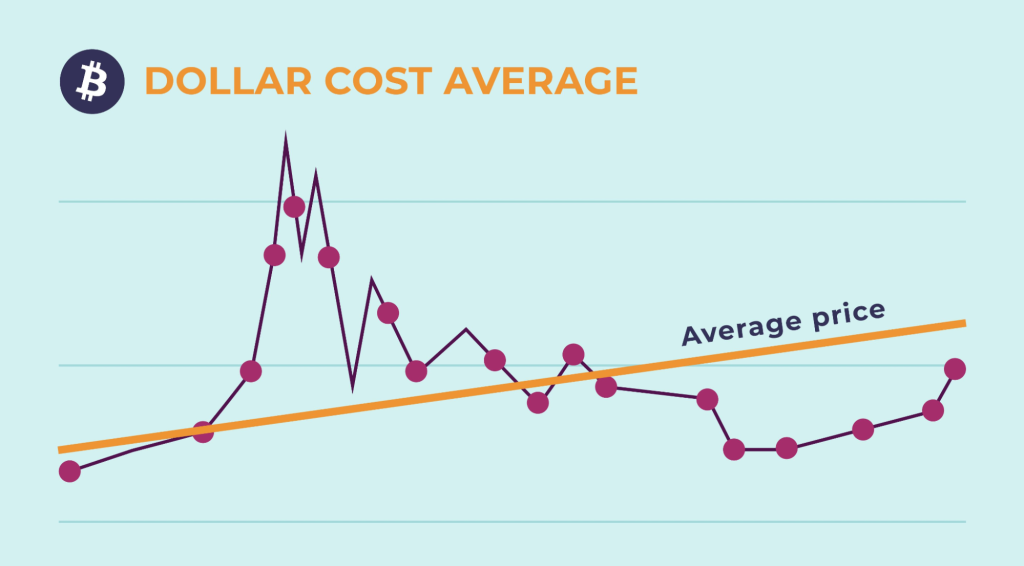

Basic dollar-cost averaging is a strategy that involves investing a fixed amount of money in an asset at regular intervals, regardless of the asset's price.This approach can help you manage volatility by reducing the impact of short-term market fluctuations on your portfolios.

By consistently investing over time, investors can potentially lower the average cost of their investments and take advantage of market downturns to accumulate more coins.

Here are some variations of DCA strategies:

DCA by levels

This strategy involves investing a fixed amount at set price levels. For example, an investor might decide to invest $100 every time the price of an asset drops by 5%. This method can help investors buy more tokens when prices are low and fewer tokens when prices are high.Additionally, you can DCA based on levels of interest.

Key Price Points as DCA Zones Why would we use key price points as DCA zones?

The reason is that in bullish market environments like the one we are in, support levels are brought around by recurring demand (buying from market participants) at certain price levels.

Our job is to be positioned where this buying occurs because when demand at certain price levels outweighs supply, the price moves higher, and we want to catch these price movements. So, if we can use technical analysis to identify these key price levels, we can use them as zones to get positioned.

Key factors to remember:

- Key levels are where the market has reacted to a price point multiple times and does so with significance, meaning we see large movements to and away from specific price points.

- These won't always be respected; nothing is a sure thing. We think in probabilities. If the market has reacted to a price point significantly before, we consider the probability that it may do so again.

- We don't just play one level. We look for a few close levels within the market context, allowing us to be dynamic and forgiving of the unpredictable nature of the markets.

As you can see, we have used blue circles to identify where the market has tested a specific price point or near a specific price point multiple times.

As you can see, we have used blue circles to identify where the market has tested a specific price point or near a specific price point multiple times.

Instead of randomly DCAing, we can use these levels with a probabilistic mindset that the market may be magnetised towards these levels.

We would ramp up our buying orders as and when the market trades down to these levels, giving us the best possible price within the current context of the market.

DCA by time

This is the most common form of DCA, where a fixed amount is invested at regular intervals, such as monthly or weekly. This method helps to spread out the risk over time and avoids the pitfalls of trying to time the market.Many people have full-time jobs and simply don't have the energy or time to keep up with the market. Additionally, dealing with the volatility of the market and strong emotions like FOMO, fear, and greed doesn't fit everyone's unique situation.

So, if you are struggling with emotions and can't keep up with everything that is happening in the market, the best and simplest strategy for such investors is to deploy an equal amount of capital at regular intervals. For example, if you have $4k to invest every month, you can invest $1k, let's say, every Monday.

4. Stay alive with Value Averaging (VA)

This strategy is similar to DCA, but instead of investing a fixed dollar amount, you aim to increase the value of the investment at regular intervals.This means that if the value of the investment decreases, a larger amount will be invested to reach the desired value, and if the value increases, a smaller amount will be invested.

For example, let's say you have a portfolio worth $1000 and aim to increase it by $100 every month. If prices stay flat, you will need to invest $100 next month to achieve your target.

However, let's say your portfolio increased 5% in 1 month. You would only need to invest $50 this month to achieve your target. But if the prices were to drop 5%, you would need to invest $150 next month.

This process continues each month, with you adjusting the amount you invest based on the portfolio's performance and your target value path. The goal is to keep your portfolio growing at a steady rate over time.

Studies seem to show mixed results regarding VA's performance vs. DCA by time (1,2,3,4). While some found VA to outperform DCA, others attributed increased risk and lower returns to VA. However, studies show VA performs better in the longer term and when market volatility is high.

Fortunately, crypto is probably one of the most volatile markets. With long-term focus and discipline, VA remains a compelling capital deployment strategy.

Currently, only Jupiter has a Value Averaging feature that automatically adjusts your investment amounts based on market conditions. It aims to buy more when prices are low and less when prices are high. So, if you are not familiar with value averaging or don't want to manually do so, try it out.

AVOID these 10 coins or lose money

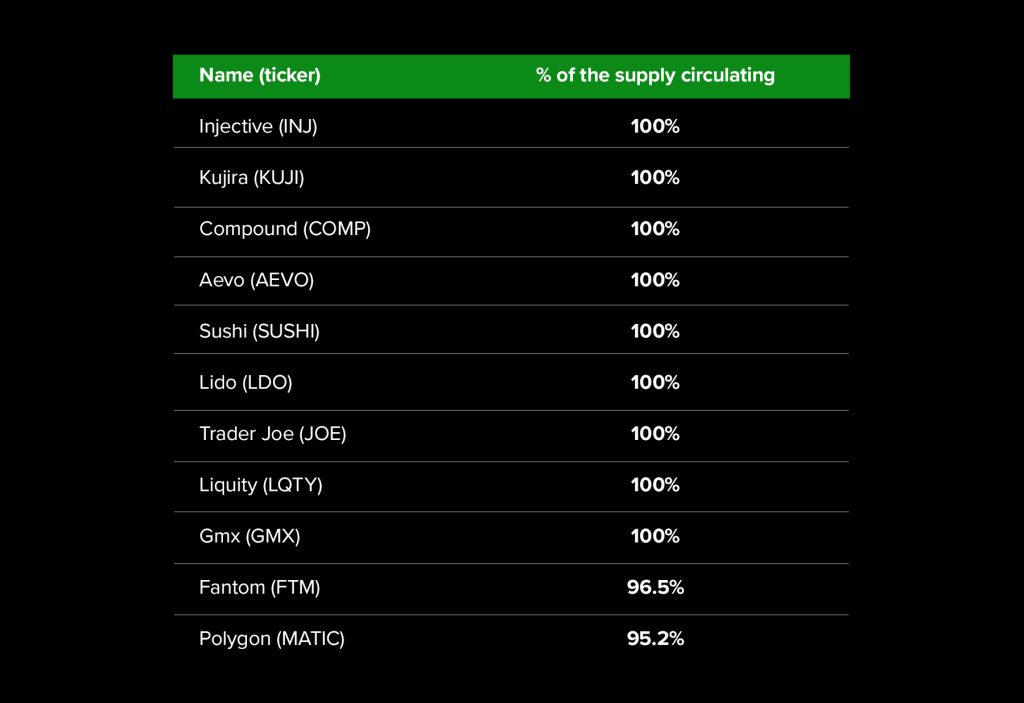

While it can be great to start slowly deploying capital, not all coins deserve your capital.In the current market, there is a proliferation of low-float, high-FDV (fully diluted valuation) coins backed by venture capitalists (VCs), influencers, and insiders. Low-float coins have a relatively small number of tokens in circulation. High-FDV coins have a high market cap, assuming the entire token supply is available.

A coin with a low float and high FDV often indicates that a large portion of tokens is held by insiders or early investors locked in vesting schedules. This situation can lead to potential downward price pressure when these tokens are eventually released.

These characteristics make low-float, high-FDV coins particularly risky because the insiders actively promote these coins to their followers, exaggerating all the project's merits. However, many of these followers (including cpro members) may end up serving as exit liquidity for the VCs and insiders unless these VC coins are exposed.

Vesting schedules for these coins are typically short, often around one year. This means that VCs and insiders will be able to sell their coins relatively quickly, potentially using their following as exit liquidity and leaving the market for good.

Here are the top 10 VC coin, their vesting schedule and the unrealised profits of insiders to be aware of.

It is paramount to avoid these coins during this bull market unless new information is available regarding their tokenomics.

Examples of altcoins without risky unlocks

However, not everything is bleak in the altcoin market. There are dozens of quality alts with more than 90% of their supply circulating.Here are some examples.

Please note that the analysis below is for educational purposes on what accumulating zones one should consider buying the coins ahead of the altcoin season. There are other factors beyond technical analysis that determine whether a coin deserves a spot in your portfolio or not.

INJ

We would recommend stacking buy orders between $18 and $20. This has been a key area of support for INJ, where the market has bottomed out numerous times over the last few months.

KUJI

Kuji has an attractive accumulation zone between the $1 mark and $0.80. The dollar mark is always a strong price point for a lot of assets and their development; this also allows for a slightly deep retracement in case price does bleed slightly deeper.

COMP

The buy box for COMP is slightly deeper, considering both a level in $45, which has seen multiple wicks and then a deeper wick which formed and may be filled. Stacking orders within this price range is justified by the recurring demand around this price point.

AEVO

The buy box for COMP is slightly deeper, considering both a level in $45, which has seen multiple wicks and then a deeper wick which formed and may be filled. Stacking orders within this price range is justified by the recurring demand around this price point.

AEVO

AEVO has seemed to bottom out and show consolidation within a price range from which we would look to capitalise. It also incorporated a psychological number, which has seen a lot of intra-day price action around $0.50. You should look to accumulate between here and $0.345.

SUSHI

SUSHI shows with its price action that it is susceptible to bleeding quite aggressively, so we have factored that in with this buy box whilst still taking into consideration the key levels of support price, which price has respected historically. Which has a high probability of magnetising price.

LDO

LDO is interesting because between August and October, we consolidated for some time before making a huge drive upwards. This is within the range where we are plotting our buy box to capitalise on a future potential scenario similar to that. The region is $1.350 and $1.500. JOE

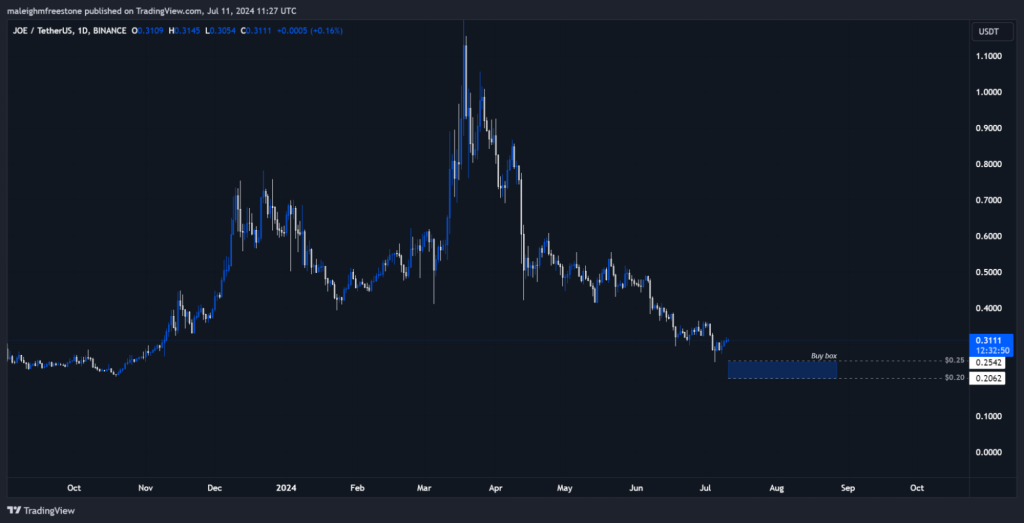

This buy box on JOE is taking advantage of the long floor that formed at the back end of last year. JOE has been trending in a nice, steady corrective manner and hasn't shown any signs of flipping direction just yet, so its likely price will be magnetised to this region between $0.20 and $0.25.

LQTY

This buy box on JOE is taking advantage of the long floor that formed at the back end of last year. JOE has been trending in a nice, steady corrective manner and hasn't shown any signs of flipping direction just yet, so its likely price will be magnetised to this region between $0.20 and $0.25.

LQTY

LQTY is another asset that has seen sharp corrections in its bearish environment, so we are taking this into consideration with a slightly deeper buy box; based on price action, we can't strategically be positioned for anything deeper than this, so look to accumulate between $0.6300 and $0.7050.

GMX

With GMX being at the bottom of its big-picture context and not printing any lower prices than where we currently are, we are taking the market's lows and some key demand levels around $20.00 and $24.00.

FTM

FTM is still swinging quite nicely within some solid higher time frame bullish structure; we are taking the low of the last major significant swing the market printed back at the start of the year, $0.3500 - $0.4000. However, we are not saying go ape into these coins or start building positions. Beyond its tokenomics, there are many factors to consider before investing in an altcoin.

Nevertheless, despite altcoins' underperformance, DeFi remains one of the best use cases in our industry.

Therefore, it is worth monitoring the assets with the least friction in case there is a positive catalyst or attention switch to the altcoin market. For now, cash management and survival remain priorities.

However, if you have enough dry powder and can't wait for the green light from the macro environment, we have covered 7 high-conviction bets to start DCAing during summer during summer.

Cryptonary's take

Successfully managing a portfolio in periods of volatility requires a blend of strategic foresight, disciplined execution, and psychological resilience.By staying informed about market conditions, avoiding high-risk investments, and focusing on assets with strong fundamentals/virality, you can mitigate risks and position yourself for the next leg up.

We are not yet looking into altcoin opportunities except for those highlighted in our 7 picks.

That said, in contrast with VC-backed altcoins, we can see some altcoins with very attractive tokenomics. However, we are still waiting for the macro greenlight to risk-on on them, and we are happy to stay on the sidelines until then.

This is all: have a long-term focus, accumulate cash, get your hands on defi yields, use DCA smartly, and say no to VC coins with predatory tokenomics.

Don't fumble the bag.

Cryptonary, OUT!