Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

By adding AURA (or insert your favourite project name) to liquidity pools, you're not only collecting on-chain fees, you're also deepening the token's market, reducing volatility, and making it more attractive to new buyers, traders, and even institutions. You’re turning belief into action, and getting paid for it.

The Basics: Volume vs Liquidity

- Volume is how much trading is happening — like how many entities are swimming in the pool, and their size (it could be a small fish or a large whale).

- Liquidity is how deep and large that pool is — how much water (money) is there to swim in.

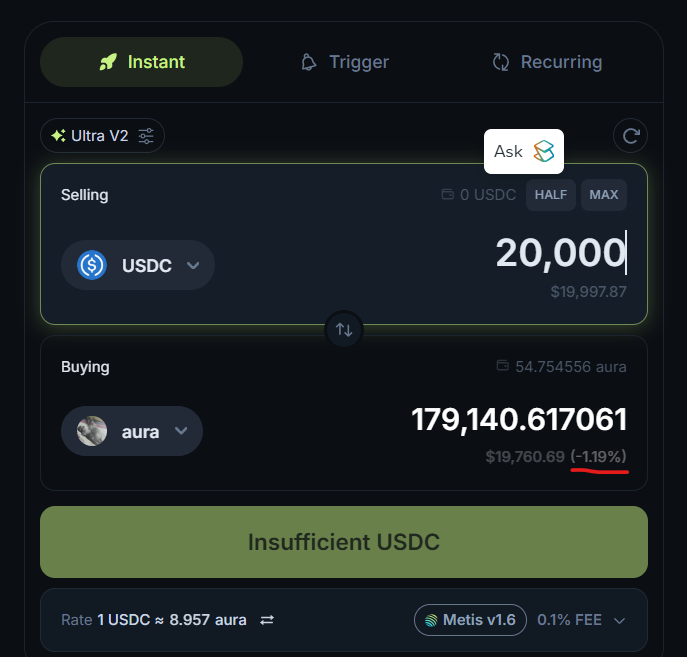

Right now, AURA’s liquidity is shallow. A $20K swap causes nearly 1.2% slippage, which is a red flag for whales and funds. But here’s the good news: you can help fix this and get paid for it.

The Strategy: Add Liquidity, Earn Yield

When you add tokens to a liquidity pool, you’re helping traders swap tokens — and they pay you a fee each time. This is real, on-chain yield, not some shady farm token.Better yet? You can focus your liquidity in a tight price range — this is called concentrated liquidity.

Concentrated Liquidity = Fishing Where the Fish Are

Instead of spreading your tokens across all prices, you target a tight range where the market is likely to stay (e.g., AURA/SOL between 0.0006 and 0.0008).Why? Because:

- You earn more fees when trades happen in your range.

- You’re “fishing” exactly where the action is.

- In the middle: You’re split 50/50 AURA/SOL.

- Going up: You slowly sell AURA and buy SOL.

- Going down: You slowly sell SOL and buy AURA.

Your liquidity position is like a dynamic investment plan between AURA and SOL. As the price moves, the pool automatically adjusts your holdings, effectively “buying” AURA when it’s cheaper (DCA-in) or “selling” AURA when it’s more expensive (DCA-out), all while collecting substantial fees paid in AURA and SOL

Why Add Liquidity to Aura?

Pros:- Deeper liquidity attracts institutional and larger players.

- Reduces volatility from large sells.

- Makes $AURA a more robust, long-term asset.

- High yield: By providing liquidity in certain ranges, you can earn real on-chain fees (currently as high as 1-4% per day in some zones).

- Large buys might not spike price as easily — but that’s a feature, not a bug, for long-term stability.

- If the price of SOL or/and AURA drops, the $-value of the position will decrease

- Smart contract risk

How to Add AURA Liquidity

1. Set Up Your Wallet

- Use Phantom or another Solana wallet.

- Buy AURA and SOL.

Important: Use fresh capital for this. We do not recommend using existing AURA spot holdings, as the pool will rebalance AURA into SOL during price increases.

2. Head to a DEX

- Go to Orca and connect your wallet.

3. Choose a Pool and Range

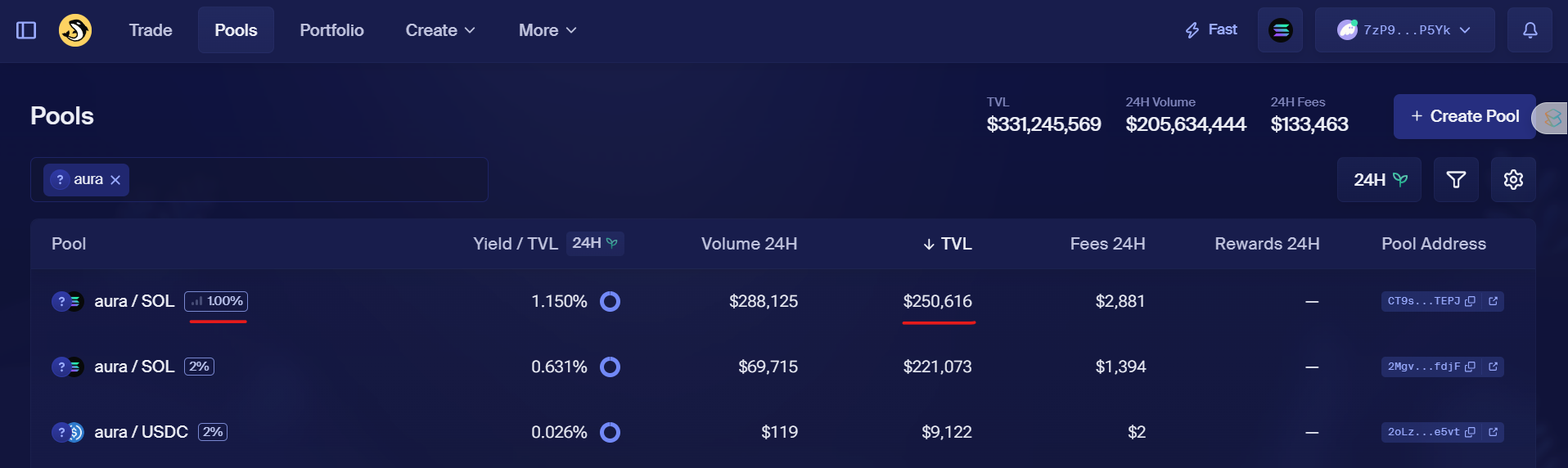

- Pick the AURA/SOL (1.00%) pool.

- Choose your price range. Here are 3 options:

1) 0.00065 - 0.00091 (2.42% daily; 72.6% monthly)

For Degens Only- High yield, tight range.

- Great if AURA stays sideways.

- High risk of going out of range quickly.

- $1000 invested would yield $24.2 per day and $726 per months

2) 0.00065 - 0.0011 (1.62% daily; 48.6% monthly)

Balanced Play- Allows some volatility up or down.

- Decent reward with reduced risk.

- Great for active participants.

- $1000 invested would yield $16.2 per day and $486 per months

3) 0.0004 - 0.003 (0.5% daily; 15% monthly)

Set and Forget- Wide range, lower yield.

- Good for long-term holders.

- Safer, lower-maintenance strategy.

- $1000 invested would yield $5 per day and $150 monthly

- You’ll earn fees in AURA and SOL.

- This isn’t staking or farming — it’s pure trading fees.

- Monitor the range and adjust as needed.

- Break large deposits into chunks to avoid slippage.

💬 Final Thoughts

The current TVL on the AURA/SOL pool on ORCA is slightly higher than $200k. Therefore, liquidity providers need to be careful of slippage when depositing large amounts. The best practice is to start slow and break down the whole position into smaller amounts.

Liquidity providers usually use fresh capital, and we don’t want to use our existing aura bags. Once the liquidity gets deeper, it opens up the door to a stronger narrative: “Trading $100K of AURA has less slippage than most memecoins.” Something that draws bigger whales in.

For a more comprehensive look into Concentrated liquidity, here is our full deep dive. And also check out why we believe AURA is the next multi-billion-dollar meme movement