Hyperliquid: Is this the next Binance?

Picture this: you log in one morning to discover 5-6 figures waiting in your wallet, which you got airdropped simply for trading on a platform you already love. On top of this, that money triples in value within a week. No effort. No gimmicks. Just life-changing money handed to you for being an early believer.

For early adopters of Hyperliquid (some CPro members included), this wasn't a fantasy-it was their reality. When Hyperliquid launched its $HYPE token, it didn't rely on flashy VC-backed promotions or overhyped influencers.

Instead, it rewarded its community traders who believed in the platform as one of the largest airdrops in DeFi history. At launch, $HYPE was priced at $3.50.

A week later, it is trading around $13.50, turning the 31% airdrop (310 million tokens) into a staggering $4.18 billion windfall for its users. This isn't just a token launch; it is a statement: Hyperliquid is here to change the rules of the game.

Let's dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A new standard for decentralized trading

We've talked about Hyperliquid several times as an exciting airdrop opportunity, but let's go back to square one and break it down from the basics. Many see it as just another decentralized exchange (DEX), but Hyperliquid is so much more. This isn't your typical DEX.It is a custom-built layer-1 blockchain that combines lightning-fast transactions, unmatched scalability, and an effortless user experience that feels like using a top-tier centralized exchange. In just two years, it's gone from a modest start on Arbitrum to becoming a powerhouse in the perpetual DEX space, with metrics that show strength against the biggest names in crypto:

- Daily volume: $8.3 billion, making it the top-performing perpetual DEXes globally.

- Open interest (24 hours): $3.1 billion, highlighting strong liquidity and market activity.

- Perpetual pairs: 157 pairs, rapidly expanding across various asset categories.

- User base: 220,000+ active traders and growing daily.

Hyperliquid, on the other hand, has achieved its meteoric rise with no VC funding, no paid marketing, and a core team of just eight people-graduates from Harvard, MIT, and Caltech.

This self-funded, community-driven approach has not only made Hyperliquid a standout in the DeFi space but also a beacon for what's possible when innovation, execution, and community alignment are prioritized.

Its HyperEVM blockchain, capable of processing up to 200,000 transactions per second, combined with its fully on-chain order book system, sets it apart as a DEX built for the future.

One of the team's most impressive achievements, however, is how they executed their airdrop...

Airdrop: One of DeFi's largest distributions

Hyperliquid's $HYPE token airdrop is one of the most significant in decentralized finance (DeFi) history, distributing 31% of its total supply to eligible users. This strategy mirrors successful airdrops from other prominent platforms, fostering mass adoption and liquidity within their ecosystems.At launch, $HYPE was priced at $3.50, valuing the airdrop at approximately $1.2 billion. With the current price at $13.50, the airdrop's value has surged to around $4.18 billion.

Comparison with historic airdrops:

- Uniswap (2020): On September 16, 2020, Uniswap distributed 400 UNI tokens to over 250,000 addresses. At its all-time high (ATH) of $42.88, each recipient's allocation was valued at approximately $17,152, culminating in a total distribution worth around $4.29 billion.

- Arbitrum (2023): On March 23, 2023, Arbitrum launched its native governance token, ARB, distributing tokens worth $1.97 billion at an ATH of $1.69. This airdrop significantly boosted the Arbitrum ecosystem's total value locked (TVL) by 147.2%, from $1.49 billion to $3.68 billion.

- Jupiter (2024): On January 31, 2024, Jupiter initiated its JUP token airdrop. The initial phase distributed 1 billion JUP tokens to approximately 955,000 eligible wallets, with future airdrops planned to distribute a total of 4 billion JUP tokens over four phases. The valuation of the airdrop depends on the market price of JUP tokens at the time of distribution.

The $HYPE token

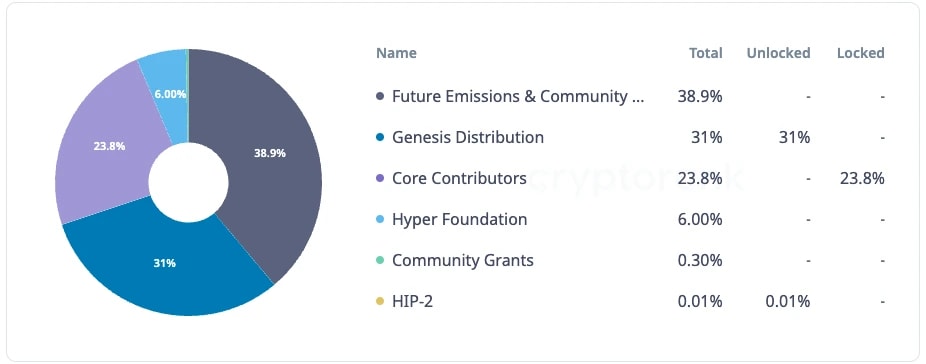

The $HYPE token serves as the cornerstone of the Hyperliquid ecosystem, functioning both as the staking asset for the platform's consensus mechanism and as the gas token for HyperEVM. The Genesis Airdrop, however, has truly captured the community's attention due to its generosity and token supply distribution.

As we mentioned earlier, there were no allocations for private investors, centralized exchanges, or market makers. Everyone who wanted exposure was forced to buy Hyperliquid itself. Well played by the team.

What is special about Hyperliquid?

Apart from having a product that had one the slickest UX and clearest product-market fits this cycle, Hyperliquid is distinguished by innovative features and robust technological infrastructure such as:1. Pre-markets: Pioneering pre-launch token trading

Hyperliquid introduced the "Pre Markets" feature, enabling traders to speculate on tokens prior to their official launch. This initiative debuted with LayerZero's governance token (ZRO) on September 7, 2023.

Upon the official release of these tokens, pre-market contracts automatically transition into standard perpetual contracts, providing traders with early exposure to emerging assets and the opportunity to capitalize on anticipated market movements.

2. Vaults and Hyperliquidity Provider (HLP): Enhancing liquidity and passive income opportunities

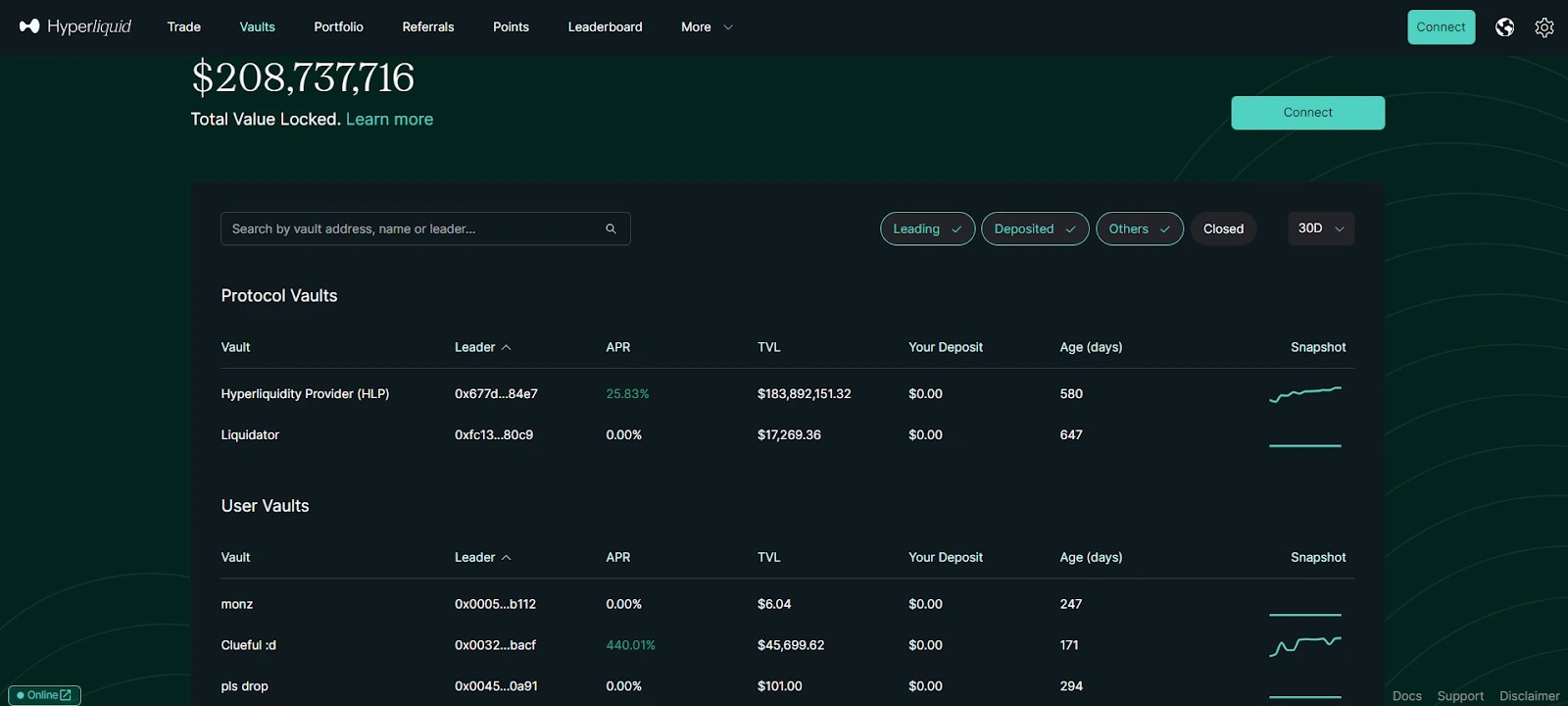

- Hyperliquidity Provider (HLP): Hyperliquid's deep liquidity is underpinned by the HLP pool, where users deposit USDC to act as counterparty capital for traders. This model has yielded consistent returns for depositors, achieving an annual percentage rate (APR) of approximately 14% in recent months.

- Vaults: The platform offers Vaults that allow users to automatically replicate the trading strategies of successful traders. Vault leaders earn a 10% share of the profits, while depositors benefit from passive exposure to potentially high-performing strategies. As of now, the total value locked (TVL) in Vaults exceeds $18.6 million, indicating strong user engagement.

- HyperEVM: HyperEVM operates on its custom-built Layer 1 blockchain, HyperEVM, which is compatible with Ethereum Virtual Machine (EVM). This design facilitates seamless interaction with decentralized applications (DApps) and ensures interoperability within the broader blockchain ecosystem.

- HyperBFT consensus mechanism: The platform employs the HyperBFT consensus mechanism inspired by advanced algorithms like HotStuff and LibraBFT. This system enables the network to process over 200,000 orders per second with sub-second latency, rivalling the performance of centralized exchanges. HyperBFT allows for rapid block production as soon as a quorum of validators communicates, a property known as "optimistic responsiveness."

The road ahead: Hyperliquid's broader vision

Hyperliquid is evolving from a perpetual decentralized exchange (DEX) into a comprehensive decentralized financial ecosystem. Central to this transformation is the development of the HyperEVM blockchain, designed to support a diverse array of decentralized applications (DApps), including lending protocols, Telegram bots, and gaming platforms. With over 35 projects preparing for mainnet launch, Hyperliquid aims to become a significant hub for DeFi innovation.

Ecosystem expansion

The launch of HyperEVM is expected to attract a wide range of DApps, positioning Hyperliquid as a competitor to general-purpose Layer 1 blockchain like Solana and Avalanche. By offering a robust and scalable infrastructure, Hyperliquid seeks to foster a vibrant ecosystem that appeals to both developers and users.Token growth

The $HYPE token is integral to Hyperliquid's ecosystem. As the ecosystem expands and more DApps integrate with HyperEVM, demand for $HYPE is likely to increase, contributing to its growth. Furthermore, unlike many Layer 1 tokens like SOL or AVAX, Hype has a fixed supply and is deflationary. Fees from the trading volume of the token are used to buy back and burn the token.Institutional adoption

Hyperliquid's high-speed infrastructure and advanced trading features are designed to attract professional traders and institutions. By providing a seamless and efficient trading experience, Hyperliquid aims to cater to the needs of institutional participants, thereby enhancing liquidity and fostering greater adoption of its platform.Valuation exercise

To assess Hyperliquid's potential market capitalization (MC) relative to its Total Value Locked (TVL), we can analyze the MC/TVL ratios of comparable Layer 1 blockchains. Here's a comparative overview:| Blockchain | Peak FDV | Peak TVL | FDV/TVL Ratio |

| Fantom | $10.4B | $5.8B | 1.35 |

| SUI | $37.9B | $1.6B | 23.69 |

| Aptos | $19.3B | $1.27B | 15.2 |

| Avalanche | $50..8B | $11.44B | 4.44 |

The average FDV/TVL ratio among these blockchains is approximately 11.17. As of December 5, 2024, Hyperliquid's TVL is approximately $1.52 billion. Using the average FDV/TVL ratio of 11.17, we can project Hyperliquid's potential market capitalization: $1.52 billion (TVL) * 11.17 (FDV/TVL ratio) = $146.33 billion.

Given Hyperliquid's current FDV of approximately $13.34 billion, this projection suggests significant potential for growth as the platform continues to expand its ecosystem and attract more value.

However, we need to remember that HyperLiquid is yet to deliver a fully functioning ecosystem of dapps on its blockchain. Given that we are no longer early in the cycle, we cut our valuation by half. Therefore, our target for Hyperliquid for this cycle is $70b FDV (roughly 5x) at most.

Challenges and risks

1. Decentralization and validator diversityCurrently, Hyperliquid's network is maintained by a limited number of validators, all of whom are members of the core team. This centralized structure poses risks related to network resilience and governance.

The introduction of the $HYPE token is intended to facilitate decentralization by enabling the integration of external validators, thereby enhancing operational security and decentralization.

However, the platform must ensure that expanding the validator set does not compromise its performance. It can be easy to run a 200k TPS network if it runs on a centralised server. It is much harder to achieve similar performance with a large set of distributed validators.

2. Regulatory compliance

As Hyperliquid expands its services, including potential offerings that resemble traditional financial instruments, it is likely to encounter increased regulatory scrutiny.

Navigating the complex and evolving regulatory landscape for DeFi platforms will be crucial to ensure compliance and maintain operational integrity. Proactive engagement with regulatory agencies and the implementation of robust compliance frameworks will be essential to address these challenges.

3. Competition and market positioning

The DeFi space is highly competitive, with numerous platforms offering similar services. Hyperliquid must continuously innovate and differentiate itself to attract and retain users, especially as other perpetual decentralized exchanges (perp DEXs) and financial platforms enhance their offerings.

Focusing on unique features, superior user experience, and building a strong community can help Hyperliquid maintain a competitive edge.

4. Bridging complexity: User-friendliness for new crypto adopters

For newcomers to the crypto market, the process of transferring funds from the Ethereum mainnet to the Arbitrum network and subsequently depositing them into a Hyperliquid account can be complex and intimidating. This procedure requires a solid grasp of blockchain networks, wallet configurations, and bridging protocols.

Managing multiple transactions across different platforms increases the risk of errors, such as sending funds to incorrect addresses or selecting the wrong network, which can result in irreversible loss of assets and limited adoption of Hyperliquid.

Cryptonary's take

Hyperliquid isn't just another project; it's one of this cycle's highlights, similar to SOL running from $8 to $260+ and the memecoin supercycle. In a space dominated by overhyped VC-backed campaigns, Hyperliquid has demonstrated that it is a product-first, community-driven powerhouse. Its $HYPE token airdrop was a transformative playbook many could learn from, fairly and generously rewarding its loyal users and forcing everyone else to buy in the open market. Very well played!We have been bullish on it for a very long time as an airdrop opportunity. However, even after receiving the airdrop, it is still one of our favourite products in the crypto market. We are excited about the future of the platform and its ecosystem.

That said, we approach the $HYPE token's current price with caution. After a 300% surge since launch, the risk-to-reward ratio at these levels isn't ideal for a full entry.

While price action continues to build momentum, we prefer waiting for more data and a better setup before committing. Since we are in a later stage of the cycle, we wouldn't recommend entering from an investing perspective. Trading-wise? Follow our trading channels…

Peace!

Cryptonary, OUT!