Hyperliquid update: Fundamentals, security, and plan moving forward

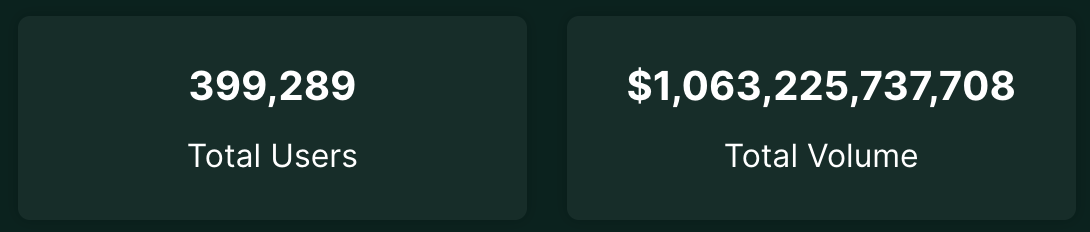

Hyperliquid's rise has been relentless-$1T+ in volume, 400K users, and a top revenue-generating protocol. But even the strongest projects face stress tests. A $170M outflow within 24 hours of the major mechanism exploit sparks concerns. Should you be worried?

In this report:

- Latest on Hyperliquid

- The exploit?

- Current market positioning

- When to buy?

- Cryptonary's take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Quick primer

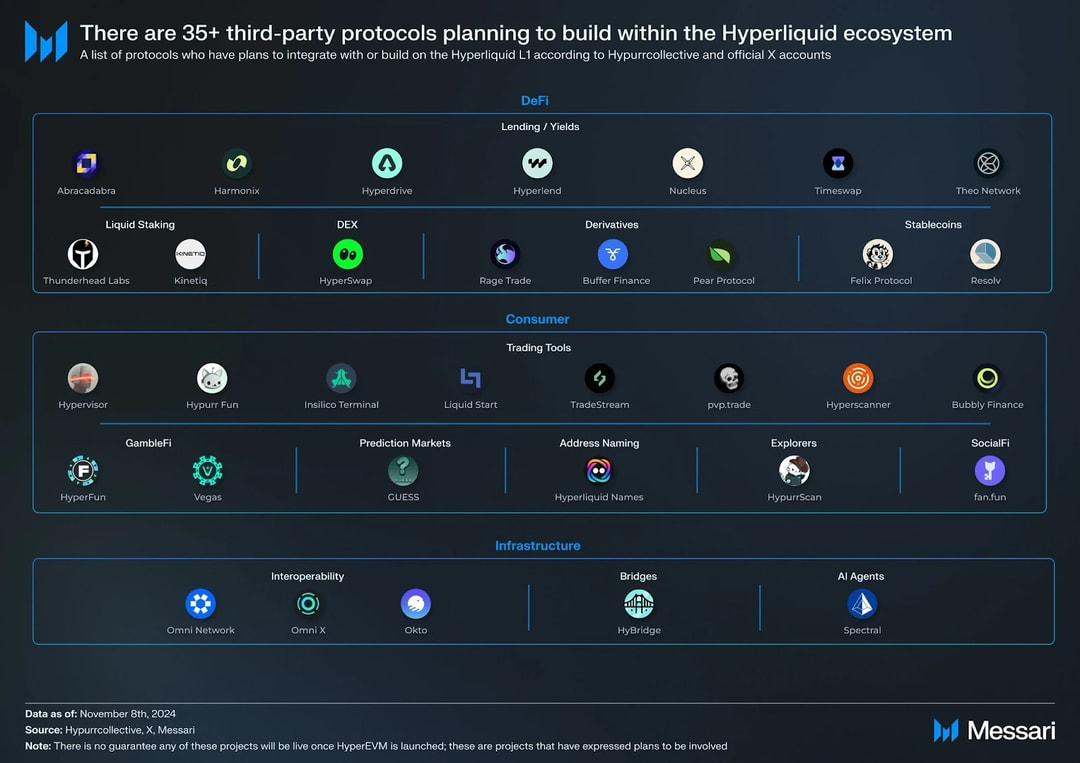

Hyperliquid isn't just another on-chain exchange. That's what many assume at first glance. In reality, the exchange is just one part of a much larger ecosystem. Since our last report, the ecosystem has expanded rapidly with the launch of HyperEVM, pushing Hyperliquid beyond just trading and into a broader Defi application.Built for high-speed execution and deep liquidity, Hyperliquid operates with the efficiency of a centralised exchange while remaining fully on-chain. At the core of Hyperliquid is HyperCore, its execution layer that powers perpetual futures, spot trading, and staking with deep on-chain liquidity. This is now complemented by HyperEVM, a smart contract infrastructure that expands its capabilities beyond trading. Together, they create a seamless, high-performance ecosystem designed for both traders and developers, eliminating many of the inefficiencies seen in traditional DEXs.

This high-performance infrastructure has fueled Hyperliquid's rapid growth, but even the strongest projects face stress tests. The recent $170M in outflows following a major mechanism exploit has raised concerns, with $HYPE facing increased sell pressure and traders reassessing their positions. Is this a deeper issue or just a temporary reset before the next phase of growth?

We will break down what's really happening inside Hyperliquid later in this report. Let's first take a look at the current product.

Hyperliquid = HyperCore + HyperEVM

Hyperliquid is more than just a perps exchange-it's a fully integrated financial system. Unlike most DeFi platforms that separate trading from smart contract execution, Hyperliquid unifies both under one state, removing inefficiencies like bridges, fragmented liquidity, and external verifications.HyperCore - The execution layer

- Handles order book perps, spot trading, staking, oracles, and multi-sig wallets.

- The backbone of Hyperliquid's trading infrastructure, providing CEX-level execution speeds in a decentralised setup.

- Simply speaking, HyperCore is where the famous trading app is built.

HyperEVM - The smart contract layer

- EVM-compatible blockchain allows builders to deploy smart contracts that directly interact with HyperCore.

- Enables permissionless token listings, native on-chain lending, and automated liquidations using HyperCore's price feeds and liquidity pools.

- Simply speaking, this where you can use your Metamask and Rabby wallets to interact with array of dApps built on of Hyperliquid just like you would do on Solana on Ethereum.

Why Hyperliquid's model is a Game Changer

- No Bridging Risks between HyperCore and HyperEVM - Unlike traditional DeFi platforms, HyperCore and HyperEVM interact natively, eliminating security risks from cross-chain transfers.

- Improvements Over CEXs - Unlike Binance or Bybit, there are no hidden deals, preferential listings, or custody risks-everything is on-chain and permissionless.

- Composability Without Fragmentation - DeFi, trading, and execution are all unified, unlike most DeFi ecosystems where liquidity is spread across multiple chains.

The exploit

Now, let's talk about the recent "exploit", or let's say a stress test, that HyperLiquid has gone through recently. We covered it almost in real-time in our Market Pulse update.Here is what happened. Hyperliquid's rapid growth has put it in the spotlight, but with expansion comes inevitable stress tests. The recent $4M liquidation event forced the protocol's risk management system into action, leading to $170M+ in outflows as users reassessed their exposure. While the scale of the reaction was significant, the core question remains-was this a serious flaw in its design or just a natural market event?

A heavily leveraged ETH long position was liquidated, resulting in a $4M loss to the HyperLiquidity Provider (HLP) vault. The trader removed the margin, forcing HLP to absorb bad debt and slippage, ultimately leading to losses for some depositors. Initially, concerns about an exploit surfaced, but the Hyperliquid team quickly clarified that this wasn't a security breach- just the mechanics of how liquidations function on the platform. In response, the team lowered the maximum leverage on BTC and ETH to mitigate similar risks in the future.

Market Reaction: $170M+ in Withdrawals and HYPE Under Pressure

The aftermath of the event was swift, with $170M+ in withdrawals as users weighed their risk. HYPE dropped 8.5% immediately, currently down about 12% and has remained under pressure.Some depositors faced a 1%-1.5% haircut on their HLP holdings, temporarily shaking confidence in the system. However, HLP remains net profitable in the long term, and there were no deeper structural failures.

How Serious Is This?

While the event caused short-term instability, it didn't break the system. The key takeaways:- Short-term pain, but not a collapse - The incident exposed a weakness in HLP's structure, but it wasn't fatal.

- No security breach - This wasn't a hack, just a market-driven event playing out.

- Immediate response - The Hyperliquid team adjusted leverage limits for BTC and ETH to reduce future risk exposure and an additional update was made to require a 20% margin ratio on margin transfers starting from 15th March .

Now we take a look at where Hyperliquid currently stands in the DeFi landscape and what this means for its future positioning.

Current market positioning: where Hyperliquid stands today

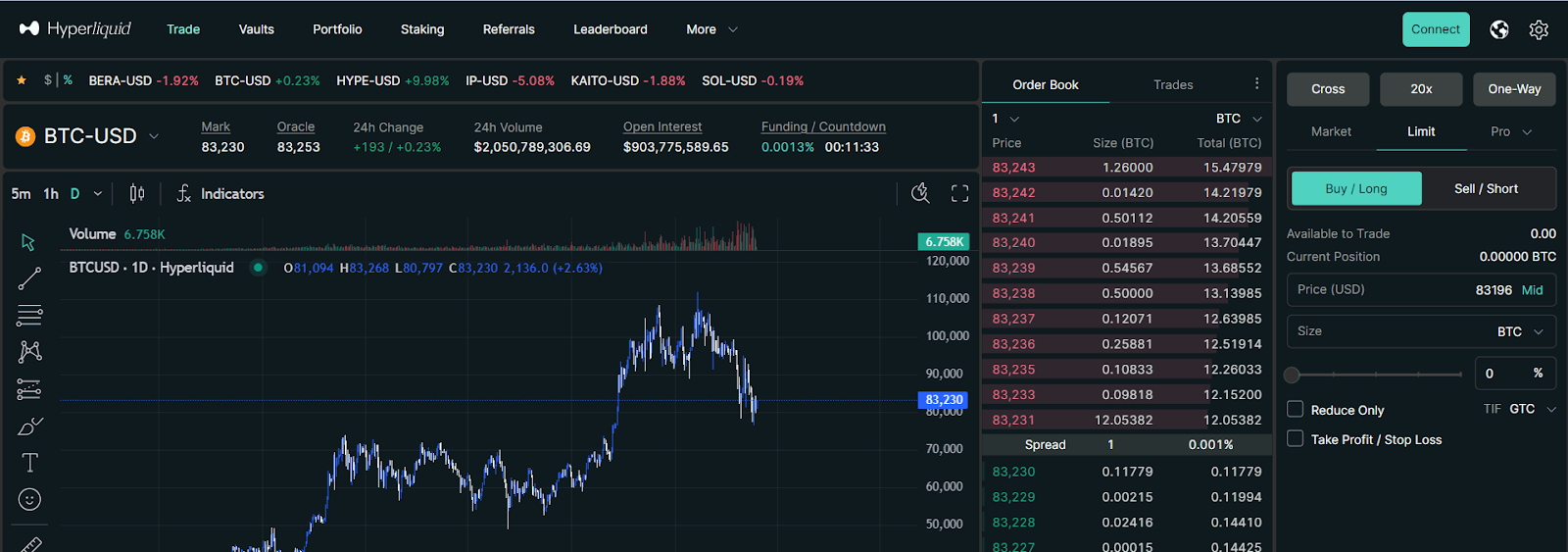

Despite recent volatility, Hyperliquid remains the dominant force in decentralised trading. It continues to lead in trading volume, liquidity, and user engagement, proving that short-term setbacks haven't changed its fundamental strength. Below is a breakdown of where Hyperliquid stands today and why it matters.Trading volume & Open Interest

- $1 Trillion+ in total trading volume - A major milestone that underscores Hyperliquid's sustained trading activity.

- 24-hour open interest at more than 13% of Binance's (Hyperliquid OI: $2.6B, Binance OI: $19.8B) - A significant achievement for a decentralised protocol, competing with top centralised exchanges.

User growth & adoption

User growth remains organic and sticky, with 399.2K unique users rapidly approaching the 400K milestone. Unlike many DeFi platforms that rely on VC-funded incentives or short-term airdrop hype, Hyperliquid's retention rate remains high because of its superior trading experience.Many users initially joined for potential airdrops but have stayed because of strong execution, deep liquidity, and a smooth trading experience. The lack of paid marketing or influencer-driven promotion further proves that Hyperliquid's traction is built on product-market fit rather than temporary incentives.

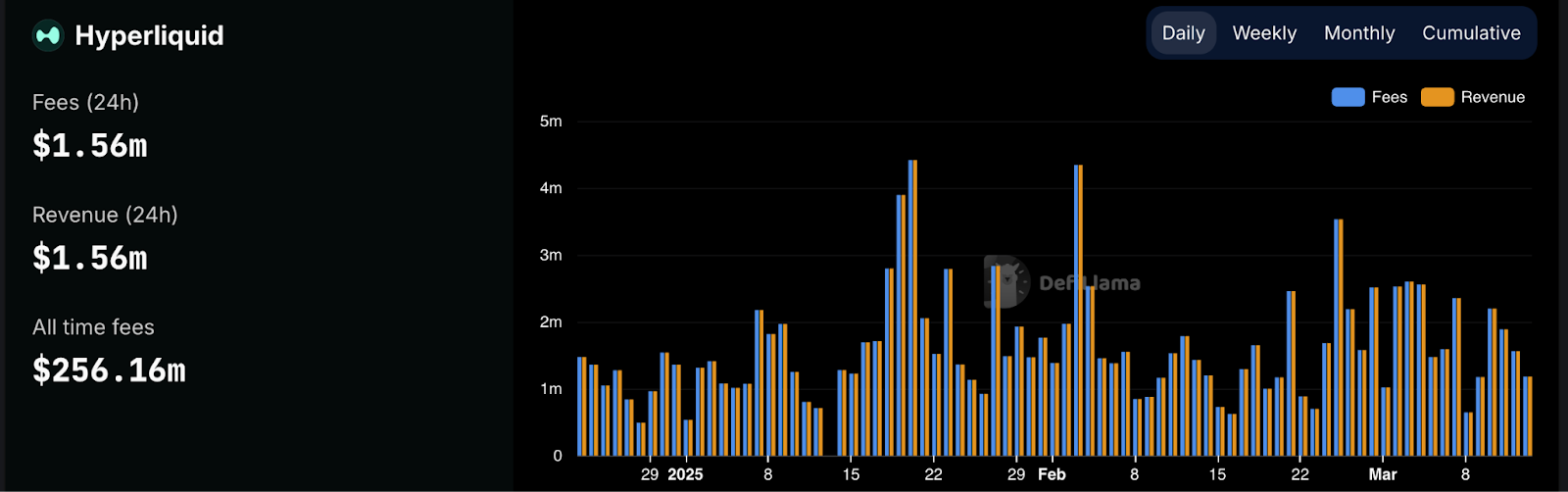

Revenue & protocol earnings

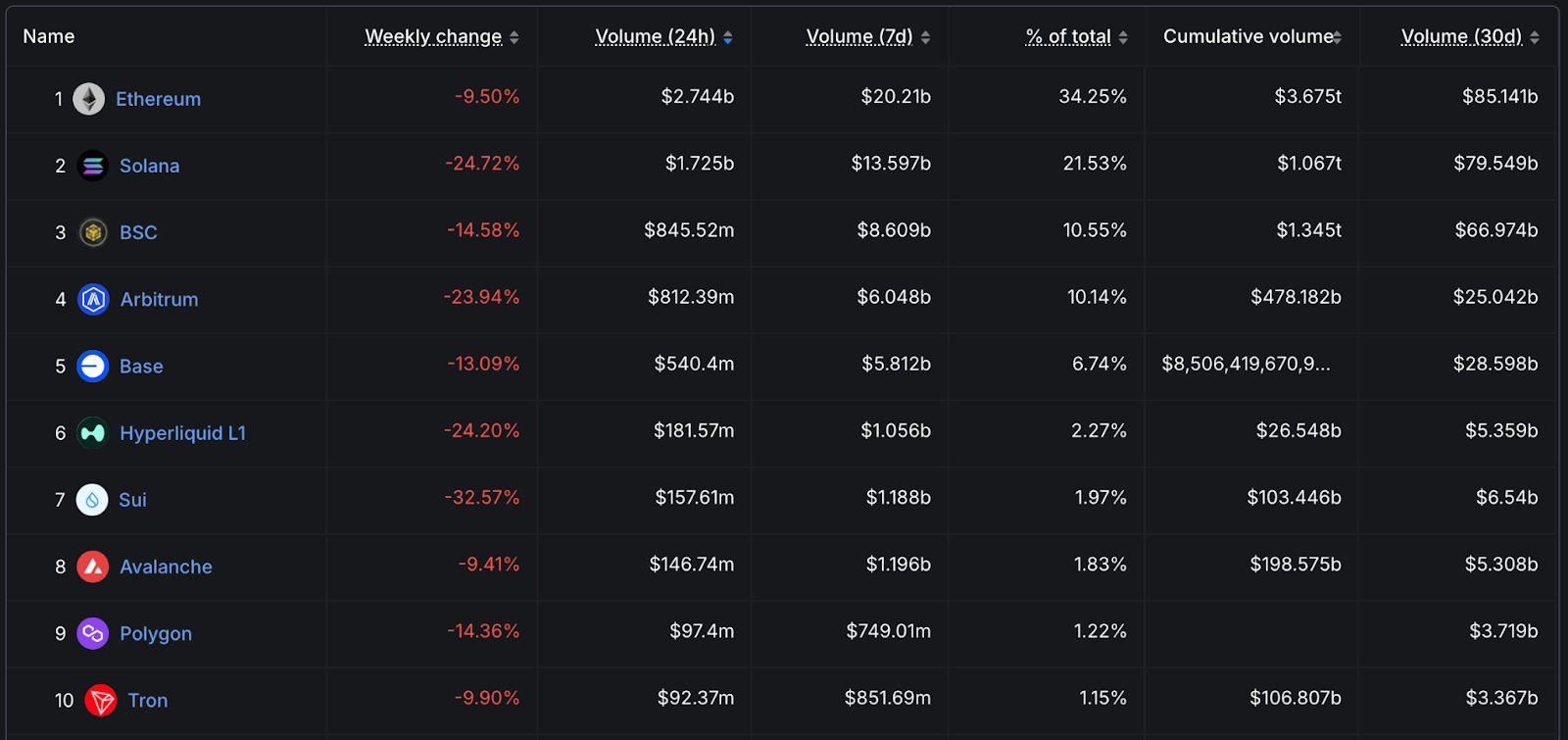

- $1.5M - $2M in Daily Revenue - Among the top 10 revenue-generating protocols, alongside Ethereum and Solana.

- Sustained Fee Generation - Revenue is driven by trading activity rather than inflationary token emissions.

- One of the Most Profitable Layer 1s - Hyperliquid has consistently outperformed chains like Avalanche, Polygon, and Tron in fee generation.

Positioning among layer 1 chains

- 6th Largest Blockchain by Trading Volume - Hyperliquid's L1 now processes more volume than Sui, Tron, Avalanche, Polygon, and ThorChain.

- Expanding Network Activity - The launch of HyperEVM is attracting developers and extending Hyperliquid's ecosystem beyond trading.

Hyperliquid is evolving from a trading platform into a broader DeFi hub, with increasing network effects as more projects build on HyperEVM.

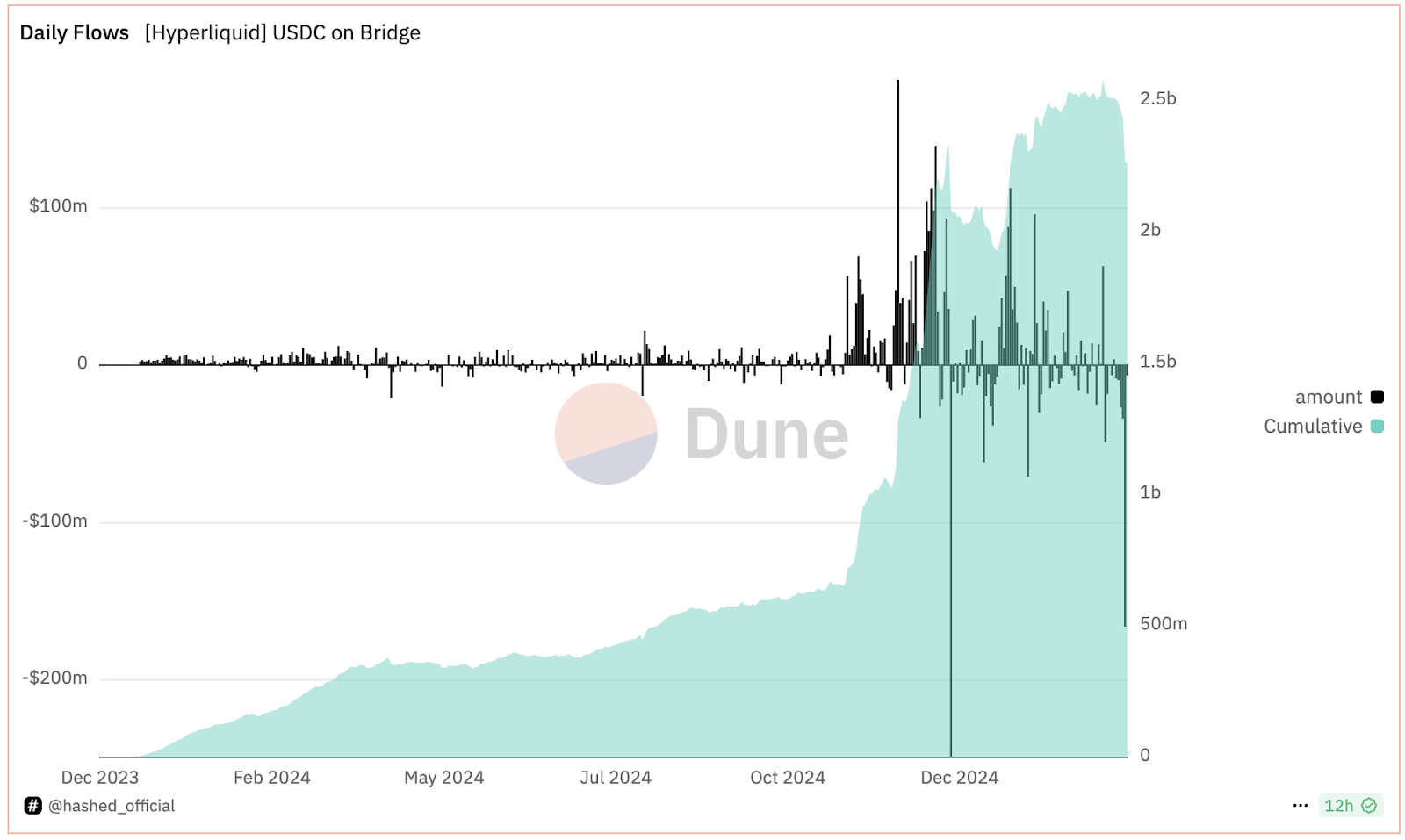

Capital flows: The recent outflow impact

- $170M+ in Withdrawals After the Liquidation Event - A significant outflow, though still small relative to the platform's total volume and liquidity.

- HYPE Price Reaction - After reaching an all-time high of $35.2, HYPE has corrected to the $12 range. The exploit happened when the price was trading between $13-$14, and it has fallen about 10-12% ever since to the $12 level, continuing to look weak in the short-medium term.

Next, we will analyse Hyperliquid's buyback mechanism and its impact on HYPE's price action.

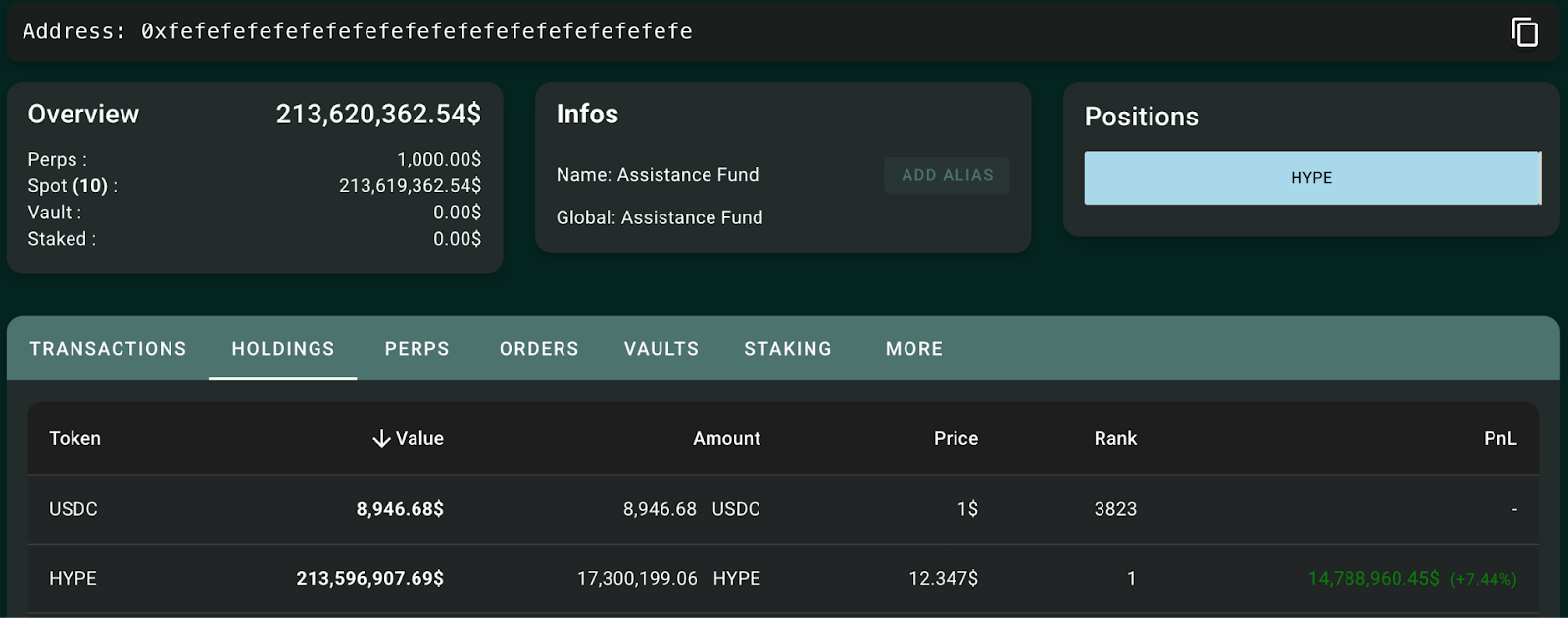

Hyperliquid buybacks

One of the most defining aspects of Hyperliquid's token model is its Assistance Fund buyback mechanism, which continuously absorbs supply and provides sustained demand for HYPE. Unlike most DeFi projects that rely on speculative pumps or inflationary emissions, Hyperliquid ties token demand directly to its revenue, ensuring a more stable and structured economic model.To date, the Assistance Fund has purchased 17,293,960.58 HYPE tokens, amounting to approximately $215 million in buybacks. This isn't a temporary buybacks-it's a core part of Hyperliquid's tokenomics, funded by its daily protocol revenue, which consistently ranges between $1.5 million to $2 million per day. With 54% of this revenue allocated toward HYPE buybacks, the system creates a recurring, self-sustaining demand for the token.

However, despite the strength of this model, HYPE's price has dropped significantly, currently trading at around $13, down from its $35.2 all-time high. The combination of macroeconomic uncertainty, recent protocol outflows, and overall market sentiment has created short-term selling pressure that is likely to persist in the coming weeks or months. While the Assistance Fund's buybacks act as a stabilising force, they haven't been enough to counteract broader market conditions.

We need to note that although this mechanism is creating buy pressure on the token, there has been no clear statement made around the use of all the HYPE being bought by the AF, it's not being burned (only spot trading fees are being burned), it's just being accumulated. For what? No one knows yet.

That said, Hyperliquid's long-term outlook remains strong. The protocol continues to rank among the top revenue-generating platforms, and as trading volume grows, so will the scale of the buybacks. The key question now is whether sentiment can recover and whether HYPE can stabilise before its next leg up. While the short-term may present challenges, the fundamental demand for HYPE remains intact, positioning it for a potential rebound when market conditions improve.

Technical analysis

HYPE has been in a downtrend, currently trading around $13.6 after bouncing from the $12 support zone. Looking at the daily time frame, we can identify key levels of support and resistance that will determine HYPE's price action in the short to medium term.Key support and resistance levels

- Current support zone ($15 - $12): Hyperliquid has entered a critical support region between $15 (upper bound) and $12 (lower bound). Yesterday, it touched $12 and has since shown signs of a small bounce from oversold levels.

- Fibonacci resistance at $14.64 (0.618 Level): A key resistance area lies at $14.64, aligning with the 0.618 Fibonacci retracement level. HYPE recently lost this level, meaning it may act as a strong resistance if the price attempts a recovery.

- Deeper support at $9.8 - $7.2 (Fibonacci 0.786 Level): If macro conditions worsen or HYPE faces further selling pressure, the next major support zone lies between $9.8 and $7.2. This range aligns with the 0.786 Fibonacci retracement level at $9.

What to watch next?

- Short-term rebound to $14.64? - If HYPE continues its bounce from $12, it will likely face resistance at $14.64. If it fails to reclaim this level, further downside is expected.

- Potential breakdown to $9 - $7.2 - If market-wide selling accelerates, HYPE could dip into single-digit prices.

- Consolidation before a trend shift? - If HYPE stabilises in the $12-$15 range, we could see a period of sideways consolidation before the next move.

Risks & weaknesses: The challenges Hyperliquid faces

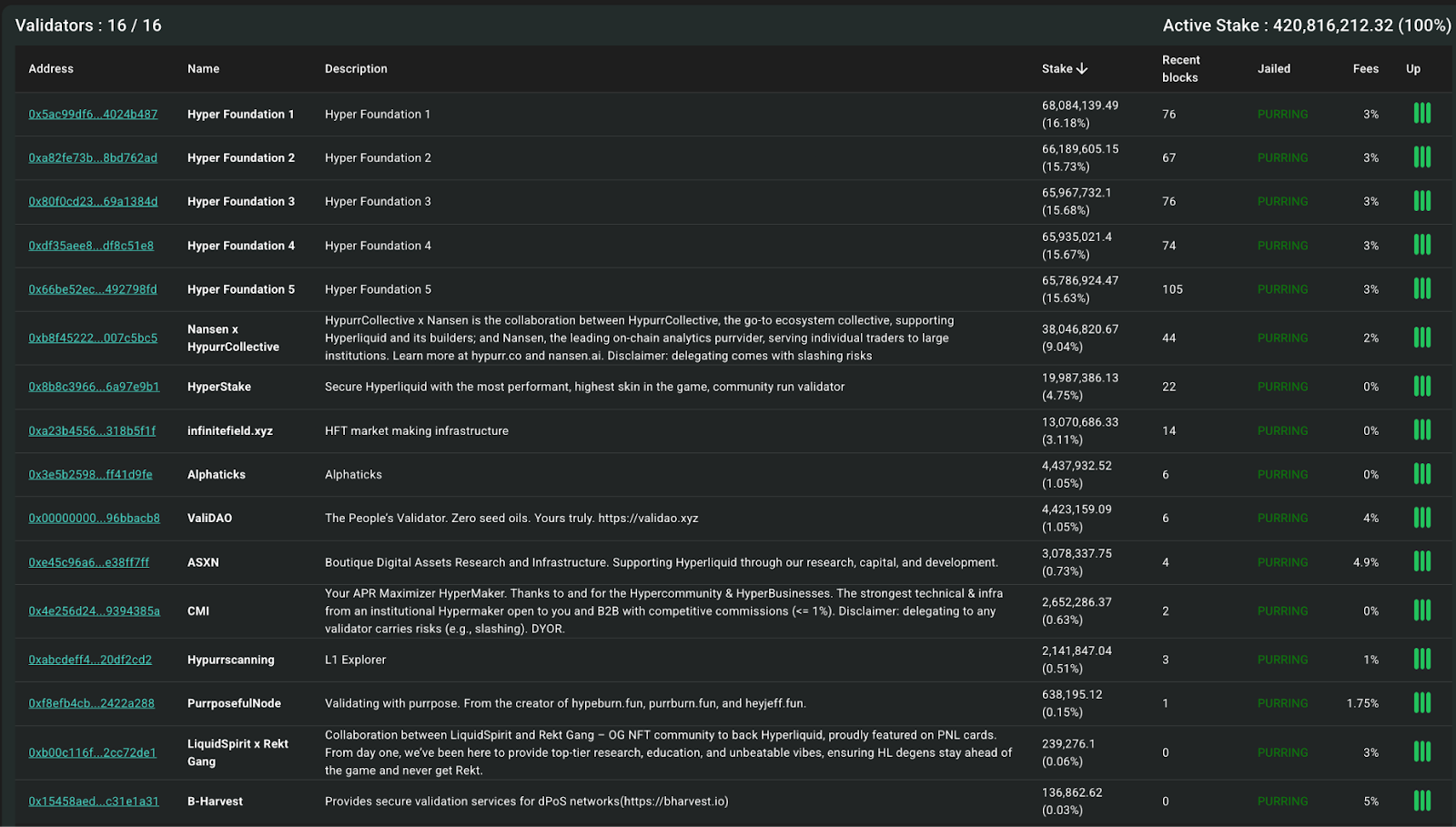

Now, let's go through the risks again. Hyperliquid has cemented itself as a leader in decentralised derivatives, but several key risks could impact its long-term success. These include concerns around centralisation, risk management, market sentiment, and external competition. Addressing these weaknesses will be crucial for Hyperliquid to maintain its dominance and expand further.Centralisation of validators

Hyperliquid's blockchain relies on only 16 validators, which is a highly concentrated setup for a Layer 1 network. While this number has grown since launch, it remains significantly lower than competing networks. A limited validator set means that a small group of participants control consensus, increasing the risk of network manipulation or failures.If Hyperliquid wants to be perceived as a true decentralised alternative to CEXs, it must increase the number of validators and improve network security. Without this, institutions and serious capital allocators may hesitate to engage with the ecosystem at scale.

Risks of the 2/3 threshold in Hyperliquid bridge and unit protocol

Both the Hyperliquid bridge (from Arbitrum) and the Unit protocol (for spot BTC trading) rely on a 2/3 consensus mechanism, meaning two out of three validators or Guardians must approve critical actions like fund transfers or transaction signing. While efficient, this design introduces serious security risks if compromised.With only four validators securing the Hyperliquid bridge, an attacker gaining control of just two-whether through hacking, collusion, or coercion-could seize the $2.2 billion in USDC locked on Arbitrum by minting unauthorised tokens on Hyperliquid. Similarly, Unit Protocol's 2-of-3 MPC threshold creates a single point of failure where breaching two Guardians would allow attackers to sign fraudulent BTC transactions, either stealing locked Bitcoin or minting fake representations on Hyperliquid.

The small validator and Guardian count amplifies these vulnerabilities, making it crucial for Hyperliquid to decentralise its security model to reduce the risk of systemic failure.

Recent capital outflows & liquidity risks

Following the liquidation event in March, over $170 million was withdrawn from Hyperliquid, signalling a loss of user confidence. While the protocol handled the stress event without collapse, the fact that a single liquidation caused such a reaction raises concerns about market depth and risk exposure.Although Hyperliquid has since adjusted leverage limits for BTC and ETH, further exploits could lead to an increase in outflow and reduced investor sentiment. Ensuring better risk controls and refining liquidation mechanisms will be crucial to maintaining user trust.

Selling pressure & market sentiment

HYPE has fallen from $35.2 to around $12, reflecting both internal challenges and broader market uncertainty. Even with strong buybacks, macro conditions remain unfavourable, and speculative traders who initially entered for short-term gains are exiting positions.For Hyperliquid to recover in price, it needs a shift in sentiment and new demand drivers beyond just buybacks.

Cryptonary's take

Hyperliquid is one of the few protocols in crypto that didn't need VC backing, influencer hype, or artificial narratives to gain traction. It built a product so efficient that traders stuck around on their own. That's why, despite the $170M outflow and recent shake-up, we still see Hyperliquid as a strong contender among outperformers when risk-on returns.The fundamentals are intact-execution remains unmatched, liquidity is deep, and trading volumes are holding strong. Hyperliquid still generates $ 1.5M-$2M in daily revenue, ranking among the top 10 earning protocols. More importantly, the team acted fast, lowering leverage on BTC and ETH to prevent similar liquidation risks, a sign of strong risk management, not weakness.

The HYPE buyback model of trading fees being allocated to buybacks creates consistent token demand. As long as trading volumes stay high, this mechanism will be a strong support in a bull market. Meanwhile, HyperEVM has the potential to be a key growth driver in a bear market. If the team executes it right, it could expand Hyperliquid's ecosystem beyond trading and provide sustained utility for $HYPE.

Short-term volatility doesn't define long-term success. Every top project faces stress tests, and Hyperliquid is no different. It needs to decentralise further, stabilise liquidity, and keep proving itself, but the bigger picture is clear- this is still one of the strongest trading ecosystems in crypto.

However, to build long-term positions, we would like to see some bottom formation (e.g., a downtrend followed by an accumulation phase). The macro uncertainty still prevails, and the broader market remains at risk. Despite our strong conviction in HYPE, it is still a bit premature to build significant positions in HYPE. But we are watching and will tell you when to pull the trigger. Stay tuned.

Peace!

Cryptonary, OUT!