Born out of nowhere and now operating like a full-stack financial engine, Hyperliquid has gone from airdrop darling to market leader in under a year. It's no longer "just another perp DEX"; it's the protocol generating more fees than most of the "Majors" combined.

With $66M in fees in May alone, 93% of that revenue is funneled straight into buying $HYPE from the open market, a structural source of demand rarely seen in DeFi.

And that's just the surface.

Behind it sits a custom Layer-1 chain (HyperEVM), serious institutional inflows (Eyenovia, Everything Blockchain Inc.), a booming DeFi stack, and trading infrastructure that can handle $1b positions without blinking. From bridging BTC and SOL into its ecosystem to enabling real on-chain perps at scale, Hyperliquid is rewriting the rules entirely.

If you haven't read it already, here is our original master thesis on Hyperliquid. This report is an update on what's happened since, what's changed under the hood, and why Hyperliquid is one of the best picks among Majors.

Let's dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

How a DEX Is Beating the Giants

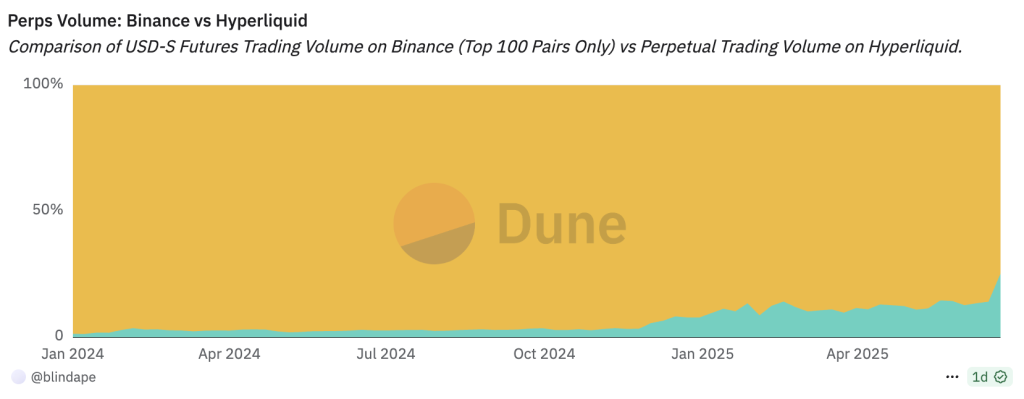

From underdog to unstoppable, Hyperliquid's rise in perpetual futures trading volume has been nothing short of a hostile takeover.Just a year ago, it accounted for barely 2% of the volume compared to Binance. Fast forward to today, and it's now clearing over 25% of Binance's USD-S perps volume, a 12x gain that marks one of the most aggressive market share grabs in crypto history.

This isn't just a narrative. It's backed by data:

- In the last 30 days alone, Hyperliquid processed about $200 billion in perpetual volume.

- It now sees more daily perp volume than most CEXs outside of Binance, often exceeding $5b - 6b/day.

- It's the first and only DEX to hit $1b/day in perps volume sustainably, and it did that in under 100 days of going live.

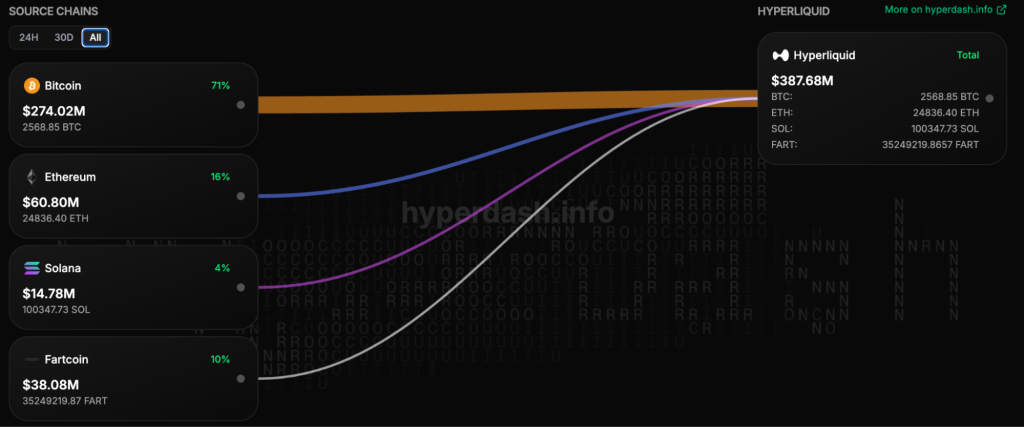

Over $387.68M has been bridged to Hyperliquid from chains like Bitcoin, Ethereum, Solana, and others, including 2,568 BTC, 24,836 ETH, and 100,000+ SOL.

Capital flow to Hyperliquid from other chains

Capital flow to Hyperliquid from other chains

Even the meme liquidity is coming over, with 35m FARTCOIN tokens bridging in. And then there's this chart:

Binance vs Hyperliquid market share

The orange blob is Binance. The blue wave creeping up? That's Hyperliquid. The flippening arc has begun. Now let's dive into the engine behind this surge, Hyperliquid's fee revenue and the buyback mechanism that's fueling $HYPE.The Money Printer: Revenue and Fees

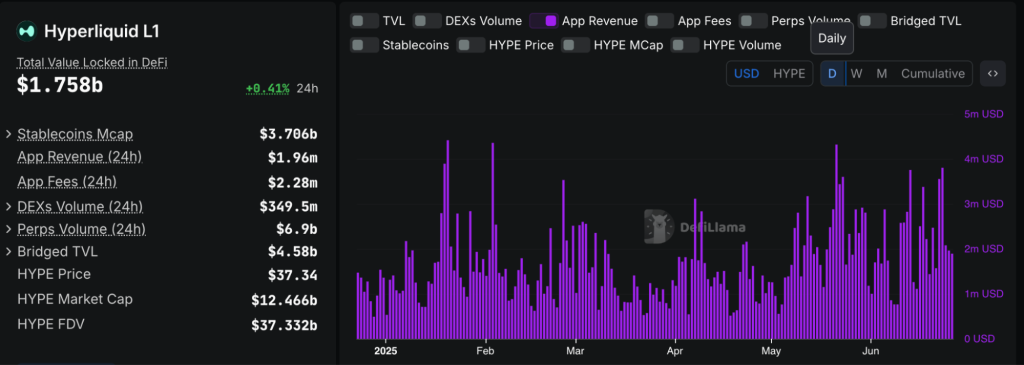

That means among all actual DeFi protocols, Hyperliquid is #1. Not in TVL games. Not in hype. But in real, protocol-level cash flow.And the consistency backs it up. A closer look at daily revenue data shows that:

- Daily revenue peaked at $4.42M, and the lowest days hovered around $0.6M-$0.8M.

- Average daily revenue steadily ranged between $1.5M and $2.5M.

- This translates to an estimated 30-day average of $2.15M per day, aligning with the reported $64.45M monthly figure.

Hyperliquid daily revenue

Hyperliquid daily revenue

Hyperliquid's revenue profile is stable and growing, driven by on-chain perps volume, leveraged trading activity, and a fee structure that funnels 93% of all revenue directly into buying $HYPE from the open market.

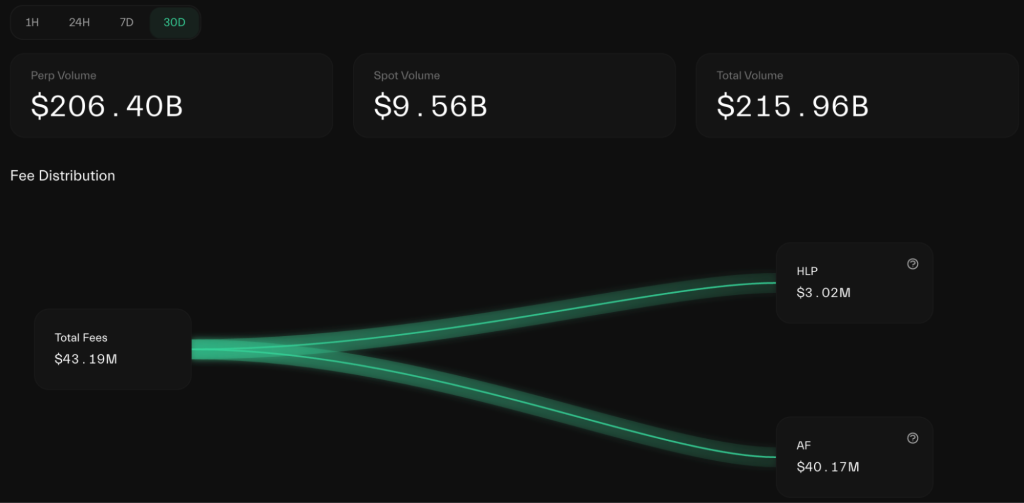

From the $43.19m collected in trading fees (last 30 days):

- $40.17m (93%) goes directly to the Assistance Fund (AF)

- That fund buys back $HYPE on the open market, creating real, reflexive demand for the token

Distribution of total perp market fees between Assistance Fund and HLP vault on Hyperliquid

Distribution of total perp market fees between Assistance Fund and HLP vault on Hyperliquid

This isn't theoretical. It's automated, on-chain, and constant. Think of it like a self-fueling engine….

- The more people trade, the more fees are generated.

- The more fees, the more $HYPE gets bought.

- The more $HYPE gets bought, the more the token strengthens, attracting even more traders.

And the best part? It's sustainable. Unlike emissions-based models that pay users with inflationary tokens, Hyperliquid pays through real economic activity.

This is a cash machine, and $HYPE holders sit at the center of it.

- At current volumes, this translates to around $500m annualised buyback rate.

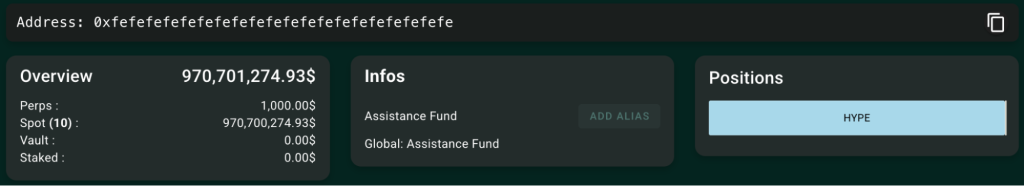

- The AF already holds 25.3M $HYPE ($970M+) and continues to purchase on the open market.

Assistance Fund on-chain balance

Assistance Fund on-chain balance

This is automated buy pressure, directly tied to protocol usage.

Institutional Money Is Buying HYPE

Here is an interesting update: in June 2025, Eyenovia, a Nasdaq-listed company, dropped $50 million to buy over 1,000,000 HYPE tokens, publicly announcing plans to:- Hold $HYPE on their balance sheet

- Run a validator on the Hyperliquid L1

- Launch a staking program via Anchorage Digital

Now let's shift from capital inflows to what they're really backing, Hyperliquid's Layer-1 and the expansion of HyperEVM.

It’s Not Just a DEX. It’s a Full Ecosystem

The biggest misconception we hear about Hyperliquid?"That it's just a DEX."

That couldn't be further from the truth.

Since launching HyperEVM in February 2025, Hyperliquid has evolved into a full-stack DeFi-first Layer-1, home to over 40+ dApps spanning DeFi, NFTs, GameFi, and AI. It's a hyper-efficient execution layer backed by deep liquidity, near-zero latency, and composability with real on-chain order books.

Real Apps, Real Users, Real TVL

HyperEVM integrates directly with HyperCore's native liquidity (spot + perps), letting builders tap into a fast, liquid backend that would put many L2s to shame. The result is an expanding ecosystem with real users and sticky protocols:- HyperLend ($327.75m TVL) and Felix ($297.62m) dominate lending.

- HyperSwap ($95.24m) handles hundreds of millions in monthly volume.

- Hyperdrive, a novel stablecoin borrowing engine, supports 3x leverage on HLP positions.

- Community tools like ASXN, HypurrCo, and Hyperliquid.wiki are shipping fast, without VC dollars or grant farming.

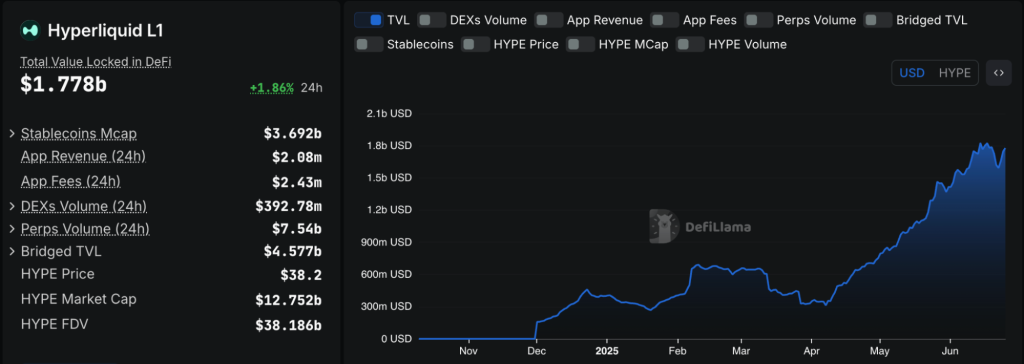

Total Value Locked (TVL) in Hyperliquid ecosystem

Total Value Locked (TVL) in Hyperliquid ecosystem

And this is just the start. As of June 2025, deposits on-chain surged past $387m in bridged spot assets via Unit Protocol, indicating real usage far beyond leverage trading.

Fast, Composable, and On-Chain: Built Different

Hyperliquid's edge is infra-level performance:- Powered by HyperBFT, a custom consensus mechanism capable of 200,000 transactions per second

- Block latency: median 0.2 seconds, 99th percentile at 0.9s

- EVM apps settle synchronously with the Layer-1, enabling deterministic, high-speed trading logic on-chain

Now that we've covered the fundamentals and the ecosystem, let's turn to the charts and break down how $HYPE is performing on the technical front.

Let’s Talk Charts: What the Price Is Saying

HYPE/USD

HYPE continues to outperform most assets, holding steady even as the broader market faces weakness. On the daily timeframe, HYPE is currently trading around $37, comfortably above its 2024 all-time high of $35.37, a strong sign of trend strength. Immediate resistance lies at $39, while the all-time high sits near $45. A breakout above $39 could open the door to fresh price discovery. On the downside, $32 is acting as strong local support and has been successfully defended on recent dips.Looking lower, $28 stands out as a major untested level and could act as a magnet for price if there's any deep pullback. It's a clear accumulation zone, offering one of the best risk-reward entries for medium to long-term positioning. The 200 EMA on the daily timeframe is still far below, currently hovering around $23, which gives the market plenty of room to cool off without violating structure. This reinforces the idea that DCAing from $32 and going heavier below $28 could be a strategic move.

HYPE/USD chart

HYPE/USD chart

On the momentum side, RSI is currently around 51, with the average RSI at 55, signaling a neutral and healthy zone, not overheated. This gives bulls ample breathing room for further upside. All in all, the chart structure remains bullish, with momentum, trend, and structure all leaning in favor of continued strength as long as $32 holds.

HYPE vs BTC: Still One of the Strongest

HYPE/BTC chart

HYPE/BTC chart

HYPE continues to show remarkable strength not just in USD terms, but also against Bitcoin, a rare feat in today's market. While most altcoins have struggled to keep up with BTC's dominance, HYPE has already broken into new all-time highs relative to Bitcoin when compared to its December 2024 levels. After breaking past the previous ATH (Line 6), the pair pulled back and is now consolidating within its former range. The recent rejection from Line 6 suggests HYPE/BTC could range between Line 5 and Line 6 in the near term. This consolidation remains constructive, showing signs of a healthy, trend-confirming pullback.

If HYPE/BTC drifts toward Line 5, that's when DCA levels begin to activate, offering a strategic opportunity to accumulate with strong relative strength. The pair is still forming higher highs and higher lows, which signals an ongoing bullish structure. If Line 6 is reclaimed cleanly, we could see an aggressive move toward Line 7 and beyond, continuing the strong uptrend. Notably, the 200 EMA on the daily chart sits at Line 3, which interestingly aligns with the $23 200 EMA on the USD chart, adding even more confluence.

Bottom line: HYPE/BTC is sending a loud message, Hype is here to stay for the long game.

Last but not least, let's address the concerns floating around. Every major player attracts FUD, and Hyperliquid is no exception. So let's break down the challenges and see if they're actually worth worrying about.

The Risks: What Could Go Wrong?

No protocol scales without scrutiny, and Hyperliquid is no exception. Its explosive growth has put it in the spotlight, but that spotlight also reveals cracks and rising threats from all sides.Custody concerns: A $3.5B single point of failure?

One of the most talked-about issues within the community is Hyperliquid's current custody setup. Reports suggest that all $3.5 billion in user funds are held in a single address, secured by a 3-of-4 multisig configuration. With no deposit finality checks, this exposes the system to risk, especially if connected infrastructure like the Arbitrum sequencer is compromised.While this model allows for frictionless deposits and withdrawals, a key part of Hyperliquid's user experience, it raises serious concerns for institutional users and long-term security. So far, the team has not publicly addressed or restructured this setup, which leaves an unresolved vulnerability.

Validator centralisation: Still just under 25 validators

For a Layer-1 chain, decentralisation is non-negotiable. But Hyperliquid's validator set remains extremely concentrated, with only 21 active validators securing the network. Compared to Ethereum's 800,000+ validators, this raises potential concerns over:- Block production is being controlled by a few actors

- Risk of coordinated downtime or censorship

- Lack of geographic or jurisdictional diversity

Token unlock FUD: Unstaking queue shrinking, but eyes on TBD supply

Hyperliquid's token economics are under scrutiny, with questions around future sell pressure from locked tokens. Here's what the data actually says:- Sell Pressure is Decreasing:The current HYPE unstaking queue has dropped from 5.06M to 3.42M tokens, now just 0.92% of the circulating supply. Spread across 7 days, this equals only 5-6% of daily volume, a manageable figure for the market to absorb.

- Future Unlocks Are the Real Watchpoint: While most of the team tokens (238m HYPE) are locked until 2026-2028, 388.88m HYPE is reserved for future emissions, with no clear vesting schedule yet. If deployed wisely (airdrops, incentives), the impact could be muted, but a sudden unlock could shift supply dynamics sharply.

Who’s Trying to Catch Up (And Can They?)

Hyperliquid's dominance in on-chain perps has set off alarm bells at major centralised exchanges, and they're now firing back.- Bybit is going all-in with Byreal, a Solana-based hybrid DEX aiming to combine CEX-level liquidity with DeFi transparency. Testnet launching late June, and mainnet is comingin Q3 2025. It uses RFQ + CLMM routing for low-slippage trading, directly targeting Hyperliquid's edge.

- Binance is exploring hybrid DEX features too. Users can now access DEXs via Binance wallets (live since March), and CZ has hinted at a dark pool perps DEX to counter MEV. No launch yet, but it's clear Binance is watching closely as Hyperliquid eats into its daily volumes.

Coinbase’s Perpetual Futures Launch

- Coinbase wallet, out since 2017, hasn’t kept up with newer ones like Phantom and Rabby, both launched in 2021.

- The Coinbase NFT marketplace, launched in 2022, was shut down by 2024, while OpenSea and Magic Eden keep going strong among NFTs marketplaces.

- USDC, started with Circle in 2018, still trails Tether, which has led the stablecoin market since 2014.

- And finally, Base, Coinbase’s DeFi push, was supposed to rival Solana but still couldn't match its ecosystem or UX.

Cryptonary's take

Hyperliquid is a revenue machine with real traction, surging volumes, and growing institutional interest. The ecosystem is expanding fast with HyperEVM, validator onboarding, and cross-chain stablecoin demand. And the best part? Almost all of the revenue is used to buy back $HYPE. That's 93% of protocol fees going straight into market support.This is a protocol putting its money where its mouth is. However, aside from being a revenue-generating machine, HyperEVM is making $HYPE a consumable product that users buy regardless of revenue multipliers.

What does it mean? It means traditional valuation metrics like Price-to-Earnings and Price-to-Revenue go out the window because some users will be buying HYPE to pay for transaction fees. That means HYPE should be traded at way higher multipliers than 30x or 40x because being a gas asset translates into a monetary premium. This is one of the strongest tokenomics we have seen in crypto.

However, the market has yet to understand it. If you're serious about being early, this is how you front-run the crowd.

Start bidding around $32. If you get sub-$28 fills, back the truck up. That range is your high-conviction zone.

If you hold HYPE already stake it to earn yield, rotate it into ecosystem dApps, and farm airdrops through the HyperEVM if you want some extra exposure .

Peace!

Cryptonary, OUT!