Hyperliquid Update: Resilience, Risks, and the Road Ahead

Hyperliquid turned ordinary traders into millionaires and reshaped how people think about decentralized exchanges. Yet the same qualities that made it rise to prominence have also painted a target on its back. Whether it succeeds will shape the direction of DeFi for many years to come. Let's dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A Quick Primer

Hyperliquid began as an underdog in the crowded world of decentralised exchanges, but its ascent has been nothing short of historic. What set it apart was not only relentless innovation and unmatched performance but also the wealth-generation effect of its airdrop. Active users became instant millionaires simply for trading on the platform. Even those who had lost money were rewarded with life-changing allocations that dwarfed their losses many times over. That moment forged a loyalty to the protocol rarely seen in DeFi, creating a community whose financial and cultural alignment continues to anchor the ecosystem to this day. Institutions soon followed, recognizing that this was not just another venue for perpetuals but a market leader reshaping the very structure of on-chain finance.Perpetual futures remain its foundation, but Hyperliquid's ambitions now stretch far beyond sheer trading volumes. The launch of HyperEVM has seeded an ecosystem of builders and protocols, and the upcoming HIP-3 upgrade will mark the next phase of growth. Once implemented, HIP-3 is designed to transform Hyperliquid from a curated exchange into permissionless financial infrastructure, giving builders the ability to deploy their own perpetual markets. If executed successfully, HIP-3 would expand Hyperliquid's reach from crypto pairs into exotic derivatives, real-world assets, and even event-driven markets.

But leadership always carries risk. Aster and Lighter are no longer speculative challengers but real competitors, with Lighter even briefly surpassing Hyperliquid in daily trading volume. The moat remains wide, but it is no longer uncontested. At the same time, November's token unlocks hang over the market like a storm cloud. The buyback and burn program has shown its strength, yet the scale of new supply on the horizon could test market confidence in ways not seen before.

Hyperliquid remains the beating heart of decentralized trading and one of the defining success stories in DeFi. Yet its story is still unfinished. The question for this next phase is whether it can not only defend its position but also continue accelerating, keeping its foot on the gas long enough to fulfill the vision that many now see as its ultimate destiny: the blockchain to house all of finance.

Competitors: Aster, Lighter, and the First Real Threats

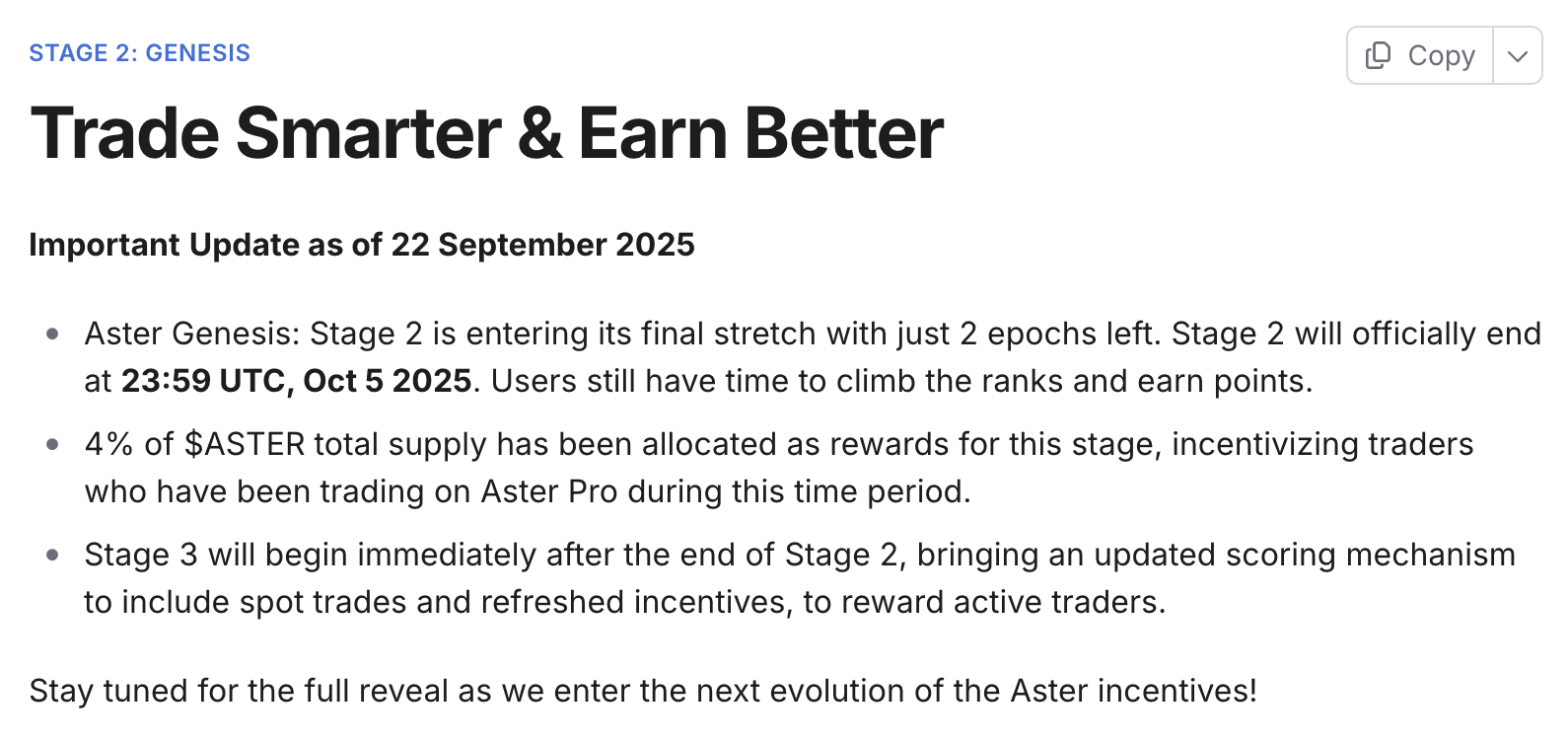

For the first time ever, Hyperliquid's dominance is being tested by rivals with real momentum. Aster, rebranded from Astherus, has emerged as the most aggressive. It offers ultra-low latency execution, hidden orders, and leverage up to 1000x. More strikingly, it has introduced perpetual trading on stocks like Apple, Tesla, and Nvidia, an expansion Hyperliquid has not yet implemented. On paper these are technical differentiators. In practice what makes Aster dangerous is not its features alone but the coordinated effort behind them.

Binance founder CZ has repeatedly amplified Aster. From praising its hidden order feature just days after posting about it himself, to promoting its HYPE perps listing that mirrored Hyperliquid's own launch wording, the signals are too deliberate to ignore. Aster is not an isolated experiment. It looks like a direct counterweight to Hyperliquid. With CZ's history as one of the most ruthless operators in the industry, it would be naive to dismiss the risk. A single tweet from him helped trigger the implosion of FTX. Now he is watching Hyperliquid eat into the market share Binance once controlled. Aster could be the vehicle he uses to strike back.

Aster's surge has also been fueled by aggressive incentives. Its points system and ongoing airdrop campaign have drawn speculative flows, with traders farming rewards while testing the exchange. This combination of features, incentives, and backroom support has allowed Aster to scale at alarming speed.

Lighter poses a subtler but no less serious challenge. Its zk-based order book emphasizes fairness, transparency, and gas efficiency, appealing to traders who prioritize neutrality as much as speed. It has also gained traction with a zero-fee model, underwritten by aggressive incentives and a points program designed to fuel farming activity. For retail traders this looks like free trading, but in practice high-frequency participants still face costs through infrastructure fees and order flow management, meaning the model is more subsidized than sustainable. For a brief moment Lighter even surpassed Hyperliquid in daily trading volume, hitting $4.3 billion. Its TVL has since climbed to $500 million with open interest past $1 billion. The question is whether this activity reflects durable adoption or mercenary flows chasing rewards.

Even if much of the activity is incentive-driven, Lighter's rise cannot be dismissed. It now accounts for more than half of Hyperliquid's daily volumes on certain days, showing that liquidity can shift quickly when traders are given alternatives. The risk is not that Lighter has overtaken Hyperliquid, but that it has demonstrated credible challengers exist.

It is worth noting most leading new perp exchanges remain tokenless, relying on points campaigns and future airdrop speculation as their primary engines of growth. Both Avantis and Aster delivered significant airdrop rewards to early users, and the strong price action following their launches has only heightened the appeal of these strategies. Most of the time airdrop tokens are immediately dumped, but Hyperliquid and CZ have shown renewed interest in the sector. As Perpetual Pulse data shows, tokenless platforms like Lighter are capturing meaningful trading volume, and their points schemes could translate to substantial rewards for traders. In a market still driven by incentive-driven growth, trading across a wide array of platforms with points campaigns remains a practical strategy for traders seeking exposure to that sector. You will not find these opportunities on centralized venues like MEXC or Binance.

By most measures, Hyperliquid is still far ahead. Its cumulative volumes, liquidity depth, and builder ecosystem continue to dwarf both Aster and Lighter, with $2.3 billion in HyperEVM TVL and a commanding 70 to 80 percent share of the decentralized perps market. Its community loyalty remains one of the deepest in DeFi, anchored by the wealth effect of its airdrop and reinforced by a relentless pace of delivery. Hyperliquid is also leaning on its proven buyback program and the upcoming HIP-3 upgrade to accelerate innovation, moves that could widen the gap once more. But the moat is no longer unquestioned. For the first time, Hyperliquid faces rivals with both substance and strategy.

Stablecoin Synergy: The Role of USDH and USDC in Hyperliquid's Growth

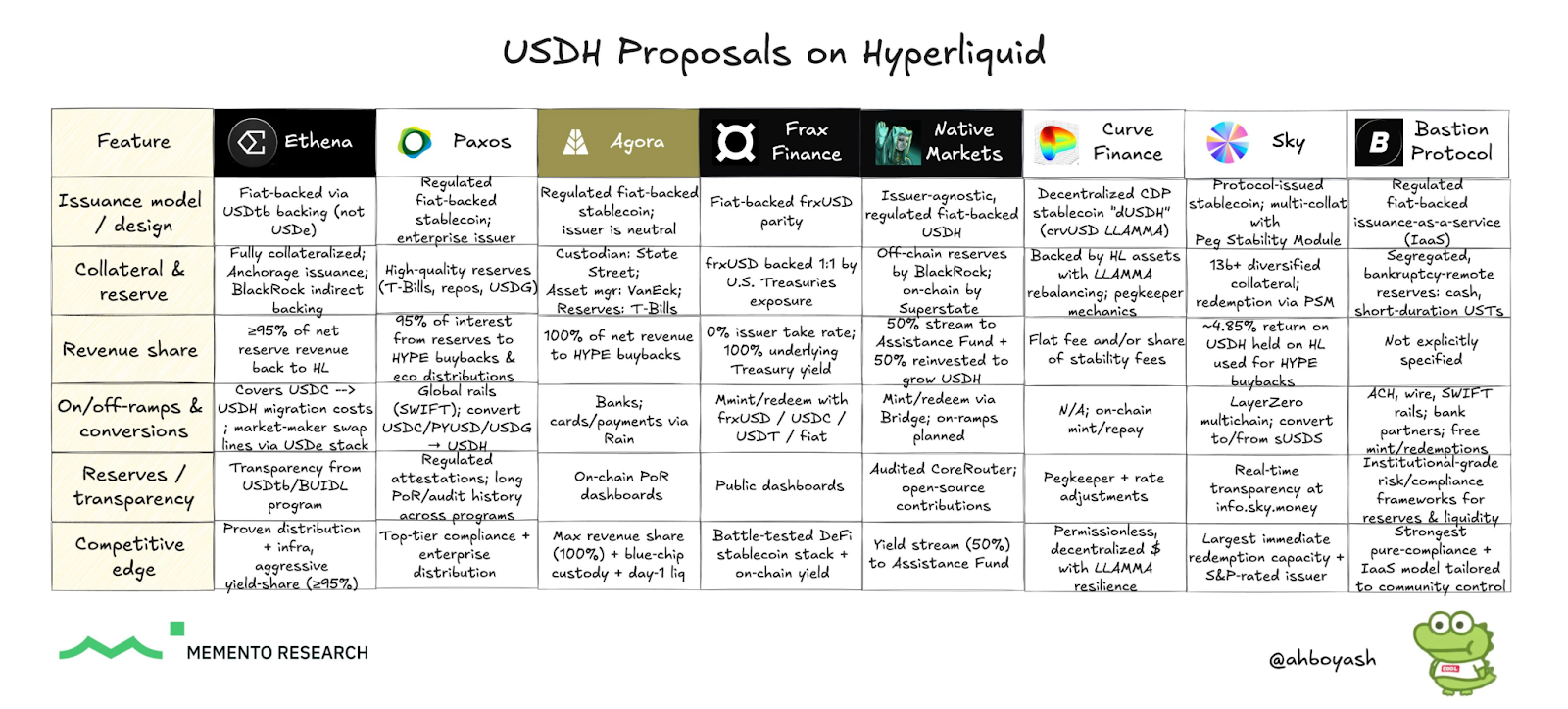

The USDH governance vote was the most contentious decision Hyperliquid has faced to date. For the first time, validators were tasked with choosing who would issue the network's native stablecoin. Proposals came from Paxos, Ethena, Sky (the successor to MakerDAO), and newcomer Native Markets. Each represented a distinct vision. Paxos leaned on its regulated rails, enterprise pedigree, and $75M liquidity commitment. Ethena pushed its synthetic collateral mechanics and BlackRock-linked reserves. Sky highlighted its $8B diversified reserves and Peg Stability Module. Native Markets stood apart by offering an issuer-agnostic framework that routed 50% of reserve yields to HYPE buybacks via the Assistance Fund and 50% to ecosystem growth, with earlier drafts even floating 95% returns.

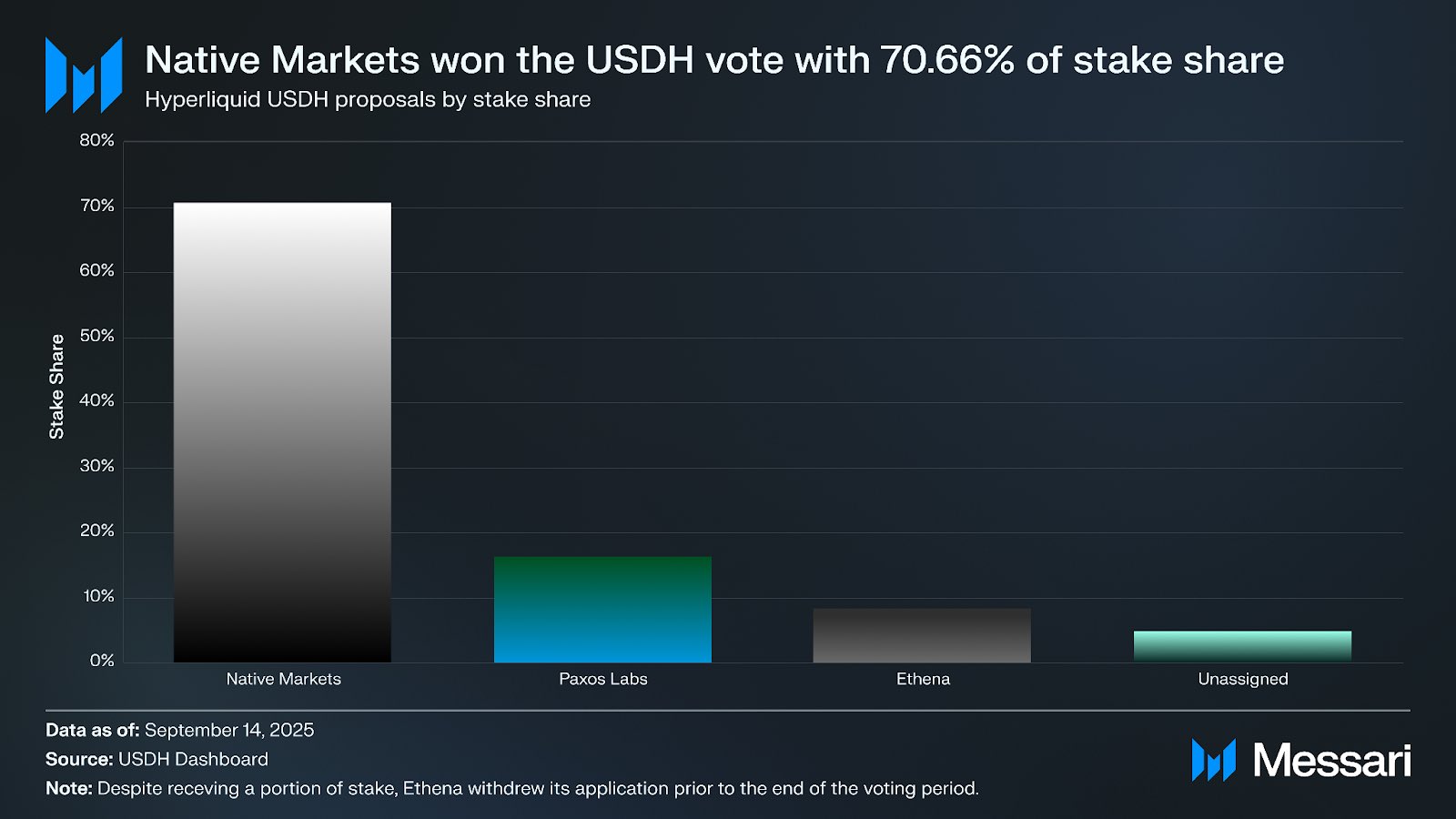

In the days before voting closed, Ethena abruptly withdrew after community pushback over its rushed, non-native design. That shift gave Native the advantage, with prediction markets quickly pricing its odds above 90%. The contest became a referendum: should Hyperliquid partner with a regulated issuer, or back a team explicitly aligned with HYPE holders?

Mechanics mattered as much as the outcome. Validators, not the team, cast the votes. The Foundation abstained, and all team-staked HYPE was excluded from weighting. Those safeguards ensured procedural legitimacy, though critics argued Native benefitted from a "home team" advantage and questioned whether the contest was ever level. Native ultimately secured nearly 70% of validator support, and the decision was confirmed on-chain. No evidence of manipulation has surfaced. USDH now carries the burden of proving that alignment was worth sidelining issuers with established track records.

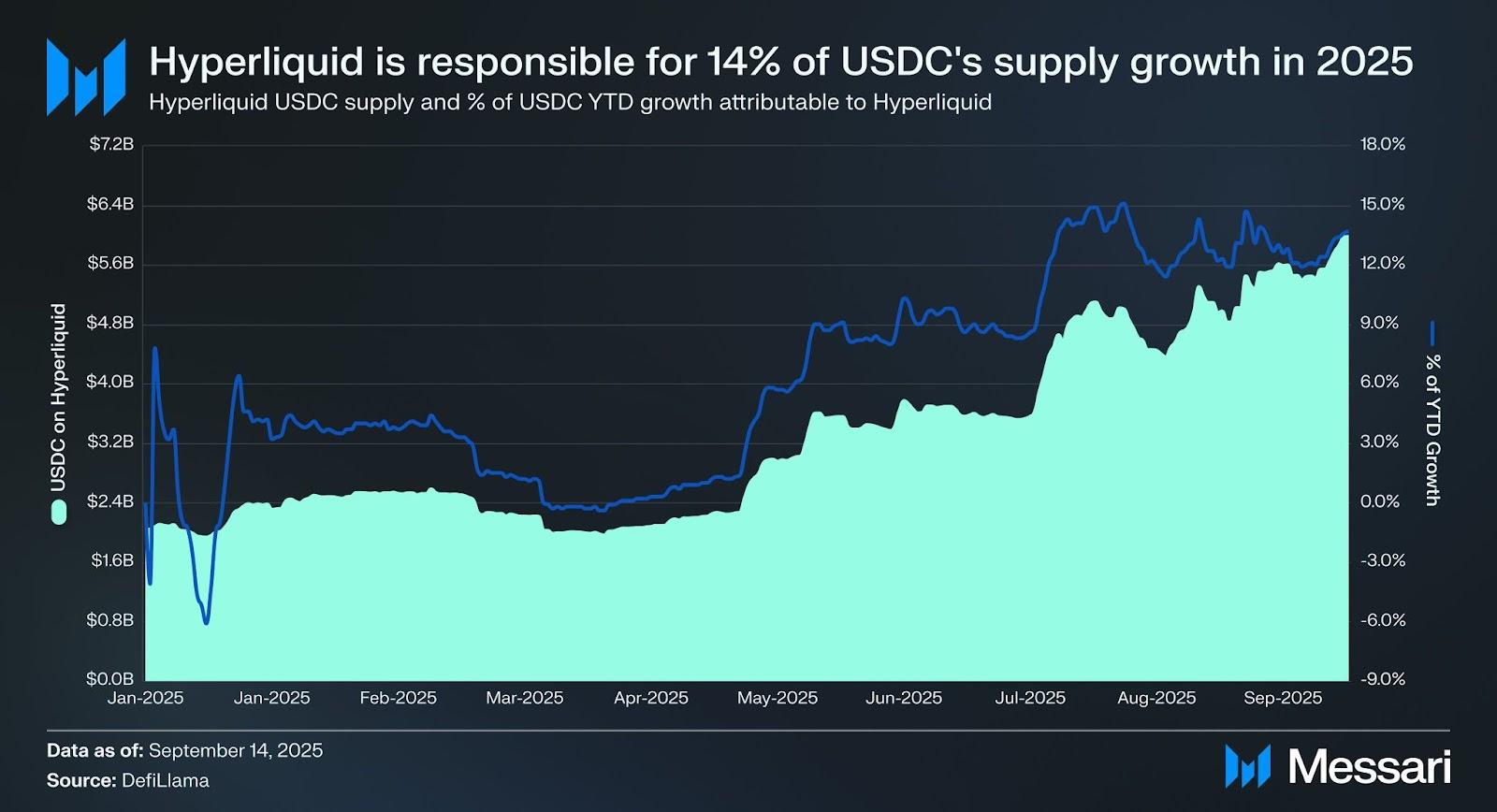

That context made Circle's mid-September move even more notable. Just days after the USDH outcome, Circle deployed native USDC on HyperEVM alongside CCTP v2. For months, traders had relied on bridged USDC via Arbitrum contracts, a process that added friction and slowed adoption. Native integration removed those barriers, but more importantly, Circle went beyond technical support. It became a direct stakeholder in the ecosystem, taking exposure to HYPE and exploring validator participation. USDC supply on Hyperliquid has already grown 200% year-to-date to $6B, accounting for 14% of Circle's global growth in 2025. Circle was compelled to buy in, embedding itself into DeFi's fastest-growing exchange in order to prevent natively aligned challengers like USDH and Ethena's USDe from eroding its market share.

The outcome is a dual-track stablecoin ecosystem where USDH embodies native alignment, funneling yields back into HYPE, while USDC delivers global legitimacy, regulatory efficiency, and institutional gateways. Together, they give Hyperliquid a combination few others can match. If both succeed, the platform could anchor crypto's most strategically advantaged stablecoin mix, one that locks in internal value while simultaneously unlocking external flows. Early estimates suggest USDH alone could redirect $150M to $220M in annual yield into buybacks and liquidity, a scale that would materially reinforce HYPE's value loop. But success will not be determined by design. It will hinge on whether traders migrate margin into USDH, whether peg stability holds under stress, and whether Circle's presence complements rather than cannibalizes adoption.

Builder Codes and the Integration Flywheel

One of the most important yet underappreciated innovations of 2025 has been Hyperliquid's builder codes. On the surface they resemble a referral program, but in practice they form a modular layer of growth. Each code acts as a unique identifier that lets wallets, front ends, and applications route orders directly into Hyperliquid's order book while tracking attribution and sharing rebates, with up to 76% redistributed to users on top apps.

Adoption has accelerated rapidly. Rabby integrated perps with up to 40x leverage across more than 100 markets, enabling seamless deposits from any chain. Front ends like Dexari and Based App are building community-driven interfaces powered entirely by builder codes.

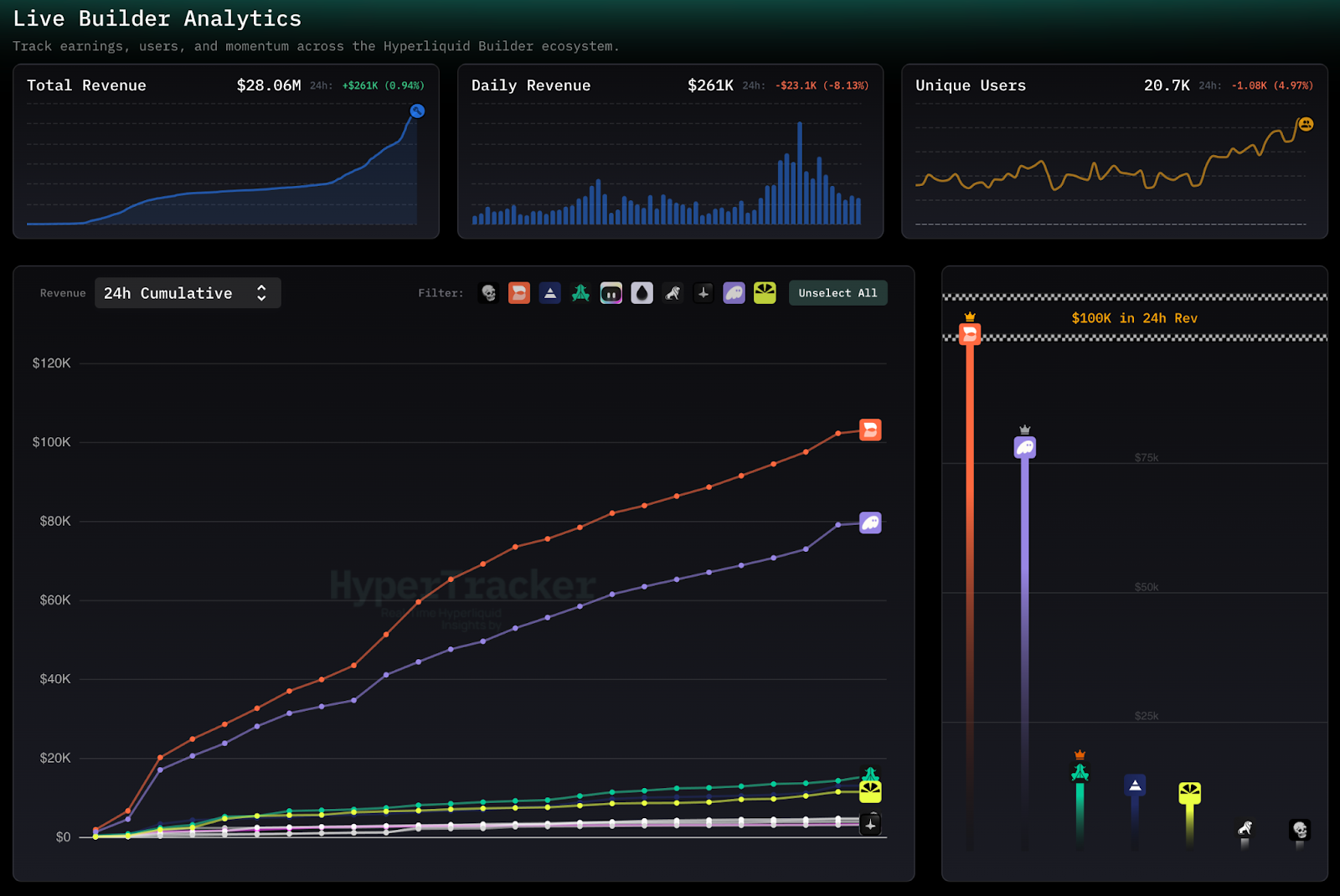

Leading builders now average more than $200K in daily revenue, with peaks above $850K in a single day. Based App alone, backed by Ethena's investment, briefly grew revenue 55 times in a matter of weeks, at one point accounting for 25 to 30 percent of Hyperliquid's perp volume and supporting more than 16K users. Ethena, despite withdrawing from the USDH governance race, is pressing forward with direct deployments through Based, including collateral integrations, signaling confidence that Hyperliquid remains the deepest venue for execution.

It is also worth noting that both Based and Dexari run their own point systems and are likely to launch tokens in the future. Using their interfaces instead of Hyperliquid's directly gives users exposure not only to Hyperliquid's rewards but also to these parallel incentive programs.

The genius of the system lies in how it lowers the barrier for innovation while protecting liquidity depth. Developers can spin up new products, capture value through their codes, and still contribute to a unified order book. As HIP-3 enables permissionless market creation, builder codes prevent fragmentation by ensuring all experiments feed into the same pool of liquidity. This creates a structural flywheel: more builders drive more users, more users increase liquidity depth, and deeper liquidity attracts more builders.

For competitors, replicating this model is far from simple. It demands not only technical infrastructure but also the compounding network effects already in motion on Hyperliquid. With builder codes scaling, Ethena embedding through Based, and wallets like Rabby routing flows natively, Hyperliquid's integration architecture is evolving into a moat. This infrastructure is what allows the protocol to outpace rivals like Aster and Lighter, not just in raw volume but in sustaining growth through an expanding ecosystem of aligned builders.

Token Unlocks, Buybacks, and Burns

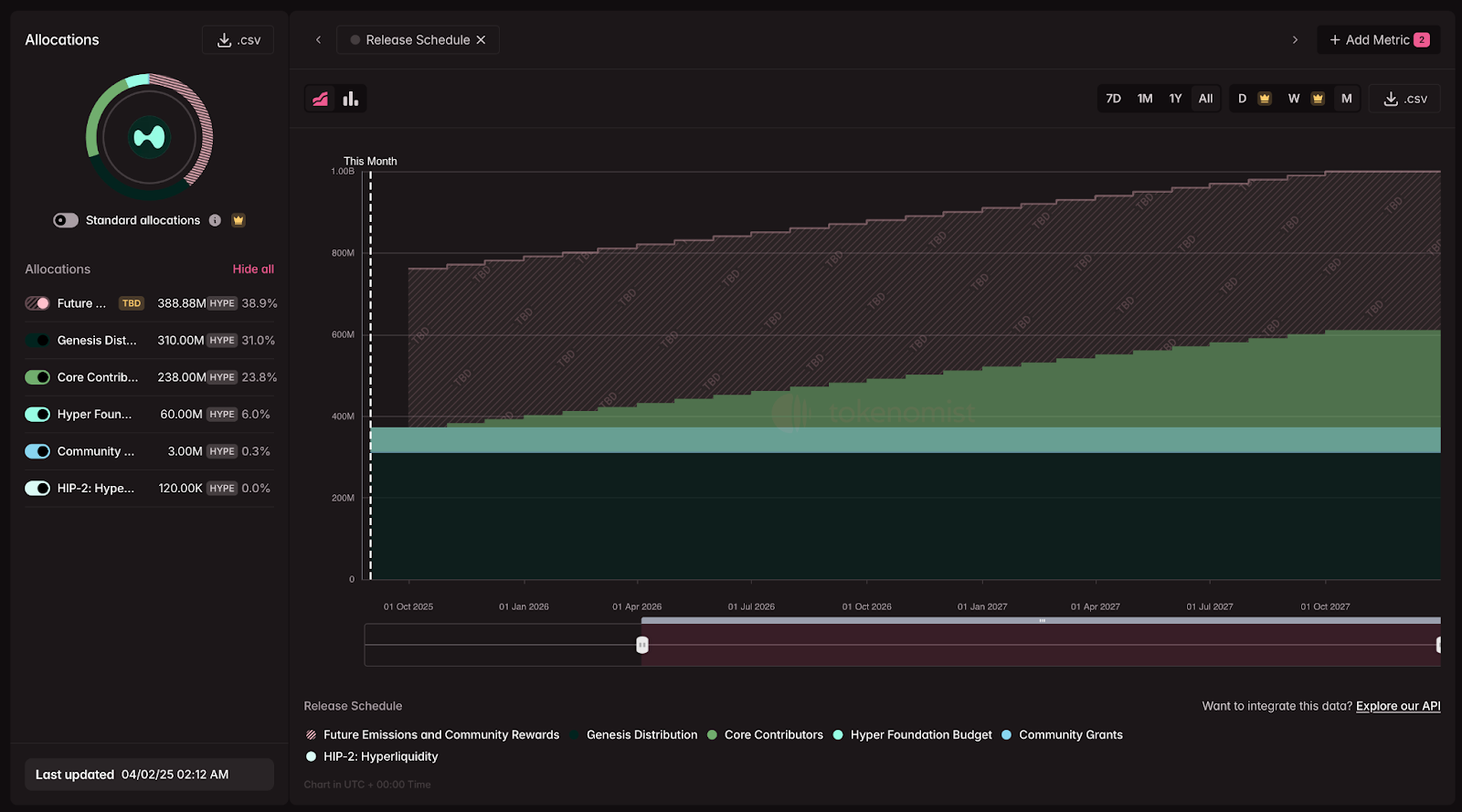

The single largest risk facing Hyperliquid today is supply overhang. On November 29, 2025, the first major unlocks for team and contributor allocations begin, setting in motion a two-year vesting schedule that could release close to $12 billion worth of HYPE at current prices.

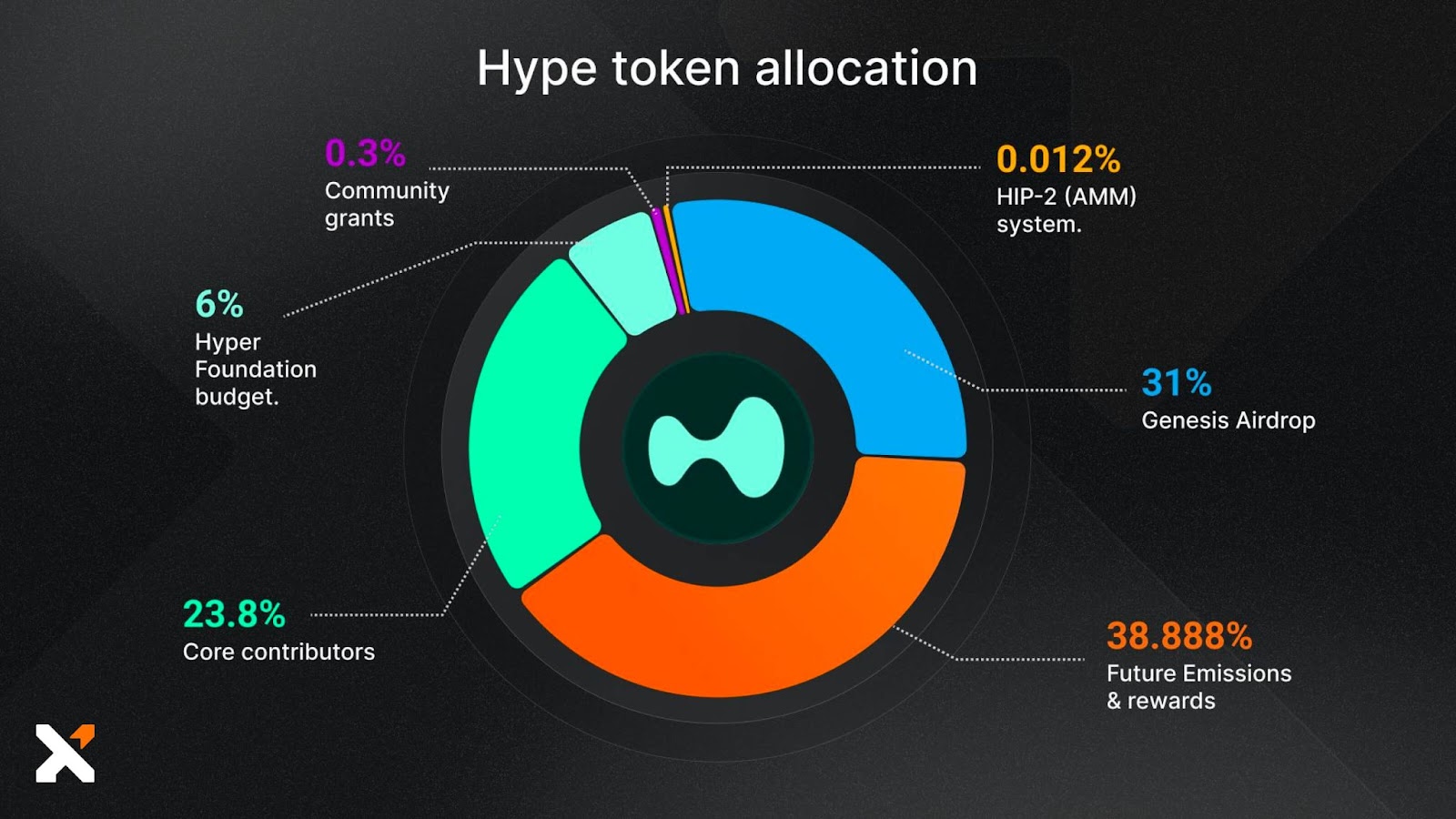

It is important to note that the 31% Genesis Distribution airdrop has already entered circulation. The true overhang lies in the remaining 600 million tokens still locked across the following groups:

- Core Contributors (23.8%) – 238M tokens subject to vesting, beginning unlocks Nov 29, 2025.

- Future Emissions & Community Rewards (38.888%) – 389M tokens reserved for incentives and liquidity mining, distributed gradually.

- Hyper Foundation Budget (6%) – 60M tokens under Foundation control.

- Community Grants (0.3%) – 3M tokens.

- HIP-2 (0.012%) – a tiny 120K allocation tied to the AMM.

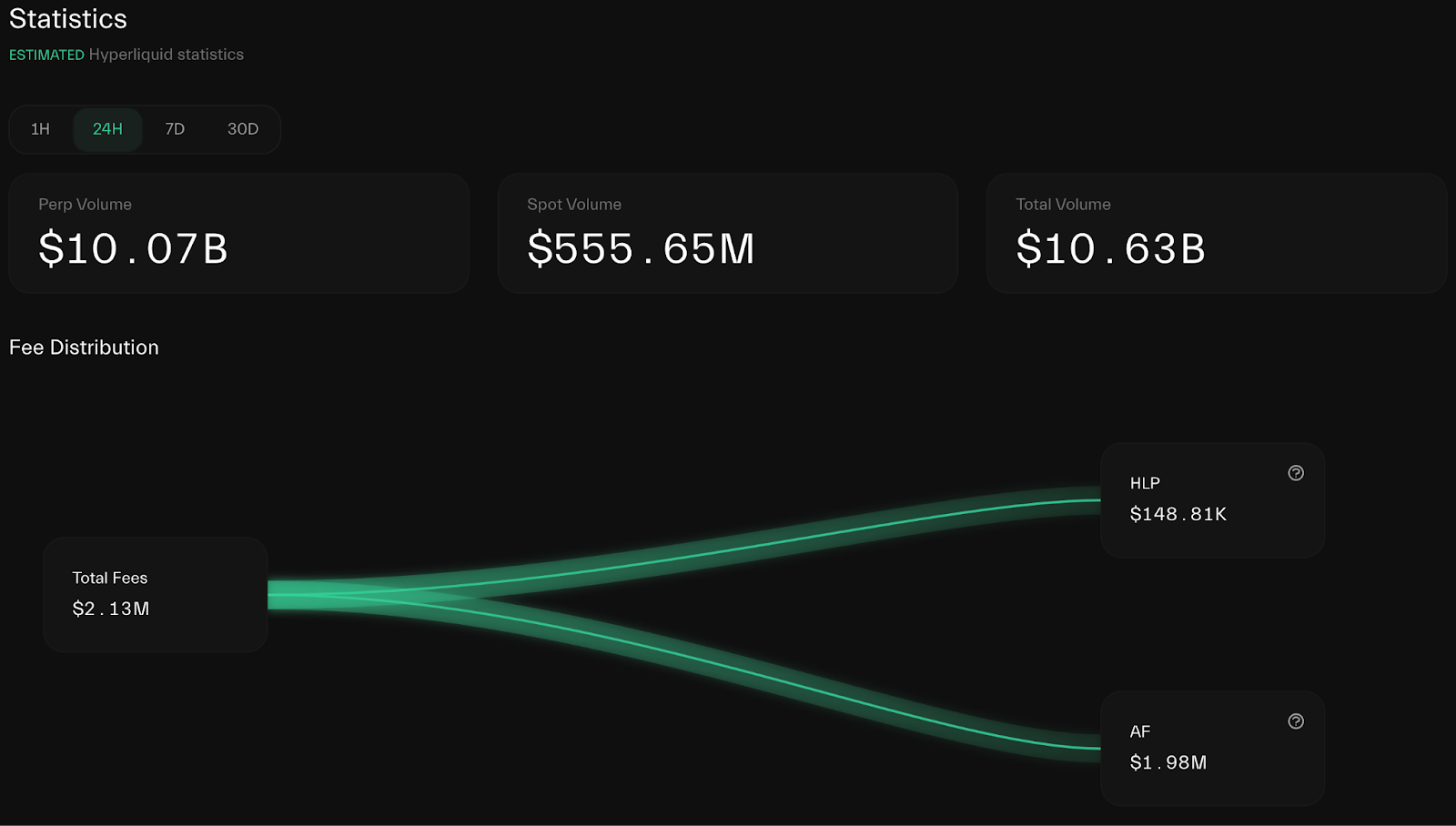

Unlocks of this scale often crush token economies, but Hyperliquid has a powerful counterweight in the form of its Assistance Fund (AF). This mechanism captures roughly 97 percent of protocol fees and recycles them directly into open-market HYPE buybacks. This structure ensures that trading activity, which in most ecosystems generates sell pressure through emissions, is instead converted into sustained buy pressure.

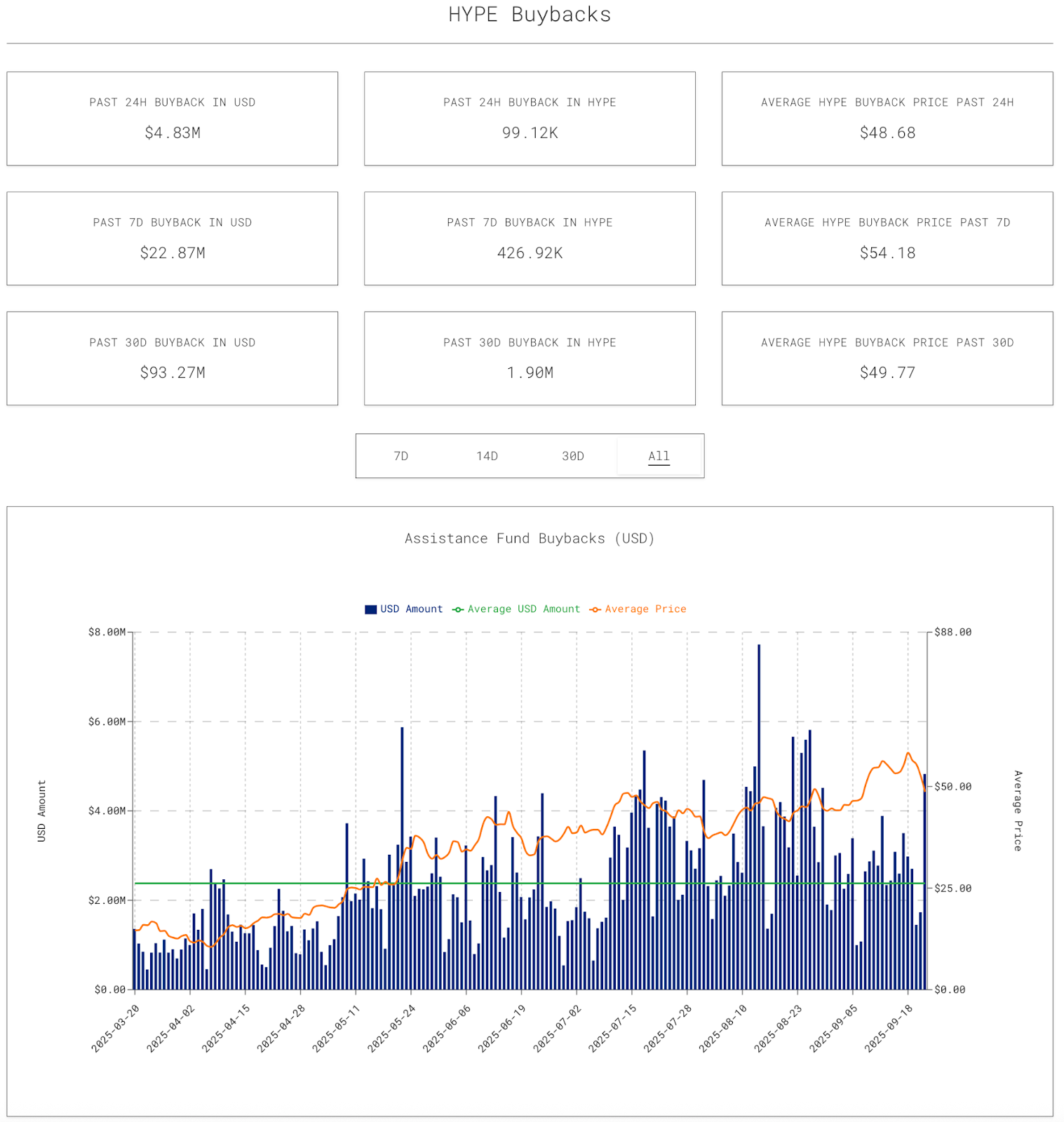

The scale is already evident. By August 2025, cumulative buybacks surpassed $1.26 billion, and in the past 30 days alone the AF deployed $93 million to absorb supply. On a rolling basis, this equates to $30–35 million per month or $350–400 million annualized. At current run rates, the AF is positioned to offset a large portion of the unlock schedule.

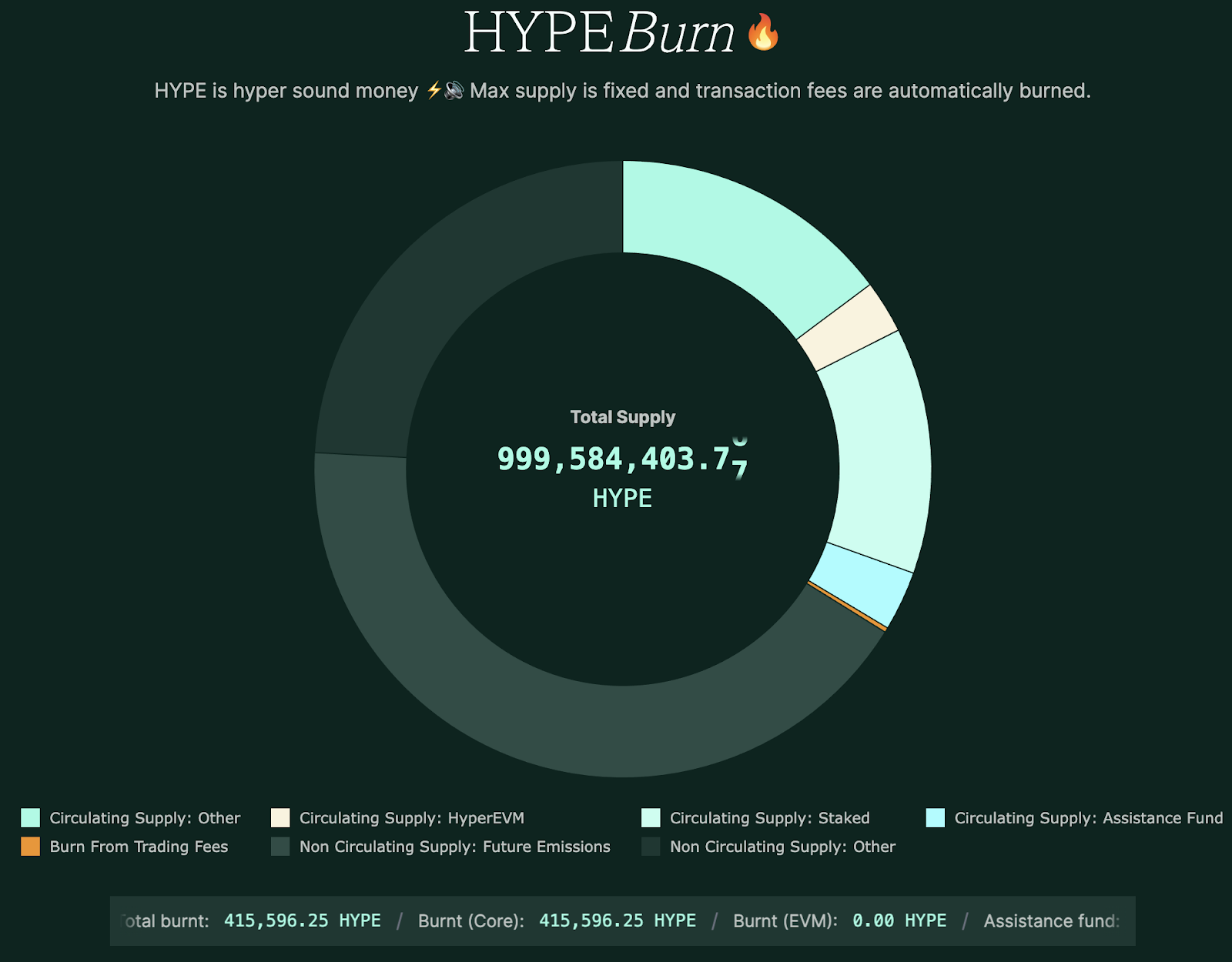

Equally important is what happens after the buybacks. A portion of repurchased tokens are permanently removed from circulation. Over 413,000 HYPE have already been retired, with an annualized burn rate near 503,000 tokens and daily peaks above 3,200. While this represents just 0.05 percent of total supply annually, the symbolic and structural impact is significant. Hyperliquid is one of the few protocols that systematically converts revenue into both buy pressure and permanent supply reduction. Ongoing community proposals to burn the AF's 31 million HYPE balance and all future buybacks would take this deflationary design even further.

Still, the question is not whether Hyperliquid can buy back tokens, but whether the Assistance Fund can absorb the unlock wave without breaking. The AF Absorption Ratio illustrates the balance. Throughout 2025, the fund offset 2–5% of daily sell volume, with spikes above 6% during periods of heavy unlock anticipation. As long as volumes remain high, with $12–13 billion in daily perp trading and over $1 billion in DEX flows, the fund has the firepower to neutralize new supply in real time. If volumes contract, however, the buffer thins quickly.

This is why the next several months are pivotal. Hyperliquid's tokenomics now rest on a delicate balance between growth-driven fees and unlock-driven dilution. If trading activity continues to expand and stablecoin depth grows beyond the current $6.1 billion USDC base, the AF can not only neutralize unlock pressure but also strengthen HYPE's monetary premium through consistent burns. If adoption slows, unlocks could overwhelm buybacks, undermining confidence in the value loop.

In short, Hyperliquid has engineered one of the most sophisticated defense systems against dilution in crypto. But defenses must be stress-tested. November's unlocks will mark the beginning of that test, when the Assistance Fund's scale, efficiency, and burn mechanics will either validate HYPE as sound money or reveal the limits of buybacks against sustained token inflation.

Arthur Hayes and the Optics of Exit Liquidity

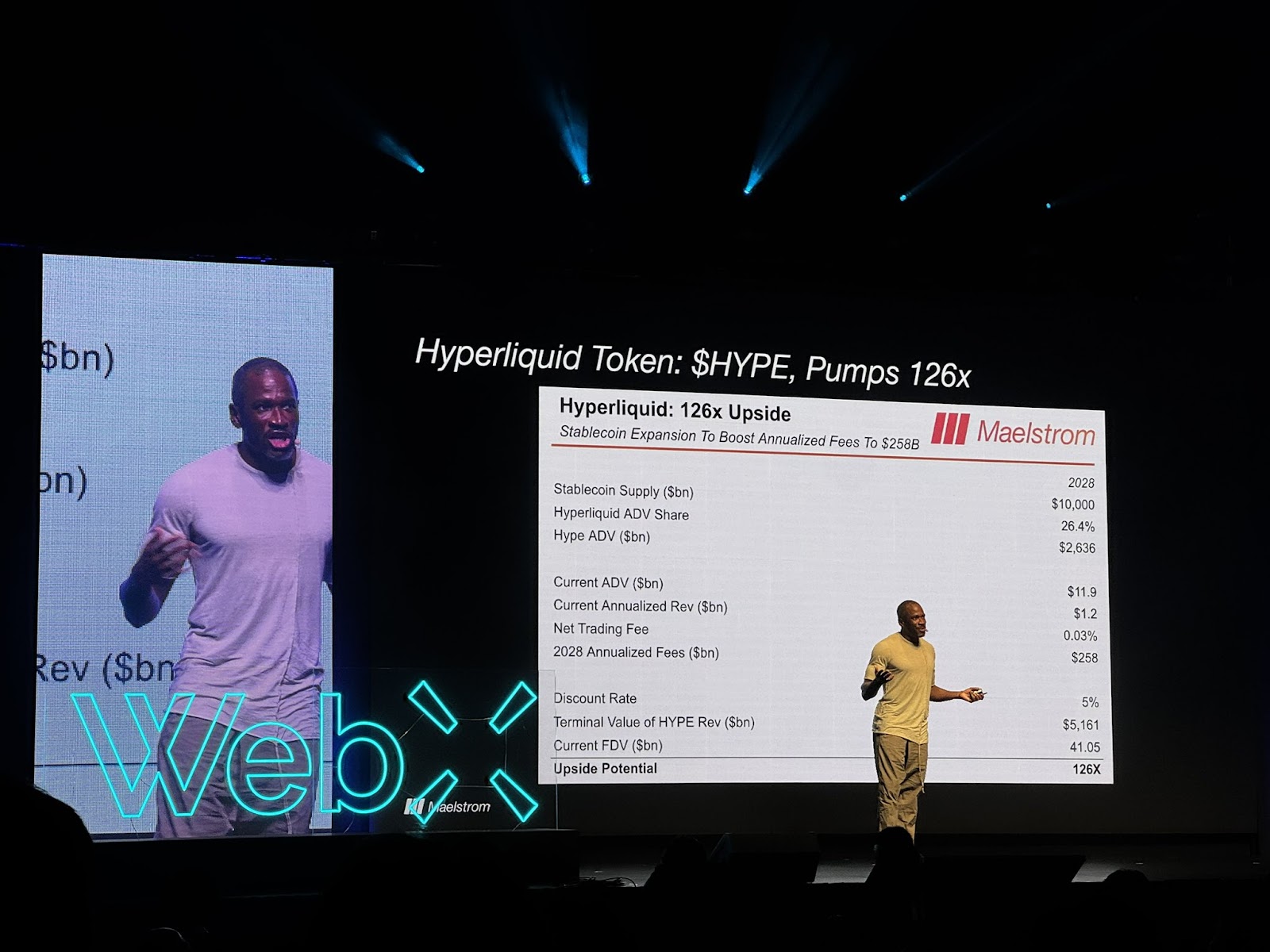

Arthur Hayes, through his Maelstrom fund, has been one of the loudest champions of Hyperliquid while also becoming a lightning rod for criticism. At Token2049 he laid out a bold thesis projecting that HYPE could deliver 126x upside by 2028 if protocol fees scaled in proportion to stablecoin depth. The model spread quickly across X, reinforcing HYPE's reputation as the crown jewel of DeFi and giving traders another reason to frame it as a once-in-a-cycle opportunity.

Weeks later, blockchain data revealed a wallet linked to Hayes sold 96,600 HYPE, worth roughly $5.1 million. The sale came so soon after his 126x presentation that critics accused him of using his platform to pump sentiment and then exit into the strength he helped create. Hayes brushed off the controversy by joking that the sale was to fund a Ferrari deposit, insisting his 2028 thesis remained unchanged. But the optics were damaging, and the backlash spread in the form of viral memes and open accusations that retail enthusiasm was being used as exit liquidity.

To his credit, Hayes' original thesis did acknowledge risks, including the $12 billion in upcoming unlocks, the scale of future emissions, and the growing pressure from competitors like Aster and Lighter. And in crypto, trading around positions does not necessarily negate conviction. Still, the episode sharpened a longstanding criticism: that many VCs and KOLs accumulate tokens early, push narratives aggressively, and then quietly sell into the demand those same narratives generate.

Cryptonary's Take

Hyperliquid remains the dominant force in decentralized perpetuals, but the coming months will test its resilience. Competitors like Aster and Lighter are gaining traction, token unlocks loom large, and the ecosystem must continue to innovate if it wants to maintain its lead. The fundamentals are strong: buybacks and burns continue at scale, HyperEVM is onboarding builders, and HIP-3 is approaching mainnet. But dominance can breed complacency, and the moat is no longer unchallenged.What sets Hyperliquid apart is not just technology or volume, but values. In a space where most projects are optimized for insiders, Hyperliquid has been optimized for users. No VC allocations. No backroom deals. No foundation farming. One hundred percent of supply went to traders, and 97 percent of revenue flows back into HYPE. The team paid themselves nothing until the protocol proved itself.

Jeff and his team are not building for quick exits or headlines. They are building because they believe finance should look different. If Hyperliquid succeeds, it will not just be remembered as another exchange but as the turning point where crypto finally proved it could serve its users first. If it fails, critics will say the industry was destined to remain a casino.

Bitcoin has always been the people's asset. Hyperliquid has the chance to become the first people's altcoin — and perhaps the proof that DeFi can finally outgrow the cycles of greed that defined its past.

Cryptonary, Out!

Hyperliquid