The coin pulled a 400% rally in Q4 2023, and we argued that we would be doing Injective an injustice if we didn't explore what was under the hood. While DeFi, as a sector, is currently struggling, Injective is one of the DeFi projects that has continued to push on with an almost fanatical commitment to succeed.

Earlier this month (September 2024), Injective launched the BUIDL Index – acknowledged as the world's first perpetual market tracking the supply of BlackRock's $BUIDL Fund.

With that single move, Injective has set the stage for unprecedented 24/7 exposure to tokenised assets, including U.S. treasuries. The best part is that you can do it with leverage.

But again, what's special about Injective and why does it deserve a spot on Cpro's pick?

Let's find out.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Injective?

Injective is a Cosmos-based, financial services-oriented blockchain. It utilises the Cosmos SDK and is directly interoperable with a wide range of other Cosmos-based chains as standard.Additionally, through connections to other cross-chain communication protocols, users can connect to a wide variety of blockchains outside the Cosmos ecosystem, including Ethereum, Solana, and Avalanche.

But Injective goes a step further than just connecting to Ethereum and Solana. Developers can deploy Solidity (Ethereum) and Rust (Solana) smart contracts directly on Injective through the inEVM (Injective Ethereum Virtual Machine) and inSVM (Solana Virtual Machine).

In simpler terms, Injective is a blockchain platform specifically designed for DeFi; it offers a range of cutting-edge features and capabilities that are tailored to financial applications.

Some key features that differentiate Injective from the pack include:

- Fiat on-ramp via Mercuryo: Injective offers seamless fiat on-ramp services through a partnership with Mercuryo, allowing users to purchase its native token, $INJ, using various popular payment methods such as Visa, Mastercard, Apple Pay, Google Pay, and bank transfers. This on-ramp supports more than 25 fiat currencies, enhancing accessibility to the Injective ecosystem of decentralised applications (dApps).

- Tokenized Financial Products: Injective allows for the creation and trading of tokenised financial products. Notably, it has facilitated the first-ever tokenised index for BlackRock's BUIDL Fund, making it accessible to individuals with as little as $1 versus the previous $5 million minimum investment required by institutions.

- Advanced Web3 modules: Injective boasts a range of advanced Web3 modules that bolster its status as the premier blockchain for finance. These modules support enhanced functionalities and applications tailored for financial use cases.

- Low transaction fees: Through its gas compression technology, Injective offers some of the lowest transaction fees in the industry. Users can perform over 3,000 transactions with just $1.

- Innovations and integrations: Injective is constantly evolving with new features and integrations. It has recently integrated with the TON ecosystem, allowing for the bridging and utilisation of assets across both Injective and TON platforms.

- Layer 1 advancements: Injective's Altaris Mainnet release represents a significant upgrade, enhancing scalability and introducing advanced asset tokenisation methods. The platform is also noted for providing the fastest Layer 1 blockchain and the first Real-World Asset (RWA) oracle.

- Institutional and real-world assets: Injective supports various institutional and RWA use cases, including tokenised treasury instruments and the introduction of yield-bearing stablecoins. For instance, its integration with Mountain Protocol introduced the first native yield-bearing stablecoin (USDM) to its ecosystem.

The bullish case for Injective

Our thesis on Injective is simple and straightforward – building DeFi platforms on Injective is considerably more straightforward than on other chains – inasmuch as there's a market for DeFi; there's a market for Injective.Premade DeFi modules

There are a few DeFi native blockchains around, but Injective stands out in its plug-and-play primitives.Rather than reinventing the wheel, developers can utilise Injective-native modules such as limit order books without investing resources into creating their own.

On Injective, much of the heavy lifting regarding development requirements for new protocols has already been done. It's like building a house in the city - you already have the infrastructure, like roads, sewers, powerlines, etc.

You only need to connect the newly built house to that infrastructure.

These modules include:

- Insurance module: allows for higher leverage as there is more cover for liquidated positions.

- Exchange module: facilitates spot and derivatives trading activity.

- Peggy module: bridges ERC-20 tokens from Ethereum to Cosmos and vice-versa.

A growing ecosystem of DeFi projects

The Injective ecosystem has taken off since the launch of mainnet in mid-2022. Helix, DojoSwap, and Hydro, are the biggest projects, accounting for about 80% of the TVL.

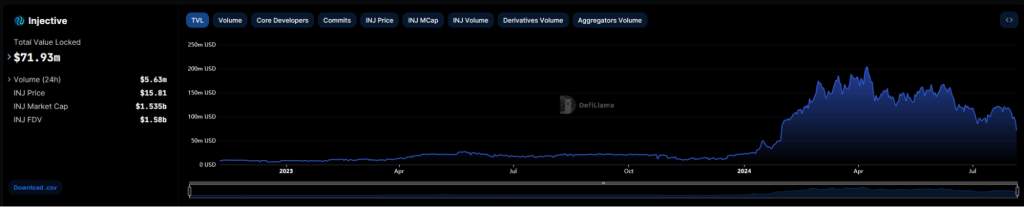

TVL has exploded this year, jumping from ~$30m at the beginning of the year to around $142m—a 450% increase in just two months.

This figure has been affected by the ongoing market turmoil. However, this year's performance clearly indicates that Injective is in demand.

Injective is also tailored for DeFi from the ground up.

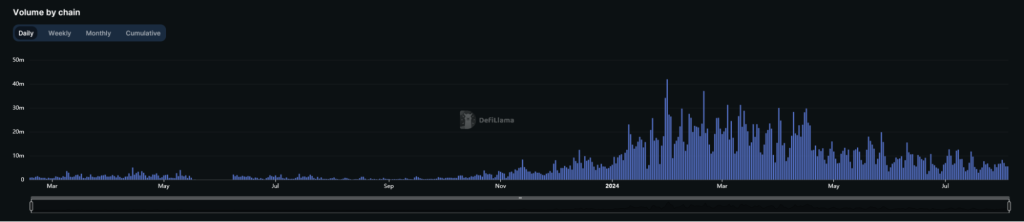

Take Helix, for example. It is the built-in decentralised exchange on Injective, complete with order books. It's basically Injective's answer to Serum on Solana. Liquidity is shared across all DEXs on Injective, like a built-in aggregator, so all DEXs have deep liquidity pools that are able to handle high-frequency trading. This has allowed protocols like NinjaRoll, a predictions market, to flourish.

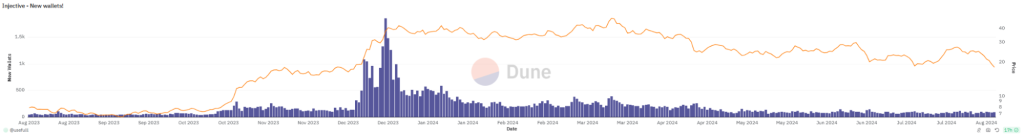

As seen, Helix volumes have grown significantly since December 2023. This is indicative of the increase in activity on-chain. DEXs are like the beating heart of any blockchain - to see Helix pulling higher volumes is a healthy sign of sustainable growth. New users have arrived - and stats show they have hung around.

However, TVL growth has largely been driven by one of the newer protocols on Injective - HydroFi, which already accounts for ~50% of Injective's TVL.

If you've been with us for a reasonable amount of time, you'll know we are very keen on LSD-Fi protocols, which is exactly what HydroFi is.

Hydro Protocol launched on Injective at the beginning of February and has seen huge TVL growth, accumulating over $122 million in locked value in a very short time. Around half of that is on Injective.

Again, if you've been paying attention, you'll know we recently covered ERC-404s - the experimental token standard that will make non-fungible tokens fungible - but still non-fungible.

Injective has also jumped right on that train, launching the CW-404 standard.

The unique wallet count reflects all of these selling points and more. Injective continues to bring in new users at a rapid pace, with a huge surge in late 2023.

So, we have a solid foundation to build on via the Injective blockchain and a few notable catalysts for ecosystem growth.

Are the tokenomics playing ball?

Impressive tokenomics

The INJ token is similar to any other L1 blockchain token, such as ETH, AVAX, SOL, etc. It is primarily used for paying transaction fees, securing the network through a Proof-of-Stake consensus, and governance.Here are the key metrics:

- Circulating supply: 97.73 million INJ.

- Total supply: 100,000,000 INJ.

- Market cap: $1.8 billion.

- FDV: $1.842 billion.

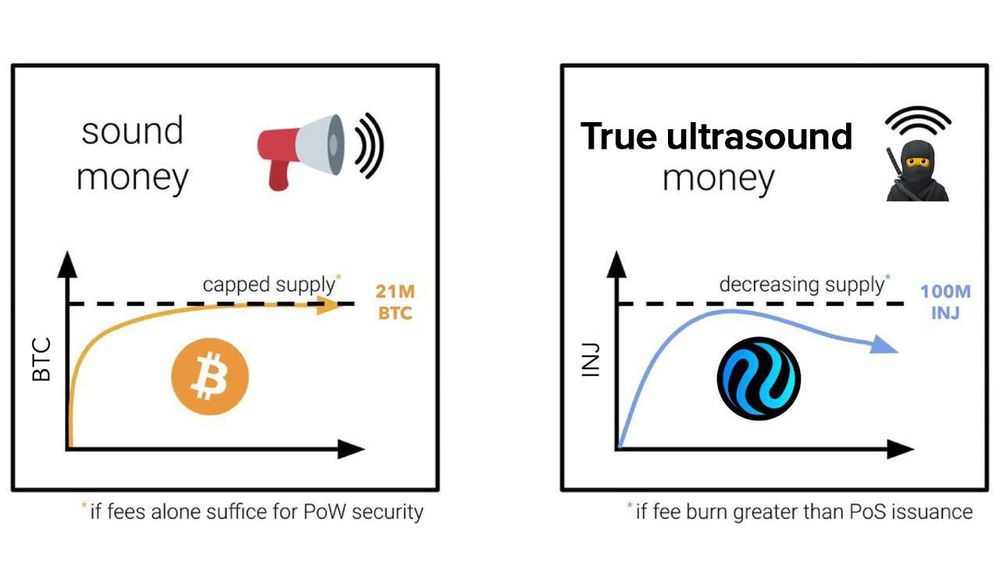

Of course, this assumes that fees burned are higher than staking rewards for any given week.

The tokenomics are sound - Injective has been around for a while, the fundamentals are solid, and, most importantly, people are using the chain.

How does Injective fare against the competition?

Injective's primary competitors are other super-fast chains like Solana. However, where Solana seeks to become dominant in a broad range of sectors, Injective is primarily built to handle any and all DeFi applications.Solana is a jack of all trades and master of none. Injective is being positioned as the master of DeFi.

Other competitors would be Ethereum and its vast ecosystem of Layer-2 protocols. However, the key difference that sets Injective apart is that all of these chains are not necessarily competition.

Injective has been going from strength to strength with their most recent announcement of integration with Arbitrum.

Interoperability has always been the goal for Injective (apart from becoming the number one DeFi chain). So, the integration between the inEVM and Arbitrum represents another target hit for Injective.

To recap, the inEVM allows Injective to use the INJ token as a gas token, similar to ETH's role in the Ethereum ecosystem. The more chains they integrate with inEVM, the more transactions will occur and the larger the validator set that will be required. Since inEVM works as a proof-of-stake chain, this essentially means more INJ is locked up, which is great for price appreciation.

Injective's valuation exercise + price targets

Given the already significant market cap of $1.8 billion, we must limit expectations in the short term - this won't be a 100x.However, the growth potential is still greater than you'd expect—we're thinking Solana levels on this one. Injective has a lot going for it—the ease at which developers can access the infrastructure they need to build, the standard interoperability of the chain, the deflationary tokenomics model, and the spike in unique users; it's no wonder INJ has flown.

We anticipate that this growth will continue. There's an inherent buzz about the ecosystem—market cap far outweighs TVL, so the speculation factor is arguably already there. We're living in a world where Solana has a $62 billion market cap and a $8.2 billion TVL. But this doesn't consider Injective's connections to other chains.

Similar to our previous valuation frameworks, we employed a mix of quantitative and qualitative methods for Injective's valuation.

We downloaded the historical market cap of Injective and utilised machine-learning models based on different methods to forecast future market cap, resulting in the following projections:

For 24/25

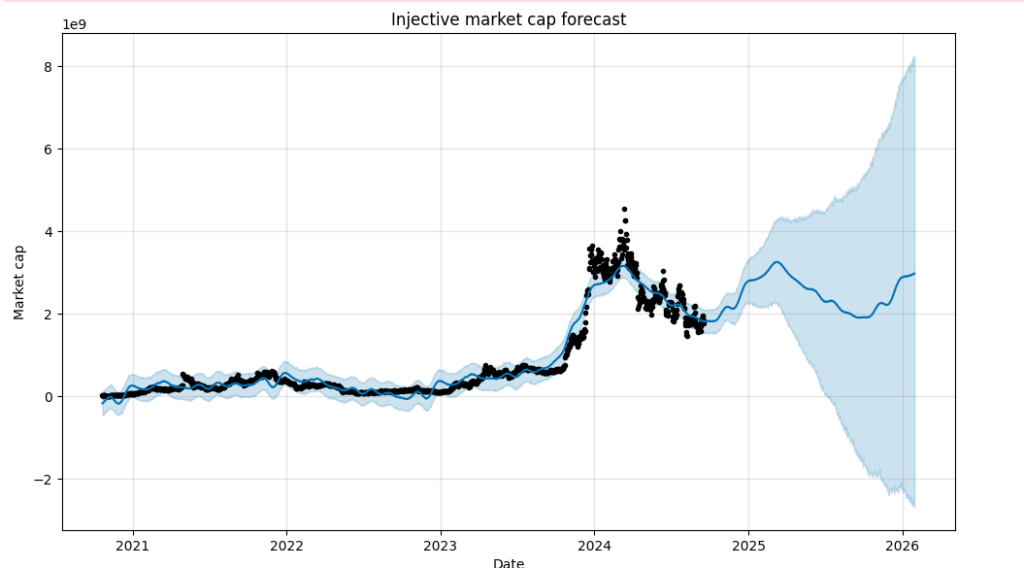

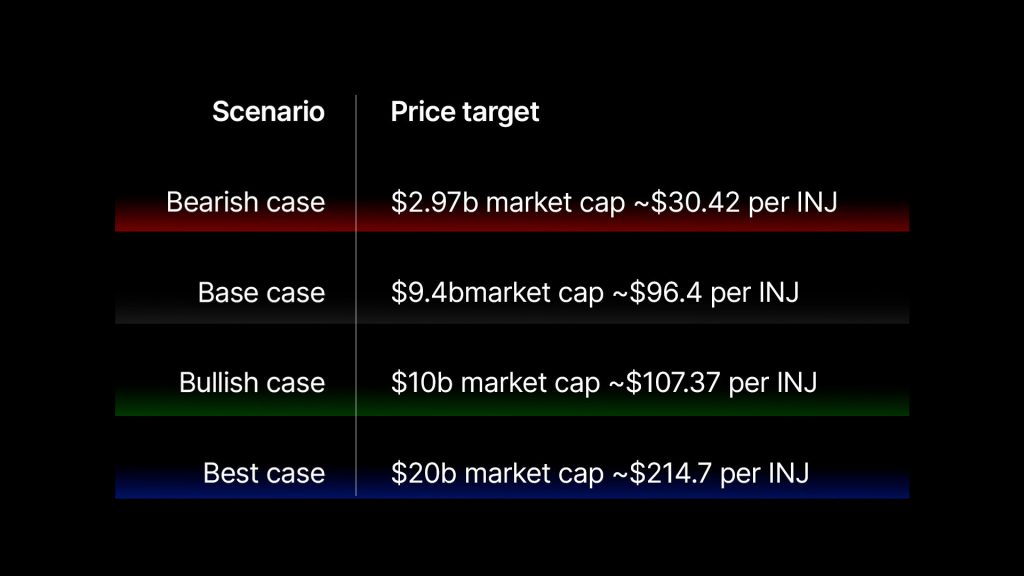

For the 24/25 valuation of Injective, we employed a set of different models for different scenarios. Here are the scenarios:- Bearish scenario: For the bearish scenario, we employed Prophet forecasting. The graph shows a time series forecast with actual values (black line) and predicted values (blue line) along with a confidence interval (shaded area). This scenario suggests that the mcap of Injective is expected to reach $2.97b ($2,972,950,745) by the end of 2025. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Given the very high float of INJ, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations. Considering future market cap and circulating supply, this model results in $30.42 per INJ per our bearish scenario.

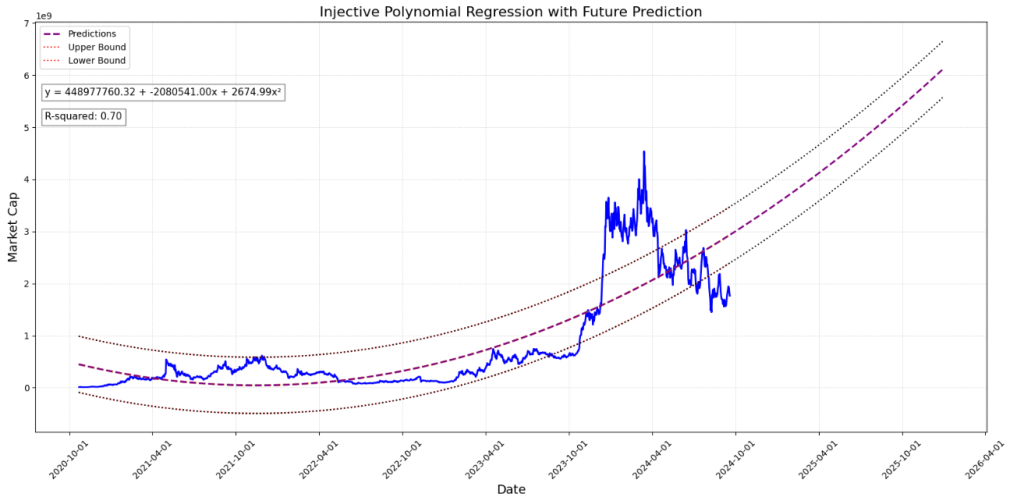

- Base scenario: This scenario suggests that the mcap of Injective is expected to reach $9.4b ($9,429,777,436) by the end of 2025. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Given the very high float of INJ, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations. Considering future market cap and circulating supply, it will result in $96.4 per INJ per our base scenario.

- Bullish scenario: In this scenario, the model suggests that the mcap of Injective is expected to reach $10b ($9,968,634,159) by the end of 2025. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Injective has amazing tokenomics, where the network burns fees generated by dapps, making INJ deflationary with growing adoption. For the bullish scenario, we will assume that 5% of the current supply will be burnt. Thus, we can expect a circulating supply of 92,840,860 tokens. Considering future market cap and circulating supply, it will result in $107.37 per INJ per our bullish scenario.

- Best scenario: In this scenario, the market can exceed our expectations, and things that we previously didn't consider came up or were believed to be low-likelihood events. Potential changes might include a rebirth of the Cosmos ecosystem, failure of alternative L1s (e.g., Ethereum, Solana, etc.), and making Injective a de facto ecosystem for DeFi activities. To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Summary

For 2032

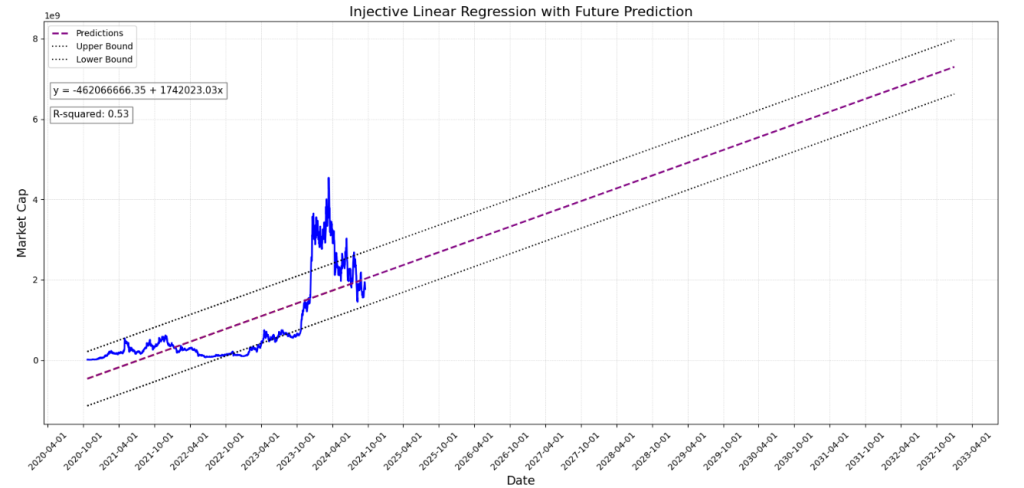

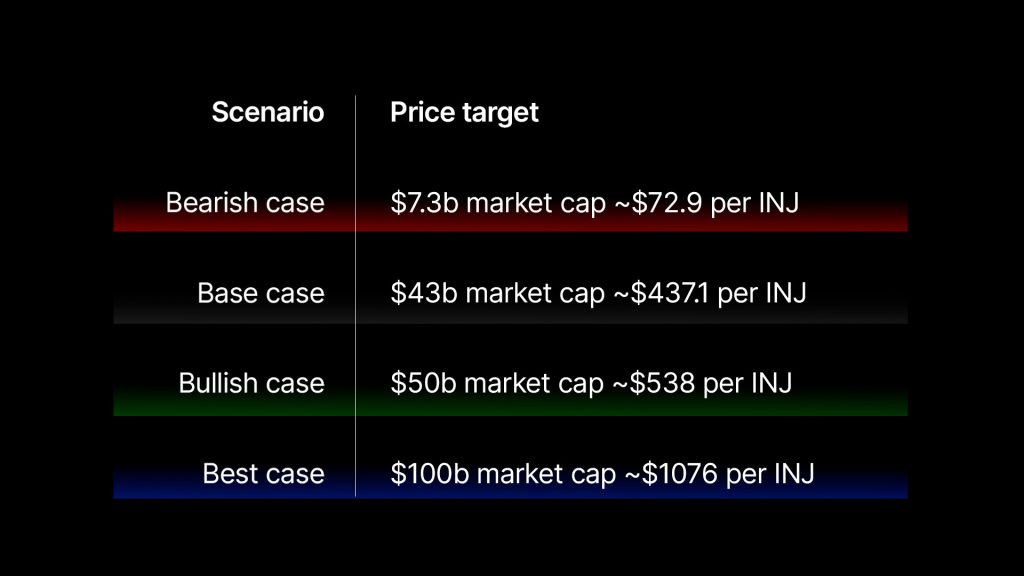

For our long-term predictions, we used a mix of quantitative methods depending on various scenarios:- Bearish scenario: In the chart below, the Y-axis represents Injective's market capitalisation, while the X-axis represents time.

The fitted line (rising purple line) shows a linear upward trend. Based on this model, Injective will reach $7.3b ($7,296,903,908) by the end of 2032. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Similarly, given its very high float, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations.

Considering future market cap and circulating supply, it will result in $72.9 per INJ per our bearish scenario.

The fitted line (rising purple line) shows a linear upward trend. Based on this model, Injective will reach $7.3b ($7,296,903,908) by the end of 2032. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Similarly, given its very high float, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations.

Considering future market cap and circulating supply, it will result in $72.9 per INJ per our bearish scenario.

- Base scenario: We employed a different model for our base and bullish scenarios. For these scenarios, we opted for the best-fit exponential model instead of linear models to generate the long-term valuation for Injective. Our analysis resulted in the following model:

This model suggests that the mcap of Injective is expected to reach $43b ($43,710,199,412) by the end of 2032. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Given the very high float of INJ, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations.Considering future market cap and circulating supply, it will result in $437.1 per INJ per our base scenario.

This model suggests that the mcap of Injective is expected to reach $43b ($43,710,199,412) by the end of 2032. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Given the very high float of INJ, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations.Considering future market cap and circulating supply, it will result in $437.1 per INJ per our base scenario.

- Bullish scenario: We estimate roughly $50b for the bullish scenario by the end of 2032. The current supply of INJ is 97,727,222 tokens (97.7% circulating). For the bullish scenario, we will assume that 5% of the current supply will be burnt. Thus, we can expect a circulating supply of 92,840,860 tokens. Considering future market cap and circulating supply, it will result in $538 per INJ per our bullish case scenario.

- Best scenario: In this scenario, the market can exceed our expectations, and things that we previously didn't consider came up or were believed to be low-likelihood events. Potential changes might include a rebirth of the Cosmos ecosystem, failure of alternative L1s (e.g. Ethereum, Solana, etc), making Injective a de-facto ecosystem for DeFi activities. To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Summary

Cryptonary's definitive price targets on Injective

Over the short term, we are confident about Injective's upside potential, and INJ has a decent shot at hitting the 24/25 price targets. We are even much more confident about the 2032 targets because it gives Injective more than enough time to prove itself, for network effects to happen within the Injective ecosystem and for DeFi to take a larger part of TradFi.

Risks to consider before buying INJ

While the report thus far has consistently supported our bullish stance on Injective, we must address potential risks and considerations crucial for making informed investment decisions.New competition

The potential launch of new blockchains with similar goals poses a risk. In the past, we've seen protocols attract stiff competition just because of their initial success. Newer projects that have learned from the incumbent's mistakes can launch superior products. Examples include the launching of Stargate Finance, which rendered multi-sig bridges obsolete.Although we are unaware of protocols that will soon launch with the same moat as Injective, it cannot be ruled out as a possibility, so we'll be keeping an eye out for developments on that front.

Regulation

Similar to other chains, regulation is a key risk. But it's even more critical to Injective as a financial operation hub. If companies and individuals cannot legally use Injective for operations, then the whole reason for Injective's existence is brought into question.Complexity

Another risk is that due to Injective's niche purpose, it is generally more complex and harder to navigate than other chains like Solana. The user experience is excellent for those familiar with blockchain, but it certainly isn't a beginner-friendly chain. Obviously, this could affect adoption, coupled with the DeFi niche that Injective is going for.Ecosystem stagnation

Finally, INJ's success depends entirely on its ecosystem's growth. You can build the world's biggest, fanciest cruise liner, but what's the point if no one is on the cruise? Although TVL growth has been significant since late 2023, there is always the concern that INJ will fade into the annals of crypto history as another failed experiment.Yet, we believe that Injective is reflexive enough to change with the times, as the recent updates outlined above show. Innovation is the name of the game, and Injective continues to innovate. If that stops, we'll have to revisit our thesis.

Cryptonary's take

Injective presents a fantastic opportunity going into the bull market, and betting on the ecosystem (or farming airdrops) will supplement and enhance gains.Although a fair portion of the INJ gains have already played out, we know what bull markets are capable of; equally, Injective is fully capable of big things.

Injective (INJ) stands out as one of the more innovative Layer 1s, with a focus on DeFi infrastructure and dApp development. Its unique positioning within decentralised derivatives trading, combined with the integration of the Cosmos IBC, sets it apart in terms of interoperability and scalability. INJ's long-term commitment to enhancing its ecosystem is evident through its partnerships, infrastructure upgrades, and the continued build-out of its decentralised financial tools.

While Injective's focus on niche markets like decentralised derivatives might limit its immediate mainstream appeal, its ambitious roadmap and active developer community provide solid groundwork for future adoption. For investors, this dual focus on technical advancement and market fit makes INJ a project worth keeping an eye on.

However, its performance will likely be closely tied to the broader market sentiment surrounding DeFi and its ability to execute on its long-term vision.

However, in terms of actual performance, giving Solana a run for its money in terms of blockchain performance is no easy feat. Throw in the DeFi native modules, and we can begin to build a case for Injective to become a "Solana Killer."

Whether or not it can flip Solana's market cap remains to be seen. But we're certainly impressed with Injective, and we think you will be, too, when you get connected!

Content ledger

- Simply Explained: Injective Protocol (INJ)

- Injective is repositioned for profits

- Injective is undervalued right now

- Spotlight on HONEY + the latest on LINK, INJ, SYN, and LBR

- Defying the downturn: LINK, THORChain, and Injective forge ahead

- Injective is the web3 equivalent of a swiss army knife for DeFi