Injective: the Web3 equivalent of a swiss army knife for DeFi

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

There have been a few key winners in the current crypto rally, and Injective was one of them.

In Q4 2023, Injective rallied almost 400%, and it has retained most of those gains as 2024 gets underway.

But that’s not why we’re writing this report. INJ has been on our radar for a while.

However, the time is ripe for Injective to get some screentime, and now we feel we would be doing Injective and injustice (pardon the pun) if we didn’t cover it.

So here we are - what do we have to say?

TLDR

- Injective is a Cosmos-based, financial services-oriented blockchain.

- Developers can utilise Injective-native modules such as limit order books without investing resources into creating their own.

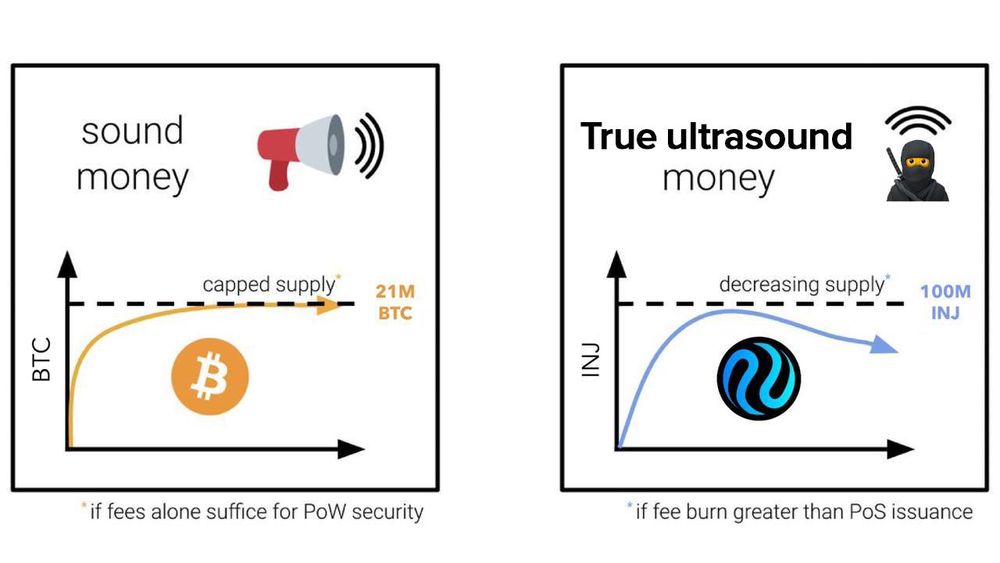

- The INJ token benefits from a buy-and-burn mechanism whereby up to 100% of fees collected by any protocol or DApp built on Injective are burned every week, making the token deflationary over time.

- Given a $40 billion valuation, we see INJ going all the way to INJ at $452, a ~12x from here.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Injective Protocol

Injective is a Cosmos-based, financial services-oriented blockchain. It utilises the Cosmos SDK, the chain is directly interoperable with a wide range of other Cosmos-based chains as standard. Additionally, through connections to other cross-chain communication protocols, users can connect to a huge variety of blockchains outside the Cosmos ecosystem, including Ethereum, Solana, and Avalanche, to name a few.But Injective goes a step further than just connecting to Ethereum and Solana. Developers can deploy Solidity (Ethereum) and Rust (Solana) smart contracts directly on Injective through the inEVM (Injective Ethereum Virtual Machine) and inSVM (Solana Virtual Machine).

So what we’re talking about here is a blockchain designed like a DeFi Swiss army knife.

But, where Injective stands out is in its plug-and-play primitives.

Building DeFi platforms on Injective is considerably more straightforward than on other chains. Rather than reinventing the wheel, developers can utilise Injective-native modules such as limit order books without investing resources into creating their own.

On Injective, much of the heavy lifting regarding development requirements for new protocols is already done. It’s like building a house in the city - you already have the infrastructure, like roads, sewers, powerlines, etc.

You only need to connect the newly built house to that infrastructure.

These modules include:

- Insurance module: allows for higher leverage as there is more cover for liquidated positions.

- Exchange module: facilitates spot and derivatives trading activity.

- Peggy module: bridges ERC-20 tokens from Ethereum to Cosmos and vice-versa.

Injective's ecosystem

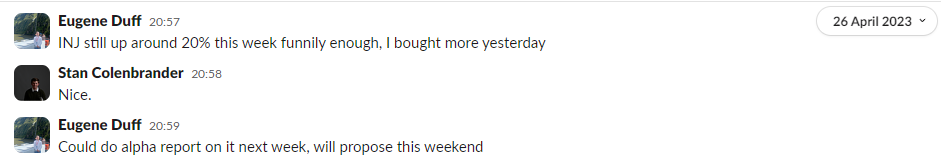

The Injective ecosystem has taken off since the launch of mainnet in mid-2022. Helix, DojoSwap, and Hydro, are the biggest projects, accounting for about 80% of the TVL.Looking at INJ’s token performance (+120%), it’s clear that market sentiment is very much in favour of Injective. And there are excellent signs that this growth is likely to continue.

TVL has exploded this year, jumping from ~$30m at the beginning of the year right up to ~$142m - a 450% increase in just two months.

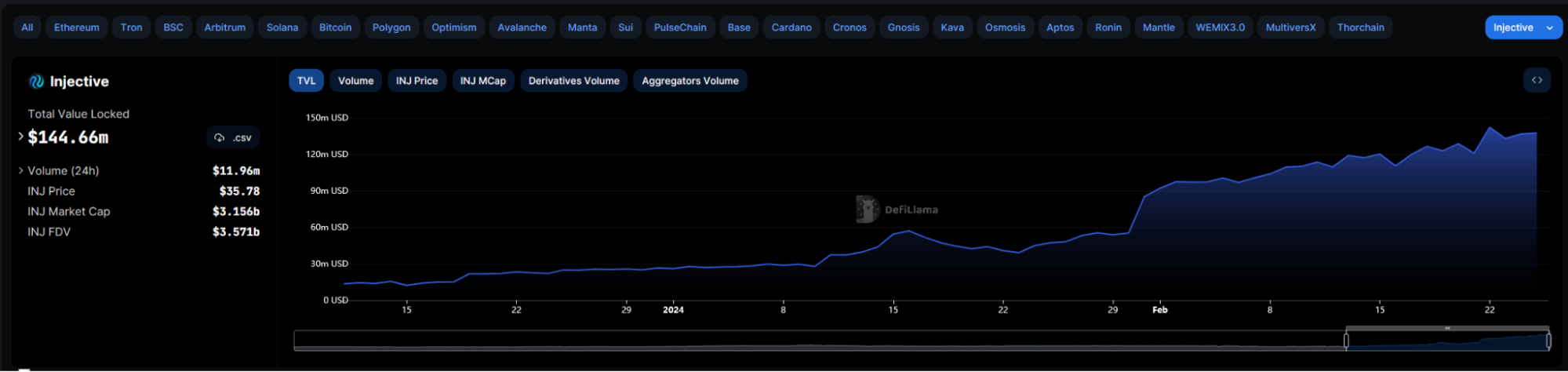

Injective is also tailored for DeFi from the ground up. Take Helix, for example. It is the built-in decentralised exchange on Injective, complete with orderbooks. It’s basically Injective’s answer to Serum on Solana. Liquidity is shared across all DEXs on Injective, like a built-in aggregator, and so all DEXs have deep liquidity pools able to handle high frequency trading. This has allowed protocols like NinjaRoll, a predictions market, to flourish.

As seen, Helix volumes have grown significantly since December 2023. This is indicative of the increase in activity on-chain. DEXs are like the beating heart of any blockchain - to see Helix pulling higher volumes is a healthy sign of sustainable growth. New users have arrived - and stats show they have hung around.

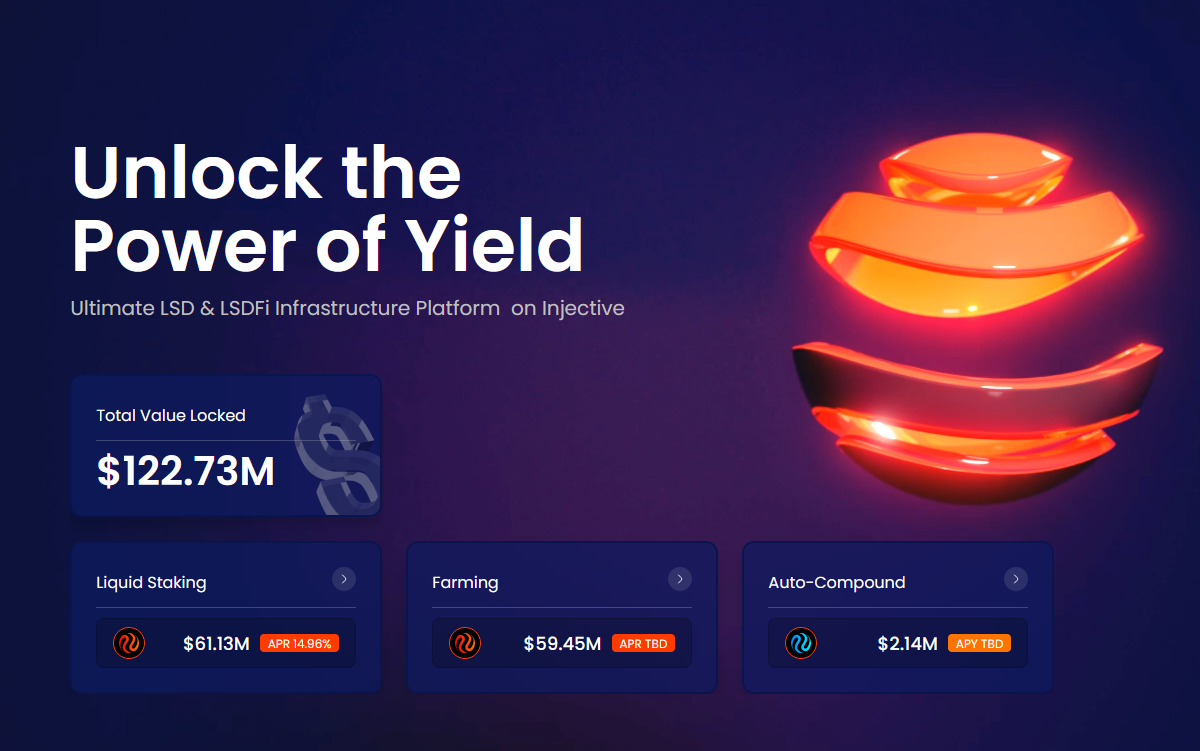

However, TVL growth has largely been driven by one of the newer protocols on Injective - HydroFi, which already accounts for ~50% of Injective’s TVL.

If you’ve been with us for a reasonable amount of time, you’ll know we are very keen on LSD-Fi protocols, which is exactly what HydroFi is.

Hydro Protocol launched on Injective at the beginning of February and has seen huge TVL growth, accumulating over $122 million in locked value in a very short time. Around half of that is on Injective.

Again, if you’ve been paying attention, you’ll know we recently covered ERC-404s - the experimental token standard that will make non-fungible tokens fungible - but still non-fungible.

It’s a bit complicated, but you can catch up here.

Injective has also jumped right on that train, launching the CW-404 standard.

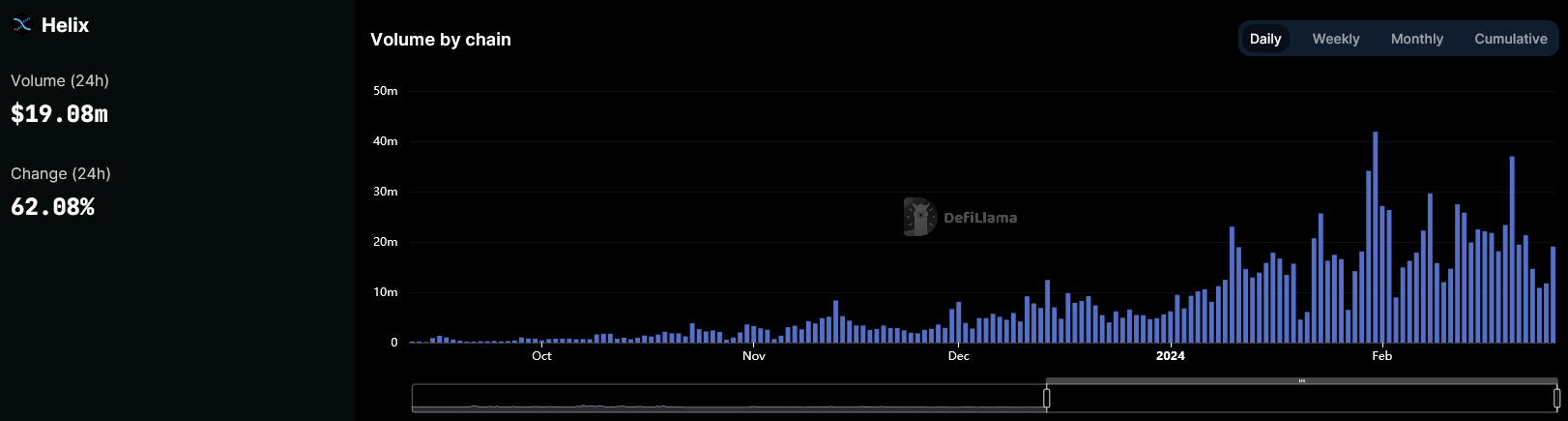

The unique user count reflects all of these selling points and more.

So, we have a solid foundation to build on via the Injective blockchain and a few notable catalysts for ecosystem growth.

Are the tokenomics playing ball?

INJ token

The INJ token is similar to any other L1 blockchain token like ETH, AVAX, SOL, etc. It is primarily used for paying transaction fees, securing the network through a Proof-of-Stake consensus, and governance.Here are the key metrics:

- Circulating supply: 88.4 million INJ.

- Total supply: 100,000,000 INJ.

- Market cap: $3.275 billion.

- FDV: $3.7 billion.

Of course, this assumes that fees burned are higher than staking rewards for any given week.

The tokenomics are sound - Injective has been around for a while, and there’s a reason for the recent pump.

Valuation exercise

Given the already significant market cap of $3.2 billion, we must limit expectations - this won’t be a 100x.However, the growth potential is still greater than you’d expect - we’re thinking Solana levels on this one.

Injective has a lot going for it - the ease at which developers can access the infrastructure they need to build, the interoperability of the chain as standard, the deflationary tokenomics model, and the spike in unique users; it’s no wonder INJ has flown.

We anticipate that this growth can continue.

There’s an inherent buzz about the ecosystem - market cap far outweighs TVL, so the speculation factor is arguably already there.

We’re living in a world where Solana has a $62 billion market cap with a $5.5 billion TVL.

But this doesn’t consider Injective’s connections to other chains.

A fair amount of Injective’s current valuation is speculative for sure. There is merit to that - Solana is notoriously difficult to get to from other chains without using CEXs. Even THORChain doesn’t support Solana yet.

So, where does that leave us?

Injective is easily a $40 billion chain in a bull market - especially since market liquidity is increasingly locked up in INJ liquid staking. With the addition of INJ liquid staking through Hydro, we anticipate there is going to be a significant shortage in floating INJ, which plays a key part in actual market value.

We’ve not just pulled that number out of nowhere - Injective is superior to Solana regarding TPS, coming in at a theoretical max of 100,000 compared to Solana’s 50,000. Transaction costs are less than a cent; again, comparable to Solana. These factors are huge when it comes to user experience - and the increased AU figures confirm this.

It’s twice as fast as Solana and has much less historical baggage (and nearly no downtime).

Thus, we think the fair value for Injective is around ⅔ of Solana’s current market cap.

The $40 billion potential valuation puts INJ at a $452 per token value, or ~12x from here.

Technical analysis

INJ has been building up and forming a wedge pattern, very similar to how BTC was forming just before it popped up to $57k from the recent range. Could a similar pattern be forming here?

Regardless, this price action shows a build-up of pressure, and with the bullish case for injection, we are now in a great place to accumulate more.

Injective presents a fantastic opportunity going into the bull market, but betting on the ecosystem (or farming airdrops) will likely give better returns.

Bonus (airdrop opportunity)

Hydro Protocol is tokenless - you know what that means (get clicking).Given Hydro Protocol's performance in terms of TVL accrued since the start of February, we suggest interacting with Hydro on Injective at this early stage to maximise your chances of receiving a healthy airdrop.

Transaction fees on Injective are on Solana levels of cheap - there’s no excuses.

For those worried about OpSec (as you should be), here are some links:

Cryptonary’s take

Injective presents a fantastic opportunity going into the bull market, and betting on the ecosystem (or farming airdrops) will supplement and enhance gains.Although a fair portion of the INJ gains have already played out, we know what bull markets are capable of; equally, Injective is fully capable of big things.

Giving Solana a run for its money in terms of blockchain performance is no easy feat. Throw in the DeFi native modules, and we can begin to build a case for Injective to become a “Solana Killer.”

Whether or not it can flip Solana’s market cap remains to be seen. But we’re certainly impressed with Injective, and we think you will be, too, when you get connected!