TLDR 📃

- We dissect the strategies of four distinct crypto trader profiles, from a struggling beginner to a multi-million dollar veteran.

- Current trends show a bullish market sentiment, with rising interest in LSD-Fi, the gambling sector, and AI and meme coins.

- The key to success lies in adapting to market narratives and having a clear, well-researched investment thesis.

- Diverse strategies and asset preferences underline that there isn't a 'one-size-fits-all' approach in the volatile world of crypto trading.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility.

Smart Money overview 🔎

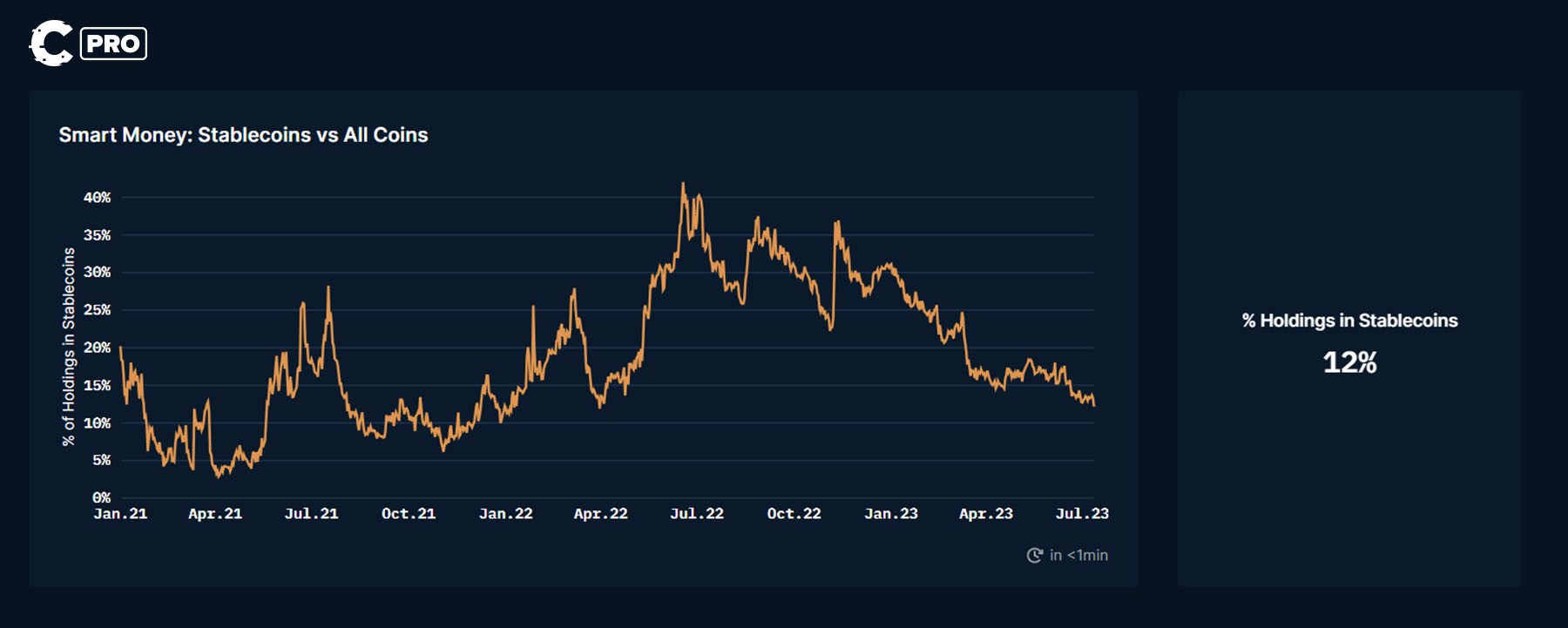

Before we delve into the minds of our traders, let's take a bird’s eye view of the market and understand the ebb and flow of the crypto market – starting with stablecoins.

The fewer stablecoins our ‘Smart Money’ have, the more bullish they are.

The ‘Smart Money’ wallets are reducing their stablecoin holdings, now at a yearly low, at only 12% of their portfolios. What does this imply? Smart Money feels bullish, ready to charge forward with investments in more volatile but potentially high-reward assets.

This bullish sentiment could be fueled by positive news surrounding the Bitcoin Spot ETF, the improving macro conditions, and the favourable news regarding Ripple.

Now let's dive into the wallets.

Trader 1: (The loser) 👎

This trader is an example of who you don't want to be.

Just as the story of Limitless starts with Eddie Morra, a down-on-his-luck writer battling the blank page, our crypto narrative begins with Trader 1 - let's call him our 'Pre-NZT Eddie.'

From the start of the year, they have concentrated all their funds in a single asset, which, unfortunately, has experienced a decline in value.

Despite this setback, the trader has persisted with their unchanged strategy, resulting in significant underperformance.

- Net worth: $6,880

- 2023 ROI: -69.89%

- Style: being excessively attached to their positions

- Wallet address: 0x55d84689878702a8501ec9f40ec1feed2bd39b0f

- Top pick(s): NITRO

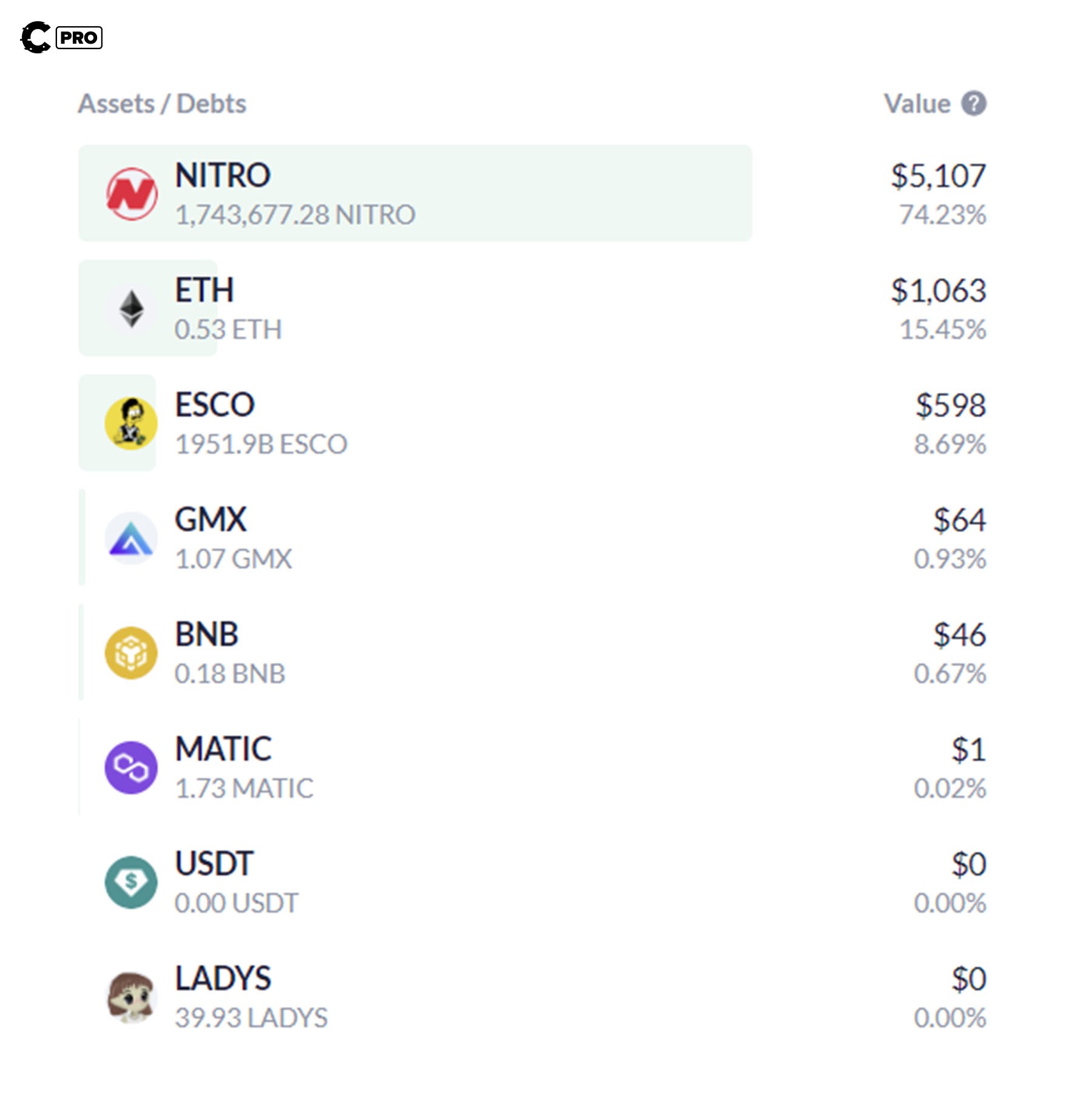

Portfolio

The losing trade

- This trader bought $34,000 worth of NITRO at an average price of $0.02.

- Still holding NITRO now at ~$0.002. Portfolio now worth $5,107, to mark an -84.71% loss.

Strategy

This trader is struggling, caught in a loop of ill-advised decisions and near-misses, leading to a portfolio sadly lacking in diversification.

Ser!! Why is 90% of your portfolio held in a single coin in a Game-Fi project?

Consequently, the initial investment of $34,000 has now dwindled to a mere $5,107.

While you can get big wins on making high-conviction bets in crypto, this individual made a critical mistake.

They failed to adjust their position when they observed the market turning against them, so they could not cut their losses early enough.

Trader 2: (The swing trader) ↗️

Just as Eddie Morra, our protagonist from Limitless, took his first pill of NZT-48, catapulting him into a world of superhuman cognitive prowess.

Trader 2 - let's call him 'NZT Eddie' - has harnessed the transformative power of strategic, high-conviction trading.

We are looking at a genuine swing trader who makes high-conviction plays, one of which has already paid off significantly this year.

- Net worth: $301,590

- 2023 ROI: +357.14%

- Style: Swing trader

- Wallet address: 0x2fcc020f72e5d2edd2a24d04f3dc90d7fdfbd1dd

- Top pick(s): wTAO

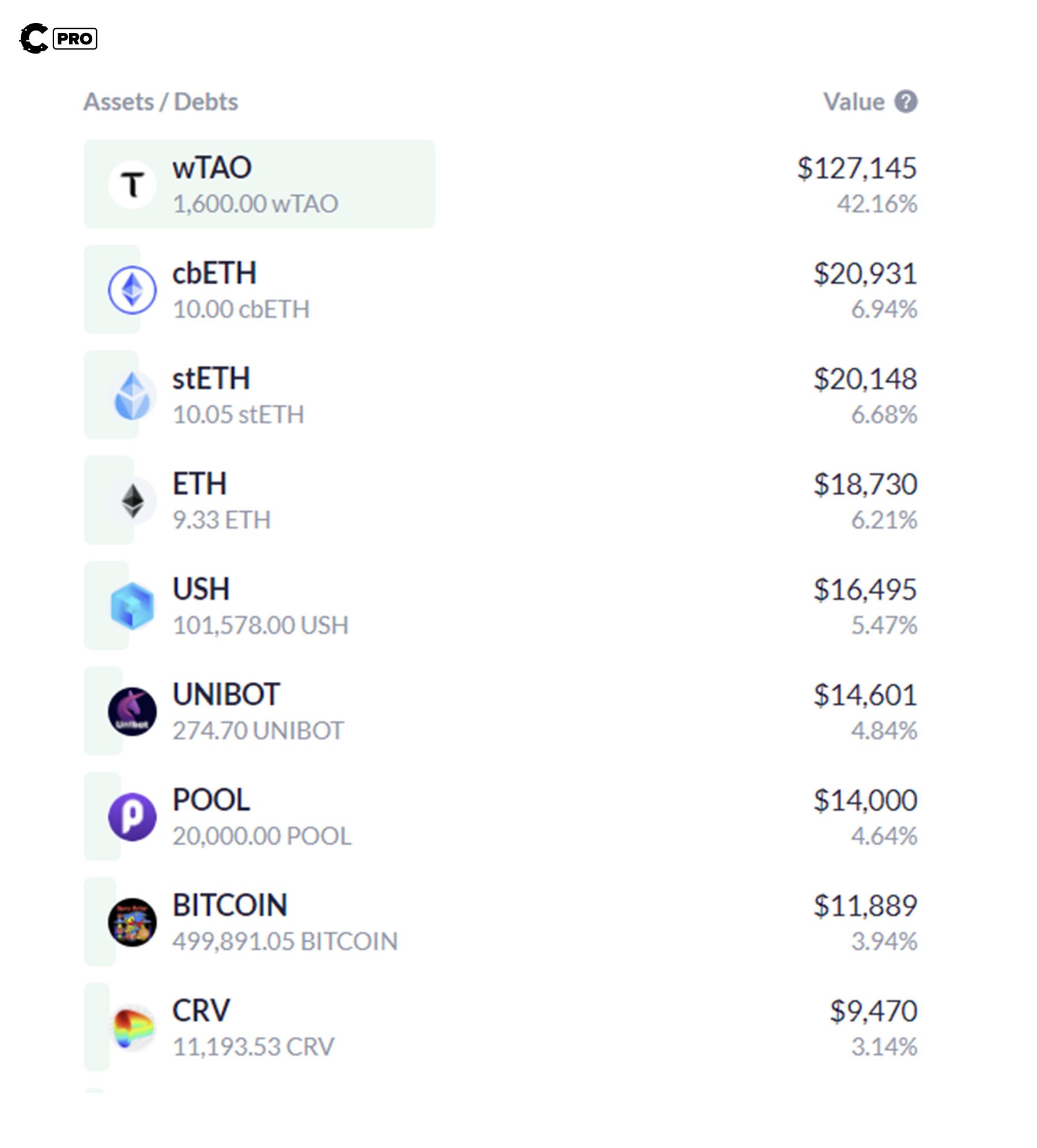

Portfolio

Big wins

- Bought $7,976 worth of BOTTO at ~$0.04

- Sold BOTTO $0.42 to net $75,534 or an ROI of 847.02%

- Bought $24,302 worth of BLUR at ~$0.64, investing

- Sold BLUR at $1.02 to score $34,631 or an ROI of 42.50%

Strategy

Trader 2 is currently surfing the AI wave. BOTTO, his initial win, was cashed in for hefty profits. His sights are on the promising $TAO, Bittensor's token. Like Bitcoin's mining network, Bittensor aims to build a decentralised network of machine learning models.

Furthermore, a chunk of his portfolio (5.47%) is invested in USH, an LSD-Fi project, complemented by 4.84% in UNIBOT, a rising trading bot on Telegram built on Uniswap.

If LSD-Fi sounds foreign, refer to our trendspotting piece last month.

Trader 3: (The degen) 💎

Let’s call Trader 3 - 'Peak Eddie!'

They rode a single meme coin trade to an incredible 916.96% ROI in 2023.

- Net worth: 183,315

- 2023 ROI: 916.96%

- Style: High conviction trader/Degen

- Wallet address: 0xa395dcfac017afc771fda1cc2424cb72a84725f5

- Top pick(s): PEPE

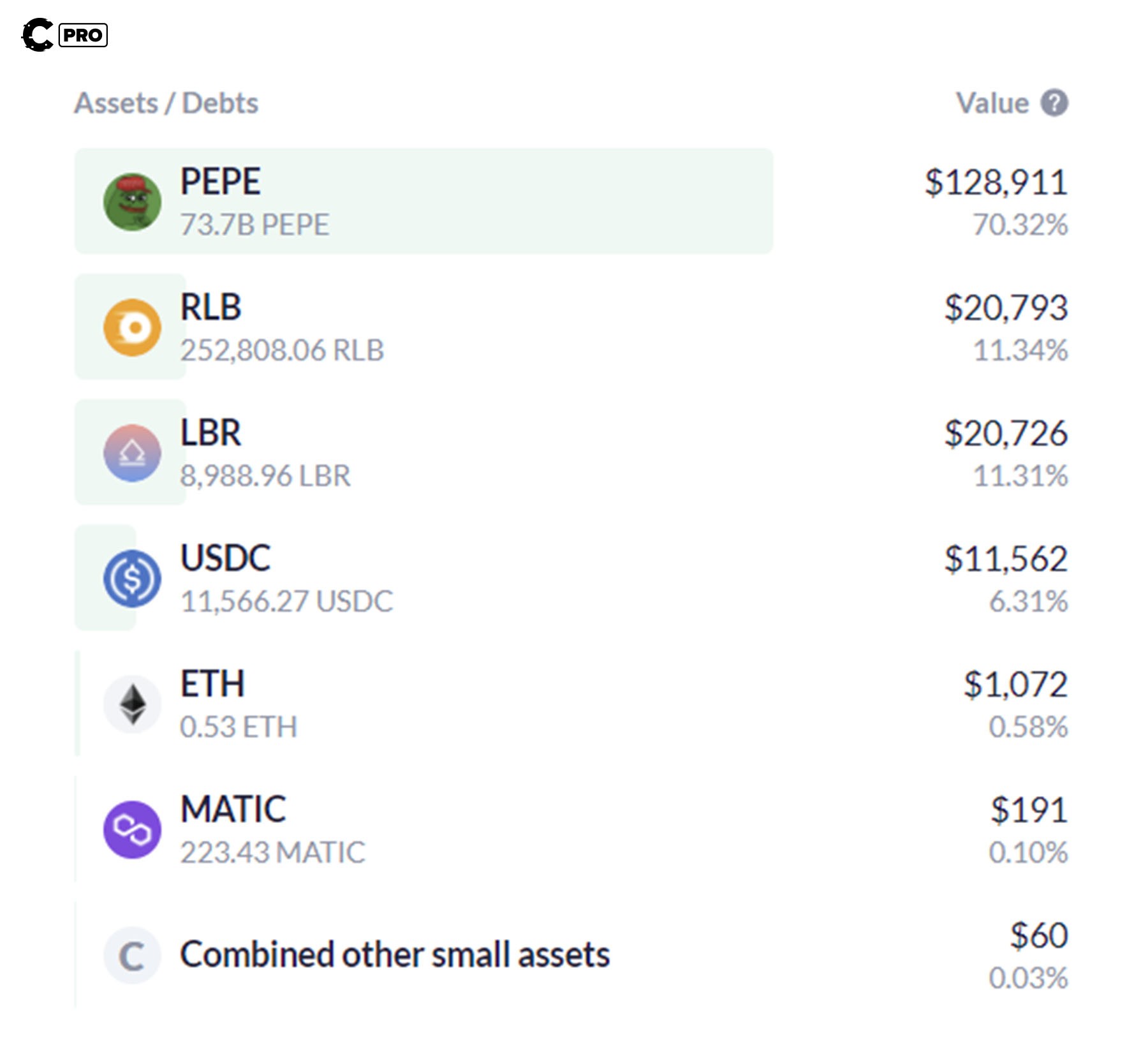

Portfolio

Big wins

- Bought $18,563.925 worth of PEPE at an average price of 0.000000253375

- Took $40,000 of profit in May

- Still holds $128,911 worth of PEPE making a bag of $150,348 or an ROI of 809.93%

Strategy

Experiencing an adrenaline-charged upswing that mirrors Eddie's rollercoaster ride, 'Peak Eddie' invested in PEPE when it was still an obscure gamble. But as an old cat, he's no stranger to the prudence of diversification.

Shrewdly chipping away from his PEPE holding, he's started investing in tokens backed by more robust fundamentals. LBR, the LS-DFi project Lybra Finance token, now constitutes 11.31% of his portfolio. We also invested in LBR through Skin in The Game,

He's also betting on the emerging theme of decentralised gambling platforms, evidenced by an 11.34% investment in Rollbit's token.

Of course, he remains tethered to his initial triumph in PEPE. Only time will tell whether this is sentimentality or a firm belief in its potential. For now, he's soaring high, dominating the crypto skies in full flight.

Trader 4: (The long-term investor) 💼

Trader 4 - we'll call him 'Politician Eddie' - has risen through the ranks of the crypto market to become a veteran investor.

We aren’t playing here. This wallet has amassed a net worth of more than $7 million.

Instead of playing short-term games, they’ve carefully crafted a long-term portfolio.

- Net worth: $7,771,158

- 2023 ROI: +130%

- Style: Long-term investor

- Wallet address: 0xa66f8db3b8f1e4c79e52ac89fec052811f4dbd19

- Top pick(s): DYDX

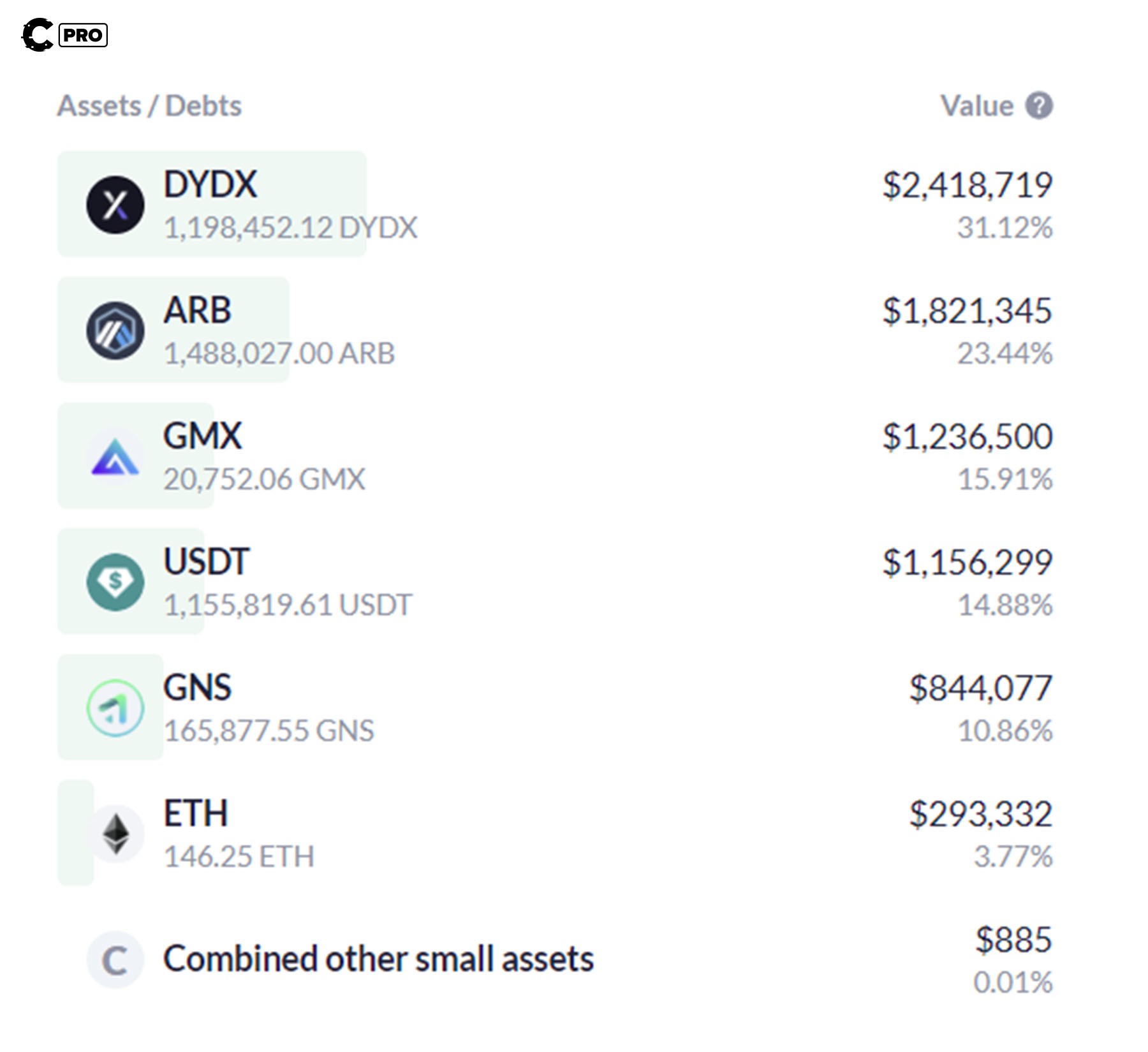

Portfolio

Big wins

- Bought $1,537,336 worth of GMX at an average price of ~$43.

- Sold GMX at $77, taking out $1,115,819

- Still holds 20,752 GMX

- Total GMX play worth $865,777, delivering an ROI of 57.53%

- Bought $1,413,625.65 or ARB at ~ $0.95 and netting a profit of $428,254.00 with an ROI of 30.29%

Strategy

Since this investor already has a portfolio worth millions, they no longer chase after the hype and meme coins. Instead, they score decent returns through many trades, earning gains of 10% or even 30%.

While these percentages may appear small individually, they can rapidly accumulate when dealing with such a substantial amount.

The positioning is a clear bet on DeFi and layer 2s, with a significant allocation to Dydx, which he recently acquired, likely to gain exposure to their V4 upgrade.

His diverse portfolio includes investments in GMX and GNS, another decentralised exchange. Plus, a significant position in ARB, signalling a bullish stance on the Arbitrum ecosystem.

His investment thesis - focused on the growth potential of decentralised exchanges on layer 2 - mirrors our approach at Skin In The Game.

Cryptonary’s take 🧠

Smart investors show a notable interest in LSD-Fi, as seen through their inclusion of USH and LBR in their portfolios. They also demonstrate optimism regarding potential growth in sectors like gambling, as indicated by their inclusion of UNIBOT and Rollbit.

Two unexpected factors that stand out are meme coins and AI coins. One investor strongly believes in the AI narrative and allocates 42% of their portfolio to an AI coin. The other investor sees potential for another surge in PEPE.

However, successful investing can sometimes be as simple as having a clear thesis. For instance, our long-term investor predicts increased market share for decentralised exchanges and Layer 2s during the next bull run—a thesis we agree with.

Overall, each investor has unique strategies and areas of specialisation. The most important thing is not to behave like pre-NZT Eddie, who is married to a dead bag. However, the distinction between the high flyers and those struggling to gain altitude is the ability to quickly adapt to the evolving market narratives and spotlight assets that the market favours.

Action points 📝

- Create accounts on DeBank or Zerion to track the wallets of these traders.

- Check out our research reports on some of the projects profiled.

- Got questions? Hit us up on Discord!

As always, thanks for reading. 🙏

Cryptonary, out!

Loading...