While Big Tech giants like Google, Microsoft, and OpenAI lead the charge in developing powerful AI models, a growing chorus raises concerns about the centralisation of this transformative technology in the hands of a few.

This reality has sparked a grassroots movement to democratise AI and counterbalance Big Tech's dominance. Among these decentralised pioneers, three blockchain projects - Fetch.ai, Ocean Protocol, and SingularityNET - have embarked on an ambitious merger to create the most formidable decentralised AI force.

This alliance represents a pivotal milestone in ensuring AI's democratisation and ethical development. But what are the key capabilities each project brings to the table?

Can their synergy catalyse the breakthrough required for ASI? What does this merger mean for those already holding FET, OCEAN, and AGIX tokens?

We explore these critical questions in depth.

Let's dive in.TLDR

- Fetch.ai, Ocean Protocol, and SingularityNET are merging to form a new entity called Artificial Superintelligence (ASI).

- The merger aims to combine their complementary capabilities to create a unified decentralised AI stack powerful enough to compete with Big Tech.

- Existing token holders of FET, OCEAN, and AGIX will have their tokens swapped into the new ASI token based on ratios captured from a March 25th snapshot.

- We analyse the benefits of the merger and the value proposition of each project's technology.

- We also explore the implications for token holders and how to maximise your ASI token allocation with strategic token swaps.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

The problem with centralised AI

The risks of an AI monopoly are severe - potential violations of privacy, stifling of innovation, censorship, and the ability of a handful of actors to manipulate and control the technological fabric that will underpin our future. As AI exponentially advances, centralised control poses existential dilemmas for humanity.- Centralised AI companies control vast amounts of user data. With access to this data, AI companies can influence user behaviour and manipulate public opinion.

- AI companies can potentially violate user privacy. They can track, monitor, and analyse user behaviour, preferences, and personal details, leading to privacy breaches and misuse of personal information.

- The dominance of a few large centralised AI companies can stifle innovation by making it difficult for smaller companies to compete. This could lead to a situation where only a handful of powerful companies dominate the AI space, potentially slowing down the pace of innovation.

- Centralised AI companies are subject to censorship and political bias. If AI systems are used to manipulate information or suppress certain viewpoints, it can undermine the ability of citizens to make informed decisions and participate in democratic processes.

FET x AGIX x OCEAN

We've seen the debut of many decentralised AI platforms in response to the problems associated with centralised AI.The challenge, however, is that they cannot compete with centralised counterparts on their own. And this is why the merger between Fetch, Ocean, and AGIX is a welcome development. This merger is positioned to unlock a synergy in which the new whole is greater than the sum of the initial parts.

Before diving into the synergy, let's look at each project in this merger.

Ocean Protocol

Ocean Protocol facilitates secure and privacy-preserving data sharing using blockchain technology, decentralised networks, and cryptographic techniques. It was founded to level the playing field for artificial intelligence (AI) and data by providing a platform where data can be shared, monetised securely, and decentralised.

The protocol is built on the Ethereum blockchain to allow data creation, trading, exchange, and monetisation through data tokens.

At the core of the Ocean Protocol are two key components: data tokens and Compute-to-Data (C2D). Data tokens are ERC20 tokens representing data assets, granting the holders access to data sets or services. This enables data providers to monetise their data while preserving privacy, as the data does not move. Instead, users must hold the necessary data tokens to access the data.

C2D, on the other hand, allows users to run compute against the data on the same premises, ensuring that sensitive data never leaves the premises of the data owner.

In 2023, Ocean Protocol saw significant advancements, including the launch of Ocean Predictor, a platform for running AI-powered prediction or trading bots on crypto price feeds. Its core technology stack expanded to allow token-gated access to AI, models, and data.

SingularityNET

SingularityNET is a decentralised, full-stack Artificial Intelligence (AI) network with an AI-as-a-Service (AaaS) marketplace. SingularityNET's core team is complemented by specialised teams focusing on various application areas, such as finance, robotics, biomedical AI, media, arts, and entertainment.

Dr. Ben Goertzel founded it to create a decentralised, democratic, inclusive, and beneficial Artificial General Intelligence (AGI) that is not dependent on any central entity and is open to anyone without being limited to the narrow goals of a single corporation or country.

The platform was developed to bridge the gap between AI developers and businesses by offering a marketplace where AI services can be easily shared, monetised, and utilised. The platform uses smart contracts to facilitate services like matchmaking, voting for governance issues, and other transactions, ensuring network validity through a ranking system among AI Agents.

The project has been a significant success, raising $36 million in its Initial Coin Offering (ICO) in December 2017. Its native utility token, AGIX, is used for transactions and decentralised community governance within the platform.

SingularityNET has been involved in notable projects, including the creation of Sophia, the world's most expressive robot, and the development of "OpenCog," an AI framework that aims to achieve advanced general intelligence.

Fetch AI

Fetch AI is a platform using artificial intelligence to help automate everyday tasks. It is a blockchain-based system where digital representations of you, called 'digital twins' or Autonomous Economic Agents (AEAs), can negotiate deals on your behalf. We've covered it at length in our deep dive report.

For example, you could book a holiday or find a parking space without doing it manually. The FET token powers the platform and is used to pay for services and to stake for governance rights.

Additionally, Fetch AI is changing how developers and organisations integrate legacy systems into the AI ecosystem. By utilising Fetch AI's technology, it is possible to transform a wide range of existing systems and platforms into AI agents, enhancing their functionality and capabilities without the need for a complete overhaul of their core API structure.

For example, communication platforms like WhatsApp, Slack, and Discord can be integrated with Fetch AI to create AI agents that can automate various tasks, such as scheduling meetings, providing real-time updates, and even engaging in natural language conversations with users.

By leveraging Fetch AI's technology, organisations can unlock the potential of their legacy systems and enhance their capabilities to meet the demands of the rapidly evolving AI landscape. This saves time and resources and enables a smoother transition into the world of AI-driven applications and services.

A merger of titans

If you are familiar with AI in general, you probably have heard about Artificial General Intelligence (AGI)AGI refers to artificial intelligence capable of understanding and learning any intellectual task a human can perform.

On the other hand, artificial superintelligence (ASI) represents a hypothetical level of artificial intelligence that is significantly more advanced than AGI. It is characterised by its ability to surpass human intelligence in every possible aspect, including reasoning, problem-solving, and creativity.

What does it take to create ASI?

Creating such intelligence requires vertically integrating infrastructure, data management, AI agents and models into a single technology stack.

Fortunately, the trio of Fetch.ai, Singularity.Net, and Ocean Protocol have unique capabilities that potentially position them to develop ASI. For instance,

- AI agents (Fetch AI)

- Data management and data sharing (Ocean Protocol)

- Rich R&D heritage in AI development and integration (SingularityNet)

We believe the merger is advantageous, and the strengths are complementary to compete with centralised counterparts. This collaboration is expected to usher in a new era for decentralised AI, bringing forth innovative advancements and opportunities.

What can FET, AGIX, and OCEAN investors expect?

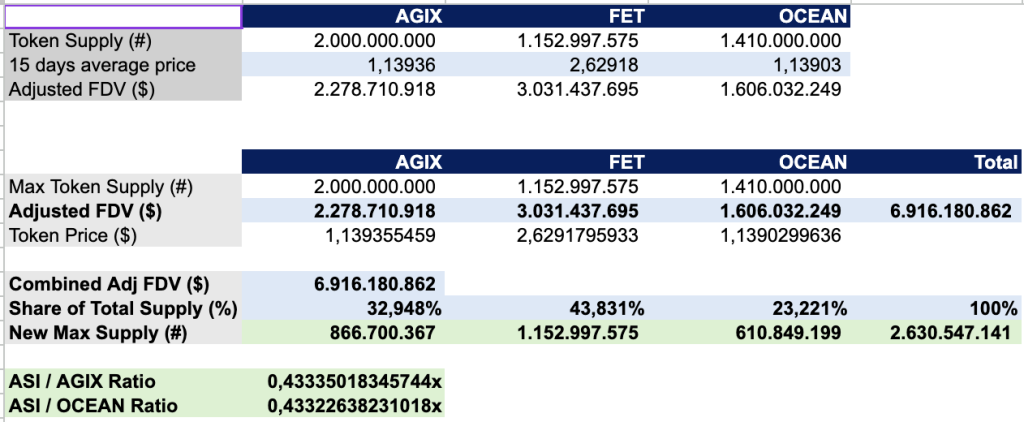

The merger aims to create the largest open-sourced, decentralised network through a token swap that combines the $FET, $OCEAN, and $AGIX tokens into a single $ASI token.The snapshot of 3 respective tokens was taken on March 25, and the combined value at the time of the snapshot was $7.5 billion.

Based on the snapshot, the ratios for swaps have been established (fixed) with FET (1:1 ratio), AGIX (1: 0.4333 ratio) and OCEAN (1: 0.4332 ratio)

That means if you hold FET, there is nothing extra to do, and the token will be upgraded on 1 to 1 basis. Similarly, AGIX and OCEAN will be automatically upgraded based on their respective ratios.

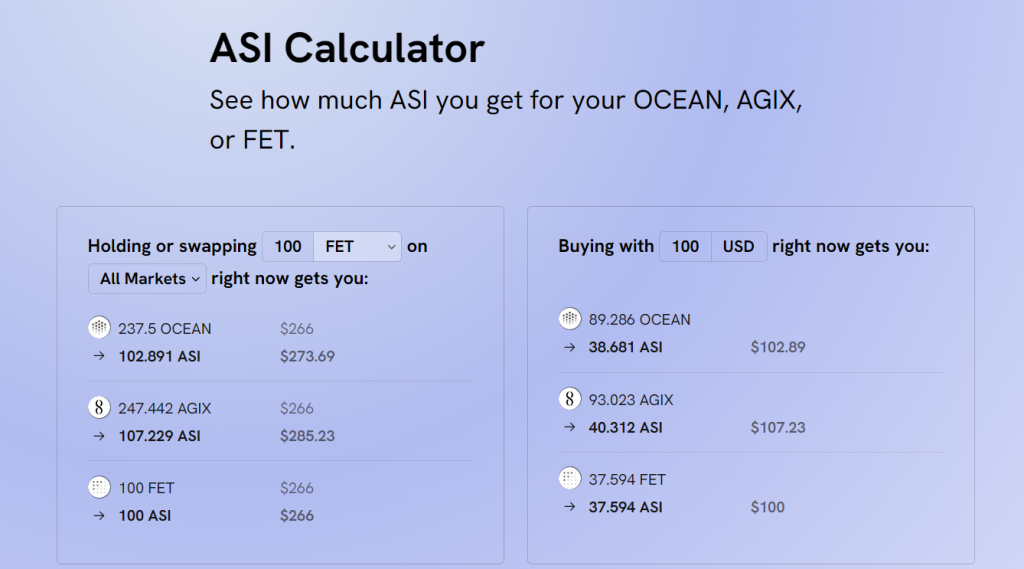

We found a real-time calculator showing how many ASI tokens you will receive if you hold or swap between them.

The above calculator shows that if you hold 100 FET, you will receive 100 ASI tokens. But if you swap 100 FET to AGIX, you will receive around seven extra ASI tokens. Based on current market conditions, this is almost $20 extra.

Therefore, if you hold a substantial amount of FET on centralised exchanges that support both assets, it might be a good deal(at the time of writing) to swap your FET to AGIX.

If you hold FET on-chain, gas fees on Ethereum might not be worth it.

Updated price targets

With important new information emerging, there is a need to have a second look at estimated price targets.Previously, our targets for FET were a $3b - $5b market cap that potentially provides a 3x to 5x upside at the time of the report. However, three independent AI projects are now merging under the ticker ASI, and we believe it is a value-creating merger.

Based on complementarities and vision for the alliance, we estimate that mcap from ASI could reach $30b-$45b (4x-6x from the $7.5b that the token will launch with).

It makes sense to continue holding FET through this merger because the upside potential has increased.

If you had bought FET when we wrote about it on March 4 at ~$ $1.71, you'd be up about 65% at current prices of ~$ $2.83. The new $30 billion to $45 billion market cap target hints at significant upside potential.

However, it is important to note that our targets on the new ASI tokens are relatively conservative because this is a history-defining merger in Web3, and there's not much of a benchmark for where the new token goes from here.

Cryptonary's take

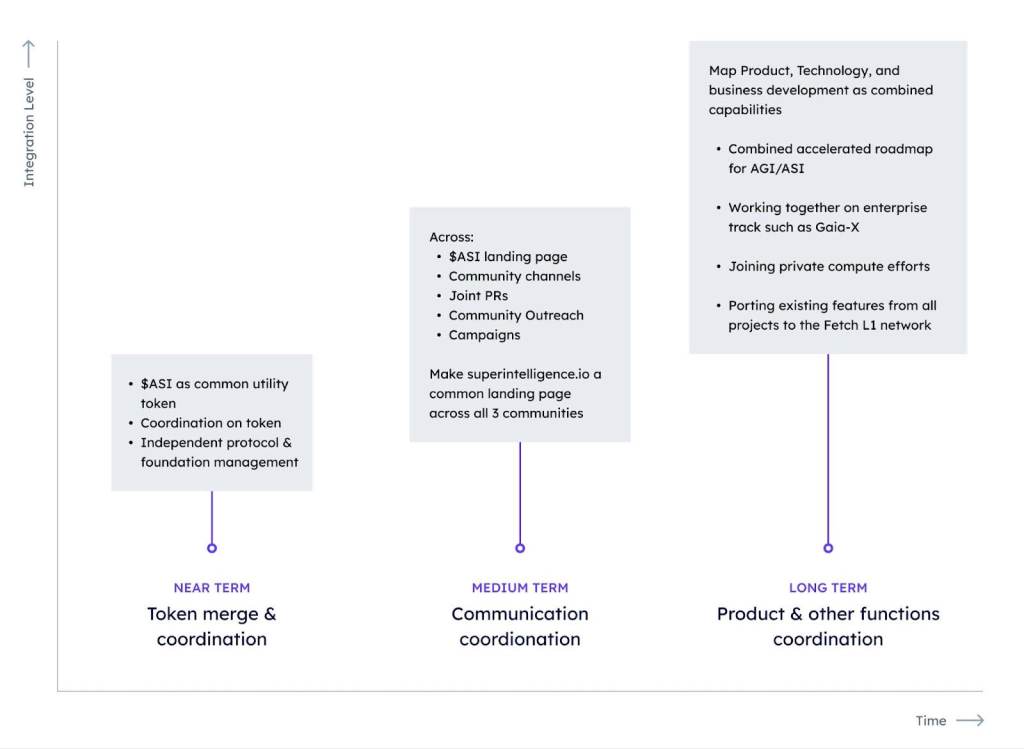

The merge of crypto platforms is not something we see often in the Web 3 space.Fetch AI, Ocean Protocol and SingularityNET are joining forces to create an Artificial SuperIntelligence Alliance to compete with centralised counterparts.

We believe it is positive for all three projects as their strength are complementary, and uniting the community and resources under the unified vision will benefit all parties involved.

However, the merger process is still under the voting process. The successful merger will require the approval of 3 governance proposals:

- Renaming the tokens.

- Hard fork on token contracts on the Ethereum and BSC networks.

- Change in the total supply of the tokens.

If you hold FET tokens, it might be a good idea to look at the calculator we provided and decide whether it's worth swapping FET for other tokens for bonus exposure.

All in all, the future looks bright for ASI from here on.

Cryptonary, OUT!