One recent innovation expected to launch with a whopping $30b-$40b market cap is EigenLayer. This project redefines what is possible on-chain and opens up new opportunities for the entire ecosystem.

While EigenLayer doesn't have a token yet, this report offers not one, not two, but THREE DeFi strategies to help you earn a compelling yield while farming EigenLayer airdrop points ahead of its token launch. You earn yield while positioning for free tokens from a $40 billion project.

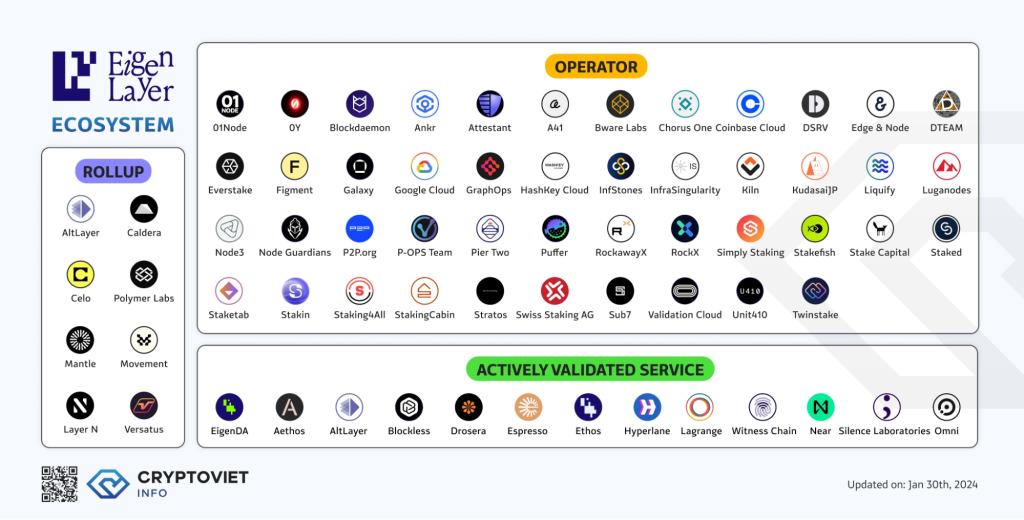

That's not all. We've also uncovered 7 AVS platforms building on EigenLayer, and these three staking strategies will make you eligible for their airdrops.

Are you ready to explore the exciting world of EigenLayer and its potential for lucrative opportunities?

Let's go!

TLDR

- Liquid staking is one of the narratives with the best product-market fit products in DeFi.

- EigenLayer is the second-biggest DeFi protocol, and it is expected to launch with a market cap of $30 billion—$40 billion.

- EigenLayer is poised to redefine on-chain possibilities and create new opportunities for the ecosystem.

- Despite EigenLayer's lack of a token yet, we outline three strategies for earning yield while farming EigenLayer airdrop points ahead of its token launch.

- These strategies could make you eligible for airdrops from 7 AVS platforms building on EigenLayer.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Ethereum staking

To understand re-staking, we first need to understand staking and liquid staking.If you aren't interested in the deep dive into restaking and EigenLayer, you can jump straight to the restaking strategies below.

Since Sep 2022, Ethereum has shifted its consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

PoS significantly reduces Ethereum's energy consumption by approximately 99.95%, making it a more eco-friendly blockchain. It also allows for more efficient transaction processing and lays the groundwork for further scalability upgrades that were impossible under PoW.

In Ethereum's PoS system, validators replace miners in maintaining the blockchain. To secure the Ethereum network, validators must stake at least 32 ETH. Validators receive rewards for correct transaction validation. However, their staked ETH gets slashed if they validate the wrong transactions.

This practice provides economic security for the network, as validators are incentivised for proper behaviour and are punished for the wrong one.

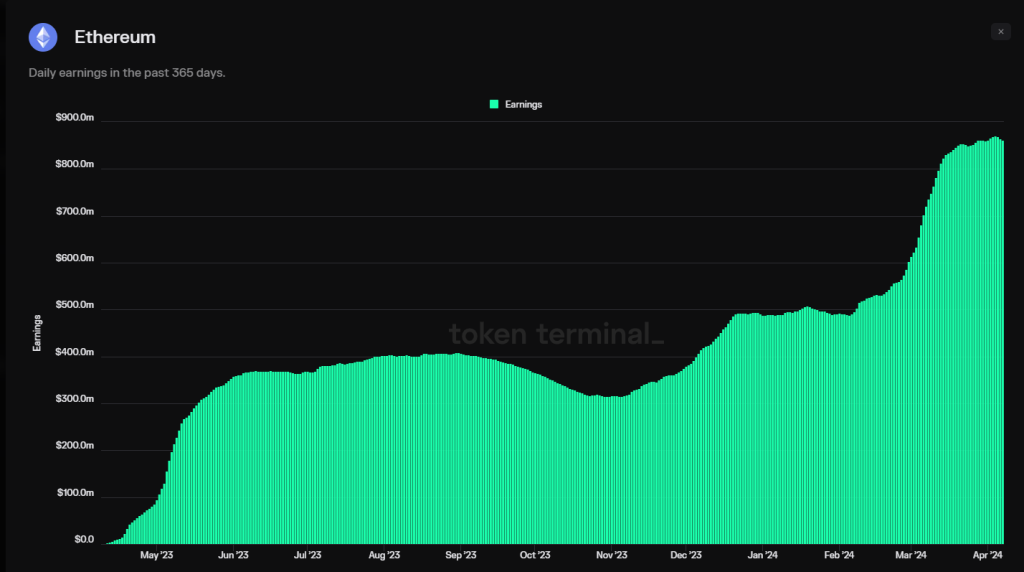

Ethereum is one of the few, if not the only, networks that is economically sustainable and has positive earnings (more fees generated than ETH emitted). In other words, after switching to PoS, it became a very profitable network.

However, the requirement of 32 ETH to participate in staking is a significant financial hurdle for many individuals, as it represents a substantial investment beyond the means of most people.

Additionally, staking Ethereum involves technical knowledge and skills that may be challenging for those without a background in DevOps or a related field.

Therefore, "liquid" staking platforms emerged as a solution to this problem.

What is liquid staking?

Liquid staking is an innovative approach to traditional staking. It allows users to participate in the staking economy with any amount of ETH.

The process of liquid staking involves depositing cryptocurrency into a staking pool or a smart contract, which in turn issues a derivative token representing the staked asset.

These derivative tokens, also known as Liquid Staking Tokens (LSTs) or Liquid Staking Derivatives (LSDs), are pegged to the value of the original asset and can be traded, lent, or used in other DeFi applications while still earning staking rewards.

This provides stakers with increased liquidity and capital efficiency, as they can begin earning rewards within a short period and can utilise their staked assets in various ways.

This DeFi compatibility allows users to enter and exit the staking process anytime.

This solution found an almost perfect product-market fit, as there are over $50b in liquid staking platforms today, and the number has been growing since inception.

However, what if you could re-stake already staked LSTs?

Restaking x EigenLayer

Simply speaking, restaking refers to the process of staking already staked LSTs.You might think that doesn't make any sense. Why would anyone restake the LSTs they got from staking ETH?

Here's why someone might want to restake their already-staked ETH:

- Increased yield: By restaking the ETH LSTs, users can earn additional staking rewards on top of the original staking rewards they are already earning.

- Diversification: Restaking LSTs across different staking pools or protocols can help users diversify their staking exposure.

- Capital efficiency: Restaking allows users to keep their staked assets working without having to withdraw and re-stake them.

Imagine you need to reserve a hotel room for your boss in another country; why would you choose Booking.com or AirBnB instead of Craiglist? Now, imagine you need a taxi to drive your kids home. Why would you choose Uber over some random person off the street?

Simply speaking, it is about extended trust and security that derives from the platforms. Both platforms aggregate various hotel options, offer reviews and ratings, and provide a seamless booking experience.

Similarly, with restaking, EigenLayer, in particular, is commoditising Ethereum's trust and security to create a marketplace where one can buy and sell the trust and security of Ethereum.

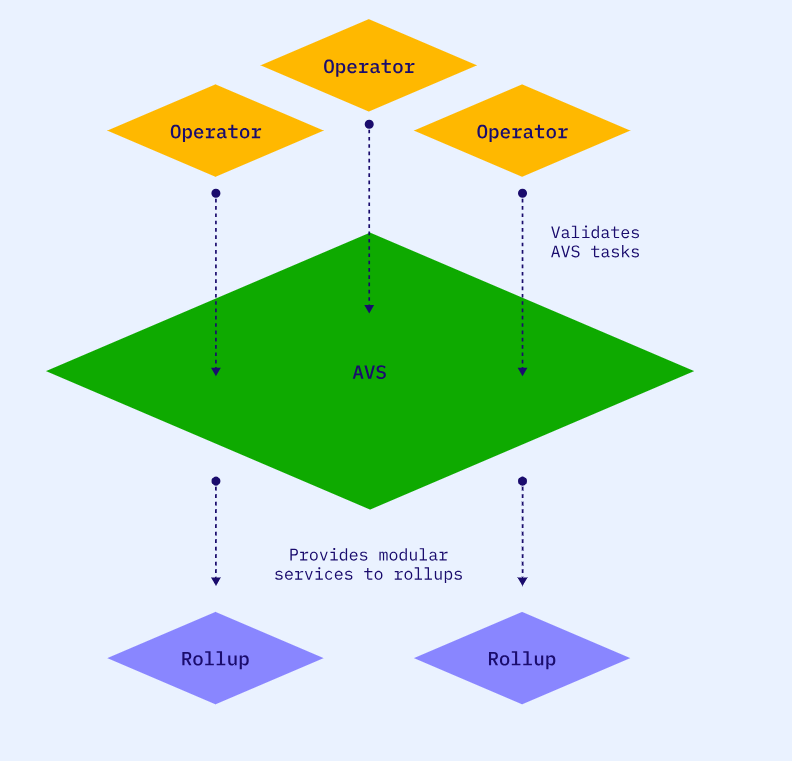

So, speaking more formally, EigenLayer is a middleware that leverages the security of the Ethereum network to enable protocols and applications built on Ethereum to benefit from this security without needing to establish their own validator set. This approach enhances the security of these protocols, reduces costs, and promotes decentralisation.

Ethereum's staking consensus has over 900k validators, making it the world's most decentralised and largest smart contract platform. With EigenLayer, Ethereum can "export" its massive economic security and validator network.

How?

Imagine you want to build a secure and decentralised service (e.g., Oracle, Bridge, etc.). You can create a new network and try to bootstrap and secure it with your own token. In this case, you hope the token will have enough value to protect you from various attack vectors (validators being incentivised, lack of liquidity, etc.).Alternatively, you can use EigenLayer.

EigenLayer is a marketplace where devs can tap into Ethereum's robust security layer.

Traditionally, protocols had to allocate a significant portion of their tokens to incentivise validators. With EigenLayer, the capital can be used more effectively, allowing protocols to tap into Ethereum's existing validator set rather than establishing their own.

This reduces the operational costs of the protocols and allows more capital to be used for protocol development and innovation.

How does it work?

EigenLayer pools together high-quality LSTs and uses their economic security to secure any projects (Actively Validated Services and Rollups) built on top of EigenLayer. This is beneficial for LST operators since they get more yield for securing additional networks, and it is also helpful for builders because now they can rent Ethereum's security without setting up their own validators and Data Availability layers.

So far, EigenLayer has gathered significant attention and capital. It is the second biggest protocol in DeFi, with over $13 billion locked.

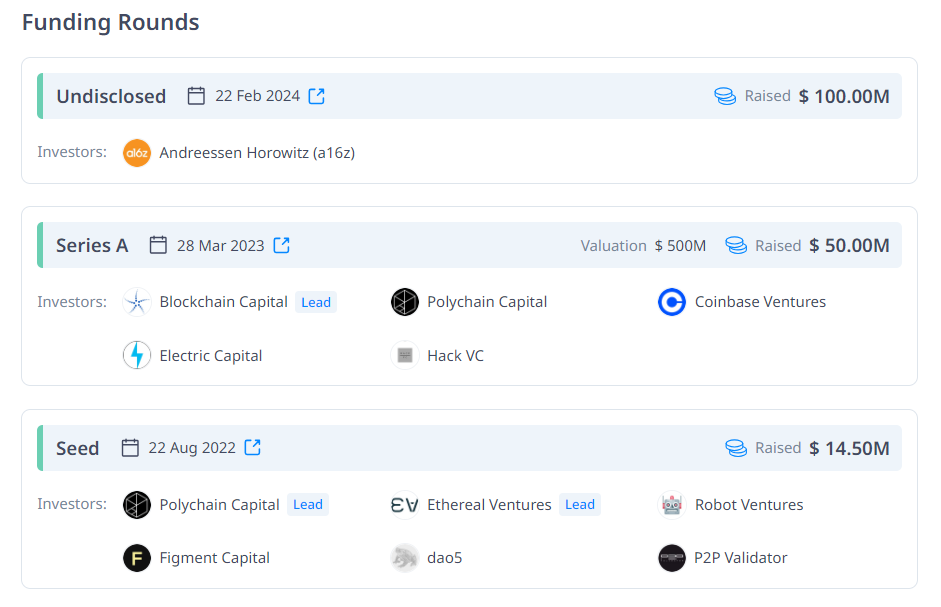

It has huge backers like Coinbase Ventures, A16z, Polychain Capital, etc.

A16Z's general partner believes that EigenLayer has the "potential to change everything." And despite being young, EigenLayer already has a massive ecosystem.

How do we position ourselves to win with EigenLayer?

So, we now understand that EigenLayer will be an important part of the Ethereum ecosystem infrastructure. Still, the problem with it, from the investment perspective, is that It doesn't have a token yet.Fortunately, we found strategies that would let us position ourselves for the EigenLayer airdrop and the whole EigenLayer ecosystem. This includes:

- ETH Stacking yield

- EigenLayer airdrop

- Liquid Restaking platforms' airdrop (e.g. Airdrop from EtherFi has been juicy)

- Potential AVS airdrops (E.g. Airdrop from AltLayer has been juicy as well)

- Composable Defi Yield strategies (e.g. Pendle + Beefy, Renzo+Ionic)

- Mode airdrop

- Ionic airdrop

- Scroll airdrop

- Ambient finance

- LayerBank

Want to know how?

Let's start!

Strategy 1

- You will need some ETH on the Arbitrum network (500$ - 1000$ at least; size matters in this one; therefore, the more, the better)

- Go to KelpDAO and re-stake your ETH (you will receive rsETH)

- Go to Pendle and zap in your rsETH with "zero price impact mode" enabled

- Go to Beefy and deposit your LP token to the farm

- Happy farming!

- (Optional) If you are aggressive and can manage risks, you can borrow ETH for 2%-3% on CEXs or DeFi Lending platforms and pocket the differences and points. However, leverage is typically risky and can result in loss of funds. We strongly discourage this practice if you are a beginner.

Benefits

- Staking yield on ETH 2%-3%

- EigenLayer points (currently valued at around $0.18-$0.2 each on secondary markets)

- 2.5x Kelp Miles (2.5 x 10k Miles per day per 1 rsETH; 1 mile is valued at $0.0004 -> should be over 80% APY)

- Pendle LP -> 63% for the pool maturing on the 25th of Apr and 40% for the pool maturing on the 27th of June

- Yield boost with Beefy auto-compounding through Equilibria -> around 60%

For Pendle yield, you need to claim on Pendle's website. You can buy Yield Tokens ( YT-tokens) as an alternative to adding LP. YT tokens will help you accumulate EigenLayer and Kelp points with around 18x to 50x leverage.

However, as you get closer to the maturity date, your principal will slowly go to 0, but you will have many points. By buying YT tokens, you are betting that the airdrop will be worth much more than the principal. People who bought YT tokens for Ethena don't regret their decision; however, there's no guarantee with airdrops, so exercise caution.

Alternatively, you can also buy PT tokens. By buying PT tokens, you give up all your EigenLayer points and Kelp miles, but in exchange, you receive around 60% fixed yield on ETH. That is, if you don't want to farm airdrops and want to receive a stable yield, this is a much simpler play.

Beefy auto-compounds some of the yield by selling rewarded Pendle and Equilibria's gov tokens back into rstETH.

EigenLayer and KelpDAO will probably drop their tokens in the coming month. If you think it is late, let us show you what Kamino, Ethena, EtherFi, and Parcl are all doing. They are all launching Season 2.

Therefore, even though there might be little time left for the initial drop, we believe projects requiring liquidity will launch Season 2 to prevent the mercenary behaviour of airdrop farmers.

Here is a step-by-step tutorial

Strategy 2

- You will need ETH on the Scroll network (You can bridge using Orbiter; 500$ - 1000$ at least; size matters in this one; therefore, the more, the better)

- Go to KelpDAO and re-stake your ETH (you will receive rsETH)

- Add rsETH (KelpDAO Restaked ETH) as liquidity to Ambient Finance to wrsETH/ETH pool

- Lend wrsETH on LayerBank

- Happy farming!

Benefits

- Staking yield on ETH 2%-3%

- EigenLayer points (currently valued at around $0.18-$0.2 each on secondary markets)

- 100 extra EigenLayer points per ETH staked

- Kelp Miles (10k Miles per day per 1 rsETH; 1 mile is valued at $0.0004 -> around 40%)

- Ambient points

- Layer Bank points

- Transactions on Scroll (tokenless as well)

- Potential airdrops from AVSs

Strategy 3

- You will need ETH on the Mode network (You can use Orbiter/Symbiosis to bridge to Mode)

- Go to Renzo and restake your ETH to get ezETH (500$ - 1000$ at least; size matters in this one; therefore, the more, the better)

- Supply ezETH to Ionic

- Chill

- (Optional) if you are bullish on ETH long term, you can borrow USDC/USDT against your ezETH on Ionic (bonus points) and swap it to ETH using Kim exchange and repeat the process starting with step 1 (bonus points)

Benefits

- Staking yield on ETH 2%-3%

- EigenLayer points (currently valued at around $0.18-$0.2 each on secondary markets)

- Renzo points ($0.27 per ezPoint; 1 ezPoint per $ezETH per hour → 8,760 Points per year → $2,365. APY: 71%.)

- Mode points

- Ionic points

- Potential airdrops from AVSs

Cryptonary's take

EigenLayer and restaking are becoming key pieces of infrastructure pushing innovation forward within the Ethereum ecosystem.Despite being a tokenless project, we presented you three defi strategies for earning an attractive yield, farming airdrop points for EigenLayer, seven tokenless platforms and potential airdrop from AVSs that are building on top of EigenLayer in a smart and composable manner.

Based on industry trends, despite airdrops potentially dropping soon, we believe there will be Season 2s because projects don't want capital leaving.

Therefore, we believe there is still time to position ourselves for substantial upcoming airdrops and yields from the EigenLayer ecosystem.

Cryptonary, Out!