We brought this project to your attention in May when we discussed its potential to unlock about $70b in latent capital on Solana. But it didn't have a token then, and beyond farming airdrops, there was not much you could do.

With Bitcoin above the $63k resistance and the market environment improving, many teams that delayed their token generation events are now starting to execute their token launches.

One such project is Sanctum.

This critical piece of infrastructure in the Solana ecosystem is launching its token this week. If you missed this airdrop, this launch presents a unique opportunity for quick short-term profits. If you got the airdrop, we will also share a playbook on how to get the maximum value out of your allocation.

Sounds exciting?

Let's dive in…

TLDR

- Sanctum is launching its CLOUD token, featuring Alpha Vaults for discounted purchases with a six-month vesting period.

- Significant airdrop rewards community participation; linear distribution model deters Sybil attacks.

- Monitor prices between $0.15 and $0.5; we recommended actions for buying and selling based on market movements.

- Sanctum's innovations enhance Solana's liquidity and capital efficiency, making it a key infrastructure component and promising investment.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A quick primer

As we covered here, Sanctum is a DeFi protocol that facilitates liquid staking on the Solana blockchain. It aims to unlock $70b of latent capital on Solana.One of Sanctum's key innovations is its unified liquidity pool, which allows an infinite number of LSTs to be added to a single pool.

Sanctum has shown significant traction within the Solana community, with TVL exceeding $900 million.

Similar in importance but different in roles, the Sanctum has become one of Solana's key infrastructure, just like Jupiter.

It plays a crucial role in improving the liquidity and capital efficiency of liquid staked tokens on Solana and bringing interesting use cases that unite the community not only with monetary incentives but also culturally.

Alpha Vaults

Sanctum is pioneering an "Alpha Vault" to launch its CLOUD tokens. Alpha Vaults are designed to allow long-term believers in Sanctum to purchase $CLOUD tokens at a potentially better price.In return, these tokens are vested for six months. This mechanism encourages long-term alignment with Sanctum's vision and mission.

To participate in the Alpha Vault, users need to deposit USDC into the vault. The amount of USDC deposited determines the estimated amount of tokens and discount received.

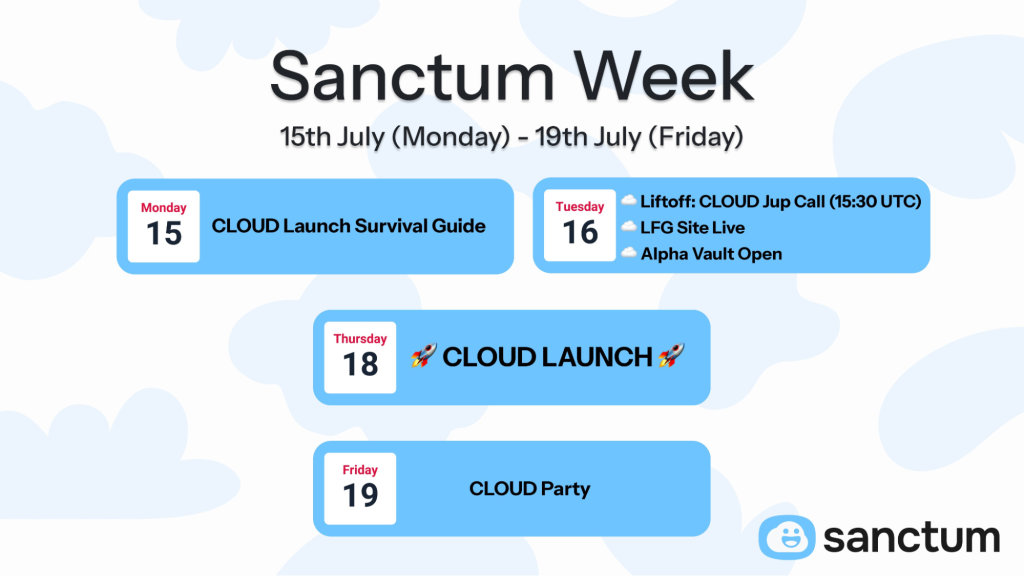

The Alpha Vault will be open for deposits from Tuesday, July 16th, 12:00 GMT, to Thursday, July 18th, 10:00 GMT. The vault is not first-come-first-served; there is no need to rush.

If the vault fills completely, the maximum price vault buyers will pay is $0.15 ($7.5M / 50M CLOUD = $0.15 per CLOUD); the spot price will start around $0.278. (46% discount!)

If the vault does not fill completely, both the spot price and price paid by vault buyers will be even lower.

Thus, if you enter Alpha Vault, your maximum price is $0.15, the circulating market cap will be just $30m, and the fully diluted market cap will be $150m.At $30m, you will buy at a lower valuation than first-round VCs and at 3x the VC price when looked at from a fully diluted perspective.

We believe we will see positive price action in crypto in the next six months. Therefore, if you are okay with swallowing short-term volatility due to potential whales selling, Alpha Vaults is an excellent opportunity to enter $CLOUD at the minimum possible price in the medium term.

Overall, it is an excellent opportunity for retail to enter $CLOUD at prices very close to early investors.

Here is our deep dive if you want to build conviction first and learn about Sanctum.

Short-term playbook

The price of the LFG pool will range between $0.0001 and $0.5. Currently, $CLOUD is trading at $0.31 on secondary markets, implying around $62m circulating market cap and $310m fully diluted market cap.Now, if the price is between $0.15 < x < $0.2, we will potentially look to add to our spot position in the short term.

That would mean we have the same price VCs bought two years ago, at least in terms of circulating supply.

The token is expected to launch at $0.278. However, as we have seen repeatedly in the market, airdrop farmers usually rush to sell their tokens the moment they go live.

Given that the majority of the airdrop is allocated to 1% of wallets, we can expect some profit-taking when the token launches. However, we expect it to be short-term and prices to rebound, as with Jupiter.

If the prices reach $0.15 < x < $0.2 region, it might be an excellent area to bid and take profit in the upper range between around $0.42 - $0.5. We can also expect prices to surpass the price curve on secondary markets since $CLOUD will be listed on several CEXes.

If prices don't reach $0.42- $0.5 in the first 12 days, it is essential to take profits at around $0.3 due to potential selling pressure from whales.

We don't have a long-term target valuation yet. However, after everything settles, we will come back with a valuation exercise and explore the long-term opportunity.

Airdrop update

We covered Sanctum as a potential airdrop opportunity several times here and here.Finally, this week is set to be a Sanctum Week, with an eligibility checker, token distribution, and Meteora vaults for true Sanctum fans.

The airdrop will launch on July 18th on Jupiter's LFG launchpad and distribute the governance token $CLOUD.

Sanctum has opted for a linear distribution model for the airdrop, which will reward true community participation while deterring Sybil attacks.

If you have followed our airdrop guides, you should check your eligibility on July 16th (Tuesday)

Additionally, there will be Alpha vaults on Meteora where you can buy $CLOUD tokens before they launch in exchange for vesting.

So, how to play Sanctum launch.

CLOUD launch playbook

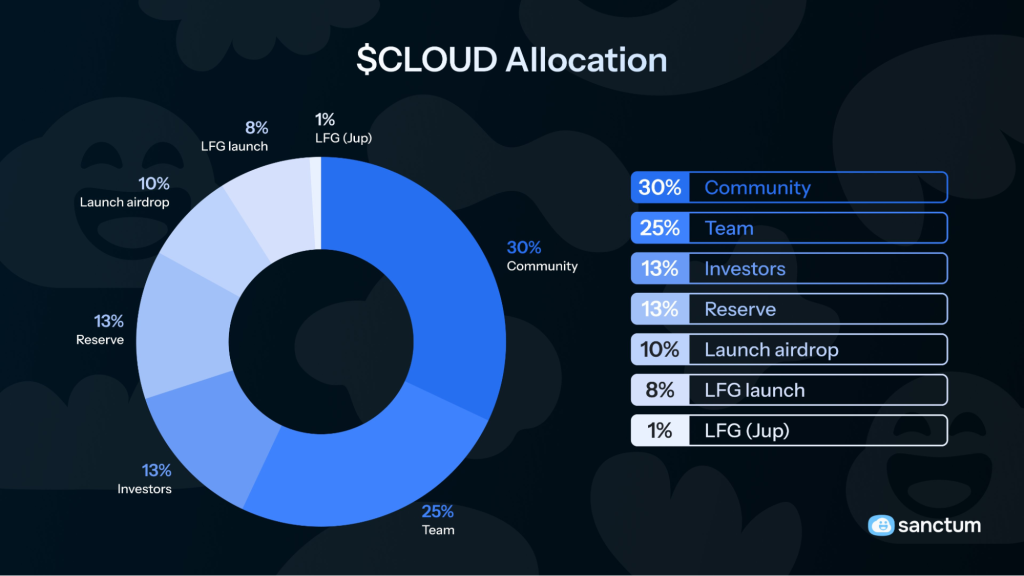

First, 10% of the supply will be allocated to airdrop participants, while another 9% will be used for launch on Jupiter. Thus, the initial circulating supply is expected to be 19%.

1% of wallets accumulated 73.6% of Wonderland EXP (points). Since there is no tiered distribution, over 70% of tokens will be claimed by just 1%, so an initial sell-off is likely. However, on a brighter sight, the Sanctum team conducted a rigorous sybil filtering.

Therefore, eligible wallets will receive additional tokens (for "Earnestness") in addition to their normal allocation.

You can check your eligibility here.

If you are eligible, you will have two choices to make:

- If you like Sanctum as an investment, you can wait 14 days to claim your allocation, and you will get 100% bonus tokens (two times more tokens). Your bonus allocation will increase linearly the longer you wait, topping out at 100% in 14 days.

- Similarly, your "Earnestness" allocation will have similar mechanics but with a longer timeframe. To get the total 100% bonus for Earnestness, wait 180 days.

The playbook for users qualified for the airdrop is similar to the short-term trading described above.

The price of the LFG pool will range between $0.0001 and $0.5. Currently, $CLOUD is trading at $0.31 on secondary markets, implying around $62m circulating market cap and $310m fully diluted market cap.

We don't recommend selling the airdrop immediately; instead, we would let the market discover the price first.

If it trades at around $0.42 - $0.5 in the first 14 days, we recommend claiming and selling Earnestness allocation. If the token starts trading above $0.5 on secondary markets like Bybit, we sell half of our main allocation and let the rest ride.It is important to secure some profits because 1% of whales control 77% of the airdrop.

If the token starts trading at $0.3, we won't sell in the first 12 (not 14) days (because we want to front-run others waiting for a full 14 days) since even VCs entered at $50m and $60m valuations and wait to double our allocation.

However, after 12 days, if the price is around $0.3, we will sell our bonus allocation and "Earnestness" allocation and let the rest ride.

Now, if the price is between $0.15 < x < $0.2, we will potentially look to add to our spot position in the short term.

Cryptonary's take

Sanctum, a DeFi protocol on the Solana blockchain, is launching its CLOUD token, offering investors a lucrative opportunity.It is launching Alpha Vaults, which will allow you to purchase tokens at a discount, with a six-month vesting period and a significant airdrop rewarding community participation.

The short-term strategy involves monitoring price ranges between $0.15 and $0.5, with recommended profit-taking actions.

We have provided a similar playbook for airdrop farmers on what to expect and how to conduct the launch.

The long-term strategy will be refined post-launch. Sanctum's innovations, such as its unified liquidity pool, enhance liquidity and capital efficiency on Solana, making it a pivotal infrastructure component in the ecosystem and a promising investment opportunity.

Cryptonary, OUT!