Institutional Capital: What's Coming Next?

At the end of 2020, we posted a journal where we analysed data from the Grayscale Fund in order to deduce where institutional capital might flow next. We recommend reading that journal first, as it will provide some context for the ideas presented in this journal.

Since then, we have seen the local Bitcoin top set at ~$64k, followed by the sharp correction in May.

One thing that hasn’t changed though is that institutions are still looking for crypto exposure, and there has only been a couple of examples of institutions selling through this period.

Whether through one of the investment funds or direct exposure by purchasing assets, institutional demand for crypto exposure is still ripe – and growing.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

2021 Highlights

Since we released the journal in December of last year, we have seen a substantial increase in both direct and indirect institutional involvement in the crypto market. We cannot talk about institutional investment in crypto without mentioning two of the largest Bitcoin holding entities.MicroStrategy

MicroStrategy holds one of the largest Bitcoin portfolios in existence, with over 105,000 BTC in their possession, equal to 0.5% of the circulating supply. Michael Saylor, the CEO and one of the most prominent Bitcoin miners, has shown no signs of slowing down in his hunger for Bitcoin.MicroStrategy had been accumulating $10 million or so worth of Bitcoin frequently since around August 2020, a prime example of dollar-cost averaging (DCA). However, one month after the correction in May of this year, MicroStrategy executed another large purchase of just over 13,000 Bitcoin at an average price of $37,617.

The majority of MicroStrategy’s market capitalisation is due to the value of Bitcoin they own—so much so that there are a couple of examples of MicroStrategy stock being purchased with the intention of gaining indirect exposure to Bitcoin.

Tesla

One of the biggest events of February 2021 was Tesla announcing they had purchased 43,200 BTC. The news pumped Bitcoin over 20% on the day of the announcement. The hype surrounding Elon at the time with respect to his public support for crypto was more influential than the actual purchase.Tesla also announced that they would be taking payments in Bitcoin for Tesla vehicles, but they have since backtracked and removed that option for customers. The reasoning for these environmental concerns is the Proof-of-Work consensus mechanism, which requires huge amounts of electricity in order to run the processors required for mining. This caused a noticeable dip in the Bitcoin price.

Paul Tudor Jones (PTJ)

PTJ is one of the most accomplished macro-investors on the planet, with investment experience spanning 45+ years. In an interview in mid-June, he stated that he liked Bitcoin and viewed it as a great asset for diversifying a portfolio. He added that he believes Bitcoin to be a solid asset for storing wealth over time. His statements further the case for the store-of-value narrative that we have been seeing from many institutional players, such as Michael Saylor and Mark Cuban.To provide a bit of background, Jones successfully predicted and shorted the 1987 Black Monday stock market crash, and the 1990’s Japanese Equities Bubble. His macro views have largely been accurate for the last several decades, so his opinions are not to be taken lightly. He had previously invested in Bitcoin in 2020, but was not as publicly outspoken about it until recently.

Square Inc.

Square, the creator of CashApp, is a digital payments company started in 2009 by Jack Dorsey and Jim McKelvey. Jack Dorsey, the CEO of Square and co-founder of Twitter, has been one of the most vocal supporters of blockchain technology in recent years. He has stated on multiple occasions that he believes the crypto market “feels like the early days of the internet” and that there “isn’t anything more important” for him to work on in his lifetime.In July, Square announced that it was beginning the first steps towards the creation of a new business that will provide decentralised financial services with a focus on Bitcoin. Additionally, Dorsey has recently announced that Bitcoin will have a large role to play in the future of Twitter, and he is actively looking for ways to integrate the currency into the social media platform. It has been suggested that Bitcoin could be used on the site for applications such as tipping, “super follows," subscriptions, and other services, both currently available and in development.

Twitter is one of the largest social media platforms on the planet, and so the involvement and integration of cryptocurrencies within that space is a clear indicator of the ongoing adoption of crypto.

Grayscale (GBTC)

Grayscale Investment Funds are used by many institutional investors to gain exposure to crypto-assets. In the December 2020 journal, we analysed volume on the Bitcoin Trust (GBTC). Let’s have a look at what has happened since then.

The above chart shows the weekly trading volume for GBTC shares. This is an important metric, as generally, Bitcoin is the go-to asset for institutional investors due to its greater liquidity (in USD denomination), and GBTC shares are attractive to these investors because they are traded on the stock market.

As predicted in December, the average trading volume has increased considerably since last year in line with the wider bull market rally. This indicates clear institutional interest in crypto exposure for investors that may find it more convenient to buy GBTC shares than the Bitcoin they represent.

One important point is that substantial volume has remained despite the May correction. Compare this to the 2017/18 bubble, where volume dropped off to lows almost immediately after the first signs of market weakness. The relative stability of trading volume suggests that a number of the new market participants that entered in the last 12–18 months have remained active in the markets and are likely here to stay.

Market Movements

There has been a subtle sign of institutional involvement that has become evident through the recent Bitcoin price action around the time when the New York trading session opens. Trading desks in New York are most active around 8–10 a.m. local time, which is around 1-3 UK time.

The above chart shows the Bitcoin price in the 2H timeframe, with the New York sessions highlighted in green. From the end of July through mid-August, there were notable price increases in most of the New York sessions. This suggests institutional activity in the largest financial centres in the world, specifically bid and buying pressure. Although volume has been on the decline since around mid-August, the apparent trend of increased institutional activity during these times is likely a sign that the crypto market is becoming more linked with the trading activity of the New York trading desks.

Where has the institutional capital flowed to?

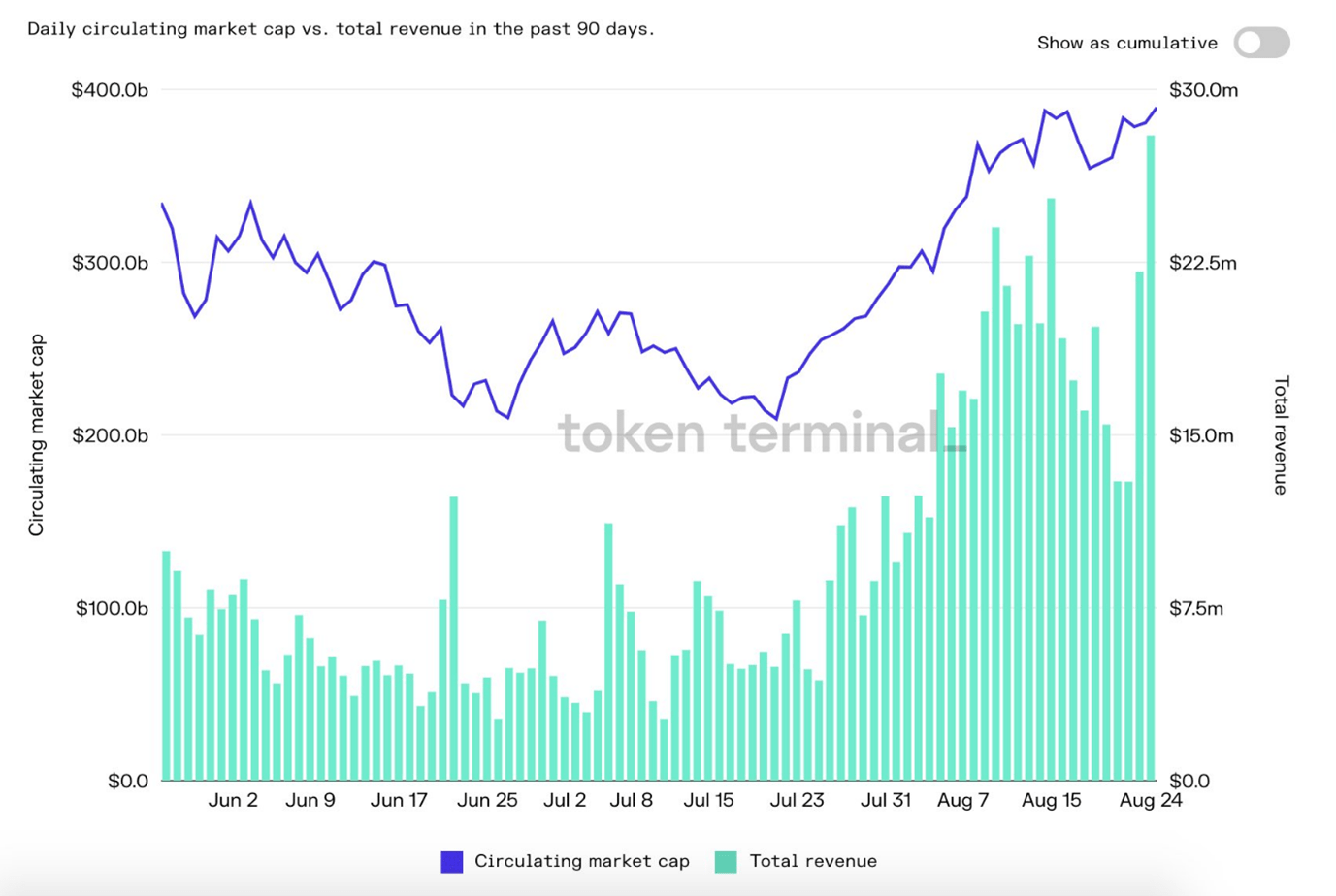

Bitcoin has been at the forefront of institutional involvement for the last 18 months, but Bitcoin is not the endgame. Rather, BTC is the institutional gateway to crypto owing to its greater liquidity and popularity as the current leader of the crypto market. In the previous journal, we stated that we believed Ethereum would likely be the next asset that would attract institutional interest. The reasoning behind this is that Ethereum has the most liquidity (in US Dollar/capitalisation terms) after Bitcoin and boasts the dominant DeFi ecosystem in the crypto market.In December 2020, the Managing Director of Grayscale, Michael Sonnenshein, stated that Grayscale was witnessing a new wave of investors who are “ethereum-first” and “ethereum-only.”. What he meant by this is that there is a large cohort of investors who are more interested in Ethereum than any other asset, and there is growing conviction around Ethereum as an asset class. As stated previously, Grayscale is used by many institutional investors to gain exposure to the crypto market. As such, what is ultimately implied through these statements is that ETH is becoming a more attractive avenue for investment for large-scale institutional funds than it has been previously.

And it’s no wonder—ETH is a productive asset. With Proof-of-Stake coming to Ethereum through the ETH2.0 upgrades, staking ETH will become a vast source of revenue. Earlier this year, a couple of senior analysts at JP Morgan suggested that the enhanced capabilities of Ethereum through the ETH2.0 upgrades coming in the next 12 months or so could create a staking industry generating $40 billion+ in revenue (rewards) per year by 2025.

It is not so much their prediction that is the striking news; it is the fact that they’re actively analysing and putting out this sort of information. The crypto space doesn’t listen much to what banks have to say, but other institutions do. The fact that JP Morgan (and others) appear to be doing their homework on crypto builds up the legitimacy of crypto as a viable institutional asset class.

Ethereum is the settlement layer for a huge portion of the burgeoning DeFi economy. We have stated this before, but ETH is to DeFi what the US dollar is to the world economy. ETH is the fuel that powers Ethereum, and Ethereum is the network on which the majority of decentralised financial activity occurs.

Additionally, with the EIP-1559 improvements, Ethereum has become partially deflationary, meaning that ETH is being removed from supply regularly and at a massive rate. Over 150,000 ETH has been burned since the improvements went live on the 5th of August (just under 4 weeks at the time of writing), which is a ~43% reduction in issuance when compared to ETH emissions before EIP-1559. Further reducing the circulating ETH supply is the ETH2.0 staking uptake – over 6% of total circulating ETH is currently locked in the staking contract. These parameters add up to a substantial supply shock, one that we believe the market has yet to fully realise.

Another interesting development came in March when Meitu, a Chinese company that creates photo editing software, announced that they had added $22.1 million worth of ETH and $17.9 million worth of BTC to their balance sheet. Although these numbers are relatively small, they effectively became the first large company to purchase Ether. If the first major company has only invested in Ether this year, think where things are heading in 1, 5, 10 years.

Towards the end of August, Coinbase announced that the board had approved the allocation of $500 million towards the addition of crypto to the company's balance sheet. Additionally, a further 10% of profits are to be invested in crypto, a number that is expected to increase over time. This move is set to establish the crypto exchange as one of the first publicly traded companies to hold ETH and other decentralised finance tokens.

These direct purchases go way beyond using derivatives or exchange-traded funds (ETFs) to gain exposure to the crypto market and show a growing level of conviction from institutional investors not only in Bitcoin but in the altcoin market as well. The legitimisation of DeFi and other alternative investments in the crypto market from an institutional perspective provides ample evidence for the ongoing adoption of cryptocurrencies and blockchain technology.

Final Thoughts

The effect that institutions have on the market, either through direct means such as purchasing large quantities of crypto or through the influence of their key figures or the reputation of their brand, is undeniable. Institutional involvement in crypto is still at relatively low levels considering the trillions of dollars of cash that is currently not being utilised by thousands of large companies.The door has been open to institutions for a while, and we believe it is only a matter of time before investment in crypto assets becomes common practice. The result of this happening in terms of the crypto market cap and the future of cryptocurrencies would be huge. Watch this space.