For years, the crypto community has been dreaming about institutions with popular memes about waiting for institutions to pump our bags. In 2020, we saw that door open and money started flowing into BTC and then it seemed like things just... dried off. No new corporate announcements.

In the following report, we analyse the institutional capital flow and interest to answer the question: was that the beginning, or the end?

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Institutional Capital

First and foremost, we'll define what institutional capital is.Definition: Institutional money tends to be the big money. The most common types of institutional investors are mutual funds, family offices, hedge funds, pension funds, investment banks and insurance companies. They usually invest capital on behalf of other investors, whom range from being average everyday people to HNWI (high net worth individuals) and even sovereign funds.

Why are institutions important? They control the majority of investable assets. Some estimate that they're responsible for about 70% of stock exchange volumes.

From Internet Meme to Investment

Crypto can be both a blessing and a curse for institutions. For one, there's the obvious side of high returns but on the other there's the possibility of ending up investing in the very thing that kills them: decentralised entities. For the latter reason and the regulatory uncertainty, many institutions tried to keep away from crypto, but they've just hit a wall.You see, until the pandemic was kicked off in March 2020, many saw crypto as "magic internet money beans". Crypto was this "thing" you'd be deemed stupid for investing in on Wall Street because if you were going against the crowd and if you lost money on it, you'd kiss your career goodbye by taking a very odd road with your investments.

Suddenly though, things changed. The pandemic hit and the Federal Reserve turned on their printers and just "Brrrrr"-ed.

There are two main types of investors that make up TradFi:

- The wave makers

- The sheep that follow

When the FED started printing money like never before, investors began worrying about inflation and needed a way to hedge. Of course, they could take the traditional route of investing in gold or they could look at this alternative investment that has a fixed supply and is fully governed by code with no transport, storage or liquidity issues: Bitcoin. That's exactly what legendary investor Paul Tudor Jones did and as a wave-maker, the sheep started following but not in bulk yet.

Institutions invest capital on behalf of investors and when the asset owners see that there's a brand new asset class that's practically an untapped market, their interest peaks and they often want to dip their toes in them. Then, they express that interest to their money managers whom have fulfill their wishes. Otherwise the investors would simply take their capital elsewhere and hand it over to someone that would. That's exactly what happened with JPMorgan.

JPMorgan

JPMorgan is the biggest bank in the U.S; they control over $3.3 Trillion worth of assets. On the 22nd of July 2021, the bank announced that they've given the greenlight to start offering cryptocurrency funds to their wealthy clientele from the wealth management wing. These clients hold no less than $10,000,000 each. Customer demand pushed through the move which goes to show that the institutional interest truly is alive and well.Many often perceive this bank as a "crypto-hater" due to their CEO's public stance. However, the bank itself is not as anti-crypto as many believe. In fact, in recent weeks they even announced that Ethereum may kickstart a $40 Billion staking industry.

Now let's look at some more concrete numbers.

7 out of 10 Institutional Investors

Fidelity Digital Assets has conducted a survey in July which states:- 71% of institutional investors plan to buy or invest in digital assets

- 90% of interest institutions expect to make an investment within the next five years

- 80% of institutional investors believe digital assets must be part of a portfolio

President of Fidelity Digital Assets has stated:

The increased interest and adoption we’re seeing is a reflection of the growing sophistication and institutionalization of the digital assets ecosystem.Investing in digital assets itself is difficult for most institutions because they don't know how to value them and the volatility is extreme, yet they still want to dip their toes. This is where investments in crypto-business comes in.

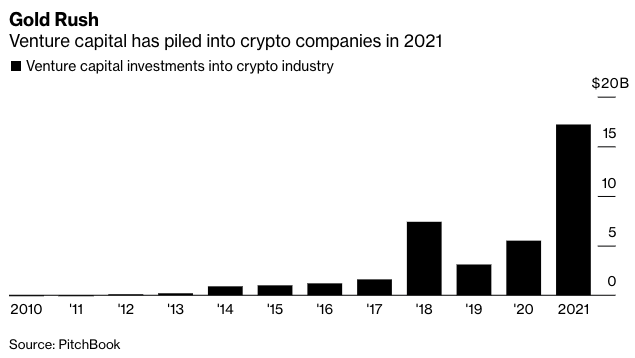

Record Numbers from VCs

According to Pitchbook, the amount of venture capital invested in crypto-businesses this year has dwarfed every other year in the past. From less than $1 Billion in 2014 to $5.5 Billion last year and over $17 Billion this year.

Businesses are more tangible and familiar investments to institutions. They are slightly less volatile and can be valued based off fundamentals.

One specific example is the recent Series B raise fo the cryptocurrency exchange FTX where $900 Million was raised at an $18 Billion valuation. The investors included Paul Tudor Jones family, VanEck, Hudson River Trading and Alan Howard.

Closing Words

The institutional flow is only at its start. This industry's maturity and institutional capital invested will grow in tandem over the next few years. Crypto-markets will become more efficient and growth more sustainable.The question to ask is:

If more capital is flowing and buying, do we want to be selling? Our answer is: No.