Introducing a new real estate project with a 45x upside on Solana

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

We found a project that aims to drastically improve the real estate markets, making them more efficient, transparent, and open for everyone to participate in.

Beyond that, this project aims to become a data hub for global real estate markets.

Many people are missing its USP and fading its potential -- but not us.

We believe this project can deliver up to 45x if it lives up to its potential.

Do you want to know more?

Let's dive in.

TLDR

- This project aims to transform the real estate market by making it more efficient, transparent, and open for broader participation.

- It provides a unique solution for investing, hedging, and gaining exposure to real estate markets globally in a liquid and low-cost manner.

- The project has a data platform that can provide real-time, accurate real estate analytics to empower property investments. We see institutional adoption as the key moat.

- The data platform's ability to be more dynamic than industry benchmarks like the Case-Shiller Index gives it a significant competitive edge.

- The project has significant upside potential, with price targets ranging from a $500M market cap in the base case to a $3B market cap in the best-case scenario.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Parcl

Let's start with what we believe most people would think about Parcl.

Parcl is a real-time liquid real estate trading platform built on the Solana blockchain. It enables users to invest in and trade - long or short with up to 10x leverage - in specific geographical markets.

This is a significant departure from traditional real estate investment, which typically lacks the liquidity and flexibility that Parcl provides.

By merging exposure to real estate price movements with DeFi, Parcl offers a unique solution to the limited options for investing, hedging, and gaining exposure to real estate from all around the world in a liquid and low-cost manner.

One of the key advantages of Parcl is its use of machine learning and geospatial data to capture the price per square foot/meter of any given neighbourhood or city, with data moving dynamically in real time.

Parcl's vision is to democratise access to real estate investments, offering a platform where individuals can gain exposure to real estate markets. This inclusivity aims to attract a wide range of users, including those without property seeking exposure to real estate markets, homeowners looking to hedge their investments, and commercial real estate owners seeking to diversify their portfolios.

Sounds great? Absolutely!

How does it work?

Liquidity providers provide USDC, an Oracle feeds the prices, and traders trade against that liquidity. This is basically how Synthetix works, except there is no Oracle that feeds real estate data on a scalable and real-time basis.

But more about it later; let's look at numbers first.

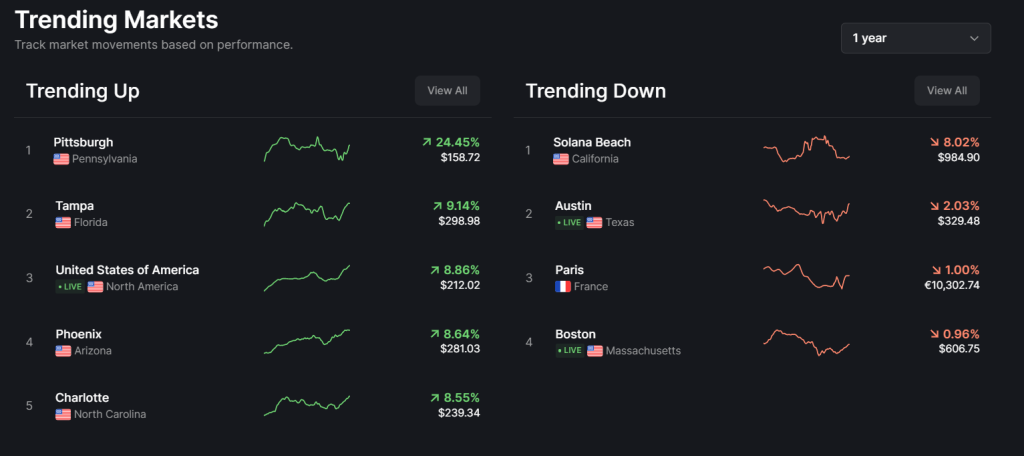

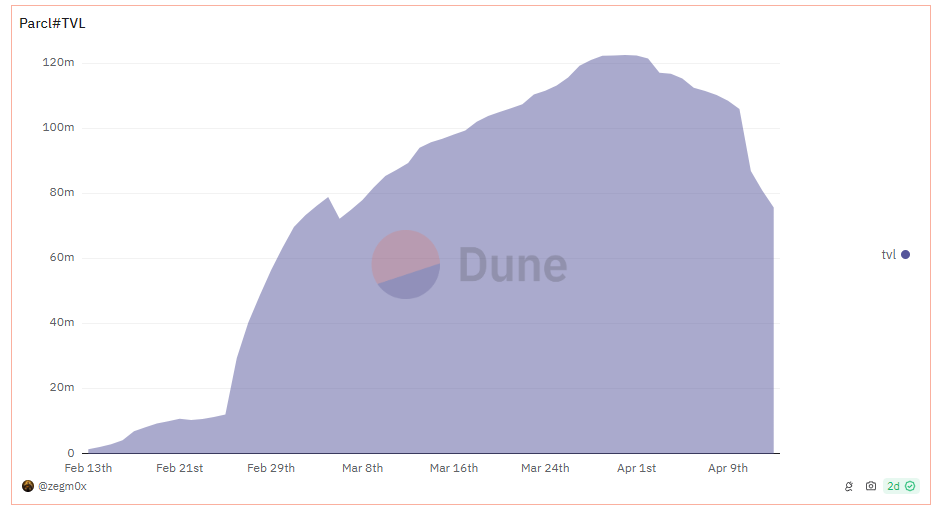

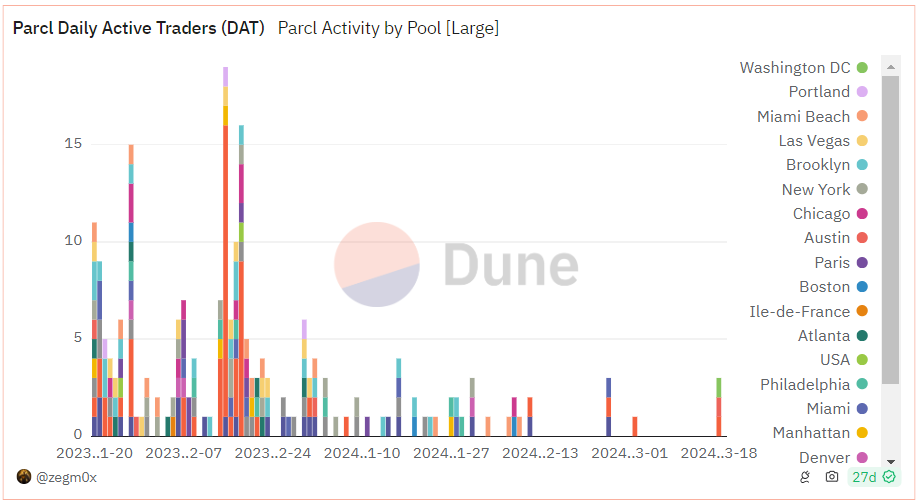

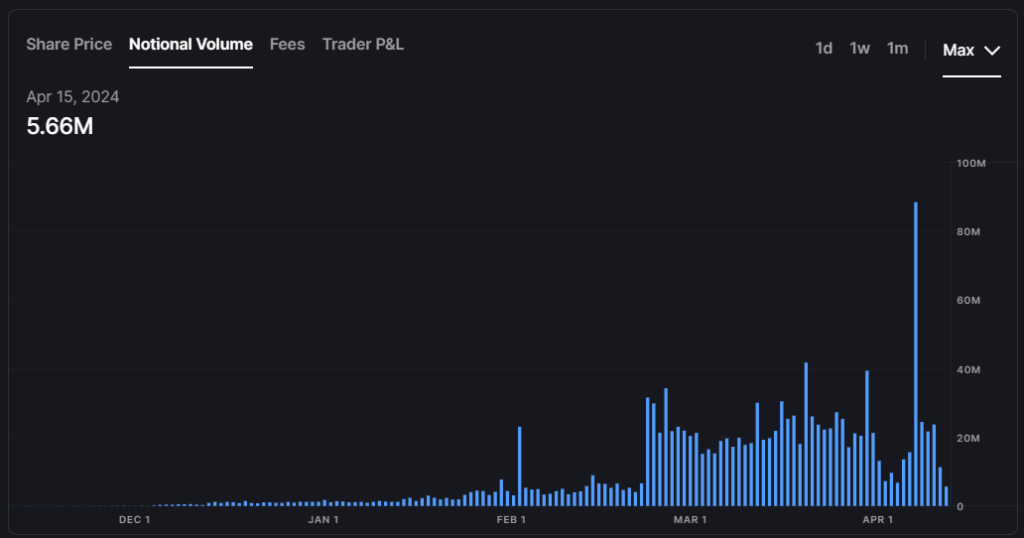

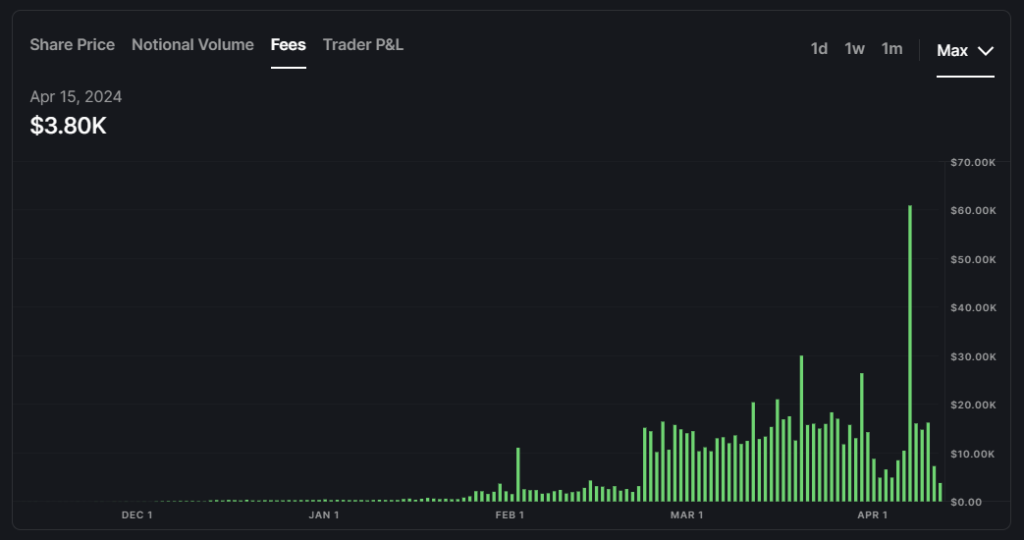

As the graphs below show, TVL and the number of daily traders significantly declined after the snapshot for the airdrop was taken.

However, the platform volumes have generally been trending up, and we have just seen the tip of the iceberg.

Similarly, if we zoom out, the fees have also been trending up in the same period.

Based on the above information, the current sentiment around Parcl is generally positive, with many individuals being bullish on its long-term prospects.

However, there is a crucial piece of information that can significantly alter the investment perspective on Parcl, but we believe most are missing out.

The important piece of information is…

Parcl Labs

Many are focused on Parcl, a real-time real-estate trading platform. Parcl is a cool and unique trading platform that brings blockchain technology to a well-known and established industry.However, the reality is that Parcl is just one product of Parcl Labs, and many are just focused on Parcl, missing the bigger picture.

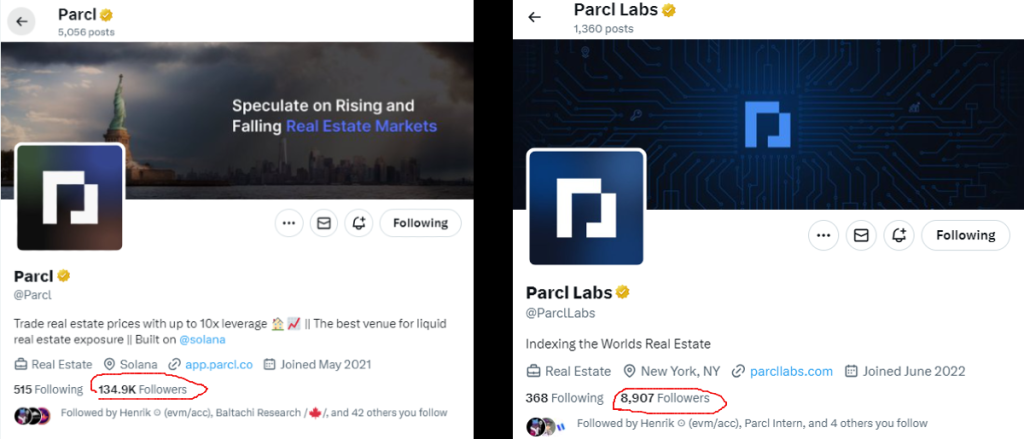

Let's look at these two images below.

We can see that over 130k people follow Parcl, while roughly 9k people follow Parcl Labs. Over 90% of Parcl's followers presumably don't know what Parcl Labs is. Therefore, we believe many have an incomplete investment thesis on Parcl due to a lack of understanding.

But let's look at what Parcl Labs does and why this is an important piece of the puzzle.

Parcl Labs is focused on residential data analytics. While Parcl is about applications, Parcl Labs is a full-suite data platform.

It all started when the team behind Parcl couldn't find a third-party Oracle for the real-time trading platform.

The famous Case-Shiller Index for home prices couldn't satisfy their needs. The team needed real-time, globally representative and scalable data.

However, the Case-Shiller Index and similar are updated roughly once every month. Imagine being able to trade only 12 times a year.

The solution was to create their own data platform. With the help of distinguished data scientists and engineers, Parcl Labs got to the forefront of the real estate analytics industry, offering a unique and valuable tool for investors and stakeholders in the global real estate market.

The platform's ability to provide real-time, accurate real estate data analytics empowers property investments. It allows users to speculate on the price movements of real estate markets across the globe with a high degree of accuracy and reliability. It has a unique, scalable, and enterprise-level database that results from processing hundreds of millions of data points.

Therefore, Parcl Labs is uniquely positioned to provide real-time data to Parcl and other interested parties. That is a moat against competitors if they emerge. Anyone trying to build a real-estate perps trading platform will need to build a strong analytics platform first.

Many view a bet on the $PRCL token as a bet on the trading platform. But we believe the actual play isn't there.

The bet on $PRCL should be on institutional and TradFi adoption of the data platform.

Why?

Parcl Labs provides unique data that isn't available in traditional real estate. For example, the team showed that you can accurately predict the Case-Shiller Index using the Parcl Price Index before it is even out.Imagine you are a firm/institution/analyst in the real estate industry and front-runned by those using Parcl Labs' data.

Letting that happen would be a huge mistake.

But here is the catch…

The team explicitly stated that institutions and corporations need to stake a certain amount of $PRCL tokens to access Parcl Lab's datasets.

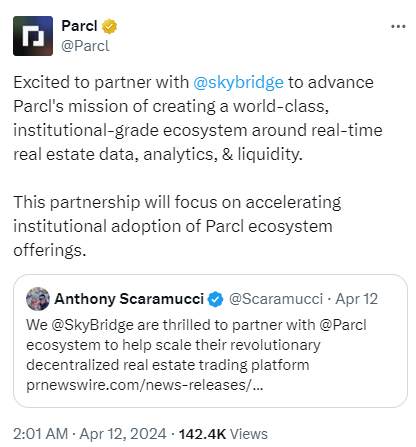

We have already seen real estate analysts and institutions with huge followings using data from Parcl Labs.

Below are some examples.

Therefore, unlike the reports from other sources, our thesis on $PRCL revolves around Parcl Labs being a data platform and gaining institutional real-world adoption.

Funding x Airdrop

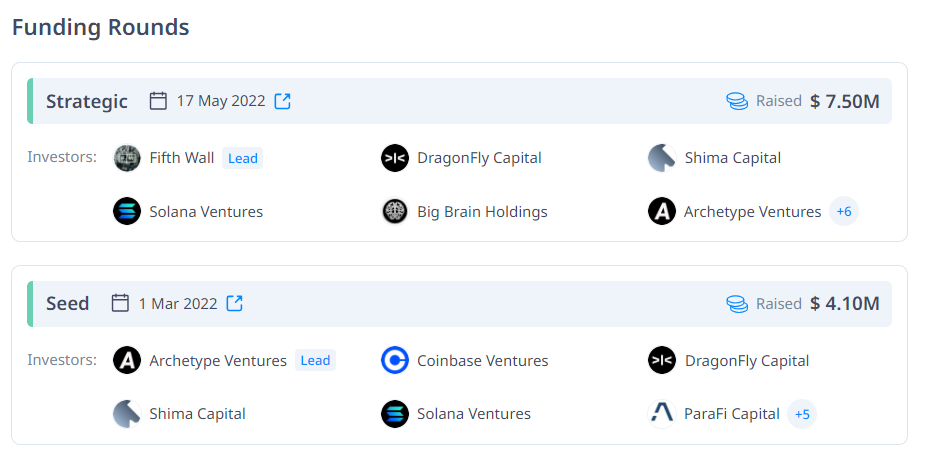

Parcl raised $11.6m in May 2022 from prominent investors like Solana Ventures, Coinbase Ventures and DragonFly Capital.

Recently, it had a Season 1-3 airdrop campaign that culminated at the beginning of April. It rewards those who trade and provide liquidity on the platform with points.

Currently, you can check your allocation by visiting the website. Trading will go live today.

Now let's look at tokenomics

Tokenomics

The $PRCL token is the governance token of the Parcl protocol, used to decentralise the platform and empower holders. It will also be used as an incentive to grow the platform.Additionally, $PRCL will be used to access Parcl Lab's APIs for unique real-estate data and insights.

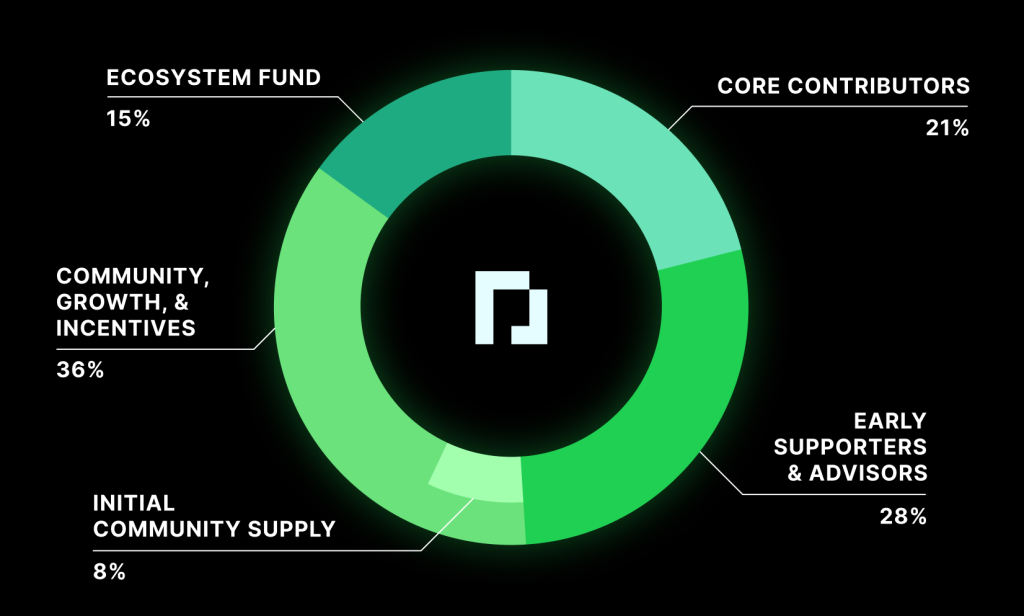

The distribution of tokens looks like this:

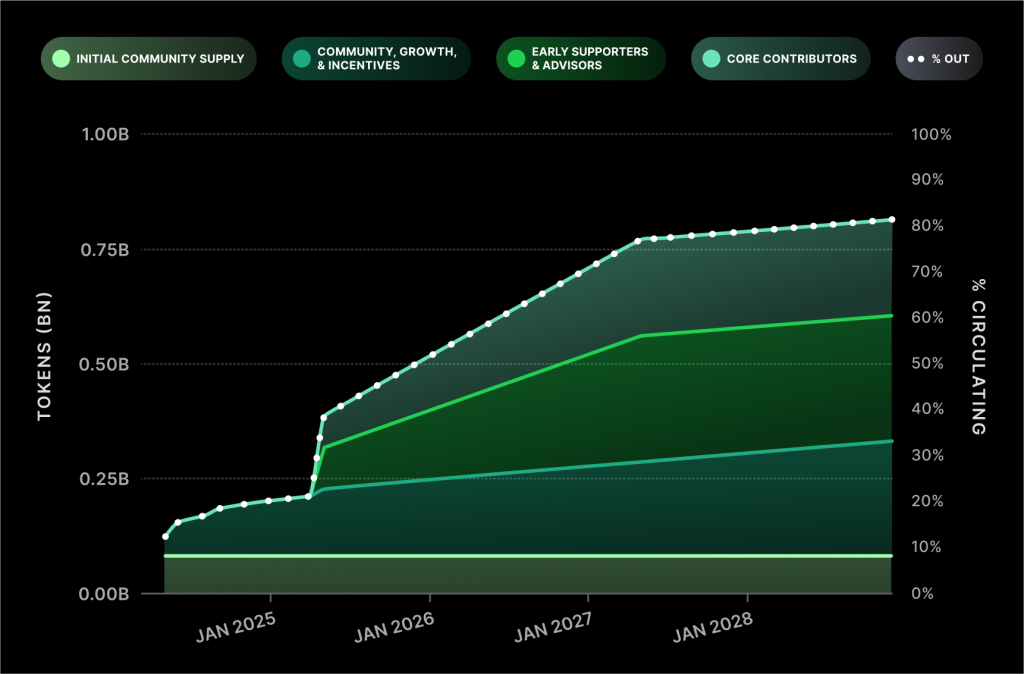

8% of the supply is distributed to the community as airdrops. The initial estimated float will be 10-12%.

The team, early supporters, and advisors' tokens will be locked for one year and then linearly unlocked for three years.

The total token supply looks like this:

Price targets

Parcl is unique, first-of-its-kind, and part of the $300 trillion industry. We believe $PRCL will be a multi-billion-dollar asset.It launched today and is currently trading at $0.67 per token with a circulating market cap of $57m

In terms of price targets

- In the base case, we expect a $500m market cap (that would result in around $5 per $PRCL; roughly 7.5x)

- In the bull case, we expect a $1.5b market cap (that would result in around $15 per $PRCL; roughly 22.5x )

- In the best case, we expect a $3b market cap (that would result in around $30 per $PRCL; roughly 45x)

If you decide to invest in $PRCL, here is what to do

Action plan:

- Go to Jupiter and connect your wallet

- In the section "To receive", input the following address: 4LLbsb5ReP3yEtYzmXewyGjcir5uXtKFURtaEUVC2AHs

- Execute the swap

Main risks

Liquidity dries up

Parcl, like Synthetix, relies on liquidity providers (LPs) to provide a real estate trading platform. After the airdrop is concluded, LPs might leave, damaging Parcl's ability to provide a smooth platform.We will need to continuously monitor whether the liquidity is sticky.

Team tokens unlocks

49% of the token supply is allocated to insiders. Even though they are locked for 1-year and are linearly unlocked during the following three years post-unlock, it represents a significant amount.That said, in terms of market cap, $PRCL will reach our targets – it is only a matter of time. But if there is significant selling pressure from the insiders, our return multipliers will be lower.

However, until next year, there is nothing to worry about.

Cryptonary's take

The real estate industry has been a cornerstone of wealth accumulation for decades. It is the largest asset class in the world, with a market capitalisation of over $250 trillion.Parcl is bringing liquidity and efficiency to this massive market. It can become the global standard for real-time real estate data, analytics, and price exposure.

We believe the market isn't pricing the Parcl Lab's valuable data platform. Institutions can use Parcl as a hedge against real-world real estate and derive valuable insights regarding their portfolio, market, competition, etc, from the Parcl Labs.

Any TradFi player that relies on traditional data sources that are updated once a month will be left behind.

That builds a very bullish case for $PRCL, where institutions will have to stake the tokens to get access to the data.

Therefore, we are very bullish on $PRCL and can't wait to see this project live up to its full potential.

Cryptonary, Out!