Inverse proportion in action: The US dollar vs BTC

Have you ever wondered how many hamburgers can you buy with 1 BTC? What may seem like a very random question can be explained using Bitcoins current purchasing power. To understand this better, we will explore the purchasing power of the U.S. dollar against Bitcoin.

In pure economic terms, purchasing power (P.P.) is the value of a currency measured in terms of how many goods and services it can purchase. This simple term can impact many aspects of the economic system, from consumer's behaviour to investor's sentiment. This is why governments focus on keeping this unit of measure as healthy as possible. The cost of goods, interest rates, the cost of living, the supply of currency (monetary policy) are directly linked to the purchasing power of a currency.

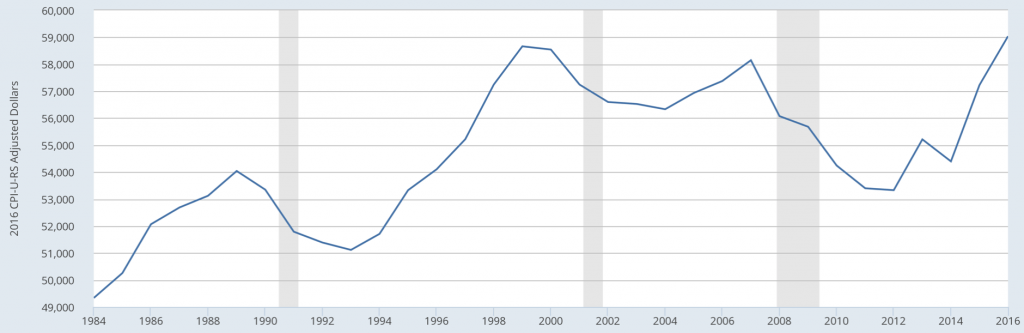

In the last couple of decades, researchers have used the Consumer Price Index (CPI) of each nation to determine whether the P.P. of a currency has declined or increased. Also, in 1986 The Economist created The Big Mac Index to compare P.P.'s between countries. What can both indicators tell us about the value of the U.S. dollar during the last couple of decades? Simple, the dollar is losing value every day.

The chart below shows variations of the Consumer Price Index since 2000. The data from the U.S. Bureau of Labor Statistics shows how the CPI for all urban consumers has increased gradually and without stop since the beginning of the century.

[caption id="attachment_1859" align="aligncenter" width="1024"] Variations of the Consumer Price Index since 2000[/caption]

Variations of the Consumer Price Index since 2000[/caption]

It is clear that the greenback has lost its purchasing power significantly. Why? Inflation. The silent killer has been affecting the USD since the FED took control of the supply in 1913. As more currencies and financial instruments are created, the USD keeps losing value. To many, the US is inside the global financial system, decreasing its intrinsic value significantly.

Between 1930 and 1940, with 1$ you could have bought 16 cans of Campbell's soup (money supply was $46billion by then). In 1950, estimations showed that 20 bottles of Coca Cola could have been bought with a single dollar (money supply at that moment: $55billion). What happens if we skip a few years? Well, currently with $1 you can buy a song on iTunes or 200g of Pringles.

Now why we don't make the same comparison using the BTC purchasing power instead?

“Nine years ago, to the day May 22nd 2010, early Bitcoin enthusiast Laszlo Hanyecz exchanged 10,000 BTC for two pizzas, with 1 Bitcoin priced at $0.003”

- P. Amish, “The $78m Bitcoin pizza” (read our article here).

As covered in our article a few days ago, the purchasing power of BTC in its early stages was quite insignificant. By December 2011, one BTC was able to buy a little bit more than two pizzas and by 2019… well, $8,600 is quite enough to hire your own Pizza chef.

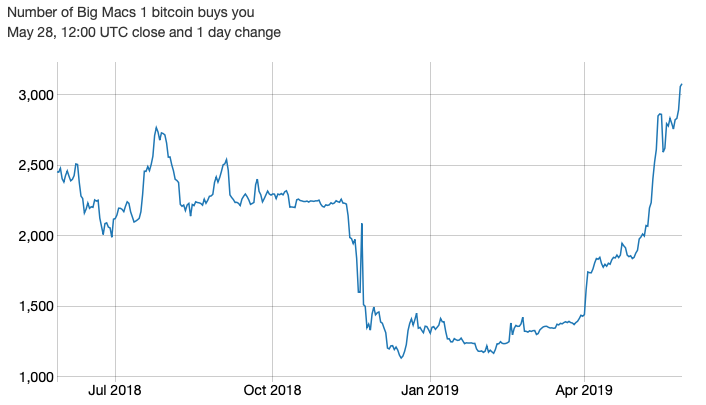

Did you know that there is a crypto version of The Big Mac Index?

As Bitcoin is now treated by many as a currency, it deserves its own purchase index. The team at BitBond launched BitcoinPPI to cover the gap in BTC data. The Bitcoin Purchasing Power Index is based on the exact formula of The Economist theory of McDonalds’ Big Mac. Therefore, the BTCPP is based on the question: How many burgers can you buy with 1BTC?

[caption id="attachment_1860" align="aligncenter" width="706"] Big Macs against BTC. Source: BitcoinPPI.[/caption]

Big Macs against BTC. Source: BitcoinPPI.[/caption]

Even when we compare the value of the many altcoins during the bloodbath, they still had a purchasing value worth being compared against the dollar. Cryptos have only one single rule in their bible: there is no need for monetary policy. This single characteristic will be a key piece in the expansion and adoption.

One thing is for sure, the greenback won't be able to maintain its status of reserve-currency for much longer. In countries such as Turkey and Venezuela, people are buying BTC to hedge against inflation. Next time you decide to buy crypto, don't focus only on easy cash from a pump and dump, but rather in the purchasing power of your selected cryptocurrency will have in a couple of years.

“Burgernomics” is not the best way to compare the USD purchasing power vs BTC purchase power over time, but it is simple and easy to understand. All in all, this points to the fact that the Dollar Kingdom is coming to an end soon, with more and more citizens finding increased value within the crypto space (not only BTC).

Image licensed via Shutterstock