Is Bitcoin's volatility going down?

Over time, Bitcoin's volatility has been a rollercoaster. Back in 2012, BTC price would surge more than 50% in each spike. Similarly, between 2012 and 2013, BTC rate kept moving at around 30% in every bull run. However, from 2014 onwards, the situation has changed.

Currently, BTC tends to surge and decline between 4% and 10% when the volume is high, while it moves between 2% and 5% when the volume is significantly low.

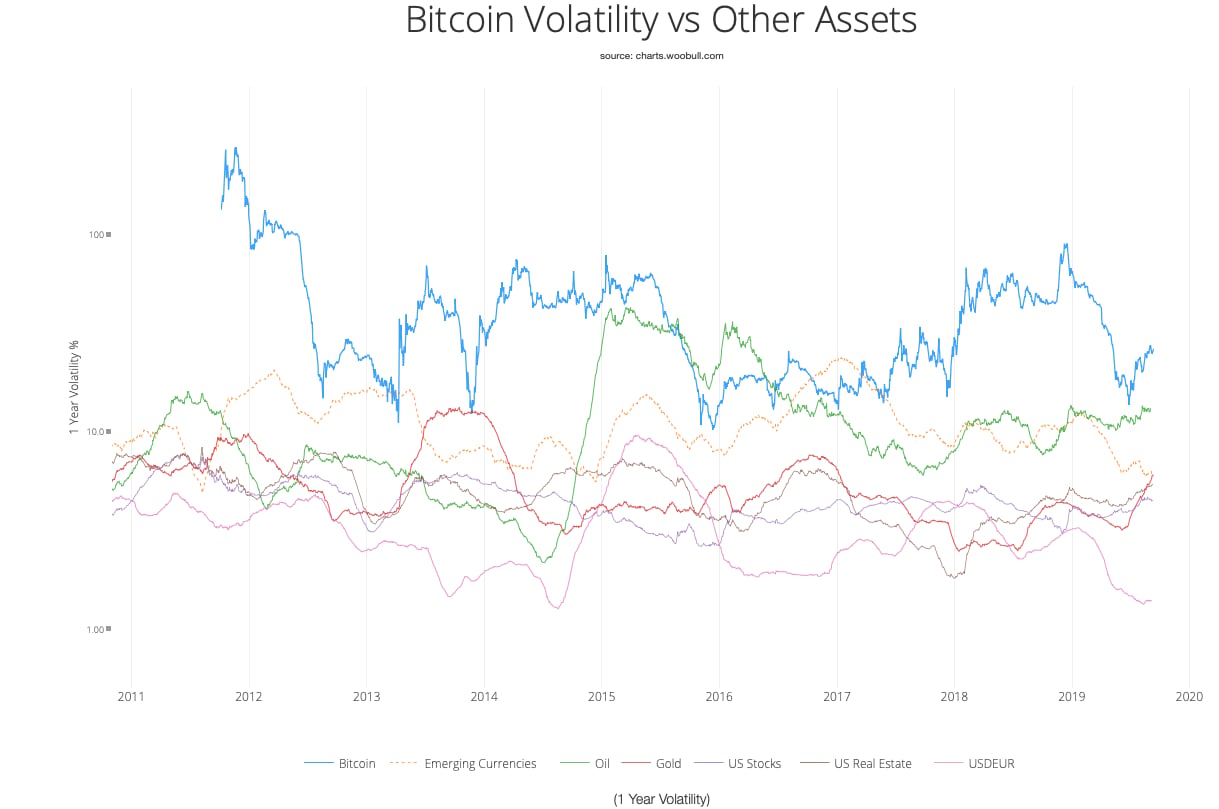

Why is volatility decreasing? One hypothesis is adoption. Many analysts are starting to realise that the regulation of BTC derivatives made the asset less exposed to manipulation. The main goal of global regulation on Bitcoin is to transform the market a more mature one, and they are succeeding, albeit slowly. Data provided by Woobull Data clearly shows that BTC volatility is approaching other’s asset volatility.

Based on the same chart, is evident the fact that BTC volatility is still significantly above the volatility of gold, oil, US stocks or emerging currencies, but the standard deviation is getting every day slower, that's why the analyst Willy Woo believes that “Bitcoin volatility will match major fiat currencies by 2019”. The argument presented by Woo claims that:

“The economic properties needed for bitcoin to go mainstream are developing quickly. If we take fiat-level FOREX volatility as a level in which the public find acceptable (this is not necessarily true), we are less than 2 years out for the start of prime time “bitcoin as payments” heaven”.

Bitcoin's Standard Deviation shows that unpredictable movements in price action are diminishing. The calculations presented by Coindesk gives us a clue of this “normalisation” in the data. In this sense, Coindesk is positive in the discovery, by expressing:

“Bitcoin’s volatility has often been cited as the reason why it will never make a good store of value, a reliable payment token or a solid portfolio hedge. Volatility implies sharp changes and usually has negative connotations. Even when it comes to financial markets, we intuitively shy away from investments that would produce wild swings in our wealth."

Willy Woo believes that price stability will give BTC even more bullishness, and he isn't wrong. Let's think about it, why were institutions and hedge funds afraid of investing in Bitcoin? Mainly due to uncertainty in its price. This may be an attractive feature for traditional and conservative investors, in fact, a large majority of them are moving from traditional assets to new alternatives. Gold is losing ground among millennials as its uses are limited and the returns could not even be compared with the return of the cryptocurrency market. Hype and speculation are huge barriers for BTC, but normality isn't too far off…

Decreased volatility increases trust in Bitcoin as both a medium of payment and store of value. Theoretically speaking, with higher volatility, the cost of converting into and out of Bitcoin will increase, attracting even more investors in the medium and long-term. Woo notes that:

“Ventures that focus on bitcoin as a form of payment are premature – examples include payment gateways like BitPay and cryptocurrency point-of-sale ventures Plutus and BlockPay. We are probably at least 2 years out from the necessary price volatility necessary for this sector to be ready. For now, bitcoin HOLDers are speculative investors. Given bitcoin has by far the largest network effects and an exponential head start on stability and liquidity, I would say any other payment altcoin is going to have a hard time competing, especially in 2 years and we get a critical mass of sorts on the bitcoin network. ”.