Is BTRFLY still on track for a 31x?

In our April 2023 report, we delved into Redacted Cartel's innovative products and meta-governance strategy.

We highlighted the potential of their interconnected protocols – Hidden Hand, Pirex, and the anticipated Dinero stablecoin – and projected a significant 31x growth trajectory for the BTRFLY token.

This update revisits Redacted Cartel's journey through 2023, evaluating the progress and developments unfolding since our initial analysis.

And more importantly, is our 31x thesis on the BTRFLY token still valid?

Let's dive in.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Redacted Cartel overview

As a quick refresher, Redacted Cartel is a decentralised autonomous organisation (DAO) focused on acquiring governance power within crypto protocols to influence development. The DAO uses a productive treasury of tokens from partner protocols like Aura, Convex and Balancer to gain voting sway.Redacted's core products include Hidden Hand, a leading marketplace for governance token incentives, and Pirex, which offers simplified management and yield opportunities for locked tokens like CVX and GMX.

The protocol recently rolled out Pirex ETH, a liquid ETH staking token and is building DINERO, a novel stablecoin optimised for Redacted's ecosystem.

BTRFLY is the governance token of the Redacted DAO. Holding BTRFLY allows participation in voting and access to protocol revenue. Revenue-locked BTRFLY (rlBTRFLY) grants proportional revenue share from Redacted products.

As the adoption of Redacted's offerings expands, BTRFLY stands to benefit from growing protocol monetisation.

Financials & key developments

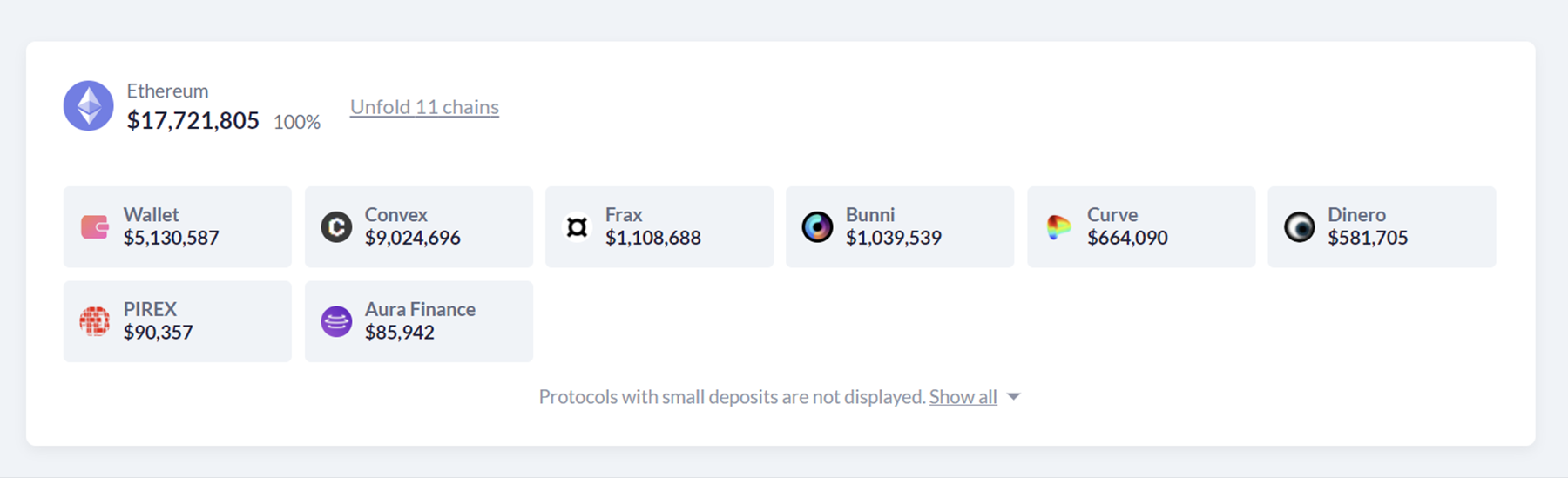

To start, let's evaluate Redacted Cartel’s financials.Over the nine months from late April 2023 to late January 2024, Redacted Cartel's treasury value decreased by around 24%, from $23.4 million to $17.8 million.

The most significant drivers of this decline were major decreases in the value of holdings like CVX (-$2.8 million) and CRV (-$210k).

Price decreases primarily drove these drops, as the token amounts held were relatively stable or increasing in some cases.

A few assets, like ETH, increased in value over the period, but not enough to offset the losses in CVX and other larger holdings.

This drawdown was worsened by Redacted's average spending of around $200k per month in 2023. Based on the November 2023 expenses report, this monthly burn rate went predominantly to audit fees, salaries, domains, infrastructure, and other operating costs.

This meaningful spending rate consumed around $2.1 million of the starting $23.4 million treasury value over the nine months.

However, the current treasury balance of $17.8 million still represents a substantial buffer for Redacted, especially with ongoing revenue. The DAO also maintains stable assets to hedge volatility. Careful expense management will be key to sustaining the treasury as a protective reserve.

Hidden Hand's growth

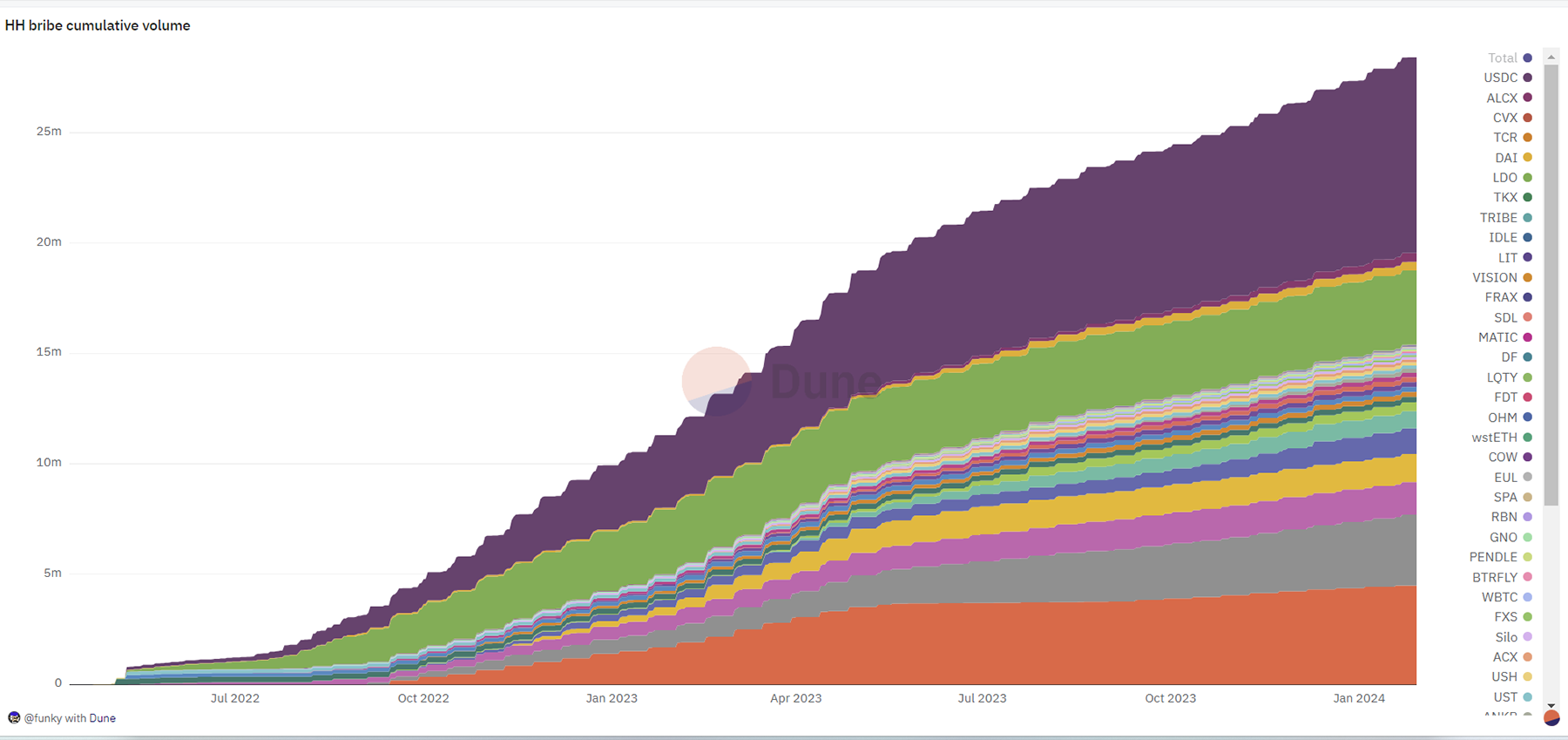

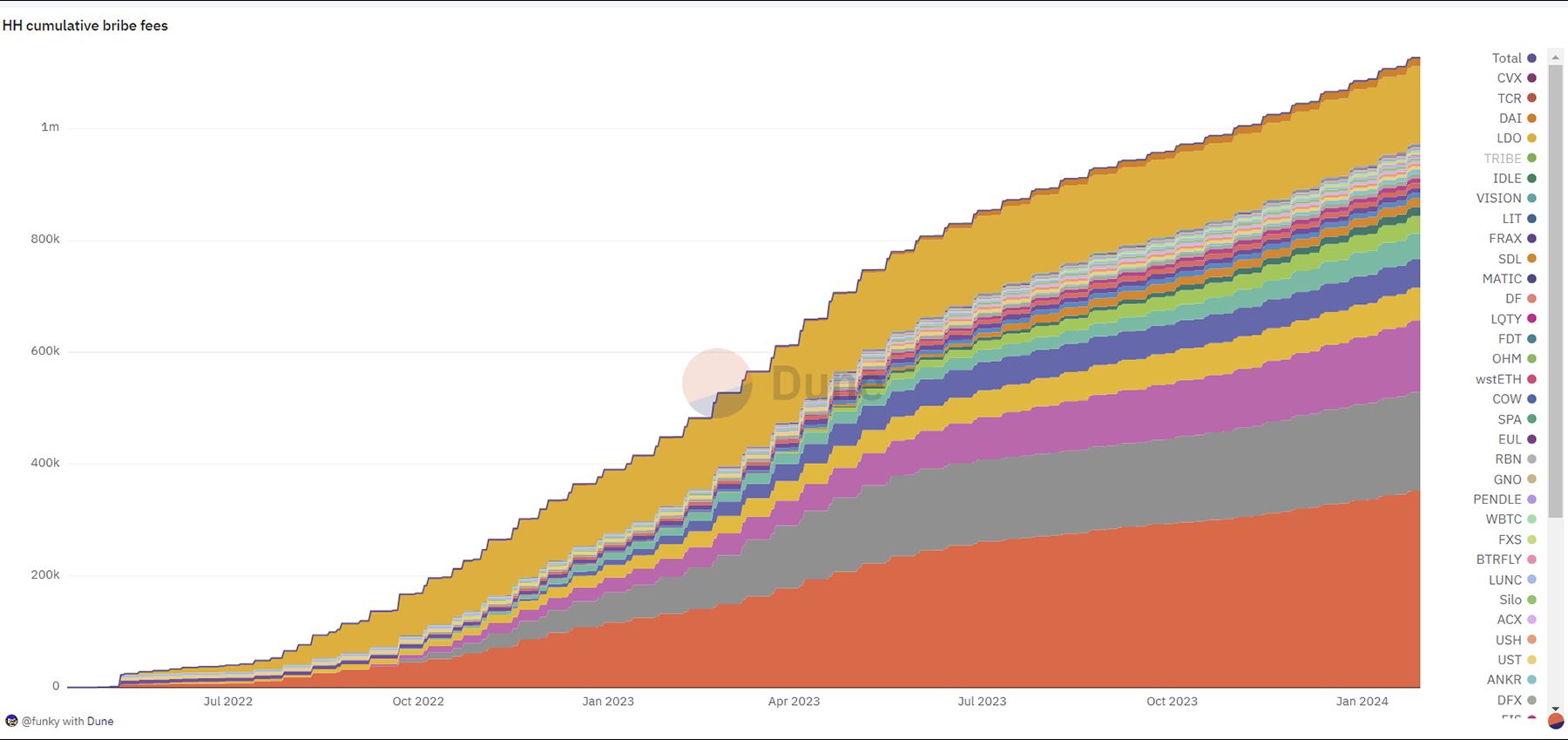

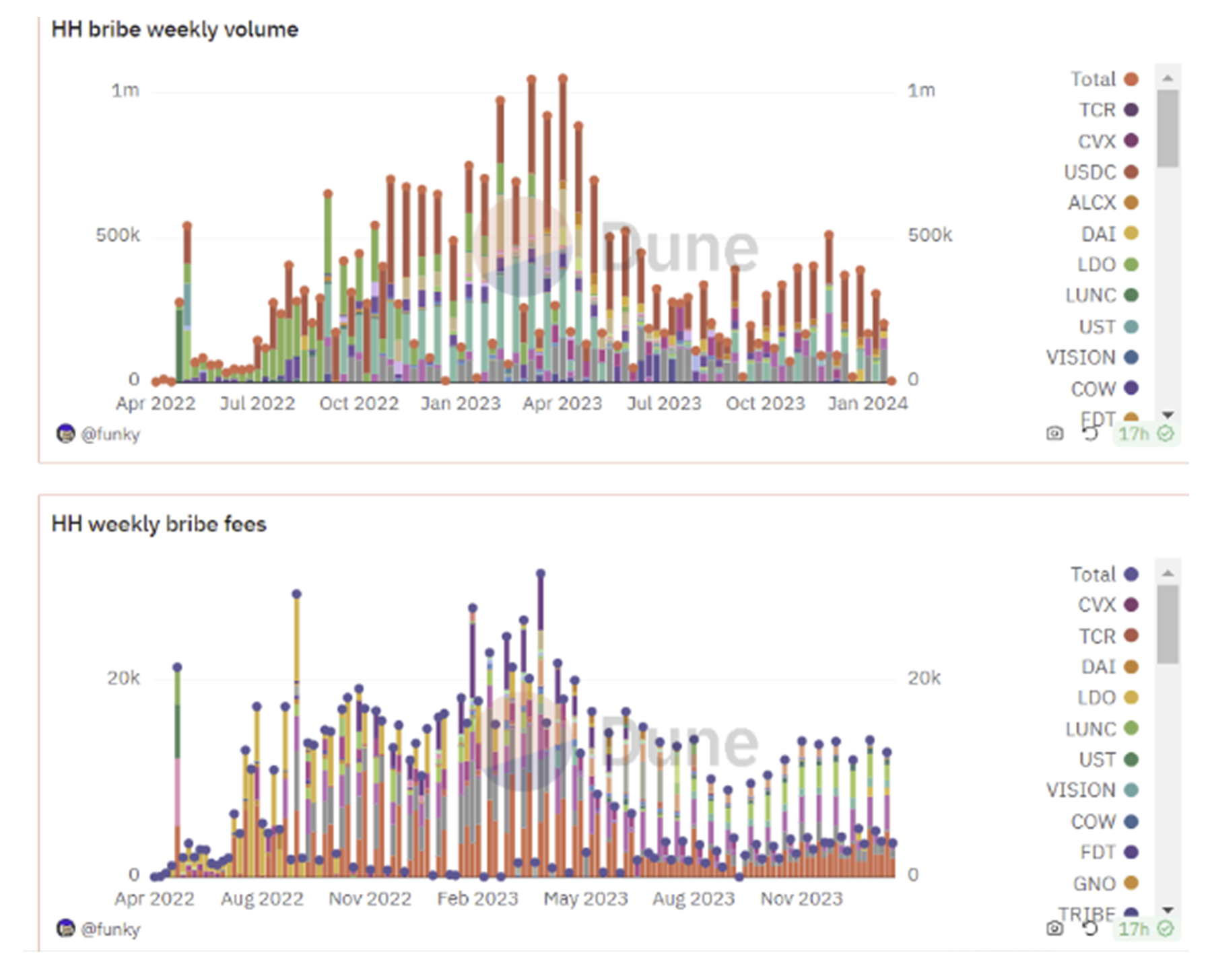

In 2023, Hidden Hand, the bribe marketplace operated by Redacted, demonstrated sustainable growth. By the year's end, the total bribe volume significantly increased from $9 million to over $24 million. This surge represented a 169% growth, earning the project $1.12 million in fees.

This surge represented a 169% growth, earning the project $1.12 million in fees.

However, it's important to note that while the volume of transactions has increased substantially, the revenue growth hasn't been as remarkable.

The primary reason is the relatively low margins on which the bribe marketplace operates.

For instance, on the week of December 4, which was one of the best-performing weeks in recent months for Hidden Hand, it handled a volume of $500K but generated only $3,000 in fees.

Further expanding its reach, Hidden Hand has partnered with 15 protocols, with PancakeSwap being the latest addition. While Aura and Balancer dominate as the largest bribe markets, new entrants like Bunni and Prisma are steadily gaining market share.

This trend underscores the growing diversification within the platform's ecosystem.

As meta-governance strategies become increasingly prevalent in the DeFi space, Hidden Hand is solidifying its position as the premier platform. Also, the fact that larger protocols, such as Pancakeswap and new protocols, such as Prisma, have decided to partner with Redacted Cartel shows that it is a clear market leader in this field.

Pirex's growth

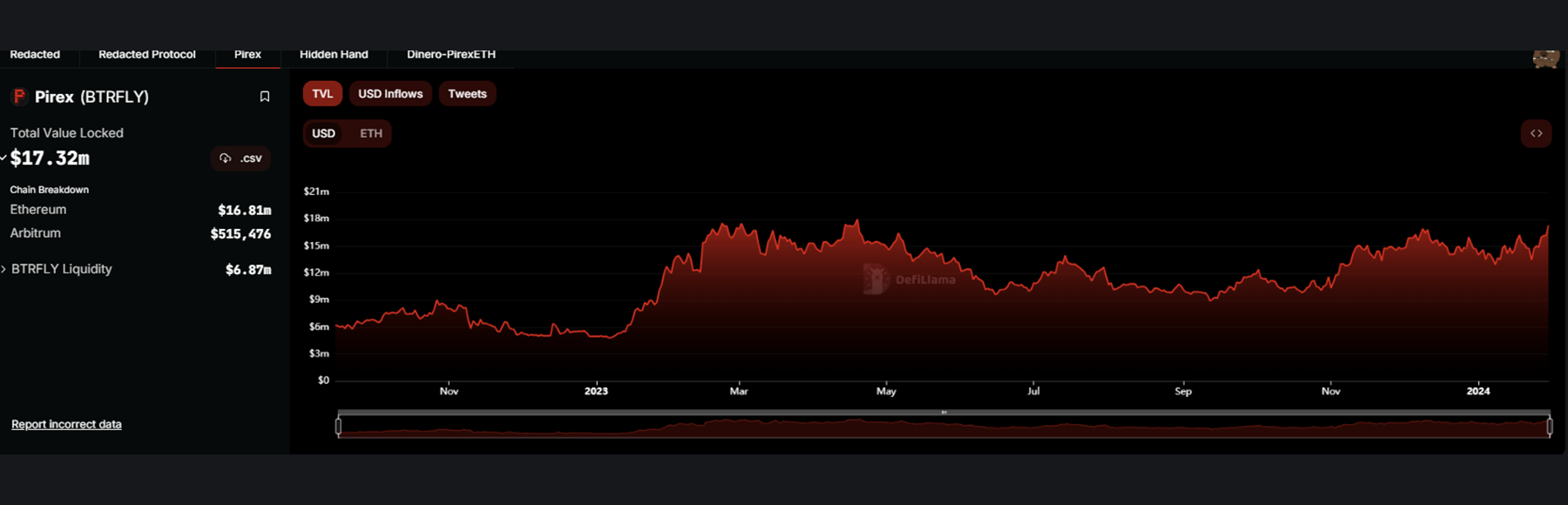

Pirex also saw growth as its TVL more than doubled to $17.32m in 2023, driven by continued deposits to Pirex CVX and expansions into new assets like GMX, GLP, and BTRFLY.

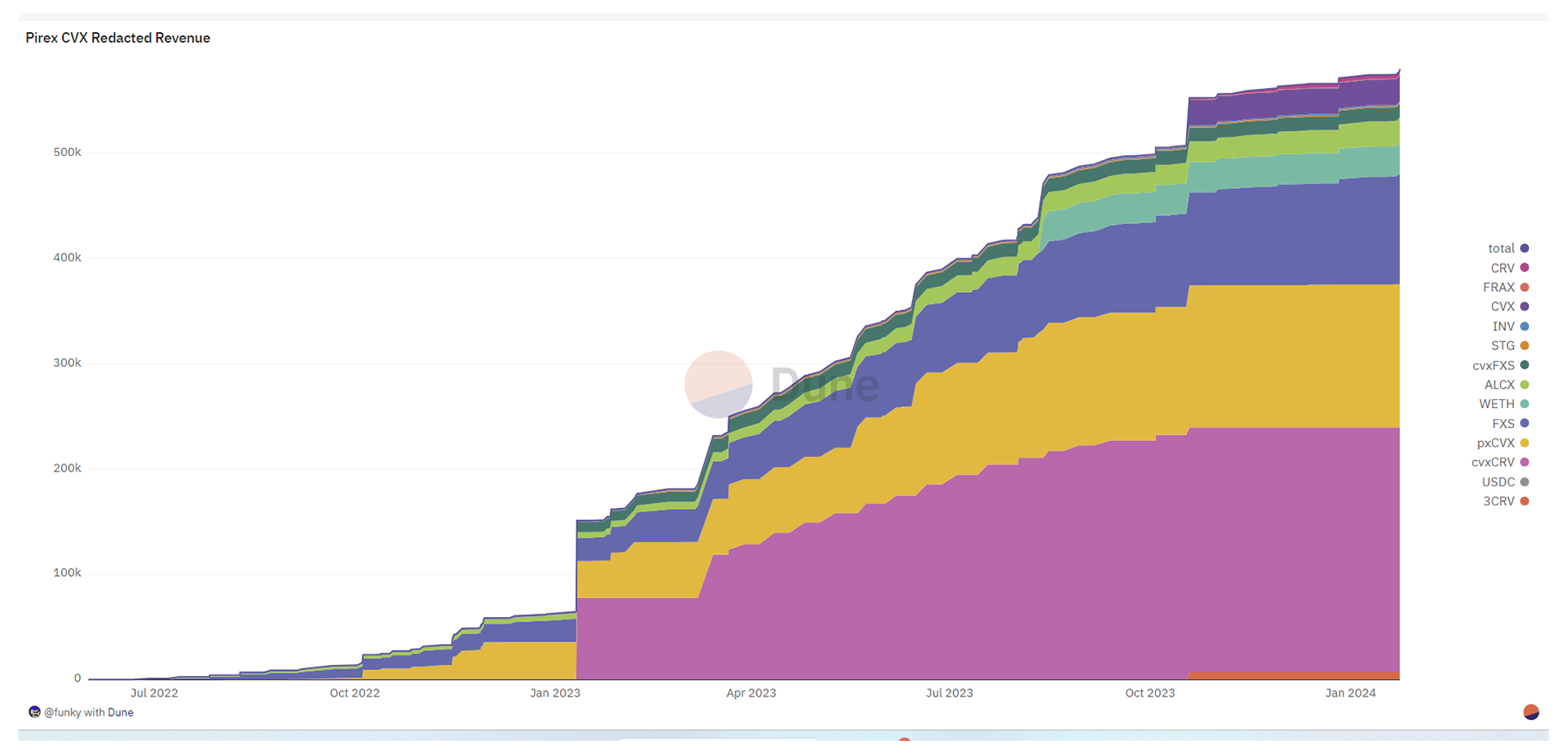

Examining the revenue generated by Pirex reveals that Redacted has accrued a total of $580,070.26 from its CVX Total Value Locked (TVL) on Pirex.

On the other hand, Pirex's GMX vault generated $11k in fees, which is still relatively low. However, only $949,272 of its TVL currently consists of GMX-related tokens.

Pirex ETH and the road to Dinero

The big milestone for 2023 was the launch of Pirex ETH, Redacted's innovative liquid staking solution.It consists of a two-token model using pxETH and apxETH to cater to different user needs.

pxETH

The pxETH token is an ERC-20 token that users receive when they deposit ETH into the Pirex ETH contracts. It maintains a 1:1 peg to ETH, effectively serving as a redeemable wrapper for ETH.pxETH provides liquidity and enables use throughout DeFi for earning yields. Users can leverage pxETH to provide liquidity on DEXs like Curve and Balancer, participate in lending protocols, use it as collateral for borrowing, and access other yield opportunities.

The Redacted DAO focuses on expanding integrations for pxETH to maximise earning potential. pxETH brings liquidity to ETH staking without sacrificing staking rewards. This flexibility makes it attractive for users who want exposure to DeFi opportunities.

apxETH

While pxETH caters to liquidity-seeking users, apxETH targets those focused on maximising passive ETH staking yields. When pxETH is deposited into the Pirex ETH auto-compounding vault, users receive apxETH vault shares in return.apxETH uses the ERC-4626 standard to track user vault shares. It allows earning staking rewards from the ETH deposited as pxETH. A key advantage is that apxETH accrues yields from a larger pool of staked ETH than the user deposited. This is because not all pxETH is staked in the vault, meaning apxETH benefits from amplified yields.

Redacted manages the underlying validators to ensure reliability. For users who want set-and-forget ETH yields, apxETH provides market-leading APYs of over 5% from pooled staking.

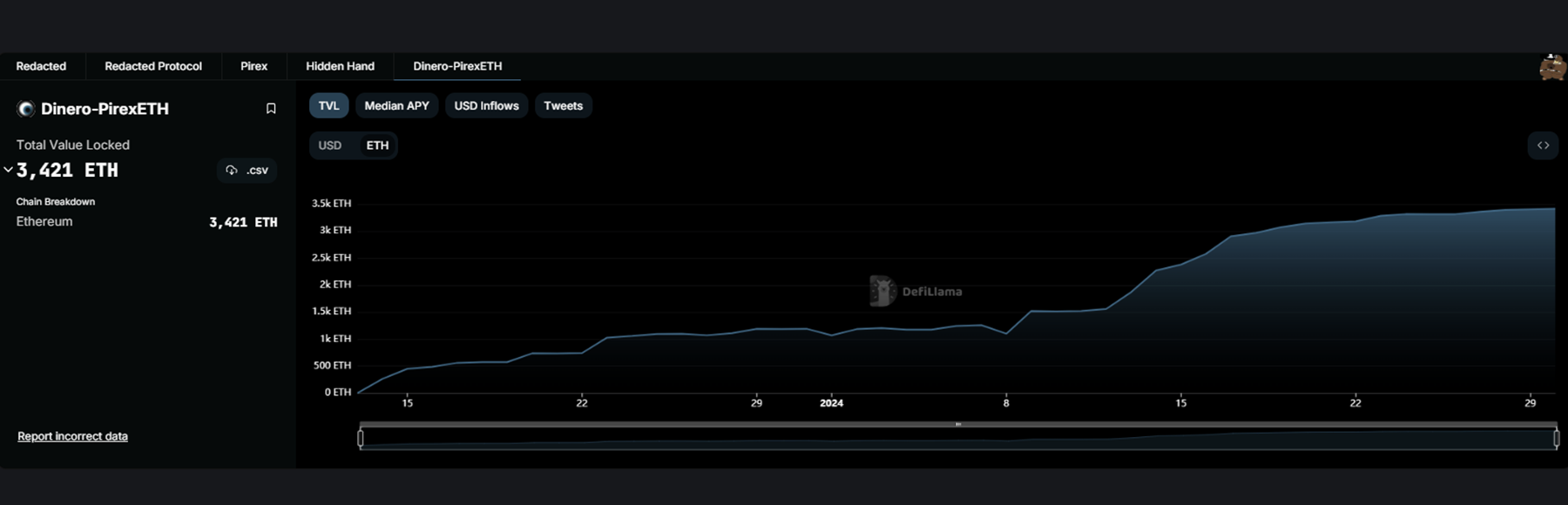

Pirex ETH’s performance since launch

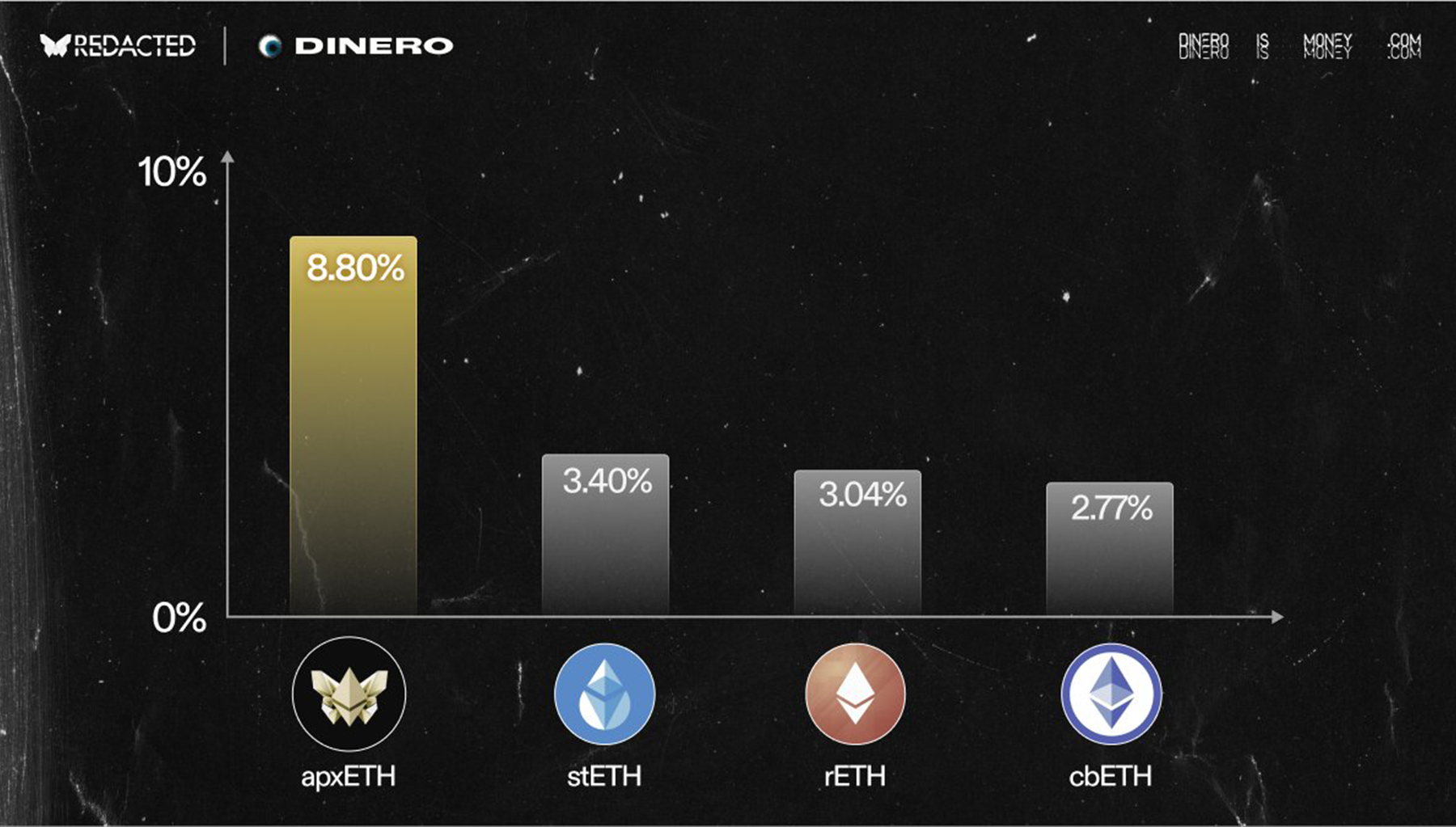

Since its release, Pirex ETH has seen deposits of 3,421 ETH, valued at approximately $7.93 million.Given that this is a relatively modest sum, it currently earns an APY of around 8.8%. It is anticipated that this rate will gradually decrease as the amount of staked ETH increases.

However, this does not imply that the yield from apxETH will drastically reduce, even if the amount of staked ETH doubles. With its current scale, apxETH has considerable potential to remain competitive, thanks to its dual-token model.

This strategy is the same one that contributed to the success of frxETH, which also launched with an initial APY of around 9% in January 2023. At that time, frxETH succeeded in attracting 70K ETH, which would be worth about $100 million at today's prices.

As time progressed, frxETH experienced a substantial increase in staked ETH, reaching 300,000 ETH.

This surge significantly reduced its yield. This decline in frxETH's yield has, in turn, provided apxETH with a substantial advantage, especially when comparing their yields with other major protocols.

Since Pirex ETH imposes a 10% yield tax, with its current size, the protocol would generate $69,784 in revenue based on the current APY and size. However, this is just the beginning, and we anticipate these numbers to grow over time as we know that young liquid staking projects often take time to gain market share.

The current roadmap for Pirex ETH involves integrating the token into more DeFi protocols, such as lending platforms, and making it available on additional chains.

One strategy for achieving this is through a partnership with Chainlink, where Chainlink's CCIP is utilised for secure cross-chain transfers of pxETH across Ethereum, Arbitrum, and Optimism. This interoperability broadens access to pxETH and unlocks more use cases.

So what about DINERO?

Redacted Cartel's development of Pirex ETH marks a significant step forward, but the community eagerly anticipates their core product, DINERO. This ETH-backed stablecoin is inspired by collateralised debt position models seen in protocols like Lybra Finance and Prisma Finance, which have been super successful.Progress on the DINERO stablecoin is well underway, with its core smart contracts and architecture already established. Redacted Cartel has strategically divided the development into three phases. Currently, we are in Phase 1, which focuses on the launch of Pirex ETH.

This phase is crucial as Pirex ETH is set to be the backbone of the DINERO stablecoin. Phase 2 will involve the actual launch of DINERO, which is still in the development stage. The team is prioritising the successful rollout and security of Pirex ETH before introducing this new product.

For a more detailed insight into DINERO, you can refer to our initial report.

Valuation and price targets

The Redacted Cartel, according to the latest financial data, has generated a total revenue of approximately $1.78 million and possesses a robust treasury valued at $17.8 million.These figures indicate the project's operational income and overall financial health. In terms of market valuation, BTRFLY currently has a market capitalisation of $107,048,189.

When we analyse these figures in terms of valuation multiples, the project is trading at approximately 60.14 times its revenue.

However, a more comprehensive assessment that considers both its revenue and treasury value yields an adjusted trading multiple of about 5.47.

This is considered quite healthy, particularly in crypto.

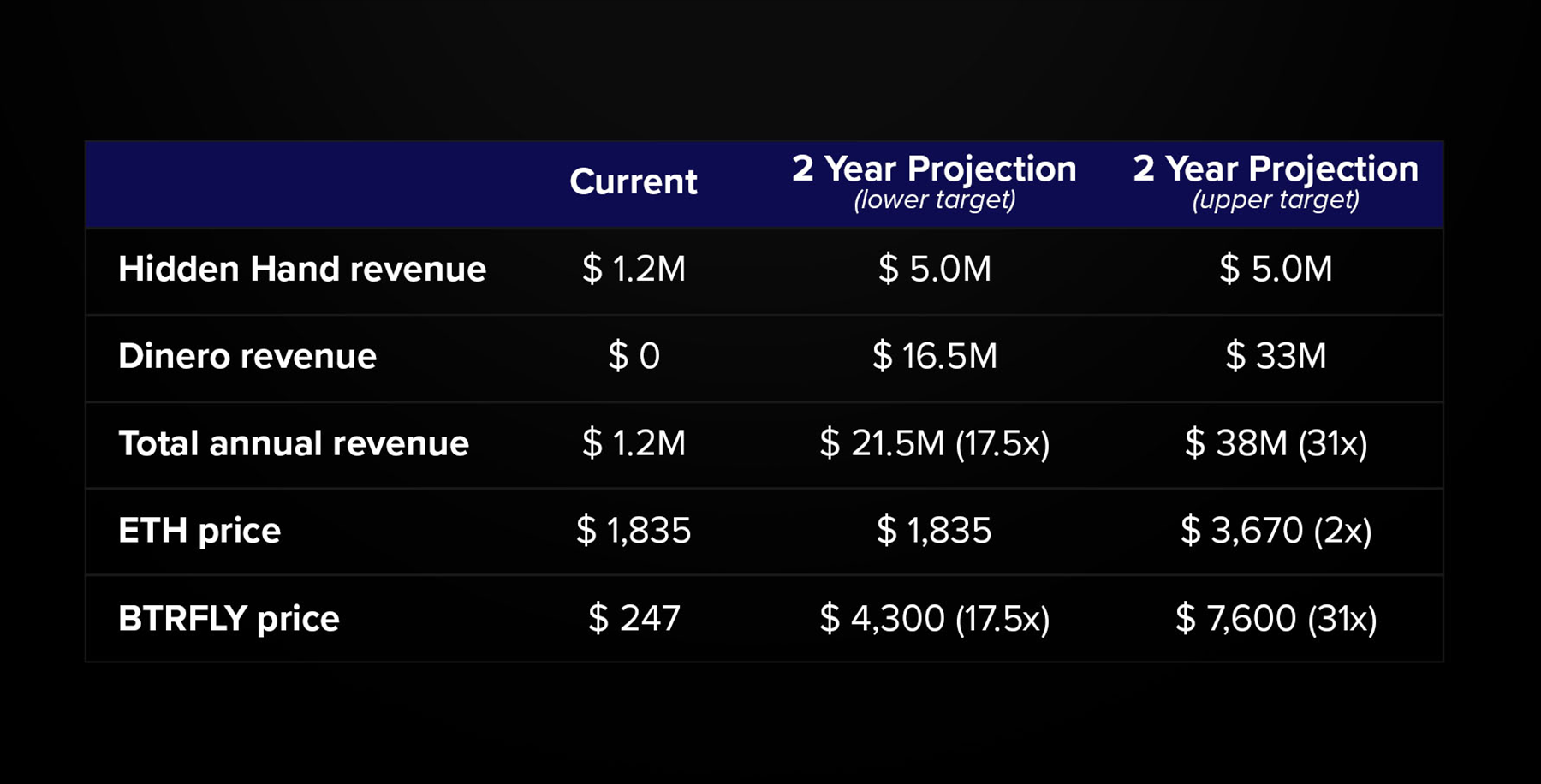

In our previous report, we projected revenues for Redacted Cartel for 2024 through 2025, which we believe are still attainable.

This optimism is partly due to the recent launch of their product, Pirex ETH, which is expected to be a major revenue generator + the fact that the project's other product, DINERO, has not yet been launched and that also is expected to generate a lot of revenue for BTRFLY holders.

Given these factors, we maintain our valuation estimates. The valuations for its Hidden Hand product might end up lower than anticipated. However, we believe an increase in the value of the tokens held in its treasury could offset any slower growth in this area.

These valuations are based on a base-case scenario of a $4,300 token price in 2025 and a best-case scenario of $7,600. For these projections to hold, we would need to see sustained growth in Pirex ETH over the coming months, and the launch of DINERO would need to be successful.

We maintain our confidence in our previous price target of $4,300 per BTRFLY as a base case.

However, we have some recommendations for those considering buying or holding BTRFLY.

Action points and forward-looking strategy

- Monitor Pirex ETH's performance: Close monitoring of Pirex ETH's growth and market adoption over the next six months is essential. This will provide a clearer picture of its contribution to Redacted Cartel's overall revenue and valuation.

- Evaluate DINERO's progress: Keep a close eye on the development and eventual rollout of DINERO. Its success or failure will significantly impact our valuation projections.

- Reassess valuations if necessary: While our current valuation projections remain valid, we must be prepared to update them based on the performance of key products like Pirex ETH and DINERO 6 months from now.

Cryptonary’s take

Our analysis indicates that Redacted Cartel remains undervalued despite its recent rise in prominence, with a current market capitalization of $107,048,189.The adjusted trading multiple, which considers both revenue and treasury value, stands at around 5.47, suggesting room for upward adjustments in valuation.

Key growth drivers include the successful performance of Pirex ETH, with 3,421 ETH deposited and an 8.8% APY, and the anticipation surrounding the upcoming launch of DINERO.

Hidden Hand, the bribe marketplace, has demonstrated sustainable growth, forming partnerships with established and emerging protocols. Despite a decrease in the treasury's value, Redacted Cartel maintains a substantial financial buffer.

The project is clearly at the beginning of a potential revenue increase with Pirex ETH and the forthcoming DINERO launch.

Even doubling its revenue would significantly impact its position, considering its substantial treasury, which also plays a crucial role in its valuation.

Therefore, we think it is not too late to invest.

Cryptonary, OUT!