Chainlink is now evolving into a total blockchain beast!

In this deep dive, we'll explore Chainlink's transformation from a "public good" into a thriving business focused on profits.

They're expanding services, exploring new opportunities in cross-chain communication, and partnering with financial giants like SWIFT.

This shift from patron saint to profit powerhouse unlocks Chainlink's true potential.

Now that Chainlink is revving to turbocharge its utility and revenue, could this be the perfect time to bet on LINK?

Let's get into it...

TLDR

- Chainlink is a crucial Oracle network in the world of DeFi, facilitating access to off-chain data securely for blockchain networks.

- Chainlink's diversification into various services, monetisation, potential revenue sharing, and cross-chain communication makes it an attractive investment opportunity.

- Chainlink's transformation towards revenue generation and LINK token staking provides a sustainable model for token holders.

- Using a conservative valuation methodology, we arrive at a potential LINK valuation of $26.5 billion.

- Criteria that could invalidate the thesis include Chainlink losing its dominant position or not implementing the revenue-sharing strategy.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Chainlink is the cornerstone of DeFi

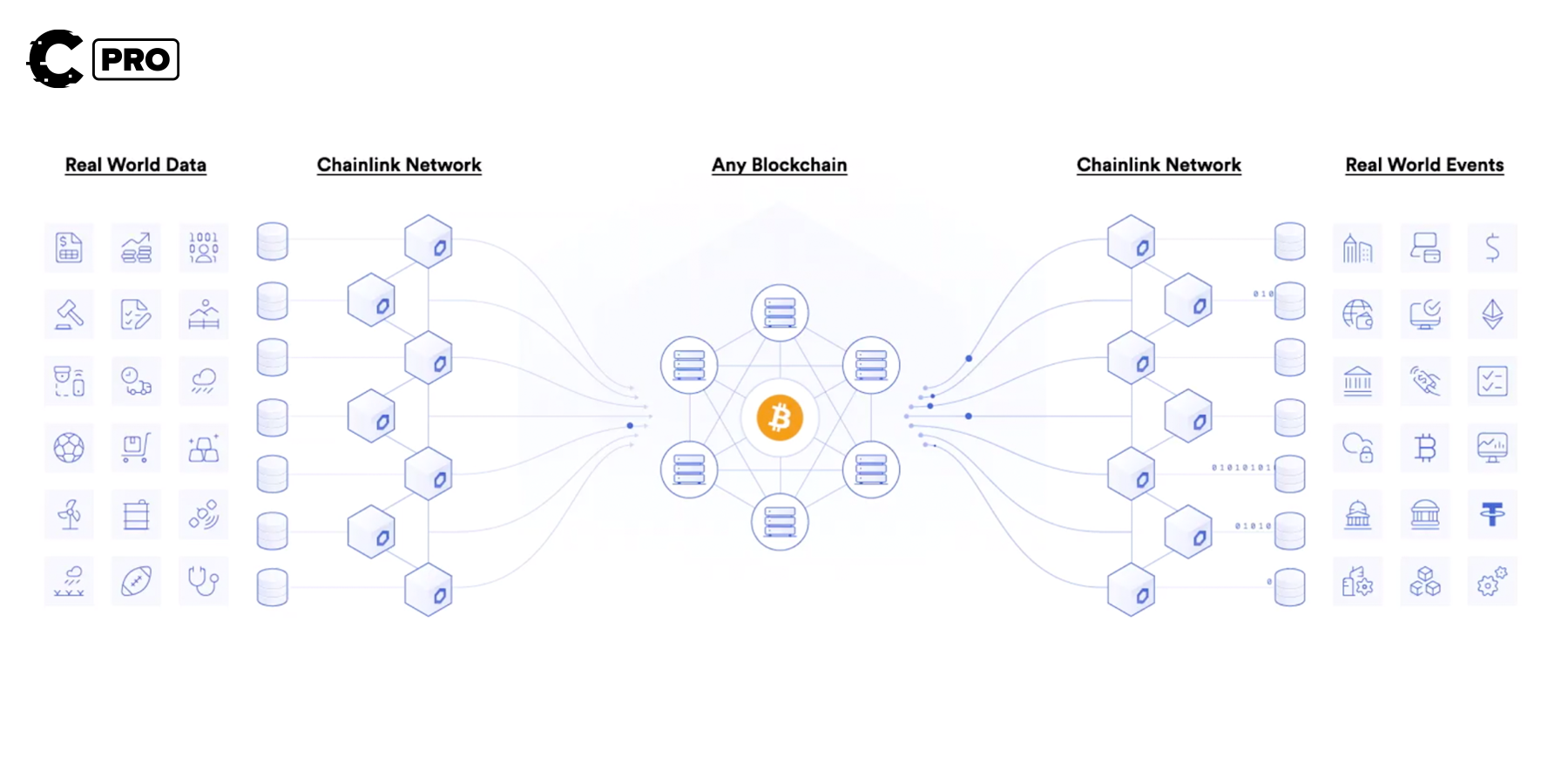

Chainlink is the most widely used Oracle network for powering hybrid smart contracts. It enables any blockchain to access off-chain data and computations securely.But what exactly is an oracle?

An oracle is a bridge that connects real-world data to blockchain networks.

Blockchains are essentially self-contained ecosystems.

But here's the thing - DeFi apps need outside info to really be useful. Like price data, interest rates, sports scores, you name it.

Real-world stuff that exists off the blockchain. Without it, DeFi apps are missing crucial ingredients and won’t be really useful to anyone.

This is where Chainlink comes to the rescue! It's like a bridge between blockchain and non-blockchain data.

Chainlink is that middleware piece that lets smart contracts tap into external data securely. It's the secret sauce that makes DeFi apps work their magic!

See, Chainlink has these "oracles", which are basically APIs that feed real-world info into any blockchain. So, DeFi apps can pull data like market prices or sports results directly into the smart contract logic. It's brilliant! Chainlink unlocked a whole new wave of next-gen smart contract apps.

But you probably knew all that already, so why bring up Chainlink now?

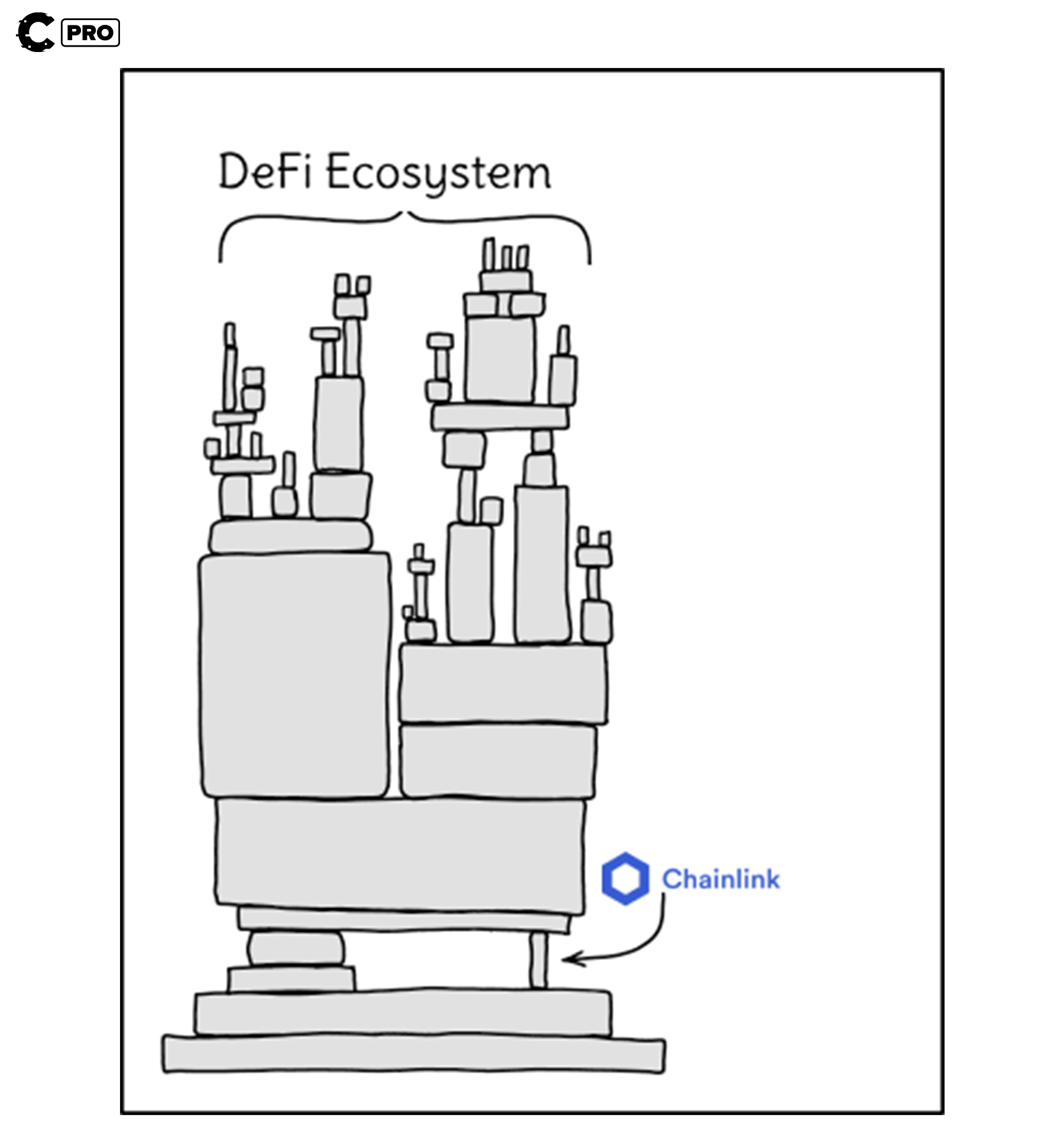

While Chainlink has been one of the most important protocols in the DeFi ecosystem, it has always acted more as a public good than a business. Chainlink kept the whole ecosystem running but wasn't worried about profits.

But that's changing...this year, Chainlink wanna get PAID! And that's big news if you're an investor.

They're expanding services, striking partnerships, and cooking up ways to reward LINK hodlers. Chainlink is levelling up fast!

Let us break it down...

Turning from a public good to a sustainable business

The outlook on Chainlink has improved in three key ways over the year. This change leads us to believe that the product and token have finally become attractive to investors.

We are talking about diversification into different services, monetisation, potential revenue sharing, and their move into cross-chain communication.

Diversifying services away from just data feeds

While Chainlink's core product has gained a strong foothold in the DeFi sector due to widespread adoption, it's important to note that the underlying infrastructure that powers Chainlink's connections between dApps and off-chain data can serve as a versatile platform.Since most decentralised applications already use Chainlink and are familiar with the technology, it is extremely well-positioned to become one of the key infrastructure providers in various domains, making it a highly diverse protocol.

Here are some noteworthy examples showcasing both the potential revenue streams these products offer and the value they bring

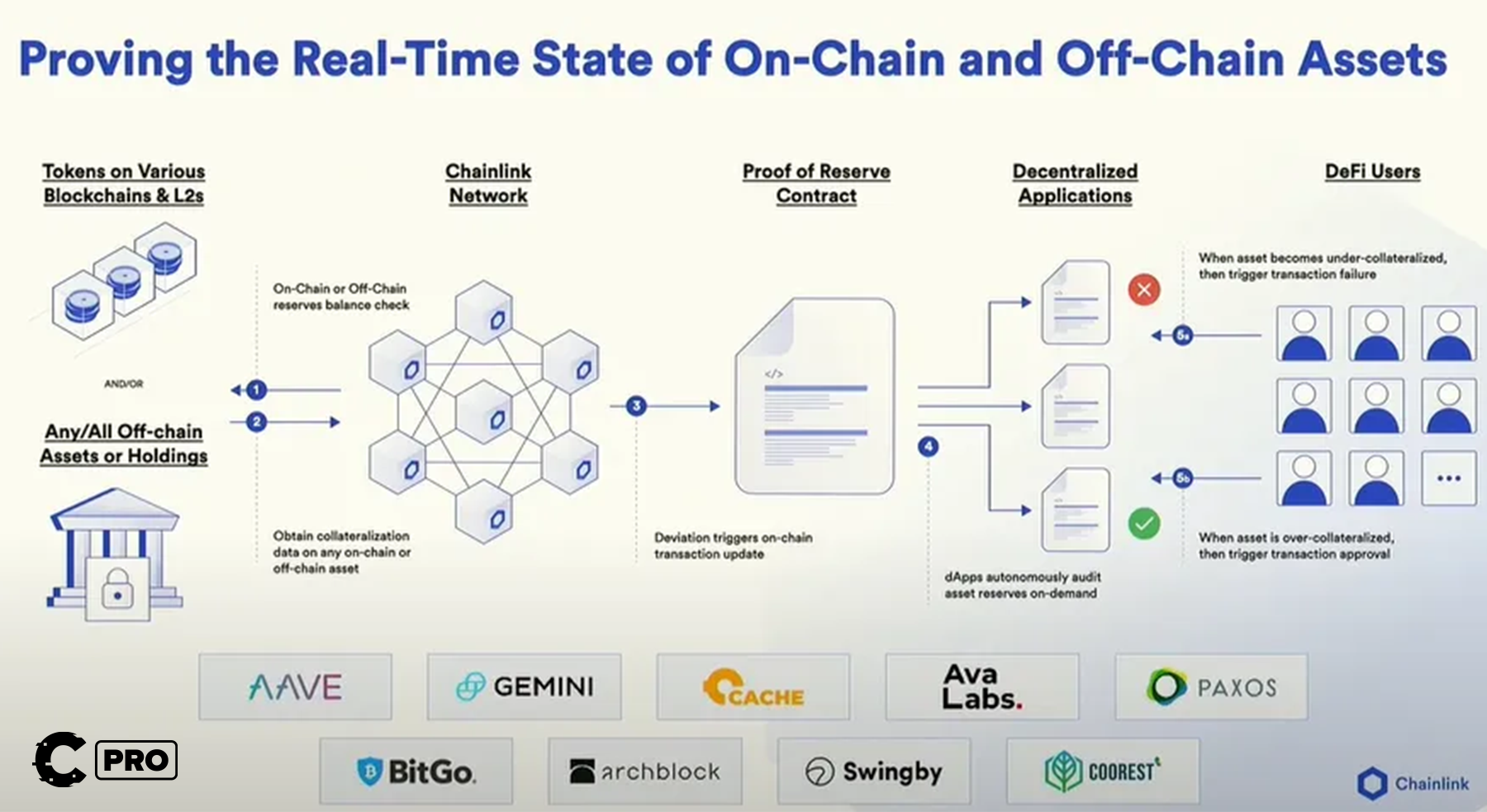

Proof of Reserve

Service: Chainlink provides Enhanced Asset Verification through automated audits based on cryptographic truth, ensuring the integrity and accuracy of reserve assets.

Revenue Model: Chainlink can generate revenue by charging fees for automated audits and verification services.

Value: This service enhances trust in decentralised finance (DeFi) by reducing the risk of fraud or mismanagement of reserve assets, making it a crucial component of the DeFi ecosystem.

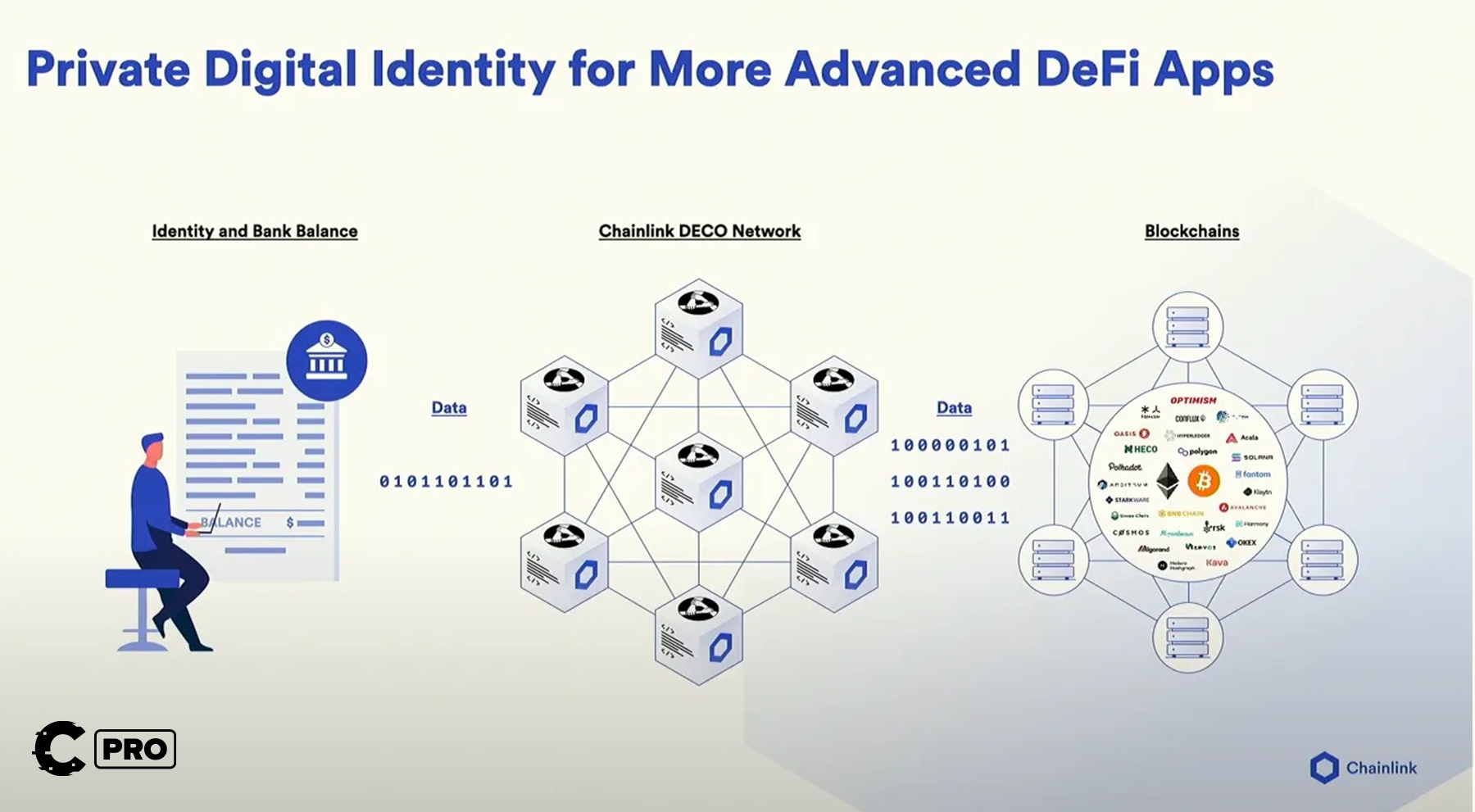

Privacy-Preserving Data (DECO)

Service: Chainlink's DECO Network ensures data privacy by maintaining sensitive information off-chain while providing cryptographic verification on-chain.

Revenue Model: Chainlink can charge organisations for implementing DECO Network solutions or facilitating private transactions.

Value: DECO Network creates privacy-preserving computational environments suitable for applications like private digital identity and financial data protection, enhancing data privacy and security.

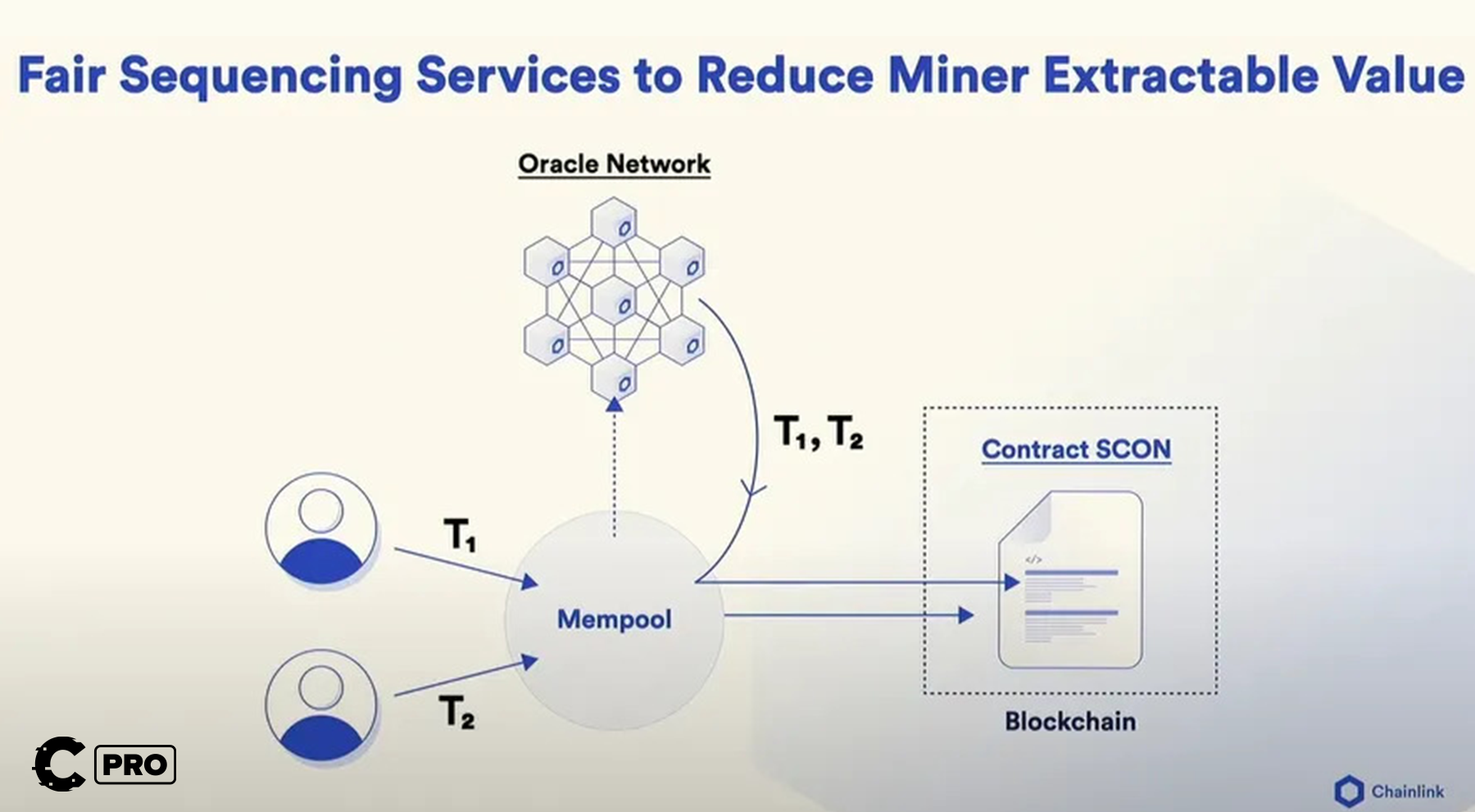

Fair Sequencing (FSS)

Service: Fair Sequencing Services (FSS) is a blockchain technology designed to address the Miner Extractable Value (MEV) issue. This issue occurs when miners or validators manipulate the order of transactions in a crypto network for financial gain.

Value: FSS enhances the fairness and security of transaction ordering in blockchain networks, reducing the potential for front-running and unfair practices. This service benefits blockchain networks, DeFi platforms, and users by providing trust-minimized transaction sequencing.

Revenue Model: FSS may generate revenue by licensing the technology to blockchain networks, DeFi projects, or other platforms prioritising fair transaction ordering. It can charge fees for its implementation and use, contributing to sustainability and development.

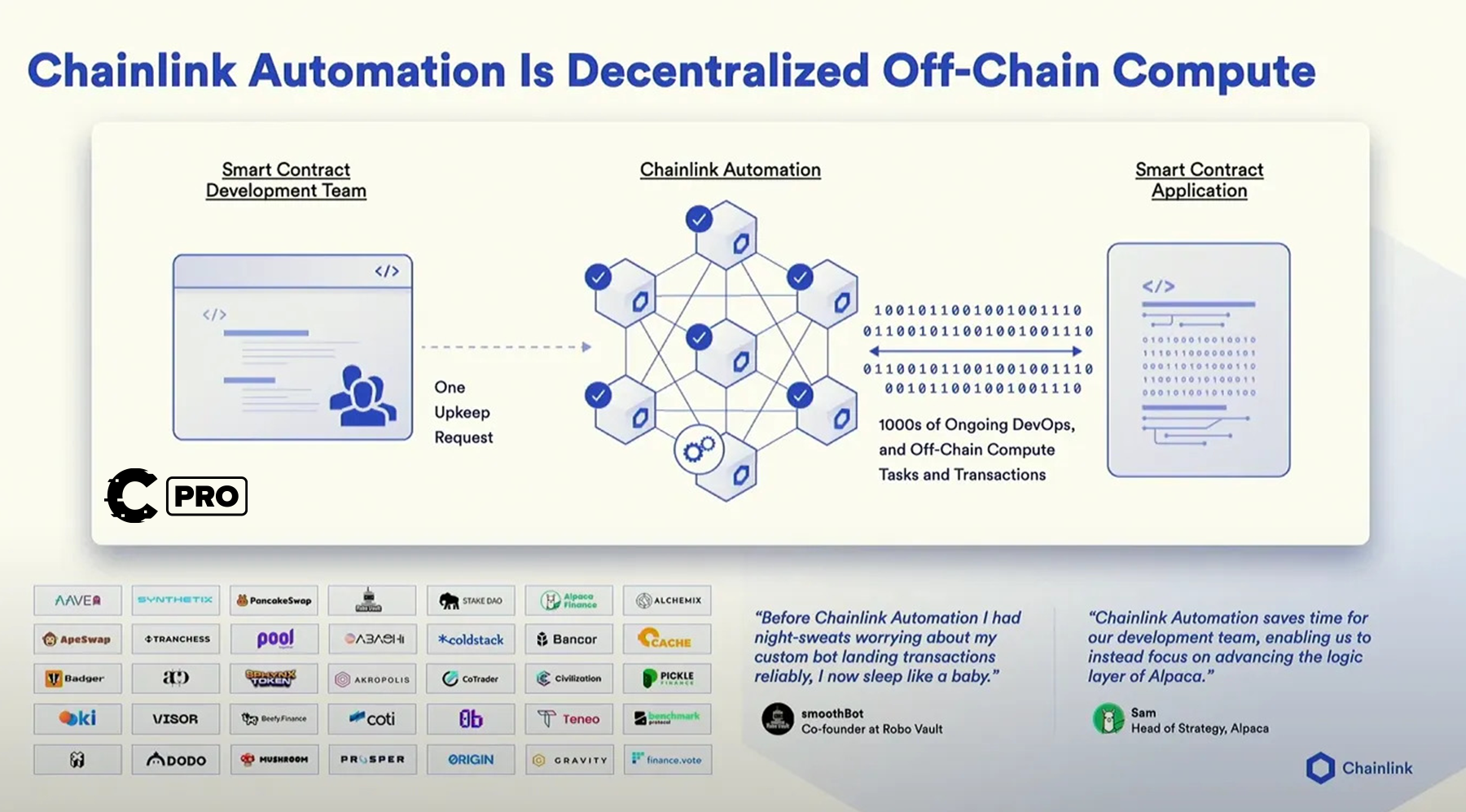

Off-Chain Computation

Service: Chainlink offers essential computational functionalities supporting automated DeFi trading, liquidity management, rewards distribution, dynamic NFTs, and gaming. It also envisions becoming a powerful general compute and storage services provider for decentralised applications (dApps).

Revenue Model: Chainlink can earn fees for providing computational services to DeFi platforms, NFT marketplaces, and gaming applications.

Value: This service enhances the functionality of decentralised applications, supporting various activities and transitioning dApps from centralised cloud infrastructure to a fully decentralised architecture

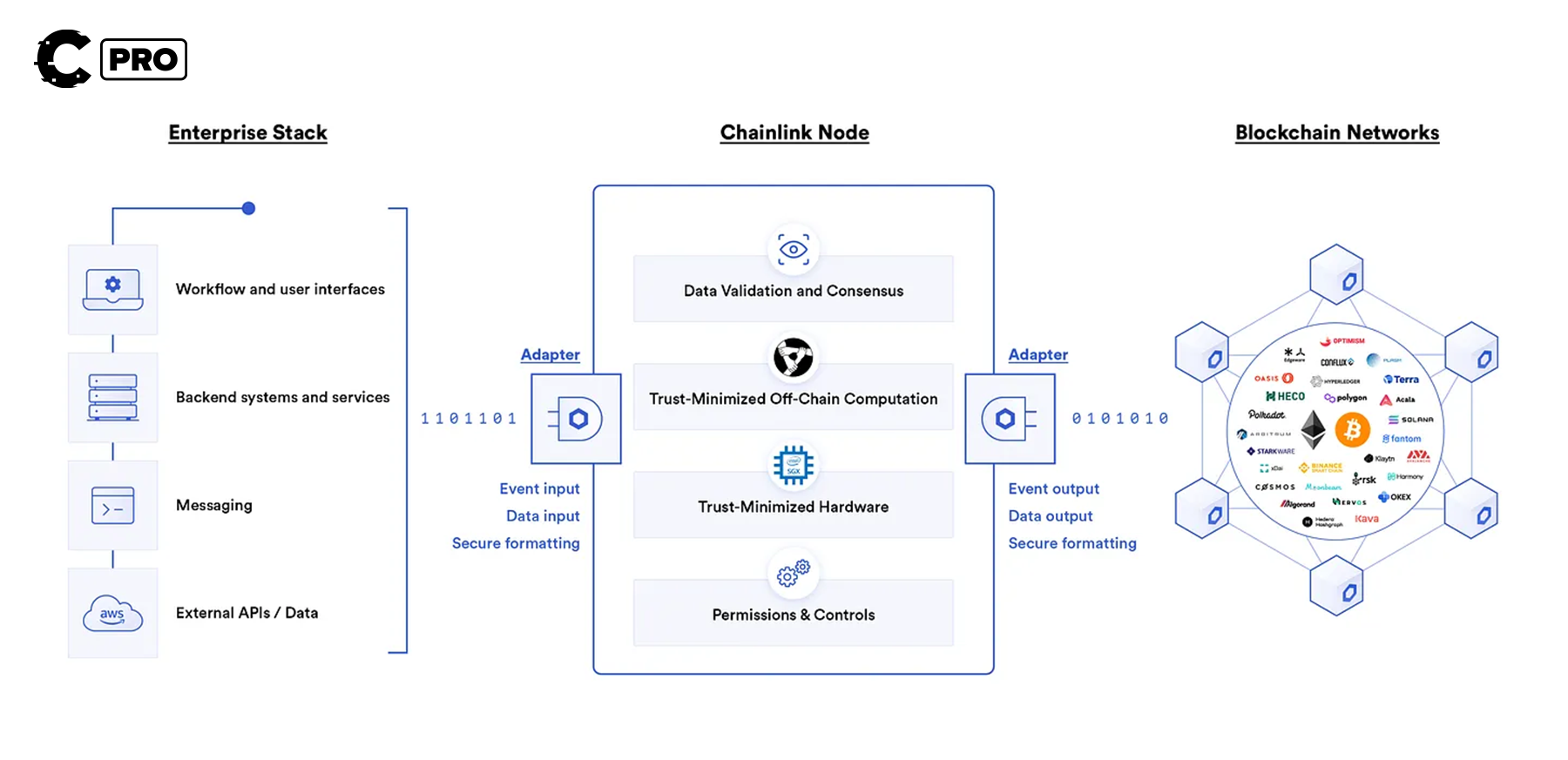

Enterprise Integration

Service: Chainlink offers tailored solutions, consulting services, and integration support to facilitate the seamless integration of blockchain technology into various enterprise applications and processes.

Revenue Model: Chainlink can earn revenue by providing enterprise-specific integration solutions and support services.

Value: Chainlink's expertise and solutions enhance business processes and enable innovative blockchain applications, appealing to enterprises looking to leverage blockchain technology for competitive advantages.

Solving liquidity fragmentation: The next major revenue opportunity

While all the products that Chainlink offers are impressive and will undoubtedly add value to the protocol by addressing challenges faced by decentralised applications and enterprises, they may not be as groundbreaking as Chainlink's initial introduction of blockchain oracles.However, one issue remains particularly significant and presents the most promising opportunity for Chainlink to excel: liquidity fragmentation.

This problem arises due to the lack of interoperability among blockchains, leading to seamless communication and usage difficulties because they can not communicate with each other.

We believe that solving this challenge is key to the future of blockchain infrastructure.

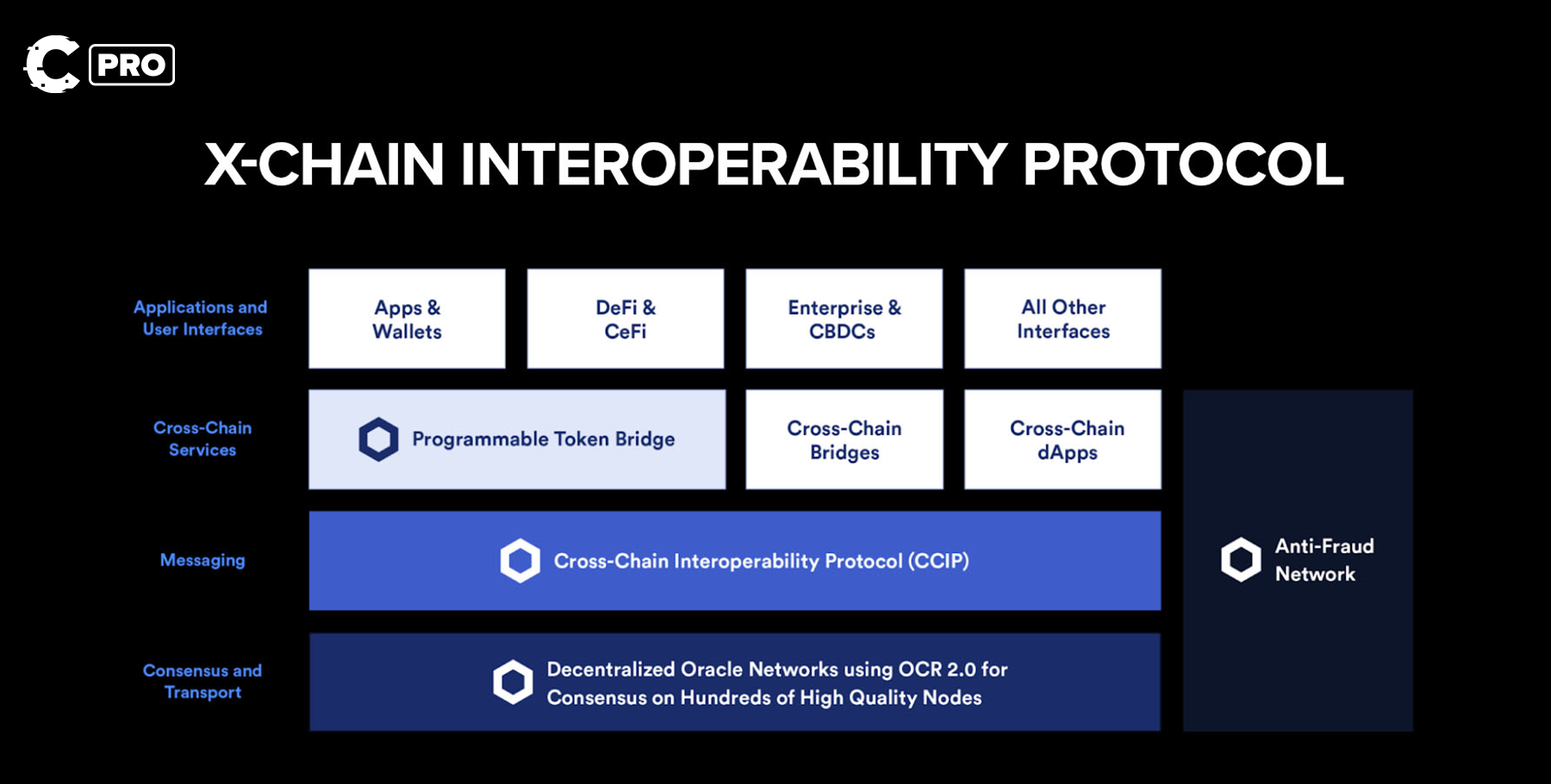

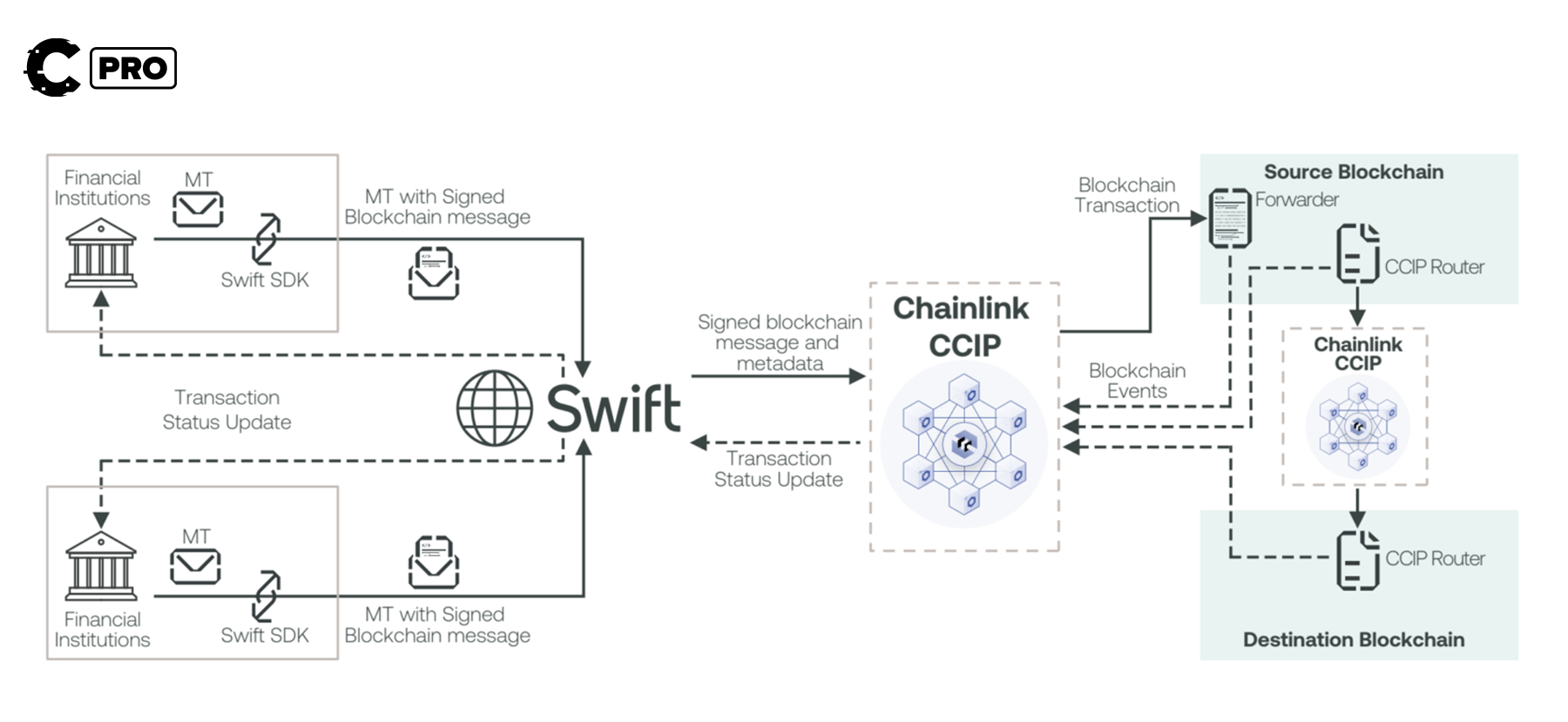

However, Chainlink has embarked on a mission to bridge these gaps. They have been hard at work, developing what they believe is the solution to this problem: the Cross-Chain Interoperability Protocol, or CCIP.

At its core, CCIP is a cross-chain messaging framework, empowering developers to build services and applications that communicate seamlessly across multiple blockchain networks.

For example, a user could deposit ETH into Aave on Avalanche. Aave would then use CCIP to transfer the ETH to Compound on Ethereum, which mints cETH representing the collateral. The user can borrow assets on Ethereum using the cETH as collateral.

When finished, the cETH is burned, triggering CCIP to send the ETH back to Aave on Avalanche and repay the loan. This allows the user to earn Aave yield on Avalanche while accessing Ethereum DeFi apps with borrowed assets, saving on fees compared to manual bridging, with no bridge custody requirements.

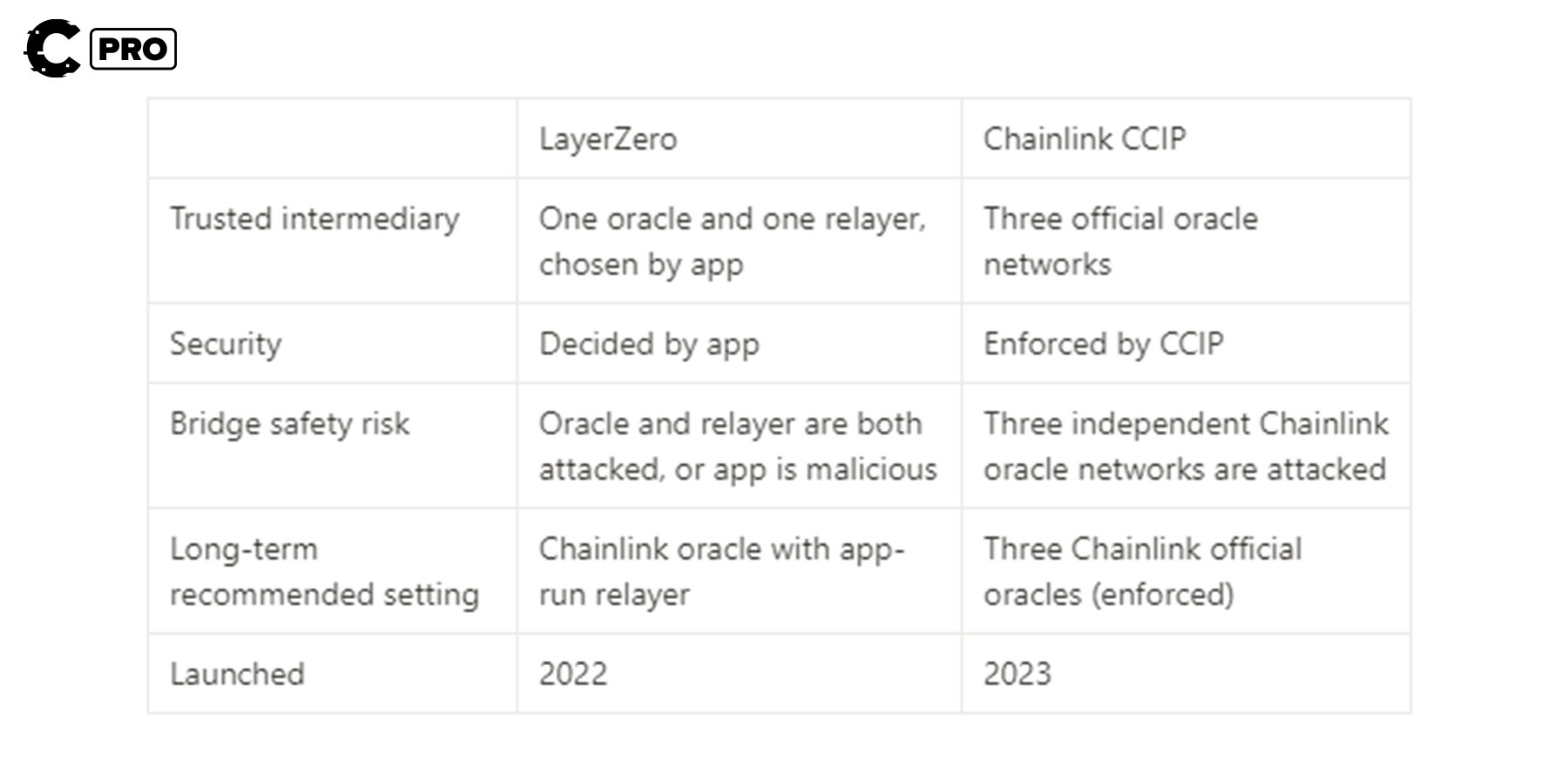

To provide perspective on the scale of this infrastructure, Chainlink's largest competitor in cross-chain messaging, LayerZero, was recently valued at $3 billion in its latest funding round.

This valuation already represents 40% of Chainlink's current Fully Diluted Valuation (FDV), which is $7.47 billion. This showcases that offering this service could significantly increase LINK's valuation, underscoring the magnitude of the pain point it could address.There are several reasons why CCIP could outshine Layer Zero.

Chainlink Oracle Integration: CCIP leverages the established and decentralised Chainlink Oracle network, providing a reliable and proven data source for cross-chain applications.

True Decentralization: CCIP does not rely on default or centralised entities, enhancing security and reducing the risk of single points of failure.

Customisable Security: Developers can configure security settings according to their application requirements.

Transparent Fee Structure: CCIP employs transparent fees paid in LINK tokens, ensuring clarity and predictability for users.

Despite being a bit late to the party, these advantages make Chainlink well-positioned to disrupt another industry, just as it has done with oracles, and gradually capture a significant market share over time despite Layer Zero's head start in terms of adoption.

Potential for revenue sharing

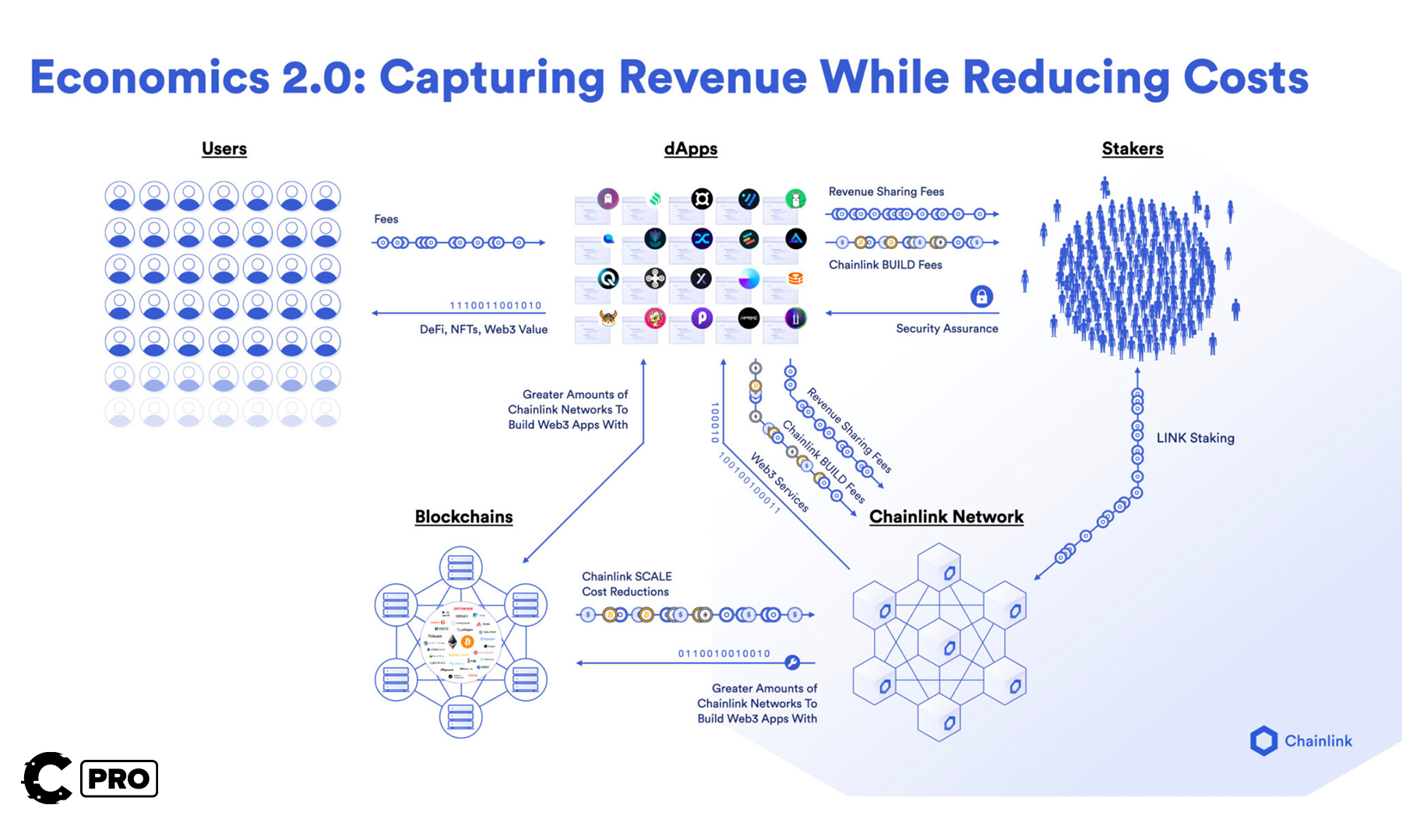

Let's delve into what makes Chainlink particularly compelling compared to its 2021 state, especially given its noteworthy strategic transformation since 2022.This is because, since 2022, the network has undergone a significant strategic shift. This transformation signifies a departure from its prior focus on market expansion, now pivoting towards a pronounced emphasis on revenue generation, marking a pivotal stage in the network's evolution.

It reflects the network's maturation and evolving need for sustainable revenue generation, demonstrated by its launch of 'Economics 2.0.'

Within this initiative, Chainlink has introduced LINK staking and an all-encompassing revenue framework that delineates the capture and distribution of earnings generated from its services.

There are three primary avenues through which LINK token stakers can anticipate receiving their rewards:

Staking Rewards: Active participants in LINK token staking stand to earn rewards as part of the staking mechanism. The initial target for annualised staking rewards is up to 5%, allowing participants to increase their LINK holdings through these additional tokens.Service Fees: Chainlink's growth and heightened adoption result in higher fees from users availing themselves of its dependable Oracle services. A proportion of these fees is allocated to stakers, with the potential for more substantial rewards as Chainlink's user base expands, thus amplifying the fees available to stakers.

Partner Growth Program (PGP): In a strategic move, Chainlink has devised a Partner Growth Program (PGP) to foster collaboration with projects integrated into the Chainlink ecosystem. Through this program, integrated projects provide incentives to accelerate their growth while aligning their economic interests with the Chainlink community. Stakers can actively participate in the PGP, potentially yielding rewards and a range of benefits.

With this mechanism in place, any future revenue generated by Chainlink or partnerships formed within its PGP program will directly benefit LINK holders.

This connection significantly ties the value of Chainlink to its token and establishes a more sustainable model. Token holders can now reap rewards not only through price appreciation but also through revenue generation.

Two important catalysts for Chainlink

Besides these favourable advancements, two primary catalysts are establishing a robust position for Chainlink this quarter and into 2024.These catalysts encompass a growing demand for real-world assets and Chainlink's strategic partnership with SWIFT, both of which signal a highly promising trend for Chainlink's future.

1. Demand for real-world assets

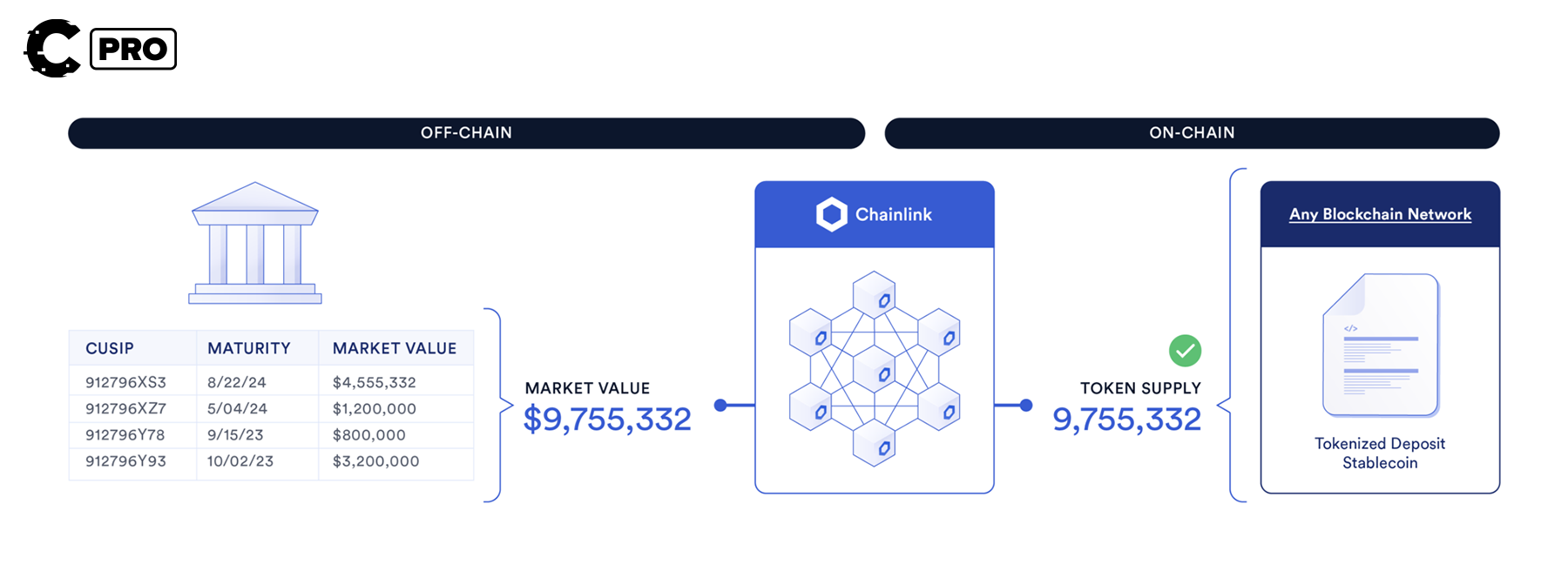

The world of tokenisation is not new, but today's landscape presents an exceptional opportunity for widespread adoption.Stablecoins have proven themselves as efficient mediums of exchange while pursuing higher yields. That's why protocols like MakerDAO to explore tokenising 'Real World Assets,' even including U.S. treasuries.

What might not be widely known is that Chainlink, with its comprehensive suite of products and robust infrastructure, is strategically positioned to harness the renewed interest in asset tokenisation. It offers the essential infrastructure for companies to commence their asset tokenisation journey.

Here's how Chainlink's capabilities align seamlessly:

- Blockchain Compatibility: Chainlink ensures that tokenised assets can settle on any blockchain.

- Risk Mitigation: Through secure Delivery vs Payment (DvP) workflows, Chainlink effectively reduces settlement risks.

- Seamless Integration: Chainlink can effortlessly integrate with existing legacy systems. This simplifies the adoption of blockchain technology, reducing complexity and expenses along the way.

- Standardisation and Compliance: Chainlink takes the lead by establishing a blockchain interoperability standard.

- Transparent Asset Verification: Using Chainlink's Proof of Reserve, tokenised assets undergo real-time on-chain audits.

2. Partnership with SWIFT

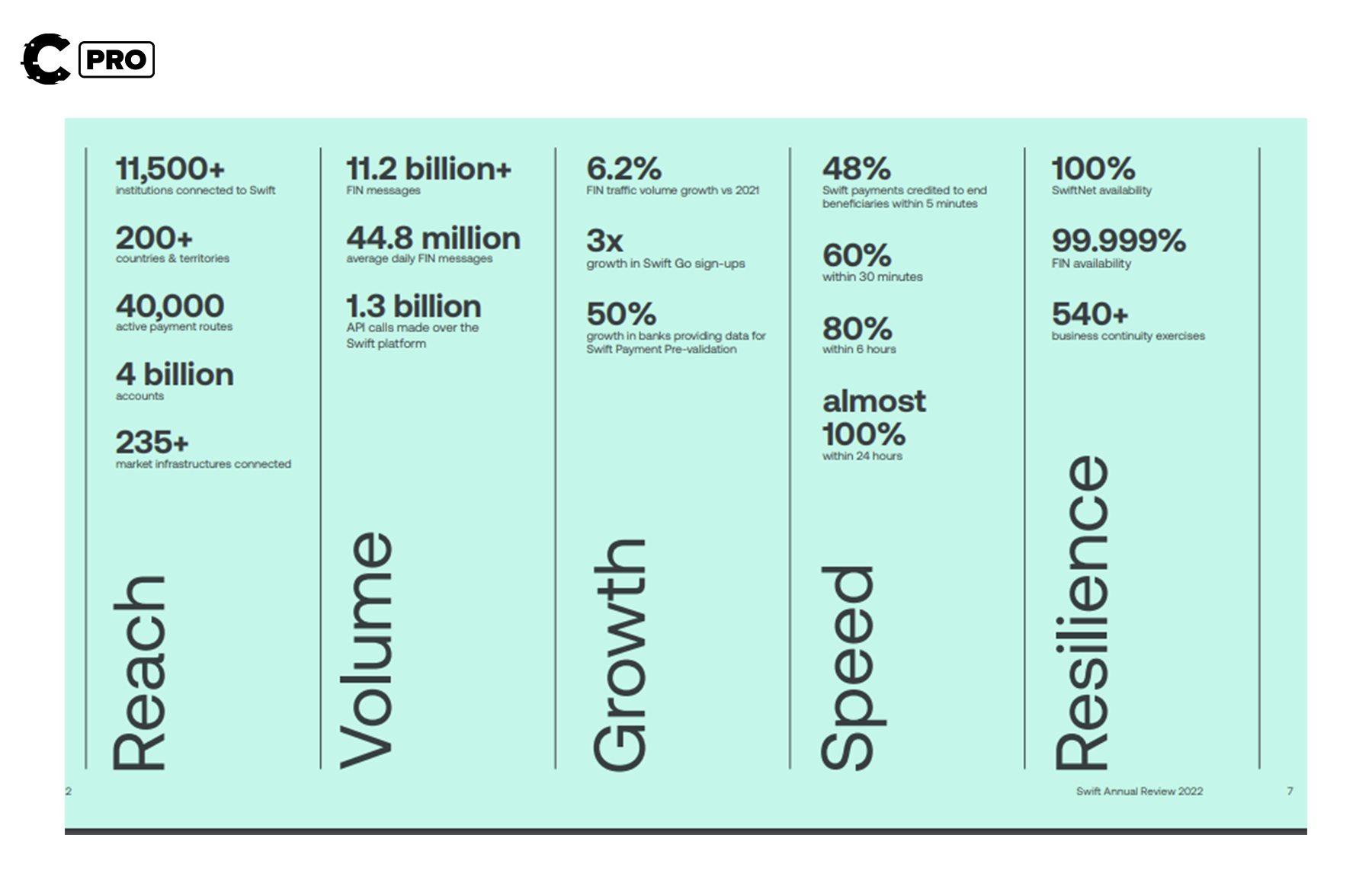

An essential aspect to consider is Chainlink's strategic collaborations with key players in traditional finance. Perhaps the most noteworthy is its partnership with The Society for Worldwide Interbank Financial Telecommunication (SWIFT).SWIFT is a major financial industry player, connecting over 11,000 financial institutions across more than 200 countries. This makes SWIFT a highly impressive partner for Chainlink.

Recently, SWIFT conducted a pilot program in collaboration with major financial institutions, including Australia and New Zealand Banking Group Limited, BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange, and The Depository Trust & Clearing Corporation.

The objective was to assess whether these institutions could effectively interact with tokenised assets and perform transactions using their existing systems on blockchain platforms.

The positive results demonstrate that blockchain and traditional banking systems can securely collaborate for transactions. Chainlink's continued partnership with SWIFT and other traditional financial institutions provides a significant advantage over other infrastructure providers.

This area is worth close attention. Any further positive developments arising from the partnership with SWIFT will likely substantially impact the value of LINK. It could also open up massive revenue opportunities if Chainlink can strike enterprise deals to offer its services to financial institutions.

Assessing the value of the LINK token

Now that we have understood the fundamental value of Chainlink and why this is an opportune time to pay attention to LINK, it's time to focus on the LINK token.While we are bullish, the question remains: What is a fair valuation for this project, and where do we see the price of LINK going?

Considering Chainlink's ambitious goals, creating a valuation for the product can be challenging. We have gone with a conservative valuation methodology that does not address the entire addressable market that Chainlink could serve.

Valuation

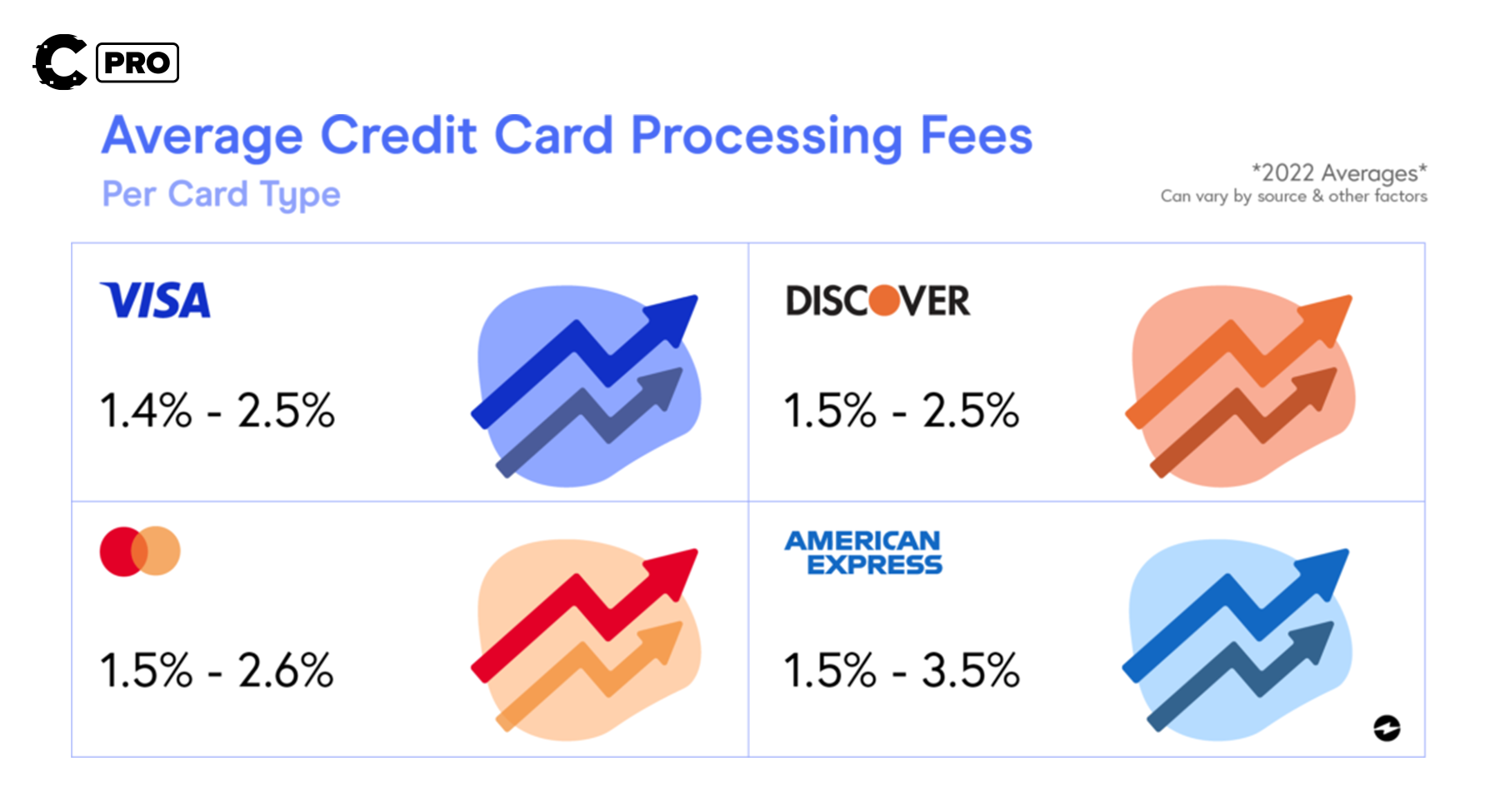

Chainlink operates with a business model akin to traditional B2B financial services. Like well-established credit cards companies like Mastercard and Visa, Chainlink plans to institute fees across its service offerings, marking a clear shift toward a revenue-driven approach.

With this transition towards monetisation, it's reasonable to anticipate a fee structure similar to that of its peers. To exercise caution, we've assumed an average fee of 2% across most of its services.

Estimating total revenue projection:

Our journey towards valuing Chainlink begins with a fundamental step—estimating the total revenue expected to be generated within the decentralised finance (DeFi) sector over the next two years.We anticipate the DeFi sector to generate approximately $10 billion in total revenue during an optimistic market phase.

This projection is fortified by conservative assumptions and empirical evidence, such as Uniswap's remarkable achievement of earning $100 million in monthly fees during the last bull run in March 2021.

Chainlink's share of the DeFi market

Now that we have a projection for the total DeFi revenue let's estimate Chainlink's potential market share within this sector. With its established presence and critical role in the DeFi space, Chainlink is well-positioned to capture a substantial portion of this revenue.Our conservative estimate suggests that Chainlink could secure approximately 2% of the total DeFi revenue through the fees it charges for its services.

Diversification into additional revenue streams

However, Chainlink's revenue potential extends far beyond the DeFi sector. In addition to DeFi, Chainlink has the opportunity to explore and capitalise on other revenue streams.These additional streams encompass areas we previously discussed, such as potential enterprise integrations with web2 companies and any deals that may result from the SWIFT partnerships. With that in mind, an additional revenue stream of $50 million from web2 and enterprise deals is realistic.

This figure would be approximately five times the average revenue of a typical SaaS company offering enterprise solutions. We think the SWIFT partnership will play a significant role in achieving this multiple as it opens up Chainlink to a vast client base of thousands of banks.

LINK’s final valuation

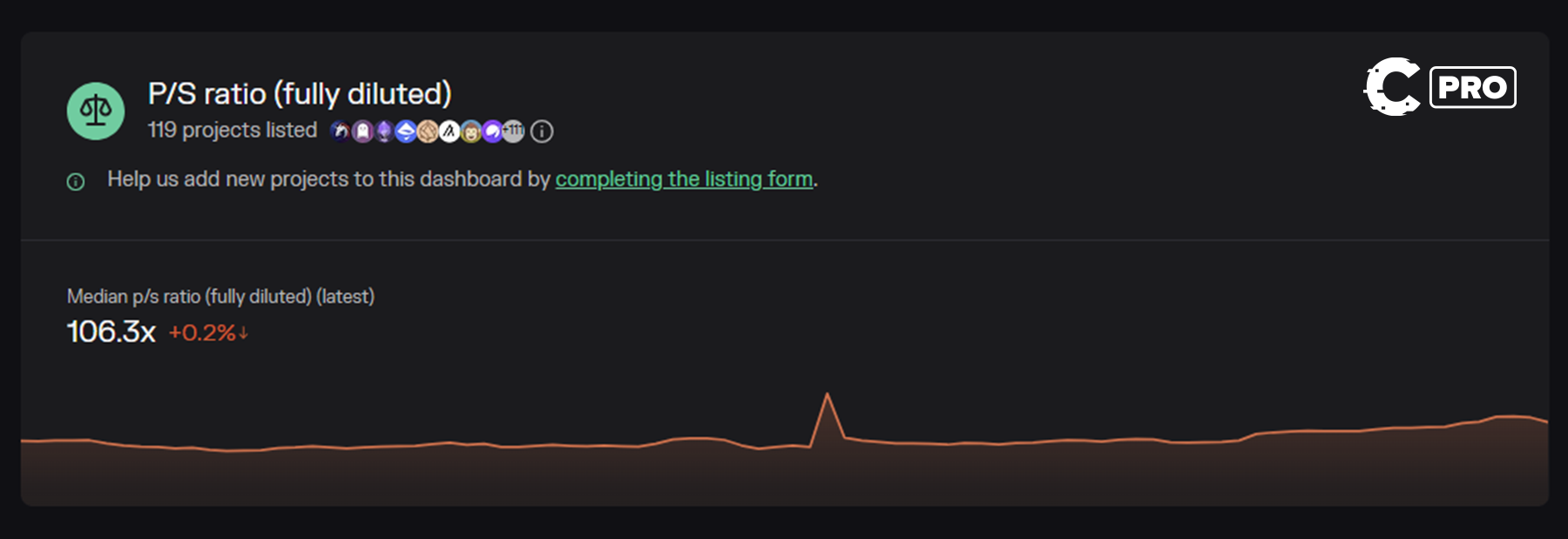

Assuming DeFi revenue of $200 million and non-DeFi revenue of $50 million, Chainlink's total revenue reaches $250 million. We utilise the widely recognised Price-to-Sales (P/S) ratio to evaluate Chainlink's worth.This methodology aligns Chainlink's valuation with industry standards, leveraging the crypto sector's median P/S ratio of 106 as our benchmark.

Using the P/S ratio approach, we arrive at a potential LINK valuation of $26.5 billion as we expect stakers to benefit from these revenues significantly.

Price targets

Now that we have this valuation, we can explore price targets.Currently, Chainlink's market cap is $4,197,241,537, with a Fully Diluted Valuation (FDV) of $7,537,472,845 and 55% of the circulating supply available.

The majority of the other 45% is held by the Chainlink Foundation in its treasury, making it challenging to predict how much the circulating supply will increase.

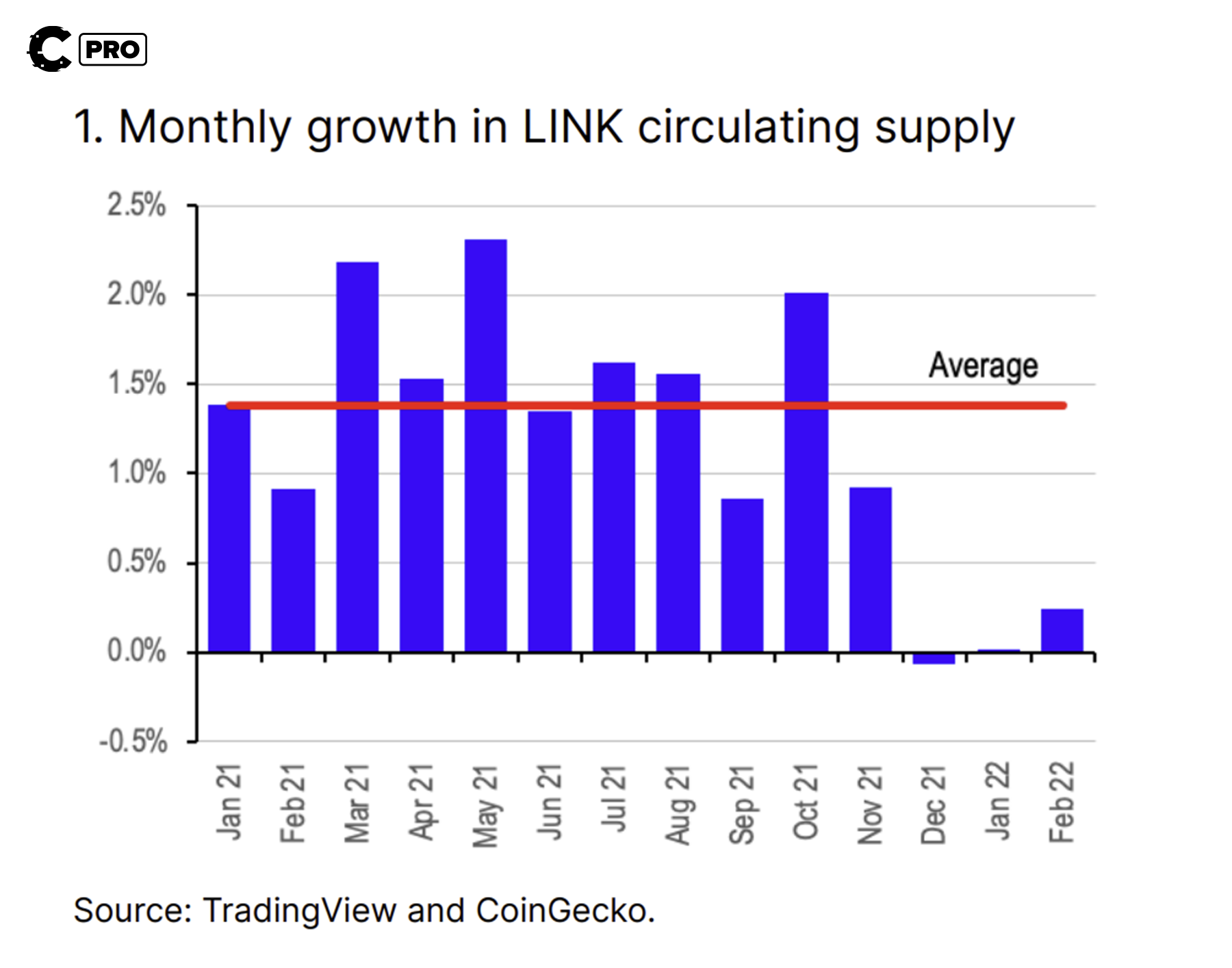

However, on average, it has been increasing by 1.4% per month. Assuming this trend continues, we can expect the circulating supply to reach 623,179,051.42 in 1.5 years.

When considering the circulating supply and project where Chainlink could be in the next 1 to 2 years, we arrive at a price target of $42.54.

Achieving this price from the current level of $7.55 represents a remarkable 464.24% increase, offering a 4.64X opportunity.

It is important to note that this is a very conservative price target in which we have a high conviction.

Invalidation criteria

There are a few key events that would invalidate the thesis:- We will become concerned if Chainlink loses its dominant position as the leading Oracle provider and falls below 60%. The same applies to a lack of adoption of CCIP, with Layer Zero gaining a market share multiples higher than Chainlink in cross-chain communications.

- The Chainlink Foundation holds a significant portion of LINK's supply. We would be concerned if the foundation were to add these tokens to the circulating supply at a high rate.

- The thesis assumes that Chainlink will pursue its monetisation and revenue-sharing strategy as outlined in Economics 2.0. If it does not begin to monetise in the way it outlined and share its revenue with stakers, this could invalidate our thesis.

Price analysis

Last quarter, LINK recovered above its main horizontal support at $5.85, which was crucial to maintaining a reasonable price structure for LINK. Following this, LINK surged back up to the $8.50 area, acting as the main horizontal resistance during 2023.

Since then, LINK has done a round trip back down to the $5.85 horizontal support and back up to $8.20 (just shy of the $8.50 area).

Going forward, LINK will likely remain range-bound between $5.85 and $8.50. A clean break above $8.50 may take us to the next overhead horizontal resistance of $9.07.

If this were to happen, it may be worth trimming your LINK position (taking some chips off the table). This is particularly true while macro headwinds remain - not supportive for risk assets.

In the short term, the $7.00 level, supported by another uptrend line, needs to hold for LINK to retest $8.07 potentially and then possibly break above there and push on to $9.07. Overall, we remain cautious and patient for lower prices.

If the opportunity presents itself, where LINK falls back below its main horizontal support of $5.85, the $4.55 to $5.25 would be an attractive zone for beginning to Dollar-Cost-Average into LINK. The plan will then be to hold for the long term as we await the next bull run.

Cryptonary’s take

Chainlink's logo is just the beginning of what sets LINK apart as a blue-chip asset. The strategic shifts it has made since 2022, focusing on revenue generation and service expansion, are commendable.What distinguishes Chainlink is its deep integration within the crypto ecosystem. Another key point is its remarkable ability to bridge the worlds of traditional finance and crypto. It does this through strategic partnerships, exemplified by its collaboration with SWIFT.

Incorporating LINK into a diversified crypto portfolio offers stability and a reduced risk profile compared to other assets, thanks to its sustainable business model and dominant market position. It serves as a robust foundation, offering a high degree of upside potential with some limitations.

Considering Chainlink's rapid growth, we have set a target of $42.54 within the next 1-2 years. However, we advise careful consideration, especially if LINK retraces below its primary horizontal support at $5.85. In such a scenario, $4.55 to $5.25 presents an attractive opportunity for Dollar-Cost Averaging.

Action points

- Accumulate LINK between $4.55 and $5.85

- 50% of the position will be sold at $42.54

- The rest will be held for re-evaluation at a later date.

As always, thanks for reading.

Cryptonary, out!