Is Crypto Dead? The Survival Playbook for 2026

Since October 10, crypto has been in a different regime. Bitcoin went from $126,000 to $60,000 in four months. The largest liquidation event in crypto history erased $30–$40B in a single day. Sentiment is the worst since FTX. And yet, the rails underneath crypto have never been stronger. Here’s how we think about what broke, what survived, and what comes next…

In this report:

- How peak optimism gave way to the sharpest correction since FTX

- The October structural break and crypto's largest ever liquidation cascade

- Institutional flows, ETF positioning, and on-chain data today

- Regulatory progress: GENIUS Act, CLARITY Act, and what is still in play

- Stablecoins, lending, perps, and RWA tokenization as real product-market fit

- The dot-com parallel and which parts of crypto survive the sorting phase

- How to think about positioning from here

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The Setup: Peak Optimism

Let’s start from the top. Coming into 2025, the setup looked as good as it has ever looked for crypto. Trump's victory created a wave of pro-crypto policy expectations. The "America as the crypto capital" narrative gained real traction in Washington, and for the first time, that rhetoric came with legislative follow-through.ETF approvals had already normalized institutional Bitcoin exposure. Spot Bitcoin ETFs accumulated over $56 billion in cumulative net inflows within their first year, with BlackRock's IBIT alone commanding roughly $72 billion in AUM as time progressed. Fidelity, Bitwise, and others followed. Ethereum spot ETFs launched. The plumbing was built, and institutional capital was flowing through it.

On the legislative front, stablecoin and market structure bills advanced further than they had in any prior session. The GENIUS Act, establishing the first federal framework for payment stablecoins, was signed into law in July 2025. The CLARITY Act, which draws jurisdictional lines between the SEC and CFTC, passed the House. The SEC under Chair Paul Atkins dropped nearly all non-fraud enforcement actions from the prior administration and proposed an innovation exemption for crypto startups.

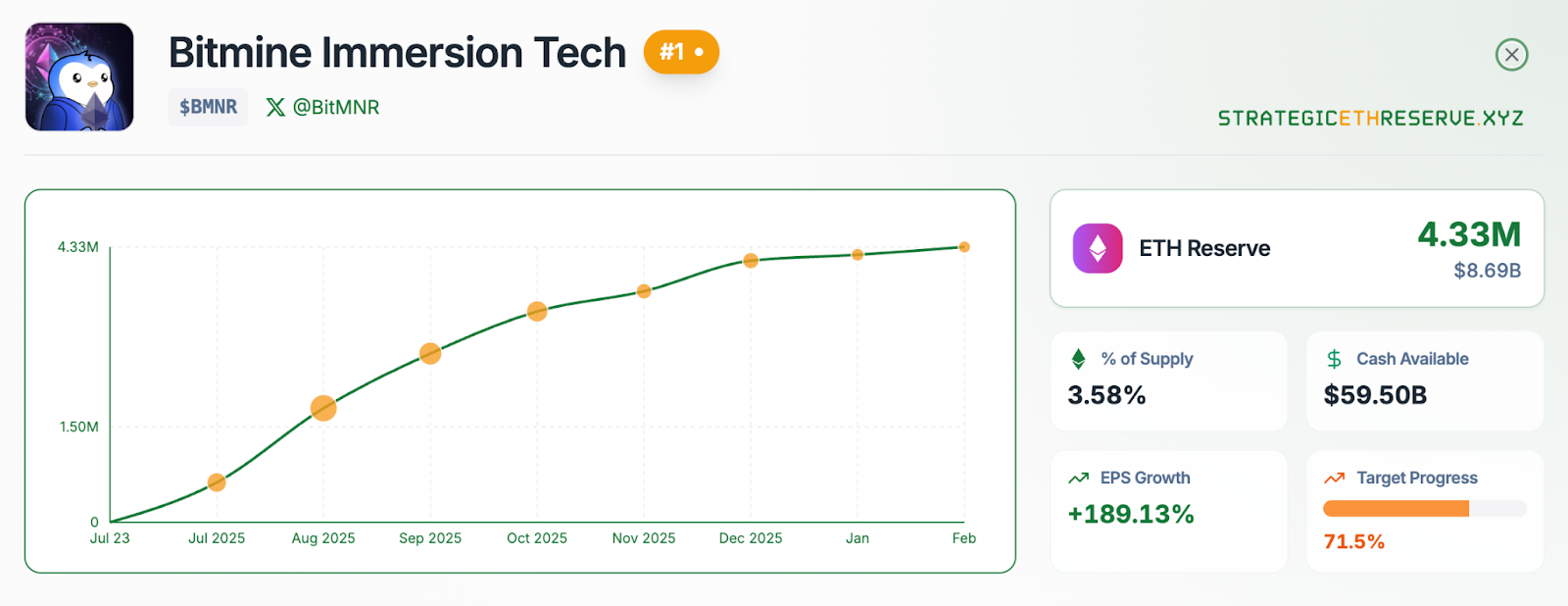

Bitcoin pushed toward and eventually broke through to new all-time highs, peaking near $126,000 in early October. Ethereum hit its own all-time high of roughly $4,950 in August 2025, driven by ETF inflows and corporate treasury accumulation. Digital asset treasury vehicles like BitMine helped push ETH higher. Broad confidence settled in that 2025 would be a breakout year, with a strong end of the year.

The backdrop was genuine: policy tailwinds, institutional acceleration, broad confidence. It was not imagined. It was real.

October 10: The Structural Break

However, things started to break towards the end of the year. On October 10, a 100% tariff announcement on Chinese goods injected a fresh wave of macro uncertainty. MSCI flagged concerns around crypto-heavy equities and, as a result, risk assets wobbled across the board.The Binance glitch triggered what became the largest liquidation event in crypto history. Between $30 billion and $40 billion in forced selling cascaded through the market within hours. Altcoins fell 60% to 70% intraday. Positions that had been built on the assumption of a continued bull run were wiped out in a matter of minutes.

Equities, on the other hand, did not meaningfully break just yet. The S&P absorbed the tariff shock and held near its highs. But crypto, thinner and far more heavily levered, absorbed the impact disproportionately. The structure of the market (concentrated leverage and reflexive liquidation cascades) amplified a macro shock that other asset classes largely shrugged off.

The Damage Report: Risk-Off Scoreboard

Here’s the simplest way to understand the damage: treat it like a scoreboard. Majors are deep in drawdown, while stablecoins sit at highs… This is a clean snapshot of risk-off behavior.

This is all happening while the S&P 500 remains near all-time highs and gold recently pushing back above $5,000. Meanwhile, crypto sits roughly 40 to 50% below its peaks across the board. Most altcoins are deeply underwater. Bitcoin dominance has climbed to approximately 58.5%, reflecting a flight to relative safety within the asset class.

This is not a clean rotation into quality. This was broad de-risking. Spot volumes on major exchanges have dropped roughly 30% since late 2025, and retail participation has faded. The Crypto Fear & Greed Index sits at its lowest level since June 2022.

Even institutional positioning has not insulated the market. Digital asset treasury vehicles like BitMine accumulated ETH through the rally while framing ETH as structurally undervalued. Those positions are now sitting on serious drawdowns.

Ethereum, trading around $2,090, has underperformed Bitcoin significantly, with its staking ratio just crossing 30% for the first time. A sign of long-term conviction, but not enough to offset the near-term selling pressure.

But the drawdown hasn’t been uniform. A few pockets of outperformance have started to separate based on real usage and buybacks. One notable example has been Hyperliquid, which has shown relative strength while most of the market retraced sharply. Weekly protocol revenue surged nearly 200% from late December into February, with the platform hitting $6.84 million in daily revenue on February 5, its highest since October.

The protocol averages roughly $2.7 million in daily revenue with no active points season and multiple zero-fee competitors running. Its share of decentralized perpetual open interest has climbed to a record 6.7%. Recently, HYPE rallied more than 80% off its lows. That does not confirm a new cycle but it may signal early differentiation based on real revenue and usage…

The Next Domino: If Stocks Roll Over

Even if a handful of protocols are differentiating, the macro driver still dominates the tape. The next question is simple: what happens to crypto if equities finally roll over?Despite BTC being down roughly 50% from highs, crypto still remains high-beta to equity markets and global liquidity. If the S&P corrects meaningfully from current levels, risk managers can further reduce ETF exposure and mechanical Bitcoin selling will accelerate. A broader equity selloff would compound that pressure.

Bitcoin ETFs, which purchased 46,000 BTC at this point last year, are now net sellers in 2026. The same vehicles that provided a floor on the way up can become a source of supply on the way down. That reflexivity cuts both ways.

Political & Regulatory Risk

And it’s not just macro. Even if markets stabilize, policy can still change the path, especially with U.S. elections and unfinished legislation ahead.The CLARITY Act remains stuck in the Senate. If it does not pass before the November 2026 midterms, the window could close. A shift in congressional composition, particularly if Democrats regain control of either chamber, could stall or reverse the regulatory momentum that has been building. While bipartisan support for crypto legislation has improved, the majority of Democrats remain wary of the industry.

Regulation is closer than it has ever been. But it is not irreversible. The GENIUS Act implementing rules is due by July 2026, and the rulemaking process has already become contentious, with banks lobbying aggressively to restrict stablecoin issuers from offering yield.

Miner Stress

Here’s an interesting thing we’ve come across though: Bitcoin mining difficulty dropped 11% in early February, the largest decline since 2021. The estimated average cost to mine one BTC now sits around $87,000 according to Checkonchain data, while JPMorgan estimates a production cost closer to $77,000. Either way, both figures are well above the current market price of roughly $68,500. Inefficient miners are shutting down or pivoting to AI compute. If prices remain below production cost for an extended period, forced selling of treasury BTC by miners adds incremental spot supply at the worst possible time.However, historically, large difficulty adjustments like this have coincided with cycle bottoms. Weak miners exit, the hashrate floor stabilizes, and surviving miners' margins begin to recover. But "historically" does not mean "immediately."

The Dot-Com Parallel & the Necessary Purge

Many assets (ADA, DOT, and dozens of others) may never reclaim their prior relevance. Large portions of the market remain speculative excess. Capital that was misallocated during the euphoria phase needs somewhere to go, and for a lot of these tokens, the answer is toward zero.The dot-com bubble offers the clearest historical parallel. In the late 1990s, thousands of internet companies went public. Most went to zero and entire sectors were wiped out. But out of that wreckage emerged companies like Amazon, which not only survived but became one of the most dominant businesses in global history.

Crypto may be entering a similar sorting phase. If that analogy holds, many tokens disappear, capital consolidates around projects with defensible advantages, Bitcoin regains its monetary narrative, and high-utility protocols that generate real revenue strengthen over time. The market does not need a thousand tokens to succeed. It needs a dozen that actually work.

The Messy Middle

Let's be honest about where we are. Equities correcting could drag crypto lower. Political shifts could reintroduce regulatory hostility and many projects will go to zero. Volatility is not going away.Crypto is roughly 17 years old. The dot-com parallel is not just an analogy. If the sorting phase holds, we are not at the end of crypto. We are in the middle of figuring out what actually deserves to exist.

One major difference from 2021 is that market participants are far more informed while capital is more selective. The automatic, reflexive alt season where nearly everything goes vertical did not return. The promised repeat of 2021 never fully arrived. Many coins that peaked in prior cycles will never revisit those all-time highs. Capital now demands revenue, product-market fit, and real usage. Or 100% pure speculative upside for when things start getting silly. But this will be closer to the next cycle.

When equities eventually bottom, crypto likely bottoms alongside them or slightly before. But the recovery will not be evenly distributed. This is the time to take a hard look at your portfolio. Trim what is clearly speculative excess. Reduce exposure to projects with no revenue, no users, no defensible advantage. Rotate toward assets with real usage, real cash flow, real network effects, and a plausible long-term future.

Positioning during this phase matters more than perfectly timing the bottom.

What Actually Has Product-Market Fit

So the question isn’t “is crypto dead?” It’s “what kept growing while prices fell?” That’s how you identify what has real product-market fit.It is easy to be nihilistic after a drawdown like this. Everything is red, sentiment is wrecked, and the loudest voices are the ones calling for zero. But zoom out and something becomes clear: the products that work in crypto are no longer theoretical. They exist, they have users, and they generate revenue.

Stablecoins

This is the clearest success story in the entire ecosystem. Over $310 billion in market cap. Embedded in cross-border payments, remittances, DeFi collateral, and increasingly in institutional treasury management. Tether alone processes more daily volume than most traditional payment networks. USDC has become the preferred on-chain dollar for regulated entities. The GENIUS Act ratified the demand that existed.Prediction Markets

Prediction markets emerged as one of crypto’s most compelling proof points in 2025. Polymarket processed billions in volume during the U.S. election cycle, consistently outperforming traditional polling and proving that on-chain markets can aggregate information more efficiently than legacy systems. That traction has not faded. Polymarket continues to attract volume across political, economic, and cultural events, and its model is being adopted as a template across the industry.The core value proposition is simple: capital can be deployed around events, probabilities, and outcomes rather than price direction alone. In a market where directional conviction is low, that flexibility is a meaningful advantage. Polymarket has not launched a token, but a distribution is widely rumored. Given the platform’s volume, brand recognition, and category dominance, a Polymarket airdrop could be one of the most significant wealth generation events of 2026 for active participants.

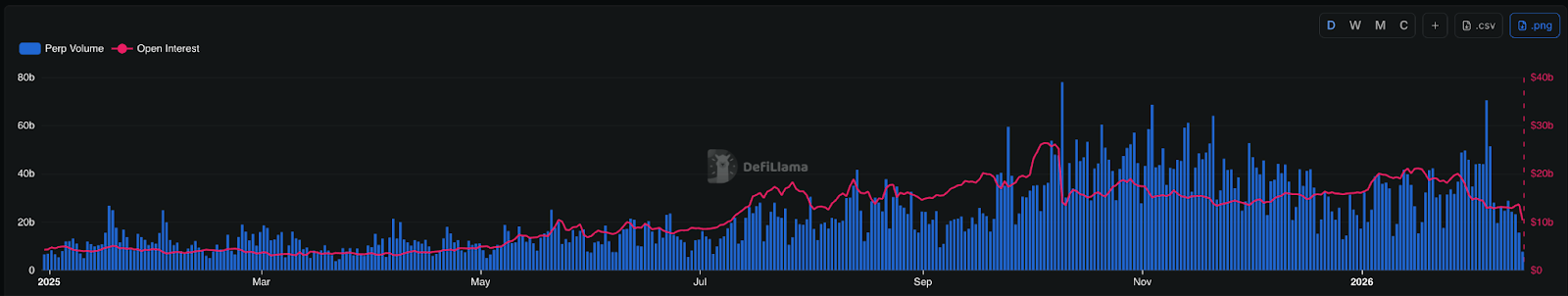

Perpetual Futures & Derivatives

Perpetual swaps are the backbone of crypto trading. Platforms like Hyperliquid have demonstrated that decentralized derivatives can compete with centralized venues on speed, liquidity, and user experience, while generating meaningful protocol revenue.These tools are moving from isolated leverage instruments to core DeFi primitives integrated with lending, collateral management, and hedging. Equity perps may become the preferred vehicle for a new generation of global retail traders seeking 24/7 access with capital efficiency.

Lending & Borrowing

On-chain lending captured roughly two-thirds of the $73.6 billion crypto-collateralized lending market by late 2025. Aave holds approximately $27 billion in TVL. Maple Finance is targeting $10 billion in institutional deposits for 2026. These are not experiments. They are functioning credit markets with transparent collateral, programmable liquidation, and yields that compete with or exceed traditional money markets.Real-World Asset Tokenization

Tokenized RWAs crossed $30 billion in on-chain value by late 2025, up from $6 billion in 2022. Yield-bearing stablecoins backed by treasuries grew from $9.5 billion to over $20 billion. Baillie Gifford is launching a tokenized bond fund on Ethereum. BlackRock's BUIDL fund continues to grow. This is not speculative. It is traditional finance migrating onto blockchain rails because the settlement is faster, cheaper, and more transparent.Privacy & Infrastructure

Privacy-preserving technologies, zero-knowledge proofs, and modular blockchain infrastructure continue to develop largely outside the price action. These are the unsexy layers that everything else runs on. When the market recovers, the protocols that invested in real infrastructure during the drawdown will be the ones positioned to capture the next wave of usage.The point is not that everything is fine. It is that the products with genuine utility are still here, still growing, and in many cases hitting new usage highs even while prices fall. That divergence between usage and price is exactly what you want to see at this stage of a cycle.

Cryptonary’s Take

Put those pieces together (a purge, but stronger rails and a few categories compounding through it), and the playbook becomes clearer. Here’s our take.Drawdowns like this one have a way of making people forget why they got involved in the first place. The noise takes over and the losses feel permanent. The thesis feels broken.

But crypto has been through this before. Multiple times. Each cycle has been declared the last. Each recovery has surprised the people who capitulated at the bottom. The difference this time is that the infrastructure left standing is meaningfully better than what existed in any prior trough. Regulated ETFs, federal stablecoin law, institutional-grade custody, real lending markets, real derivatives markets, real settlement infrastructure. These are not speculative narratives anymore. They are operational realities.

The market is reflexive by nature. Prices overshoot in both directions. That reflexivity is what creates the drawdowns that feel unbearable, but it is also what creates the recoveries that feel improbable. Crypto offers one of the most asymmetric risk-reward profiles in any liquid market, precisely because of that reflexivity. The catch is that you have to survive the downside to participate in the upside.

As long as human civilization exists, there will always be new opportunities in this market. New protocols, new primitives, new applications that have not been invented yet. And for those paying attention, periods like this are often when the most valuable airdrop opportunities emerge.

Protocols building through the drawdown still need users, liquidity, and activity. The teams that survive this phase tend to reward early participants disproportionately, and right now, competition for those rewards is at its lowest point in over a year. Staying active on the right platforms during market stress is one of the few strategies that can generate real value without requiring directional conviction.

The landscape a year from now will look different from the landscape today, just as the landscape today looks nothing like 2022. Capital that is positioned in assets with real usage, real revenue, and real defensibility will be the capital that benefits most when conditions turn.

For now the priority is to survive:

- Have ample dry powder

- Forget your portfolio ATHs. Cut weakness

- Have income outside of crypto

We will catch what the market has to offer in a couple of months/quarters. Again, there will always be new opportunities as long as you survive.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms