Is Cryptonary’s 20X Project a Failure?

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

It’s Autumn 2020 and you come across something called DeFi. Your friends are talking about it, and Elon is tweeting about it. All you hear about are crazy valuations and rags to riches stories.

Of course, your first thought – Google “Best DeFi projects to invest in?” Who pops up at the top but Cryptonary, of course! You open up the site and right there at the top, the last report published— Cryptonary’s 20X.

You read the report and are amazed! This project seems incredible. You feel like you’re about to get into Amazon in the 90’s.

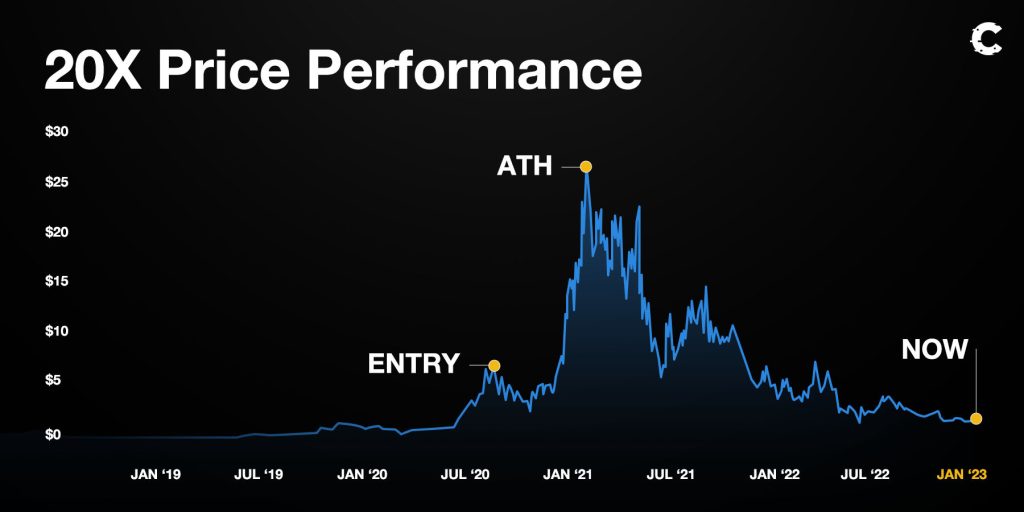

Next thing you know, you’re holding this 20X asset and watching the numbers go up every day. $3.55, now we’re at $5, five weeks later and we’re at $12, one month in and $20 it is!

20X is now at $27, a 9X! and then… boom…

The market crashes in April 2021, you’re not sure what dropped faster, 20X or your stomach. We’re back where we started, $3!

So what went wrong? Today friends, we’re going to lay all our cards on the table and outline the future of 20X.

Let’s get into it.

TLDR: Extra Alpha at the bottom, C’mon scroll along

- Cryptonary’s 20X is an asset called Synthetix (SNX). All signs pointed towards an explosion in value and SNX began on that trajectory, 9Xing over a few months.

- The bear market hits in April 2021 and the price is crippled. Was this simply the bear doing its work, or was it something else?

- A small but significant pump in 2022 was caused by a new feature, but flaws in the product make it short-lived.

- The SNX team are hard at work, building away and implementing two key changes. The future looks bright.

- The Cryptonary team holds strong in its position, 20X is primed, and we are as bullish as ever.

What is Synthetix?

Aptly named Synthetix, SNX facilitates the issuance of ‘synthetic’ assets, which reflect the price of their real-world counterparts. You can call these ‘synths’ for short. Synths are key as they allow for real-world assets to be traded on-chain, this also leads to more liquidity which is a big win.An example is sBTC, which mirrors the price of BTC. Synths can be used for any real-world asset (gold, oil, property even - anything you can think of).

For a more in depth look at Synthetix - check out this Simply Explained article.

So what went wrong?

The inevitable

Look, the reality is that in a bull market picking a winner is nothing special. Everyone and their grandma were pulling 2 and 3X’s.That said, assets like SNX had an advantage. Whilst most projects were moving solely on hype, fundamentally sound assets like SNX had the advantage of actually being a good investment.

Unfortunately, that was not enough to spare from the bear.

Cryptonary’s 20X looked like a dud! Now, all was not lost, 1-year post-report SNX was still sitting at 3.5X our entry point, whilst most projects with no fundamentals had completely crashed.

Up until this point, Cryptonary and SNX investors had no qualms. Everything got smashed in the crash. At least SNX was outperforming the market, right?

Then, in June 2022 things took a shift. SNX doubled overnight! You check out the news and come to see SNX revenues are up 3000%. Twitter fingers are yelling SNX to the moon, and publications globally are calling for a $10 SNX.

What caused all of this? Well, Synthetix launched a shiny new product— Atomic Swaps.

Atomic swaps equal swapping two real world assets at the same time. This allowed for more accurate pricing and fewer restrictions.

This was fantastic news and meant even though sentiment was down, SNX had a shot of hitting that 20X mark sooner than one thought.

The real problem

There was, however, an issue with this sentiment. With huge orders, zero slippage, and prices coming from an oracle (data providers), traders could arbitrage prices. The result? Synthetix liquidity providers losing money.The music paused. The dancing stopped. It all came crashing down. Volume and fees dropped off a cliff, causing prices to plummet.

Was this the end of SNX?

New hope, and the return of SNX

Friends, Synthetix didn’t pick up their ball and go home after the crash. They went back up the net and started putting in work.They buckled down and made two massive changes:

V3 Synths and a shift in their business model.

V3 Synths are the latest feature Synthetix offers. For those inclined, check out this deep dive on how it works, but in short; more liquidity, less risk for stakers, and higher rewards.As for their business model. B2C (business to consumer) wasn’t working, so they pulled an Uno reverse card. Instead of trying to get retail users to interact directly with Synthetix (where fees are high, making it unusable for most retail), they are going B2B (business to business).

Now, they are partnering up with protocols such as Lyra and Kwenta. These protocols use synths as their base assets, allowing access to liquidity and avoiding slippage. For Synthetix this generates fees, for Lyra and Kwenta, it solves liquidity issues and allows great efficiencies.

This change has already seen success, with more protocols building on Synthetix, and Lyra and Kwenta seeing good volumes. We only expect this to improve as the market shifts for the better, as the more SNX is worth, the more liquidity there is available in the Synthetix ecosystem!

So what does all this mean?

Cryptonary’s Take

Synthetix is active! They have the best governance model in DeFi, an extremely active developer community, and a reflexive stance – allowing them to build in the bear.We didn’t mean to scare you with the opening, but we hope reading to the end paid off.

Look, it’s a bear market, but we’re still bullish on SNX. The key changes they’ve made have laid the foundation for a successful comeback in the bear market and massive outperformance when the bull comes running.

Do we still believe in SNX? Absolutely! Is 20X still on the table? Damn right it is!

Action points

- We’re holding strong. Our team, who all entered at different price points, might I add, are holding strong. An all-time high is inevitable once the bull market returns.

- For those who aren’t yet invested. When looking at the charts, SNX looks primed to outperform BTC and ETH. Check out our analysis for more details

- Relax, and embrace the bear, this is where opportunities are found. Money is made when buying, not when selling. Hold tight. 20X might be a little late to arrive, but it is certainly inbound.

Thanks for reading.