Bitcoin has mostly consolidated in a high range, but a few altcoins have registered more than 50% corrections.

Some altcoins have recovered from the decline, while others have continued to bleed out in the market. One prime example of a project still bleeding out is Kujira.

KUJI shot up almost 30% in less than two weeks after the initial report in February, but it has since trended down close to 64%. The on-chain analysis also shows that it is losing momentum. While the team has remained consistent in naming progress on the development pipeline and shipping new products, the critical issue remains that Kuji is not currently making investors money.

In this market update, we are taking another look into Kujira and estimate the next step forward.

Let's dive in!

TDLR

- Kujira, a promising Layer-1 DeFi ecosystem, has plummeted nearly 64% since February as its on-chain metrics and user activity have slowed dramatically.

- Key factors behind Kujira's troubles: Lack of new user growth outside the Cosmos ecosystem, dwindling total value locked (TVL) across its DeFi apps like GHOST and FIN, and declining revenue

- Silver linings remain with a steady pipeline of new product launches and integrations, but recent on-chain reception has been underwhelming.

- Bull case: Now is the opportunity to "buy the fear" and double down before an anticipated DeFi resurgence boosts usage of Kujira's unique apps

- Bear case: With price downtrend persisting and user retention issues, it may be time to cut losses and rotate capital to trendier narratives.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A brief primer in Kujira

Kujira is a Layer-1 ecosystem that offers a suite of unique DeFi products to users, developers, and traders in the DeFi industry. The ecosystem's unique approach is that each native decentralised application or dApp accelerates the growth of other applications. Its wide range of products includes:- Fin: A decentralised exchange with low transaction fees, maker and taker fees

- Bow: Liquidity solution and AMM for FIN, LPs receive fees generated by Kujira

- Orca: Marketplace place to bid on discounted collateral, one-of-a-kind

- Blue: Kujira's central hub for staking, voting on governance proposals, etc

- Ghost: money market for Kujira, facilitating lending and borrowing

(For a deeper understanding, please go through our Kujira deep dive since we are not diving into product technicals in this update.)

Why is Kujira down?

We highlighted Kujira's strong on-chain performance and revenue metrics in our February report. The valuation exercise was estimated based on strong projects such as NEAR and INJ as competitors. We mentioned that it was important for Kujira to continue improving its user base and adoption.Unfortunately, that hasn't been the case for the DeFi blockchain. As a result, KUJI's price has taken a massive nosedive.

Let's examine a couple of metrics that attest to this underperformance.

On-chain pulse

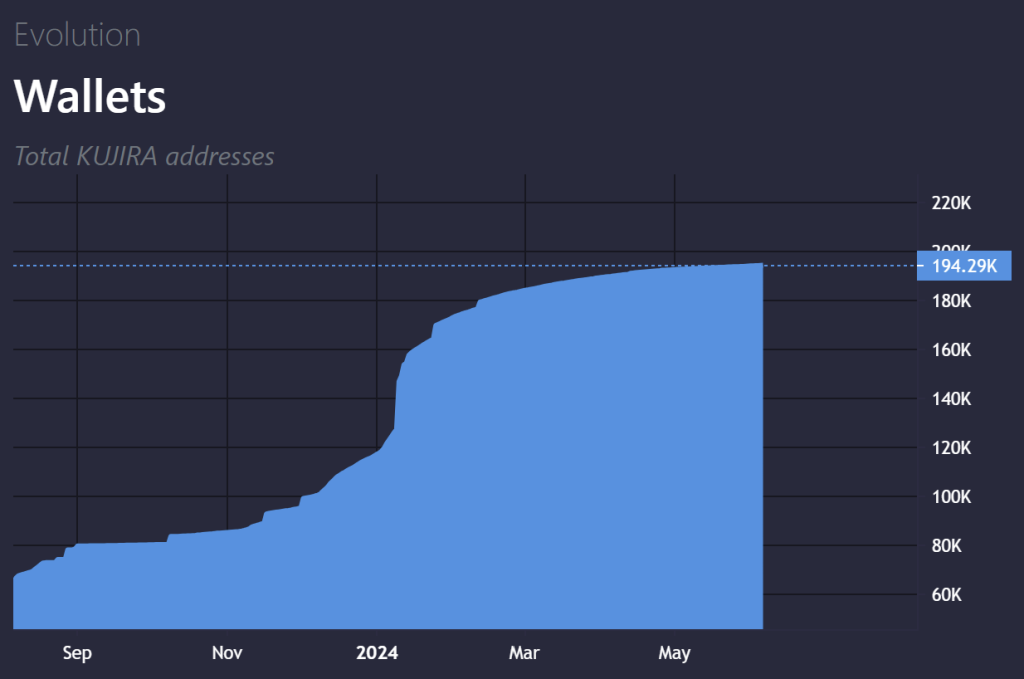

Kujira had blistering momentum at the start of 2024. During the first six weeks, the number of Kujira wallet addresses increased by 53%, from 117k to 180k. Since then, the total number of wallets has only increased to 194k, marking a measly 7.7% growth in almost four months. While this is still a positive metric, it is also an obvious signal that Kujira's growth is slowing down.

Beyond wallet addresses, the other on-chain data do not signify a net positive development for Kujira.

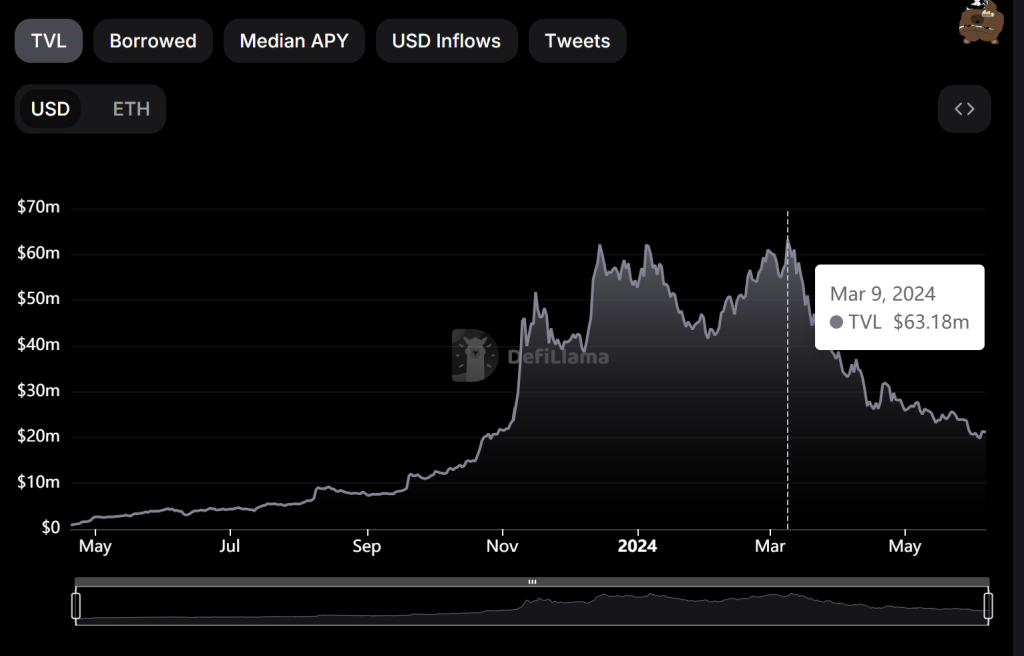

Kujira's total value locked peaked at $171 million on March 9. Since then, it has dropped 60% to $68 million. It is important to note that Kujira's price decline and TVL decline are correlated because the entire valuation of Kujira depends on its DeFi products.

GHOST, Kujira's lending and borrowing protocol, and FIN, its decentralised exchange, witnessed the largest TVL wipe-out. For GHOST, TVL dropped from $63 million to $21 million, while FIN's TVL declined from $34 million to $8.7 million.

The total lend deposits on GHOST are merely $17 million, which means there are no high liquidity providers. The largest liquidity pool is currently at $2.5 million, where the APR for LPs is 3.03%, which is not very rewarding. For the same reason, FIN might have been affected by low trading liquidity. In this case, the dependency of each Kujira DeFi product on each other became a boon.

The annualised revenue for Kujira was $2.8 million in February 2024. It is down by 57% at the moment, down to $1.2 million.

Lack of new users

The growth was pretty significant when we discussed Kujira's adoption rate in our first deep dive. Still, we highlighted that the project potentially needed an EVM or SVM integration to cater to a larger DeFi audience.What is an EVM? It stands for Ethereum Virtual Machine, a cloud computer operating as a decentralised runtime environment designed to execute smart contracts. In a similar light, SVM stands for Solana Virtual Machine.

These virtual machines are essential components in the DeFi ecosystem because they allow trustless and tamper-resistant transactions, which is essential for dApps. When other blockchains are EVM or SVM-compatible, they can operate under the same standards, and Ethereum and Solana users can use DeFi products from other blockchains.

Kujira is currently only available to Cosmos users, which might be contributing to its lacklustre performance. While there are avenues to bridge value from Ethereum to Cosmos, Kujira DeFi products are inaccessible unless you are on the native blockchain.

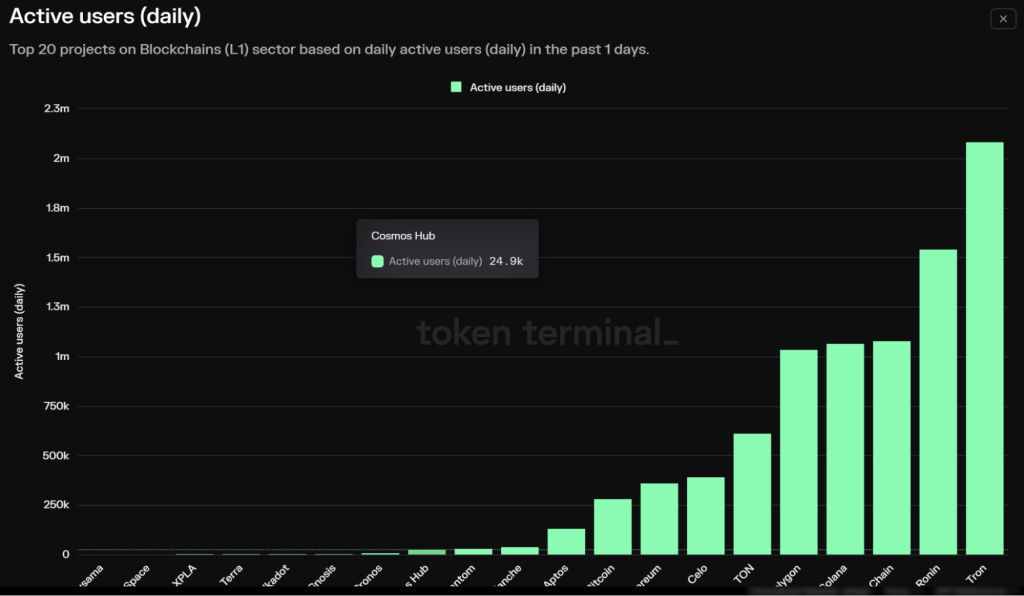

The untapped market can be visualised when active users on each L1 blockchain are observed. Cosmos Hub currently has only 24.9k daily active users or DAUs, Ethereum has 345K, Solana has over 1M DAUs, and BNB Chain has over 1M DAUs.

So Kujira is missing out on a vast DeFi market, which is key for its success.

Kujira's silver linings

Credit needs to be given where credit is due. The Kujira development team has adhered to its vision of regularly releasing new products and establishing new partnerships.The protocol currently has multiple developments. A few interesting projects have been listed below:

- Kujira V2: This was a major update for the ecosystem in May. Kujira V2 simplified protocol UX and integrated seedless smart contracts for feasibility. Non-KYC Wallet creation is easy, and DeFi interactions on the platform are swift.

- Nami protocol: This yield savings protocol on the Kujira ecosystem is a great option for beginners. It is similar to a lending borrowing platform, where users can generate token yields with as little as $25. The initial product review is good, and GHOST is expected to play a major role.

- Unstake.fi: Liquid Staking tokens integration for Cosmos liquidity providers to take advantage of LST-fi on Kujira.

- Kartel project: A GameFi/GambleFi product on Kujira to introduce more engagement-friendly on-chain applications.

- Other projects include the Kujira Index, an all-inclusive upcoming ecosystem for accessing ETFs/ index assets exposure on Kujira, backed by the KUJI token.

The expectation is that price performance will eventually increase as Kujira DeFi products gauge attention, but recent on-chain reception has been pretty underwhelming.

What's next for KUJI?

Kuji presents a dilemma—on the one hand, the fundamentals look fine, but on the other hand, the decent fundamentals haven't translated to positive price action. How you play this from here depends on whether you see the cup half-empty or half-full.We are breaking this section into two parts to communicate the thought process behind each strategy. The half-empty perspective is bearish based on today's numbers, and the half-full perspective is bullish based on future potential. Let's examine them.

Bullish strategy

This strategy needs solid conviction and patience from investors.With Kujira, we have witnessed explosive price growth, on-chain prowess, and continued development of DeFi products. On-chain activity also took a hit when the price slipped, but the project continued to build.

The foundation of this case remains "Buy Fear, Sell Greed." We haven't witnessed a full revival of DeFi in this bull run, which feels only like a matter of time. The return of capital inflows should improve user interactions on DeFi protocols again, and Kujira's products should experience another increase in traction. The native DeFi apps work smoothly, and products like ORCA carry a unique selling proposition.

The timeline is one concern because it can happen overnight or slowly over months.

Therefore, an ideal bullish strategy would be to double down with a 30% equivalent of your initial investment. This move lowers your average entry price and positions you to be profitable even before Kuji rises to its previous high in March.

The current price of $1.40 is testing the last strong technical support near $1. Ideally, KUJI should not drop below $1 because the chances of trade recovery will be very difficult. This bullish strategy will be null and void if we lose $1 support.

Our long-term targets remain the same; please refer to our deep dive.

Bearish strategy

This strategy is the data-driven strategy right now. There are clear signs that user retention has been an issue. TVL has dived by more than 60%, prices have shown no signs of recovery, and there isn't much data to hint at the possibility of a sustained upside.When capital slows down everywhere, a 50-60% correction can be normal for developing projects such as Kujira. Here, the question comes: "How fast do you need ROIs?" If the answer is short-term, then capital rotation to more trending narratives is possibly the way to go.

Kujira is not a trending project right now, so there is no positive sentiment to trigger a price rally.

The ideal exit strategy would be selling on the recovery rally, as there is a high possibility of bounce-back from current weekly support at $1. Investors looking to exit KUJI should eye $2.50 and $3, which will be tested during a recovery rally in H2 2024. Exercising patience to execute this bearish strategy will minimise your losses on Kuji.

Cryptonary' take

We are still early with Kujira. While TVL and price have taken a major hit, the product team and its DeFi ecosystem are legitimate. We continue to be confident in the KUJI token, as we need to give it a chance to perform during a bullish leg environment.However, hope is not a strategy, and the bullish strategy on KUJI is a high-risk bet that may lead to more losses. Since KUJI is at the cusp of key support, the bearish strategy also provides a chance to exit with a reduced loss and you can reallocate the funds into other trending narratives.

We will continue to monitor Kujira and the broader DeFI sector.

Until next time,

Cryptonary Out!